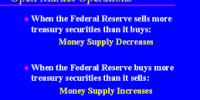

An open market operation is an activity by a central bank to purchase or sell government bonds within the open market. A central lender uses them since the primary means of implementing monetary policy. The usual aim of open market operations is to manipulate the short-term rate and the availability of base money in an economy, and thus indirectly control the whole money supply, in place expanding money or contracting the amount of money supply. There are some classifications are Asset, Tangible asset, Patents, Goodwill, Brand, Franchise etc.

Classification of Open Market Operation