NCC Bank Ltd. has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment since its inception. The Bank has set up a new standard in financing in the Industrial, Trade and Foreign exchange business. Its various deposit & credit products have also attracted the clients-both corporate and individuals who feel comfort in doing business with the Bank.

The bank could earn a modestly satisfactory result recent years, which contributed in continuing its steady growth in respect of all major indicators, namely Deposit, Advance and Profit, etc. During the year the bank has concentrated its focus to a number of income increasing sectors such as SME Financing, Inward Foreign Remittance, etc. The Bank has separate Credit Administration Department, Recovery Department and also a Task Force for continuous

monitoring of difficult loans and advances of the Bank and to propose ways of recovery of Bank’s dues.

This process will continue in next year’s also. Over the last few years remittance business contributed remarkably in increasing fee based income of the Bank. In order to motivate and inspire the Bangladeshis residing abroad to send their hard earned money through legal Banking channel, the bank has taken a number of steps like making remittance arrangements with different money exchange companies all over the world, participating in fairs and meetings with remitters and exchange companies, etc. which brought result beyond expectation.

Objective of the Report

The study has been undertaken with the following objectives:

- To analysis the pros and cons of the conventional ideas about Marketing of Bank Products.

- To have better orientation on Product management activities financing in various sector and recovery, loan classification method and practices of National Credit and Commerce Bank Ltd. (NCCBL).

- To get an overall idea about the performance of NCC Bank Ltd.

Methodology

The primary data had been collected in various ways. The different sources were:

⇒ Questionnaire survey.

⇒ Face to face conversations with the employees and opportunities were given by the management to work in relevant fields in NCC Bank.

⇒ By interviewing and interacting customers at NCC Bank Ltd. (Gulshan Branch).

⇒ Observing various organizational procedures.

Secondary data were collected

⇒ From prior research report

⇒ From any information regarding the Banking sector

⇒ From different books and periodicals related to the banking sector

⇒ From Newspapers and Internet.

ii. Data collecting instruments

In-depth interviews were conducted with various managers, employees of NCC Bank & customers of NCC Bank. A structured questionnaire was designed which was has been considered as the major tool of preparing the report.

Background of NCC Bank Limited

National Credit and Commerce Bank Ltd. bears a unique history of its own. The organization started its journey in the financial sector of the country as an investment company back in 1985. The aim of the company was to mobilize resources from within and invest them in such way so as to develop country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well. Its membership with the browse helped the company to a great extent in this regard. The company operated up to 1992 with 16 branches and thereafter with the permission of the Central Bank converted in to a fully fledged private commercial Bank in 1993 with paid up capital of Tk. 39.00 crore to serve the nation from a broader platform.

Introduction

Successful companies today are fully aware that they need to be able to rely on the services of a bank that can handle international trade with a good hand. Ever since its conversion into a fullfledged bank in 1993, NCC Bank has been an accomplished “Trade Finance” bank. With a highly professional team experienced and competent professionals we are able to provide a wide range of services to companies engaged in international trade. NCC Bank has also positioned itself as an established Correspondent Bank. Through a worldwide network of 260 correspondent banks NCC Bank is present in all key areas of the globe. Our ambit of correspondents includes top ranking international banks with a global reach. Since its inception NCC Bank Ltd. has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment.

The Bank has set up a new standard in financing in the Industrial, Trade and Foreign exchange business. Its various deposit & credit products have also attracted the clients-both corporate and individuals who feel comfort in doing business with the Bank.

Hypothesis:

NCC Bank is providing both general banking and credit banking. So, they provide different types of products for its customers, general and credit banking system. My topic of this project is about NCC Bank’s products they provide and the strategy they have to satisfy the customer which can help the bank to lead towards profit. So, my hypothesis for this project is following:

H0: NCC Bank’s marketing strategies for its products are not satisfying its customers and have positive towards profit trends.

H1: NCC Bank’s marketing strategies for its products are satisfying its customers and have negative towards profit trends.

Departments of NCCBL:

If the jobs are not organized considering their interrelationship and are not allocated in a particular department it would be very difficult to control the system effectively. If the department is not fitted for the particular works there would be haphazard situation and the performance of a particular department would not be measured. NCC Bank Limited has does this work very well. Different departments of NCCBL are as follows:

i. Human Resources Division

ii. Personal banking Division

iii. Treasury Division

iv. Operations Division

v. Computer and Information Technology Division

vi. Credit Division

vii. Finance & Accounts Division

viii. Audit & Risk Management Division

Products and Services of NCC Bank Limited:

Lending Products-

1) Continuous Loan:

- Secured Over Draft Against Financial Obligation [SOD(FO)]

- Secured Over Draft Against Work Order/Real Estate etc.[SOD(G)]

- Cash Credit (Hypothecation)

- Export Cash Credit (ECC)

2) Term Loan:

- Project Loan

- Transport Loan

- House Building Loan

- Lease finance

- Loan under Syndication

- Small business loan

- Consumer Finance

- Personal loan

3) Demand Loan:

- Loan General

- Demand Loan Against Ship Breaking

- Payment Against Documents (PAD)

- Loan Against Imported Merchandise (LIM)

- Loan Against Trust Receipt (LTR)

- Forced Loan

- Packing Credit (PC)

- Secured Over Draft Against Cash Incentive

- Foreign Documentary Bills Purchased (FDBP)

- Local Documentary Bills Purchased (LDBP/IDBP)

- Foreign Bill Purchase (FBP)

4) SME Loans:

- Small Business Loan

- Consumer Finance Scheme

- Lease Finance

- Personal Loan

- House Repairing & Renovation loan

- Working Capital Loan

- Festival Business loan

- Festival Personal loan

- Car Loan Scheme

5) Agro Credit:

- Agro-based Industrial Credit

- Crop Loan

6) Special Credit Product:

- Credit card

- Earnest Money Financing Scheme

- NCC Bank Housing Loan Scheme

- Overseas Employment Loan Scheme

7) Loan Product for Wage Earners:

- Land Mortgage Loan

- Special House Building Loan

- Advance Against Remittance

- Wage Earners Rehabilitation Loan

Deposit Products:

• Current Deposits(CD)

• Short Term Deposit(STD)

• Savings Bank Deposit(SB)

• Fixed Deposit(FDR)

• Special Savings Scheme Deposit(SSS)

• Special Deposit Scheme(SDS)

• Premium Term Deposit(PTD)

• Wage Earners Welfare Deposit Pension Scheme(WEWDPS)

• Money Double Program Deposit (MDP).

Money Transmission Products:

• Payment Order / Security Deposit Receipt (SDR)

• Demand Draft

• Telegraphic Transfer

• Outstanding Bills for Collection (OBC)

• Travelers Cheque.

International Business Products:

• Letter of Credit (L/C).

• Back to Back Letter of Credit (BTB L/C)

• Buying and Selling of Foreign Exchange

• Foreign Demand Draft

• Foreign Telegraphic Transfer (FTT)

Special Fee Earning Products:

• Bank Guarantee (B/G)

• Foreign Bank Guarantee (F.B/G)

• Portfolio Management

• Issue Management

• Underwriting

• Brokerage House

• Locker Service

• Issuance of Sanchya Patra, Wage Earners Development Bond, National Investment Bond, Prize Bond etc.

Social Service Products:

• Sale of Lottery Tickets for collection of fund for social establishment.

• Collection of Zakat fund.

• Collection of Haj Depodit and so on.

Products and Services of NCC Bank Limited:

General Banking Department:

banking creates a vital link between customers and bank. It’s really a classic as crucial department for the bank. It is the introductory department of the bank to its customers. The NCCBL Gulshan branch has all the required sections of general banking. Every day it receives deposits from customers and meets their demands for cash by honoring instruments. General banking department is that department which is mostly exposed to the maximum number of bank customer. Functions of General Banking Department:

• Account opening.

• Account closing.

• Cheque book issuing.

• Telephone receiving

• Account enquiry.

• Providing accounts statement

• Solvency certificate issuing

• Account transfer.

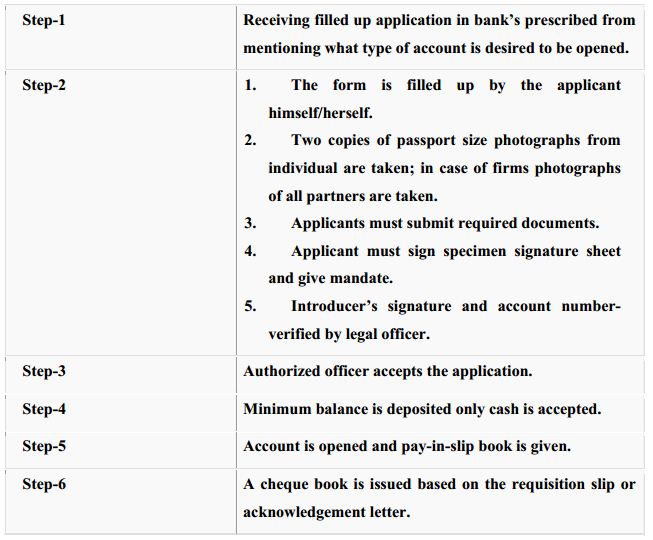

Account Opening:

A person is treated as a customer when he/she opens an account on that bank. Then it becomes a contractual banker customer relationship. The account opening section of NCCBL Gulshan branch is a very important section. This section takes care of all the relevant duties related to the opening of an account.

Account opening process:

There are different types of account facilities provided by this branch. These are:

a) Current Deposit (CD):

Current deposit is an account where numerous transactions can be made by the account holder within the funds available in its credit. No interest is paid on these deposits. Current account is mainly suitable for businessmen though nobody is debarred from opening such an account for any purpose. For opening CD account the initial deposit that is to be of minimum Tk. 5000 in NCCBL and the introducer must be current account holder. Different types of current deposits are as follows:

• Individual current account

• Joint account

• Proprietorship account

• Partnership account

• Limited company account.

b) Saving Deposit (SD):

To encourage saving habit amongst the general public, banks allow depositors to open savings accounts. As the name indicates, these accounts are opened for the purpose of savings. Interest is awarded on the balance of the account. For opening a savings account minimum Tk. 500 is taken as deposit. NCCBL offers attractive rate of profits of its saving deposits.

c) Fixed Deposit Receipt (FDR) :

The bank receives deposits for a fixed period ranging from 1 month to 3 years and above. Although the minimum period, for which a sum is received as a fixed deposit, is one month there is no maximum time limit for opening fixed deposit account but bank generally does not accept deposits, say 10 years. Interest on fixed deposit varies from maturity period. For opening a fixed deposit minimum Tk. 50000 is taken as deposit. Duration of this deposit is 5

years.

d) Short Term Deposit (STD):

STD accounts are purely a time deposit account. The formalities for opening of this account are similar to those required for current account. The account runs like an ordinary current account with the exception that seven days notice is required to be given to the bank before each withdrawal interest is paid at prescribed rate. Generally Government, semi- Government, Autonomous Bodies etc maintain STD account. NCCBL offers attractive rate of profits to its shot-term deposits.

Remittance Department:

Bank has a wide network of branches all over the country and offers various types of remittance facilities to the public. They serve as best media for remittance of funds from one place to another. This service is available to both customers as well as non-customers of the bank. The followings are some of the important modes of transferring funds from one to another bank. These are:

1) Demand Drafts (DD) :

This is an instrument through which customers money is remitted to another person/firm / organization in out station (Outside the clearing house area) from a branch of one bank to an outstation branch of the same bank of to a branch of another bank (with prior arrangement between that bank with the issuing branch).

This is an order instrument in which the issuing branch gives instruction to the payee / drawer branch to pay certain amount of money to the order of certain person / firm / organization. The payee or drawer branch on receipt of the message decodes the tested massage and being fully satisfied, pays the amount by crediting the payee’s account (if account is maintained with the payee branch). Telegraphic transfer may also be issued favoring the beneficiary who

maintains account with other banks. In such case the payee branch issues pay order favoring the payee and hand over the P.O. to the concerned bank branch for effecting payment to the payee.

Procedure of Payment DD:

a) Examine genuinely of the DD viz. Amount; verify signature, test, series etc.

b) Enter in the DD payable register.

c) Verify with the IBCA / test etc.

d) Pass necessary vouchers.

2) Telephonic Transfer (TT) :

This is mode of transfer / remittance of customer’s money from a branch of one bank to another branch of the same bank of to a branch of another bank (with prior arrangement between those banks with the TT issuing branch) through telephonic message. The issuing branch used to send the message of such remittance / transfer to the drawer / payee branch through telephone adding certain code number of test number on the basis of text key apparatus developed by the concerned bank for its different branches.

Characteristics of TT:

a) Issued by one branch to other branch and massage is tale communicated.

b) Remittance / transfer of money is done through tested tale massage.

c) Remittance is affected on the basis of tested massage.

d) Test key apparatus is required.

Procedure of Issuing TT:

a) Obtain TT application form duly filled in and signed by the purchaser / applicant with full account particulars of the beneficiary.

b) Receive the amount in cash / transfer with prescribed commission, postage, telephone / telex etc. charge.

c) Prepare TT massage inserting test number (code number).

d) Enter in TT issue register.

e) Issue credit advice to the payee branch.

Procedure for payment TT:

a) Note the TT massage and verifying the test number and confirm if TT serial no 21Etc. is ok.

b) If ok, into TT payable register.

c) Pass necessary vouchers for payment.

3) Payment order / pay order (PO):

This is an instrument issued by the branch of a bank for enabling the customer / purchaser to pay certain amount of money to the order of a certain person / form / organization / department office within the same clearing house area of the pay order issuing branch. Procedure for Issuing Payment Order:

a) Obtain PO application form duly filled in and signed by the purchaser / application.

b) Receive the amount in cash / transfer with commission amount.

c) Issue PO.

d) Enter in PO register.

Procedure of payment of PO:

a) Examine genuinely the pay order

b) Enter into PO register and give contra entry

c) Debit it fund ok for payment.

Clearing House:

Clearing House is an arrangement under which member banks agree to meet, through their representatives, at an appointed time and place to deliver instruments draws on the other and in exchange, to receive instruments drawn on themselves. The net amount payable or receivable as the case may be, is settled through an account kept with the controlling bank.

Common procedure for all kinds of cheques etc:

a) Receiving and scrutinizing the cheque and other deposit instruments, and the pay-in-slip at the counter.

b) Affixing the stamps.

c) Scrutiny and receipt by the authorized officer.

d) Returning the counter-foil to the depositor.

e) Separate the cheques into transfer, LBC and clearing cheques.

Types of Clearing:

• Outward clearing: Outward clearing means when a particular branch receives instruments drawn on the other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered outward clearing for that particular branch.

• Inward Clearing: when a particular branch receives instruments, which on them and sent by other member bank for collection are treated as inward clearing.

SWOT Analysis OF NCCBL Ltd:

Every business organization is required to judge the performance from the aspects of its strength, weakness, opportunity and threat. The Strength, Weakness, Opportunity and Threat (SWOT) analysis of the Bank is a follows:

Strengths:

• NCCBL is a financially sound company.

• The Bank provides quality service to the clients compared to its other contemporary competitors.

• Experienced bankers and corporate personnel have formed the management of the Bank, which formulates business strategies.

• The Bank is also a member of SWIFT (Society for Worldwide Inter Bank Financial Telecommunication) Alliance Access which enables the Bank to exchange critical financial messages swiftly and cost effectively.

• The bank has earned customer loyalty as organizational loyalty.

• National Credit and Commerce Bank Limited has already achieved a goodwill among the clients that helps it to retain valuable clients.

Weaknesses:

• Delegation of authority is centralized which makes the employee to realize less responsibility. Thus the employee morale is deteriorated.

• The credit proposal evaluation process is lengthy. Therefore sometimes valuable clients are lost and Bank becomes unable to meet targets.

• No substantive use of Annual confidential Report to reward or to punish employees. Hence, the employees become inefficient.

• The portfolio of Bank is not that much diversified because it inverts major portion of its fund on Government securities.

• The bank has no ATM booths.

• Compared to its competitors the bank does traditional activities.

• A remarkable portion of the total human resources is inefficient.

• The Bank does not have any research and development division.

Opportunities:

• The Bank can introduce more innovative and modern customer services to better survive in the competition.

• The bank has to launch ATM-card facility as early as possible to reach the target customer.

• They can also offer micro credit business for individual and small business.

• The bank can diversify its portfolio by introducing new sector.

Threats:

• The common attitude of Bangladeshi clients to default.

• Multinational banks with various attractive means of providing commercial banking services can take the Bank’s lucrative clients away.

• Local competitors can also capture a huge market share by offering similar products and services provided by the Bank.

Loans & Advance Department in General:

Introduction:

The main business of Bank is to settle loan & advance. Bank collects deposits of saving from one kind of people of society and invests these deposits as loan, subject to conditions, to other kind of people. Bank not sanction cash loan but also credit its good reputation, coincidence faith etc. To settle loan by the bank is called credit or loan and advance. It can be mentioned that banks do business by savings or deposits collected from local people. So before settle loan the band must ensure about the security of the disbursed amount (loan) and he also ensures about the repayment of the loan.

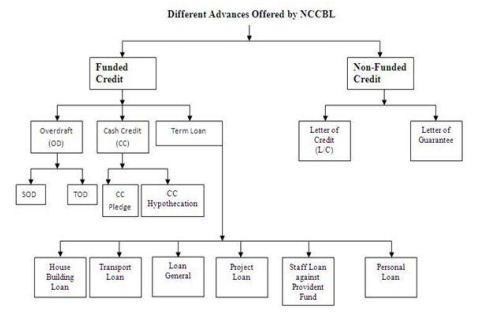

Different Types of Credit Facilities:

All types of credit facilities can be broadly classified into two ways:

• Funded

• Non- Funded

Funded Credit:

A funded credit facility that a bank offers to a customer result in a actual disbursement of cash to the customer of to any designated supplier of the customer. l on order to provide funded facility to a customer the bank has to incur real liability before hand, i.e. the bank has to arrange for funds primarily through accepting deposits or otherwise. Funded facility affects the balance sheet of the bank both in terms of increase of liability and increase of assets.

Types of Funded Credit are as follows:

1. Loans: Loans may be a demand loan of time loan or term loan demand loan is payable on demand which is allowed for a short period to meet short- term working capital need. Time loan is payable within one year and term loan is allowed for one year to five years, usually for capital expenditure such as construction of factory building purchase of new machinery, modernization of plant etc.

Types of loans:

• Loan general

• House building loan

• Loan against trust receipt (LTR)

• Loan against imported merchandise.

2. Cash credit: Cash credit facility is allowed against pledge or hypothecation of goods. Under this arrangement the borrower can borrow any time within the agreed limit and can deposit money to adjust whenever he does have surplus can in hand.

Types of Cash Credit:

• Cash credit (Hypothecation)

• Cash credit (Pledge)

• Cash credit (export)

3. Overdraft: Overdraft is an arrangement between a banker and his customer by which the latter is allowed to withdraw over and above his credit balance in his current account. This is a temporary accommodation of fund to the client. Academically, Basic difference between cash credit and overdraft is that businessmen use cash credit for longer period on yearly renewal basis, while overdraft is allowed occasionally and for short-term duration.

Types of Overdraft:

• Secured overdraft (FD)

• Secured overdraft (RE)

• Temporary overdraft

4. Bill discounted and purchased:

Characteristics:

• In land bill purchase

• Foreign bill purchase

• Foreign documentary bill purchase

• Payment against document

Discount: Banks allow advance to the clients by discounting bill of exchange / promissory note, which matures after a fixed tenor. In this method, the bank calculates realizes the interest at a prefixed rate sand credit the amount after deduction the interest from the amount of instrument.

Types of Loans and Advances Offered by NCCBL:

a. Loan General : When an advance is made in lump sum repayable either in fixed monthly installments of in lump sum and no subsequent debit is ordinarily allowed except by way of interest, incidental charges etc. called a loan is allowed for a single purpose where the entire amount may be required at a time of in a number of installments within a period of short span. After disbursement of entire loan amount, there will be only repayment by the borrower.

This bank offers three terms loan:

1. Short-term loan: Usually, short-term loans are allowed up to 1 year.

2. Mid-term: These types of loans are allowed for up to 3 years.

3. Long- term: Generally, long-term loans are allowed for over 3 years.

b) House Building loan (HBL):

To solve the residential problem of our middle class people NCCBL take this scheme. Who is qualified to take this loan is depend upon the bank. Nevertheless, the borrower must have land on which the building is constructed. Period of loan is maximum 5 years. It depends upon customer baker relationship. Interest rate of this loan is 15.5% compounded monthly. Limit of the amount of the loan in depending on customer and banker relationship. But the value, location of the land etc. are important factors.

c) Loan against Trust Receipt (LTR):

This is a temporary loan, which is allowed to the customer against their application on the basis of, trusts and trusts only. It is call loan against trust receive. Validity of LTR will be allowed as per sanction letter. However it may be allowed for 30/60/90/120 days. Adjustment of LTR may be made partially or fully. Interest rate to this loan is higher. Interest rate on LTR is charged on monthly basis. It is allowed against security. Monthly interest charge is 1505%.

d) Loan against Imported Merchandise (LIM):

The temporary loan, which is allowed to the imported against their imported goods, is called loan against imported merchandise (LIM). Validity of the LIM will allowed as per sanction letter. LIM is generally disbursed once. Interest rate of this loan is higher and it is charged on monthly basis. Control over the imported goods to be absolutely maintain by the bank. These loans are allowed against security.

e) Cash credit (Hypothecation):

Hypothecation is a charge on company for a debt, but neither ownership nor possession passes to the creditors. In hypothecation, both ownership and possession remain with debtor. The charge is created by the debtor to the lender on his execution of a document in the said document, the debtor hinds himself to give possession of the hypothecated stock to the lender, if the lender so requires.

As the goods remain in the possession of the borrower, banks grant hypothecation facility normally to first parties. It depends mainly upon the trustworthy of the part. Advance is generally allowed against hypothecation of the following:

• Raw materials

• Stock-in-trade

• Finished products

• Book debt of the debtor.

Loans and Advance (Credit) Management of NCCBL Details:

Overview:

The objective of the credit management is to maximize the performing asset and the minimization of the non-performing asset as well as ensuring the optimal point of loan and advance and their efficient management. Credit management is a dynamic field where a certain standard of long-range planning is needed to allocate the fund in diverse field and to minimize the risk and maximizing the return on the invested fund. Continuous supervision, monitoring and follow-up are highly required for ensuring the timely repayment and minimizing the default.

Actually the credit portfolio is not only constituted the bank’s asset structure but also a vital factor of the bank’s success. The overall success in credit management depends on the banks credit policy, portfolio of credit, monitoring, supervision and follow-up of the loan and advance. Therefore, while analyzing the credit management of NCCBL, it is required to analyze its credit policy, credit procedure and quality of credit portfolio.

Credit Policy of NCCBL:

One of the most important ways, a bank can make sure that its loan meet organizational and regulatory standards and they are profitable is to establish a loan policy. Such a policy gives loan management a specific guideline in making individual loans decisions and in shaping the bank’s overall loan portfolio. In NCC Bank Limited there is perhaps a credit policy but there is no credit written policy.

Credit Principles:

In the feature, credit principles include the general guidelines of providing credit by branch manager or credit officer. In NCC Bank Limited they follow the following guideline while giving loan and advance to the client. Credit advancement shall focus on the development and enhancement of customer relationship. All credit extension must comply with the requirements of Bank’s Memorandum and Article of Association, Banking Company’s Act, Bangladesh Bank’s instructions, All credit extension must comply with the requirements of Bank’s Memorandum and Article of Association, Banking Company’s Act, Bangladesh Bank’s instructions, Loans and advances shall normally be financed from customer’s deposit and not out of temporary funds or borrowing from other banks. The bank shall provide suitable credit services for the markets in which it operates. It should be provided to those customers who can make best use of them. The conduct and administration of the loan portfolio should contribute with in defined capital. Interest rate of various lending categories will depend on the level of risk and types of security offered.

Global Credit Portfolio limit of NCCBL:

The features which deals with how much total deposits would be used as lending the proportion of long term lending, customer exposure, country exposure, proportion of unsecured facility etc. the most notable ones are:

The aggregate of all cash facility will not be more than the 80% of the customer’s deposit

Long term loan must not exceed 20% of the total loan portfolio Facilities are not allowed for a period of more than 5 (Five) years.

Credit facilities to any one customer group shall not normally exceed 15% of the capital fund or TK. 100 crores.

Types of CreditCredit may be classified with reference to elements of time, nature of financing and provision base.

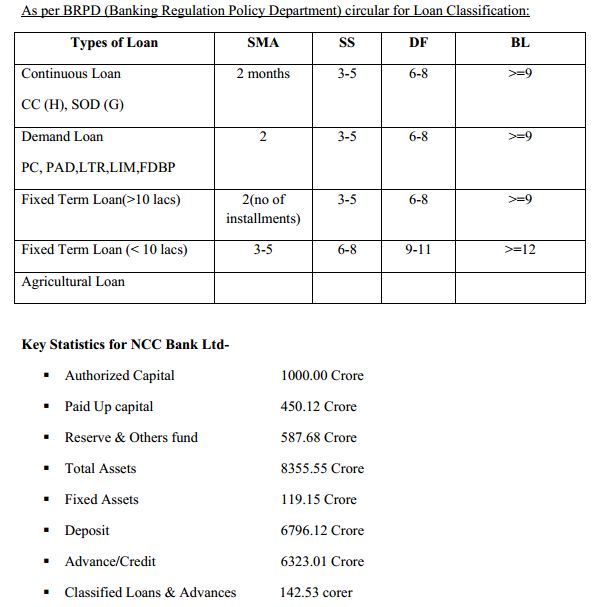

The bank conducts their classification activities on quarterly basisIt has been enclosed with 4 other forms.

i. Continuous Loan (CL-2)

ii. Demand Loan (CL-3)

iii. Fixed Term Loan(CL-4)

iv. Agricultural loan( CL-5)

Continuous loans: These are the advances having no fixed repayment schedule but have an date at which it is renewable on satisfactory performance of the clients. Continuous loan mainly includes “Cash credit both hypothecation and pledge” and “Overdraft”.

Overdraft (OD):- It’s a Continuous revolving Credit & the borrower may operate any numbers of times within sanctioned limit up to validity period of the limit.

Two Types of Overdraft:

(a) Security over deposit – (SOD-Financial Obligation)

(b) Secured over draft-(SOD-General)

Demand loan: In opening letter of credit (L/C), the clients have to provide the full L/C amount in foreign exchange to the bank. To purchase this foreign exchange, bank extends demand loan to the clients at stipulated margin. No specific repayment date is fixed. However, as soon as the L/C documents arrive, the bank requests the clients to adjust their loan and to retire the L/C documents. Demand loans mainly include “Payment against Documents,” “Loan against imported merchandise (LIM)” and “Later of Trust Receipt”.

Fixed Term loans: These are the advances made by the bank with a fixed repayment schedule. Terms loans mainly include “Consumer credit scheme”, “Lease finance”,” Hire purchase”, and “Staff loan”. The term loans are defined as follows:

• Short term loan: Up to 12 months.

• Medium term loan: More than 12 months & up to 36 months

Agricultural loan: In Long term loan: More than 36 months. Case of loan the banker advances a lump sum for a certain period at an agreed rate of interest. The entire amount is paid on an occasion either in cash or by crediting in his current account, which he can draw at any time. The interest is charged for the full amount sanctioned whether he withdraws the money from his account or not. The loan may be repaid in installments or at expiry of a certain period. Loan may be demand loan or a term loan.

Interest Rate: 12%-15% per annum (Quarterly paid).

Loan Classification:

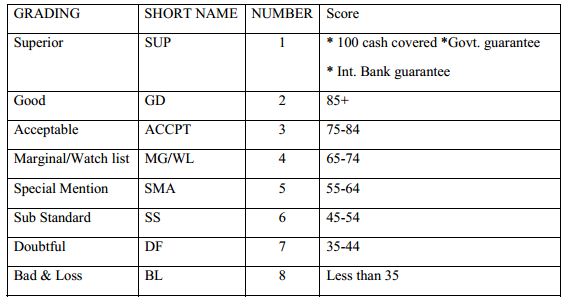

Credit Risk Grading (CRG) is the basic module for developing a Credit Risk Management system.

Credit Risk Grading is an important tool for credit risk management as it helps the banks and financial institutions to understand various dimension of risk involved in different credit transaction.

CRG scale consists of 8 categories with short name and Numbers are provided as follows:

Credit Ratification Authority of NCCBL:

Credit decisions are heart of all credit works. Generally branch manager and the credit in-charge of a branch are held responsible for appraising of a loan proposal. The customer request for credit limit and the credit officer prepares a credit memo and send it to the head office, credit division. After taking all the relevant information from the branch the head office credit division sent the credit memo to the credit committee. Credit committee of NCCBL is comprised of Managing Director and other top-level executives, that is, DMDs and EVPs. If credit committee is convinced about the merit of the proposal then it is sent the broad of directors. The board is final authority to approve or decline a proposal. The whole process takes a month or more. In NCCBL broad meeting occurs once in every week.

Credit Evaluation PrinciplesSome

principles or standards of lending are maintained in approving loans in order to keep credit risk to a minimum level as well as for successful banking business. The main principles of lending are given below:

Liquidity:

Liquidity means the availability of bank funds on short notice. The liquidity of an advance means it repayment on demand on due date or after a short notice. Therefore, the banks must have to maintain sufficient liquidity to repay its depositors and trade off between the liquidity and profitability is must.

Safety:

Safety means the assurance of repayment of distributed loans. Bank is in business to make money but safety should never be sacrificed for profitability, To ensure the safety of loan. The borrower should be chosen carefully. He should be a person of good character & capacity as well as bank must have to maintain eligible number of security from borrower.

Profitability:

Banking is a business aiming at earning a good profit. The difference between the interest received on advances and the interest paid on deposit constitutes a major portion of the bank income, Besides, foreign exchange business is also highly remunerative. The bank will not enter into a transaction unless a fair return from it is assured

Intent:

Banks sanction loans for productive purpose. No advances will be made by bank for unproductive purposes though the borrower may be free from all risks.

Security:

The security offered for an advance is an insurance to fall bank upon in cases of need. Security serves as a safety value for an unexpected emergency. Since risk factors are involved, security coverage has to be taken before a lending.

Marketing Mixed of NCC Bank Ltd.

Fixed Deposit:

Fixed deposit account may be opened in the names of two or more persons and even in names of minors jointly with guardians. No introductory reference is required furnished for opening fixed deposit account. NCCB offers attractive following rates of profits to its fixed deposits. Special Deposit Scheme

Any individual person, businessman, firm, limited companies, local bodies, corporation, corporate bodies etc. can open a Special Deposit Scheme A/c with NCC Bank Limited. Special Deposit Scheme A/c is a term deposit of 3 (Three) years and interest is payable on monthly basis. Special Deposit Scheme is 100% term deposit and account holder can withdraw his/their deposits (Principle amount) after expiry of maturity of deposit.

Place:

NCC Bank has one Head Office and 59 branches under its control. For remaining of sufficient branches NCC bank can give some special customer services to the customer as for examples:-

• Remittance facilities can be provided to the customer very cheaply because, inter office indebtedness can be more easily adjusted.

• Clearing of cheques is comparatively easy since cheques deposited at a branch in the

city where there is a clearing house and can be cleared in the customary way.

• By the difference branch NCC Bank can serve the customer services more efficiently.

• For Branch banking NCC Bank increases the mobility of capital which brings uniformity of interest rates.

• NCC Bank can create handsome deposits from customers by branch banking.

There are some problems raised for the place decision of NCC Bank Ltd. They are,

• If any one branch of NCC Bank failed to achieve customer satisfaction then the effect spared all over the branches.

• For any kind of critical banking decision the branch manager has to get permission of Head Office & it is lengthily process. And which brings totally ignorant of customers.

• If a branch operates his banking in that area where traffic jam is higher than most of people hesitate to continue their all sorts banking. NCC Bank, Jatrabari Branch is also facing the same situation.

• NCC Bank should analysis their strategy when are likely to be opened new branches in Bangladesh for which they have not followed this strategy for port city Khulna. They should increase their branch in Khulna.

Promotion:

Modern Marketing calls for more than just developing a good product. Pricing it attractively and making it available to target customer. Companies also must communicate with their customers and what they communicate should not be left to chance.

This theory is also applicable for banking business. To communicate well bank often hire advertising agencies to develop effective advertisement, give appointment to active experienced officers and executives, gives on-line services to the big businessmen or organization, create a private relationship with clients.

The marketing communication program of a company or a banking business is called “Promotion mix”-consist of specific blend of advertising, personal selling, sales promotion and public relation tools that the bank uses pursue its marketing objects.

Definition of the four major promotion tools as follows:

• Advertising: Any paid form of non- personal presentation and promotion of ideas, goods or services by an identified sponsor.

• Personal Selling: Oral presentation in a conversation with one or more prospective purchase for the purpose of marketing sales of services.

• Sales Promotion: Short-term incentive to encourage the purchase or sales or a products or services is called sales promotion.

• Public Relation: Building good relation with the organization’s various public by obtaining favorable publicity, building up a good “corporate image”, and handling or heading off unfavorable reamers, stories and events.

The following tools are used with NCC Bank Ltd. are given:-

Advertising:

Advertising is one of the most important tools of promotion. The NCC Bank Ltd. is to arrange to publicity or to draw attention of businessmen to various media regarding their product or service. On the other hand the Bank is always to the door of their clients if any new service is arranged. In connection with this they distribute their prospectus to the clients. At the end of 1999 NCC Bank Ltd. issue their shares to the market. NCC Bank Ltd. issued/offered share of Tk. 19,50,00,000 out of which public offer is Tk. 5,25,000 shares @Tk. 100 each. NCC Bank Ltd. tries to draw the attention of general public and businessmen regarding their shares, which has been already issued, in the market through “The Daily Prothom Alo” and “The Daily Financial Express”.

In the meantime they market public of their best services as to prospectus with the newspaper by each month and they distribute it to service holder and clients. Even though it is very important for any bank to make introduce them in the market of their products and services as needed but NCC Bank is not achieved this capability as yet. But it goes without as that an established bank can lose his name and fame with their clients as well as deposits due to proper and effective advertisement which can activate the clients to lessen their deposits. We can say here as for example “The American Express Bank Ltd.” Standard Chartered Bank is not only in Bangladesh they are always ahead than others all over the world implementing the advertisement if needed. They at least make sure their clients about services in each week through add by newspapers as well as any reputed magazines. I think NCC Bank should

follow this strategy of Standard Chartered Bank Ltd. NCC Bank can make introduce them to the public by banner in the busiest area and can hang signboard on the road as public can recall their business thinking first.

Meanwhile NCC Bank Ltd. published well calendar, pocket calendar, and desk calendar as well as diary every starting year what they distribute to the clients and to the service holders. As matter of fact we already became to introduce ourselves with the different cable channels and Internet in which NCC Bank Ltd. may give there add with effectively. On the long run it is to say that without add or publicity any product or service would be boneless since how a client can introduce himself with this service. So NCC Bank Ltd. should consider this case.

And all should accept the strategy of perfect advertising.

Sales Promotion:

According to banking business, short-term incentive to encourage the sales of services or products of Bank is called sales promotion. They sometime reduce the interest of loan and enhance the interest of deposit as client may remain with them.

Public Relation:

Public relation means building a good relation with other bank and with various publics by obtaining favorable publicity, building up a good corporate image and handling unfavorable reamers, stories and events. A Bank can participate in any domestic or international fair and jointly with other bank they can participate in the workshop to produce their goodwill. On the other hand they can sponsor any domestic or International popular games like cricket, football etc. But NCC Bank till today didn’t do this.

Sponsorship:

NCCBL considers sponsorship concept as one of their major tools for marketing. The bank has already sponsored many social welfare programs to show its interest on corporate social responsibility. Beside this the bank has also helped to build up many beautiful monuments at Dhaka city like the one at Science laboratory.

Findings:

After go through the whole report, we come up with some finding. Some of the tasks which NCC Bank does are very much traditional. Today’s’ modern banking system has been changed than the before. If we compare them with other local banks like City bank, Eastern Bank, BRAC Bank, Prime bank we came to know about this. With the modern computerized system they make their works easier than the NCC Bank. NCC Bank follow the same old process to save their data and they do their whole operation manually where other banks are doing with their computer. Some findings are given below.

They save their all kinds of data in papers

⇒ They find the interest suspense account through their computer but manually they check those out

⇒ Sometimes very simple work is done by the head office which takes time and make difficult

⇒ Sometimes verification is done by a new officer which dangerous both for the bank and the branch office.

Suggested new loan products for NCCBL:

Introduction:

Financial institutions are playing a great role for industrial development of Bangladesh. More industrialization means increase of employment opportunity and increase of buying power of individuals. For that reason regulatory authority always encourages the banks for industrial loan in liberal format. On the other hand, textile sector is the key player for earning foreign remittance for the country. But in this sector most of the basic ingredients are imported, which are draining foreign currencies. So, considering this back ward linkage industries for the textile sector is very much important. Modern banking system offers various types of industrial loans in different

format. That is why we are proposing a loan scheme especially for textile back ward linkage industries which will help the small and medium entrepreneurs.

Benefits:

The bank will benefit by investing the idle money by quick recycling through this loan scheme. On the other side, the borrower will be benefited by enhancing its running capital as well as physical growth. As a result it will create more employment and play role to reduce poverty level.

Young Entrepreneur Loan Scheme- “Atto-Nirvorshil Jobok”:

Now-a-days NCC Bank is offering different types of credit to the different groups like traders, industrialist, businessman, and individuals in case of personal loan. These are generally for all people but we are not providing something special for young talent. As Bangladesh bank has declared that for every five branches in metropolitan area one branch must be opened in rural area. We can utilize this opportunity. For the rural young people those who have innovative ideas but insufficient capital.

In rural area young people are not getting chance to involved with many productive works like poultry, handicrafts etc. due to the lack of capital. They can’t able to get that job to the smalllarge extent for the shortage of capital. In urban and sub urban area there are also so many potential young talented entrepreneurs who are sitting idle only because they don’t have enough capital to run their business. If we finance them at low rate under our SME project then it will be a great help for the growth of our economy. We can easily do that as BB offers confessional rate under the SME project to the disbursing bank in case of young talented entrepreneurs borrower.

Ship Building Loan (Industrial loan):

Ship building industry in Bangladesh is set to emerge as new export leader. Since major ship manufacturing countries like South Korea, Vietnam, China and Singapore are becoming less interested in building Small Ocean going vessels. European buyers are now coming to Bangladesh and India. The industry is gradually shifting towards developing countries like us mainly because of the availability of a cheap labor force. The global market for small ships is now about $400 billion. If we can grab one per cent of the global order for small ships, the amount will be worth $4.0 billion. Recently Bangladesh government has declared Ship Building Industry as 7th thrust sector. This is a very lucrative sector and will improve day by day. But this is a highly capital intensive industry. So there is a huge demand for Bank loan there. If we invest in this infant sector with lower interest rate then it would be a great help for this sector as well as our economy, which will flourish our image throughout the country. We can launch a new loan

product especially for the Ship Building Industry named “Ship Building Loan”.

Suggested more products for NCC Bank Ltd. as a whole:

• Islamic banking:

Islamic banking system has enormous opportunity in the local market based on mostly Muslim customers and NCC bank didn’t introduce it yet. So introducing new Islamic banking system or combining it with the existing banking system will bring huge profit to the bank.

• Strong marketing activities:

NCC bank lacks of clearly defined marketing objectives. It requires improvement in its current marketing strategies and mass implementation on that. This will contribute in earning more market share in the banking industry.

• Promising market growth:

In developing countries like Bangladesh banking sector is the best sources of financing. So the banking sector itself promises a significant growth for deserving banks. NCC bank can be one of the leading players if it utilizes the opportunity.

• Defaulters:

The common attitude of Bangladeshi clients to default can be a problem to the bank’s profit trend.

• The impact of centralized authority:

Delegation of authority is centralized which makes the employee to realize less responsibility. Thus the employee morale is deteriorated.

• Bureaucratic hassles in loan department: The credit proposal evaluation process is lengthy. Therefore sometimes valuable clients are lost and Bank becomes unable to meet targets.

• Absence of employee evaluation: No substantive use of Annual confidential Report to reward or to punish employees. Hence, the employees become inefficient.

• Ineffective portfolio: The portfolio of Bank is not that much diversified because it inverts major portion of its fund on Government securities.

• Untouched rural sector: The bank does not go for rural banking. But rural people are bankable which NCCBL can get from the activities of the NGOs.

• Lacks in promotional activities: The Bank lacks aggressive advertising and promotional activities to get a broad geographical coverage.

• Impact of competitor’s strategies: Multinational banks with various attractive means of providing commercial banking services can take the Bank’s lucrative clients away. Local competitors can also capture a huge market share by offering similar products and services provided by the Bank.

• Problems resulted from illegal micro credit firms: Opening the recent no permitted new banks or micro credit firms, without implementation of the needed reforms, could lead the unethical competition and horse-trading in the local banking sector.

• Limited ATM service: The bank has only a few ATM booths but not in mentionable places. So, the scope of the use of ATM card is limited and competitors can capture the potential market for ATM service.

• Preference to traditional methods: Compared to its competitors the bank does banking activities through traditional methods and the management is not open minded enough to follow up with the new methods.

• Inefficient employees: According to the employees remarkable portion of the total human resources is inefficient.

• Absence of R&D department: The Bank does not have any research and development division which can react to the developing customer demands or competitor’s strategies.

• Limited branches: NCC bank’s total numbers of branches are lower than other competitors.

• Lack of proper customer service: The customer service of the Bank is not too good like other banks. In the Foreign Banks, there are customer service department. But there is no Customer service department in NCC bank. Other products for NCCBL, keeping next 5 years in mind-

• Rural Banking

• NCCBL’s approach to Rural Banking – Promoting Capitalization

• NCC Bank for promoting “self-help savings and credit groups”

• Purpose of NCCBL’s support

• Assets Securitization

• Mutual Fund

Recommendations:

• Today’s and tomorrow’s business world is more challenging. To face the challenge bankers must have knowledge about different economic and business variable. So the bank must recruit business graduate like BBA and MBA holders as a probationary officer.

• The bank should made advertisement on newspaper and TV so that every initiatives and special facilities of the bank can go at the door of the customers.

• 24 hours banking facilities like credit card ATM card should be made within short period.

• The bank should introduce new short term schemes like micro credit for poor and urban people.

• Changes in industry trends may directly affect business so that it calls no longer completely Profitable. Therefore, the Bank should keep information about the environment of each industry in which its customers operate.

• To attract more clients NCCBL has to create a new marketing strategy, which will increase the total export Import business.

• Attractive incentive package for the exporter will help to increase the Export and accordingly it will diminish the balance of payment gap of NCCBL.

Conclusion:

National Credit Commerce Bank Limited (NCCBL) is serving the market with almost full range of services. As the number of branches implies, still Bank has limited operation in our country, but it should also be noted that within the next few years from its establishment, no bank could make as good standing as NCCBL has now done. The bank is following a certain traditional marketing strategy and it is doing well. This marketing strategy is quite satisfying customers and it has positive impact on its profit trend. But with this modern age, the bank should improve its marketing strategy. If it improves its marketing strategy, then it can attract more customers towards this Bank and it will have more positive impact towards its profit trend. So far NCC Bank Limited has been able to manage its credit portfolio skillfully and kept the classified loan at a very lower rate thanks go to the standard and stringent credit appraisal policy and practices of the bank. They will do better if they continue with their same policy but also they have to maintain the trend as well.