Introduction

Background

Various newspaper articles published in the last few months reveal that Bangladesh Bank, the regulator of the banking industry in Bangladesh, is planning to implement the Basel II accord for the banks in Bangladesh from 2009. Basel II is an effort by international banking supervisors to update the original international bank capital accord (Basel I), which has been in effect since 1988 (in Bangladesh since 1996). Basel II reflects the latest round of deliberations by central bankers held in Basel, Switzerland, where they agreed to ensure uniformity in the way banks and banking regulations approach risk management across national borders. The Basel-II Capital Accord titled “International Convergence of Capital Measurement and Capital Standards: A Revised Framework” has been published by the Bank for International Settlement (BIS) in November 2005 for adoption globally.

The new accord, though complex, carries a lot of virtues and will be a milestone in improving commercial banks’ internal mechanism and supervisory process. It will be beneficial to the commercial banks, as it requires review and measurement of different types of risk, which ultimately have effect on risk management approach to comply with the accord standards. Once implemented, banks would also be benefited with significant improvements in their risk management systems, business models, capital strategies and disclosure standards as well as overall efficiency. At present, Bangladesh is following Basel-I for banks’ capital adequacy requirement, wherein risk-weighted capital adequacy ratio was 8 per cent when it was first adopted in 1996. Later in 2002, the ratio was increased to 9 per cent. The idea of the new framework is to strengthen risk-based requirements by laying out principles for banks to assess the adequacy of their capital. It will also enable the supervisors to review such assessments to make sure that banks have adequate capital to support their risks. It also seeks to strengthen market discipline by enhancing transparency in banks’ financial reporting.

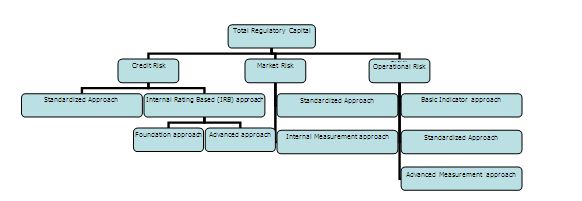

The new Basel accord has been prepared on the basis of three pillars: minimum capital requirement, supervisory review process and market discipline. Three types of risks — credit risk, market risk and operational risk — have to be considered under the minimum capital requirement. For credit risk measurement, new framework provides two different methods – standardized approach and internal ratings-based approach. Implementation of standardized approach requires credit assessment intuitions or rating agencies for determining capital requirements of the banks in line with the Basel fixed risk-weight. On the other hand, internal rating based approach allows banks to rate their credit risks, which again have two different approaches — foundation approach and advanced approach.

However, implementation of Basel II at individual bank’s level is not likely to be an easy task. It will require training for the banking professionals, investment in hard and soft infrastructure and high level professional skill in risk management system implementation. More importantly, it may increase the banks’ capital requirement as the banks’ risk weighted capital adequacy ratio may fall because of more stringent risk assessment and higher risk weights.

This report provides a brief overview of the prevailing status and conditions of the banking sector in Bangladesh in line with Basel II requirements. However, this study has mainly concentrated on the implementation aspects of Pillar I, which has three components such as credit risk, operational risk and market risk. In fact, this study has further narrowed down its scope to focus on different approaches for the measurement of capital charge against credit risk and operational risk and seeks to answer the following questions: (a) What kinds of challenges are likely to be faced by both the Bangladesh Bank and the scheduled banks (including HSBC Bangladesh) in adopting different approaches to credit risk and operational risk? (b) Which approaches are likely to be more appropriate for Bangladesh to measure and charge capital against those risks?

Objectives

This report tried to achieve the following objectives:

- Give a brief overview of the Basel II accord and the requirements under this accord.

- Analyze the advantages and disadvantages of the options available under Basel II to assess different types of risks and predict which methods are likely to be adopted by Bangladesh Bank for implementation by the scheduled banks in Bangladesh.

- Analyze how the adoption of Basel II accord by Bangladesh Bank will affect the capital adequacy position and existing risk assessment process of HSBC Bangladesh

- Determine the level of preparedness of HSBC Bangladesh to meet the new requirements and find out the steps the bank should take to minimize these effects.

Scope

The report stayed limited only to evaluating the changes that will have to be implemented in risk assessment processes due to the first pillar of Basel II accord, i.e. Minimum Capital Requirement, by Bangladesh Bank and HSBC Bangladesh. It did not focus on the other two pillars, namely Supervisory Review and Market Discipline in detail. Neither did the report attempt to judge the overall impact of Basel II accord on the banking industry of Bangladesh.

Methodology

The report used both secondary data and primary data. Secondary data was collected and used to provide overview of the Basel II accord and the requirements under this accord, the changes introduced in measuring credit risk, market risk and operational risk etc. Secondary data was also used to determine the suitability of the various alternative risk assessment approaches for implementation in Bangladesh and their likelihood of being selected by Bangladesh Bank. Primary research was done to find out the impact of the proposed changes on capital requirement and risk assessment process of HSBC Bangladesh.

Primary source

Primary data was collected by interviewing concerned officials of the bank in the Financial Control, Credit Risk Management, Operations and Corporate Banking Divisions of HSBC Bangladesh.

Secondary source

The secondary data was collected partly from the Basel II accord itself, i.e. “International Convergence of Capital Measurement and Capital Standards: A Revised Framework” published by the Bank for International Settlement (BIS). Additional data was collected from various newspaper articles, internet articles and Bangladesh Bank publications on the accord. Some data was also collected from the HSBC Group’s intranet to find out the Group’s planned strategy in meeting Basel II requirements.

Data Collection Method

For the organization part and secondary data for the research part, information was collected from different published articles, journals, reports and brochures on HSBC. Primary data for the research part was collected through interviewing the relevant officials of the bank. However, no formal questionnaire for data collection will be used.

Limitations

Some of the relevant information of the bank is confidential & critical. For this reason, these figures were not available from the bank. In such case, proxy figures was used, if possible, while analyzing many issues related to risk assessment and capital adequacy.

Overview Of HSBC Group

An Overview of HSBC Group

The HSBC Group is named after its founding member, The Hongkong and Shanghai Banking Corporation Limited, which was established in 1865 in Hong Kong and Shanghai to finance the growing trade between China and Europe.

Thomas Sutherland, a Hong Kong Superintendent of the Peninsular and Oriental Steam Navigation Company helped to establish this bank in March 1865. Throughout the late nineteenth and the early twentieth centuries, the bank established a network of agencies and branches based mainly in China and South East Asia but also with representation in the Indian sub-continent, Japan, Europe and North America.

The post-war political and economic changes in the world forced the bank to analyze its strategy for continued growth in the 1950s. The bank diversified both its business and its geographical spread through acquisitions and alliances.

HSBC Holdings plc, the parent company of the HSBC Group, was established in 1991 with its shares quoted on both the London and Hong Kong stock exchanges. The HSBC Group now comprises a unique range of banks and financial service providers around the globe.

HSBC maintains one of the world’s largest private data communication networks and is reconfiguring its business for the e-age. Its rapidly growing e-commerce capability includes the use of the internet, PC banking over a private network, interactive TV, and fixed and mobile, including wireless application protocol or WAP-enabled mobile, telephones.

HSBC History

The HSBC Group has an international pedigree, which is quite unique. Many of its principal companies opened for business over a century ago and they have a history rich in variety and achievement.

Foundation and Growth

The inspiration behind the founding of the bank was Thomas Sutherland, a Scot who was then working as the Hong Kong Superintendent of the Peninsular and Oriental Steam Navigation Company. He realized that there was considerable demand for local banking facilities both in Hong Kong and along the China coast and he helped to establish the bank in March 1865. Then, as now, the bank’s headquarters were at 1 Queen’s Road Central in Hong Kong and a branch was opened one month later in Shanghai.

Throughout the late nineteenth and the early twentieth centuries, the bank established a network of agencies and branches based mainly in China and South East Asia but also with representation in the Indian sub-continent, Japan, Europe and North America. In many of its branches the bank was the pioneer of modern banking practices. From the outset, trade finance was a strong feature of the bank’s business with bullion, exchange and merchant banking also playing an important part. Additionally, the bank issued notes in many countries throughout the Far East.

During the Second World War the bank was forced to close many branches and its head office was temporarily moved to London. However, after the war the bank played a key role in the reconstruction of the Hong Kong economy and began to further diversify the geographical spread of the bank.

The post-war political and economic changes in the world forced the bank to analyze its strategy for continued growth in the 1950s. The bank diversified both its business and its geographical spread through acquisitions and alliances. This strategy culminated in 1992 with one of the largest bank acquisitions in history when HSBC Holdings acquired the UK’s Midland Bank plc (now called HSBC Bank plc). However, it remained committed to its historical markets and played an important part in the reconstruction of Hong Kong where its branch network continued to expand.

Table 1: Timeline of Progress: HSBC

| Key events in the growth of the HSBC Group

| The HSBC Group evolved from The Hongkong and Shanghai Banking Corporation Limited, which was founded in 1865 in Hong Kong with offices in Shanghai and London and an agency in San Francisco. The group expanded primarily thought offices established in the bank’s name until mid-1950s when it began to create or acquire subsidiaries. The following are some key developments in the Group’s growth since 1959 |

| 1959 | The Hongkong and Shanghai Banking Corporation acquires The British Bank of Middle East (formerly the Imperial Bank of Persia, now called HSBC Bank Middle East Limited). |

| 1965 | The Hongkong and Shanghai Banking Corporation acquires a majority shareholding in Hang Seng Bank Limited, now the second-largest bank incorporated in Hong Kong. |

| 1971 | The British Bank of the Middle East acquires a minority stake of 20% in The Cyprus Popular Bank Limited (now trading as Laiki Group) |

| 1972 | Midland Bank acquires a shareholding in UBAF Bank Limited (now known as British Arab Commercial Bank Limited). |

| 1978 | The Saudi British Bank is established under local control to take over The British Bank of the Middle East’s branches in Saudi Arabia. |

| 1980 | The Hongkong and Shanghai Banking Corporation acquires 51% of New YorkState’s Marine Midland Bank, N.A. (now called HSBC Bank USA). Midland acquires a controlling interest in leading German private bank Trinkaus & Burkhardt KGaA (now HSBC Trinkaus & Burkhardt KGaA). |

| 1981 | Hongkong Bank of Canada (now HSBC Bank Canada) is established in Vancouver. The Group acquires a controlling interest in Equator Holdings Limited, a merchant bank engaged in trade finance in sub-Saharan Africa. |

| 1982 | Egyptian British Bank S.A.E. is formed, with the Group holding a 40% interest. |

| 1983 | Marine Midland Bank acquires Carroll McEntee & McGinley (now HSBC Securities (USA) Inc.), a New York based primary dealer in US government securities. |

| 1986 | The Hongkong and Shanghai Banking Corporation establishes Hongkong Bank of Australia Limited (now HSBC Bank Australia Limited) |

| 1987 | The Hongkong and Shanghai Banking Corporation acquires the remaining shares of Marine Midland and 14.9% equity interest in Midland Bank plc (now HSBC Bank plc). |

| 1991 | HSBC Holdings is established; its shares are traded on the London and Hong Kong stock exchanges. |

| 1992 | HSBC Holdings purchases the remaining equity in Midland Bank. |

| 1993 | The HSBC Group’s Head Office moves to London. |

| 1994 | Hongkong Bank Malaysia Berhad (now HSBC Bank Malaysia Berhad) is formed. |

| 1997 | The group establishes a new subsidiary in Brazil, Banco HSBC Bamerindus S.A. (now HSBC Bank Brasil S.A. – Banco Mǔltiplo), and acquires Roberts S.A. de Inversiones in Argentina (now HSBC Argentina Holdings S.A.). |

| 1999 | Shares in HSBC Holdings begin trading on a third stock exchange, New York. HSBC acquires Republic New York Corporation (now integrated with HSBC USA Inc.) and its sister company Safra Republic Holdings S.A. (now HSBC Republic Holdings (Luxembourg) S.A.). Midland Bank acquires a 70.03% interest in Mid-Med Bank p.l.c. (now HSBC Bank Malta p.l.c.), Malta’s largest commercial bank. |

| 2000 | HSBC acquires CCF, one of France’s largest banks. Shares in HSBC Holdings are listed on a fourth stock exchange, in Paris. The Group increases its shareholding in Egyptian British Bank to over 90% and later renames it HSBC Bank Egypt S.A.E. |

| 2001 | HSBC acquires Demirbank TAS, now HSBC Bank A.S., Turkey’s fifth largest private bank; and signs an agreement to purchase an 8% stake in Bank of Shanghai. |

| 2002 | Acquisitions include Group Financiero Bital, S.A. de C.V., one of Mexico’s largest financial services groups; and a 10% interest in Ping An Insurance Company of China Limited, the second largest life insurance operations in China. |

| 2003 | HSBC acquires Household International Inc., a leading US consumer finance company; and Lloyds TSB’s Brazilian assets including Losango Promortora de Vendas Ltd, a major consumer credit institution. Four French private banking subsidiaries combine to form HSBC Private Bank France. HSBC Insurance Brokers Limited forms a joint venture, Beijing HSBC Insurance Brokers Limited, in which it has a 24.9% stake. Hang Seng Bank acquires 15.98% of Industrial Bank Co Ltd, a mainland China commercial bank, and HSBC agrees to purchase 50% of Fujian Asia bank Limited (no Ping An Bank Limited). |

| 2004 | HSBC acquires The Bank of Bermuda Limited, a leading provider of fund administration, trust, custody, asset management and private banking services; and shares in HSBC Holdings are listed on a fifth stock exchange, in Bermuda. |

| 2005 | HSBC marked 140 years in China by increasing its stake in the country. In the Middle East, HSBC reopened its branch in Kuwait, while in the USA, the integration of Household International with the Group’s North American operations was completed, under the name ‘HSBC Finance Corporation’. HSBC Asset Management, HSBC Investment Management and HSBC Multi-manager become HSBC Investments. HSBC Halbis Partners, a specialist fundamental active investment business is formed from part of HSBC Asset Management and all of HSBC Alternative Investments. |

| 2006 | HSBC acquires Bank of Panama for USD 1.77 billion to increase its presence in South America. Currently the Group has presence in 76 Countries worldwide. |

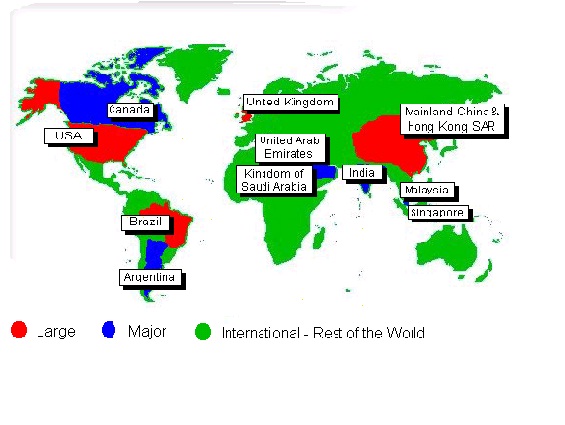

The HSBC Group at present

HSBC Holdings is a public limited company incorporated in England and Wales. Headquartered in London, the HSBC group operates in five regions: Europe; Hong Kong; the rest of Asia Pacific; including the Middle East and Africa; North America; and South America. The entities which form the HSBC Group provide a comprehensive range of financial services to personal, commercial, corporate, institutional and investment, and private banking clients. To more easily promote the Group as a whole, HSBC was established as a uniform, international brand name in 1999. In 2002, HSBC launched a campaign to differentiate its brand from those of its competitors by describing the unique characteristics which distinguish HSBC, summarized by the words ‘The world’s local bank’.

Banks under the HSBC Group

Many of the members of the group have changed their name into HSBC (The Hong Kong and Shanghai Banking Corporation Limited) to introduce the whole group under one brand name.

Midland Bank, one of the principal UK clearing banks, was acquired by HSBC Holdings in 1992. The bank has a personal customer base of five and a half million, business customers of over half a million, and a network of almost 1,700 branches in the United Kingdom. Midland has offices in 28 countries and territories, principally in continental Europe, with a number of offices in Latin America.

Hang Seng Bank, in which HongkongBank has a 62.1% equity interest, maintains a network of 146 branches in the Hong Kong SAR, where it is the second-largest locally incorporated bank after HongkongBank. Hang Seng Bank also has a branch in Singapore and four branches in China.

Marine Midland Bank, headquartered in Buffalo, New York, has 380 banking locations state-wide. The bank serves over two million personal customers and 120,000 commercial and institutional customers in New YorkState and, in selected businesses, throughout the United States.

Hongkong Bank of Canada is the largest foreign-owned bank in Canada and the country’s seventh-largest bank. It has 116 branches across Canada and two branches in the western United States.

Banco HSBC Bamerindus was established in Brazil in 1997. The bank has its head office in Curitibank and a network of some 1,900 branches and sub-branches, the second largest in Brazil.

Hongkong Bank Malaysia is the largest foreign-owned bank in Malaysia and the country’s fifth-largest bank, with 36 branches.

The British Bank of the Middle East (British Bank) is the largest and most widely represented international bank in the Middle East, with 31 branches throughout the United Arab Emirates, Oman, Bahrain, Qatar, Jordan, Lebanon and the Palestinian Autonomous Area, including an offshore banking unit in Bahrain. The bank also has branches in Mumbai and Trivandrum, India, and Baku, Azerbaijan, as well as private banking operations in London and Geneva.

HSBC Banco Roberts was acquired in 1997. Based in Buenos Aires, it is one of Argentina’s largest privately owned banks, with 60 branches throughout the country.

HongkongBank of Australia has 16 branches across Australia. It is the flagship of the HSBC Group’s businesses there, operating under the name HSBC Australia, and providing a complete range of financial services.

The Saudi British Bank, a 40%-owned member of the HSBC Group, has 63 branches throughout Saudi Arabia and a branch in London.

Other associated Group banks are British Arab Commercial Bank, The Cyprus Popular Bank and Egyptian British Bank. Wells Fargo HSBC Trade Bank is a San Francisco-based joint venture between HSBC and Wells Fargo Bank, providing trade finance and international banking services in the United States through its offices in five western states and in conjunction with Wells Fargo’s 32 regional commercial banking offices in 10 western states. In addition, the Group has a non-equity strategic alliance with Wells Fargo Bank, which provides access to a wide range of banking services through that bank’s more than 1,900-staffed outlets. The Group also has a non-equity alliance with Wachovia Corporation, one of the leading corporate banks in the United States, with business relationships in 50 states.

HSBC’s International Network

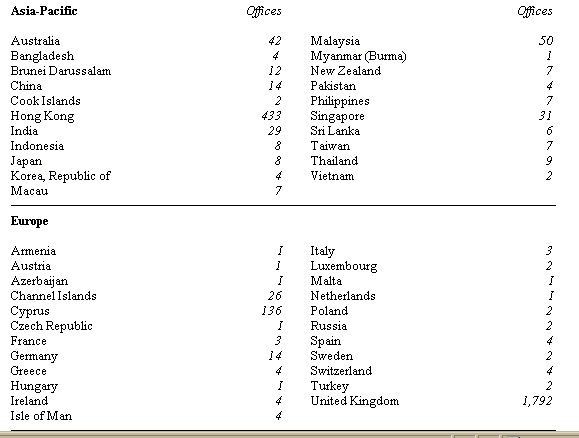

The HSBC Group’s international network comprises of some 9,500 offices in 76 countries and territories. A brief list is presented below:

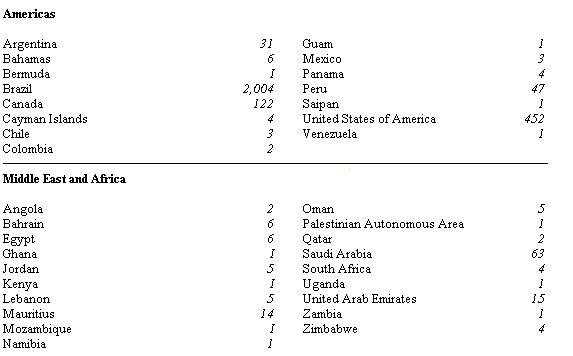

Country Classifications

To ensure that the key resources (management time, capital, human resources and IT) are correctly allocated and that the exchange of best practice is accelerated between entities, the group has classified the countries where it operates into 3 categories: the large, the major and the international.

These classifications are a function of sustainable, attributable earnings, the number of retail clients, balance sheet and size of operation. A brief presentation of this classification is shown below:

HSBC Brand & Corporate Identity

A key part of the Group’s business strategy, announced in 1998, is the creation of a global brand featuring the HSBC name and hexagon symbol. The symbol is now a familiar sight around the world. The Group has embarked on the next phase — making the HSBC brand universally synonymous with its core values of integrity, trust and excellent customer service.

The Hexagon logo of HSBC is derived from HSBC’s traditional flag, a white rectangle divided diagonally. Like many other Hong Kong company flags in the last century, the design of the flag was based on the cross of St. Andrew, The Patron Saint of Scotland.

HSBC presents it self as a prudent, cost conscious, ethically grounded, conservative, trustworthy international builder of long-term customer relationships.

HSBC Vision Statement

“We aim to satisfy our customers with high quality service that reflects our global image as the premier international bank”

Objectives of HSBC

HSBC’s objectives are to provide innovative products supported by quality delivery of systems and excellent customer services, to train and motivate staff and to work in a socially responsible manner. By combining regional strengths with group network, HSBC’s aim is to be the leading bank in its target markets. HSBC’s goal is to achieve sustained earnings growth and continue to enhance shareholders value.

Basic Drives

HSBC’s basic drives are Higher Productivity, Team Orientation, and Creative Organization & Customer Orientation.

The essence of HSBC brand is integrity, trust and excellent customer service. It gives confidence to customers, value to investors & comfort to colleagues.

Through the process of listening to individuals needs and then acting in partnership to deliver the right solutions, HSBC’s is committed to helping the clients make the most of their financial assets.

HSBC operate on a global basis, but also work on a local level to ensure the cross-border differences are identified and any related benefits exploited. HSBC teams of specialists ensure that whether you need solutions across the world, regionally or locally, they have the skills, expertise and resources to deliver them. They automate as many functions as possible, whilst ensuring you retain control.

HSBC claims that they are the people to talk to if anyone wants the following: –

- Global cash flow co-ordination

- Enhanced risk management

- Improved security and audit controls

- Minimized costs and reduced operating expenses

- Maximized liquidity, returns and interest benefits

Group Business Principles and Value

The HSBC Group is committed to Five Core Business Principles:

- Outstanding customer service;

- Effective and efficient operations;

- Strong capital and liquidity;

- Conservative lending policy;

- Strict expense discipline;

HSBC Operates According to Certain Key Business Values:

- The highest personal standards of integrity at all levels;

- Commitment to truth and fair dealing;

- Hand-on management at all levels;

- Openly esteemed commitment to quality and competence;

- A minimum of bureaucracy;

- Fast decisions and implementation;

- Putting the Group’s interests ahead of the individual’s;

- The appropriate delegation of authority with accountability;

- Fair and objective employer;

- A merit approach to recruitment/selection/promotion;

- A commitment to complying with the spirit and letter of all laws and regulations wherever we conduct our business;

- The promotion of good environmental practice and sustainable development and commitment to the welfare and development of each local community

HSBC’s reputation is founded on adherence to these principles and values. All actions taken by a member of HSBC or staff member on behalf of a Group company should conform to them.

In the following two sections a brief outline of the HSBC group’s financial profile and customer segment is provided.

Financial Profile of the Group

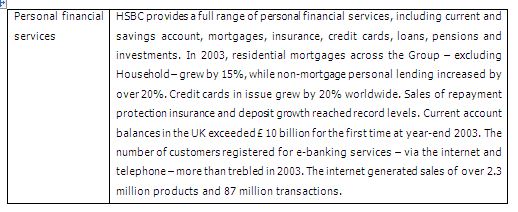

Customer Segments of HSBC Group

Overview Of HSBC Bangladesh

HSBC Bangladesh

The HSBC Asia Pacific group represents HSBC in Bangladesh. HSBC opened its first branch in Dhaka in 17th December, 1996 to provide personal banking services, trade and corporate services, and custody services. The Bank was awarded ISO9002 accreditation for its personal and business banking services, which cover trade services, securities and safe custody, corporate banking, Hexagon and all personal banking. This ISO9002 designation is the first of its kind for a bank in Bangladesh. The HongKong and Shanghai Banking Corporation Bangladesh Ltd. primarily limited its operations to help garments industry and to commercial banking. Later, it extended its services to pharmaceuticals, jute and consumer products. Other services include cash management, treasury, securities, and custodial service.

Realizing the huge potential and growth in personal banking industry in Bangladesh, HSBC extended its operation to the personal banking sector in Bangladesh and within a very short span of time it was able to build up a huge client base. Extending its operation further, HSBC opened a branch at Chittagong, three branch offices at Dhaka (Gulshan, Mothijheel and Dhanmondi) and an offshore banking unit on November 1998.

HSBC Bangladesh is under strict supervision of HSBC Asia Pacific Group, Hong Kong. The Chief Executive Officer of HSBC Bangladesh manages the whole banking operation of HSBC in Bangladesh. Under the CEO there are heads of departments who manage specific banking functions e.g. personal banking, corporate banking, etc.

Currently HSBC Bangladesh is providing a wide range of services both two individual and corporate level customers. In the year 2000, the bank launched a wide array of personal banking products designed for all kinds of (middle and higher-middle income) individual customers. Some such products were Personal loans, car loans, etc. Recently the bank launched three of its personal banking products – Tax loan, Personal secured loan & Automated Tele Banking (ATB) service. These products are designed to meet the diverse customer needs more completely.

HSBC in Bangladesh also specializes in self-service banking through providing 24-hour ATM services. Recently it has introduced Day & Night banking by installing Easy-pay machines in Banani, Uttara and Dhanmondi to better satisfy the needs of both customers and non-customers. In total HSBC currently has 10 ATMs and 3 Easy-pay machines located at various geographical areas of Dhaka & Chittagong.

Over the years, HSBC has dynamically expanded its operations in Bangladesh both in terms of customer base and business volume. At present it is one of the fastest growing and most profitable banks in Bangladesh.

| Name of the Organization | The Hong Kong Shanghai Banking Corporation Bangladesh Ltd. |

| Year of Establishment | 1996 |

| Head Office | AnchorTower, 1/1-B Sonargaon Road Dhaka 1205, Bangladesh |

| Nature of the organization | Multinational company with subsidiary group in Bangladesh |

| Shareholders | HSBC group shareholders |

| Products | Savings & deposit services Loan products Corporate and Institutional services Trade services Hexagon |

| Management | Mr. Steve Banner, Chief Executive Officer Mr. Mamoon Mahmood Shah, Head of Personal Financial Services Mr. Mahbub-Ur-Rahman, Head of Corporate Banking Mr. Syed Akhtar Hossain Uddin, Human Resource Manager Mr. Munir Hussain, Marketing Manager Mr. Wasim Adnan Wahed, Chief Operating Officer |

| Number of Offices | 8 |

| Number of ATM’s | 10 |

| Number of employees | Approximately over 600 |

HSBC in Bangladesh also has an Offshore Banking Unit, which provides banking services for foreign companies based in the Export Processing Zones in Dhaka and Chittagong.

Different Activities in Bangladesh

As one of the largest international banks in Bangladesh, HSBC has a long-term commitment to its customers and provides a comprehensive range of financial services: personal, commercial and corporate banking; trade services; cash management; treasury; consumer & business finance; and securities and custody services.

Personal Banking Services

HSBC offers a full range of personal banking products and services designed to take care of its customers’ growing needs and requirements. HSBC in Bangladesh has launched a number of loan products during 2000. Personal Installment Loan is an unsecured loan that does not require any personal guarantee or cash security; Car Loan, also, does not require any down payment or personal guarantee. The Bank has already launched Phone banking, a state-of-the-art automated telephone banking service available 24 hours a day, 7 days a week, and 365 days a year, which allows customers to access their account from the comfort of the office or home. HSBC is the market leader in the local Auto-Pay service with which the company can initiate bulk Taka payments to, or Taka collections from, any HSBC current or savings accounts of counterparts for a specified sum at a specified date, regardless of the branch. HSBC also offers Power-Vantage, a unique all-in-one package of products and services designed to give total financial control to the customer; a unique savings account, which allows the customer to do any number of transactions without any charges being incurred or credit interest lost. To satisfy the growing needs of real estate HSBC Bangladesh recently launched Home Loan Scheme and a special type of deposit product named “Bangladesh International” for non-resident Bangladeshi. Details of these products and more will be discussed later.

Corporate Banking Services

HSBC offers a wide range of cash financing, working capital, short and medium-term loans and guarantee facilities from its Head Office and Chittagong branch. The Offshore Banking Unit (OBU) provides US Dollar denominated working capital as well as short-term finance for capital imports to eligible businesses. Using high-speed communication links, HSBC connects customers to international payment systems.

Trade Services

As the leading provider of trade finance and related services to importers and exporters in Asia, HSBC in Bangladesh operates a highly automated trade-processing network and offers an Electronic Data Interchange (EDI) capability through Hexagon. The Bank also uses SWIFT, an efficient and secure mechanism for bank-to-bank global communications used for all trade related activities including fund transfers and issuance of DC’s (Documentary Credit).

Financial Institutions

HSBC provides global trade services and cash management services to local banks. HSBC’s worldwide network strength, with over 9500 offices in 76 countries and territories, coupled with a world class reputation in Trade Finance (“Best Trade Documentation Bank” – Euro money) places HSBC in an ideal position to render unmatched correspondent banking services.

HSBC’s commanding presence in the USA (5th largest USD clearing bank globally), UK (largest GBP clearing bank globally), and the Euroland (largest Euro clearing bank in the UK) allows the Bank to also provide first class cash management solutions in 3 major global currencies; USD, GBP and Euro.

Payments and Cash Management

HSBC was the pioneer in introducing electronic cash management solutions in Bangladesh, by introducing its state-of-the-art proprietary software, Hexagon, back in 1997. This was initially made available to corporate clients only but has since been expanded to include banks and retail clients.

With Hexagon, the Bank’s cash management system, corporate customers can access banking services from anywhere in the world to view account balances and statements, make transfers and international payments, and to open documentary credits, by using only a PC, a modem and a telephone line.

Organizational Structure of HSBC Bangladesh

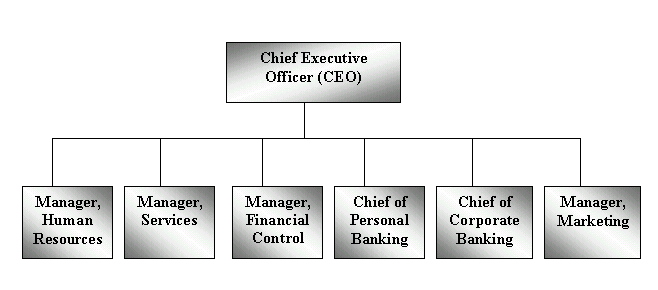

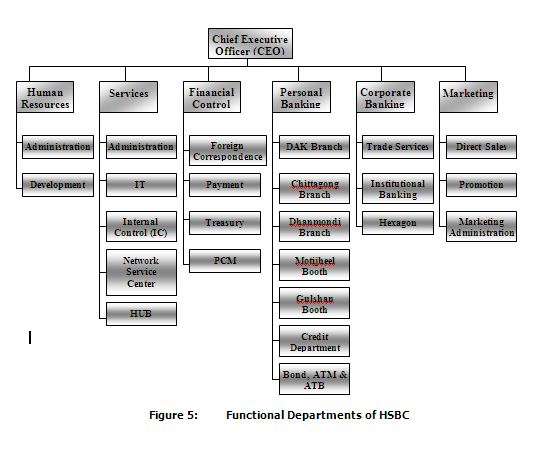

The organizational structure of HSBC Bangladesh is designed according to the various service and functional departments. The Chief Executive Officer (CEO) heads the chief executive committee, which decides on all the strategic aspect of HSBC. The CEO supervises the heads of all the departments and he is the ultimate authority of HSBC Bangladesh. The HSBC Chief Executive Committee is formed with the heads of all the departments along with the CEO. Its structure is shown in the following figure.

Figure : Organogram – Chief Executive Committee

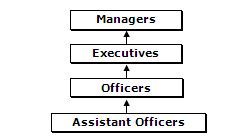

HSBC follows a 4 layer management structure in Bangladesh. These are Managers, Executives, Officers and Assistant Officers. The CEO is the top most authority. Managers are the departmental heads who are responsible for formulating the strategies and the overall activities of their departments. Executives are basically responsible for certain activities & organizational functions. e.g. Admin Executive. These two layers represent the management level of HSBC Bangladesh.

Officers are the typical mid-level employees and are responsible for managing the operational activities and operating level employees. The operating level employees of HSBC who are ranked as Assistant Officer fill the last layer of this hierarchy. They perform the day-to-day operational activities of HSBC. An organizational hierarchy chart is shown below:

Figure : Organizational Hierarchy

Functional Departments of HSBC

HSBC activities are performed through functional departmentalization. So, the departments are separated according to the functions they perform. Within the major departments there are some other subsidiary departments that allow smooth operation of their own major departmental function.

Personal Banking / Personal Financial Services (PFS)

PFS is the most flourishing department of HSBC Bangladesh. This department basically deals with the management of products and services offered to the individual consumers. Within a span of only five years, HSBC PFS has grown tremendously and is still growing with its innovative products and service offerings. PFS Head Mr. Mamoon Mahmud Shah manages this department. PFS Head manages and supervises the Personal Banking activities of the branch network of HSBC Bangladesh. The branches and booths of HSBC basically deal with the personal banking activities and provide various accounts services to individual customers.

Operations of PFS

Manages daily operation

Plans and directs sales and marketing

Plans for service development

Top-level authority for customers’ dealings and transaction

Provides required service to the customers directly

Maintains documentation and report flow vary rapidly

Helps in planning in field level

Assists PFS Head in decision-making process

Assists PFS Head in different level of research

Assists PFS Head day-to-day work

Keeps track and inform PFS Head in present condition of the competition in the market

Branch Network

There are eight branches of HSBC. Only the Dhaka office (head office) branch & Chittagong branch deals with both corporate and personal banking. The other offices only deal with the personal banking activities. There functions are to provide various financial services to the consumers. These include customer services, sale of various PFS products, opening new accounts, providing cash, remittance and other teller services, etc. The branches are quite decentralized for better delivery of services to customer and have their own premises and facilities. These branches are headed by branch managers. Each branch is staffed with its own team of employees. A great deal of teamwork is seen within these branches. ATM’s are situated with each branch premises.

ATMCenter

The ATM center ensures smooth operation of the ATM machines. The ATM center is responsible for regular replenishment of the off-site ATM’s and servicing of all the ATMs. Currently a total 16 ATMs are in operation. The ATM center also deals with issuance, termination and servicing of the ATM cards. On a whole, the ATM center is the department that is solely responsible for all the activities related to ATM and is the facilitating department that enables customers 24 hour banking support.

BondDepartment

This department is under the same manager as the ATM center. They basically deal with all the buying and selling of government bonds and treasury bills as per customer instruction, i.e. BSP, PSP, TSP etc. This department keeps under its control the transactions regarding USDB, USDIB and WEDB.

ATBCenter

ATB refers to Automated Tele Banking. This department deals with the back office servicing of the HSBC phone banking services provided to customers. This department is basically responsible for the activation of ATB, ATB pin generation, and ATB security management, ATB blocking and troubleshooting of all ATB problems. This department is fairly new and was constructed on January 2001. Currently this department is staffed with one executive and one officer.

PFS Credit Department

The personal banking credit department deals with the consumer credit schemes such as the Personal loan, Car loan, Travel Loan, Personal Secured loan, etc. which are tailored to meet the demand of individual customers. The manager of PFS credit who approves and administers all the activities heads this department. He is staffed with one loan approval officer, one loan processing officer, two assistant officers and one MIS clerk. The approval officer mainly rejects or approves the credit requests. After being checked by the approval officer, the credit requests go to the processing officer for further processing of the application. This department is a member of ALCO (Asset Liability Management Committee), which coordinates in preparation of lending analysis and data on concentration of risk and identifies possible lending risks. This department is also responsible for monitoring all necessary documents and securities related to loans.

Corporate Banking

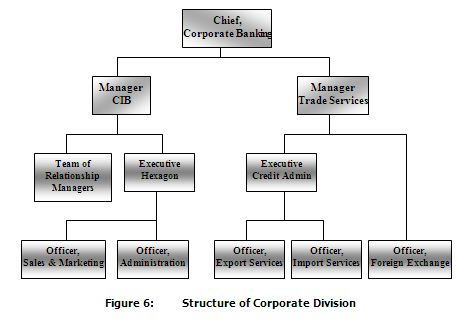

This division if HSBC provides financial services to organizational (corporate) clients. HSBC is a worldwide leader in banking and financial services whose success is based on its relationships with its corporate clients. Whether it is locally or around the world, HSBC offers a comprehensive range of services that can be tailored to the individual needs of the company. The Head of this department is the Chief of Corporate Banking. He is also the Vice-CEO of HSBC Bangladesh. The chief of Corporate Banking manages the activities of corporate banking of HSBC Bangladesh. Two offices of HSBC Bangladesh offer corporate banking services to corporate clients. These are the Dhaka Head Office and Chittagong office. Corporate Banking of HSBC Bangladesh includes Corporate Institutional Banking (CIB), Trade Service (HTV), and Hexagon. These sub-divisions are discussed briefly in the following sections along with a structure chart of Corporate Banking division of HSBC Bangladesh.

Corporate Institutional Banking (CIB)

As their major customers operate internationally, HSBC services them internationally. Operating through the major centers and in close liaison with HSBC Investment Bank, Corporate and Institutional Banking provides the full range of the Group’s capabilities at local and global levels, with a particular focus on payments and cash management, trade and securities custody. HSBC also offers local financial institutions and banks access to wide range of financial services available on an international basis. The services are tailored to suit the needs of the companies. CIB has two separate wings: Relationship management department and Hexagon. These are discussed below:

Relationship Management Department

The RM department consists of various relationship managers who are assigned to different corporate client to better satisfy their needs. These RM’s communicate with the clients and are solely responsible for the companies they deal in. Any information regarding a corporate client must be communicated through the respective RM assigned to that corporate client. A relationship manager may be assigned more than one company and this decision depends on the chief of Corporate Banking.

HSBC Trade Services

Trade service is known by various names in other banks, e.g. Trade Finance Foreign Exchange, Foreign Trade etc. However, the functions are the same. As the name suggests, this department is involved in facilitating trade, both international & within Bangladesh. HSBC is the leading provider of trade finance and related services to importers and exporters in Asia. Trade is considered a core business of the group. The group’s presence in 81 countries of the world gives a good opportunity to control both ends of a trade transaction and keep the business within the Group. The various awards it has won from the leading publications of the world acknowledge HSBC’s excellence in trade. The trade service department has two separate subsidiaries: Credit Administration & Foreign Exchange Division.

Payment and Cash Management (PCM)

PCM deals with the inter-bank payment. PCM strategies are designed to ensure efficiency, profitably and comprehensive support.

Marketing Department

The sixth major department of HSBC is the marketing department. The marketing department of HSBC play a vital role in fostering the continuos growth HSBC in Bangladesh. A manager is assigned to this department who looks after the overall marketing operation of HSBC in Bangladesh. This department is basically concerned about marketing the company’s products, services and building a strong corporate image. The marketing department of HSBC has three subdivisions: Direct Sales, Promotion & Marketing Administration. These are discussed below:

Direct Sales (DS)

An executive is assigned to this part of the marketing department. The Direct Sales division coordinate & manages the sales activities of all the Mobile sales officers (MSO) of HSBC Bangladesh. The MSO’s basically makes sales of the company various Personal Banking products such as, savings accounts, consumer loan, etc outside the banking premises. There are a total of more than 50 mobile sales officers (MSO) employed in the cities of Dhaka and Chittagong. A MSO’s are assigned to specific branches for making sales activities more smoothly. The DS executive sets sales strategies & targets for the Sales officers and manages the whole team of MSO’s in Bangladesh. The direct sales department also decides upon the commission and remuneration of the mobile sales officers as their salary structure is based on sales performances. Thus this part of the marketing division is very important for the overall growth of the Personal Banking Division.

Promotion

This part of the marketing department deals with all the promotional activities of HSBC Bangladesh. Prime responsibilities of this department are: Maintaining strong public relations with various media intermediaries, Advertising the companies products and services, building a strong corporate image of HSBC in Bangladesh.

Public Relations

The promotion department organizes various environmental and social activities in order to build a strong corporate image of HSBC in the minds of customers as well as in the media. Maintaining strong relationship with news media is another major duty of this department.

Advertising

The promotion also coordinates all the advertising of HSBC products within Bangladesh. Some of the advertising tools that are frequently used by the company are as follows:

a) Newspapers Advertising: Regular advertisements of various products and services of HSBC are given in some of the countries most renowned daily newspapers.

b) Billboards: Huge colourful billboards with HSBC logo are found in various major areas of Dhaka and Chittagong. These billboards emphasize on the needs of customers and shows HSBC logo as solution to their needs.

c) Road Side Signposts: Medium sized multi colour signposts focusing on various products of HSBC are found on the roadsides of various posh areas such as, Gulshan, Dhanmondi, Baridhara, Motijheel, etc.

d) Mailers: various product updates and new product information are regularly sent to existing customers of HSBC.

e) Brochures: Various colourful brochures featuring specific products of HSBC are being displayed and distributed to existing and potential customers via branch offices and Mobile sales officers.

Marketing Administration Department

This department formulates & executes various marketing strategies of HSBC Bangladesh. This department also administers various marketing research activities on the existing and potential customers of HSBC. Some such research activities are: mystery shopping, critical incident surveys, customer suggestion surveys, etc. The results of these surveys are integrated while formulating various marketing strategies. This department also deals with the billing and invoicing of various marketing & advertising costs of HSBC Bangladesh.

Treasury

This department works under FCD. Their main job is to take decisions regarding purchase and sell of foreign Currency. The purpose of Treasury’s operations is to utilize the funds effectively and arrange funds at a lowest possible rate of interest, through maintaining effective relationship with other banks and following the Government rules and foreign exchange regulations.

Credit Administration

Credit Administration department basically deals with all the documentation, processing, administration and disbursement of the import-export services provided to corporate clients. This department is known to be the heart of HSBC trade services that administers and manages all the trade tools and facilities provided by HSBC Corporate Banking. Some important aspects of this department are LC advising, documentation, OD facilities, guarantees, etc.

Finance Department of HSBC Bangladesh

This is considered as the most powerful department of HSBC. It keeps tracks of each and every transaction made within HSBC Bangladesh. It is headed by Manager of FCD who ensures that all the transactions are made according to rules and regulation of HSBC group. Violation of such rules can bring serious consequences for the lawbreaker. FCD is responsible for the preparation of the Annual Operating Plan (AOP), monitoring treasury risk limits, profit exposure and maintaining strong liquidity. FCD is the key member of the Asset Liabilities Management Committee (ALCO), which deals with how efficiently the bank’s assets and liabilities are managed. FCD also deals with money market matters. FCD acts as a custodian of all vouchers. FCD as the name implies does all the banks monitoring of the banks internal compliance and all local regulatory requirements.

The functions of FCD are briefly discussed below.

Services Department of HSBC

This is an integral and vital part of the bank. The services department ensures smooth operation and functioning within and between all the departments of HSBC. It also provides continuous support to the core banking activities of HSBC. The Manager of Services heads this department who formulates and manages various critical issues of the services function of HSBC. He is followed by a group of executives who are the heads of various subsidiary divisions that operate within the services department. The services department is considered as the backbone of all other departments. The various subsidiary divisions within this department are Administration, IT, Internal Control (IC), Network Services Center (NSC), and HUB. A briefing of the subsidiary divisions is presented below:

Administration

Like that of any other organizations, the Admin department of HSBC makes sure that the organizations moves on with all its departments and staffs operating according to all the rules and regulations of the company. It also prevents any bottlenecks within the work process and ensures smooth functioning. The admin department has two divisions – General Administration and Business Support Services.

The general admin division is pretty much similar to the admin departments of other companies that ensure discipline and regulatory concerns. The business support services provide supports to the departments during employee leaves and sudden terminations so that the department can function without problems.

Information Technology (IT)

This department gives the software and hardware supports to different departments of the bank. As HSBC is engaged in online banking, the role of IT is very crucial for the bank. This department is the most active department of HSBC where employees always stand by to solve any problems in the system. The managers and executives of IT division work continuously to develop the total IT system of HSBC so that it can be operated with ease, accuracy and speed.

Internal Control

HSBC has internal auditors who visit on regular basis and submit the report to the higher authority for audit purposes. This gives different departments the chance to know their mistakes and take necessary corrective actions. Again, the Bank annually administers a company wide audit program to evaluate the overall performance of the bank in Bangladesh.

HSBC Universal Banking (HUB)

The HSBC banking system is called HUB. HSBC does the online banking and it is HUB, which sets up the parameter for that. This HUB is linked with the HSBC group via satellite and each and every transaction made by HSBC within Bangladesh is being recorded at the HSBC Asia-pacific headquarters at Hong Kong via HUB. Thus the HUB is the most powerful and important equipment of HSBC Bangladesh that monitors and tracks any fraud and faults made with HSBC Bangladesh.

NetworkServicesCenter (NSC)

This department can be described as the ‘Power House’ of HSBC Bangladesh. NSC does the back office job for the bank. The main four jobs that are performed by NSC are Clearing, Scanning of signature cards, issuing checkbooks and sending & receiving Remittances. NSC looks after the clearing process of HSBC and makes necessary contact with the central bank for maintaining account flows. All the customer signatures are scanned in this department and are entered into the system. NSC also issues checkbook for new and old accounts based on requisition from various branches. ‘Remittance’ is a banking term, which means ‘Transfer of funds through banks’. When a bank remits on behalf of its customers, it is termed as outward remittance. On the other hand, when the bank receives the remittance on behalf of the bank, it is inward remittance. The following are the methods that NSC used to remit money for customers: Telegraphic Transfer (TT), Demand Draft (DD) & Cashier’s Order.

Human Resource Department

The Human Resource Manager heads this department. The major functions of this department are strategic planning and policy formulation for Compensation, Recruitment, Promotion, Training and developments, Personnel Services and Security. The HR department is very much concerned with the discipline that is set up by the HSBC group. HSBC group has got strict rules and regulations for each and every aspect of banking, even for non-banking purposes; i.e. The Dress Code. All these major personnel functions are integrated in the best possible way at HSBC, which results in its higher productivity. The Human resource officer monitors the employee staffing and administration activities. The Training officer supervises Training, development & rotation activities.

These are the major departments of HSBC Bangladesh. Except the branches all other departments are situated at HSBC Bangladesh head offices located at AnchorTower, Kawran Bazar. Most of HSBC’s operations and activities are operated centrally from the head office. But to deal with customers more completely, the branches are given considerable authority and they operate in a more decentralized manner but subject to verification of the respective departments.

Introduction to Capital Adequacy and Basel Accords

Capital Adequacy

Capital adequacy (CA) is defined as the minimum level of capital, which is required to protect a bank from portfolio losses. The concept of CA is very important in the banking industry as capital acts as the safeguard against depositors’ funds. Banks run primarily on depositors’ funds – they have the authority to mobilize deposits and lend the same. As such, they expose public deposits to potential credit risks and must take appropriate measures to minimize these credit risks through proper risk management systems. Capital acts as the cushion against any unforeseen losses arising market risks (interest rate risk, exchange rate risk, market price risk etc), operational risks and credit risks.

Bank owners are required to put in adequate capital:

- To act as a cushion between depositors’ funds and loans made by the bank

- To absorb any unforeseen losses arising from credit and other risks

- Otherwise, depositors’ funds will be depleted with every loss.

But capital is only a supplementary arrangement for risk management and not a substitute. Hence, risk management should not be neglected even if there is adequate excess capital. Poor risk management can wipe out the entire capital of a bank and lead to collapse of the bank.

However, debate on the quantum of minimum level of capital required seems to be never ending. Though different methods and approaches were adopted in different points in time, they were insufficient to capture new dimensions and magnitudes of risk emanated from the continuous innovations in the domestic and international business. Consequently the 1970s and 80s experienced many uncertainties and volatilities that caused serious banking problems. The prevailing approach that a bank’s capital should be linked to a fixed ratio of its time and demand liabilities went under strong criticism on the ground that bank’s major risk is derived from the riskiness of its assets. The Basel Committee, based on this idea, designed Capital Regulation in 1988, which is known as the Basel Accord I.

The Basel Committee on Banking Supervision is a committee of banking supervisory authorities that was established by the central bank governors of the Group of Ten countries in 1975. It consists of senior representatives of bank supervisory authorities and central banks from Belgium, Canada, France, Germany, Italy, Japan, Luxembourg, the Netherlands, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The name of the committee has been derived from the location of its permanent Secretariat at the Bank for International Settlements (BIS) in Basel, Switzerland.

Basel I accord requires banks to maintain a Regulatory Capital (RC) of not less than 8% (9% in Bangladesh), in relation to their total credit risk, measured on the basis of aggregated risk weighted value of their:

- On balance sheet exposure (all assets other than riskfree assets, such as cash, Treasury bills etc)

- Off balance sheet exposure (commitments & contingencies such as LCs)

In 1996, the RC requirement was extended to cover market risk as well.

Hence, Basel I can be summarized as follows:

[(Tier I + Tier II) – deductions]

Regulatory Capital Adequacy Ratio (RCAR) = ——————————————- X 100 >=9%

[Credit Risk (= Risk weighted assets

+ Contingencies) + Market risk]

Shortfall in RCAR is not permitted under this accord. However, excess in RCAR is always encouraged as it has many advantages as follows:

- Having the minimum 9% capital adequacy (CA) means that the bank can take a hit upto 9% of its RC without endangering depositors’ funds.

- Any excess over 9% CA enhances the bank’s loss sustaining capacity

- It also indicates the size of the capital buffer available for future growth

- Regarded as symbol of financial stability

- Facilitates higher credit ratings for banks (CA is the 1st pillar in CAMEL rating)

Thus the Basel I accord established a direct relationship between the total risk profile and the RC of the bank Hence risk assets expansion of a bank is required to be backed by adequate growth in RC. Not only the capital expenditure or overseas expansion projects, but the entire risk-asset creation process of banks, including their lending, has to be backed by capital. Therefore, ebem the normal organic growth of a bank has to be backed by RC.

If we look at the components of the RCAR, we see that the denominator, i.e. total risk profile of the bank increases with the growth in business volumes. Unless the numerator, i.e. RC too increases at the same pace, the RCAR falls. But this kind of growth is not possible, unless the bank has excess RC. Even in situations where the bank has excess RC, this kind of growth would reduce the RCAR.

Banks are compelled to curtail their risk asset growth in instances where:

- There is not enough excess RC or

- They are unable to raise the required capital

Even if

- Funds have been raised through low cost deposits

- There is a demand for good quality advances.

Sources of raising RC:

One source of raising RC is through retained profits. However, retained profit alone is not sufficient as fund based operation simply cannot produce the required rate of return (say 9%) as

- Rate of interest on advances are market determined

- Cost of funds and overhead expenses are to be incurred.

- High amount of tax and VAT has to be paid.

- Fair dividends also has to be set aside.

Hence no advance can produce a return of 9% after tax and dividends. The following calculation illustrates the mechanism.

BDT

Return on an advance of BDT 100 granted @ 15% p.a. 15.00

Less: Average funding cost after the SLR (est) 7.90

Net Interest Income 7.10

Less: Operational expense (Based on bank’s cost/income ratio) 3.76

Net Income 3.34

Less: Corporate tax @ 40% 1.34

Post-tax return on the advance 2.00

Thus, the advance granted @ 15% p.a. generated return of only 2.00% after all taxes. After dividends, the ultimate return may be around 1.20%. Hence a capital shortfall arises as follows:

Required return on advances 9.00%

Possible return on advances 1.20%

Capital shortfall 7.80%

This shortfall has to be funded from other sources. The return on other low yielding assets may be even lower. In the case of NPLs, there is no return at all and hence banks are compelled to provide for the NPL to the extent necessary and to provide the entire 9% capital from external sources for the loan amount not covered by provisions.

Another source of raising RC is through issuance of ordinary shares, but shareholders will naturally ask for a fair return of around 15-16% p.a., inclusive of a risk premium over bank deposit rates due to the market risk involved. To generate a ROE of 15-16% on the RC, the ultimate return on advance (after tax and after dividends) should at least be 1.2% p.a.

If a good rate of return of around 1.2% is maintained on advances, a bank could produce a ROE very close to this expected level, even if the full capital shortfall of 7.80% is raised through Tier I.

1.2 X 100

ROE = ————- = 15.38%

7.8

Properly run banks can produce this return, provided the loan remains performing. The return could however be further improved if part of the RC shortfall can be raised from Tier II. Hence Tier II instruments are also important.

Tier II instruments, the other source of RC, mainly includes corporate debts. These debts are usually priced 2.0% to 4.0% over the T bills rates. However, allowable quantum of Tier II instruments is capped at 50% of Tier I under Basel II accord. There are also various market limitations in raising capital under corporate debts. In addition, annual discounting has to be done on outstanding corporate debt.

The Basel I Accord:

Two fundamental objectives of the Accord were (a) to strengthen the soundness and stability of the international banking system and (b) to obtain a high degree of consistency in its application to banks in different countries with a view to diminishing an existing source of competitive inequality among international banks. To that end, the accord requires that banks meet a minimum capital ratio that must be equal to at least 8 percent of total risk-weighted assets.

If judged by the extent to which it has been taken up around the world, the 1988 Basel Capital Accord (“Basel I”) was a great success: it has been implemented as the capital adequacy standard for banks by more than 100 countries. A relatively simple measure of capital adequacy, Basel I has been adopted not only by the leading industrialized nations, but also by middle income and developing countries, including most in Asia.

The original accord was intended to apply to internationally active banks with the aim of shoring up bank capital levels globally while also promoting a more “level playing field” so that weakly capitalized institutions from one country would not have a competitive advantage over its better capitalized competitors that needed to charge higher interest rates to achieve an adequate return on capital.

Weaknesses in Basel I Accord

Despite its many merits, the Accord has been widely criticized for its failure to achieve the stated objectives. Since it introduced risk-based capital requirement, which was adopted by many developed and developing countries as well, it was expected that the Accord would help to strengthen financial system stability and reduce banking and financial crises. On the contrary, banking crises again occurred in 1990s even in some robust economies of East Asia.

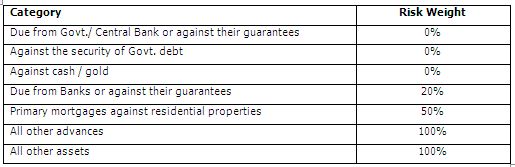

Basel I has been effective in raising capital levels globally. It was clear from the beginning, however, that the accord had weaknesses, mostly with respect to its crude measurement of a bank’s credit risk exposure. There was no customer wise assessment of risk. In stead, all exposures were classified into a few broad risk brackets based on either “due from whom” or “collateral held” and a standard set of risk weights applied on groups as follows:

Table : Risk Weights used under Basel I Accord

Hence, most advances were risk graded at a flat rate of 100%, irrespective of their credit worthiness and totally disregarding whether they are:

- Corporate or small industry

- Short-term or long-term

- High risk or low risk

- AAA rated or hard-core/non-performing

The 8% charge (or 100% risk-weight) applied to almost all corporate credits is an excessively broad brush approach. This provided very little incentives for the banks to improve risk management. As all advances were subject to same capital charge, cost of capital became flat for all loans (irrespective of risk) and there were no capital incentives for good quality lending. Over time, this treatment has generated some perverse incentives, notably for banks to sell off high quality assets and retain exposures to higher risk, lower quality borrowers, since both are subject to the same 8% charge. This could even lead to under-pricing of risky loans and denial of price advantage to good quality borrowers.

Rodriguez (2002) and others argue that the use of arbitrary risk categories and arbitrary weights that bear no relation to default rates incorrectly assume that all assets within one category are equally risky. The risk assessment methodology is flawed in the sense that it assumes a portfolio’s total risk is equal to the sum of the risks of the individual assets in the portfolio. No account is taken of portfolio management strategies, which can greatly reduce the overall risk of a portfolio, or of the size of a portfolio, which can greatly influence its total risk profile. Collaterals other than cash, government guarantees and government debt was not given any consideration also.

The accord gives preferential treatment to government securities, which are considered risk-free. The sovereign debt defaults of Russia in the summer of 1998 and Argentina in early 2002 demonstrated that government debt is not a risk free investment. Other criticisms include that the accord sets capital standards only for credit risk (i.e., the risk of counterparty failure), but not for other types of risk such as operational risk and market risk. Consequently, capital requirement was not reflective of economic risk. It has not provided enough incentive for risk management, risk mitigation and innovation in risk management such as arbitrage opportunities through securitization.

The use of securitization posed a particular problem for regulators, as it provided a mechanism for banks to “arbitrage” their regulatory ratios. By securitizing high quality assets and keeping the subordinated tranche of their issues (e.g. 20% of the amount securitized) the banks were in effect retaining the bulk of the credit risk, yet this risk was not being fully reflected in their Basel I ratios. Another example is the Basel I use of membership in the Organization for Economic Cooperation and Development (OECD) as a basis for determining a country’s creditworthiness, with OECD bank and sovereign lending benefiting from lower capital charges. An anomaly became increasingly apparent as banks from certain OECD members, such as Mexico, Turkey and Korea, attracted lower charges than banks from better-rated and hence lower-risk non-OECD countries such as Hong Kong and Singapore.

When the Accord was formalized, no consensus and consultation were taken from the representatives of the developing nations. Therefore, it is sometimes criticized as OECD Club-rule. McDonough (2000) argues that as banks have developed innovative techniques for managing and mitigating risk, credit risk now exists in more complicated, less conventional forms than is recognized by the 1988 Accord, thus rendering capital ratios, as presently calculated, less useful to banking supervisors. The financial world has changed dramatically over the past dozen years, to the point that the Accord efficacy has eroded considerably (McDonough, 2000).

Development of Basel II Accord:

The Basel Committee on Banking Supervision has been working over recent years to secure international convergence on revisions to supervisory regulations governing the capital adequacy of internationally active banks in order to rectify the weaknesses of Basel I accord. Following the publication of the Committee’s first round of proposals for revising the capital adequacy framework in June 1999, an extensive consultative process was set in motion in all member countries and the proposals were also circulated to supervisory authorities worldwide. The Committee subsequently released additional proposals for consultation in January 2001 and April 2003 and furthermore conducted three quantitative impact studies related to its proposals. As a result of these efforts, many valuable improvements have been made to the original proposals. The final Basel II accord presents the consensus agreed by all its members. It sets out the details of the agreed Framework for measuring capital adequacy and the minimum standard to be achieved which the national supervisory authorities represented on the Committee will propose for adoption in their respective countries. This Framework and the standard it contains have been endorsed by the Central Bank Governors and Heads of Banking Supervision of the Group of Ten countries.

The primary objective of the new Accord is to make it more risk-sensitive so that financial institutions will be able to sustain even in periods of financial crisis. Consequently, the new proposal moves ahead of the “one-size-fit-all” approach. Another objective of the Accord is to continue to enhance competitive equality among the internationally active banks throughout the world.

The Committee believes that the revised Framework will promote the adoption of stronger risk management practices by the banking industry, and views this as one of its major benefits. The Committee notes that, in their comments on the proposals, banks and other interested parties have welcomed the concept and rationale of the three pillars (minimum capital requirements, supervisory review, and market discipline) approach on which the revised Framework is based. More generally, they have expressed support for improving capital regulation to take into account changes in banking and risk management practices while at the same time preserving the benefits of a framework that can be applied as uniformly as possible at the national level.

In developing the revised Framework, the Committee has sought to arrive at significantly more risk-sensitive capital requirements that are conceptually sound and at the same time pay due regard to particular features of the present supervisory and accounting systems in individual member countries. The Committee is also retaining key elements of the 1988 capital adequacy framework, including the general requirement for banks to hold total capital equivalent to at least 8% of their risk-weighted assets; the basic structure of the 1996 Market Risk Amendment regarding the treatment of market risk; and the definition of eligible capital.

A significant innovation of the revised Framework is the greater use of assessments of risk provided by banks’ internal systems as inputs to capital calculations. In taking this step, the Committee has also put forward a detailed set of minimum requirements designed to ensure the integrity of these internal risk assessments. Each supervisor will develop a set of review procedures for ensuring that banks’ systems and controls are adequate to serve as the basis for the capital calculations. Supervisors will need to exercise sound judgments when determining a bank’s state of readiness, particularly during the implementation process.

The revised Framework provides a range of options for determining the capital requirements for credit risk and operational risk to allow banks and supervisors to select approaches that are most appropriate for their operations and their financial market infrastructure. In addition, the Framework also allows for a limited degree of national discretion in the way in which each of these options may be applied, to adapt the standards to different conditions of national markets. These features, however, will necessitate substantial efforts by national authorities to ensure sufficient consistency in application. The Committee intends to monitor and review the application of the Framework in the period ahead with a view to achieving even greater consistency. In particular, its Accord Implementation Group (AIG) was established to promote consistency in the Framework’s application by encouraging supervisors to exchange information on implementation approaches.

It should be stressed that the revised Framework is designed to establish minimum levels of capital for internationally active banks. As under the 1988 Accord, national authorities will be free to adopt arrangements that set higher levels of minimum capital. Moreover, they are free to put in place supplementary measures of capital adequacy for the banking organizations they charter. National authorities may use a supplementary capital measure as a way to address, for example, the potential uncertainties in the accuracy of the measure of risk exposures inherent in any capital rule or to constrain the extent to which an organization may fund itself with debt. Where a jurisdiction employs a supplementary capital measure (such as a leverage ratio or a large exposure limit) in conjunction with the measure set forth in this Framework, in some instances the capital required under the supplementary measure may be more binding. More generally, under the second pillar, supervisors should expect banks to operate above minimum regulatory capital levels.

Under the Basel II accord, banks and supervisors are to give appropriate attention to the second (supervisory review) and third (market discipline) pillars of the revised Framework. It is critical that the minimum capital requirements of the first pillar be accompanied by a robust implementation of the second, including efforts by banks to assess their capital adequacy and by supervisors to review such assessments. In addition, the disclosures provided under the third pillar of this Framework will be essential in ensuring that market discipline is an effective complement to the other two pillars.

The Committee is aware that interactions between regulatory and accounting approaches at both the national and international level can have significant consequences for the comparability of the resulting measures of capital adequacy and for the costs associated with the implementation of these approaches. The Committee believes that its decisions with respect to unexpected and expected losses represent a major step forward in this regard.

The Committee has designed the revised Framework to be a more forward-looking approach to capital adequacy supervision, one that has the capacity to evolve with time. This evolution is necessary to ensure that the Framework keeps pace with market developments and advances in risk management practices, and the Committee intends to monitor these developments and to make revisions when necessary. In this regard, the Committee has benefited greatly from its frequent interactions with industry participants and looks forward to enhanced opportunities for dialogue. The Committee also intends to keep the industry appraised of its future work agenda.

Conceptual Framework of the New Accord

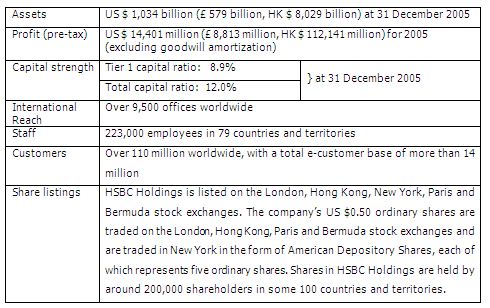

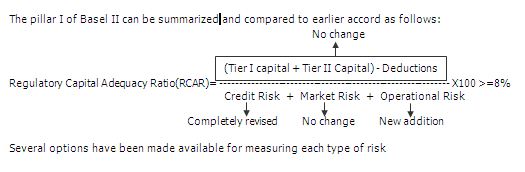

The New Accord has defined a structured framework comprising three pillars such as Pillar I, II and III. Pillar I sets out minimum capital requirements. Pillar II defines the process of supervisory review of a financial institution’s risk management framework. Pillar III determines market discipline through improved disclosure.

Pillar I ‐ Minimum Capital Requirement

In Pillar I, three kinds of risk such as credit risk, market risk and operational risk are considered to determine the minimum capital requirement. The definition of eligible regulatory capital remains the same as outlined in the 1988 Accord i.e., the ratio of capital to risk-weighted asset remains unchanged at 8%. However, the credit risk assessment process has been completely revised.

Figure : Structure of the Pillar I Under Basel II Accord

Banks are given a choice of options to measure each risk, subject to

- Extent of their preparedness to adopt such an approach and

- With the concurrence of the regulator

Pillar II ‐ Supervisory Review

Pillar II ensures that not only do banks have adequate capital to cover their risks, but also that they employ better risk management practices so as to minimize the risks. Supervisors will be expected to evaluate the board and management of banks, to look into strategic decisions and to evaluate portfolio diversification as well as the ability to react to future risks in a rapidly changing environment. In particular, issues of transparency, corporate governance and efficient markets can be considered as additional challenges in pillar II enforcement.

Pillar III ‐ Market Discipline

Banking operations are becoming complex and difficult for supervisors to monitor and control. In this context, Basel Committee has recognized the importance of market discipline and has suggested to implement it by asking banks to make adequate disclosures. The potential audiences of these disclosures are supervisors, bank’s customers, rating agencies, depositors and investors. With frequent and material disclosures, outsiders can learn about the bank’s risks.

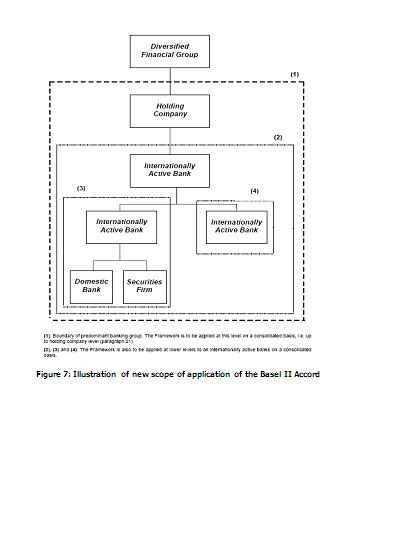

Scope of Application

This Framework will be applied on a consolidated basis to internationally active banks. This is the best means to preserve the integrity of capital in banks with subsidiaries by eliminating double gearing.

The scope of application of the Framework will include, on a fully consolidated basis, any holding company that is the parent entity within a banking group to ensure that it captures the risk of the whole banking group. Banking groups are groups that engage predominantly in banking activities and, in some countries, a banking group may be registered as a bank.

The Framework will also apply to all internationally active banks at every tier within a banking group, also on a fully consolidated basis (see illustrative chart at the end of this section). A three-year transitional period for applying full sub-consolidation will be provided for those countries where this is not currently a requirement.

Further, as one of the principal objectives of supervision is the protection of depositors, it is essential to ensure that capital recognized in capital adequacy measures is readily available for those depositors. Accordingly, supervisors should test that individual banks are adequately capitalized on a stand-alone basis.

Banking, securities and other financial subsidiaries