Assignment on Intangible assets

Intangible assets are assets that lack physical existence and are not financial instruments. Intangible assets are usually classified as concurrent (long-term) assets because they produce benefits over several years. They are valuable because they provide rights and privileges to their owners.

Examples of intangible assets are: trademarks, copyrights, patents, franchises, customer lists, and goodwill.

Intangible assets have the following classifications:

- Purchased vs. internally created intangibles

- Limited-life vs. indefinite-life intangibles

# Purchased intangibles are recorded at the cost incurred to purchase an intangible asset from another entity, which includes the acquisition costs as well as expenditures made to get the asset ready for its intended use (e.g. legal fees).

# Internally created intangibles are often not recorded on the balance sheet: most costs incurred to internally develop an intangible asset have to be expensed (including Research and Development costs), and only certain costs (e.g. legal costs) might be capitalized (e.g. debit Patent for the cost of defending the patent).

# Limited-life intangibles are intangible assets with a limited useful life (e.g. copyrights, patents). Limited-life intangibles are systemically amortized throughout the useful life of the intangible asset using either units of activity method or straight-line method. The amortization amount equals the different between the intangible asset cost and the asset residual value. The owner of the intangible asset, in this case, either credits the appropriate intangible asset account or the appropriate accumulated amortization account.

# On the other hand, indefinite-life intangibles are not amortized because there is no foreseeable limit to the cash flows generated by the intangible asset. Such intangible assets have no legal, contractual, regulatory, economic, or competitive limiting factors. Indefinite-life intangibles, nevertheless, are subject to an impairment test that should be performed at least annually. Examples of indefinite-life intangibles are: goodwill, trademarks, perpetual franchises, etc.

TYPES OF INTANGIBLE ASSETS:

- Artistic-related: copyrights (photos, videos, audio materials)

- Consumer-related: customer lists, contractual customer relationships, etc.

- Contract-related: franchises, licensing agreements, broadcast rights, construction permits, exploration permits, import and export permits, service contracts, etc.

- Goodwill (identified only with a business as a whole)

- Market-related: trademarks, brand names, internet domain names, magazine mastheads, etc.

- Technology-related: patents, trade secrets, computer programs, product formulas, etc.

Intangible assets (other than goodwill) are reported similarly to property, plant, and equipment (PP&E) assets on the balance sheet. Goodwill is reported separately. The notes to financial statements should include information about purchased intangible assets (e.g. amortization expense for the next five years; changes in the carrying value of goodwill; accumulated depreciation if separate accumulated amortization accounts are not used).

AMORTIZATION:

Amortization refers to the gradual elimination of a liability, such as a mortgage, in regular payments over a specified period of time. Such payments must be sufficient to cover both principal and interest.

Example:

Suppose XYZ Biotech spent $30 million dollars on a piece of medical equipment and that the patent on the equipment lasts 15 years, this would mean that $2 million would be recorded each year as an amortization expense. While amortization and depreciation are often used interchangeably, technically this is an incorrect practice because amortization refers to intangible assets and depreciation refers to tangible assets.

Amortization can be calculated easily using most modern financial calculators, spreadsheet software packages such as Microsoft Excel, or amortization charts and tables.

Amortization, like depreciation, is the process of deducting, over a set period of time, the costs incurred in the procurement of assets. Whereas depreciation is used to expense out (over the useful life) the costs of tangible assets such as buildings, furniture, and machines; amortization is used to recover the cost of intangible assets such as:

* Going into Business Costs – start up expenditures, cost of incorporating, etc.

* Lease for Business Property

* Goodwill, patents, customer base, permits, etc.

* Reforestation Costs – direct costs of planting or seeding

* Pollution Control Facilities

When the intangible asset is originally purchased the cost should be debited to an asset account. This cost is then “written off” or amortized, generally using the straight line method, over the legal useful life of the asset (see IRS Publication 535 Chapter 9 for amortization period guidelines). The straight line method is simply dividing the initial cost of the asset by its useful life. For example if a patent is purchased for $12,000 and amortized over 15 years (180 months) then the monthly write-off would be $66.67 (12,000/180)

| General Journal | Page: 1 | ||||

| Date | Account Titles/Explanation | Ref | Debit | Credit | |

| 2007 Jan | 31 | Amortization Expense – Patents

Patents | 55

14 | 66.67 |

66.67 |

Suppose XYZ Biotech spent $30 million dollars on a piece of medical equipment and that the patent on the equipment lasts 15 years, this would mean that $2 million would be recorded each year as an amortization expense. While amortization and depreciation are often used interchangeably, technically this is an incorrect practice because amortization refers to intangible assets and depreciation refers to tangible assets.

GOOD-WILL:

Goodwill in financial statements arises when a company is purchased for more than the fair value of the identifiable assets of the company. The difference between the purchase price and the sum of the fair value of the net assets is by definition the value of the “goodwill” of the purchased company. The acquiring company must recognize goodwill as an asset in its financial statements and present it as a separate line item on the balance sheet, according to the current purchase accounting method. In this sense, goodwill serves as the balancing sum that allows one firm to provide accounting information regarding its purchase of another firm for a price substantially different from its book value. Goodwill can be negative, arising where the net assets at the date of acquisition, fairly valued, exceed the cost of acquisition.[1] Negative goodwill is recognized as a liability.

Example:

A software company may have net assets (consisting primarily of miscellaneous equipment, and assuming no debt) valued at $1 million, but the company’s overall value (including brand, customers, intellectual capital) is valued at $10 million. Anybody buying that company would book $10 million in total assets acquired, comprising $1 million physical assets, and $9 million in goodwill. In a private company, goodwill has no predetermined value prior to the acquisition; its magnitude depends on the two other variables by definition. A publicly traded company, by contrast, is subject to a constant process of market valuation, so goodwill will always be apparent.

BAD-WILL:

The negative effect felt by a company when shareholders and the investment community find out that is has done something that is not in accordance with good business practices. Although typically not expressed in a dollar amount, bad-will can play out in the form of decreased revenue, loss of clients or suppliers, loss of market share and federal indictments for any crimes committed.

Example:

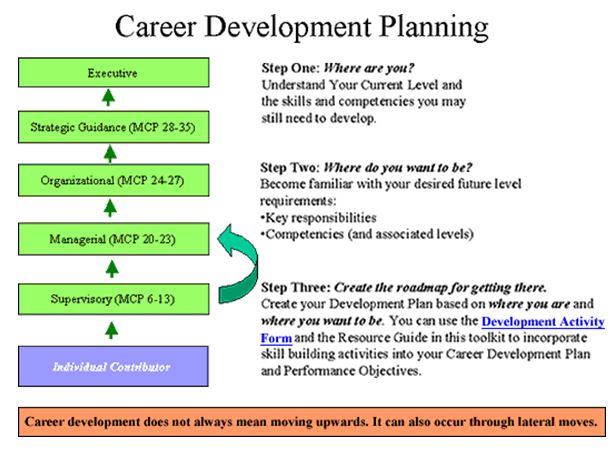

DEVELOPMENT ACTIVITIES:

Development Activities can be work assignments, projects, training and other activities that help you develop the skills you require to be successful for the next step in your career path. The following examples of Development Activities have been provided to assist you in your own career development planning. Choose one or two that are appropriate for your situation and feel free to add your own development activities to the list. Incorporate these into your Career Development Plan and work towards achieving your goals.

FAIR VALUE:

# The estimated value of all assets and liabilities of an acquired company used to consolidate the financial statements of both companies.

# In the futures market, fair value is the equilibrium price for a futures contract. This is equal to the spot price after taking into account compounded interest (and dividends lost because the investor owns the futures contract rather than the physical stocks) over a certain period of time.

# A valuation, in accordance with standard methodology, that is reasonable to all parties involved in a transaction in light of all pre-existing conditions and circumstances

In the case of futures, the sum of the value of the underlying securities and the cost of carry (interest earned due to not holding the underlying minus dividends lost due to not holding the underlying). Under GAAP, the fair value of an asset is the amount at which that asset could be bought or sold in a current transaction between willing parties, other than in liquidation. On the other side of the balance sheet, the fair value of a liability is the amount at which that liability could be incurred or settled in a current transaction between willing parties, other than in liquidation. If available, a quoted market price in an active market is the best evidence of fair value and should be used as the basis for the measurement. If a quoted market price is not available, preparers should make an estimate of fair value using the best information available in the circumstances. In many circumstances, quoted market prices are unavailable. As a result, difficulties occur when making estimates of fair value.

FRANCHISE:

A form of business organization in which a firm which already has a successful product or service (the franchisor) enters into a continuing contractual relationship with other businesses (franchisees) operating under the franchisor’s trade name and usually with the franchisor’s guidance, in exchange for a fee.

Example:

Jimmy Carter Com. Has provided information on intangible assets as follows:

A patent was purchased from Gerald Ford Com. for $2000000 on January 1, 2003. Carter estimated the remaining useful life of the patent to be 10 years. The patent was carried in ford’s accounting record at a net book value of $ 2000000 when Ford sold it to Carter. During 2004, a franchise was purchased from Ronald Com. for $480000. In addition, 5% of the revenue from the franchise must be paid to Ronald. Revenue from the franchise for 2004 was $2500000. Carter estimates the useful life of franchise to be 10 years and takes a full year’s amortization in the year purchase.

Carter incurred research and development costs in 2004 as follows:

Materials & Equipment $ 142000

Personnel $ 189000

Indirect Cost $ 102000

Carter estimates that this cost will be recouped by Dec. 31, 2007. The materials & equipment purchased have no alternative users. On Jan 1, 2004 because of recent events in the field, Carter estimates that the remaining life of the patent purchased on Jan1, 2003, is only 5 years from Jan 1, 2004

COPY-RIGHT:

A copy-right is a federally granted for the life of the creator plus 70 years. It gives the owner or heirs, the executive right to reproduce & sell an artistic or published work. Copy-right is not renewable. Generally, the useful of the copyright is less than its legal life. The cost of copy-right should be allocated to the years in which the benefits are expected to be received. Copy-right can be valuable.

Example:

Really Useful group is a company that consist the copy-rights on the musical of Andrew Lloyd Webber. It has a little way of hard assts, yet it has been valued at $300 millions. The Walt Disney Co. Is facing loss of its copy right on Mickey Mouse on Jan 1, 2004, which may affect sales of billions of dollars of Mickey related goods and services. Although Disney may be able to use its trademarks on Mickey to protect itself.

IMPAIRMENTS:

The general accounting standard of lower of cost or market for inventories does not apply to property, plant, and equipment. Even where property, plant, and equipment has suffered partial obsolescence, accountants have been reluctant to reduce the carrying amount of the asset. This reluctance occurs because, unlike inventories, it is difficult to arrive at a fair value of property, plant, equipment that is not subjective and arbitrary.

Example: Falconbridge Ltd. Nickel mines had to decide whether all or a part of its property, plan and equipment in a nickel mining operation in the Dominican Republic should be written off. The project had been incurring losses because nickel prices were low and operating costs were high. Only if nickel prices increased by approximately 33 percent would the project be reasonably profitable. Whether a write off was appropriate depended on the future price of nickel.

RECOGNIZING IMPAIRMENTS:

In this standard, an impairment occurs when the carrying amount of an asset is not recoverable, and therefore a write off is needed. Various events and changes in circumstances might lead to impairment.

* A significant decrease in market value of an asset.

* A significant change in the extent or manner in which an asset is used.

* A significant adverse change in legal factors or in the business climate that affects the value of an asset.

* An accumulation of costs significantly in excess of the amount originally expected to acquire or construct an asset.

* A projection or forecast that demonstrates continuing losses associated with an asset.

Example: If the expected future net cash flows from an asset are $400000 and its carrying amount is $350000, no impairment has occurred. However, if the expected future net cash flows are $300000 impairment has occurred. The rationale for the recoverability test is the basis presumption that a balance sheet should report long lived assets at no more than the carrying amount that are recoverable.

MEASURING IMPAIRMENTS:

The impairment loss is the amount by which the carrying amount of the asset exceeds its fair value. The fair value of asset is measured by its market value if an active market for it exists. If no active market exists, the present value of expected future net cash flows should be used. To summarize, the process of determining an impairment loss is as follows.

* Review events or changes in circumstances for possible impairment.

* If the reviews induct impairment, apply the recoverability test. If the sum of the expected future net cash flows from the long lived asset is less than the carrying amount of the asset, impairment has occurred

* Assuming impairment the impairment loss is the amount by which the carrying amount of the asset is grater than the fair value of asset. The fair value is the market value or the present value.

Example:

The expected future net cash flows from Ross Inc equipment are $580000 (instead of $650000). The recoverability test indicates that the expected future net cash flows of $580000 from the use of the asset are less than its carrying amount of $600000. Therefore impairment has occurred. The difference between the carrying amount of Ross asset and its fair value is the impairment loss. This asset has a market value of $525000. The computation of the loss is

Carrying amount of the equipment $600000

Fair value of equipment (market value $525000

Loss $75000

IMPAIRMENT OF INDEFINITE-LIFE INTANGIBLES OTHER THAN GOODWILL:

Indefinite life intangibles other than goodwill should be tested for impairment at least annually. The impairment test for an indefinite life asset other than goodwill is a fair value test. This test compares the fair value of the intangible asset with the asset’s carrying amount. If the fair value of the intangible asset is less than the carrying amount, impairment is recognized. This one step test is used because it would be relatively easy for many indefinite life assets to meet the recoverability test. As a result, the recoverability test is not used.

Example:

Acorn Radio Purchase a broadcast license of $2000000. The license is renewable every 10 years if the company provides appropriate service. Arcon’s existing license has 2 years remaining and cash flows are expected for these 2 years. Arcon performs an impairment test and determines that the fair value of the intangible asset is $1500000. If therefore reports an impairment loss of $500000, computed as follows.

Carrying amount of broadcast license $2000000

Fair value of broadcast license $1500000

Loss on impairment $500000

The license would now be reported at $1500000, its fair value. Even if the value of the license increases in the remaining 2 years, restoration of the previously recognized impairment loss is not permitted.

IMPAIRMENT OF GOODWILL:

The impairment rule for goodwill is a two step process. First the fair value of the reporting unit should be compared to its carrying amount including goodwill. If the fair value of the reporting unit is grater than the carrying amount, goodwill is considered not to be impaired, and the company does not have to do anything else.

Example:

On July 1, 2003, Brigham Corporation purchased young company by paying $250000 cash and issuing a $100000 note payable to Steve Young. At July1, 2003 the balance sheet of Young Company was as follows.

Cash $50000

Receivables $ 90000

Inventory $100000

Land $40000

Building (net) $75000

Equipment (net) $70000

Trademarks $10000

$435000 |

Account payable $200000

Stockholders equity $235000

$435000 |

The recorded amount all approximate current values except for land (Worth $60000), Inventory (Worth $125000) and trademarks (Worth $15000).

Purchase pries = 250000+100000 =350000

Fair value of assets

Cash $50000

Receivables $ 90000

Inventory $125000

Land $60000

Building (net) $75000

Equipment (net) $70000

Trademarks $15000

(-) A/P ($200000)

$285000 |

Fv of asset

Goodwill = 350000-285000 = 65000

INDEFINITE LIFE INTANGIBLES:

If no legal regulatory, contractual, competitive, or other factors limit useful life of an intangible asset, it is considered an indefinite life intangible asset. Indefinite means that there is no foreseeable limit on period of time over which the intangible asset is expected to provide cash flows. An intangible asset with an indefinite life is no amortized.

INTANGIBLE ASSET:

Economy dominated today by information and service providers and their major assets are often intangible in nature. Accounting for these intangible is difficult and as a result many intangibles are presently not reported on a company’s balance sheet. Intangible assets have two main characteristics.

1. They lack physical existence: Unlike tangible assets such as property, plan and equipment, intangible assets derive their value from the right and privileges granted to the company using them.

2. They are not financial instruments: Assets such as bank deposit, accounts receivable and long term investments in bonds and stocks lack physical substance but are not classified as intangible assets. These assets are financial instruments. They derive their value from the right to receive cash or cash equipments in the future.

VALUATION:

*Purchased intangible: Intangible purchased from another party are recorded at cost. Cost includes all costs of acquisition and expenditure necessary to make the intangible asset ready for its intended use.

Example: Purchase price, legal fees and other incidental expense.

*Internally-created intangibles: Costs incurred internally to create intangible are generally expense as incurred. Thus, even though accompany may incur substantial research and development costs to create an intangible, these costs are expensed.

LICENSE:

Contract-related intangible assets represent the value of rights that arise from contractual agreements. The agreement commonly entered into by a municipality and a business enterprise that uses public property. In such cases, a privately owned enterprise is permitted to use public property in performing its services.

Example:

The public waterways for a ferry services, the use of public land for telephone or electric lines, the use of phone lines for cable TV , the use of city streets for a bus line, or the use of the airwaves for radio or TV broadcasting.

Such Operating rights, obtained though agreements with governmental units or agencies, are frequently referred to as licenses or permits.

LIMITED LIFE INTANGIBLES :

The expiration of intangible assets is called amortization. Limited life intangible should be amortized by systematic changes to expense over their useful life. The useful life should reflect the periods over which these assets will contribute to cash flows. Factors considered in determining useful life are:

*The expected use of the asset by the entity.

*The expected useful life of another asset or a group of assets to which the useful life of the intangible asset may relate.

*Any legal, regulatory, or contractual provisions that may limit the useful life.

*Any legal, regulatory, or contractual provisions that enable renewal or extension of the asset’s legal or contractual life without substantial cost.

MASTER VALUATION APPROACH:

Goodwill is viewed as one or a group of unidentifiable values (intangible assets) the cost of which is measured by the difference between the cost of group of assets and the sum of the assigned cost of individual tangibles and identifiable intangible assets acquired less liabilities assumed. This procedure for valuation is referred to as a master valuation approach because goodwill is assumed to cover all the values that cannot be specifically identified with any identifiable tangible or intangible asset. This approach is shown bellow:

Determination of goodwill- master valuation approach:

The entry to record goodwill is as follows:

Cash $25,000

Receivables $35,000

Inventory $122,000

Property plant and equipment $205,000

Patents $ 18,000

Liabilities ($55,000)

Fair market value of net identifiable asset $ 350,000

Purchase price $400,000

Value assigned to Goodwill $50,000

NEGATIVE GOODWILL:

Negative goodwill arises where the net assets at the date of acquisition, fairly valued, exceed the cost of acquisition. It is reflected on the balance sheet net of other intangible assets. Negative goodwill is recognized as income as follows:

* To the extent that negative goodwill relates to expected future losses and expenses, it is recognized in the income statement when the future losses and expenses are recognized.

* The amount of negative goodwill relating to identifiable non-monetary assets (not exceeding the fair values of such acquired assets), is recognized as income on a systematic basis over the remaining useful lives of the identifiable acquired depreciable/amortizable assets with a maximum of 20 years.

* The amount of the negative goodwill in excess of the fair values of the acquired identifiable non-monetary assets is recognized as income immediately.

* The amount of the negative goodwill relating to monetary assets is recognized as income immediately

* Negative goodwill is accounted for under the Purchase (Accounting) Method when the fair market value of the net assets of the acquired company exceeds the purchase price paid. The credit difference reduces certain assets acquired. If any remaining credit exists, it is accounted for as an extraordinary gain.

ORGANIZATIONAL COSTS:

Expenditures incurred in launching a business. They include attorney’s fees, various registration fees paid to state governments, and other start-up costs. These costs are expensed as incurred.

Prior to the effective date of this statement, it had been common industry practice to capitalize and amortize organization costs, typically over a five-year period. Organization costs include initial incorporation, legal, and accounting fees incurred in connection with establishing the entity. The statement now requires that organization costs be expensed as incurred. When the exposure draft was issued in April 1997, organization costs were excluded from the scope of the statement. However, in the end, AcSEC concluded that organization costs are similar to startup costs and their exclusion from the scope of the SOP could not be justified.

Patent:

Exclusive right given by the government to the company to use, manufacture, and sell a product or process for a nonrenewable 20-year period without interference or infringement by other parties. Patent is classified as an intangible asset. Costs such as registration fees and attorney costs incurred in obtaining the patent are capitalized. Research and development costs applicable to developing the product, process, or idea are immediately expensed. Legal costs of a successful defense of a patent are capitalized and amortized over the remaining life. If the patent right is lost in court it should be written off and shown as an extraordinary charge. The cost of a patent purchased from an outsider is deferred and amortized. If the sole purpose of buying the outsider patent is to eliminate the competition, the amortization period is the remaining life of the company’s patent that is being protected. The patent is amortized on a straight-line basis over its 20-year life, or its economic life, if less. As a practical matter, often the useful life is less than 20 years due to changes in the marketplace and new technology. If a patent is assigned to others, royalties obtained are accrued as revenue is earned

When a patent is purchased from another company, the cost of the patent is the purchase price. If a company invents a new product and receives a patent for it, the cost includes only registration, documentation, and legal fees associated with acquiring the patent and defending it against unlawful use by other companies. Research and development costs, which are spent to improve existing products or create new ones, are never included in the cost of a patent; such costs are recorded as operating expenses when they are incurred because of the uncertainty surrounding the benefits they will provide.

The legal life of a patent is seventeen years, which often exceeds the patent’s useful life. Suppose a company buys an existing, five-year-old patent for $100,000. The patent’s remaining legal life is twelve years. If the company believes the patent’s remaining useful life is only ten years, they use the straight-line method to calculate that $10,000 ($100,000 ÷ 10 = $10,000) must be recorded as amortization expense each year.

The two principal kinds of patents are:

1. Product patent :

This covers actual physical products

2. Process Patent:

It governs the process by which products are made.

The cost of the patent should be amortized over its legal life or its useful life which ever is shorter.

For example: The useful life for patents in pharmaceuticals and drug industry is frequently less than the legal life because of testing and approval period that follows their insurance. Atypical drug patent has 5 to 11 years knocked off its 20 year legal life because 1-4 yeas must be spent on tests on animals , 4-6 years on human test and 2-3 years on food and drug administration to review the tests – all after the patent is issued but before the product goes on pharmaceutical shelves .

Assume that Harcott Co. incurs $180,000 in legal cost on January 1,2003 to successfully defend a patent. The patent has a useful life of 20 years and is amortized on a straight line basis. The entries to record the legal fees and the amortization at the en of each year are as follows:

January 1, 2003

Patents 180,000

Cash 180,000

(To record legal fees related to patent)

December 31, 2003

Patents Amortization Expense 9,000

Accumulated patent Amortization 9,000

(To record amortization of patent)

IMPAIRMENT OF INTANGIBLE ASSETS:

- IMPAIRMENT OF LIMITED-LIFE INTANGIBLES

The rules that apply to impairments of long-lived assets also apply to limited-life in tangibles. As indicated in chapter 11, long-lived assets to be held and used by a company are to be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable (recoverability test). In performing the review for recoverability, the company would estimate the future cash flows expected to result from the use of the asset and its eventual disposition. If the sum of the expected future net cash flows (undiscounted) is less then the carrying amount of the asset an impairment loss would be measured and recognized. Otherwise, an impairment loss would not be recognized.

- IMPAIRMENT OF INDEFINITE LIFE INTANGIBLES OTHER THAN GOODWILL:

Indefinite life intangibles other goodwill should be tested for impairment at least annually .The impairment test for an indefinite life asset other than goodwill is a fair value test. This test compares the fair value of the intangible asset with the asset’s carrying amount .If the fair value of the intangible asset is less then the carrying amount. Impairment is recognized. This one step test is used because it would be relatively easy for many indefinite life assets to meet the recoverability test (because cash flows may extend many years into the future). As a result, the recoverability test is not used.

- IMPAIRMENT OF GOODWILL :

The impairment rule for goodwill is a two step process. First, the fair value of the reporting unit should be compared to its carrying amount including goodwill. if the fair value of the reporting unit is greater then the carrying amount , goodwill is considered not to be impaired and the company does not have to do anything else.

RESEARCH AND DEVELOPMENT COSTS:

Research and development (R&D) costs are not in themselves intangible assets. The accounting for R&D costs is presented here however because research and development activities frequently result in the development of something that is patented or copyrighted (such as a new product, process, idea, formula, composition, or literary work).

Two difficulties arise in accounting for these research and development (R&D) expenditures :(1) identifying the costs associated with particular activities, projects or achievements, and (2) determining the magnitude of the future benefits and length of time over which such benefits may be realized .

IDENTIFYING R&D ACTIVITIES:

To differentiate research and development costs from similar costs, the following definitions are used for research activities and development Activities.

Example of research activities:

Laboratory research aimed at discovery of new knowledge searching for applications of new research findings.

Example of development Activities:

Conceptual formulation and design of possible product or process alternatives: construction of prototypes and operation of pilot plants.

OTHER COSTS SIMILAR TO R&D COSTS:

Many costs have characteristics similar to research and development costs .

Examples are:

1. Start up costs for a new operation.

2. Initial operating losses.

3. Advertising costs.

4. Computer software costs.

START UP COSTS

Starts up costs are costs incurred for one time activities to start a new operation. Examples include opening a new plant introducing a new product or service or conducting business in a new territory or with a new class of customers. Start up costs includes organizational costs. These are costs incurred in the organizing of a new entity, such as legal and state fees of various types.

TRADEMARK & TRADE NAME:

A trademark and trade name is a word, phrase or symbol that distinguishes or identifies a particular enterprise or product. Under common law the right to use a trademark or trade name whether it is registered or not rests exclusively with the original user as long as the original user continues to use it. Registration with the U.S. Patent and Trademark office provides legal protection for an indefinite number of renewals for periods of 10 years each.