The concept of the Cost of Money

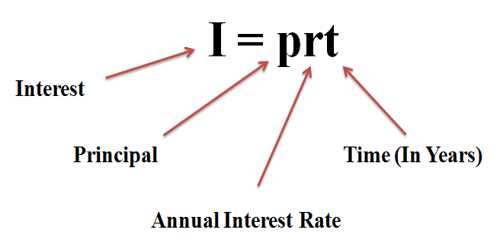

The cost of money refers to the price paid for using the money, whether borrowed or owned. In a sentence, it is the rate of interest or dividend payment on borrowed capital.

Every sum of money used by corporations bears the cost. The interest paid on debt capital and the dividends paid on ownership capital are examples of the cost of money. The supply of and demand for capital is the factor that affects the cost of money. It changes with variance in interest rates and is used to gauge the opportunity costs involved in the potential investment of that money in securities or other assets.

The cost of money is the opportunity cost of holding money instead of investing it, depending on the rate of interest. It is the amount of profit that could be generated from interest payments on a given amount of money if it were invested in government bonds. The time value of money is the value of money, taking into consideration the interest earned over a given amount of time. The concept of cost of money is very significant in economics because it influences the production, supply, sales and the determination of price in the market. The four most fundamental factors that affect the supply of and demand for investment capital and, hence, the cost of money are investment opportunities, time preferences for consumption, risk, and inflation.

Information Source;