Comparative study on the loan

products “Life Line”

Dutch-Bangla Bank Limited is a scheduled commercial bank. The Bank was established under the Bank Companies Act 1991 and incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the primary objective to carry on all kinds of banking business in Bangladesh. The Bank is listed with Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. DBBL- a Bangladesh European private joint venture scheduled commercial bank commenced formal operation from June 3, 1996. The head office of the Bank is located at Senakalyan Bhaban (4th floor), 195, Motijheel C/A, Dhaka, Bangladesh. The Bank commenced its banking business with one branch on 4 July 1996.

Dutch Bangla Bank Limited (DBBL) a public company limited by shares, incorporated in Bangladesh in the year 1995 under companies Act 1994. With 30% equity holding, the Netherlands Development Finance company (FMO) of the Netherlands is the international cosponsor of the Bank. Out of the rest 70%, 60% equity has been provided by prominent local entrepreneurs and industrialists & the rest 10% shares is the public issue. During the initial operating year (1996-1997) the bank received skill augmentation technical assistance from ABN Amro Bank of the Netherlands.

DBBL‟s focus is to provide one counter service to clients covering: Commercial Banking (Deposit Accounts), Consumer Banking (Retail Baking) – Traveler Cheques- Foreign & Inland Remittances, Financial Services, Corporate Banking, Asset & liability management, Liquidity & capital Resources Management, Information technology, Human Resources. DBBL Internet banking enables customer to access his/her personal or business accounts anytime anywhere from home, office or when traveling. Internet Banking gives customer the freedom to choose his/her own banking hours. It can save time, money and effort. It’s fast, easy, secure and best of all.

DBBL, since its inception was active in various social activities, which increased manifold over the period of time and its growth. It is one of the fast growing leading online banks in private sector. The emergence of Dutch-Bangla Bank Ltd. in the private sector is an important event in the banking area of Bangladesh. The Netherlands Development Finance Company (FMO) of the Netherlands is the international sponsor of the Bank. The FMO is the Dutch development bank of the Netherlands specialized in the financing of private enterprises in Asia, Africa, Latin America and Eastern Europe. Dutch-Bangla Bank Ltd. came into existence with joint venture as a public limited company incorporated in Bangladesh on June 26, 1995 with the primary objectives to carry on all kinds of banking business in and outside of Bangladesh. DBBL has started its business with foreign bank. DBBL commenced its business as scheduled bank with effect from July 04, 1995 with one branch-Motijheel Branch, Dhaka, with a motto to grow as a leader in the banking arena of Bangladesh through better counseling and effect service to clients and thus to revitalize the economy of the country. All the branches are currently providing truly On-Line banking facility. DBBL resumed its operational activities initially with an authorized capital of Tk.400 million and paid up capital of Tk.202.14 million.

An over view of DBBL

Dutch-Bangla Bank is a second generation commercial private Bank. During the period of its operation, this bank creates a milestone of success in banking sector. This bank holds an experienced team of banking professional. They achieve this success because of their experienced banking professional team, proper management & so on. Dutch-Bangla Bank Limited is a Bangladesh–Netherlands joint venture scheduled commercial bank established in Bangladesh with the primary objective to carry on all kinds of banking business in and outside of Bangladesh.

Starting with one Branch in 1996, DBBL has expanded to thirty nine (39) branches including nine Branches outside of the capital. To provide client services all over Bangladesh it has established a wide correspondent banking relationship with a number of local banks. To facilitate international trade transactions, it has arranged correspondent relationship with large number of international banks which are active across the globe.

In addition to its banking activities, Dutch-Bangla Bank Limited takes part in different national activities promoting sports, culture, social awareness, etc. Participation in these activities as sponsors is part of its business development policy.

Philosophy of DBBL

The objectives of Dutch-Bangla Bank Limited remains to offer modern & innovative products & services to its clients in Bangladesh the partnership with FMO is optimistically scene to offer scopes opportunities to draw on modern tools & techniques of Banking from western world which could be blended with the currently prevalent local customs & practice. The Bank is committed to being a sophisticated prominent and professional institution, providing a one window service to its customers. During the first five years Dutch Bangla Bank‟s strategy was focused on continuing in provident of internal procedures and operating structures, to have a greater control on the quality of our business and to provide better management direction. After five years of working on the Banks structure, its culture and controls, the management is confident that the Bank can move forward on a rapid growth path. The DBBL‟s corporate philosophy is to build its nonfunded fees and commission income stream, thus reducing its reliance on interest income alone.

Objectives regarding this study are as follows:

Understanding the environment, functions and management of DBBL.

- To learn banking more thoroughly

- To fulfill academic requirement

- To identify major strengths and weaknesses of DBBL in retail products in respect to other banks

- To recommend for the successful operation of the services offered by DBBL.

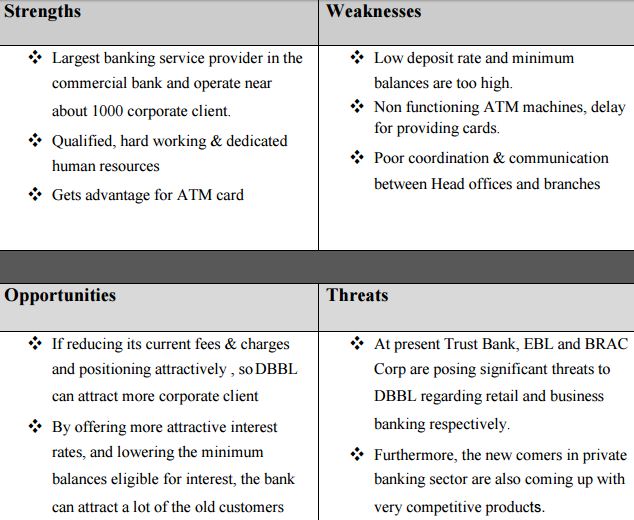

SWOT Analysis

Project Summary

The internship program is done on the purpose of learning banking more thoroughly and applies the learning in the real life situation. The project paper identifies various types of loan products and then compare these products with that of other banks. Thus, the project infers the strength and weakness of DBBL. In preparing the project, I mainly depend on the primary data; however, some information was collected from the secondary sources. To sustain in the highly competitive market, DBBL has come up with new product lines named “Life line”. The life line includes two types of products categorized as loans without security and loans with minimum security. The report summarizes the features and borrower‟s eligibility for the life line products. While comparing the interest rates of life line products with that of HSBC, it was found that DBBL is in better position. This implies that DBBL is trying to capture market share which is currently captured by HSBC. Based on the findings, some recommendations have been made in the end of the report.

Description of the project

The project is based on my critical observation while working in the loans and advancement division of DBBL. The project reveals the various types of loan scheme and the criterion to get the loan. Then, I tried to compare the schemes with that of HSBC bank. Based on the analysis, the report made some recommendations.

Objective of the project

- Objectives regarding this study are as follows:

- To apply theoretical knowledge in the practical filed and dealing with the customers to gather practical knowledge.

- Understanding the environment, functions and management of the loan department of DBBL.

- To learn banking more thoroughly

- To fulfill academic requirement

- To find the length and variety of loan products and to analyze the lending procedures

- To identify major strengths and weaknesses of DBBL in retail products in respect to other banks

- To identify problems in personal loan disbursement of DBBL

- To recommend for the successful operation of the department and delivery of the services.

Methodology

For preparing this paper, I used both Primary and Secondary data.

Primary data

Most of the necessary information has been collected by from the personal observation and one to one discussion with the relevant officials. Throughout the tenure of my internship, I worked in different departments and that gave me a great opportunity to collect information and learn more.

Secondary data

The details of the bank and the selected department have been collected from secondary sources. The relevant information of other private banks has been collected from annual reports, web pages and other published documents.

Life Line: The services

To sustain in the highly competitive market, DBBL has been endeavoring to come up with new products which are essential for individual and family life. Life line is not an exception. This is a product category specially designed to meet up the need of everyday life. DBBL considers the product line in the following way:

“A complete series of personal credit facilities to add more color in very step of your life”

The life line products can be divided into two parts, namely clean credit line and secured credit lines.

Clean Credit Lines

This type of credit line does not require any cash security or any personal guarantee.

- Health Line: health line credits are given mainly for hospitalization or other emergency medical needs or to purchase body fitness equipments

- Education Line: education loans are given for Higher education purposes, for tuition fees or other Educational expenses and to purchase of computer etc.

- Professionals Line: targeted to purchase of Professional equipments and for Office renovation/decoration

- Marriage line: Marriage line credit are designed to meet marriage expenses for himself/herself and Marriages in the family

- Travel Line: travel line credits are given for Honeymoon trip, abroad or in the country or for any Family trip, abroad or in the country

- Festival Line: To enjoy festive period Gift for the family / in laws / relatives Dreams come True line: these are special credit lines designed to purchase TV, Fridge, Furniture, Home Theatre, Motor Cycle, AC etc. Or to decorate/renovate own Home/Car.

- Care Line: care loans are for the fulfillment of parents need/dream and to purchase economy car for the family

- General Line: if there is any other legitimate purpose which does not fall under the above specific lines, then DBBL calls it general line loans.

Secured Credit Lines:

Consumers enjoy flexible facilities with minimum security it requires.

Auto Line: Auto loan is for purchasing a new / re-conditioned car or Refinancing of availed car 34

Home Line: Home loan is usually disbursed for the following categories:

- To purchase a flat

- Refinancing of owned house property

- Home renovation

- Extension / construction of building

Full Secured Lines: for family purpose or any other valid purposes, full secured loans are disbursed.

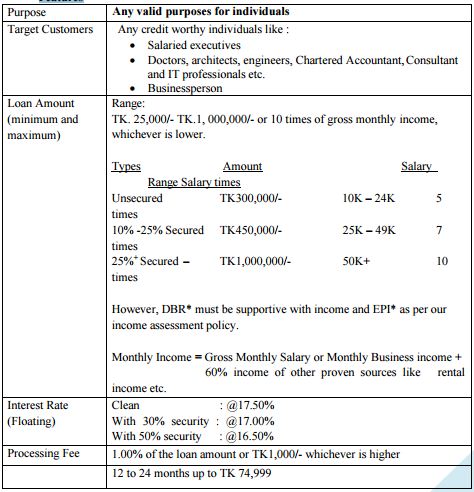

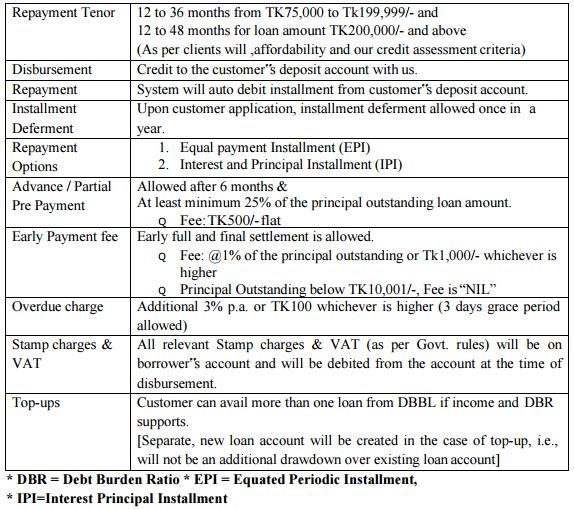

DBBL Clean Credit Line (no cash security, no personal guarantee

Product Features & Credit Criteria

Features

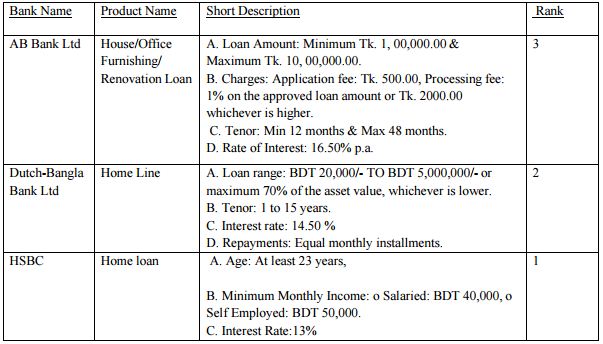

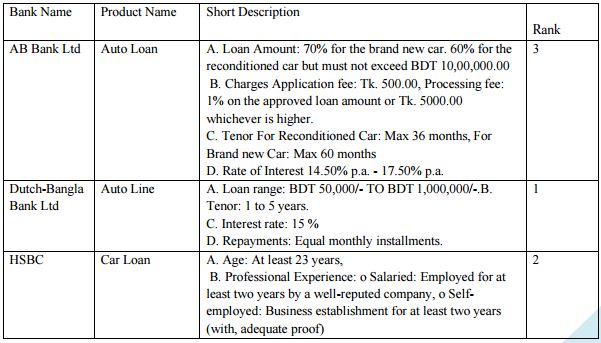

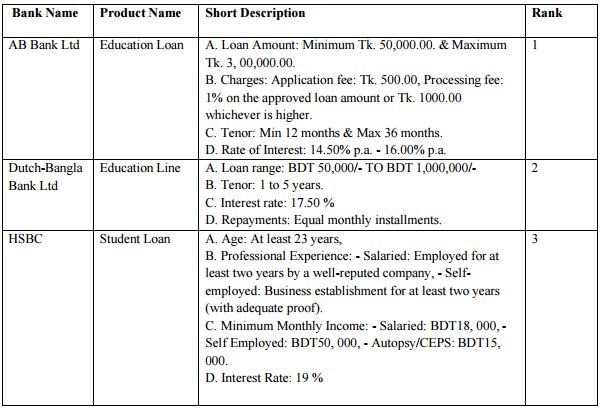

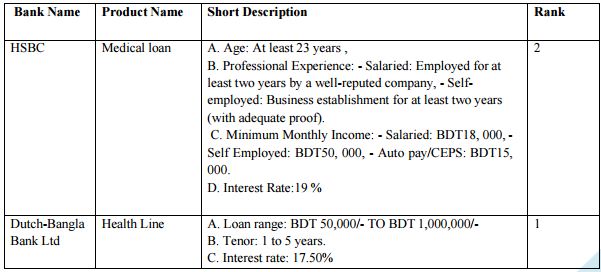

Comparison with other Banks

Home loan

Car loan:

CLEAN CREDIT LINE:

Education loan:

Health line;

Interest rate comparison

The interest rate comparison is done to show the comparative position of the bank considering the similar products of other banks. Other than the home loan service, all other products have higher interest in HSBC than in DBBL.

HSBC maintains a steady state 19% interest for its life line products. During the study, it was found that HSBC is successful in keeping higher mark up due to its brand value to the customers. On the other hand, DBBL is still promoting its life line products to the customers and that‟s why, it offers competitive price for the products. Since, the market is very much competitive and uncertain; DBBL has to compete by both quality and price. One of the reasons behind the lower interest rate is the brand value of DBBL. As the brand value is not as same as HSBC or other multinational banks, it has to compromise the price of the products.

However, over the period, DBBL has established itself as the quality service provider. Having the highest number of ATM booths, it has become the most popular bank among the consumers. As a part of the expansion strategy, it is now offering lower interest rate for the products necessary in everyday life. The aim is to make the clients loyal to the bank. This will help the bank to create a sustainable brand value and thereby, have a strong customer base in the long run.

Risk involved in the loans

The eligibility of the borrowers shows how much risk is involved in the loan products. The clean credit products are offered to the persons whose salary varies from 10000 (salaried person) to 30000 (businessman). In addition, the required age is just 22 years. This implies that there are risks involved in the process of disbursing loan without any collateral. Salaried persons are more secured than the businessmen. But the age requirement is too low for the business borrowers. A person of 22 years is presumed to have very limited management capability. So, there are risks of being failure in the business. This implies that the bank has to be very careful in terms of giving loans to the business persons without any collateral.

On the other hand, the secured credit lines are offered to the employees who are not less than 23 years of age. This criterion is set at 25 years for the businessman seeking loans. This implies that there are lees risks involved as these businessmen are presumed to have better management capacity. So, chances are more to be successful in doing business with the loan money.

Industry interest rate versus Life Line rate

The current industry interest rate is around 16%-17% per year. However, some banks are charging more than that. HSBC is charging around 19% whereas DBBL is charging around 16.5%-17.5%.

But, it is a matter of concern that the central bank has issued a guideline to keep the interest rate at 14% maximum for the term loans and working capital financing. This will create pressure for the commercial banks to lower down the interest rate. This will cut down the margin further for the banks. This also indicates that the market situation might change at anytime. So, there is risk of losing profit margin if the central bank intervened in the market.

There is another possible impact of lessening the interest rates. The middle class families will be more attracted to the life line products due to the low interest rate. This will lead to more sales and hence, more profit in future.

Recommendation

- Management should think about increasing the number of employees in the branch. It was found that the employees cannot provide quality services during the pick hours as there are fewer employees than what is needed. Sometimes, customers have to wait more than the usual time required for a service. In addition, some employees go for professional training. At that time, the bank does not have any alternative way of compensating the position. To fill up the gap, interns are recruited which actually lowers the quality of the services. Interns should be used for assisting the mainstream employees.

- ATM services should be improved. There are lots of complaints about the ATM service of DBBL. Everyday, employees including the management have to face the wrath of the customers. A considerable time and money are wasted due to the bad service of the ATM booths. DBBL has branded the bank as the highest number of ATM booths holders. This actually motivates the clients to deposit money in DBBL as it provides the opportunity to withdraw the cash at any time. However, if the bad service continues, then the clients will be de-motivated to deposit money in DBBL.

- The bank should develop culture of timeliness over the period. However, exceptional case should be considered. There are lots of services which DBBL cannot provide in specific time. There are situations when there is no scope of providing prompt service. Other than that, everyone of the bank must be prepared both mentally and physically for providing prompt service.

- Management should emphasize on the employee satisfaction. Employee satisfaction is supremely important in an organization because it is what productivity depends on. If your employees are satisfied they would produce superior quality performance in optimal time and lead to growing profits. Satisfied employees are also more likely to be creative and innovative and come up with a breakthrough that allows a company to grow and change positively with time and changing market conditions. Many employees are not satisfied due to the rough behavior of the management. The management never favors it employees while dealing with the customers.

- Physical working environment should be improved. Neat and clean working environment should be the top priority issue. A healthy work environment provides people with opportunities to meet work and personal goals. It was found during the internship period that the branch lacks neat and cleanliness. Some of the customers also complained about the neatness of the fresh rooms. This sort of careless management of the physical working environment de-motivates employees to stay longer time in the branch. Customers also get annoyed by the fact. The bank should immediately look into the fact and take measures

- The satisfaction of their customer‟s needs is their prime focus and they want to achieve it by offering products and services. Dutch-Bangla Bank should analyze the need of the people in the locality in which the bank is operating. But for lack of cooperation customer dissatisfaction is increasing which may result of company‟s reputation loss, decrease in profit, cost increases, increase competitor.

- Business target should be material enough to motivate the employees. The normal practice of account opening is just 150 new accounts per week. But, the new target has been set at 400 new accounts per week. This is more than double of what is the usual practice. During the tenure of my internship, I have found that the employees are very much disappointed about the new target. My analysis reveals that the general employees might think about switching jobs as their performance will be evaluated based on the target achieved. Therefore, management should think the feasibility of the target they set.

Conclusion

Dutch-Bangla Bank Limited is one of the most potential Banks in the banking sector. It has a large portfolio with huge assets to meet up its liabilities and management of this bank is equipped with the export bankers and managers in all level of management. So it is not an easy job to find out the drawbacks of this branch.

It has been observed that DBBL started its banking services with a view to minimize the customer‟s needs by offering different products and services which are easy and affordable for all level of customers. To that extent, DBBL always emphasizes its customer services, product development, resource management, branch networking and the contribution to the economic development of the country. The bank also provides social services through DBBF as their social responsibility.

The success of a bank depends on the quality of the services it offers. All the commercial banks, therefore, try to provide quality services with competitive interest rates. DBBL is not an exception. Life line package has been developed with the same purpose. Although, the comparative analysis shows that DBBL is in better position, but there are some obstacles it faces to sustain the position. However, the continuous improvement of the services will certainly place the bank in the best position in one decade.