Introduction:

Bank is very old institution that is contributing toward the Development of any economy and is treated as an important service industry in the modern world. Economic history shows that development has started everywhere with the banking system and its contribution towards financial development of a country is the highest in the initial stage. Modern banks play an important part in promoting economic development of a country. Bank provides necessary funds for executing various programs in the process of economic development. They collect savings from large masses of people scattered throughout the country, which in the absence of banks would have remained ideal and unproductive. These scattered amounts are collected, pooled together and made available to commerce and industry for meeting the financial requirements.

Economy of Bangladesh is in the group of world’s most underdeveloped economies. One of the reasons behind this may be its underdeveloped banking system. Government as well as different international organizations have also identified that underdeveloped banking system causes some obstacles to the process of economic development. So they have highly recommended for reforming financial sector. Since 1990, Bangladesh Government has taken a lot of reform activities to ensure high economic growth. In 1996, World Bank published “Bangladesh: Agenda for Action” in which it has suggested lots of recommendations for economic development of our country. These recommendations include special presentation for reforming banking sector.

Bank plays a vital role in the economy by providing means of payment and in mobilizing resources. Bank is the most important financial institution in the economy. The economic development of a country depends on the development of banking sector. Today’s modern banks are not only providing traditional banking but also expanding the many financial services. In today’s world the life of the people directly or indirectly are within the arena of banking whether conventional or Islamic banking. Although Islamic banking is not a newer concept in Bangladesh as it has started its operation since 1983, very few people are aware about its operation. But things are changing. Islamic Banking is also getting popularity in the country.

An Overview of the Banking Sector:

After Independence of Bangladesh the Banking sector was restructured as a fall out of war of liberation. Banking grew primarily in the public sector with main emphasis development needs of the war-torn economy with gradual liberalization in subsequent years. It was increasingly felt that Banks should be allowed in the private sector. In the 80’s for the first time a number of Banks in the private sector was allowed. Subsequently in the mid 90’s some more Banks in private sector commenced operations. Finally 1999 3rd Generation of private sector Bank was given permission to operate. As a result while up to 80’s public sector Banks dominated financial sector, Banks in the private sector were given increased responsibility with the passage of time. The share of deposits of Nationalized Commercial Banks (NCBs) in total deposits, which stood at 89% in 1980 gradually, declined over the years to reach the level of 55% in 2000. Simultaneously, Private Commercial Banks (PCBs), which were responsible for only 18% of deposits in 1985, this share increased gradually over the years to constitute about one third of the total deposits of the country by the end of the millennium. But market share of deposits of Foreign Commercial Banks (FCBs) did not change much during the last twenty years. In the early 80’s, the share was 6% and it stood at 7% by the end of the century with a relatively small branch network in the country.

Likewise share of NCBs in total advances of the country declined gradually from 80% in 1980 to reach the level of 47% by the end of year 2000. At the same time, share in advances of the PCBs increased from 14% to 31% over the same period.

A break-up of deposits and advances indicates that share of rural branches contribute higher share in advances. Rural deposits constitute slightly more than one-fifth of the total deposits of the Banks. On the other hand, rural advances constitute around 17% of the total advances of the Banking sector.

Origin of the Report

As a prerequisite for the Bachelor of Business Administration Degree of University of Liberal Arts Bangladesh (ULAB), I was required to complete an internship in a suitable business organization and submit a report on my findings. I had been selected to work as an Internee in Export Import Bank of Bangladesh Limited, Panthapath Branch for a period of 3 months from June 02, 2008 to August 30, 2008. ShahMd. Abdul Bari, Senior Vice President, HR division, Export Import Bank of Bangladesh Limited appointed me as an Internee. After discussion and getting consent, I started to work on the project titled “Foreign Exchange Operation of EXIM Bank”.

Without practical exposure, theory can never be fruitful. For this reason, B.B.A program has been designed in such a way that a student can get practical knowledge. A student needs to go for practical orientation in some organization where his/her duty is to bear all the some things from operations and activities of that branch.

This internship report is generated under the supervision of Assistant Professor Quazi Akhlaqur Rahman, School of Business, University of Liberal Arts Bangladesh (ULAB).

Objective of the Report

The objective of the study may be viewed as:

- General Objective

- Specific Objective

Specific Objective:

More specifically, this study entails the following aspects:

- To have exposure to the foreign exchange operation of EXIM Bank Limited.

- To discuss the services offered by EXIM Bank Ltd.

- To identify the major strengths and weaknesses of EXIM Bank Limited in respect to other banks regarding foreign exchange operation.

Methodology of the Report:

This report has been prepared on the basis of experience gathered during the period of internship from June 02, 2008 to August 30, 2008. For preparing this report, I have undergone group discussion and interviewed with officers and clients of the bank. To carry out the study both primary and secondary data were used.

| Primary Sources | Secondary Sources |

| Face to face conversation with the employees Appointment with the top officials of the Bank By interviewing clients of the Bank | Internal SourcesBank’s Annual Report Different circulars, manuals and files of the bank. External Sources Different books and periodicals related to the banking sector.

|

Figure : Source of Primary and Secondary Data

Organizational Part

Overview of the EXIM Bank:

EX1M Bank Ltd is the name implies a newly formed commercial Bank but is the 1st” of its kind in Bangladesh. It has been incorporated in Dhaka, EX1M Bank as a public limited company and its Head Office of the Bank is located at Printers Buildings, 5, Rajuk Avenue, Motijheel Commercial Area, Dhaka-1000.

In the world of consumerism the business organization of the world strive for the consumers satisfaction as a number one business strategy whatever may be the product of the organization, either service or non service. Service is the product of Bank. There is a saying that customer service starts rights right from the stairs of the Bank building. The guard at the door is first person represents of the Bank, receives a customer with wishes in smiling face.

Historical Background of the EXIM Bank:

EXIM Bank Ltd. was incorporated under the Companies Act 1994, on the 2nd June 1999. EXIM Bank Ltd. believes in togetherness with its customers, in its march on the road to growth and progress with service. As a commercial Bank we will do all traditional Banking, business including introduction of a wide rang of savings and credit products, retail Banking and ancillary services with the support of modem technology and professional skills.

The Export Import Bank of Bangladesh Ltd. commenced formal commercial Banking operatic from 3rd August 1999 with the permission of Bangladesh Bank. The sponsors of the Bank are leading business personalities and reputed industrialists.

The Bank has a sound capital base; its Authorized Capital is Tk. 1000.00 Million while its Initial Paid up Capital is Tk. 225.00 Million subscribed by the sponsors. To solidify its capital by further the paid up capital will rise to Tk. 450.00 Million within a reasonable period by pub offering of shares of the Company. The Bank will be immensely benefited further more from the able leadership of the Chairman and the valuable advice and guidance the advisor.

Originally the name of the Bank was BEXIM Bank of Bangladesh Ltd. Later the management BEXIM Bank of Bangladesh Ltd. changes the name of the Bank to EXIM Bank Ltd. because the case lodged by BEXIMCO Group of Industries.

The Board of Directors wants to carry out in the management all of this service industry’s administration and credit portfolio independent without any undue influence from out side. The board will formulate policy and give policy directives to the Management Transparency and accountability will be strictly ensured at all levels of the Bank. The Bank will operate with integrity, competence and farsightedness abiding by all principles and provisions laid down the Bank Company Act, 1991, the guidelines of Bangladesh bank

Objective of the EXIM Bank:

Bangladesh is now an integral part of global market. As such there is an urgent requirement for Bangladesh to place the traditional Banking practices in harness with the global trades of a free market economy by following international Banking customs, practices and standards. Today clients of a Bank in Bangladesh are exposed as well as international markets. They have to stay update with their practice and standards to meet the demands of achieving harmony in the high standards of a free economy. Hence, by getting into both corporate and retail Banking and rapid innovation and networking the Bank believes that it can accomplish its goals.

The core objectives are:-

- To carry on, Transact, undertake and conduct the business of Banking in all its branches and to transact and do all matters and things incidental there to in Bangladesh and abroad.

- To receive, borrow or raise money on deposits, loan or otherwise, upon such terms as the Company may approve and to hive guarantees and indemnities in respect of all debts and contracts.

- To establish welfare oriented Banking systems.

- To play a vital role in human development and employment generation.

- To invest money in such manner as may from time to time be thought proper.

- To carry on the business of buying and selling bullion, gold and other valuable assets.

Hierarchy of the EXIM Bank:

| Managing Director |

| Deputy Managing Director |

| Senior Executive Vice President |

| Executive Vice President |

| Senior Vice President |

| Vice President |

| Senior Assistant Vice President |

| Assistant Vice President |

| Senior Principal Officer |

| Principal Officer |

| Executive Officer |

| Officer |

| Management Trainee Officer |

| Junior Officer |

| Assistant Officer |

| Trainee Assistant Officer |

Figure : Hierarchy of the EXIM Bank

Special Products and Services of EXIM Bank:

Export Import Bank of Bangladesh Limited launched several financial products and services since its inception. A them are Money Grower Monthly Saving Scheme, Steady Money Scheme, Super Savings Scheme, Multiplus Savings Scheme. All of these have received wide acceptance among the people.

A) Mudaraba Money Grower Monthly Savings Scheme

The prime objective of this Scheme is to encourage people to build up a habit of saving. In this Scheme one can save a fixed amount of money every month and receive substantial lump sum of money after five, eight, ten or twelve years. Monthly installment rate is Tk. 500/-, 1,000/-, 2,000/- or 5,000/-

B) Mudaraba Steady Money Scheme

Monthly Income Scheme: Under this Scheme, customer has to deposit a fixed amount of money for five years and in return he will receive benefits on monthly basis. Benefits start right from the first month of opening an account under the Scheme and will continue up to five years when the depositor will get refund of his deposit. This scheme is an investment for a steady return.

C) Mudaraba Super Savings Scheme

Super Saving Scheme offers a small depositor to invest his fund (minimum 10.000/-) and fund will be double in 6 (six) years period. This scheme will secure the future of the investment with ease.

D) Mudaraba Multiplus Savings Scheme

Savings helps to build up capital and capital is the prime source of business investment in a country. Investment takes the country towards industrialization, which eventually creates wealth. That is why savings is treated as the very foundation of development. To create more awareness and motivate people to save, EXIM Bank offers Multiplus Savings Scheme. Any individual, company, educational institution, government organization, NGO, trust, society etc may invest their savings under this scheme. The deposit can be made in multiples.

Guidelines for premature encashment & Loan Advantage

A) Mudaraba Money Grower Monthly Savings Scheme (MSS):

Premature Encashment

- In case of premature encashment before 1 year no profit shall be paid.

- In case of premature encashment after 1 year but before maturity profit shall be paid at savings rate.

Loan Advantage

- After three years of savings in this scheme the depositor (if an adult) is eligible for a loan up to 80% of his deposited amount. In that case, interest rates on the loan will be applicable as per prevailing rate at that time.

B) Mudaraba Steady Money Scheme (MIS):

Premature Encashment

- In case of premature encashment before 1 year no profit shall be paid.

- In case of premature encashment after 1 year but before maturity profit shall be paid at savings rate.

Loan Advantage

- A depositor can avail loan up to 80% of the deposit amount under this scheme. In this case, interest will be charged against the loan as per Bank’s prevailing rate. During the tenure of the loan, the Monthly Income will be credited to the loan account until liquidation of the loan amount inclusive of interest.

C) Mudaraba Super Savings Scheme (MSSS):

Premature Encashment

- In case of premature encashment before 1 year no profit shall be paid.

- In case of premature encashment after 1 year but before 3 years profit shall be paid at Savings Rate plus 1%.

- In case of premature encashment after 3 years but before maturity profit shall be paid at Savings Rate plus 1.5%.

Loan Advantage

- A depositor can avail loan up to 80% of the deposit amount under this scheme. In this case, interest will be charged against the loan as per Bank’s prevailing rate.

D) Mudaraba Multiplus Savings Scheme (MPS):

Premature Encashment

- In case of premature encashment before 1 year no profit shall be paid.

- In case of premature encashment after 1 year but before 3 years profit shall be paid at Savings Rate plus 1%.

- In case of premature encashment after 3 years but before 5 years profit shall be paid at Savings Rate plus 1.5%.

- In case of premature encashment after 5 years but before 8 years profit shall be paid at Savings Rate plus 2%.

- In case of premature encashment after 8 years but before maturity profit shall be paid at Savings Rate plus 2.5%.

Loan Advantage

- A depositor can avail loan up to 80% of the deposit amount under this scheme. In this case, interest will be charged against the loan as per Bank’s prevailing rate.

SWIFT Service:

The SWIFT Service helped in sending and receiving the messages and instructions related to NOSTRO Account operations and L/C related matters. The banks have brought 11 of branches under SWIFT network. Other branches will come under the network hopefully by the 2005.

SWIFT aims to provide a prompt and efficient service to help you gain the most from our products. As a part of this service a documentation set is supplied with each product. This Guide is a part of that documentation set and contains as comprehensive and as up-to-date a description of the product as possible.

SWIFT Network

SWIFT or the Society for Worldwide Inter bank Financial Telecommunication is a cooperative institution established in 1973 by a group of banks to manage their international telecommunications activities. Now over 2900 member banks, and regularly processes in excess of three million banking messages per day between banks in over 150 countries around the world own SWIFT.

SWIFT is the logical choice for most international financial transactions:

With over 5900 connections among the world’s major banks, the chance is high that for any given transaction the bank you are dealing with is a SWIFT user.

The SWIFT network provides facilities for ensuring that messages are transmitted in standard, internationally accepted formats, simplifying processing and permitting end to end automation of many banking transactions.

SWIFT is highly secure, with elaborate mechanisms to ensure that information remains confidential, authentic and intact.

With an extremely low unit transaction cost, SWIFT is nearly always the most cost-effective means of transmitting an international message.

SWIFT Messages

In order to use SWIFT Message Types and the SWIFT network, however, banks have to employ strict controls on the ways that messages are prepared to ensure that standards are respected and that the control Header and Trailer are complete and accurate. For this reason, most banks employ specialized computer software, such as PC Connect, to perform message preparation and processing.

Foreign Exchange Point of View:

In the modern world no country is self-sufficient, one country is to depend on other countries and from this point of view there arises the question of foreign trade and foreign currency transactions. That is, the international trade involves foreign exchange transactions particularly for receipt and payment against export and import of goods and services from one country to another. Because without foreign exchange transactions we cannot think of foreign trade. Of course, various rules and regulations are to be followed in connection with the foreign trade and foreign exchange transactions.

Foreign Exchange Regulation Act, 1947

Foreign Exchange Regulation (FER) Act, 1947 (Act No. VII of 1947) enacted on 11th March, 1947 in the then British India provides the legal basis for regulating certain payments, dealings in foreign exchange and securities and the import and export of currency and bullion. This Act was first adapted in Pakistan and then, in Bangladesh. The Act is reproduced. Bangladesh Bank is responsible for administration of regulations under the Act. Bangladesh Bank’s offices and their jurisdictions provide a list.

Basic regulations under the FER Act are issued by the Government as well as by the Bangladesh Bank in the form of Notifications, which are published in the Bangladesh Gazette. Notifications issued by the Bangladesh Government and the erstwhile Government of Pakistan and the Bangladesh Bank and the erstwhile State Bank of Pakistan is reproduced. Directions having general application are issued by the Bangladesh Bank in the form of notifications, foreign exchange circulars and circular letters.

The major objectives of the act are to conserve the limited foreign exchange resources and to ensure that the available foreign exchange is utilized only for priority requirements the economic and financial interests of Bangladesh and the maintenance of the proper accounting of foreign exchange receipt and payments. Bangladesh Bank is responsible for administration of regulations under the Act. Bangladesh Bank reviews the exchange control measures from time to time and revises the instructions on policy and measures, whenever necessary through different Foreign Exchange (FE) circulars.

Authorized dealers in foreign exchange are required to bring the foreign exchange regulations to the notice of their customers in their day-to-day dealings.

Authorized dealers at the level where transactions with the customers take place implement all the regulatory amendments or changes. And so Authorized dealers are to ensure compliance with the regulations by the customers. The ADs should report to the Bangladesh Bank any attempt, direct or indirect, of evasion of the provisions of the Act, or any rules, orders or directions issued they are under.

This publication summarizes the instructions issued under the FER Act as well as the prudential instructions issued by Bangladesh Bank (as of 30th September, 1996) to be followed by ADs in their day-to-day foreign exchange transactions.

Bangladesh Bank

Bangladesh Bank (BB) means the Bangladesh Bank established under the Bangladesh Bank Order, 1972 (President’s Order No. 127 of 1972).

Taka

Taka means the Bangladesh Taka unless otherwise specified.

Dollar

Unless otherwise indicated the term dollar used in this publication shall mean the US dollar.

Authorized Dealers

Wherever used in this publication, the term Authorized Dealer or AD would mean a bank Authorized -by Bangladesh Bank to deal in foreign exchange under the FER Act, 1947.

Foreign Exchange Regulation Act, 1994

This Act regulates the exchange of foreign currencies, remittances and opening of foreign currency account under various classifications. According to this law, FC Accounts can be opened without initial deposits, and bears no interest and both the account holder and the nominee can operate the account. The entire remittance from adored is free from income tax. It also states the documents required for the opening of such account.

Deregulatory Measures:

Since 1976 a lot of reform measures have been undertaken in Bangladesh. On October 20, 1993 Bangladesh Taka was declared convertible on current account transactions and in April, 1994 Bangladesh government has been awarded with the status of article VII of IMF.

The major deregulatory Measures and changes taken place during last few years have been pointed out in the following paragraphs —

- Bangladesh bank in exercise of the powers conferred by the Foreign Exchange Regulations act, 1947 issue licenses to commercial banks to deals in foreign exchanges. Recently the Central bank also permitted a number of Moneychangers to exchange cash foreign currency notes, coins or foreign currency instruments such as Travelers’ Cheques.

- With the exception of a few reserved sectors, foreign investors are free to make investment in Bangladesh in industrial enterprises. Foreign investors are free to remit their post-tax profits and dividend to their own country.

- Foreign owned as well as joint venture industrial units located in Bangladesh might freely borrow funds in foreign currency from abroad. Local banks may extend working capital loans or term loans in local currency to foreign controlled or foreign owned firms operating in Bangladesh.

- Non-resident foreign currency deposit (NFCD) accounts may now be

maintained as long as the account holder’s desire. - Bangladesh nationals having bank accounts abroad who were opened while working there may now maintain such accounts even after return to Bangladesh.

- Education sectors were declared folly convertible. Prior permission of Bangladesh Bank is not required for releasing foreign exchange in favor of Bangladesh students studying abroad or willing to proceed abroad for studies.

- Bangladesh Bank has stopped sales and purchases with Authorized dealers of any currency other than the US Dollar; to encourage the Authorized dealers to buy and sell other currencies in the inter bank market.

- Bangladesh Foreign Exchange Dealers Association (BAFEDA) has been formed and a ‘Code of Conduct’ for treasury operations and Inter-Bank foreign exchange market has been formulated.

Authorized Dealer and Money Changer:

Bangladesh Bank issues licenses normally to scheduled banks to deal in foreign exchange if it is satisfied that the bank applying for this license has adequate manpower trained in foreign exchange, there is prospect to attract reasonable volume of foreign exchange business in the desired location and the applicant bank carefully complies with the instructions of the Bangladesh Bank especially with regard to submission of periodical returns. Bangladesh Bank may issue general licenses or licenses with authority to perform limited functions only.

Licenses with limited scope are also issued to persons or firms to exchange foreign currency notes, coins and travelers’ cheques in places where money-changing facilities are required. The authorizations are granted to persons or firms of adequate means and status who, in the opinion of the Bangladesh Bank, will be able to conduct their dealings strictly in accordance with the Foreign Exchange Regulations.

Applications for the grant of AD licenses should be made to the General Manager, Foreign Exchange Policy Department, Bangladesh Bank, Head Office, Dhaka.

Bangladesh Bank Transaction with ADS:

Bangladesh Bank’s purchases and sales from and to the ADs are in US Dollar only, on spot basis. All such transactions with Bangladesh Bank are required to be in multiples of US$ 10,000, subject to a minimum of US$ 50,000. ADs are free to quote their own rates, ready and forward, for transactions in the inter bank market and with their customers.

The Central Banks of Bangladesh, India, Iran, Nepal, Pakistan, Sri Lanka, Bhutan and Myanmar have an Agreement to settle current transactions between these countries through the Asian Clearing Union (ACU) mechanism. All such payments to the ACU member countries excepting those covered by loan/ credit agreements are accordingly settled through the ACU mechanism in Asian Monetary Unit (AMU), also called ACU dollar which is defined as equivalent to the US dollar.

The ACU Agreement referred to above provides for settlement of the following types of payments:

- Payments from residents in the territory of one participating country to residents in the territory of another participating country.

- Payments permitted by the country in which the payer resides.

An AD needing to fund its ACU dollar Nostro account with a correspondent bank in an ACU member country shall do so through Bangladesh Bank against surrender of the required amount in US dollar, or of equivalent Taka at Bangladesh Bank’s selling rate. Bangladesh Bank will advise the central bank of the concerned ACU member country to make the amount available to the transferee bank in that country. After making the payment, the central bank of the recipient ACU member country shall advise the GM of the ACU secretariat to credit its account by debit to Bangladesh Bank’s account.

Bangladesh Bank on receipt of the advice shall make the fund available to the recipient AD and shall advise the GM of the ACU secretariat to credit its account by debit to the account of the central bank of the transferor ACU member country.

Bangladesh Bank operates a foreign currency clearing system enabling the AD banks to settle their mutual claims in US dollar, Pound Sterling, Euro and Japanese Yen arising from inter bank transactions; to economize the time and cost involved in settlements through correspondents abroad.

Forward Dealing in Foreign Exchange:

ADs, on their own, are free to buy and sell foreign currencies forward in accordance with tile internationally established practices however, in all cases the ADs must ensure that the cover is intended to neutralize the risks arising from definite and genuine transactions. Be it forward sale or purchase, ADs must cover their own risk within die shortest possible time.

All forward contracts should be treated as firm and should be closed out on expiry. In such cases the ADs should charge the difference between the contracted rate and the TT clean spot buying or TT spot selling rate, as the case may be, ruling on the date the contract is closed out. The forward contract should be closed without charging any difference if the rate moves in favor of the customer on the date of the closure. Similarly, no difference should be charged for closing out a forward sale contract if the TT clean spot buying rate on the date of closure is at par or higher than the booked rate.

No forward contract should be renewed at the old rate. All cases of renewal should be treated as new contracts and the rates as applicable for purchase-sale of forward contracts on the date of renewal should be applied.

Outward Remittances:

Most outward remittances are approved by the ADs, on behalf of the Bangladesh Bank following declaration of Taka as convertible for current accounts payments from March, 1994. Only a few remittances of special nature require Bangladesh Bank’s prior approval.

All remittances from Bangladesh to a foreign country or local currency credited to on resident Taka accounts of foreign banks or convertible Taka account constitutes outward remittances of foreign exchange. ADs must exercise greatest caution to ensure that foreign currencies remitted or released by them are used only for the purposes for which they are released; they should also maintain proper records for submission of returns to Bangladesh Bank as also for the letters inspection from time to time.

It is most important that, once forms have been approved by or on behalf of the Bangladesh Bank, the ADs carry out the transactions only on behalf of the original applicants for whom the forms were approved.

Remittances made against permits or approval letters of Bangladesh Bank should be reported on TM form. The AD must state on the TM form the number of the permit against which the remittance has been made by him and must certify that the remittance has been endorsed by him on the permit. The remittance must be endorsed on the back of the permit giving the date of the remittance under the stamp and signature of the AD. When the permit is exhausted or no longer required, it should be returned to the Bangladesh Bank by the AD along with the TM form on which the last remittance is reported.

Original copies of all IMP forms, TM forms covering remittances affected by the ADs must be submitted to the Bangladesh Bank along with the appropriate Returns. In the event of any remittance, which has already been reported to the Bangladesh Bank on the prescribed return being subsequently cancelled either in full or in part, the ADs must report the cancellation of the outward remittance as an inward remittance. A letter giving the following particulars should support the return in which the reversal of the transaction is reported:

- The date of the return in which the outward remittance was reported.

- The name and address of the applicant.

- The amount of the sale effected originally.

- The amount cancelled.

- Reasons for cancellation.

Inward Remittances:

The term “Inward Remittances” includes not only remittance by T.T., M.T., Drafts etc., but also purchases of bills, purchases of drafts under Travelers’ Letters of Credit and purchases of Travelers’ Cheques.

The ADs may freely purchase foreign currencies or raise debits to non-resident Taka Accounts of the respective bank branches and correspondents. Remittances equivalent to US$ 2000 and above should be reported oil Form C attached to the appropriate schedule. However, declaration on Form C by the beneficiary is not required against remittances sent by Bangladesh nationals working abroad. The purpose of remittances should be clearly stated on the Form C. Where the country of origin of funds and currency in which remittances received are the same, the ADs may submit a consolidated Form C in respect of those remittances attaching therewith a separate list showing details of remittances comprising the amount reported on Form C. Remittances received against exports should be certified and reported on EXP Forms. In case of remittance received in advance for exports the AD should obtain a signed declaration from the beneficiary on the back of the “Advance Receipt Voucher” certifying the purpose of remittance.

There is no objection to the ADs obtaining reimbursement from non-resident banks in freely convertible foreign currency in respect of Taka bills and drafts purchased by them under instructions from such a non-resident bank whether under Letters of Credit or under other arrangements.

If an inward remittance already reported to the Bangladesh Bank is cancelled, either in full or in part, because of non-availability of beneficiary, the ADs must report the cancellation of the inward remittance as an outward remittance on TM form. The return in which the reversal of the transaction is reported should be supported by a letter giving the

- Reference of the return in which the inward remittance was reported

- Name and address of the beneficiary

- Amount and the reason for cancellation and

- Amount of the purchase as affected originally.

Convertible and Nonconvertible Taka Account:

ADs may open convertible Taka accounts in the names of foreign organizations/ national’s viz., diplomatic missions, UN organizations, non-profit international bodies, foreign contractors and consultants engaged for specific projects under the Govt. semi Govt. agencies and the expatriate employees of such missions/organizations who are resident in Bangladesh.

A convertible Taka account may be debited for payments in foreign currency abroad, for local expenses, for transfers to foreign currency accounts or other convertible Taka accounts or for credits to a non-convertible Taka account.

The ADs may open Taka STD (7-30 days special notice) accounts in the names of foreign diplomatic missions and their expatriate personnel, foreign airlines and shipping lines operating in Bangladesh, international non-profit organizations including charitable organizations, UN organizations and their respective expatriate personnel and pay interest thereon provided that the amount of interest accrued on balances of these accounts will be disbursed locally in non-convertible Taka and that no part of the earned interest will be remittable abroad at any stage.

Foreign Investment and Operation in Securities:

Foreign Investment:

Foreign Investors are free to make investment in Bangladesh in the industrial enterprises excepting a few reserved sectors. An industrial venture may be set up in collaboration with local investors or may even be wholly owned by the foreign investors.

Prior permission of the Bangladesh Bank is not required for issue and transfer of shares in favor of non-residents against foreign investment in Bangladesh; general permission is accorded in this behalf subject to the following conditions:

- The industrial venture will have secured permission from the Board of Investment (BOI)/ Controller of Capital Issues, under the Capital Issues (Continuance of Control) Act 1947, about its capital issue. To avail of the facilities and institutional support provided by the Government, entrepreneurs/sponsors may secure registration with the Board of Investment;

- Before issue of shares against foreign investment in the form of capital machinery, the machinery will have to be cleared from the Bangladesh customs authorities at the port of entry;

- Foreign Investment and Inspection Department, Bangladesh Bank, head office should be informed about the issue and transfer of shares to non-residents pursuant to (a),(b) & (c) above, within 14 days of such issue/ transfer, along with the following documents/papers:

(i) Attested copy of registration, if any, of the foreign investment in the industrial ventures accorded by the BOI;

(ii) Attested copy of the permission for the capital issue accorded by the BOI/Controller of Capital Issues:

(iii) Original certificate of encashment of foreign exchange in Taka in case of issue of shares against foreign exchange received from abroad through the banking channel; and

- Non-resident persons/institutions including non-resident Bangladesh nationals may buy Bangladeshi shares and securities in Bangladesh against freely convertible foreign currency remitted from abroad through the banking channel. Transactions relating to such investments including repatriation of dividend/ interest earnings and sale proceeds shall be made through a Non-resident Investor’s Taka Account (NITA) according to the following procedure:

(i) The non-resident investor shall open a NITA with any AD in Bangladesh, with freely convertible foreign currency remitted from abroad through normal banking channel.

(ii) Balances in the NITA may freely be used to buy Bangladeshi shares/securities.

(iii) Relevant instructions contained in The Securities and Exchange Commission (SEC) Notifications regarding placements, allotments and issuance of right shares are to be carefully complied with.

- Incidental expenses related to sales and purchases of shares/ securities and to operation of the accounts may be debited to NITA.

- After the non-resident investor has purchased the shares/securities, the related certificates/scripts can be deposited/kept with any person/organization nominated by the investor. The investor can as well take them outside the country, if he so desires.

Operation in securities:

- Section 2 of the FER Act defines “security” as shares, stocks, bonds, debentures, debenture stock and Government securities, deposit receipts in respect of securities and units or subunits of unit trusts. A “foreign security” is defined as a security issued elsewhere than in Bangladesh and any security the principal of or interest on which is payable in any foreign currency or elsewhere than in Bangladesh. “Security” also includes coupons or warrants representing dividends or interest and life or endowment insurance policies.

- Persons resident in Bangladesh who are or become owners of foreign securities are permitted to hold or retain such securities provided they have acquired them in a manner not involving a breach or violation of the foreign exchange regulations. Holders of foreign securities who wish to sell, transfer or otherwise dispose of or deal in securities must, however, ensure that the proposed transactions do not contravene the provisions of the FER Act and the orders issued by the Government of Bangladesh and/or the Bangladesh Bank there under and must obtain prior permission of the Bangladesh Bank wherever necessary.

- Under the existing foreign exchange regulations all persons resident in Bangladesh who are or become the owners of any security in respect of which the principal, interest or dividend is or are payable in the currency of any foreign country or in respect of which the owner has the option to acquire the payment of principal, interest or dividend in such currencies, are required to submit a return to tile Bangladesh Bank within one month of their acquiring the securities giving certain particulars in respect of the said securities.

Learning Part

Foreign exchange department deals with foreign currency and the transaction of it. The major job of this department is listed below:

1. Letter of Credit (for Export and Import)

2. Dollar/Traveler’s Cheque (TC) Endorsement

3. Foreign Remittance

4. Foreign Currency Account

1) Letter of Credit (LC):

In case of any foreign trade requirement L/C is a must. As we know, there is no guaranteed relationship between import and export. As a result, they use a media to secure their goods and currency. So, Exporter and Importer use their respective bank as a media and L/C is a legal obligation between Exporter and Importer. In case of a single L/C, it is necessary to prepare six credit vouchers and one debit voucher. After preparing those vouchers it should be sent to the computer section for computer entry.

2) Dollar and Traveler’s Cheque Endorsement:

EXIM is a Authorized Dealer of American Express T/C. At the same time, they can buy and sell T/C and dollar. Every morning they get a telex from Head Office, Which carries the rate of the foreign currency transaction of the day. EXIM fix the rate by them. At the end of the each month the branch uses to submit all supportive documents (all foreign transactions documents and balance of the foreign currency) to the Bangladesh Bank and their Head Office.

3) Foreign Remittance:

Foreign DD and paving or receiving any bill from foreign country is known as foreign remittance. The amount of foreign remittance is very significant in EXIM, Panthapath Branch.

4) Foreign Currency Account:

A Foreigner, a Wage Earner working in foreign country can open this account, but it is possible to open a foreign currency (Dollar) account in Pantapath branch. The account holder gets a cheque book against the account and has to mention the amount in respective currency.

Letter of Credit (L/C):

Foreign trade financing is an integral part of banking business. Letter of credit is the key player in the foreign exchange business. The import section deals with L/C in the perspective of the exporters. In case of import, the importers are asked by the exporters to open letter of Credits so that their payment against goods is ensured.

Types of Letter of Credit:

The Letter of credit can be either revocable or irrevocably. It needs to be clearly indicated whether the L/C is Revocable or Irrevocable. In the absence of any indication, it will be deemed to be a Revocable Letter of Credit (UCPDC 1993 Revision, ICC No. 500).

- Revocable L/C:

A Revocable Letter of Credit is one which can be Amended or cancelled by the Issuing Bank at any moment without prior notice to the beneficiary. So, this is clear that revocable Credit can be revoked any time without prior notice.

- Irrevocable L/C:

An Irrevocable credit is one, which cannot be cancelled or amended any time without the consent of each party. Through this L/C, the issuing Bank gives a definite, absolute and irrevocable undertaking to honor its obligations, provided the beneficiary complies with all the terms and conditions of the credit.

Different Types of Letter of Credit provided by EXIM Bank:

Back to Back L/C:

Back-to-Back L/C is defined as a credit, which is opened at the instructions and the request of the Beneficiary of the original Export L/C on the strength credit. Back to Back is a term given to an ancillary credit, which arises where the seller’s uses the credit, granted to him by the Issuing Bank to his supplier. Sometimes Back-to-Back credit is called Counter Veiling Credits, i.e. credit and counter credit.

There are two types of Back-to-Back credit:

- Foreign Back to Back Credit

- Local Back to Back Credit

Revolving L/C:

A revolving credit is a credit, which provides for the amount of the credit to be renewed automatically after use without the need to renew the credit every time. It can be revolved with respect to either:

- Time

- Amount (i.e. total value of the credit)

Transferable L/C:

A transferable credit is a credit, which can be transferred in whole or part by the original beneficiary to one or more “Second beneficiaries”. It is normally used when the 1st beneficiary does not supply the goods himself, but acts as an intermediary between the supplier and the ultimate buyer.

3.2.2 Document require for Opening L/C:

- L/C Application and agreement from duly filed and signed by proposed importer.

- Exchange control copy of L/C Authorization Form.

- Indent or Proforma Invoice (one kind of price list describing the details on the items wanted to import.

- Insurance cover note with premium paid receipt.

- Offering Sheet.

- L/C opening sheet.

- L/C Forms (in set).

- L/C Amendment Form (in set).

- L/C Forwarding Form.

- IMP Form (set in quadruplicate).

- Liability Voucher.

- Voucher for L/C Advising Charge & Realizing of margin.

Discrepancy & Indemnity:

After the shipment of goods, the Exporter submits the Export documents to Authorized Dealer for Negotiation of the same. Here Authorized Dealer is Exporters Bank. The Banker is to ascertain that the documents are strictly as per the terms of L/C. Before negotiation of Export Bill, the Banker should scrutinize and examine each and every document with great care and must be go through the Original L/C. In the time of scrutiny and kind of lacking can be found by the Banker. This is called Discrepancy. The Discrepancy may be classified as major or minor. There are may be some Discrepancies which are removable. If the Discrepancies are removable, the Exporters are to be advised and the Discrepancies are to be moved. If the Discrepancies are minor, the Export bills against submission of indemnity. Documents with Discrepancies should be negotiated. With the permission of the Exporters, such documents are to be sent on collection.

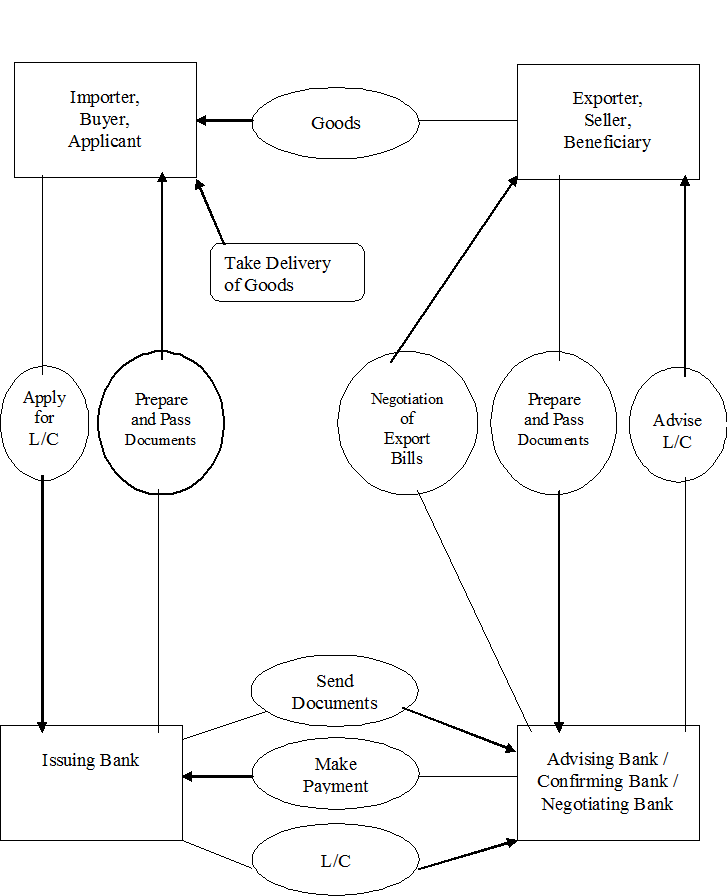

The various steps involved in the operation of a letter of credit are described as follows. Please refer to Figure below for an elaborate illustration.

- The importer and exporter have made a contract before a L/C has been issued.

2. The importer applies for a L/C from his banker known as the issuing bank. He may have to use his credit lines.

3. The issuing bank opens the L/C that is channeled through its overseas correspondent bank, known as the advising bank.

4. The advising bank informs the exporter (beneficiary) of the arrival of the L/C.

5.Exporter ships the goods to the importer or other designated place as stipulated in the L/C.

6. Meanwhile, the exporter also prepares his own documents & collects transport

documents or other documents from relevant parties. All these documents will be sent to his banker, which is acting as the negotiating bank.

7. Negotiation of export bills happens when the banker agrees to provide him with finance. In such case, he obtains payment immediately upon presentation of documents.If not, the documents will be sent to the issuing bank for payment or on an approval basis as in the next step.

8. Documents are sent to the issuing bank (or reimbursing bank, which is a bank nominated by the issuing bank to honor reimbursement from negotiating bank) for reimbursement or payment.

9. Issuing bank honors it’s undertaking to pay the negotiating bank on condition that the documents comply with the L/C terms and conditions.

10. Issuing bank releases documents to the importer when the latter makes Payment to the former or against the latter’s trust receipt facility.

11. The importer takes delivery of goods upon presentation of the transport (Usually Shipping) documents.

Parties Involved in Letter Of Credit (L/C):

The Applicant:

The applicant is the party who approaches a bank in order to issue the L/C. Generally, the applicant is an importer who reaches an agreement with the exporter before approaching the bank to issue the L/C. The applicant is also normally obligated to reimburse the issuing bank for any payments made under the L/C.

The Issuing Bank:

The bank issuing the L/C is known, as the issuing bank and it is usually the bank with which the importer maintains an account. The issuing bank undertakes an absolute obligation to pay upon presentation of documents drawn in strict conformity with the terms and conditions of the L/C.

The Advising Bank:

The correspondent bank in the beneficiary’s country to which the issuing bank sends the L/C is commonly referred to as the advising bank. The advising bank simply advises the L/C without any obligation on its part. However, the advising bank shall take reasonable care to check the apparent authenticity of the credit that it advises.

The Beneficiary:

The beneficiary or exporter is the party entitled to draw payment under the L/C. The beneficiary will have to present the required documents to avail payment under the L/C.

The Confirming Bank:

The confirming bank confirms that the issuing bank has issued a L/C. The confirming bank becomes directly obligated on the credit to the extent of its confirmation and by confirming, it acquires the rights and obligations of an issuer. The advising bank usually does L/C confirmation or a third bank in the beneficiary’s locate.

The Negotiating Bank:

The bank that agrees to examine the documents under the L/C and pay the beneficiary is called the negotiating bank. Typically, the advising bank is nominated as the negotiating bank.

Reimbursing Bank:

The bank nominated by the issuing bank to provide reimbursement to the negotiating bank or the payee bank is referred to as the reimbursing bank.

Foreign Exchange Operation of EXIM Bank:

In EXIM bank limited foreign exchange is divided in to two parts according to the major activities:

- Import oriented foreign exchange activities.

- Export oriented foreign exchange activities.

Import section:

Import and Export (control) Act 1950 regulate the Import and Export trade of the country. There are a number of formalities, which on Importer has to fulfill before import goods. These formalities are explained bellow —

Import Registration Certificate (IRC)

The first thing one need to carry on a business of import is called Import Registration Certificate. But registration is not required for import goods, which do not involved remittance of foreign exchange like medicine; reading materials etc. can be imported without registration by the users within monetary limit. Documents to be required for Import Registration Certificate are as follows —

- Income Registration Certificate

- Nationality Certificate

- Certificate from Chambers of Commerce and Industry Registered Trade Association

- Bank Solvency Certificate

- Copy of Trade License

- Requisite fees

On receiving application, the respective CCI&E officer will scrutinize the documents and conduct physical verification and issue demand note to the prospective importers to furnish the following papers through their nominated Bank —

- Original copy of treasury deposited as IRC fees

- Assets Certificate

- Affidavit from 1st class Magistrate

- Rent receipt

- Two passport size photograph

- Partnership deed in case of partnership firms

- Certificate of Registration, Memorandum and Articles of Association in case of Limited Company.

After scrutinizing and verifying, the nominated Bank will forward the same to the respective CCI&E office with forwarding schedule in duplicate through Banks representative. CCI&E then issue Import Registration Certificate to the Applicant.

Function of Import section:

Imp-Form:

The form IMP contains the followings—

- Name and address of the Authorized dealers.

- Amount of remittance to be permitted (i.e. L/C amount)

- LCA form no. Date and value in Taka.

- Description of goods.

- Invoice value in foreign currency, (i.e. L/C amount)

- Country of origin.

- Port of shipment.

- Name of steamer / Airline (i.e. By road/ship/air)

- Port of importation.

- Indenter’s name and address.

- Indenter’s registration number with CCI & E and Bangladesh Bank.

- Full name and address of the applicant.

- Registration number of the applicant with CCI & E.

- Type of LCAF.

Import Procedures:

The procedures, which follows at the time of Import are as, follow —

- The buyer and the seller conclude a sale contract provided for payment by documentary credit.

- The buyer instructs his Bank (the issuing Bank) to issue a credit in favor of the seller / Exporter / Beneficiary.

- The Issuing Bank then send messages to another Bank (Advising Bank / Confirming Bank), usually situated in the country of seller, advice or confirms the Credit Issue.

- The Advising / confirming Bank then informs the seller through his Bank that the Credit has been issued.

- As soon as the seller receives the credit, if the credit satisfy him the he can reply that, he can meet its terms and conditions, he is in position to load the

goods and dispatch them.

- The seller then sends the documents evidencing the shipment to the Bank where the Credit is available (nominated Bank). This can be the issuing Bank or Confirming Bank; Bank named in the Credit as the paying, accepting and Negotiating Bank.

- The Bank then checks the documents against the credit. If the documents meet

the requirements of the credit, the Bank then pay, accept or negotiate according to the terms of credit. In the case of credit available by negotiation, Issuing Bank will negotiate with recourse.

- The Bank, if other then the issuing bank, sends the documents to the issuing Bank.

- The issuing Bank checks the document and if they found that the document has meet the credit requirements, they realize to the buyer upon payment of the amount due or other terms agreed between him and the issuing Bank.

- The buyer sends transport documents to the carrier who will then proceed to deliver the goods.

An importer is required to have the followings to import through the bank

- A bank account in the bank.

- Import Registration certificate.

- Tax paying identification number.

- Performa invoice indent

- Membership certificate

- LCA (Letter of credit application) form duly attested.

- One set of IMP form.

- Insurance cover note with money receipts.

- Others.

Import Mechanisms:

To import, a person should be competent to be an importer. According to import and export control act, 1950, the officer of the chief controller of import and export provides the registration (IRC) to the importer. After obtaining this, this person has to secure a letter of credit authorization (LCA) from Bangladesh Bank and then a person becomes a qualified importer. He is the person who requests or instructs the opening bank to open an L/C. he is also called opener or applicant of the credit.

Proposal for opening of L/C:

In case of an L/C of a small amount only the prescribed application form i.e. the LCA (Letter of credit application) form is enough to open an L/C. but when the L/C amount is reasonably high, then the importer is asked to submit a proposal to the bank authority to have a limit of L/C amount. This proposal should be approved in the meeting of the executive committee of the bank. The sufficient features of a proposal are —

- Full particulars of bank account.

- Nature of business.

- Required amount of limit.

- Payment terms and conditions.

- Goods to be imported.

- Offered security.

- Repayment schedule.

A credit officer scrutinizes this application and accordingly prepares a proposal (CLP) and forwards it to the Head office Credit Committee (HOCC). The committee, if satisfied, sanctions the limits and returns back to the branch. Thus the importer is entitled for the limit.

L/C Application:

BDI provides a printed form for opening of L/C to the importer. This form known as credit application form. A special adhesive stamp is affixed on the form. While opening, the stamp is cancelled. Usually the importer expresses his desire to open the L/C quoting the amount of margin percentage. The importer gives the following information —

- Full name and address of the importer

- Full name and address of the beneficiary

- Availability of the credit by sight payment acceptance/ negotiation/ differed Payment

- Time bar within which the document should be presented

- Sales type (Cff/FOB/C&F)

- Brief specification of commodities, price, and quantity, indent no, etc.

- Country of origin

- Bangladesh Bank registration No.

- Import license/ LCAF No.

- IRC No.

- Account No.

- Documents required

- Insurance cover note/policy No., date, amount.

- Name and address of the insurance co.

- Weather the partial shipment is allowed or not.

- Weather the Trans shipment is allowed or not.

- Last date of shipment.

- Last date of negotiation

- Other terms and condition if any.

Letter of Credit Authorization (LCA) Form:

The LCA form contains the followings —

- Name and the address of the importer.

- IRC No. And year of renewal.

- Amount of L/C applied for.

- Description of items/to is imported.

- ITC number (s)/HS code.

- Stamp and signature of the importer with seal.

Scrutinization of L/C Application:

The bank officials scrutinizes the application in the following manners-

- The terms and condition of the L/C must be complied with UCPDC 500 and Exchange control & import trade regulation.

- Eligibility of goods to be imported.

- The L/C must not be opened in favour of the importer.

- Radioactivity report in case of food item.

- Survey reports or certificate in case of machinery.

- Carrying vessel is not of Israel or Serbia- Montenegro.

- Certificate declaring that the item is in operation not more than 5 years in case of car.

On scrutiny, if the application is found fit then the L/C is opened and particulars of the same are recorded in the L/C register. Then the transmission of L/C is done through tested Telex or Fax to advise the L/C to beneficiary. If the amount exceeds US$ 10,000 the bank takes the credit report of the beneficiary (CIB report) to ensure the worthiness of the supplying goods

Amendment of L/C:

Parties involved in L/C, particularly the seller and the buyer cannot always satisfy the terms and conditions in full as expected due to some obvious and genuine reasons. In such a situation, the Credit should be amended. The bank transmits the amendment by tested telex to the advising bank. In case of revocable credit, it can be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary. But incase of irrevocable letter of credit, it neither be amended nor cancelled without the agreement of issuing bank, the confirming bank (if any) and the beneficiary. If the L/C is amended, service charge and telex charge are debited from the party account accordingly.

Adding confirmation:

Add the confirming bank gives confirmation. An add confirmation letter contains the followings —

- L/C no.

- L/C amount

- Items to be imported

- Name and address of the applicant

- Name and address of the beneficiary

- Tenor

- Date of shipment

- Date of apiary

- Port of loading

- Port of discharge

- Charges on which party

- Name of the advising bank

- Name of the reimbursing bank

- Name of the confirming bank

Presentation of the Documents:

The seller being satisfied with the terms and conditions of the credit proceeds to dispatch the required goods to the buyer and after that has to present the documents evidencing dispatching of goods to the negotiating bank on or before stipulated expiry date of the credit. After receiving all documents, the negotiating bank, then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate to EXIM bank limited checks the documents. The usual documents are —

- Invoice

- Bill of lading

- Certificate of origin

- Packing list

- Shipping advice

- Non negotiable copy of bill of lading

- Bill of exchange

- Pre-shipment inspection report.

- Shipment certificate.

Examination Documents:

EXIM Bank officials check weather these documents has any discrepancy or not. Here discrepancy means the dissimilarity of any documents with the terms and conditions of L/C.

Retirement of Shipping Documents:

On security if it is found that, the documents drawn are in order EXIM, lodges the documents in PAD and few vouchers are passed.

Retirement of Import Bills:

- Importer will deposit the claim amount

- Banker will prepare and pass Retirement Vouchers

- Certifying Invoices

- Passing of Vouchers

- Entry in the Register

- Endorsement in the B/E and transport document i.e. B/L AWB, TR etc.

At the end of the total procedure, taking the retirement of Import Bills/Clearing Certificate from the Bank, the Importer will clear the goods from the port through the Clearing Agent and Forwarding Agent.

On the other hand, completing the above all steps in the issuing Bank will prepare “Foreign Exchange Transaction Schedule” and send one copy to international division of Head Office and another one copy to recommendation.

Payment Procedure of Import Documents:

This is the most sensitive task of the import department. The officials have to be very much careful while making payment. The task constitute the followings-

- Date of payment- Usually payment is made within seven days after the documents have been received. If the payment is become differed, the negotiating bank may claim interest for making delay.

- Preparing sale memo- a sale memo is made at B.C rate to the customer. As the TT & O.D rate is paid to the ID, the difference between these two rates is exchange trading. Finally an inter branch exchange trading credit advice is sent to ID.

- Requisition for foreign currency- for arranging necessary fund for payment a requisition is sent to the ID.

- Transmission of telex- a telex is transmitted to the correspondent bank ensuring the payment is being made.

Export Section:

Literally, the term Export, we mean that carrying of anything from one country to another. On the other hand Banker’s define Export as sending of visible things outside the country for dale. Export Trade plays a vital role in the development process of an Economy. With the Export earning, we meet our Import Bills.

Export Registration Certificate (ERC)

Like any other business it needs Registration. The chief Controller of Import and Export (CCI&E) makes export registration. For Registration, prospective Exporters required to apply through Q.E.X.P from the CCI&E along with the following documents —

- Trade License 50

- Income Tax Clearance

- Nationality Certificate

- Bank’s Solvency Certificate

- Asset certificate

- Registered Partnership Deed

Function of Export Section:

Export Form:

All Export of which the requirements of declaration vide para-1 of chapter XXI of Exchange Control Manual of Bangladesh Bank applies must be declared on the EXP forms by the customer, now issued by the Authorized Dealers.

Disposal of Exp. Form:

Original: From Custom Authority to Bangladesh Bank after shipment goods.

Duplicate: From Negotiating Bank to Bangladesh Bank after Negotiation.

Triplicate: From Negotiating Bank to Bangladesh Bank after realization of the proceeds of the Export Bill.

Quadruplicate: Retained by the Negotiating Bank as Office Copy.

Export procedure:

A person desirous to export should make application to obtain ERC from CCLNE. Then the person should take step for export purpose into the bank for obtaining EXP form. He must submit following documents:

- Trade license

- ERC

- Certificate from concerned Government Organization

After satisfaction on the documents the banker will issue EXP form to the exporter. Now exporter will be getting shipping and other documents from the shipment procedure. Exporter should submit all these documents along with letter of indemnity to his bank for negotiation.

Back to Back L/C (BTB L/C):

Back to Back L/C Open:

It is a secondary letter of credit opened by the advising bank in favour of a domestic/foreign supplier on behalf of the beneficiary original foreign L/C. As the original letter of credit of bank by import letter, it is called Back-to-Back L/C. The second L/C is opened on the strength of the original L/C for a smaller amount.

Back to Back L/C (Foreign):

When the B-To-B L/C is opened in a foreign country supplier it is called B-To-B L/C (Foreign). It is generally payable within 120 days at site.

Back to Back L/C Export Development Fund (EDF):

EDF provided by the ADB to Bangladesh Bank for export promotion of Third-World-Country like Bangladesh. When the bank is not in a position to support the amount of BtoB L/C then they apply for loans to the Bangladesh Bank for B-To-B (EDF).

Back to Back L/C (Local):

When the Back-to-Back L/C is opened for local purchase of materials, it is called Back-to-Back L/C (Local). It is generally payable within 90 days at site.

Procedures for Back to Back L/C:

- Exporter should make application for Back to Back LAC

- Export L/C or Master L/C under is lien

- Opening of Back to Back L/C

- Terms and conditions for Back to Back L/C

- That the customer has credit line facility

- That L/C is issued as per UCPDC 500

- That on the Export L/C a negotiating clause is present

- That there is no provision for blank endorsement of B/L

- That payment clause is thereon the L/C issuing bank ensuring payment

Consideration for Back to Back L/C:

- Whether client can manufacture within time period

- The un it price of the finished proforma invoice should be considering while allowing margin

- Consider the expiry date and shipment date

- Onside inspection whether manufacturing is carried out

Payment under Back to Back L/C:

Deferred payment is made in case of BTB L/C as 60, 90,120, 180 date of maturity period. Payments will be given after realizing export proceeds from the L/C issuing bank from the abroad.

Reporting of Bangladesh Bank:

At the end of the every month reporting of Bangladesh Bank is mandatory regarding the whole month export operation, the procedures in this respect is as follows —

- To fill-up the E-2/P-2 schedule of S-l category. The whole month import amount, quantity, goods category, country, currency, etc. all are mentioned. Respective IMP forms are attached with the schedule to fill E-3/P-3 for all invisible payment.

- Original IMP is forwarded to Bangladesh Bank with mentioning invoice value

- Duplicate IMP is skipped with the bank along with the bill of entry.

Documentation for Export Purpose:

Following major documents are required for export purpose —

- Commercial invoice

- Bill of lading

- EXP. Form

- Bill of Exchange

- L/C copy

- Packing List

- Certificate of Origin

- Quality Control Certificate

- Weight List

- Inspection Certificate

- Other (if required)

Procedure for Collection of Export Bill:

There are two types of procedures regarding collection of Export Bill —

- Foreign Documentary Bill for Collection (FDBC)

- Foreign Documentary Bill for Purchase (FDBP)

Foreign Documentary Bill For Collection (FDBC):

Exporter can collect the bill through negotiating bank on the basis of collection. Exporter in this case, will submit alt the documents to the negotiating bank for collection of bill from importer. The exporter will get money only when the issuing bank gives payment.

In this connection bank will scrutinize all the documents as per terms and conditions mentioned in L/C.

Foreign Documentary Bill For Purchase (FDBP):

When exporter sale all the export documents to the negotiating bank is known as FDBP. In this case, the exporter will submit all the documents to the bank. The bank gives 60-80% amount to the exporter against total L/C value.

Local documentary Bill for Purchase (LDBP):

Incoming of L/C customer come with the L/C to negotiate.

- Documents given with L/C

- Scrutinizing documents as per L/C terms and conditions

- Forward the documents to L/C opening bank

- L/C issuing bank give acceptance and forward acceptance letter

- Payment given to the party by collection basis or by purchasing documents

Secured Overdraft (SOD) Export:

Secured Overdraft is one kind of credit facility enjoying by the exporter from the export section. It is generally given to meet the back-to-back L/C claim. Sometimes it is given to the exporter by force for meet the back-to-back L/C claim due to delay of Master L/C payment.

Concluding Part

Criticism:

The whole banking sector in Bangladesh is faced by challenges due to continuous foreign bank investment. EXIM Bank Limited is facing severe competition from the other key players. Though EXIM Bank Limited trying to satisfied their customers. The upcoming challenges demand higher performance level and utmost customer satisfaction.

I have worked only in the Panthapath Branch. So, I am not able to know about Head Office activities regarding Credit and others. Branch Officers have to work within limited boundaries and time-to-time they have to take permission from the Head Office. Taking permission from the Head Office is time consuming.

The EXIM Bank Limited send Officers for training in the BIBM but the silly mistakes by the Credit officers in preparing statement of affairs or Office note is continuing, inefficiency in initial appraising process of loan or other activities still persists.

From my observation I have found that peoples are interested about that job which gives them more salary and other facilities. EXIM Bank should give its employees more salaries, job securities and other facilities to hold its existing expert and trained officers.

Conclusion:

As an internee of EXIM Bank Limited I have truly enjoyed my internship from the learning and experience viewpoint. I am confident that this three months internship program at EXIM Bank Limited will definitely help me to realize my further carrier in the job market.

Export Import Bank of Bangladesh Limited is a new generation bank. It is committed to provide high quality financial services/products to contribute to the growth of GDP of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and overall sustainable socio-economic development of the country. Though it is a new bank, EXIM Bank Limited makes a strong position through it’s varies activities. Its number of clients, amount of deposit and investment money increases day by day. This bank already has shown impressive performance in investment. The bank now should think to start new services and take different types of marketing strategy to get more customers in this competition market of banking.