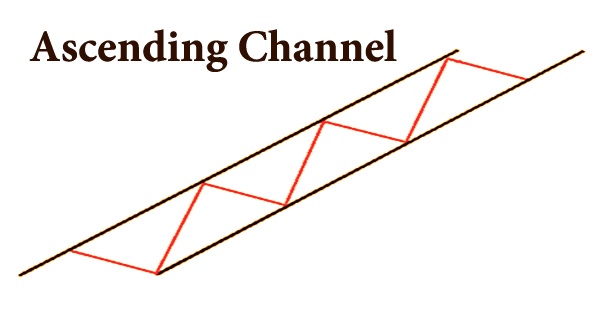

When visually evaluating an overall uptrend in the asset price of a stock, bond, or other similar investment, an ascending channel is a form of the trading channel. An ascending channel is formed by drawing a lower pattern line connecting the swing lows and an upper channel line connecting the swing highs. An exchanging channel is characterized as a reach inside which value shifts. A climbing channel or rising channel can be characterized as the upward development of costs in the middle of exact cutoff points. These cutoff points are known as the help level and the obstruction level. When the level of sale reaches a point where it is strong enough to prevent the price from increasing, resistance exists.

The opposition really happens at the point in a cost where the degree of selling is sufficiently able to keep the cost from rising any further (the roof of the climbing channel). A rising divert is seen in the graph when there is a bullish sign, i.e., the presence of higher highs and higher lows. The bottom trend line is where purchasing pressure is high enough to keep the price from dropping further (the floor). The ascending channel of a price is the region between the trendlines.

Diverts are utilized ordinarily in specialized examination to affirm drifts and distinguish breakouts and inversions. It permits the merchant to make just high-likelihood exchanges by shorting a resource when the cost of safety moves toward the obstruction and going long when the value moves toward the help line. Price does not always stay completely enclosed within the parallel lines of an ascending channel, but instead shows areas of support and resistance that traders can use to set stop-loss orders and profit goals. Something contrary to a rising channel is the sliding channel. It is a similar idea yet in turn around for a falling resource.

A breakout above an ascending channel can indicate a possible trend shift, while a breakdown below an ascending channel can indicate a possible trend change. In equities, derivatives, and forex trading, the ascending channel analysis method is commonly used. Rising channels show an obviously characterized upturn. Brokers can swing exchange between the example’s help and obstruction levels or exchange the bearing of a breakout or breakdown. The best way to take advantage of the upward trend in an ascending channel is to enter short when prices are at the resistance level and long when prices are at the support level.

Investors may use this technological indicator to make high-probability investments. They could sell when the price of the stock hits the resistance line and buy when the price reaches the support line. Sliding channel is completely different from the climbing channel. The previous is utilized for the falling resource. The method is most regularly utilized for a wide range of offers, forex, values, and subordinates. But, in a trending market, the likelihood of profiting from a trade is higher when one goes long when the price is at the support level (high probability trades). Traders use resistance and support levels to set stop-loss orders and benefit goals.

Recognizing the rising channel can at times be troublesome. The rising channel is otherwise called a “rising channel” and “channel up.” The lower line is distinguished first, as running along the lows: it characterizes the pattern line. The upper line, known as the “channel line,” is parallel to the trendline and runs along the lows. As previously mentioned, the ascending channel could have a significant impact on investors’ decisions about whether or not to invest in stocks. In view of the area of the cost in a specific pattern, the individual could decide whether they should go short or long on the resource. It additionally makes it simpler for the financial backer to sort out the ideal venture contract that could profit them over the long haul.

The ascending channel can also assist investors in getting the most out of their capital. It’s time to establish a location after discovering the ascending channel and defining the resistance and support lines. Contingent upon where the cost is in the general pattern, the financial backer can choose if they need to short or go long on a resource, contingent upon the kind of agreement they are searching for. Traders who employ this strategy should make sure there is enough room between the parallel lines of the pattern to reach an acceptable risk/reward ratio.

The investor could also opt for a wait-and-see strategy and stay away from the asset altogether. For investors, timing is crucial, and knowing which stock to purchase isn’t as vital as knowing when to buy it. The ascending channel can help the financial backer settle on that choice. Merchants could purchase a stock when its value breaks over the upper channel line of a climbing channel. It is judicious to utilize other specialized pointers to affirm the breakout.

For buyers, there are essentially two options: they can purchase or sell the asset immediately, or they can wait and see. It is just as important to invest at the right time as it is to invest in high-quality stocks. It is critical for the financial backers to know the ideal time for purchasing and selling the stocks. Before dealers take a short position when value breaks beneath the lower channel line of a climbing channel, they should search for different signs that show shortcoming in the example. However, using it solely to make stock, bond, or forex trading decisions can lead to a false sense of confidence, causing traders to make larger and larger trades without first doing due diligence, and making them more vulnerable to mistakes.

A repeated failure of price to cross the upper trend line is one such warning sign. Negative divergence between a common indicator and price, such as the relative strength index (RSI), should also be looked for by traders. Understanding that specialized apparatuses like the rising channel as a feature of a bigger large scale tool compartment is basic for the keen financial backer. Nobody marker ought to be taken outside any connection to the subject at hand, as portfolio investigation and designation ought to consistently be a comprehensive practice instead of utilizing just a single specialized pointer. Although this technical indicator is an excellent tool for investors to use when making investment decisions, traders do not rely solely on it to conduct trades. Investors may end up making an increasing number of trades that end up costing them a lot of money.

Envelope channels are another well-known channel arrangement that can fuse both dropping and rising channel designs. Envelope channels are ordinarily used to outline and dissect a security’s value development throughout a more extended timeframe. The ascending channel, on the other hand, can be a great indication that investors are on the right track and should be looking into a possible play on the underlying asset they’ve seen the ascension on. As previously mentioned, no technical metric ensures a risk-free investment. The ascending channel is no different. As a result, investors must use a combination of technical research methods to make the right and most educated decision possible.

Information Sources: