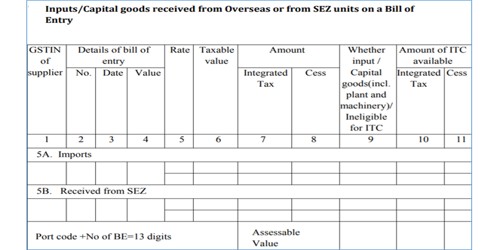

Bill of Entry

This is an important document used in import trade. It is a document created by an importer or exporter of documenting what is being shipped across political boundaries. It is a document showing the details of goods that are being transported into or out of a country. It’s submitted to the Customs department as a part of the customs clearance procedure. On the arrival of imported goods at the port, the importer is to give a declaration in writing to the customs authorities as regards the description of the goods, their quantity and value, this declaration is made in a form known as Bill of Entry. It is a legal document filed with the Customs department by an Importer or his customs broker. Customs authorities will assess the bill of entry and certified the import duty payable by the importer. It prepared on the basis of Bill of Lading, Commercial Invoice, Packing List, IEC code, IGM, Vat registration Certificate, etc.

Contents of Bill of Entry –

- Name and address of the importer.

- Name and address of exporter.

- Import license number.

- Name of the port where goods are to be cleared.

- Description of goods.

- Value of goods.

- Rate and value of import duty payable.

Bill of entry is the legal document filed by an importer or his customs house agent to complete import customs clearance procedures to take delivery of imported cargo. It is a list of goods received at a customs house for export or import. It is issued by the customs presenting the total assigned value and the corresponding duty charged on the cargo. The bill of entry can be issued for either home consumption or bond clearance. When it is issued for bond clearance, the bond number and date of issuance should be included. So, Bill of entry is the legal document that is completed by an importer, or alternatively, by his customs house agent.