Description of the Project

The report has been prepared as a mandatory requirement of the Bachelor of the Business Administration (BBA) program under Department of BRAC Business School, BRAC University, Bangladesh. This report entitled “A Comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.”

Objective of the Report

The core objective of this study is to competitive analysis between FDR & MIS services offered in IFIC Bank Ltd. and which one is customer preferred most. The objectives of the report are as

follows:

Main Objective:

– To partial fulfillment of my BBA degree.

– To match my academic knowledge with the real corporate business set up.

– To enlarge my experience from a real corporate exposure.

– To enhance my adaptive quality with the real life situation.

Specific Objective:

– To know organizational profile of IFIC Bank Ltd.

– To evaluate the factors affecting FDR & MIS in IFIC Bank.

– To identify in which areas bank need to improve.

– To emphasize areas where improvement is possible.

– Comparative analysis to identify their position

Methodology of the Study

Data Collection:

Both the primary as well as the secondary form of information was used to prepare the report. The details of these sources are highlighted below:

(a)Primary Source

I have collected primary information by interviewing customer of the organization and observing various organizational procedures. Primary data were also derived from the discussion with the employees of the organization.

• Open ended and close ended questions.

• Personal experience gained by visiting different desks.

• Personal investigation with bankers.

• Face to face communication with customers of the IFIC Bank Ltd.

(b)Secondary Source

I have elaborated different types of secondary data in my research. Sources of secondary information can be defined as follows:

• Bank’s Annual Report – 2011.

i. Internal Sources

• Survey report

ii. External Sources

• Journals of the Bank.

• Different books, training papers, manuals etc. related to the topic.

• Official Website of the Bank.

Introduction

Over the past ten years, banking system becomes accustomed to accepting the rapid pace of changes in terms of product and services. Change such as computerized banking, consumer credit, automated tellers etc, have been introduced. Banks and Financial Intuitions play an important role in financial inter-mediation and thereby contribute to the overall growth in the economy. A bank is a financial institution whose primary activity is to act as payment agent for customers and to borrow and lend money. Banks have influenced economics and politics for centuries.

The primary purpose of a bank is to provide loans to trading companies. Banks provided funds to allow business to purchase inventory, and collected those funds back with interest when the goods were sold. Banking services have expanded to include services directed at individuals and risk in these much smaller transactions is pooled.

Banking Industry in Bangladesh is fully guided by the Central Bank, i.e. Bangladesh Bank. However different Bank has different management systems, operational techniques and different guidelines. The banking system of Bangladesh is composed of variety of banks working as Nationalized Commercial banks, Private Banks, Foreign Banks and Development Banks.

However, there are many private Banks in Bangladesh. At present among other banks IFIC Bank Limited operating their banking operations effectively and efficiently and providing bank services with a view to acceleration socio-economic development of the country. IFIC Bank is one of the best private commercial banks in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity. Adoption of modern technology both in terms of equipment and terms of banking practice ensures efficient service to clients. Day by day new competitors appears with better ideas and products as well as services.

Historical Background of IFIC Bank Ltd.

International Finance Investment and Commerce Bank Limited “IFIC Bank” came in to existence in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial Institutions abroad.

IFIC was incorporated as a public limited company with an authorized capital of Tk. 20 core and paid up capital of Tk.10 core. IFIC commenced its operation on February 28, 1977 with a Subscribed capital of Tk.5 core, contributed by leading private sector entrepreneurs in the country. The Government held 49 percent shares and the rest 51 percent were held by the sponsors and general public. But, in 1983 when the Government allowed banks in the private sector IFIC was converted into a full-fledged commercial bank. The Investment Company has transformed into banking company In June 13, 1983 and started activities from June 24, 1983 through Its Motijheel Branch.

Previously IFIC Bank Ltd was Government owned bank. Now the government of the Peoples Republic of Bangladesh holds 34.34 % of shares of the bank. Leading industrialists of the country own 34% of the shares and the rest of the 31.66 % is held by the general public. The founder of IFIC Bank Ltd was Jahurul Islam of Islam Group of Industries. He was the first Chairman and A.S. F.

Rahman was first Vice Chairman. Board of Directors of the Bank is a unique combination of both private and Government sector experience. Currently it consists of 13 Director. Of them eight represent the sponsors and general public and four officials in the rank and status of Additional Secretary/Joint Secretary represents the Government.

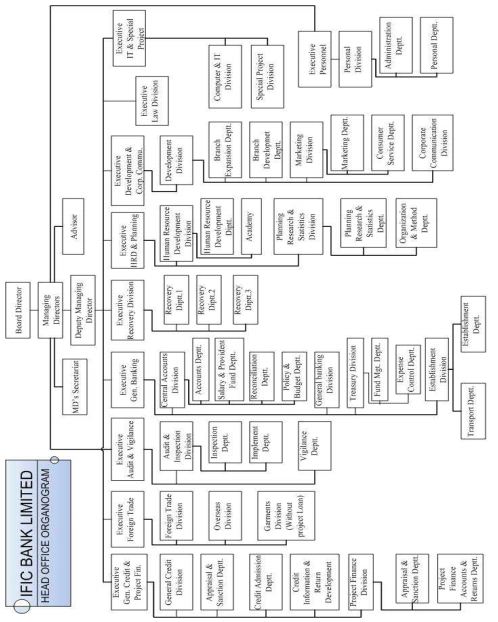

Operational Network Organogram

Organization Principles of IFIC Bank Limited

– Flat and flexible organization with few levels of management and broad spans of control, including project teams and task forces. Networking and horizontal communication are encouraged with clear accountability of the mangers and the hierarchy.

– Clear levels of responsibility and well-defined objectives are a must. Teamwork and networking do not affect the manager’s responsibilities; a team has always a responsible leader.

– A structure which assures operational speed and personal responsibility, with strong focus on results, reducing bureaucracy as much as possible.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Strategic and Financial Objectives

Strategic Objectives:

· A bigger market share

· Broader and more attractive services and products than rivals.

· Superior customer service

· Wider geographic coverage than rivals

Financial objectives:

· Growth in earnings

· Higher dividend

· A more diversified revenue base

Strategy:

· Low cost provider strategy

· Offensive Strategies to build market share

· Vacant niche strategy

· Specialist Strategy

· Superior Product Strategy

· Distinctive image strategy

Management Structure

The thirteen members of the Board of Directors are responsible for the strategic planning and overall policy guidelines of the Bank. Further, there is an Executive Committee of the Board to dispose of urgent business proposals.

Besides, there is an Audit Committee in the Board to oversee compliance of major regulatory and operational issues.

The CEO and Managing Director, Deputy Managing Director and Head of Divisions are responsible for achieving business goals and overseeing the day to day operation. The CEO and Managing Director is assisted by a Senior Management Group consisting of Deputy Managing Director and Head of Divisions who supervise operation of various Divisions centrally and co-ordinates operation of branches.

Human Resource Development (HRD)

Human Resources Development is focused on recruitment and in-house training for both on the job and off the job Bank staff members through the Bank’s Academy. IFIC Bank Academy – the oldest institution in the private sector – was conceived of as an in-house training center to take care of the training needs of the Bank internally.

Academy is fully equipped with a professional library, modern training aids and professional faculty. Library has about 4941 books on banking, economics, accounting, management, marketing and other related subjects. Main training activities consist of in-depth foundation programmers for entry level Management Trainees. Specialized training programmers in the areas like general banking, advance, foreign exchange, marketing and accounts etc. are also organized by the Academy depending on need. Frequently outreach programmers are organized to meet demand for new and specialized skills. During its 23 years of existence, Academy not only conducted courses, workshops and seminars as required by the Bank, but it also organized training programmers for the Bank of Maldives, Nepal Bangladesh Bank Limited and Oman International Exchange LLC. In addition, Academy

has also the credit of organizing system of Bank of Maldives.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

In addition to conducting courses internally, The Academy also selects candidates for nomination to various courses conducted by distinguished training organizations in the country including Bangladesh Bank Training Academy and Bangladesh Institute of Bank Management. The Academy also re-designs its courses, programmers etc, regularly to meet the requirement of new skills arising out of various directives, guidelines of the Central Bank and significant

changes in the banking sector from time to time.

Products & Services of IFIC Bank Ltd

Deposit Schemes

The deposit schemes offered by IFIC Bank are:

• Fixed Deposit Receipt (FDR)

• Special Notice Deposit (SND)

• Pension Savings Scheme (PSS)

• More Money

• School Savings Plan – A plus

• Monthly Income Scheme – Protimash

• Double Return Deposit Scheme

• Three Years Deposit PlusA comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

These schemes are designed mostly for limited income people to help them save for future. Terms and conditions vary a little from scheme to scheme. But still these are attractive for the clients. Response from people is good. You may participate in one or two which suits you most. School Saving Plan is some different from other programs. This plan may develop a saving habit in your child.

Non Resident Bangladeshis (NRB) earning foreign currencies have the opportunity to open an account in the bank. Moreover they may invest in FDR and Bonds in IFIC. NRBs can remit their earning through this bank as well.

Student File is a program for Bangladeshi students going abroad to study in under graduate or post graduate courses. They are issued Drafts for tuition and other expenses from some authorized dealer branches of IFIC Bank.

SMS Banking is a demand of time. People like to contact everything they need through their cell phone. IFIC has done this in right time. You may have very vital information about your account through SMS.

Credit Schemes

Credit schemes of IFIC bank can be classified into three major groups. These are Corporate Banking, SME Banking and Consumer Finance. From the very names it’s clear that first two are oriented towards industrial and commercial clients and the third one is mainly for individual clients. Under corporate banking this bank offers following programs:

• Working Capital Finance

• Project Finance

• Term Finance

• Trade finance

• Lease FinanceA comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

• Syndication Finance

Each of the schemes is designed to meet the growing demands of corporate clients through cash, credit and consultative services. For your big industrial projects IFIC may arrange syndication of banks even. So you may ask the bank for whatever you need from it. Small and Medium Enterprises of Bangladesh are critically vital for generation of employment, alleviation of poverty and increasing GDP growth. IFIC has given correct emphasize on this sector through a good number of programs. These are shown below:

• Easy Commercial Loan

• Retailers loan

• Transport Loan

• Commercial House Building Loan

• Possession Right Loan

• Contractor’s Loan

• Bidder’s Loan

• Working Capital Loan

• Project Loan

• Letter of Guarantee

• Letter of Credit

• Loan against Imported Merchandize (LIM)

• Loan against Trust Receipt

• Muldhan

• Women Entrepreneur’s Loan (Protyasha)

Each of the schemes is designed to meet up typical needs of SME’s. In addition women are given proper importance to come in the financial activities and contribute through their creativity. Consumer Finance schemes are mainly for limited income people to enhance their financial abilities. Thus you may get the items and services of your dream to come true right now. The schemes are:A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

• IFIC Easy Loan

• Consumer Durable Loan

• Parua (Education Loan)

• Thikana (Home Loan)

• Any Purpose Loan

• IFIC Marriage Loan

• CNG Conversion Loan

• IFIC Home Renovation Loan

• IFIC Medical Loan

• IFIC Holiday Loan

• IFIC Peshajeebi Loan

• IFIC Auto Loan

So if you are a person of this group you may have a loan to fulfill your needs and dreams and pay back in easy terms. IFIC bank provide you these services and many more through their 89 branches all over the country.

Corporate Banking

IFIC Bank is offering specialist advices and products to corporate clients to meet diverse demands of the changing market scenario. The bank has an extensive branch network all over the country to expedite the client’s business growth. The bank facilitates the clients to face the challenges and realize opportunities. The bank’s main focus is relationship based banking and understanding corporate and institutional business environments. Products and services for corporate clients include: Working Capital Finance, Project Finance, Term Finance, Trade Finance, Lease Finance, Syndication Loan etc.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Retail Banking

Retail Banking is mass-banking facility for individual customers to avail banking services directly from the wide branch network all over the country. The bank provides one-stop financial services to all individual customers through its innovative products & services to cater their need. With a view to provide faster and more convenient centralized online banking services, now, all its branches have been brought under the real time online banking system. IFIC Bank offers a wide variety of deposit products, loan product & value added services to suit the customer’s banking requirements. Products and services for individual customer include: Consumer Finance, Deposit Product, Card, NRB Account, Student File, SMS Banking etc.

SME Banking

The growth of Small and Medium enterprises (SMEs) in terms of size and number has multiple effects on the national economy, specifically on employment generation, GDP growth and poverty alleviation in Bangladesh. At present, Small & Medium Enterprise sector is playing a vital role in creation of new generation entrepreneurs and ‘Entrepreneurs Culture’ in the country. Experience shows that borrowers of small enterprise sector prefers collateral

free loan since normally they cannot offer high value security to cover the exposure. To facilitate SME sector of the country, IFIC Bank provides collateral free credit facilities to the small & medium entrepreneurs across the country whose access to traditional credit facilities are very limited. The bank is offering 15 different products for selected target groups, such as – Easy Commercial Loan, Retailers Loan, Muldhan Loan, Women Entrepreneur’s Loan (Protyasha), Transport Loan, Working Capital Loan, Project Loan, letter of Contractor’s Loan, Bidder’s Loan, Working Capital Loan, Project Loan, Letter of Guarantee, and Letter of Credit Loan against Imported Merchandize (LIM), Loan against Trust Receipt etc.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Agricultural Credit

Bangladesh is an agro-based country and majority of the population is dependant on Agriculture. Although maximum of the total population is dependant on agriculture, its contribution to GDP has gradually come down. Moreover, every year a huge amount of food grain and other agricultural products are imported to meet the demand of the country. In order to achieve desired growth in agriculture sector of the country the bank is committed to increase present loan portfolio in agricultural sector. IFIC Bank is offering Agriculture Loan products namely –

i) Krishi Saronjam Rin – for Agriculture Equipments

ii) Shech Saronjam Rin – for irrigation equipments

iii) Poshupokkhi & Motsho Khamar Rin – for Live Stock & Fish Culture &

iv) Phalphasali Rin – For Fruit Orchard for individuals & group at micro level.

Lease Finance

Lease means a contractual relationship between the owner of the asset and its user for a specified period against mutually agreed upon rent. The owner i.e. the Bank is called the Lessor and the user i.e. the customer is called the Lessee. Lease finance is one of the most convenient sources of financing of assets viz. machinery, equipment vehicle, etc. IFICBL, the highly capitalized private Commercial Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers and growth of their business houses. Its lease facility is extended to the items like Industrial Machinery, Luxury bus, Mini bus, Taxi cabs.

Money Transfer

Joining with one of the world renowned money transfer service “Money Gram”, IFICBL has introduced its customers to the faster track of remittance. Now IFICBL can bring money in Bangladesh from any other part of the globe in safer and faster means than ever before. This simple transfer system, being on line eliminates the complex process and makes it easy and convenient for both the sender and the receiver. Through IFICBL–Money Gram Transfer Service, money will reach its destination in minutes by affordable, reliable and convenient financial services.

Treasury & Capital Market

IFIC Bank Limited is devoted to capital Market of the country and offers world standard brokerage services for individual and institutional investors. The Bank is responsible for origination of sales, buy and trading of securities of Capital markets. It aims to provide relevant support to its customer with sophisticated and innovative financial solutions and delivering the highest quality of services. It has a seat in Dhaka Stock Exchange Limited. The Treasury Division of IFIC Bank is engaged with Cash Management, Liquidity Planning and Liquidity Protection. It is also conscious to protect all the bank’s Assets and Profits against loss due to domestic as well as global financial realities, particularly Interest and Exchange Rate fluctuations. The Treasury Department is also regarded as a Profit Center, which generates income by trading instruments in the Financial Market.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

To manage treasury unit as profit centre, along with guidance from regulatory authorities, the bank equipped itself with clear policies, fit organization structure, deployment of trained staff, modern infrastructural facilities and technological initiatives.

Major functions of treasury division of IFIC Bank are –

– Fund Management

– Management of Statutory Requirement

– Investment

– Trading of Foreign exchange & Money Market Instruments

– Asset Liability Management

– Risk Management

IFIC Bank has a dedicated Treasury team which is capable of providing all treasury solutions through wide range of Treasury products. IFIC Treasury has four different desks, which are specialized in their own area to provide best services with respect to pricing, best possible solution for customer requirement and market information

SWOT Analysis: IFIC Bank Limited

The strengths, weaknesses, opportunities and threats of IFIC Bank Limited are noted below as I have found in my analysis.

Strengths:

• Strong capital position of the bank

• Capability to mobilize substantial deposits through various deposit schemes despite low offering.

• Low non-performing assets or classified loans of the bank signify strengths in credit customer selection.

• Ability to maintain positive non-interest margin that signifies efficiency in earning fee incomes.

Weaknesses:

• Lack of adequate liquidity of the bank

• Management’s inability to converts assets into earnings efficiently which results in decrease in return of assets, return on equity and earnings per share.

• Inability to cope with economic conditions resulted in slower growth of interest earning assets than of interest bearing liabilities. The net effect was decline in operating profit in the recent year.

Opportunities:

• Technology integration for automation of business process can gain competitive edge over the others.

• Increasing awareness of Islamic banking can bring more success for Islamic Banking BranchesA comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

• The revolution of Information Technology (IT) in the country may lead to success for the

bank, as IT sector is a major target area for lending.

Threats:

• Increased competition in the market for public deposits

• Market pressure for lowering the profit or interest rate

• Volatile global and local economic scenarios

• High concentration in loans as percentage of total deposit may cause severe liquidity problem if significant percentage of loan holder become default.

• The declining return on equity, earnings per share and dividend can give danger signal to the investors.

FDR & MIS

FDR (Fixed Deposit Receipt)

Fixed deposits are a high-interest-yielding Term deposit offered by banks in India. The most popular form of Term deposits are Fixed Deposits, while other forms of term Deposits are Recurring Deposit and Flexi Fixed Deposits (the latter is actually a combination of Demand deposit and Fixed deposit).

To compensate for the low liquidity, FDR’s offer higher rates of interest than saving accounts. The longest permissible term for FDR’s is 10 years. Generally, the longer the term of deposit, higher is the rate of interest but a bank may offer lower rate of interest for a longer period if it expects interest rates, at which RBI lends to banks (“repo rates”), will dip in the future.

Usually in Bangladesh the interest on FDR’s is paid every three months from the date of the deposit. (e.g. if FD a/c was opened on 15th Feb., first interest installment would be paid on 15 May). The interest is credited to the customers’ Savings bank account or sent to them by cheque. This is a Simple FDR. The customer may choose to have the interest reinvested in the FD account. In this case, the deposit is called the Cumulative FD or compound interest FDR. For such deposits, the interest is paid with the invested amount on maturity of the deposit at the end

of the term.

Although banks can refuse to repay FDR’s before the expiry of the deposit, they generally don’t. This is known as a premature withdrawal. In such cases, interest is paid at the rate applicable at the time of withdrawal. For example, a deposit is made for 5 years at 8%, but is withdrawn after 2 years. If the rate applicable on the date of deposit for 2 years is 5 per cent, the interest will be paid at 5 per cent. Banks can charge a penalty for premature withdrawal.

Banks issue a separate receipt for every FDR because each deposit is treated as a distinct contract. This receipt is known as the Fixed Deposit Receipt (FDR) that has to be surrendered to the bank at the time of renewal or encashment.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Many banks offer the facility of automatic renewal of FDR’s where the customers do give new instructions for the matured deposit. On the date of maturity, such deposits are renewed for a similar term as that of the original deposit at the rate prevailing on the date of renewal.

Some Benefits of FD

• Customers can avail loans against FDR’s. The rate of interest on the loan could be 1 to 2 per cent over the rate offered on the deposit.

• Nonresident Bangladesh and a Person of Bangladesh Origin can also open these accounts.

Taxability

Tax is deducted by the banks on FDR’s if interest paid to a customer at any branch exceeds Rs. 10,000 in a financial year. This is applicable to both interests payable or reinvested per customer or per branch. This is called Tax deducted at Source and is presently fixed at 10% of the interest. If the total income for a year does not fall within the overall taxable limits, customers can submit a Form 15 G (below 65 years of age) or Form 15 H (above 65 years of age).

Advantages of Fixed Deposit Account

The advantages of fixed deposit account are as follows:-

1. Fixed deposit encourages savings habit for a longer period of time.

2. Fixed deposit account enables the depositor to earn a high interest rate.

3. The depositor can get loan facility from the bank.

4. On maturity the amount can be used to make purchases of assets.

5. The bank can get the funds for a longer period of time.

6. The bank can lend such funds for short term loans to businessmen.

7. Fixed deposits indirectly boost economic development of the country.

8. The bank can also invest such funds in profitable areas.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

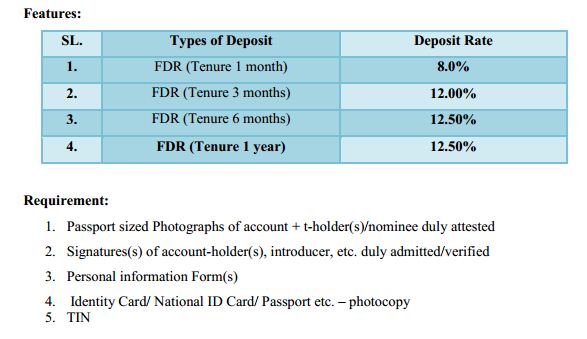

FDR (Fixed Deposit Receipt) in IFIC BANK

FDR accounts for Minor

An account can opened on behalf of a minor by his/her natural guardian or by a guardian appointed by a court of competent jurisdiction. Upon the minors attaining to the majority the right of the guardian to operate the account shall cease and thereafter the minor shall operate the account if he/she desire so.

Joint account

In the event that there is no survivor or nominee that account will then be frozen until the legal successor to the deceased is determined by the relevant court.

Fees

The bank shall be entitled without notice to levy or impose all customary banking and other charges and expenses including collection fees and legal expenses in respect of any account or in respect of any other banking facilities provided to the customer by the Bank and to debit the A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Nominee

a) The account holder for each account can appoint nominee as per section 103 of Bank Companies Act

b) Nomination will be cancelled if nominee dies in the lifetime of the account

c) The account holder can change nominee with written instruction

d) In the event of account holder’s death nominee will not be able to continue the account and the account deposit prior to the death of the account holder shall be paid to the nominee after proper identification

e) In case where there is no nominee the succession certificate from he appropriate court will be required for releasing the balance amount after the death of the account holder

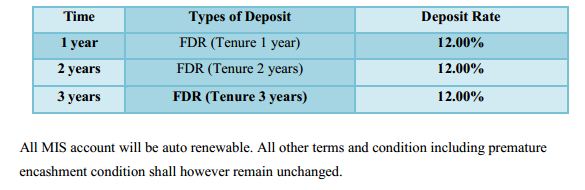

Monthly Income Scheme (MIS)

This is a Deposit Scheme where the depositor gets a fixed amount of profit every month without disturbance of the principal.

Benefit –

• The retirement benefits of service holders. The depositor gets a monthly pension.

• The investment of Wage Earners who want to pay a fixed amount monthly to their families/ dependents in Bangladesh from the profit of their investment.

• The deposit of those persons who intend to meet the monthly expense of their family from the income of their deposit.

• Investment of fund of Trusts and Foundations which award monthly scholarships/ stipends to students.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

• Parents who want to defray the educational expenses of their children from the monthly benefit of their deposit with the Bank.

What you will get

1. Guaranteed monthly income that helps fulfill your loved ones’ desires while protecting

them in case of an unfortunate event

2. You receive tax benefits under section 80C and 10(10D)

Why choose this plan

• You want to fulfill your long pending desires with additional source of income

• You want a source of guaranteed monthly income for your family if something unfortunate were to happen to you

• You want to gift your parents a guaranteed monthly income for their retirement

Monthly Income Scheme (MIS) IFIC Bank

Features:

A special kind of fixed deposit offers flexibility & comfort of having monthly return on investment.

Procedure for paying monthly income:

• The account holder will receive monthly income in any SB/CD account of same name maintained with the Branch. In case, the account holder do(es) not have any SB/CD account with the Branch, he/she/they will have to open SB/CD account for receiving the monthly income. The minimum balance requirement will be waived for these types of accounts for a new customer. However, a minimum initial deposit of tk.500/- will have to be deposit.

Nomination:

• An account holder can nominate maximum 3(three) persons as his/her/their nominees who will be able to receive the monthly income in the event of the death of the account holder.

• A minor can also be made a nominee. In that case the minor’s legal guardian will receive payment on his/her/their behalf.A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Pre- mature closure of the Account:

• In case, the account is closed within 6 months, no benefits including interest will be paid to the account holder.

• In case, the account is closed after 6 months but within 1 year, the client will be paid back principal amount with the interest at the Bank’s the then prevailing Saving Account Rate.

Credit Facility:

• The account holder can avail loan/overdraft facility against the lien on the balance of the above MIS account as per Bank’s prescribed rates and rules. Special Instructions:

• No separate cheque book will be issued to the client under the scheme

• Nominee(s) will not be able to continue the account after the death of the account holder

• Any benefit under this scheme will come under the purview on Income Tax/ Excise Duty etc. or any other levy as decided by the Government of Bangladesh from time to time.

Findings And Analysis

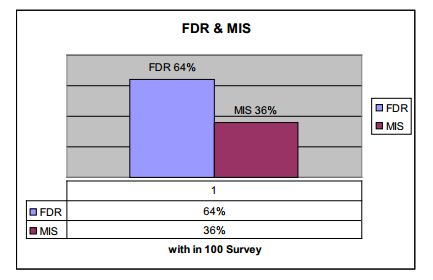

1. Which scheme is preferable to customer

In this report I took 100 interviews within IFIC Bank’s customers to know which scheme they prefer most FDR or MIS. 64% customers of them prefer FDR and 36% customer prefer MIS, and from this two scheme 41% customers prefer only FDR service, 22% customers prefer only MIS and 37% customers prefer both service.

1. FDR Benefits: Most of the time customers prefer FDR more than MIS. They think FDR opening is much easier than MIS. To open an MIS account customer need a savings account and also need nominee’s signature. With FDR customer gets some benefits which are –

• Money can grow with attractive interest rate with flexible tenure.

• Automatic renewal facility at maturity.

• Loan facility against FDR Account to meet urgent financial needs.

• The customer may avail loan facilities against FDR Account as security.

• Premature closure facility at savings rate.

2. Time period: FDR account can be open for 1/3/6/months, 1years or above. It means any customer who open FDR for one month that person can withdraw his/her capital after one month A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

3. Withdrawing money: When customers open FDR for any fixed time after that maturity date they will get full interest on the beginning fixed rate. Like for one month of FDR and after one month if customer want to withdraw the capital he/she will get full interest, but if FDR was for 6months and before maturity Customer want to withdraw money then they will get only 5% of interest rate. It will e same for MIS before one year maturity if customer want to withdraw capital then they will get 5% interest rate. So in this case FDR is better because Customer can withdraw money before one year. On the other side in MIS customer have to deposit money minimum for one year.

4.MIS Benefits: Now a day customers are more attract to this MIS service. They think MIS is more attractive and profitable. In MIS customer will get interest every month on their account. Also MIS have other benefits which are-

• The retirement benefits of service holders. The depositor gets a monthly pension.

• The investment of Wage Earners who want to pay a fixed amount monthly to their families/ dependents in other city from the profit of their investment.

• The deposit of those persons who intend to meet the monthly expense of their family from the income of their deposit.

• Investment of fund of Trusts and Foundations which award monthly scholarships/ stipends to students.

• Parents who want to defray the educational expenses of their children from the monthly benefit of their deposit with the Bank.

5.Every months Interest: Customers also prefer MIS. They think MIS is better because here they can get interest from their capital in every month. Every month their interest will send to their savings account, so that they can withdraw their money when they need from savings account every month. On the other hand, in FDR after maturity date only customer will get interest. If any customer open get 3montj\hs FDR they will get interest on capital after 3months in together. A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

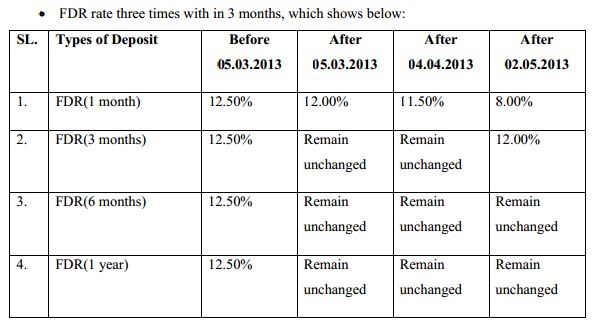

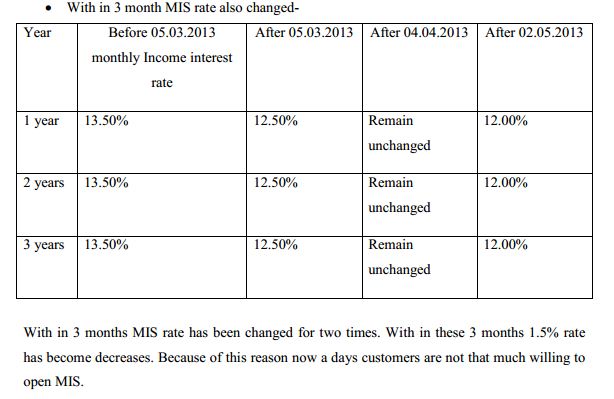

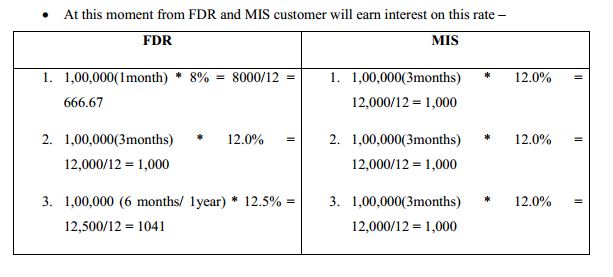

6.Change of interest rate: When customer Open a MIS account for one year from that time that interest rate will be fixed for next one year through the rate of interest changed within next one month. Customer will get that rate in which he/she open the account. But in FDR in a customer when open a FDR for one month and after one month rate become changed that customer will interest based on new interest rate. FDR & MIS rate changed very frequently. In this three month 3times MIS & FDR rate have been changed.

After 2nd may customer are not interest to open any FDR for 1month. They think it could be loss for them to open FDR for 1 month. Also few people are surprised about 3 months FDR rate because it is also decreases. Those who open FDR for 3 months in January after this rate change their interest rate will be changed automatically. Those who open FDR for 1 year in this January their FDR rate will be unchanged to next January.

So those who open FDR for one month before April after 2nd may when their account will mature they will get interest based on earlier rates. So it could be a loss for them. But people who open MIS for minimum one year they will get earlier rate for next one year maturity time. After 2nd month MIS is also decreases and because of that rate of opening MIS account also decreases. Now customers are also not that much interest to open MIS at this rate.

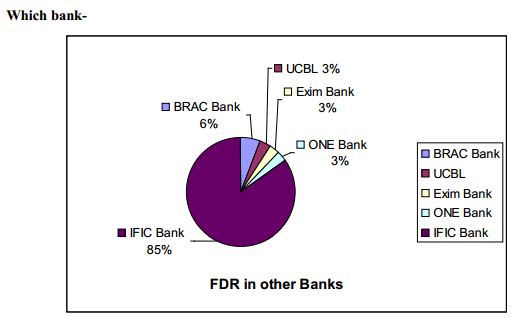

2. FDR in other banks

16% customer said that they also have FDR indifferent bank. Rest of 85% have only have FDR in IFIC Bank. Many customers do not want to share their private information in public, from them only few share. It is major problem while doing the survey.

Within 15% customer 6% of them have FDR in BRAC Bank, 3% customers have FDR in UCBL, 3% have FDR in ONE BANK and rest 3% in other bank. These entire bank’s FDR interest rates are same as IFIC Bank. These banks’s rate is also maximum 12.5%. Also now a day’s advertisement is a major factor which can attract customer. UCBL and ONE Bank has this A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

3.Access to FDR throughout the process was easy and straightforward Most of the customers think it is an easy and straightforward but few of them think it is a lengthy process because few customers are always in Harry. But they prefer this most of the time because they do not need nominees signature or any kind of savings account with in that branch. To open a FDR Customer only need Passport sized Photographs of account holder(s) and nominee duly attested, Signatures(s) of account-holder(s), introducer, and etc. duly admitted/verified, Personal information Form(s). Customers are Also national identity card and TIN (Taxpayer Identification Number).

Any non-resident customers can also open FDR. They only need to show their passport and legal paper’s. Also a non-resident customer can open his/her joint-account FDR with a resident customer. For this they did not need to go through any other difficult process. Any types of organization slow need to follow same process. They need to show all kind of organization legal paper and signature of directors.

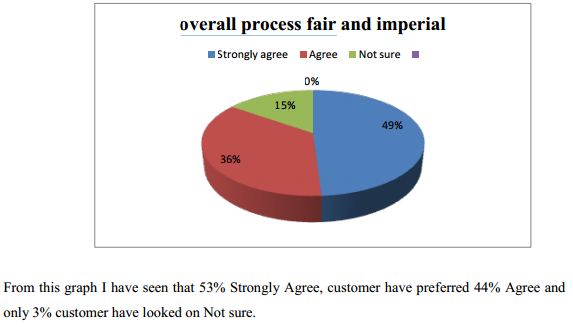

4. The overall process was fair and impartial

It simply involves filling out a form, putting together a set of documents and your photographs and submitting them. The bank will issue a fixed deposit receipt which you need to hold on to. Documents required are for proof of identity, address, signature, and in case of senior citizenship, age. There are a variety of documents you can produce for proof of identity and address, such as your passport, driving license, voter’s identity card, ration card, recent utility bills, and credit card bills and so on.

Signature proofs can take the form of passport, PAN card or a signed cheque. Apart from this, some banks, such as IFIC Bank, also demand an introduction letter from an account holder. Here, all customers were strongly agreeing with that this process is fair and imperial. They think it’s fair to showing photo of account holder and nominees, signature of account holder and TIN. Because now a days there are many type of people who took the advantage and make fraud with bank.

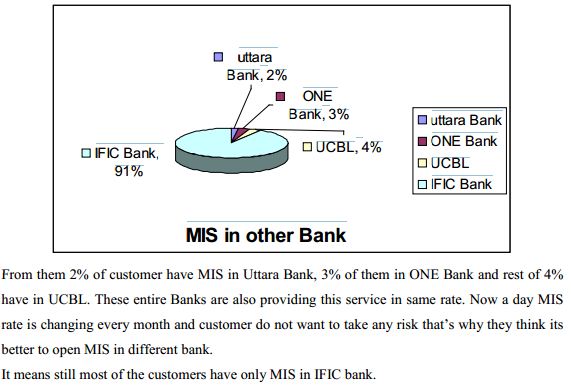

MIS in other bank

Only 9% customers have MIS in different Bank. Rests of 91% customer have MIS only IFIC Bank. Those who open MIS they always think this scheme have more benefits. Under this scheme, depositor will get a certain sum of money in each month proportion to his/her deposit during the entire tenure. Benefit starts right from the first month of opening an account under this scheme and continues up to five years. On maturity, the principal amount is paid back. Objectives of this scheme are: help the retired persons for investing their retirement benefits, create investment opportunities for Non-Resident Bangladeshi, etc. Many banks do not provide this investment opportunity for Non-resident Bangladesh. That why most of the customer do not switch in other bank.

Those who open MIS in different they think in IFIC bank interest rate very frequently and they do not want to take any risk. That why they also open MIS in different bank.

Which bank-

Recommendation:

1. Interest rate- interest rate should increases of FDR and MIS both. Because 100 out of 100 customers demand that interest should increased. Any bank increases their interest rate when bank need more capital and want to increases customer. When demand become decreases at that point bank increases their interest rate. So at this point Bank should increases interest rate.

2. Training- many employee in Shantinagar Branch do not know how to open FDR & MIS. Some it make pressure for one person to Handel so many customer at a time because in Shantinagar Branch there is one employee who know how to open FDR & MIS. So it is difficult for her.

3. Loan policy- loan policy of FDR scheme should increase.

4. Advertisement- advertisement of products should increases. So many do not know benefits about MIS where customers have more than one FDR in IFIC bank. Employee should introduce MIS to customer more.

General Recommendation:

1. Salary structure should be immediately improved if IFIC Bank wants to attract efficient workforce in their team. Also, it is necessary to reduce the turnover rate in their organization.

2. The plan for increasing the number of ATM booths should be implemented as soon as possible.

3. Technology should be updated as the present software is very slow.

4. Management should make sure that the AGM continues to be held regularly.

5. Work pressure is huge and numbers of employees are less in the Shantinagar Branch. Some more employees are needed to hire

6. The time limit for the repayment of the loan for the customers should be increased more.

7. They should improve their decoration and interior. A comparative Analysis between FDR & MIS Services offered in IFIC Bank Ltd.

Conclusion:

This report is all about “A comparative Analysis between FDR & MIS services offered in IFIC Bank Ltd.” for that I took 100 surveys of IFIC Bank customers, where I asked them some question related to topic. From this survey I have been find out some analytical data. All these data help me to find out the solution that which service is better than other. From this survey I got some quantitative data which assist me to make some graph and show some graphical analysis which will help to understand my report.

At first I asked them about which service/scheme is more preferable, from 100 surveys 64% customer have FDR in IFIC Bank and 36% customer have MIS in IFIC Bank. It means 2/3 customer prefer FDR service than MIS service and 1/3 customers prefer MIS. Then I asked them do they have any other FDR in other Banks. Only 16% customers have FDR in other banks like UCBL, EXIM Bank, ONE Bank and BRAC Bank. Rests of 84% customer have FDR in IFIC bank.

After FDR service I ask customer about MIS service. I asked them do they have any other MIS in other Banks. Only 9% customers also have MIS in different Bank. Rests of 91% customer have MIS in IFIC Bank. Uttara Bank, UCBL and ONE Bank are those banks where customers also have MIS. Only 9% customers have MIS in different bank which means still most of the customers have only MIS in IFIC bank.

Then most of the customers think that MIS process is easy and straightforward. 53% customer have looked on strongly agree, 30% looked on agree, 13% customer preferred Not sure and rest of 4% Disagree on this graph.

55% customers strongly agree, 35% agree and 10% strongly not sure when I ask them about overall process was fair and imperial or not.

At the end I ask them two more questions which are if the interest rate of FDR/MIS rate decreases in IFIC Bank will they still maintain their FDR/MIS in this Bank and are you satisfied with customer service of IFIC Bank. In both of this questions customer said ‘Yes’. It means they are fully satisfied from the customer service of IFC bank And because all customer are old customer so that they have a faith on this bank and attachment with this bank. They know most of the employees and they are very friendly with each other.

At the end we can see that 2/3 of customer prefer FDR than MIS. That is why IFIC Bank also focusing on FDR more than MIS. Customers also prefer MIS more than FDR because there are more benefits than MIS.