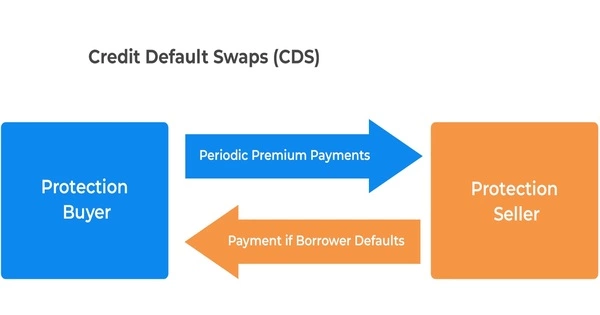

A credit default swap (CDS) is a financial contract that allows one party to transfer the credit risk of a specific asset, such as a bond or loan, to another party. CDS is a financial swap agreement in which the seller compensates the buyer in the event of a debt default (by the debtor) or other credit events. In a CDS, the buyer of the swap pays a regular fee to the seller in exchange for protection against the risk of default on the underlying asset. That is, the seller of the CDS insures the buyer against the default of some reference asset.

If a default occurs, the seller of the CDS is obligated to pay the buyer the face value of the asset, which can help offset the losses from the default. The buyer of the CDS makes a series of payments to the seller (the CDS “fee” or “spread”) in exchange for the right to receive a payoff if the asset defaults.

In the event of a default, the buyer of the credit default swap receives compensation (typically the loan’s face value), while the seller of the CDS receives possession of the defaulted loan or its market value in cash. However, anyone can buy a CDS, including buyers who do not own the loan instrument and have no direct insurable interest in it (these are called “naked” CDSs). There is a protocol in place to hold a credit event auction if there are more CDS contracts outstanding than bonds. The payment received is frequently significantly less than the loan’s face value.

How it works

A credit default swap is a derivative contract that transfers fixed-income products’ credit exposure. Bonds or securitized debt—derivatives of loans sold to investors—could be involved. Assume a company sells a bond to an investor with a face value of $100 and a maturity date of ten years. The company may agree to repay the $100 at the end of the 10-year period with regular interest payments for the life of the bond.

The risk is assumed by the investor because the debt issuer cannot guarantee that it will be able to repay the premium. The debt buyer can buy a CDS to transfer the risk to another investor who agrees to pay them if the debt issuer fails to meet its obligations.

Application

CDSs are often used by investors and financial institutions to hedge against the risk of default in their portfolios or to speculate on the creditworthiness of particular assets or companies. However, CDSs can also be complex and highly leveraged, which can amplify the risks associated with them. In some cases, CDSs have been blamed for contributing to the 2008 financial crisis, as the failure of large banks and financial institutions led to widespread defaults on CDS contracts.