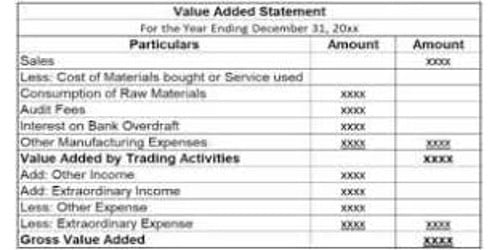

Approaches for preparing of Value Added Statement

Value added statement is a very useful statement for an enterprise. It is a financial statement of an enterprise, that is prepared for recording the monetary aspect of value added (created) and apportionment of this value added to the stakeholders of the enterprise. This statement gives the desired information to the management, government and other stakeholders from time to time.

There are two approaches for preparing the value added statement:

(1) Subtractive Approach –

Under this method, value added is determined as net turnover (revenue) which is obtained by subtracting the cost of materials from the sales proceeds.

For example,

A) Revenues (sales and other incomes) …..xxx

B) Less: Consumption of materials……… .(xxx)

C) Less: Utilities and supplies……………….(xxx)

D) Less: Services…………………………………(xxx)

Net Added Value(A-B-C-D)………………… .xxx

(2) Additive Approach

Under this method, the net added value is computed by adding the distribution of added value made to the stakeholders of the output employed to turn out the product, such as wages, salaries, taxes, interest, dividends, and retained funds.

In fact, these two approaches are not the mutually exclusive methods of value added statements. However, the value added statements include both to show how much value was added and how it was distributed to the stakeholders of production.

Information Source: