Executive summary

Credit rating is an independent, impartial, best-judged and professional opinion on the ability and willingness of a borrower in discharging its obligations in timely fashion and in case of entity rating. In this report we have done the credit rating of tow different companies from tow different industries, that is Bank and Non-Banking Financial Institution. The companies are Mercantile Bank Ltd and Union capital Ltd.

Credit rating of a company is not specific to any particular policy or contract because the standing of a particular obligation would depend on an assessment of its relative standing under the laws governing the obligation and the company. The analytical framework for companies utilizes a format that divides the analysis into several modules, ensuring that all salient issues are considered. The parameters for analysis include: industry analysis, company analysis, investment portfolio risk, financial strength, management quality etc. In our report we have done two sort of analysis. The first one is qualitative analysis and the second one is quantitative analysis.

In qualitative analysis, there is no structured basis for credit rating. For this reason, rating decisions are based on judgment. Some factors of company have been analyzed for this purpose, such as industry risk, keys to success factors, diversification factor, firm size, evaluation of management, accounting quality etc.

In the quantitative we have set up a multiple regression equation with peer companies with their respective credit rating. We have used the companies’ significant ratios, as profitability ratios, short term and long term solvency ratios, leverage ratios in this purpose. The ratios are used as independent variable in the model.

Then we have calculated the weighted average result of the qualitative and quantitative analysis to get the final credit rating score.

From the calculation we found that Union Capital Ltd (UCL) will have a credit rating of 7.75 which is analogous to “BBB+” (according to CRISL) or “A2” (according to CRAB). The overall Credit rating of Union Capital Ltd for the year 2009 is designated as per the qualitative and quantitative factor analysis.

Overall Credit rating of Mercantile Bank Ltd for the year 2009 is designated as per the Qualitative and quantitative factor analysis. Quantitative aspect of the bank is also included in the rating and we adopt a 60:40 weighting. The total weighted average credit score of Jamuna Bank is 16.044. This rating is equivalent to “AA-” (according to CRISL) or “AA3” (according to CRAB)

Credit Rating Process

Qualitative analysis:

- Company Background

Mercantile Bank Limited emerged as a new commercial bank to provide efficient banking services and to contribute socio-economic development of the country. The Bank commenced its operation on June 2, 1999. The Bank provides a broad range of financial services to its customers and corporate clients. The Board of Directors consists of eminent personalities from the realm of commerce and industries of the country.

Since beginning, the bank acquired confidence and trust of the public and business houses by rendering high quality services in different areas of banking operations, professional competence and employment of the state of art technology. During the last few years the bank has opened different Branches in different Business Centers of the country. Currently the bank is operating with 53 branches (UPTO 2009) in total. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with a number of international banks of repute across various countries of the World

MB Bank Limited, the premier sector bank of the country is making headway with a mark of sustainable growth. The overall performance indicates mark of improvement with ROA increasing to 1.64%, which is precisely 35% higher than the preceding year. One of the most important achievement of the bank in 2009 was that it had decreased its cost income ratio has decreased to 40.38% which was a very positive sign for the institution. The net profit of the bank has also grown 77% in 2009 compared to the previous year.

- Industry Risk

- Overall banking sector performance:

The banking sector of Bangladesh comprises of four categories of scheduled banks. These are state-owned commercial banks (SCBs), state-owned development finance institutions (DFIs), private commercial banks (PCBs) and foreign commercial banks (FCBs). The number of scheduled banks changed to 47 when BDBL was founded

Assets:

Aggregate industry assets in 2009 registered an overall increase by 15.3 percent over 2008. During this period, SCBs’ assets increased by 16.7 percent and those of the PCBs rose by 24.3 percent. Loans and advances played a major role on the uses of fund. Loans and advances amounting to Taka 1724.3 billion out of aggregate assets of Taka 2773.9 billion constituted significant portion (62.2 percent). Cash in tills were Taka 29.7 billion (1.1 percent); deposits with Bangladesh Bank were Taka 159.4 billion or 5.7 percent; other assets were Taka 479.6 billion or 17.3 percent and investment in Government bills and bonds accounted for 13.7 percent (Taka 381.0 billion) of the assets.

Liabilities:

The aggregate liability portfolio of the banking industry in 2009 was Taka 2773.9 billion of which deposits constituted Taka 2148.9 billion or 77.5 percent and continued to be the main sources of fund of banking industry. Capital and reserves of the banks were Taka 180.0 billion or 6.5 percent of aggregate liabilities in 2009, as against Taka 122.9 billion or 5.1 percent in 2008.

The most important indicator intended to identify problems with asset quality in the loan portfolio is the percentage of gross and net nonperforming loans (NPLs) to total advances. FCBs have the lowest and SCBs have the highest ratio of NPLs. FCBs are having excess provision for loan losses. Here we graphically display the amounts in NPLs of the 4 types of banks since 1999 through 2009. Amount of NPLs of the SCBs decreased from Taka 128.9 billion in 1999 to Taka 115.0 billion in 2008 but again increased to Taka 137.9 billion. The PCBs also recorded a total increase of Taka 3.9 billion in their NPL accounts, which stood at Taka 49.2 billion in 2009 as against Taka 45.3 billion in 1999. The amount of NPLs of the DFIs decreased to Taka 37.2 billion in 2009 from Taka 63.3 billion in 1999. The decline in NPL ratios in the recent years can be attributed partly to some progress in recovery of long outstanding loans and partly to write-off of loans classified as ‘bad’ or ‘loss’.

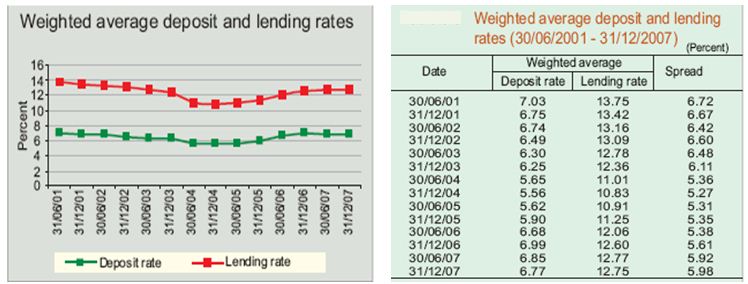

- Weighted Average Deposit and Lending Rates

The weighted average deposit rate decreased from 6.85 to 6.77 percent and weighted average lending rate of banks decreased from 12.77 to 12.75 percent during the first half of FY10. The spread between lending and deposit rate is the measure of intermediation cost of banks, which has increased over time. It was 5.92 percent at the end of FY09, which increased to 5.98 percent in the first half of FY10. Weighted average deposit and lending rates along with the spread during 30/06/2001 to 31/12/2009 have been shown in the following graphs

Legal Reforms and Prudential Regulations

As part of the ongoing efforts to strengthen the banking system through the adoption of policies aimed at both improving the financial strength of banks as well as bringing about greater transparency in their operations, several policy measures were initiated during FY08.

Capital Adequacy of the Banks

With a view to strengthening the capital base of banks and making them prepared forth implementation of Basel-II Accord, banks are required to maintain Capital to Risk-Weighted Assets ratio 10 percent at the minimum with core capital not less than 5percent effective from 31 December 2007.However, minimum capital requirements (paid-up capital and statutory reserve) for all banks will be Taka 2.0 billion as per Bank Company (Amendment) Act, 2007. Banks having capital shortfall will have to meet at least 50 percent of the shortfall by June 2008 and the rest by June 2009.

Interest Rate Policy

Banks are now free to charge/fix their deposit and lending rate other than export credit. Loans at reduced rates (7percent) are provided for all sorts of export credit since January 2004. Moreover, with a view to controlling the price hike and ensuring adequate supply of essential commodities, the rate of interest on loan for import financing office, wheat, sugar, edible oil (crude and refined),chickpeas, beans, lentils, onions, spices , dates and powder milk has been temporarily fixed to maximum of 12 percent. In 2009, banks could differentiate interest rate up to 3 percent considering comparative risk elements involved among borrowers in same lending category. With progressive deregulation of interest rates, banks have been advised to announce the mid-rate of the limit (if any) for different sectors and the banks may change interest 1.5 percent more or less than the announced mid-rate on the basis of the comparative credit risk.

- Overall banking Industry risk assessment:

Implementation of Basel capital accord is expected to raise a paradigm shift in the management pattern of the entire banking system. In the Basel II accord risk emphasis has been expanded to both credit risk, market risk and operational risk. Approach for operational risk is considered to be easy for the banks at the initial stage. In order to assess to operate bank under BASEL-II regime, bank s will be required more capital. Bangladesh bank has already initiated Basel II implementation ground work; formed high powered national implementation Committee, carrying out quantitative ground study in order to finalize the road map of Basel II implementation. Capital adequacy ratio has been increased to a risk weighted basis. Banks will be asked for more capital based on the rating of the counter parties which may also be asked for additional capital. In addition of the gross income of the banks will be applied in determining the capital base for operational risk. the above would warrant the financial institution to invest more in IT infrastructure systems and Human resource. the business operation is going to be more sensitive to risk and capital and in this connection, the supervisory oversight will be stronger. Under the above backdrops of the over all banking industry, Mercantile Bank Ltd management is found to be well equipped with its operational strategy to comply with the industry norms accordingly.

- Strategic focus:

Mercantile Bank Ltd has prioritized the focus areas depending on the business needs and regulatory requirements along with the change in technologies and delivery processes. Focus on growth and expansion was emphasized to cater for the financial restructuring and business sustainability. Resource mobilization was centered round delivery channels, technology, people and brand. This successful strategic focus of MBL resulted in doubling the size of the business over three years besides being reflected in the enhancement of the shareholders value. MBL is also moving ahead of the shareholders value. MBL is also moving ahead investment banking division being the window for next generation banking.

Rejuvenating the brand image of the bank was the prime corporate initiative taken toward the end of 2009. Beginning with the launching of the new logo following the change of its name, MBL re-positioned itself in the banking fraternity including the broad based clientele with the slogan “Bonding Generation”.

Enhanced Brand image is supported by a detailed restructuring of program in this line. On the business line, bank is focusing on SME and Retail business in the coming days.

- Corporate Credit:

Corporate credit of MBL is operated under the name tag of “Business Banking”. The bank is privileged to have all the big corporate names of the country as partners resulting in a diversified portfolio spreading into steel, ship-breaking, edible oil, food grains etc. During the year 2009, MBL participated in eight syndication deals under project financing in the area of RMG, Steel, paper, micro-financing, chemicals involving in amount of tk 351.89 crore in total. Mercantile Bank Ltd was the lead bank in sum of such syndication arrangement.

- Branch Network:

As on 31 December 2010, Mercantile Bank Ltd had 61 branches including 3 SME branches. 30 branches were located at different areas Dhaka Division, 18 branches Chittagong Division, 04 branches in Sylhet Division, 03 branches in Khulna Division, 04 branches in Rajshahi Division, and 02 in Barisal Division.

Overall status of MBL’s branch network is given below:

| Branches | 2010 |

| Dhaka | 30 |

| Chittagong | 18 |

| Rajshahi | 04 |

| Rangpur | 02 |

| Borishal | 02 |

| Sylhet | 04 |

| Khulna | 03 |

| Total | 61 |

- Technology

Being the first private sector Bank of the country, Mercantile Bank Ltd prides itself in the quality of the banking services by taking conscious decision to employ the best available banking technology. In the year 2004, pc-bank Core Banking Solution was selected for implementation to take MBL in to super highway of real time online banking of today. Beginning 2005 Misys implementation was taken-up and in the 1st phase seven Branches and HO were upgraded to the new core banking system. During 2009, pc-bank Equation roll out across all the branches were completed in the stipulated time frame. Now, MERCANTILE BANK LTD is real online service provider Bank. Misys Equation set up a fully integrated centralized system enabling the Bank to reap efficiency gains and enhance the customer service level.

In 2009, the bank was planning to implement Business Process Management System (BPM) to automate workflows across the functions and branches. Electronic Content Management ( ECM) systems is going to be integrated with BPM for electronic document management. Also disaster Recovery site of the bank was planned to be completed and put into operation in 2008. IT division took initiatives to develop MIS, SMS banking, internet banking, phone banking, Anti-money laundering/ KYC modules, fixed asset management etc.

- Human resource

The valuable contributions made by the employees for the continuous growth of the Bank have always been acknowledged. Human Resources Division of MERCANTILE BANK LTD worked with the business as the core strategic partner through performing the job of recruitment, training, placement, and through introduction of the performance management tools. The Bank has its own Training Institute for training of its staff internally. The Bank has planned to restructure the Training Institute to a full fledged Training Academy within this year. The Bank also sends its employees to the Bangladesh Institute of Bank Management (BIBM), Bangladesh Bank and other professional institutions in home and abroad for training purposes.

In 2009, total numbers of employees were 1303. The recruitment examination is managed by both internal and external agencies. The Bank has Employees’ Service Rules followed from 2002.

According to the HR division, the Bank is the top payer in the industry for the SVP & above rank. And for probationary to VP rank, the Bank provides salary according to industry practice. The employees also get other facilities like gratuity, provident fund, festival bonus, incentive bonus, medical facilities etc from the Bank. Employee turn over at mid and executive level is very low. Lower mid level employee turnover is little high.

- Risk factors

Risk management of Mercantile Bank Ltd is practiced form apex body to working desk level as far as practicable. In Compatible with the corporate strategy of growth the shareholders value addition, risk management has been structured in line with the organizational pattern of bank. Bank particularly faces risk in form of credit, market, liquidity and operations risk. However, another dimension to risk matrix is namely reputation risk.

Risk management system of the bank is geared to addressing the financial and operational losses besides being compliant on the process through which business deals. Initiatives are taken with the ultimate objective of safe-guarding the capital and protecting the flow of profit generation and growth financing.

Credit Risk Management

In October 2003, Bangladesh Bank advised all banks to put in place an effective risk management system focusing on five core areas. In response to that, MERCANTILE BANK LTD developed a Core Risk Manual on the five core risk areas approved by the Board. During 2004, as per BB guidelines, Credit Risk Management was given a new shape. A new CRM Division was created in June 2005 with identified responsibilities for managing credit risks.

The Key feature of CRM in MERCANTILE BANK LTD is the segregation of the relationship function from the credit approval function, in accordance with the core risk guidelines set by the Central Bank. Besides, an independent department, Risk Asset Management (RAM) has been established to deal with the credit disbursement and recovery process. Basel II guidelines require banks to accurately measure credit risk to hold sufficient capital to cover such risks. According to the management of MERCANTILE BANK LTD, the Bank is under preparation to implement Basel II.

Liquidity Risk Management:

This particular Risk management aspect deals with the job of ensuring all foreseeable funding commitments of the bank. Principal responsibility of liquidity management lies with the treasury division. To this end treasury had to manage the fund flows of the bank on daily basis besides maintaining the SLR and CRR. Besides bank professionally runs ALCO to make decisions on funding and, interest rate determination and asset liability management.

Foreign Exchange risk management:

FX risk management is one of the important responsibilities of the treasury division. Treasury department independently conducts the FX transactions and the mid office and bank office of treasury are responsible for back office processing. Regular FX operations are done following the Bangladesh Bank guidelines.

- Diversification Factors

As on 31 December 2009, Mercantile Bank Ltd had 53 branches including 3 SME branches. The fund base and branch network of the bank are taken as important indicators of strength. In a fast changing environment, a bigger bank can meet the competitive challenges from other financial intermediaries due to its economies of scale and wider reach. Mercantile Bank LtdCan obtain lower-interest charges when borrowing from banks and having access to a greater range of financial instruments

- Product mix diversification

In order to accommodate its goal of meeting customers expectation, Mercantile Bank Ltd has introduce a good number of innovative financial products and services to meet ever increasing demand of its clientele. MERCANTILE BANK LTD has a good number of liability product such as savings deposit, Special notice Deposit (STD), Call deposit, NFCD, RFCD, Fixed deposit and various monthly deposit scheme. The bank has also introduced deposit products like MSDS, MIDS, and DDS. The fund collected from the above products are channeled through some asset products such as providing working capital, term loan, Trade finance etc. The bank has also the plan to launch the products namely Dealer finance, Vendor finance, Cash and payroll management service etc. The above products are appeared to be satisfactory to maintain the growth rate of the bank. Mercantile Bank Ltd has a wider range of diversified products. Performances of these products are moderate compare to other peer banks. Core products of MB Banks are Retail Banking, Corporate Banking, SME Banking, Project, Finance, Loan Syndication, Lending Rates, NRB Banking, Money Transfer, Islami Banking, Investment Banking, Cards etc. As Mercantile Bank Ltd has greater number of products and a good marketing strategy it has greater economies of scope.

- Market capitalization

On March 2009 total market capitalization of banking sector was BDT 241,117.20 million. Total market capitalization of Mercantile Bank Ltdwas BDT 8,525.73 million and share of Mercantile Bank Ltd on this was 5.42%. This is moderate in comparison to other peer banks. Here market capitalization of some selected bank is given:

Mkt capitalization | Percentage of mkt Capitalization | |

| MBL Bank | 8,525.73 | 5.420 |

| Dhaka Bank | 6,297.927 | 2.612 |

| Brac Bank | 7,397.280 | 3.068 |

| Dutchbangla | 19,935.000 | 8.268 |

| NCC Bank | 4,512.678 | 1.872 |

| SouthEast Bank | 7,829.283 | 3.247 |

| Pubali Bank | 9,790.200 | 4.060 |

| Islami Bank | 23,866.920 | 9.898 |

Size of loan portfolio

Mercantile Bank Ltd provides 100% loans and advance in private sector. A sector wise analysis of the Bank’s loan portfolio shows that loans and advances more or less concentrated on commercial lending. Last few years, on an average, 37% of loans disbursed as commercial lending. During 2009, BDT 20614.60 million used as commercial lending with the growth rate of 44.8% than previous year.

2009 | % | |

| Trade finance | 14224.97 | 29.45 |

| Engineering | 4958.56 | 10.27 |

| Food & Beverage | 2471.27 | 5.12 |

| Exports | 8510.86 | 17.62 |

| Housing | 4340.75 | 8.99 |

| SME | 983.25 | 2.04 |

| Pharmaceuticals | 771.36 | 1.6 |

| Textiles | 749.09 | 1.55 |

| Transportation | 676.01 | 1.4 |

| Telecommunication | 649.02 | 1.34 |

| Hospital & Medical | 477.95 | .99 |

| Agriculture | 443.28 | .92 |

| Others | 9039.08 | 18.72 |

| Total | 54,412,358,249 | 100.00 |

Table: Sector wise segregation on loans and advances

According to BB circular No 05 of 9th April 2005, loan sanctioned to any individual or enterprise or any organization of a group amounting to 10% or more of a Bank’s total capital shall be considered as large loan. According to such regulation, during 2010, MERCANTILE BANK LTD had 34. During the last years (2007-05) the numbers of such client was 53, 71 and 47.

According to BRPD circular, if rate of net non performing loans is up to 5%, the highest rate fixed for large loan against Bank’s total loans and advance is 56%. During 2007, MERCANTILE BANK LTD’s rate of net classified loans was 2.07% and large loans were 31.44% of total loans and advances, which is under regulatory limits.

| Classification of loans and advances | ||||

2,008 | % | 2,009 | % | |

| Unclassified | 42176892481 | 97.14 | 47043494654 | 97.40 |

| Classified | ||||

| Substandard | 249393000 | 0.057 | 210154000 | .435 |

| Doubtful | 328181000 | 0.24 | 233104000 | .483 |

| Bad/Loss | 664896000 | 0.076 | 808794000 | 1.67. |

| Total classified loans and advances | 1,695,381,577 | 2.86 | 1252052000 | 4.484634 |

43419362481 | 100.00 | 48295546654 | 100 |

Size of deposit mix

Deposits include various types like current deposits, savings deposits, short-term deposits fixed deposits, etc Among the total deposits of MERCANTILE BANK LTD, maturity within 1 month is only average 9.3% in 2009 and in 2008 it is 14.52. So, Bank has to maintain modest liquid cash for deposit withdrawal at initial period. Banks whose low cost deposits (current+ saving) is high; around 50% of the deposits have to pay on demand or within 1 month. In this regard, they have to maintain enough cash for deposit withdrawal. MBL Bank’s largest portion of deposits maturity is within bucket of over 3 months to within 1 year amounting BDT 53,514.93 million or 78.04% of total deposits in 2008. The same trend showed from previous few years holding 74.7% in 2007.

| Time Frame | 2009 | 2008 | ||

| Amount | % | Amount | % | |

| on demand | 789022669 | 1.15 | 2123955564 | 5.19 |

| within 1 month | 438926805 | 0.64 | 271878340 | 9.27 |

| over 1 month but within 3 months | 4611047104 | 6.73 | 2833435975 | 8.31 |

| over 3 months but within 1 year | 11138416152 | 4.24 | 2933822999 | 23.59 |

| over 1 year but within 5 years | 29045286304 | 42.36 | 21368598613 | 50.77 |

| over 5 years but within 10 years | 9730362622 | 3.67 | 16842487344 | 10.59 |

| over 10 years | – | – | – | – |

| Total | 68560474324 | 100 | 53375348391 | 100 |

The deposits from other institutions and individuals, which are considered more stable in nature, contain a good portion of the total deposit base of MERCANTILE BANK LTD over the years. Large deposits of above one crore is held mainly by institutional depositors (Power sectors, Govt. organization, NGOs etc) and a large amount of the total deposit in this segment is core deposit in nature.

The Bank’s major portion of deposits is the term deposits which are higher at cost, and such proportion is continuing increasing trend for last few years. This high cost deposits increase the average cost of deposits, and thereby it’s average cost of fund. MERCANTILE BANK LTD’s cost of fund during 2009 was 8.81% which was 9.19% in 2007.

Cost of deposit over the Year | |||

| Year |

| 2009 | 2008 |

| Cost of fund | 8.81 | 9.19 | |

Ownership structure

Mercantile Bank Ltd has a diversified ownership pattern, Mercantile Bank Ltd as a public limited company having a total number of 21584130 ordinary shares of taka 100 each as on December 30, 2009. In it 50 percent is owned by sponsor and directors, general public is holding 49.43% of total shares. No sponsor or director together with his family is not holding more than 10% of the total shares.

| Share Holders | % | No. of Share on 2009 |

| Sponsor/Director | 51.89 | 11200005 |

| Institute | 38.32 | 8271038 |

| Public | 9.79 | 2113086 |

| Total | 100 | 21584130 |

- Accounting Quality

The financial statements, namely, Balance Sheet, Profit and Loss Account, Cash Flow Statement, Statement of Changes in Equity, Liquidity statement and relevant notes and disclosures thereto, of the Bank are prepared under the historical cost convention and in accordance with the first Schedule of Banking Companies Act 1991, Bangladesh Bank circulars, International Accounting Standards, including those that have been so far adopted by the Institute of Chartered Accountants of Bangladesh, the Companies act 1994, the Securities and Exchange Ordinance 1969, Securities and Exchange Rules 1987 and other laws and rules applicable thereto.

Significant Accounting Policies:

Consolidation: A separate set of records for consolidating the statements of affairs and income and expenditure statements of the branches including Mumbai Branch, India are maintained at the Head Office of the Bank in Dhaka, based on which these financial statements have been prepared.

Fixed assets and Depreciation: Fixed assets are stated at cost less accumulated depreciation. Depreciation on fixed assets is charged using reducing balance method except motor vehicles, computers and photocopiers for which straight line method is used.

Recognition of income and expenditures: Income and expenditures are recognized on accrual basis. Interest income is admitted only if its realization is reasonably certain. Investment income is accounted for on accrual basis except treasury bills.

Provident fund: the bank’s employees provident fund is administered by a board of trustees and is funded by contribution of both the bank and the employees at 10 percent of basic pay of each employee.

Provision for taxation: Provision for current income tax has been made @ 45% as prescribed in the finance ordinance 2009 of the accounting profit made by the bank after considering some of the add backs of income and disallowances of expenditure as per BAS-12.

Deferred tax: Deferred tax assets and liabilities are recognized for the future tax consequences of timing differences arising between the carrying values of assets, liabilities, income and expenditure and their respective tax base.

Reconciliation of books of account: Books of account in regard to inter-bank (in Bangladesh and outside Bangladesh) and inter- branch transactions are reconciled and no material difference was found which may affect the financial statements significantly.

Set-off of assets and liabilities accounts: no accounts of assets and liabilities were set-off unless these were legally permitted.

QUALITATIVE ANALYSIS:

- A. Overview of the Company

UNION CAPITAL LIMITED is one of the largest investment banks and fastest growing financial institutions in Bangladesh. Previously, it was known as Peregrine Bangladesh which had its origins and businesses rooted in Hong Kong. Out of the local office of the erstwhile Peregrine Capital Limited of Hong Kong, Union Capital Limited, Dhaka emerged in early 1998 as a Bangladesh-based company led by a group of the foremost entrepreneurs of the country. The company obtained permission from Bangladesh Bank to operate as a financial institution under the financial Act 1993 on 12th August and registered as a full fledged Merchant Banker with the Securities and Exchange Commission on April 10, 2002. The company went to the Public offering in May 2007 and listed it shares in both Dhaka and Chittagong Stock Exchange in July 2007. Union Capital, within a short span of time, has proved its worth as a most forward-working vigorous organization achieving success with its wide international network and strong local base.

Union Capital is an entrepreneurial company that prides itself on its speed of through and action. Its ability to make decisions quickly and efficiently and to generate value as an agent and executor sets it apart from all other investment banks and financial institutions in Bangladesh. The company’s strategy is to focus on Bangladesh and to develop a truly global distribution network through the major investment institutions abroad. SES Company Limited, which is wholly owned by Union Capital, has seats in both the Dhaka and Chittagong stock exchanges. This provides Union Capital with unmatched local distribution capabilities to retail and institutional investors throughout the world in relation to securities originating in Bangladesh.

Union Capital is dedicated to provide a high level of professional and personalized service to its domestic and international clients. Preferential treatment and superior service to clients is what the company believes to be its ultimate goal.

As a full-service investment bank, Union Capital offers public issue management, portfolio management, merger & acquisition, joint venture, corporate finance advice, securities dealing, research and underwriting capabilities in the financial markets of Bangladesh. Union Capital also offers capital market fund-raising expertise which is supported by a global distribution network. The company’s strong business contacts provide it with unrivalled access to investment opportunities for multi-national and local companies seeking sound and properly financed business projects in Bangladesh.

B. Industry Risk

An Overview of the NBFI Industry in Bangladesh

The non-bank financial institutions (NBFIs) constitute a rapidly growing segment of the financial system in Bangladesh. The NBFIs have been contributing toward increasing both the quality and quantity of financial services and thus mitigating the lapses of existing financial intermediation to meet the growing needs of different types of investment in the country. The leasing sector, a vital segment of financial sector has contributed significantly over the year, in spite of many constrains like tremendous competition with the banking sector of the country, challenges and regulatory changes (withdrawal of depreciation allowance) which are affecting adversely on the business. With the Challenges of time, the overall growth of the leasing business, achieved through diversification of products and services and aggressive marketing is indicative of the industry’s contribution to our national economy. The total investment by the financial institutions (non-bank) up to June 2008 was BDT 96.8 billion which is 6.41% higher than that of previous year. They have executed leases and disbursed loan aggregating Tk.39.59 billion during 2008 which is around33% growth compared to its previous year. Capital market investment was above Tk.6 billion. The financial institutions maintained recovery level of 95% which is of an international standard Among 29 NBFIs, one is government owned, 15 are local (private) and the other 13 are established under joint venture with foreign participation. Bangladesh Bank has introduced a policy for loan and lease classification provisioning for NBFIs from December 2000 on a half yearly Basis.

Asset Liability Position of NBFIs

Total assets of NBFIs showed a growth of 28.2 percent and stood at Tk.90.2 billion in June 2008 compared with Tk.70.4 billion in June 2007. Leased assets constituted about 36.5 percent of total assets of the NBFIs while term financing and working capital generated 27.3 percent and 16.1 percent respectively. Figure 4.4.1 shows that among different types of assets of NBFIs, working capital has increased significantly which indicates better capacity of the NBFIs to mitigate any financial mismatch by balancing current assets with current liabilities. However, three out of the existing 29 NBFIs showed negative position of working capital during the period which indicates that they need to be more efficient in their current liabilities and liquidity management. Up to June 2008, Delta Brac Housing (DBH), which holds about 83 percent of total housing finance of NBFIs, ranked the top in terms of share in total assets (11.2 percent) of the sector followed by the IDLC Finance Limited (9.4 percent). There exists considerable variation in terms of asset holding by NBFIs as 57.3 percent of the assets of the entire sector are accounted for by top nine of them while the bottom nine holds only 9.4 percent of total assets.

On the liability side, shareholders’ equity constituted only 23.5 percent of total liabilities of NBFIs, revealing wide scope for the NBFIs to raise capital through initial public offerings (IPOs) rather than other high cost sources of funding. A comparison of the total long term liabilities (Tk.69.0 billion) with total long term assets (Tk.75.3 billion) of the NBFIs as a whole shows the overall consistent nature of their asset liability management.

Performance of NBFIs The NBFIs are increasingly coming forward to provide credit facilities for meeting the diversified demand for investment fund in the country’s expanding economy. According to the available data (provisional), private sector credit by NBFIs grew at the rate of 38.7 percent and stood at Tk.108.6 billion at the end of December 2008 which was Tk.78.3 billion in December 2007 (Figure 4.4.2). The outstanding position of industrial lending by NBFIs also increased by 10.4 percent to Tk.61.4 billion at the end of December 2008 compared with Tk.55.6 billion in December 2007. However, overdue as a share of outstanding industrial loans increased to 8.0 percent in December 2008 from 6.8 percent in December 2007. This shows that the NBFIs need to streamline their loan disbursement methods with focus on low risk industrial segments and instill better monitoring mechanisms in order to reduce risks associated with their assets.

Nevertheless, the contribution of NBFIs to industrial financing still remains very small. During

July-December 2008, the share of the NBFIs in total disbursed industrial loans was only 4.2 percent. More than 80 percent of the loans disbursed by NBFIs were term lending as their capital structure provides better support for term financing rather than working capital financing. Total classified loan of all NBFIs stood at Tk.7.1 billion in December 2008 against their total outstanding loan of Tk.106.1 billion showing a classified loan to total outstanding ratio of 6.7 percent which was 7.1 percent at the end of December 2007.

The return on equity (ROE), which shows the earning capacity of shareholder’s book value investment, shows significant variation across NBFIs. In June 2008, the highest ROE is observed for IDCOL (24.1 percent) followed by Prime Finance (22.9 percent) and DBH (20.9 percent). On the other hand, ROEs of several NBFIs were lower than the industry average and the interest rate on deposits indicating requirements on the part of these NBFIs to access both low cost funding and ensure better portfolio management to improve performance.

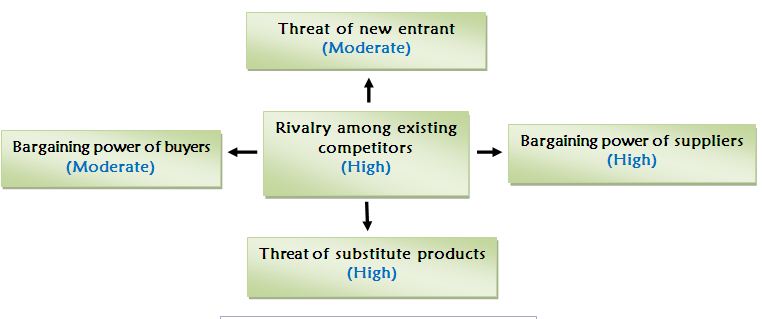

Porter’s Five Forces Model

To prepare credit rating, industry analysis is must as prosper or sufferings in the long run or during expected near term economic environment of industry will affect much. Different industries react to economic changes at different point in the business segment. Cyclical industries do much better than the aggregate economy during the expansion whereas they suffer more during contraction with contrast non-cyclical industries such as NBFI industry would experience a significant decline during a recession and also would experience a strong increase during an economic expansion. Competitive advantage and disadvantage of Non- Bank Financial Institution (NBFI) industry can be examined by Michel Porter’s 5 factors model.

Threat of new entrants: Moderate

The potential threat of new entrants is moderate for NBFI industry due to following reasons –

Growth of the industry is very high which is creating field for the new company that is observed during the past several years.

Established companies have absolute cost advantage relative to potential entrants.

Though there exist enormous growth opportunity the market is still quite small

Skilled personnel are very limited and lack of efficient secondary market is creating difficulties for the new entrant.

Customer switching cost is moderate.

There exists Government regulation to enter into the industry.

Rivalry among existing competitors: High

In most industries, the average level of profitability is primarily influenced by the nature of rivalry among industry’s firms within the industry. Several factors determine the intensity of competition among existing players in an industry. The rivalry among existing competitors is high for NBFI industry due to following reasons –

Competition among NBFI increases.

As par section 7 of banking company act, commercial banks are also start offering different services that are provided by NBFI. This is posing difficulties for NBFI because it has access to cheaper rate fund, so enjoys comparative advantage over NBFI.

In NBFI industry fixed costs are high, so these create rivalry among existing competitors.

Exit barriers are high as the firm can’t exit as they wish and there is regulatory burden.

Threat of substitute product: High

The third dimension of competition in an industry is the threat of substitute products or services. The threat of substitute product in NBFI industry is high for the following reasons

Financial innovation which are blaring differences between the product and services of NBFI and other financial institution.

Bargaining power of buyers: Moderate

There are two factors which determine the bargaining power of buyers; price sensitivity and relative bargaining power of buyers. By focusing these two issues, the bargaining power of buyers in NBFI industry is discussed below –

There are large numbers of buyers and they purchase in low volume.

Depends on the buyers for a large percentage of its total revenue.

Customer switching cost is Moderate.

Inability to backward integration.

Buyers are highly price sensitive.

Bargaining power of suppliers: High

There analysis of the relative power of suppliers is a mirror image of the analysis of the buyer’s power in an industry. The bargaining power of suppliers is high for NBFI industry due to following reasons

Excessive dependence on bank loan and deposits.

Possibility of forward integration.

Unavailability of alternative funding sources.

NBFI contribute small percentage of bank business.

- A. Key to Success Factor

Strategic Focus

UCL has prioritized the focus areas depending on the business needs and regulatory requirements along with the change in technologies and delivery processes. Resource mobilization was centered round delivery channels, technology, people and brand. This successful strategic focus of UCL resulted in increasing the size of the business over preceding years besides being reflected in the enhancement of the shareholders value. UCL is also moving ahead of the shareholders value. UCL is also moving ahead merchant banking and term deposit division.

Despite some economic problem faced during the year, UCL could show a steady growth. It has fairly diversified portfolio of investments. In 2008, a number of power generating projects were included in the investment portfolio which in the long run will contribute to the development of national economy. Participation of UCL in various projects have been satisfactory since in each case the clients’ integrity, past repayment track record, alternative cash flow, CIB report are all taken into consideration before customizing each deal, irrespective of sectors.

Branch Network

As on 31 December 2008, UCL had 3 branches including head office and 1 (one) merchant Banking Branch.

Human Resources

UCL pursues a set of service rules covering major aspects of HR practices, offering a congenial working environment to its human resources. However the remuneration package of the Company is not competitive as compared with some of its competitors in the peer group. In the entry level, UCL recruits suitable staffs from the intern. Other than the entry level, the company recruits experienced professional and executives from other financial institutions. The present human resource of the company has the professionalism and is aware of modern business policies having the capacity to match with the required productivity of the company.

Management Information System (MIS)

UCL’S highly skilled MIS team is responsible for generating and disseminating MIS to the higher management as well as making constant improvement of business processes aiming efficient service delivery and optimum risk management. UCL’S skilled IT team ensure of information technology through out the organization to increase the effectiveness of various functional units in the organization and synchronize the overall operations.

Risk Factor

Risk, the uncertainty and possibility of loss is an integral part of business specially inherent with leasing and financing business due to dealing with financial matter some of which are beyond control called uncontrollable risk. Other type of risk called controllable risk, actually not possible to control but to minimize by taking steps. Major types of risk UCL faces are given below:

Difficulty in choosing core business.

Encompassing a blend of banking and non banking services.

Loans and advances either liquid or of questionable quality.

Short term and unstable funding.

High risk area of business like transport.

Competition from commercial bank.

Lack of ideal capital market.

Poor legal and regulatory framework.

To minimize risks, several steps already been taken and effort exists on the following subjects:

Portfolio investment management.

Searching the long term loan to avoid the mismatch of short term borrowing and long term loan.

Expert opinion for choosing core business area, financial statement analysis.

Maximum effort for collection within the legal framework.

Modernization of HR and infrastructure to compete with the leading developed company.

Find out more business sectors for introduction of new products for future.

Taking steps to avoid undue and unfair competition with other commercial bank.

Recovery management

In leasing recovery is very important because recovered amount is reinvested in future lease financing. UCL has separate recovery department. It is responsible to collect any overdue amount and take legal actions if necessary. Recovery department guided the monitoring and operation department to contract with the clients and pressure them to repay the loan. Recovery department also inform the legal personnel if there is any situation where the company is bound to take legal actions against the clients to collects it’s overdue. Recover rate fluctuates month to month because some clients fail to pay monthly rentals on time. The recovery rate stays below 100% because of two reasons:

Overdue

Default

Overdue:

UCL faces overdue when there is insufficient in the client account. Before avail lease facility the lessee provides required number of post dated cheques to the lessor. In due date the account department place the cheques to designated bank and transfer the amount from client’s account to UCL’s account. But some time because of insufficient fund the rentals are not collected or transferred to lessors account. Due amounts are some times collected in the consecutive month.

Default

When the lessor is sure that the lessee will not pay the overdue as well as future rentals that is called default. In lease finance the leased assets are entitle to the lessor. If the lessee fails to pay the monthly rentals or fully fail to repay all dues to the lessor, the lessor can claim the assets. But most of the time lessor prefer and asked for monthly rentals rather than the leased assets. This psychology leads to lower recovery rate. Although UCL is very selective about their clients, but the organization does not achieved 100% recovery rate because of monthly overdue payments. There are different reasons for any leasing company fail to achieve 100% recovery rate. The reasons are mentioned below:

a) Change in Local & Foreign Policy

b) Poor Sector’s Performance

c) Poor Performance in Business

d) Political Instability

e) Insufficient Fund

f) Client’s relation with organization

g) Client’s unwillingness

Merchant banking:

Merchant banking unit renders following services:

Underwriting: The firm acts as intermediaries between the company issuing shares and the person willing to invest and in the process earn some commission from both the parties.

Portfolio management; The Company provides its services to its customers by preparing and managing a portfolio for their investment, minimizing their risks to the lowest level.

Bridge financing: Bridge financing is a short-term finance in anticipation of immediate long term financing such as loan against public issue, private placement, loan syndication, etc. The program of bridge financing involves Uttara Finance and Investments Limited to provide credit to a potential company, which is interested in floated shares. In this case Uttara Finance and Investments Limited will provide loan in a condition where the company would subscribe its shares through Uttara Finance and Investments Limited and in turn they will recover the loans from the company.

Facilities through syndication/consortia: Facilities through syndication involve sanction of term loans where the loans are divided among more than one financial institution. The process of syndication starts with a financial institution facing a credit demand, which is in excess of its legal credit limit. In that case the financial institution may form a syndicate by joining in with other financial institution or who are authorized of providing finances to give away the loans. Large financial institutions striving for the reserve funds may sell some portion of term and other loans. This also falls under the syndication service. Sometimes the financial institutions prefer to form syndicate to give away the loans, because it improves their credit diversification.

Mutual fund: Mutual funds are collection of funds by the investors with a mutual understanding to invest in different sectors. Uttara Finance and Investments Limited is an open-end investment company, that is they are eligible to issue new shares whenever investors, wishes to buy them. Likewise, they can be an active participant in a mutual fund and thus redeems shares whenever investors wishes to sell them.

Investment in capital market through investors’ account: The concept of investment in capital market through investor’s account involves collection of funds from the individual investor and then invested in stocks of different companies. The whole process goes through construction and management of a portfolio.

SME Financing

Small and Medium Enterprises (SME’s) play a vital role in the economic growth and development of the country, especially in one like ours. Bangladesh has approximately six (6) million micro, small, and medium enterprises with less than 100 workers, out of which around 27,000 are SMEs. Micro, small, and medium enterprises provide more than 75% of the income of the households in Bangladesh. The sector contributes nearly 25% of the GDP, 40% of gross manufacturing output, 80-85% of industrial jobs and constitutes around 25% of the total labor force making this sector an attractive one for lending by financial institutions.

UCL already has a diversified product portfolio, which is being constantly enriched with the addition of new products, catering to all the possible financing needs of the SME sector. At UCL, SMEs have access to long term financing in the form of Lease and Term Financing enabling the acquisition of capital machinery and other fixed assets for enhancing their productive capacity.

Market Capitalization:

If the NBFI represents a substantial percentage of the NBFI sector, its failure would cause severe disruptions for the country as a whole and it is thus likely to obtain government support in times of distress.

On December 2009, total market capitalization of NBFI sector was BDT 8621.00 million. Total market capitalization of UCL was BDT 317.00 million and share of UCL on this was 3.68%.the industry average is 3.45%. This is moderate in comparison to other. Here market capitalization of some selected NBFIs is given:

| Name | Mkt. Capitalization | Percentage of Mkt. Capitalization |

| UCL | 317.00 | 3.68% |

| UNITED LEASING | 231.00 | 2.68% |

| UNION CAPITAL | 349.00 | 4.05% |

| PEOPLES LEASING | 600.00 | 6.96% |

| IDCOL | 400.00 | 4.64% |

| IDLC | 250.00 | 2.90% |

| GSP | 206.00 | 2.39% |

| BIFC | 323.00 | 3.75% |

| IIDFC | 329.00 | 3.82% |

| IPDC | 713.00 | 8.27% |

Loan and Advances

UCL provides loans and advance in private and public sector. A sector wise analysis of the Bank’s loan portfolio shows that loans and advances more or less concentrated on real estate, agriculture, vehicle etc.. Last few years, on an average 51% of loans disbursed for industrial purposes. During 2009, BDT 8519.00 million loan and advances was distributed by UCL.

| Name | Total | Percentage of Mkt. |

| UCL | 8,519.00 | 7.39% |

| UNITED LEASING | 7,112.00 | 6.17%

|

| UNION CAPITAL | 3,253.00 | 2.82% |

| PEOPLES LEASING | 1,593.00 | 1.38% |

| IDCOL | 9,992.00 | 8.66% |

| IDLC | 15,564.00 | 13.49% |

| GSP | 1,643.00 | 1.42% |

| BIFC | 2,490.00 | 2.16% |

| IIDFC | 5,914.00 | 5.13% |

| IPDC | 4,899.00 | 4.25% |

In recent years Bangladesh Bank has introduced “Special Mention Account (SMA)” in the loan classification policy. FIs are required to make General provision @ 5% on the outstanding amount of loan and lease in “SMA” account. So there will be five categories of loan/ lease classification. However, it is reiterated that Loans and lease in “SMA” will not be treated as default loan. As per Bangladesh Bank (BB) Guidelines for NBFIs, installments overdue for the period of 3 months or equivalent are considered as Special Mention Account, overdue for more than 6 months but below 12 months are classified as Substandard, overdue more than 12 months but less than 18 months are classified as Doubtful and overdue more than 18 months are marked as Bad Loan. UCL also follows the same guideline regarding classification. The provision kept by UCL is also in line with the BB guideline.

| Classification status of Lease | ||||

| 2008 | 2009 | |||

Amount | Percentage | Amount | Percentage | |

| Standard | 2852548696 | 87.69 | 4004301508 | |

| SMA | 307870603 | 9.47 | 294995709 | |

| Total unclassified | 3160419299 | 97.16 | 4299297217 | |

| Sub- standard | 13267086 | 0.041 | 110721864 | |

| Doubtful | 33222000 | 1.02 | 88633646 | |

| Bad/loss | 45870513 | 1.41 | 112403127 | |

| Total classified | 92359599 | 311758637 | ||

| Total portfolio | 3252778898 | 4611055854 | ||

Figure : Non-performing loan

Union Capital Ltd has 3.40% lease reported under classified status in FY2008. Among these, 2.38% of lease is reported as bad loss. UCL was not able to improve the situation substantially in FY2009. Total classification portfolio under lease was increased to 3.80%. 2.58% lease was reported as bad loss in FY2009. In total, UCL has 96.60% lease portfolio as unclassified in FY2008. The company was not able to increase the percentage in FY2009.

UCL has kept in total Tk. 183.12 million for provision in FY2008. Tk. 116.95 million was kept for lease and Tk. 66.17 million was kept for term loan.

Rescheduled loan

UCL rescheduled 17 lease contracts in up to 30th September, 2009 with an amount of Taka. 144,354,753 which was 3.25% of total outstanding lease at the end of year 2009. Among the 17 rescheduled contracts in 2009, 4s are standard, 13s contract are bad loss. UCL rescheduled 22 term loan contracts in FY2008 representing an amount of Tk. 292,404,926. This amount is 12.00% of total outstanding term loan at the end of year 2008. Among the 22 rescheduled term loan contract in 2009, 10 contracts are standard, 7 contracts are Special Mention Account (SMA) and the rest 5 contracts are bad loss.

Ownership structure

UCL has a diversified ownership pattern; UCL is a public limited company having a total number of 3,168,000 ordinary shares of taka 100 each as on December 30, 2009. In it more than 65 percent is owned by directors of the company.

Delegation of Authority

The Managing Director of UCL approves all loan proposals. For the purpose of prompt service, UCL has Executive Committee headed by one of the directors. This Executive committee has the authority to approve any loan proposals with few exceptions. Exceptions are placed before Board of Directors.

Board Audit Committee

Members Board Audit Committee is functioning in order to oversee the activities of the company and to minimize operational risk in all affairs of the company. Company’s audit is done by S. F. Ahmed & Co

Well known

The board of directors of the company consists of 10 members including one independent Director. As per article 62 of the company one third of the total number of directors are to retire by rotation every year. Directors are not public face but they are recognized in their respective field.

Track Record

During the year 2009, the board of directors met 5 times. Most of the directors were present in all the meeting. During the year 2009, average presence of the board members was 82%.the company secretary and Chief Financial officer was also present in all the meeting.

Political Community

The board keeps friendly relationship with the government. No visualizing support was present there.

Status of the compliance with the condition imposed by the commission notification no.SEC/CMRRCD/2006-158/Admin/02-08 dated 20th February 2006 issued under section 2CC of the SEC ordinance, 1969.

- A. Accounting Quality

The financial statements, namely, Balance Sheet, Profit and Loss Account, Cash Flow Statement, Statement of Changes in Equity, Liquidity statement and relevant notes and disclosures thereto, of the Bank are prepared under the historical cost convention and in accordance with the first Schedule of Financial Institution Act 1993, Bangladesh Bank circulars, International Accounting Standards, including those that have been so far adopted by the Institute of Chartered Accountants of Bangladesh, the Companies act 1994, the Securities and Exchange Ordinance 1969, Securities and Exchange Rules 1987 and other laws and rules applicable thereto.

Significant Accounting Policies

Basis of Accountig:

The account are prepared under historical cost convention on generally accepted accounting principles and in accordance with international accounting standard (IASs) as adopted by the institute of chartered accountants of Bangladesh so far, and the companies act 1994 and the securities and exchange ordinance 1969 and securities and exchange rule 1987.

Accounting for leases

Following the Bangladesh accounting standard (BAS) 17, accounting for lease transaction have been recorded under finance lease method since all the risk and reward incidental to ownership are substantially transferred to the lessee as per agreement.

Fixed Assets and Depreciation Technique

Fixed assets are stated at cost less accumulated depreciation. Depreciation on fixed assets is charged using reducing balance method except motor vehicles, computers and photocopiers for which straight line method is used. Depreciation on fixed assets acquired for company’s own use is charged on a straight line method at different rates varying from 15% to 20% during the estimated useful lives of the assets. Full month’s depreciation is charged on the assets procured within 15th day of the month and no depreciation is charged for the month when the assets are procured after 15th day of the month.

Recognition and income expenditure

Income and expenditures are recognized on accrual basis. Interest income is admitted only if its realization is reasonably certain. Investment income is accounted for on accrual basis except treasury bills. The revenue during the year is recognition as follows complying with all the condition of revenue recognition as provided in IAS no. 18

Lease rental is recognized on accrual basis

Interest on term finance is recognized on accrual basis

Interest during construction period is recognized on accrual basis when found is disbursed for acquisition of leased assets

Income from lease rental and interest on term finance on classified lease and finance are not taken into income but credited to interest suspense account as per financial institutions development ( FID ) circular no.08 dated 03 August 2002 issued by Bangladesh Bank

Provision for Taxation

Income tax expense comprises current and deferred tax. Provision for current income tax has been made @ 45% as prescribed in the finance ordinance 2007 of the accounting profit made by the NBFI after considering some of the add backs of income and disallowances of expenditure as per BAS-12.

Disclosure : UCL published the necessary data required for the related party. It also maintains its business secrecy.

On time: Publishing of financial report by UCL is always in time. Account department try their best to deliver it on the time.

Detail: The financial statement of the company provides every things that can be required by an investor. It is one of the best reports recognized by the business world.

Consistency: There is no so much inconsistency in number, income recognition or significant change in account.

Provision for Classified Lease & Term Finance

Provision has been made in accordance with FID circular no 08. 03 August 2002 issued by Bangladesh Bank effective from the year 2002. Contents of the FID circular no.08 dated 03 august 2002 in respect of provision for classified leases and term finances are summarized below

Lease and term finance running overdue for 6 months and above are treated as substandard /doubtful/ bad depending on nonpayment statues of rentals’ / installments

Investments and interest which include overdue rentals / installment are not taken income but remain suspended till recovery

Basis of classification and percentage of provision are as under,

| Limit of overdue rentals / installments | Classification | Percentage (%) of provision on overdue |

| Up to 3 months | Standard | 1 |

| From 4 to 5 months | Special mention account | 5 |

| From 6 to11 months | Substandard | 20 |

| From 12 to 17 months | Doubtful | 50 |

| From 18 months & Above | Bad | 100 |

Rating | Rate |

Accounting quality | 8.20 |

- B. Risk Management

Risk management Leasing business is emerging to play a role between commercial banks and small enterprises requiring finance mainly for acquisition of vehicles and machinery on hire purchase basis. Firms that had difficulty to borrow from bank being regarded as risky are the main area of investment of non banking financial institutions (NBFIs). The NBFIs found it profitable to borrow from banks and lend the proceeds through leased or direct finance

In the ordinary course of business exposure to credit and market and liquidity risks are identified, measured and monitored through various control mechanisms establishment by Union Capital Limited.

Credit Risk

The management of specific credit risk is developed for individual business units. The lease risk management function ensures that appropriate policies are established to ensure compliance with the related monitoring procedure and controls at the business unit’s level. Credit exposures are aggregated from individual business units and are monitored on a regular basis.

Credit related risks may be summarized as under;

– Difficulty in selecting core business

– Encompassing a blend of banking and non banking services

– Granting of loans and advances either in liquid form or of questionable quality

– High risk area of business

– Competition with commercial banks

– Insufficient legal and regulatory framework

Portfolio monitoring is being carried out by measuring asset quality (credit rating) sector of the economy cost of long term borrowing to match with the long term investment. As other parts of the leasing business, the controlling staff follows a programm of regular monitoring and follows up

Market Risk

Expert opinion for choosing core business areas, finding out new business sectors, arranging low cost fund to invest at lower rate, taking step to avoid undue and unfair competition with commercial banks, etc are in effect to reduce the market risk.

Liquidity Risk

Liquidity risk is another important area for leasing companies to match the borrowing with the landings. long term and stable borrowings are prerequisite for long term investment. Beside this, inflow of cash through collection of dues on time is also essential. Effective monitoring and follow up are important tools to ensure the required collection. The company has an effective system to minimize the liquidity risk.

Rating | Rate |

Risk Management | 8.10 |

Ratios Used for Rating

| Operating performance | |

| Net interest income | 123311215 |

| Total operating income | 279459576 |

| Net income after tax | 163163332 |

| |

| Financial performance | |

| Earnings Per Share | 3.9 |

| Current Ratio | 0.28 |

| Net Profit Margin | 19.32% |

| Return on Equity | 28.48% |

| Return on Total assets | 3.27% |

| |

| Leverage position | |

| Debt Equity Ratio (Times) | 5.36 |

| Total investment to Net worth | 9.33 |

| Net asset value per share | 15.48 |

| Long-term liability to total investment | 73% |

| Provision to total investment | 7.40% |

| Financial Expenses Coverage Ratio | 1.62 |

| Financial Expenses to Income From Investments (Times) | 4.2 |

Peer Companies

| SL No. | Company Name |

1 | Delta Brac Housing Finance Corp. |

2 | GSP Finance Company Ltd |

3 | Islamic Finance |

4 | International Leas. & Fin. Serv. Ltd. |

5 | Lanka Bangla Finance |

6 | Prime Finance |

7 | Phoenix Fin. & Inv. Ltd. |

8 | Uttara Finance & Investment Co. Ltd. |

9 | Peoples Leasing & Financial Services Ltd. |

10 | Ind. Prom. & Develop. Fin. Co. Ltd. (IPDC) |

11 | MIDAS Finance Ltd. |

12 | National Housing Finance |

13 | Union Capital |

Findings

| Intercept | – | 12.43612579 |

| Debt Equity Ratio | X Variable 1 | -0.771612231 |

| Total investment to Net worth | X Variable 2 | 0.611321306 |

| Net asset value per share | X Variable 3 | -24.29092806 |

| Long-term liability to total investment | X Variable 4 | -3.636127907 |

| Receivables to total investment | X Variable 5 | 8.046660189 |

| Provision to total investment | X Variable 6 | 0.524893769 |

| Net Profit Margin | X Variable 7 | -8.566652571 |

From the above results, we get the following desired multiple regression equation for rating of UCL;

Y = 12.43 – .77 X1 + .61X2 -24.29X3 -3.63 X4 +8.04 X5 + .52X6 -8.57 X7

| Intercept | – | 12.436 | 12.436 | |

| Debt Equity Ratio | X Variable 1 | -0.771 | 1.58840 | (1.23) |

| Total investment to Net worth | X Variable 2 | 0.611 | 1.07980 | 0.66 |

| Net asset value per share | X Variable 3 | -24.290 | 0.16067 | (3.90) |

| Long-term liability to total investment | X Variable 4 | -3.636 | 0.00301 | (0.01) |

| Receivables to total investment | X Variable 5 | 8.046 | 0.05390 | 0.43 |

| Provision to total investment | X Variable 6 | 0.524 | 3.91580 | 2.06 |

| Net Profit Margin | X Variable 7 | -8.566 | 0.343574 | (2.94) |

| Rating | 7.502 |

From the calculation we found that UCL will have a credit rating of 8.56 which is analogous to “A+” (according to CRISL) or “AA2” (according to CRAB).

Rating | Rate | |

BBB+ (CRISL) | 7.50 | |

A2 (CRAB) | 7.50 | |

| Rating type

| Rating score |

| Qualitative Rating | |

| Industry risk | 7 |

| Key to success | 8 |

| Diversification factors | 8.1 |

| Firm size | 8.3 |

| Management Quality | 9 |

| Accounting quality | 8.5 |

| Ability to Risk Management | 8.1 |

| Total | 57.0 |

| Average score of qualitative rating | 8.14 |

| Quantitative rating | 7.5 |

| Weight of qualitative scoring | 40% |

| Weight of quantitative scoring | 60% |

| Final scoring | 7.75 |

Overall Credit rating of UCL for the year 2009 is designated as per the Qualitative and quantitative factor analysis. We assign 40% weight in qualitative analysis & 60% weight in quantitative value. By using these, we get a combine value of 7.75 for rating purpose.

This rating is equivalent to “BBB+” (according to CRISL) or “A2” (according to CRAB).

Rating | Rate |

A2 (CRAB) | 7.75 |

BBB+ (CRISAL) | 7.75 |

Conclution

Credit rating indicates assigning value to the probability of default of a firm. Credit rating provides an analysis of a company’s credit worthiness and debt capacity including a rating and a number of standard ratios analysis & model results. The report includes an analysis of a company’s creditworthiness and debt capacity by using a methodology based on well-established academic research. It provides peer-to-peer comparisons of credit risk factors analyses including credit rating, other standard credit scoring measurements, non-financial information, subsidiaries, major shareholders, profitability, interest coverage, capitalization and debt service capacity, liquidity, balance sheet and income statement.

Here we have done credit rating by using both qualitative & quantitative analysis. In qualitative section we have covered industry analysis, key to success of UCL such as branch coverage, capital adequacy, product portfolio etc, diversification factors, firm size, management performance and so on. In quantitative analysis we have taken 18 ratios of 13 companies and then run a multiple regression analysis. As per the calculation UCL deserve A2 and actual rating is AA+. Also regression equation is stating that dependent variable is explained 98.4% by the independent variable.