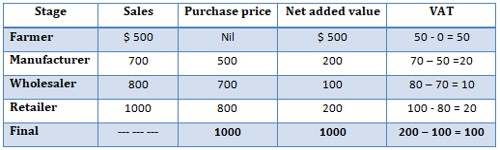

Concept of Value Added Tax (VAT) and its Computation

Value added tax (VAT) is known as the most recent and effective innovation in the taxation field. It is a consumption tax because it is borne ultimately by the final consumer. It is levied on the value added of the goods and services. It is a tax levied on the added value that results from the exchange of goods and services. Theoretically, the tax is broad based as it covers the value added to each commodity by a firm during all stages of production and distribution. It is charged as a percentage of the end-market price.

Value added tax (VAT) is considered as one form of sales taxation. A VAT is charged as a percentage of the price, meaning that the actual tax burden is visible at each stage in the production and distribution chain. The VAT is a multiple-stage tax which has grown as a hybrid of turnover tax and retail level sales tax. Businesses can collect the VAT on their sales and pay it on their purchases from other businesses.

Value added tax (VAT), however, differs from turnover tax as the turn over tax is imposed on the total value at each while VAT is imposed only on the value added at that stage. It can also be tailored to apply to specific types of goods. VAT varies from sales tax in the sense that VAT is imposed at each stage of production and distribution whereas retail sales tax is imposed only at one stage, the final stage. At each stage, it’s assumed there’s an increase in the value of the goods or services. VAT helps to minimize many problems related to tax evasion. Therefore, value added tax (VAT) is more productive and less destructive than retail sales tax.

Computation of VAT at different stages of distribution channel (VAT rate 10%) –