A credit crunch is a sudden reduction in the general availability of loans or a sudden tightening of the conditions required to obtain a loan from banks. It refers to a decline in lending activity by financial institutions brought on by a sudden shortage of funds. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. It is economic conditions that make financial organizations less willing to lend money, often causing serious economic problems. In such situations, the relationship between credit availability and interest rates changes. It often follows a period in which lenders are overly lenient in offering credit.

It occurs when there is a shortage of capital for lending. Credit becomes less available at any given official interest rate or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). It is a sudden change in certain factors that lead to a shortfall in the amount of money that can be loaned to individuals and businesses. This harms the economy because, in times of uncertainty, firms postpone decisions on investment and hiring. Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments. If every firm in the economy waits, then economic activity slows down.

Effects

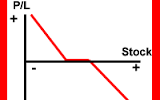

Credit Crunch is an economic condition in which investment capital is hard to secure. Financial institutions facing losses may then reduce the availability of credit, and increase the cost of accessing credit by raising interest rates. It can do a lot of damage to the economy by stifling economic growth through decreased capital liquidity and the reduced ability to borrow. In some cases, lenders may be unable to lend further, even if they wish, as a result of earlier losses. So, if you’ve ever heard the old saying that “the only people the banks will loan money to are the people who don’t need a loan”, then you understand the Credit Crunch perfectly.

When coupled with a recession, a credit crunch will often lead to many corporate bankruptcies. If participants themselves are highly leveraged (i.e., carrying a high debt burden) the damage done when the bubble bursts are more severe, causing recession or depression. Financial institutions may fail, economic growth may slow, unemployment may rise, and social unrest may increase. This increases the crunch’s economic impact by stifling the economy’s ability to recover. For example, the ratio of household debt to after-tax income rose from 60% in 1984 to 130% by 2007, contributing to the Subprime mortgage crisis of 2007–2008. The credit crunch of 2007-08 was driven by a sharp rise in defaults on sub-prime mortgages.