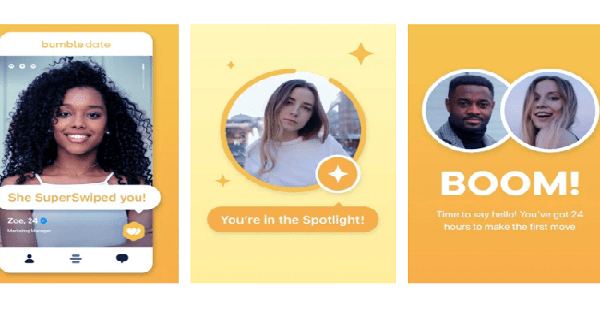

Public markets have become so active lately that it is difficult for another company to enter the bull market. However, in the case of Bumble, a dating app where women give the first message is like paying attention to next week’s public debut. There is an 11-year-old elephant in the market house of dating startups: Match Group. The Dallas Company owned by popular dating brands including Tinder, His, OkCupid and many more, which some people see as a single exit point for startups that help showed.

Bumble, founded by Whitney Wolf Hard, will change that story by entering the public market. Bumble is looking to raise more than $1 billion since his debut. Looking at the thin assessment, the company could be valued at $5.73 billion to $6.14 billion.

Bumble’s choice to go beyond the classic route of selling to match groups tells us that the exit environment for dating apps that Wolf Hard Bullish is strong is strong, because loneliness in the epidemic affects the public. Sarah Kunst of Cleo Capitals, a former senior adviser to Bumble, told me that Bumble is making history in a number of ways and could “release new funds into space and a surging wave of startups.” “Whitney has proven that dating, which has long been held by investors, is a very lucrative and fast-growing sector when it comes to publicly designing an organization as the youngest woman,” Kunst said. Gender equality in organizations, organizations founded by women and boards.”

We will do all of this at TechCrunch and Extra Crunch next week, but in the meantime, let us get through the other news of the week. Make sure to follow me on Twitter so I can annoy you the other six days of the week.

Pandemic-era valuations

Values are just the price that an investor thinks is a starting price – nothing more, nothing less. In the world of startups, when a big event happens, such as a massive exit or a blockbuster IPO, startups in the sector-of-interest often enjoy the indifference of evaluation.

Here is what to know: This week, we explored whether edtech enjoyed that same explosive power. According to more than a dozen investors, edtech is not seeing skyrocketing valuations.

Etc: Outside of edtech, this survey also provides insights into how investors, like fintech and e-commerce, faced epidemics, how investors valued and ranked. It might say that the term is more than the actual dollar and cents.

Carta tackles the startup liquidity problem

Do not let the demo days fool you: Venture capital is getting bigger, faster and older. However, if you are an angel who invested in a startup to go public in 2014, you may become a little impatient and want to get your capital back. Carta is trying to create a solution for trading startups into early events to bring liquidity early in the life of startups.

Here is what to know: The equipment, Cortex, finally launched this week after teased for months. Since its inception, Carta has sold nearly $100 million of its own shares in its own cap table, more than doubling its final valuation in the post-series F-Round.

Etc: Carta certainly hopes that its cap-table management business has tried and failed to help them stop this operation more than others do. Here are some excerpts from Danny Crichton:

The initial wave of liquidity fell into two problems: one was the regulator, and the other was the lack of company information about the cap tables and the current financial picture of that company. Stock buyers blinded when buying in companies, which some investors were unwilling to do, but that blindness significantly limited market demand in the case of secondary stocks.