Capitalization

It is the act of converting revenue into capital. It is the recordation of a cost as an asset, rather than an expense. It refers to the valuation of the total business. If a company constructs fixed assets, the interest cost of any borrowed funds used to pay for the construction can also be capitalized and recorded as part of the underlying fixed assets. It is the sum total of owned capital and borrowed capital. Example: A company pays $2,000 for maintenance on a machine. The payment exceeds the company’s capitalization limit, but it has no useful life, so the controller charges it to expense in the current period.

In accounting, capitalization is an accounting rule used to recognize a cash outlay as an asset on the balance sheet, rather than an expense on the income statement. It is the process of recording an expense or cost in a permanent account and systematically allocating over future periods. In finance, capitalization is a quantitative assessment of a firm’s capital structure. It represents the capital invested in the company, including bonds and stocks. It comprises of share capital, debentures, loans, free reserves, etc.

Capitalization = Share Capital + Debenture + Long term borrowing + Reserve + Surplus earnings.

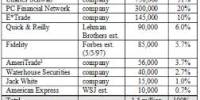

Capitalization is used heavily in asset-intensive environments, such as manufacturing, where depreciation can be a large part of total expenses. It can be used as a tool to commit financial statement reporting fraud. This practice can be spotted by comparing cash flows to net income; cash flows should be substantially lower than net income. Market capitalization is the dollar value of a company’s outstanding shares and is calculated as the current market price multiplied by the total number of outstanding shares. It also represents the value of the firm according to investors’ perceptions. It is equal to the number of shares outstanding multiplied by the share price.

Market Capitalization = Shares Outstanding x Share Price.