INTRODUCTION: The principal reason banks are chartered by state and federal authorities is to make loans to their customers. Bank’s are accepted to support their local communities with an adequate supply of credit for all legitimate business and consumer activities and to price that credit reasonably in line with competitively determined interest rates. Indeed, making loans is the principal economic function of banks-to fund consumption and investment spending by businesses, individuals and units of government. How well a bank performs its lending function has a great deal to do the economic health of its region, because bank loans support the growth of new businesses and jobs within the bank’s trade territory and promote economic vitality.

For most banks, loans account for half or more of their total assets and about two-thirds of their revenues. Moreover, risk in banking tends to be concentrated in the loan portfolio. When a bank gets into serious financial trouble, its problems usually springs from loans that have become uncollectible due to mismanagement, illegal manipulation of loans, misguided lending policies or an unexpected economic downturn.

OBJECTIVE

The main objective of this project is to analyze the performance of the loan portfolio of Southeast Bank Limited and also its credit policies which would show how the private commercial banks of Bangladesh lends to different kinds of clients. One of the other objectives of this report is to find out how effective is the loan recovery system of Southeast Bank Limited.

METHODOLOGY

Both primary and secondary sources of data were used towards the completion of this project. The main primary source of data was the interview with the different level of employees in the credit department of the Head Office of Southeast Bank Limited. Relevant files study that were provided by the officers concerned with credit department were also used.

Secondary data were mainly used for the completion of this project. Some of the secondary data that were used are

Annual Report of Southeast Bank Limited

Credit Policy Guide (SBL)

Credit Operation Manual (SBL)

Books, magazines, articles and etc. were also used.

SCOPE

This project is limited to only explaining some of the major parts of credit policies and analyzing the performance of some of the major credits that are offered by the bank.

SIGNIFICANCE

This project will allow gaining knowledge about lending policies and procedures of private commercial banks. It will also help to understand how the loan portfolio of Southeast Bank Limited is performing in comparison with other banks.

This project will help SBL to understand if they have any lacking in the lending procedure and will also help them to get an idea of how the different kinds of credit that that are offering id performing and will help them to find out ways of how those loans can perform better.

LIMITATIONS

Credit is one of the most important parts of a bank. In order to get vast knowledge regarding this sector, time is needed. Three months internship program is not enough to gain enough information regarding this topic.

Working in the credit department was not possible as the internship program was done in the Human Resources Department and it was not possible to concentrate only on the project because other duties in the HRD had to be done.

Due to two project part, some lacking may be there as concentration was not given to both of them in the same manner.

Some of the data are very confidential and as a result, those information were not revealed.

All data regarding were not available and could not be collected due to the shortage of time.

CREDIT DEPARTMENT OF SOUTHEAST BANK LIMITED, HEAD OFFICE

The credit department of any banking institution is one of the most important and busy department that has to do a lot of work and the work that are done in this department are very risky and importance. The risk is not in the sense of physical but tremendous mental works have to be done here.

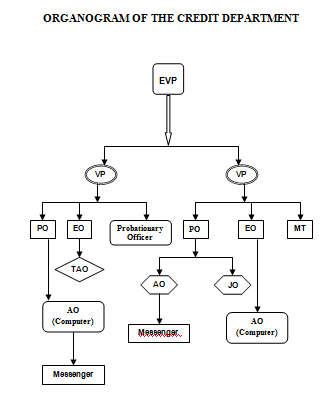

Southeast Bank Limited currently has approximately 30 people working in the credit department of the head office, which is the head of all the branches and from where all the credit facilities given to the clients are sanctioned and monitored. The credit division is headed by an Executive Vice President and two Vice Presidents under whom all the other staffs of the credit department holding different positions are working. Each and every work in the credit division is properly distributed to the subordinate staffs and it is possible because the work in the credit division is very systematic.

The Credit Division of Southeast Bank limited is divided in two parts. (i) General Credit (ii) Corporate Finance.

General Credit

The functions of this division are given below:

Analysis and appraisal / evaluation of credit proposals for approval of Credit Committee: This means that when a client place a proposal for credit, that proposal is first analyzed in order to see if the client is credit worthy or not and then approved by the committee that appraises the credit proposal.

Preparation of Board Memo: After the credit committee has approved the credit, a memo is prepared in order to get the approval of the Board.

Communication of Sanction Advice: This means that when a credit is placed in any branch, the branch manager or the concerned officer who is handling the loan must communicate with credit department of head office where the loan will be reviewed and then if the loan is feasible they head office will give sanction advice to the concerned officer of the branch to give the credit to the client.

Preparation & Submission of periodical returns to Bangladesh Bank: The credit department has to submit all the returns that they get from the loans and give a brief report on their proceedings on a periodical basis to the Bangladesh Bank.

Corporate Finance

Under this division all the corporate credit like industrial credit, long-term project credits etc. are taken into account. SBL recently is trying to increase the amount of corporate loan portfolio although it has been seen that most of the other banks are concentrating mainly on consumer loans. The main functions of corporate credit division are

Analysis, appraisal / evaluation of credit proposals: All the corporate loan like industry, commercial and other big loans are analyzed and evaluated by this department.

Processing Credit proposals for approval of Credit Committee: This is the same as above where the credit proposal has to be processed in order to get the approval of the credit committee before the sanction of corporate loan.

Preparation of Credit Information Memo (CIM) for Board: Same as above expect the fact that the credit for which the memo is placed before the board is of corporate nature.

Communication of Sanction Advice: Same as above but the sanction advice here is for the corporate loan.

TYPES OF CREDIT

Southeast Bank Limited offers different types of credit facilities to its clients comprising of both general and corporate credit. General credit comprises of facilities like consumer scheme, working capital, demand loan and etc. The corporate credit portfolio comprises of all the credit that are of long term.

All the credit facilities are actually brought under two broad categories:

Funded Credit Facility

Non-Funded Credit Facility

FUNDED CREDIT FACILITY:

A funded credit facility that the bank offers to a customer result in actual disbursement of cash to the client. In order to provide funded credit facility to a customer the bank has to incur real liability before hand, that is the bank has to arrange for funds primarily through deposits that the bank takes form different other clients. Funded credit affects the balance sheet of the bank both in terms of increase of liability and increase of assets. Some of the types of funded credit are

LOANS

Loans may be a demand loan, time loan or a term loan.

Demand loan is payable on demand which is allowed for a short period of time to meet short-term working capital need. But SBL uses the demand loan for import finance. While opening the letter of credit (L/C), the bank offers this loan to reduce the L/C margin. After the L/C document arrives, the client is requested to adjust the loan and retire the L/C document. At the time of providing the demand loan, the L/C stands as security.

Time Loan is payable within one year. This loan is generally provided to the clients where finance is required for a specific business deal. Like the bank may provide time loan to a client to procure a particular machinery. The loan is disbursed in one or toe installments abd the same amount has to be adjusted within a year in lump sum or through installments as per specific repayment dates. Depending upon the purpose time loan is generally secured by hypothecation of marketable goods and mortgage of properties.

Term loan is allowed for one year to five years, usually for capital expenditure such as construction of factory building, purchase of new machinery, modernization of plant and other long-term projects. This kind of loan is very selective in SBL. This type of loans must be approved through the Board of Directors due to the fact that there is a huge amount of finance related to this kind of loans.

OVERDRAFT:

Overdraft is an arrangement between a credit officer and his customer by which the client is allowed on the basis of prior arrangement to overdraw his current account by drawing cheques for amount exceeding the available balance up to an agreed limit within certain period of time but not exceeding one year against acceptable securities. This is a temporary accommodation of fund to the client. This is operative credit facility extended to the client as working capital finance for trading and manufacturing business and also finance against work orders.

Specific limit covering the sanctioned loan amount is given on client’s current account. Client is allowed to overdraw and maintain regular transaction upto this limit in his current account. The drawing power of the client depends on the sanctioned amount and margin stipulation.

Specific repayment dates are given within which client has to adjust his overdrawn amount. Hypothecation of stocks, assignment of bills and mortgage of properties generally secure the overdraft facility.

Overdraft against pledge of goods (stocks):

This facility may be extended to the borrowers against pledge raw materials/ finished products a security subject to credit and margin restrictions imposed by Bangladesh Bank from time to time. In this case, the client signing a duly stamped Letter of Pledge surrenders the physical possession of goods under the effective control of the Bank. The ownership of the goods still remains with the borrower and the outstanding liabilities are to be adjusted out of the sale proceeds.

Overdraft against hypothecation of goods (stocks):

This facility may be extended to the borrowers subject to credit and margin restrictions imposed by Bangladesh Bank from time to time, on the client signing a duly stamped Letter of Hypothecation creating a charge against the raw materials/ finished goods/ plant and machineries etc hypothecated to the Bank as primary security against the advance. In this case both the ownership as well as the physical possession of the goods hypothecated remain with the borrower who binds himself by an agreement to surrender the physical possession of the goods to the Bank as and when called upon to do so. The Bank only acquires a right over the goods hypothecated. The Bank, therefore, generally request the borrower to furnish collateral securities by way of legal or equitable mortgage of immovable property and/ or third party guarantee where it seems fit to the Bank.

BILLS DISCOUNTED AND PURCHASED

Discount: banks allow advances to the clients by discounting bill of exchange/promissory note which matures after a fixed tenor. In this method, when the bills of exchange is submitted by the client, a margin (covering also the interest on the loan) amount is deducted from the face value of the bill and the rest is provided to the client. At maturity of the bill, the same has to be presented to the drawer for full proceeds of the bill through which loan is adjusted. Separate bill discounting account is created. The bill of exchange itself is held as the primary security collateralized by the equitable mortgage of property.

Purchase of Bill: Banks also make advances by purchasing bills, instead of discounting, which are accompanied by documents of title of goods such as bill of landing or railway receipts etc. In this case, the Bank becomes the purchaser/owner of such bill which are treated as security for the advance. This is allowed primarily relying on the credit worthiness of the client.

Other Funded Facilities:

Bills under L/C (BLC): Advances against bills under letter of credit are originated from the lodgment of shipping documents received from foreign banks against letter of credit established by the Bank.

Loan against Imported Merchandise (LIM): Under this type of credit facility, the Bank releases the imported goods through the nominated clearing agent of the Bank. In this case, Bank holds the possession if the goods. Importer takes delivery of the goods from the Bank’s warehouse against payment. It is one type of forced loan.

The imported merchandise pledged to the Bank provides the primary security that is sometimes collateralized by equitable mortgage of property.

The following points are taken into account while allowing advance against the security of imported goods.

Storage of imported goods under LIM facility may be allowed for specified time as prescribed by Bangladesh Bank/ Head office of the Bank within which period the importer should take delivery of the goods against payment.

Generally, part delivery is not allowed from LIM account. This may however be allowed only on special terms and conditions.

While creating forced LIM, manager should satisfy that forced sales value will cover the outstanding LIM, if not, arrangement should be made to recover the liabilities through sale of goods. Prior approval of the Head office is to be made for creating forced LIM.

Trust Receipt (TR): Advance against trust receipt to the client is to release shipping documents for taking delivery of merchandise that is hypothecated to the Bank. This kind of loan is only provided to very selective clients only.

Sometimes as per earlier arrangement or under compelling situation, Bank allows valued clients to retire the L/C documents without adjusting the demand loan or outstanding BLC. The documents are provided to the client after transferring the outstanding liabilities to TR account.

Packing Credit: It is one type of export finance. Packing credit is a short-term credit granted by the Bank to an exporter to facilitate purchase of raw materials for the purpose of manufacturing processing, packing and exporting the finished goods. The credit is granted after the evidence of a letter of credit or a firm contract in favor of the borrower and against the security of inventory purchased by the borrower.

This loan is provided at low interest rate as per instruction of the Bangladesh Bank. The packing credit is adjusted through the export proceeds. The export L/C becomes primary security for the loan. The loan is sometimes collateralized by equitable mortgage of property.

NON-FUNDED CREDIT FACILITY

Non-funded credit facility to a customer refers to a bank’s commitment to a third party on behalf of the customer. The commitment itself constitutes facility but does not involve cash outflow from the Bank. The bank’s commitment essentially states that in the event of occurrence / non-occurrence of a particular event, within a particular date, due to a particular reason, a specific sum of money shall be paid by the Bank to the third party upon claim in a particular manner. Though this type of credit facilities is generally non-funded in nature but at times it may turn into the funded type. As such, liabilities against this type of credit facilities are termed contingent credit facilities and do not affect the balance sheet of the Bank at the time of commitment but it holds the possibility of affecting it. The non-funded credit facilities are

Letter of Credit (L/C): A Letter of Credit is a commitment taken by the Bank to pay an agreed sum to the seller of goods on behalf of the buyer (client) under specific defined condition. This is a non funded facility provided to the client for import of goods from abroad or in some cases to produce them locally.

Once the Bank receives the L/C documents as per specified terms and condition of the L/C, the amount is transferred to the bills under letter of credit (BLC) account. As per commitment, Bank pay the seller of goods through the seller’s bank and settles the outstanding BLC amount from the client before handling over the L/C documents to him.

Bank Guarantee: Bank guarantee is also a non funded credit facility provided to the client. The Bank on be half of the client undertakes to pay agreed amount of money at certain time if client fails in due performance.

PROCEDURE FOR GIVING ADVANCE:

Introduction

The credit policy of any banking institution is a combination of certain accepted, time tested standards and other dynamic factors dictated by the realities of changing situations in different market places.

The accepted standards relate to safety, liquidity and profitability of the advance whereas the dynamic factors relate to aspects such as the nature and extent of risk, interest on margin, credit spread and credit dispersal. General guidelines about the conduct of advances are issued by Head Office. In all business dealings, officers and employees must be guided by the principles of honesty, integrity and safeguard the interest of the depositors and shareholders of the Bank. They should strictly adhere to the Banking Laws, Rules and Regulations of the Government of Bangladesh, the instructions issued by Bangladesh Bank/Head Office from time to time which affect the business practices of the Bank. However, the key to safe, liquid, healthy and profitable credit operation lies in the quality of judgement used by the officers making lending decisions and their knowledge of the borrowers and the market place.

For the sake of sound lending, it is necessary to develop a sound policy and modern lending techniques have to be adopted to ensure that loans/advances are safe and the money will come back within the time set for repayment. For this purpose, proper and prior analysis of credit proposals is required to assess the risk. Lending itself is risky and the very purpose of analyzing the risk is to locate /identify the risk obtaining possible precaution. While deciding a loan proposal one is to judge the degree of risk in a given situation. Banker’s ability in taking prior measures to minimize the risk involved is very important. To do this a Bank must follow the Principles of Sound Lending.

Safety

Security

Purpose

Profitability

Liquidity

Diversification

National Interest

In formulating a credit judgement and making Quality credit decisions the lending officer must be equipped with all information needed to evaluate a borrower’s character, management competence, capacity, capital, ability to provide collaterals and external conditions which may affect his ability in meeting financial obligations.

Credit and Marketing Fundamentals:

- To place a high priority on the QUALITY of credit exposure, new proposals must meet Bank’s credit criteria and existing portfolio should be under constant review for improving risk positions.

- Maximization of profit is the basic aim of the Bank, as such every profit opportunity should be explored and professional skills employed in this direction.

- Growth towards the size of customer base through constant alertness towards profitable business opportunity.

- To avoid unnecessary wastage of time and energy, clear, concise and summary type communication should be used.

- To be thoroughly familiar with the Bank’s policies and functions.

- To put every effort in reducing and containing the size of classified advance portfolio.

- To keep the expense burden on credit operations to the barest minimum and endeavor to improve the cost efficiency of credit operations.

- To contribute one’s best in all matters where his approval, concurrence or other actions is involved.

- To avoid all temptations which may jeopardize or compromise the Bank’s risk assets.

Risk Management-Lending Decision

To safeguard Bank’s interest over the entire period of the advance, a comprehensive view of the capital, capacity, integrity of the borrower, adequacy, nature of security, compliance with all legal formalities, completion of all documentation and finally a constant watch on the account are called for. Where advances are granted against the guarantee of a third party, that guarantor must be subjected to the same credit assessment as made for the principal borrower. The basic security valuations will be expert third party assessments, current market price and forced sale value.

While making lending decisions, particular attention should be given to the analysis of credit proposals received from heavily leveraged companies and those dealings in non-essential consumer goods, taking special care about their debt servicing abilities.

Emphasis should be given on the following sound credit principles:

I. Present and future business potentiality for optimum deployment of Bank’s fund to increase return on assets.

II. Preference for self-liquidating Quality business.

III. Avoiding marginal performers.

IV. Risk dispersion is basic to sound credit principles and policies. Bank should be careful about large and undue concentration of credit to industry, one obligors and common product line etc.

V. Managing the amount, size, nature and soundness of one obligor exposures relative to the size of the borrower and Bank’s position among his other lenders.

VI. Personal guarantees of the principal partners or the Directors of the companies and where necessary, subordination agreement should be obtained.

VII. Recognize impact of fee income through Remittances, Letter of Credit, Letter of Guarantee, Foreign Exchange business in enhancing return on assets.

VIII. The asset-conversion or transaction flow cycle and the net-trading cycle of the customer i.e. the terms on which they conduct the business.

Credit risk evaluation:

An accurate appraisal of risk in any credit exposure is highly subjective matter involving quantitative and qualitative judgements. The financial statements of the borrower do not always provide a complete picture. Bank must use all financial data available and combine this with qualitative factors in analyzing the borrower’s financial position. In evaluating any credit proposal, the analyst must follow THREE distinct and logical steps to conclude on and make appropriate recommendations. These are:

STEP 1: Historical Analysis (Identify nature of risk)

Evaluate the past performance of the borrower. Determine the major risk factors and how they have been mitigated in the past. Identify factors in the borrower’s present condition and past performances which may foreshadow difficulties or indicate likelihood of success in his ability to repay the loan at a future time.

STEP 2: Forecast (Judging future degree of risk)

Having identified the nature of risk involved and how these can be mitigated, make a reasonable forecast of the probable future condition of the borrower and conclude on his ability to service the proposed level of debt.

STEP 3: Debt Structure and Protection

Assess the borrower’s credit worthiness and prepare a proposal for structuring a credit facility that can be repaid or amortized given the borrower’s assets or his projected Cash flow and the facility offering adequate protection against loss and control of the lending relationship.

Modern Concept of Lending Principles Applied by Southeast Bank Limited

Modern concept of lending pre-supposes a well-developed loan proposal. It will cover as many as six pertinent factors like Management, Organizational, Technical, Marketing, Financial and Economical. These are technically known as feasibility or viability study of a loan proposal. By studying all these factors if a credit officer is satisfied about the viability of a loan proposal, then he/she can finance it i.e. grant for lending otherwise not.

Techniques for Project Appraisal

“Project Appraisal” means pre-investment analysis of an investment project with a view to determine its commercial and socio-economic feasibility. It is an essential tool for judicious investment decision and project selection. It is the prime step in the process of decision making in respect of sanctioning any loan by financial institutions.

The under mentioned appraisals are conducted by the branches of SBL while evaluating an investment proposal:

- Management Appraisal

- Market Appraisal

- Technical Appraisal

- Financial Appraisal

- Economic Appraisal

Management Appraisal: A good project may fail if the Management is incomplete. It is necessary to evaluate the following managerial aspects:

Overall background of the promoters

Academic qualifications

Business and industrial experience

Past performance and market reputation

Market Appraisal: Market appraisal is concerned primary with two main issues

- The aggregate demand of the proposed product/service in the future

- The market share of the project under appraisal

To answer the above issues, it requires a wide variety of information and appropriate forecasting methods. The required information are:

Consumption trends in the past and the present consumption level

Past and present supply position

Production possibilities and constraints

Imports and exports position

Structure of competition

Cost structure

Elasticity of demand

Distribution channels and marketing policies in use.

Technical Appraisal: The importance of technical appraisal in project evaluation is beyond any question. Technical appraisal of a project broadly involves a critical study of the following:

Location and site

Raw material supplies

Transportation facilities

Power and fuel supply

Water

Manpower

Adequacy and suitability of the plant and machine

Plant layout

Balancing of different sections of the plant

Building and layout

Financial Appraisal: Financial appraisal seeks to ascertain whether the project will be financially viable in the sense of being able to meet the burden of servicing debt and whether the proposed project will satisfy the return expectations of those who provide capital. The aspects looked into while conducting financial appraisal are:

Investment outlay and cost of the project

Means of financing

Cost of capital

Projected profitability

Break-even point

Cash flows of the project

Level of risk

Economic Appraisal: Economic appraisal also referred to as social cost benefit analysis, is concerned with judging a project from the larger social point of view. In case of certain rural projects like irrigation projects, power projects, transportation projects or other infrastructural projects-social cost benefit consideration is as important as and sometimes more important than commercial profitability considerations.

The following factors should be considered so as to ensure a successful econimic appraisal of the project:

Generation of employment

Income distribution

Self-reliance

Development of small scale and ancillary industries

Development of infrastructure

Improvement of living standard

The procedure followed by Southeast Bank Limited in order to give credit facility to its client is very lengthy and quiet complicated.

First of all the potential borrower will submit application to Southeast Bank Limited for credit facility by filling a particular application form. The application form contains the following:

Name of the borrower

Account Number

Business address, Residential Address and permanent address with phone number

Introducer’s name, Account number and address with phone number

Date of establishment/incorporation

Trade license number, date of issue and expiry date

Income tax payment history for last three years

Type of business (Sole proprietorship/Partnership/Private Limited/Public Limited company etc)

Particulars of individual/partner/directors (Name, Address, Designation, Father’s name, Husbands name, Shares held)

Experience and background of individual/director/proprietorship/partner

Full particulars of the asset held by the individual/partner/director/….. with valuation

Nature and detail of business/products (for which the credit facility is requested for)

Estimated sales for next one year

Credit facilities required (Type, amount, period, purpose and mode of adjustment)

Details of securities offered with estimated value (Primary security, Collateral security, market value of the security)

Detail of liabilities in the name of the client or in the name of any other partner/director or subsidiaries/affiliates with Southeast Bank Limited or with any other bank if any (name of the bank, account number, nature of advance, amount, security and validity of limit)

Balance sheet, Income statement or statement of account usually of the last three years

Some important ratio

Other relevant information

Proposed debt/equity ratio

Signature of the Applicant

After receiving the loan application form, Southeast Bank Limited send a letter to Bangladesh Bank for obtaining a report from them. This report is called CIB (Credit Information Bureau) report. This report is important if the loan amount exceeds Tk. 5 million. But SBL usually collects this report if the loan amount exceeds Tk. 1 million. The purpose of this report is to inform that whether the borrower has taken loan from any other bank and if yes then whether these loans are classified or not.

Then after receiving CIB report from Bangladesh Bank, if the Bank thinks that the prospective borrower will be a good borrower, then the Bank will scrutinize the documents. In this stage, the bank will check whether the documents are properly filled up and signed.

After this comes the processing stage. In this stage, the Bank will prepare a Proposal. A proposal contains the following relevant information:

Name of the borrower

Nature of limit

Purpose of limit

Extent of limit

Security

Margin

Rate of interest

Repayment

Validity

Each and every branch of the Bank has certain discretionary power to sanction a specified limit against financial obligation by informing the Head Office. But for this the branch must see two basic things

- The interest rate must not be less than 5%

- The borrower must maintain a margin of 10%

Except this, the branch has to send the proposal to the Head Office where a minute will be prepared and submitted before the Executive Committee (EC) and there that minute have to be passed.

After passing of the minute by the EC, it will be send to Bangladesh Bank for approval in case of the following :

- If the proposal limit exceeds 15% of Bank’s equity

- If the proposal limit against cash collateral securities exceeds 25% of Bank’s equity

After getting the approval of Bangladesh Bank it will again come to the Head office where after the sanction advice, the Bank will collect the necessary documents. The documents that are collected are given below:

Joint Promissory Note

Single Promissory Note

Letter of Undertaking

Loan Disbursement Letter

Debit Figure Conformation Sheet

Letter of Continuity

Letter of Authority

Letter of Revival

Letter of Guarantee

Letter of Indemnity

Trust Receipt

Hypothecation of Goods

Hypothecation of Vehicles

Counter Guarantee

Letter of Lien

Letter of Lien in case of advance against FDR

Letter of Authority to encash FDR

Letter of Agreement for Packing Credit

Letter of Guarantee for opening of L/C

Memorandum of Deposit of Title deeds

Hypothecation of goods to secure Demand Cash Credit or Overdraft/Loan amount

Guarantee by third party

For withdrawing the loan amount, the customer creates a C/D account and the loan is transferred to the C/D account from where the customer can withdraw the money.

DOCUMENTATIONS AGAINST BANK CREDIT

Documentation is one of the major aspects of credit functions of Southeast Bank Limited. The main income generating activity of a Bank in Bangladesh is providing credit services to customers preferably in a secured manner. The charge in securities against credit facilities is created through execution of relevant documents formalities and as such, the Bank can largely at a future date fall back the securities held for recovery of the dues. Besides, documents are the physical embodiment of liability. It is to be ensured that documents should be prepared and executed according to the law and should not confront with the rules and practice of Banking. Consequently, documents should be drafted and executed under the supervision of professional lawyer/legal adviser.

Documentation:

Documentation is the written statement of facts or evidence in regard to a particular transaction, which on placement may bind the parties answerable and liable to the court of law. The characteristics of documentation are as follows:

It should be written statement of facts

The facts should cover all the legal aspects

It must be an evidence of certain transaction

The person having authority and legal power should sign it

There might be some witnesses

It should be stamped as per required according to the type of document

Importance of Documentation:

Documentation formalities against loans and advances should be properly completed prior to extension of the facility to safeguard the Bank’s interest. Complete and correct documentation enables the credit officer of SBL to take legal resource against the borrower in case of non-realization of dues.

Types of documentations

Documents related to securing loans and advances are classified into the following 2 categories:

- Charge documents are preformatted and printed required to create charge on securities against loans and advances and the documents are provided by the Bank to the client for execution.

- Legal documents are legal papers provided by the client, certifying the legal status of the borrower, borrowing power, tile to goods and property, legal deeds and power of attorney related to creation of charge on securities.

Steps of Documentation

The following steps of documentation should be followed in sequence:

- Obtaining of the instruments

- Stamping

- Execution

- Witnessing

- Registration

- Preservation

Obtaining of instruments/documents

The documents to be obtained depends upon 3 factors

- Legal status of the borrower

- Type of facility

- Nature of security

Common type of documents:

The documents ate are common to all type of loans and advances are specified below:

Demand promissory note: Demand promissory note is an unconditional written promise made by the borrower to the Bank to repay the amount of loans/advances at a fixed or determinable future date along with interest at a stated rate.

Letter of arrangement: The borrower acknowledges the Bank’s right to cancel the facility allowed at any time without assigning any reason and with or without prior notice.

Letter of continuity: The borrower undertakes to remain liable on the demand promissory note and other loan documentation even if the liabilities are fully or partially adjusted during the tenure of the credit facility and even though the account may show credit balance from time to time.

Letter of revival: The document refers to the law of limitation whereby documents become time barred after 3 years from the date of execution. The period of limitation within which a suit for recovery of the overdue loans/advances to be filed is the ordinary period of 3 years from the date on which the facility was extended. The limitation period for mortgage is 12 years beginning on the date of the mortgage deed.

Stamping of Documents

According to the provisions of stamp Act 1899, all documents chargeable with duty shall have to be stamped adequately and properly before or at the time of execution. An unstamped and insufficiently stamped document cannot be admitted in evidence or cannot form the basis of a regal suit.

The types of stamps are described below:

Judicial: Judicial stamps are used in the court for filing suits and for judicial noting and are not required for loan documentation.

Non-judicial: Non-judicial stamps are used for deeds, agreements, undertakings and power of attorney.

Adhesive: Adhesive stamps consoling revenue stamps and special adhesive stamps are affixed on various charge documents/forms.

Embossed: These types of stamps are used as seal of notary public and organizational stamps.

Execution of Documents:

Documents must be executed (signed) by the person(s) concerned competent to do so either in official capacity or in personal capacity as the case may be. In other words, the borrower authorized representative must do execution of documents.

Documents to be filled in with permanent ink or be typed.

The executants should sign in full according to the specimen signatures kept with the Bank.

The documents must be executed in the presence of the Manager or authorized officer of the Bank. The Manager/Officer must verify the signature.

If the document comprises of more than one page, the executant should sign all the pages.

It is a must to mention date and pace of execution. No documents and no column in a document should remain blank.

There should not be, a far as possible, any cutting, overwriting, alteration, insertion or cancellation in any documents. Any alteration under competing situation, however, must be authenticated under full signature by the executants.

The date on the promissory note must be the same as on other relevant documents.

Witnessing

The following documents are required to be must attested by at least 2 witnesses.

Mortgage deed

Sale deed

Gift deed

Assignment of life insurance policy

Will

Registration of documentation

Registration is not applicable for all the documents. In the following few cases, registration of documents is necessary to give legal effect to the instruments.

- The assignment of an insurance policy to be registered with the respective insurance company.

- The mortgage deed vetted by the legal retainer to be registered with the office of the Sub-Registrar.

- Fixed and floating charges on the assets of a limited company to be registered with the Registrar of Joint Stock Company.

Preservation of Documents:

Upon completion of all the documentation formalities, documentation checklist to be prepared consisting of the list of the required documents.

The checklist should be examined and signed by an authorized officer.

Documents should be kept in safe custody generally in the vault.

Separate files to be maintained for different customers.

Documents movement Register should be maintained under the supervision and signature of an authorized officer.

Documents required for different kinds of Loan:

In case of Loan:

Letter of disbursement

Letter of Authority

Letter of Hypothecation (when goods are hypothecated as security)

Insurance Policy (If required)

Any other documents as stated in sanction advice.

In case of Overdraft:

Letter of continuity

Letter of authority

Letter of Hypothecation (when goods are hypothecated as security)

Insurance Policy (If required)

Any other documents as stated in sanction advice.

In case of cash credit:

Letter of continuity

Letter of authority

Letter of pledge/hypothecation

Insurance policy under Bank’s mortgage clause

Letter of disbursement in case of renewed warehouse

Any other documents as stated in sanction advice

In case of Transport Loan:

Letter of Hypothecation of vehicles (in separate form)

Photocopy of blue book

Photocopy of route permit

Insurance policy under Bank’s mortgage clause

Any other documents as stated in sanction advice

In case of Legal Mortgage:

Mortgage deed

Original registration receipt

Chain of documents for title

Up to date rent receipt

Power of attorney

Legal opinion

Valuation certificate

Location plan/site plan

In case of Equitable Mortgage:

Chain of documents for title

Original title deed

Up to date rent receipt

Memorandum of deposit of title deed

Registered power of attorney

Legal opinion

Valuation certificate

PERFORMANCE ANALYSIS OF THE CREDIT PORTFOLIO

Southeast Bank Limited offers a number if loans in various forms to its customers like demand loans, time loans, term loans, consumer credit scheme, BLC, LIM and etc. These loans are the main source of income which enables SBL to operate so efficiently and effectively. The performance of each type of loan are discussed in this part.

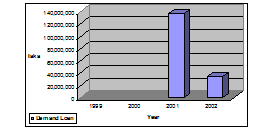

Demand Loan: During the year 1999 and 2000, there was no demand loan present in the loan portfolio of Southeast Bank Limited. However, in the year 2001, demand loan stood nearly 1.5% of the total loan but it dropped again to nearly 0.27% during 2002. It can be seen that SBL doesn’t give much importance in this type of loan.

The performance of this loan is not up to the standard because the Management doesn’t give much preference to demand loan.

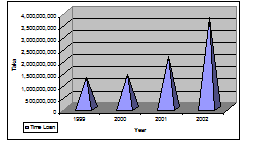

Time Loan: Time loan is one of the most important parts of the credit portfolio of any Bank that contributes quiet a lot to the Bank. Southeast Bank Limited also has a pretty healthy term loan position. During the year 1999 and 2000, the position of this loan was pretty stable but from 2000, it is rising at a good rate. The average growth rate from the year 2000 was approximately 105% which is really high. It occupies nearly 12.5 % of the total credit portfolio of Southeast Bank Limited.

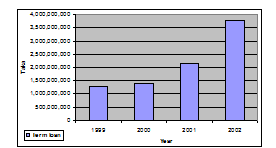

Term Loan: Term loan is the second most important and highest percentage of the total loan portfolio of Southeast Bank Limited. It nearly holds 24.5% of the total credit portfolio of SBL. It is rising every year in a stable manner and the growth rate of this loan is approximately 46%. It is expected that during the year 2003, this loan will increase to approximately Taka. 400 crore which is quiet a lot compared to other loans that are offered by SBL.

Consumer Credit Scheme: This type of loan is gradually increasing in Bangladesh and more and more people are taking this loan for various kinds of purpose. Every Bank in Bangladesh is concentrating more and more in this type of loan as it is very much secured. SBL like any other Banks is also nowadays focusing on this loan. During the year 1999, 2000 and 2001 the growth was pretty stable but after that it took a sharp rise. It is found out that SBL is giving more and more Consumer Credit in the recent times and trying to attract customers by introducing new schemes. Although its contribution to the loan portfolio of SBL is very nominal that is only about 0.25% but it is growing slowly and it is one of the most safest credit that is given to the people.

Bills against letter of credit (BLC): Bills against letter of credit is one of most important part of a ban and every bank use to have this in its credit portfolio. Southeast Bank Limited also have quiet a good position in this loan. Although it was higher during the year 1999 and 2000, the loan fall during the next year and the reason behind this was that SBL was due to some default in this loan. But the Bank knows that this is an important business and it had to give this type of loan as the business is huge. But currently Southeast Bank is taking great care in sanctioning BLC. The BLC occupies nearly 6.8% of the total credit of SBL.

Loans against trust receipt (LTR): This type of loan was very nominal before the year 2001. During the year 1999 and 2000, this loan was only 0.12% of the total loan portfolio. But in the year 2001, it jumped to nearly 21% of the total loan portfolio and last year it contributed approximately 17% of the total portfolio. This seems that the LTR is growing very fast and it is forecasted that it will continue to contribute nearly 10-20% of the loan portfolio for another 3-4 years.

Packing Loan: SBL doesn’t give away this type of loan very much. During 1999 and 2002, this loan was given but that was very nominal.

Loan against imported merchandise (LIM): LIM is quiet a common credit given away by nearly all the Banks that are operation in Bangladesh. SBL also give this type of loan but the significant side is that this loan is continuing to fall sharply. This loan was huge during the year 1999 and 2000. But in the year 2001, it fell sharply and is continuing to fall further.

Loan against foreign bills: This type of credit is also very much limited and it only consists of only around 0.07% of the total credit portfolio of SBL.

Other Loans: The other loans contains Car loan-staff, House building loan-staff and etc. which is also not very high because it is given only to the employees of the Bank and only to the high ranked officers. So ultimately, the clients of this type of loan are the employees of the Bank who are very limited in number. But even then, it is much higher than some other. Although it is usual that due to the expansion of business, branches and employees the amount of this loan is suppose to increase but it shows that it is decreasing gradually. The reason behind this is that SBL according to its new rules has lower the amount of loan that the employees can get from the Bank regarding car and house financing.

Cash Credit (CC) and overdraft: The most important part of the loan portfolio is the cash credit and overdraft. This covers nearly 35% of the total loan portfolio of SBL. From this it can be seen that how important is this loan to the Bank as majority of the money are given away in the form of CC and overdraft. This loan does vary from one year to another but this loan is performing quiet well and is increasing very gradually for the last few years.

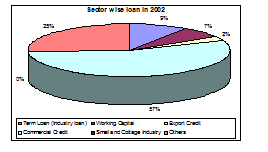

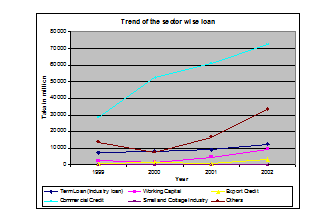

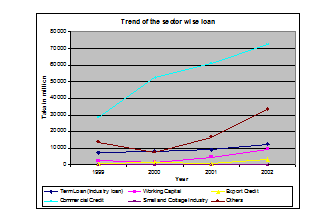

SECTOR WISE PERFORMANCE OF LOAN

Although the type of loans are defied in this report, but the brad category of loan that is submitted to the Bangladesh Bank for review and report is given below:

Large and medium scale industrial loan: This loan consists of the entire loan that comprises of the long-term project loan like infrastructure, building, factory etc. This is the type of loan that SBL has not given in large quantity because of the default nature of this type of loan and the problem of recovery. But even then the amount of money that has been given in this loan is quiet large as each investment carries huge amount of investment. On an average the percentage of term loan given away is approximately 11% of the total loan portfolio. Other Private commercial Bank (PCB) percentage of term loan is approximately 15% of the total portfolio which shows that SBL is in the lower side and this is one reason why its classified loan is low.

Working Capital Loan (WCL): SBL has been encouraging in giving Working Capital Loan in recent times as it is generally of short nature and the default nature is low in this case. It can be seen that the percentage of WCL of the total credit portfolio is increasing gradually. One reason for this must be also that the demand for WCL in recent times is very high and every bank is trying to provide WCL. The average percentage of WCL for the last few years is approximately 4.5% of the total credit given away by SBL.

Export Credit: Export credit has always been the priority of some of the nationalized banks in Bangladesh along with some first generation banks. But recent trends show that export credit has been going down for some times and the reason may be that the world business environment is not very stable. SBL has been offering export credit from the beginning and it didn’t vary much during from the start of its business. On an average, it has been giving approximately 1.5% of the total credit in export finance.

Commercial Credit: The credit that every bank provides the most and which brings the highest income is the commercial credit. This is the most because the demand for commercial credit is the highest among the entire loans. SBL’s highest percentage of loan amount all the credits is commercial loan which on an average is approximately 63% of the total loan. It comprises of more than half of the total portfolio. The industry also has approximately 50-65% of its loan concentrated towards different types of commercial loans.

Small and Cottage Industry: This sector in Bangladesh is not very prominent and still in the growing phase. PCBs don’t concentrate much in this sector as a result the industry on an average has approximately 1-2% of the total loan in small and cottage industry. SBL in comparison with the industry has only 0.03% of the loan concentrated to this sector which is the lowest among all the credit offered.

From the trend analysis over the last four years, it can be seen that the amount of each loan is increasing gradually but commercial loan and other loan is increasing is a very good pace. This is a good sign for SBL in the sense that growth rate of most of the loan is good which means that SBL is getting more and more clients which will help it to generate higher operating income.

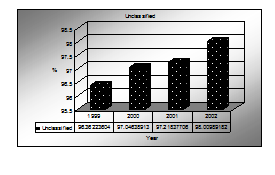

Classified Loans:

A classified loan or commitment is one which is classified as substandard, doubtful and loss as per policy of loan classification set by Bangladesh Bank or Head Office of the Bank.

Substandard: A well-defined weakness is present in loans of this category which could affect the ability of the borrower to repay. This is clearly a troubled situation for one reason or another that requires immediate and intensive effort to correct and reduce the possibility of loss.

Substandard loan position was increasing during the year 1999, then it fell in 2000 after that it again increased in 2001 and then in the last year it fell sharply again and it is projected that it will continue to be in the lower end which is very good for the Bank.

Doubtful: A serious doubt must exist that full repayment will not be forthcoming but the exact amount of the loss cannot be ascertained at the time of classification.

The last four years trend shows that the amount of doubtful loan is falling gradually and in a uniform manner which is a very good sign for the Bank. The average doubtful loan over the four years period is approximately 0.40 % of the total loan portfolio which is very nominal.

Loss: Advances or portions of advances which are determined to be uncollectible based on presently known situation/factors.

Although the amount of bad loan is in a very gradual increasing trend, it is balanced with the other two type of classified loan. It can be further seen that the percentage of bad loan of the total loan portfolio is decreasing gradually which is quiet good.

Although the amount of total loan has been slowly increasing, it is seen that the percentage of classified loan over the past 4 years has been gradually decreasing. The industry on an average has a classified loan of nearly 10-20 %. Among these the private commercial banks classified loan position stands nearly about 6-10% while the position of the nationalized banks has a classified loan position of about 35-40% which sometimes before increased to nearly 60%. This shows classified loan position in the industry is quiet high but in comparison to the industry and other PCBs, the position of SBL is on the better side of the spectrum.

It can further seen that the percentage of unclassified loan is gradually increasing while it was already found out that the percentage of classified loan is decreasing. It does creates a balance between the two and as a result it can be concluded that SBL is doing quiet from the view point of Classified loan.

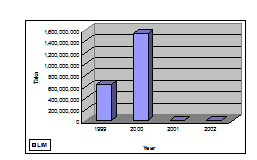

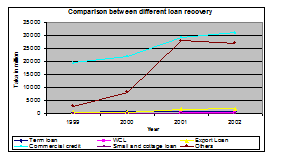

SECTOR WISE RECOVERY OF LOAN

Term Loan: Although the recovery of term loan is very slow but it is gradually increasing due to good loan recovery management present in Southeast bank Limited. For the last four the recovery is taking place in a stable manner with uniform growth which is a good sign as recovery of term loan is not very easy and default is very much in this sector. But it is the characteristics of long-term loan that recovery will be a very slow process. On an average the total recovery of term loan in each year is about Tk. 635 million. This recovery is quiet good if compared with the industry. The recovery of large and medium industry credit is about 450 million every year.

Working Capital Loan: According to the information, SBL during the year 1999 and 2000 did not recovered any WCL. But from the year 2001, it began to recover the loan given in this sector which is increasing. But if compared with the industry, its recovery is slow because the industry has an average recovery of almost Tk.200 million each year whereas SBL has a yearly recovery of only Tk.147 million. This is a concerned for the Management but as the amount of loan given in this sector is not very large, they are not in a hurry.

Export Loan: The recovery of export loan in the year 1999 and 2000 was quiet stable and growing but from 2001 the recovery jumped sharply which is a good sign for SBL. The export loan recovery every year is approximately Tk.1083 million which is pretty good and it is quiet the same as the industry whose average recovery every year is about Tk.1100 million. SBL is predicting that its export loan growth will increase and as a result, the recovery of loan has to be very effective in order to survive in the industry.

Commercial Credit: As the commercial credit comprises of the majority amount of loan in the total loan portfolio and is most important as it gives the highest earnings so its recovery is also very important because classified loan is most in this sector in SBL. The commercial loan recovery is increasing in a good speed although there are defaults. On an average the recovery of commercial loan every year is close to Tk.2550 million, whereas the industry has a recovery of approximately Tk.2200-2800 million on an average. So SBL is within the industry line.

Small and Cottage Credit: The small and cottage industry sector is pretty low in Bangladesh and loans provided in this sector are also in the lower end. As the percentage of loan allocated in this sector is very nominal, the recovery is also very small and another reason behind the little recovery is that SBL doesn’t concentrate much is this sector. The average recovery of loan in this sector is about Tk.0.89 million per year.

Others Loans: The second most large loan portfolio that makes up the portfolio of SBL is rest of the loans except the above and so its recovery is as much as important as the loan is. The recovery exactly represents the growth of loan of this sector. During 1999 and 2000, the loan was not so huge but then from the next year it climbed sharply. The loan recovery of this sector is also behaving in the same manner as the loan growth. On an average, the recovery of this loan is close to Tk.16542 million.

The comparison between the loan shows that the highest recovery loan sector is the Commercial sector after which is the other loans. Although the recovery of the other loan sector is falling, the rest almost have the same kind of recovery but the most important point is that all the recovery is in the increasing phase which is a good positive sign for the Bank.

The loan recovery trend in the last four years show that recovery is quiet good. Although the best recovery was in the year 2001, last year the recovery was also good but it was in the lower side and growing slowly.

This is one of the most important and crucial sections of the Bank where it has to work in order to recover the loan that it has disbursed to its clients and are still outstanding.

DRAWBACKS:

While doing this project, some of the drawbacks regarding the credit division, head office of SBL and credit performance itself are as follows:

v Too many people in the credit department of head office while there is a need of people in the branches.

v Absence of some quality people in the junior level of the credit department.

v Lack of interaction and communication with some of the other departments in the head office.

v Process of giving credit is very much complicated and lengthy making waste of time.

v Policies regarding some of the credit that are offered to the clients are not present in the credit policy guide of SBL.

v Flexibility and not following the exact policy in sanctioning loan to some special clients by some of the Top-level Executives.

v Very much emphasis on commercial loan which has the highest default rate.

v Not concentrating on consumer credit scheme, one of the safest credits.

v Absence of credit card.

v Absence of leasing which is very common in recent times.

v Recovery of some of the loan is very slow and inefficient.

v Lack of advance software for quick investigation of a loan proposal i.e. measurement of the ratios and other financial performance needed to sanction a loan to a client.

RECOMMENDATIONS AND CONCLUSION:

Drawback is a work that is linked with every organization and every department no matter how efficient and effective the organization is. Problems will continue to come as time passes and only those organization will be able to survive and dominate the industry that are able to find the cure and get on with those problems.

Southeast Bank Limited in order to make its credit division effective must do the following to cope with the problems that it is facing these days:

Excess people in the credit division should be removed and placed to those branches that are in shortage of people in their credit division and change those people who are not well for the job.

Recruitment of some good junior level executives for the credit department as this department needs the best people because of the kind of work pressure and mental job.

More and more interaction must be done with other departments in the head office in order to share views about different issues and problems which might help in the work of the credit department.

Revised policies regarding the giving of loan must be made in order to make the process of lending easy, efficient and effective.

Policies regarding all the credits that are offered to the clients must be written in the credit policy guide of SBL in full details.

Biasness and flexibility towards sanctioning loan to some of the clients must be stopped and strict policy should be followed in order to reduce default.

More emphasis must be given in the Consumer Credit Loan as the growth of this kind of loan in the industry is very high and gaining more and more popularity day by day while sanctioning of loan towards the commercial sector should be very selective and strict due to the nature of default.

Credit Card should be introduced immediately as the demand for credit card in the market is pretty high and people like to buy on credit rather than cash.

The Bank must introduce leasing facilities to its clients as most of the banks are offering this service to the customers and as it still have demand in the market.

Good and capable personnel should be placed in the loan division so that the recovery is more effective and faster.

Credit is one of the most vital and important parts of a banking institution. It is the prime source of income for a bank. The interest that a bank earns by giving credit covers almost 75-80% of the total earnings of a bank. So it is very important for a bank to concentrate and focus on its credit mix and monitor the credit portfolio all the time to get the best result.

Southeast Bank Limited has a quiet a good credit portfolio mix but still have some lacking which might cause problems for the bank in the future because the competition is getting intense day by day.