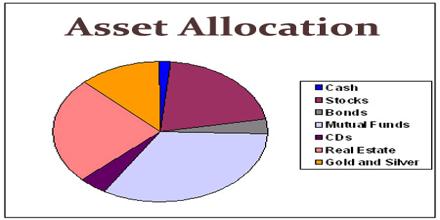

Asset Allocation is a key concept in financial planning and investment management and is the driving force behind Modern Portfolio Theory (MPT). It is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance and investment horizon. It is the notion that different asset classes offer returns that are not perfectly correlated, hence diversification reduces the overall risk in terms of the variability of returns for a given level of expected return. It is most effective in minimising risk when the assets chosen rise and fall in value independently of each other – ie their price movements are not correlated.

Asset Allocation