A complete contract is an important concept from contract theory. The complete contract method of revenue recognition is a concept in accounting that refers to a method in which all of the revenue and profit associated with a project is recognized only after the completion of the project. The method is used when there is unpredictability in the collection of funds from the customer. It is simple to use, as it is easy to determine when a contract is complete.

The complete contract method is an accounting technique that lets taxpayers and businesses postpone the reporting of income and expenses, until after a contract is completed, even if cash payments were issued or received during a contract period.

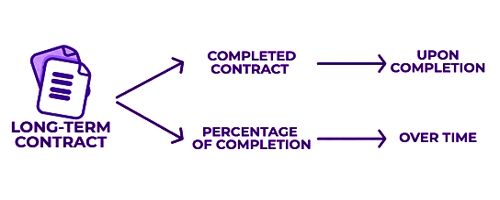

If the parties to an agreement could specify their respective rights and duties for every possible future state of the world, their contract would be complete. In addition to the completed contract method, another way to recognize revenue for a long-term contract is the percentage of completion method. There would be no gaps in the terms of the contract. The two revenue recognition methods are commonly seen in construction companies, engineering companies, and other businesses that mainly generate revenue on long-term contracts for projects.

However, because it would be prohibitively expensive to write a complete contract, contracts in the real world are usually incomplete. The complete contract method defers all revenue and expense recognition until the contract is completed. When a dispute arises and the case falls into a gap in the contract, either the parties must engage in bargaining, or the courts must step in and fill in the gap. In addition, under the completed contract method, there is no need to estimate costs to complete a project – all costs are known at the completion of the project.

The complete contract method is unique, in that it allows all revenue and expense recognition to be deferred until the completion of a contract. The idea of a complete contract is closely related to the notion of default rules, e.g. legal rules that will fill the gap in a contract in the absence of an agreed-upon provision. This accounting method is frequently used in the construction industry or other sectors that tend to involve long-term contracts.

In economics, the field of contract theory can be subdivided into the theory of complete contracts and the theory of incomplete contracts. This accounting practice contrasts with the cash and accrual methods of accounting. The two most important classes of models in complete contracting theory are adverse selection and moral hazard models. From an optics perspective, this can make businesses seem inconsistent to stock analysts, who might consequently flag such companies as investment risks. In this part of contract theory, every conceivable contractual arrangement between the contractual parties is allowed, provided it is feasible given the relevant technological and information constraints.

Information Source: