The labor rate variation is the difference between the actual and predicted labor costs. It is the gap between the specified standard pay rate and the actual wage rate paid. Labor rate variation is the portion of direct labor variance caused by the difference between the specified standard rate of pay and the actual rate paid. It is computed by multiplying the actual labor rate paid by the number of actual hours worked by the difference between the actual labor rate paid and the standard rate.

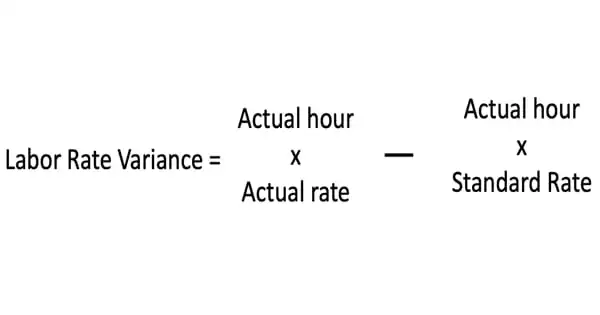

The formula for the Calculation of Labor Rate Variance (LRV)

Labor Rate Variance (LRV) = AT x (SR-AR)

Where,

- AT = Actual Time

- SR = Standard Rate

- AR = Actual rate

If the real rate is higher than the standard rate, the variance will be negative or unfavorable; if the actual rate is lower than the standard rate, the variance will be positive.

An unfavorable variance implies that the cost of labor was higher than expected, whereas a favorable variance suggests that the cost of work was lower than planned. This data can be used for budget development in the future, as well as a feedback loop back to personnel responsible for the direct labor component of a business. For example, the variance can be used to assess a company’s bargaining staff’s performance in negotiating hourly rates with the company union for the following contract period.

When the actual rate paid is less than the expected standard rate, the DL rate variance is beneficial. It generally happens when less-skilled personnel are used (hence, cheaper wage rate). Under-qualified laborers, on the other hand, may result in excessive time spent completing activities (resulting in an unfavorable direct labor efficiency variance), excessive raw materials consumed (resulting in an unfavorable direct materials quantity variance), and/or poor product quality.

It is critical for a company to research and assess the causes of both positive and negative variance. This is due to the fact that an unfavorable variance will have an effect on the bottom line. A favorable variance is generally beneficial, but organizations must ensure that it does not come at the expense of quality or any other compromises that may have an adverse effect on long-term success.

Companies consider several factors to determine the standard labor rate. These are:

- The wages of the production team.

- The average amount of overtime worked by production workers.

- Any new hires at various wage rates that a company may be considering.

- The number of employees who will retire.

- Employees get promoted to higher salary levels.

- Any ongoing pay negotiations with labor unions for production staff.

- Any change in the levels of contributing benefits or medical aid.