Annual Budget Plan for Facility Management Division

A Study on Prime Bank Limited

This report was prepared on the topic named “Annual Budget Plan for Facility Management Division” of prime Bank in Bangladesh. Prime Bank was established on 17 th April in 1995 by a group of successful entrepreneurs. Started With a slogan “Prime Bank Limited – a bank with a difference”. Prime Bank has been registered under the companies Act 1993 as a Public Limited Company on February 12, 1995 with its registered office at 5, Rajuk Avenue, Motijheel Commercial Area, Dhaka-1000, Bangladesh. Later on, the office had been shifted to Adamjee Court (annex building), Motijheel Commercial Area.

Objectives of the study:

- To understand and analyze the banking operation of FMD of Prime Bank Ltd

- To find out the pitfalls or problems associated with FMD

- To suggest the ways and means for improvement in policy and techniques

- To be acquainted with day to day functioning of service oriented Banking business

- To observe and analyze the performance of the specific division and the Bank as a whole.

Methodology of the study

Information obtained during internship at PBL has been used in this study. Samples were collected from the Branches of PBL. For the organization, part of information has collected through different published articles, journals, brochures and yearly annual reports of the organization.

In order to make the report more meaningful and presentable, two sources of data and information have been used widely and the sources are:

- The primary data discussion with concerned personnel engaged in different post of Prime Bank through set of questionnaire.

- The secondary data are those, which have already collected by someone else and wish to pass through the statistical process.

The data collection sources are given below:

Data Collection Tools

Primary sources: When data are collected from field that were called primary sources of data. I collected data from primary sources using the following methods:

Interview method:

The interview were face to face interpersonal situation in which one person, the interviewed, asks a person being interviewed, the respondent, question designed to obtained answer relevant to research.

- Face to face conversation with the respective officers and stuffs of the Bank.

- Practical work exposures, data are collected from the different Branches of the PBL.

- Internal data of the organization.

- Direct conversation with the clients etc.

Observation Method:

Observation method means systematic viewing. We can define it is -‘Accurate watching, nothing of phenomena as they occur in nature with regard to cause and effect and mutual relationship’. I had observed all the function of FMD including its six departments.

Secondary sources:

- Annual report (2013) Prime Bank Ltd.

- Audited Financial Statements

- Periodicals Published by Bangladesh Bank.

- Different publications regarding Banking functions, & different Policies of Divisions

- Internet was also used as a theoretical source of information.

- Websites and Newsletters are also was major sources.

Profile of Prime Bank Limited

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank was created and commencement of business started on 17th April 1995. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc.

As a fully licensed commercial bank, Prime Bank is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition. Prime Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMELS rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software.

Prime Bank, since its beginning has attached more importance in technology integration. In order to retain competitive edge, investment in technology is always a top agenda and under constant focus. Keeping the network within a reasonable limit, our strategy is to serve the customers through capacity building across multi-delivery channels. Our past performance gives an indication of our strength. We are better placed and poised to take our customers through fast changing times and enable them compete more effectively in the market they operate.

Vision

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

Mission

To build Prime Bank Limited into an efficient, market-driven, customer focused institution with good corporate governance structure. Continuous improvement of our business policies, procedure and efficiency through integration of technology at all levels.

Objectives of the Bank:

The objectives of the Prime Bank Limited are specific and targeted to its vision and to position itself in the mindset of the people as a bank with a difference. The objectives of the Prime Bank Limited are as follows:

- To mobilize the savings and channeling it out as loan or advance as the company approve.

- To establish, maintain, carry on, transact and undertake all kinds of investment and financial Business including underwriting, managing and distributing the issue of stocks, debentures, and other securities

- To finance the international trade both in Import and Export

- To carry on the Foreign Exchange Business, including buying and selling of foreign Currency, traveler’s cheque issuing, international credit card issuance etc.

- To develop the standard of living of the limited income group by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way and by offering Customer friendly credit service.

- To encourage the new entrepreneurs for investment and thus to develop the country’s Industry sector and contribute to the economic development.

Corporate Philosophy –

For Customers

- To provide the most courteous and efficient service in every aspect of its business.

- To be innovative in the development of new banking products and services.

For Employees

- By promoting their well-being through attractive remuneration and fringe benefits.

- By promoting good staff morale through proper staff training and development, and provision of opportunities for career development.

For Shareholders

- By forging ahead and consolidating its position as a stable and progressive financial

- By generating profits and fair return on their investment.

For Community

- By assuming our role as a socially responsible corporate citizen in a tangible manner

- By adhering closely to national policies and objectives thereby contributing towards the progress of the nation.

- By upholding ethical values and best practices.

- Constantly seeking to improve performance by aligning our goals with stakeholder’s expectations because we value them.

Corporate Social Responsibilities (CSR) at a glance

The biggest CSR of Prime Bank is to establish Prime Bank Foundation to execute its corporate social responsibilities activities in a greater scale. Prime Bank Limited and Prime Bank Foundation are proud to continue CSR activities for the greater interest of country’s socio economic development:

Investment in Education

Education Support Program: Believing education as a tool for social change, Prime Bank Foundation is proud to have another year of success of its Education Support Program launched in 2007. It is a long term, renewable scholarship program for underprivileged but meritorious students from across the country. In 2009 reporting year, 198 underprivileged but meritorious students, the highest in one year since its inception, have been included to provide with financial support in the form of monthly stipends for the persuasion of their graduation/post-graduation level studies in the country’s public sector universities and colleges. With the inclusion of these students, the total number of poor but meritorious students who are the recipients of Prime Bank Foundation stipends stood at 490.

Prime Campus: Prime Campus, an English medium school in Uttara, Dhaka, was created by Prime Bank Foundation in 2008 as an alternative to the expensive English primary schools at an affordable charge schedule. Commitment to corporate social responsibility ensures we remain true to our heritage of integrity; maintain a long term point of view to make economically sound, environmentally responsible and socially supportive decisions. More specifically, we maintain an unwavering commitment to honesty, integrity and fairness in all our CSR practices; show compassion by becoming involved with and supporting local and national communities; and consistently act in a manner that fosters our stewardship and sustainability.

Work with Handicap Population

Investment in eradicating and preventing different disabilities such as drug addicts, blindness etc; setting up vocational training centers; undertake mass awareness raising campaigns etc.

Dristy Daan Project

Setting a target of sight restoration of 1200 poor/ultra poor citizens of the country, the Prime Bank Foundation started off the Dristy Daan project in 2007. A total of 1357 poor/ultra poor cataract patients were operated till date.

Health Care

Support setting up state-of-the-art hospital like Vellore CMC Health Care, Universal Health Care Centers; Eye Hospitals; Health Support to garment workers; more preventive activities; infant, child feeding and breastfeeding; support to facilities providing treatment and care of non communicable diseases such as heart, and diabetes; activities related to prevention of maternal mortality and morbidities; setting up trauma centers etc.

Health Management

Developing supervision; leadership training; nursing training; setting up accrediting body in the private sector; provide equipment to existing voluntary health facilities etc. Develop a CSR strategy of PBF, partnership support has been offered by one organization.

The bank has extended finance for establishing countrywide health centers and a teachers’ training college under the supervision and implementation of Diabetes Association of Bangladesh.

The bank has also provided financial support to an innovative, non-conventional yet a useful and much needed socio-medical project, popularly known as, “health line” (accessible by dialing “789” from any mobile phone under Grameen Phone network) by Telemedicine Reference Center Limited (TRCL), the only registered telehealth and electronic health service provider in Bangladesh. The bank’s finance was made available for upgrading of existing project as well as set up offshore health line call centers for Bangladeshi workers based in Kingdom of Saudi Arabia and the United Arab Emirates. The bank also financed TRCL to launch an Intensive Diabetes Management (IDM) services program in Bangladesh under its brand name “amcare”.

Environment

Activities related to the prevention of environment degradation and promotion of environment; support people living in the coastal and ‘char’ areas; carbon trading etc. Another important undertaking by the bank also merits mentioning, which involves financing of a geo-textiles manufacturing project. Geo-textiles products are being used in ample quantity in construction of bridge and approach road, and building protection for riverbank, coastal, and embankment.

Bangladesh being a riverside country is always in need of geo-textiles products, and implementation of such an import-substitute product manufacturing facility would definitely help the country to save drainage of foreign exchanges.

Support to Martyr Family

The loss of lives in the BDR carnage shocked the entire nation. Prime Bank came forward to support the Martyr families and donated Tk. 2.5 million to Prime Minister’s Relief Fund. PBL also took responsibility to support two such families @ Tk. 0.48 million per year for ten years starting from 2009.

Games & Sports

The Bank participated in major sponsorship programs in the area of sports viz. Golf, Tennis to popularize the same among the public. Financial assistance was provided to Bangladesh Cricket Board for development of the game.

Other CSR activities of the Bank –

- Donations of Passenger cum bed lift to Sylhet Diabetic Association Hospital.

- Sponsoring 20 KVA Diesel Generator for Division of Development Studies, Dhaka University.

- Construction of Shahbag Foot Over Bridge.

- Awareness Campaign at the three international airports of the country against swine flu.

- Improvement of Porter and Luggage Handling Services at the Kamalapur Railway Station, Dhaka.

- Blankets and winter-clothes distribution among the winter distressed people of the

- CSR Contribution in 2010 (other than Prime Bank Foundation)

Education

- Children’s Art Competition and Exhibition was arranged by Zoinul Abedin Art School with the sponsorship of Tk. 25,000/- Prime Bank Limited.

- Donation of Tk. 4,16,500/- for 10 pcs. Computers for the students of Chittagong

- Financial Assistance of Tk. 7,00,000/- to Tania Zarifa Mazid, valedictorian of North South University and graduate student at Columbia University, New York, USA.

- Sponsorship of Tk. 4, 00,000/- million to Marine Academy Bangladesh for purchasing speed boat for the academy and for Gold Medals and crest for outstanding cadets passing out.

- Sponsorship of Tk. 4,98,000/- to Notre Dame College for 22nd National Debate Competition 2010 hold on 24 July, 2010.

- Sponsorship of Tk. 3,50,000/- for English Festival in Dhaka organized by Notre Dame

Health

- Donation of Tk. 50,00,000/- as financial assistance to purchase equipment for National Heart Foundation Sylhet.

- Donation of T 3,00,000/- million to Bipul Bhattacharya for his treatment.

- Donation of Tk. 25,000/- to Journalist Mustafiz for his treatment.

- Donation of Tk. 1, 00,000/- to the Dr. Lenin Azad to help a Kidney disease patient.

Sports

- Sponsorship of Tk. 50,00,000/- for “Sa Games 2010” hold from 29 January-9 February, 2010.

- Sponsorship of Tk. 10,00,000/- for “Asian Games Qualifying Round Hockey Tournament-2010” hold from 07-16 May, 2010 at Dhaka.

- Donation of Tk. 1,00,000/- to organize football tournament in Moulvibazar District Sports Association.

Arts & Culture

- Sponsorship of 3, 00,000/- to Ustad Capt. Azizul Islam to arranging a flute program in

- Sponsorship of Tk. 15, 00,000/- for arranging “1st FM Radio Award Night 2010”.

- Financial contribution of 1,00,00,000/- for construction of permanent Liberation War Museum.

- Sponsorship of Tk. 3,00,000/- to Ex-Collegiates Re-Union 2010 of Chittagong Collegiate, Chittagong.

Others (for benefits of mass people)

- Finance of Tk. 2,00,00,000/- for construction of Shahbag Foot-Over Bridge in Dhaka.

- Donation of Tk. 8,00,000/- for setting up 2 (two) passenger sheds in Savar Cantonment,

- Like other years PBL donated 5, 00,000/- for the “Walk the Event 2010” organized by World Food Program.

- Sponsorship of Tk. 20,00,000/- to Bangladesh Scouts for Bangladesh Scouts Lottery-

Community Investment

- Sponsorship of Tk. 24,000/- for National Vitamin A plus Campaign.

- Donation Tk. 2,60,000/- million to National Anti-Tuberculosis Association of Bangladesh (NATAB), Chittagong Branch for purchasing a Semi Automated Chemical Chemistry Analyzer.

- Prime Bank manages its activities in the community and creates a positive impact both for the community and the business.

Data Analysis and Findings –

Facility Management at PBL

Facility Management Division (FMD) is one of the integrated parts of PBL. FMD is entrusted with the responsibility of providing continuous and seamless support services to the Bank and ensuring high quality routine maintenance in all respects. Logistics support means, to proper supply of demands, mitigate the requirements, ensure proper maintenance, facilitate appropriate environment etc.

Facility Management Division of Prime Bank Limited is committed to provide the right kind of supports to all the bank’s Delivery Outlets and Head Office Divisions by introducing an effective procurement and delivery system. Its objective is to provide right kind of logistics at right time, at right place, at right quality, at right price and at right quantity.

There are six Departments in this division. They are-

- Project Management Department.

- Procurement & Maintenance Department

- Printing & Stationary Department

- General Administration Department

- Transportation & Communication Department

- Real Estate Department

Project Management Department:

Structural feasibility survey for suitable premises.

- Use of space for Head of Branch, Head of Division, Officers, Teller, Vault, Store ETC.

- Criteria of usage furniture.

- Maintenance of decorative items/premises.

- Maintenance of furniture/fixture.

- Maintenance of Sanitary fitting/fixture.

- Maintenance of sign board/signa

Procurement & Maintenance Department:

- Procurement, Installation & Maintenance of Air Conditioner units.

- Procurement, Installation & Maintenance of Generators.

- Procurement, Installation & Maintenance of CCTV Surveillance system.

- Procurement, Installation & Maintenance of PABX.

- Procurement, Installation & Maintenance of Photocopier/Fax Machine.

- Procurement, Installation & Maintenance of electrical systems/Solar panels.

- Usage of Office equipment.

- Procure, Repair & Replacement of Cell Phone.

- Usage of Cell Phone.

- Save power & Energy.

- Earthing system.

- Feasibility survey for suitable premises for perfect installatio

Printing and Stationary Department:

- MICR cheque.

- Visiting card.

- Store Man

- Delivery cheque book.

- Supply different stationary items to all division in Head office.

General Administration Department:

- Affairs on leave, office discipline/punctuality, attendance.

- Affairs on movement, visit, inspection.

- Cleaning, washing, plantation of premises.

- Engagement of safety and security firm.

- Supervision on safety and security system.

- Enhancement of Cash in Safe, Cash in Transit, Cash on Counter.

- Cash carrying service.

- Insurance like ITs, ATM, Vehicle, Office equipment & furniture, Locker etc.

- Awareness on fire protection system & usage of fire protection equipment.

Transportation and Communication Department:

- Procurement of vehicles.

- Auction of vehicles.

- Use of vehicles.

- Maintenance of vehicles.

- Administration for Drivers.

- Allocation of vehicles

Real state Department:

- Selection of suitable premises for Branches.

- Scale of negotiation.

- Execution of Memorandum of Understanding/Lease Agreement/Deed of Contract.

Supply Chain Management of Prime Bank Ltd

The stages of the supply chain maintain by the FMD of Prime Bank Limited, to meet with the demand of its users or Branches are mention below:

Prime Bank Limited is a private commercial bank which sells different banking services to both corporate and retail clients. To ensure the smooth and timely delivery of services to the customers, the PBL needs to manage its own supply chain of supporting products and services.

The value a supply chain generates is the difference between what the final product is worth to the customer and the costs the supply chain incurs in fulfilling the customer’s request. For any supply chain, there is only one source of revenue: the customer. All other cash flows are simply fund exchanges that occur within the supply chain, given that different stages have different owners. All flows of information, product, or funds generate costs within the supply chain. Thus, the appropriate management of these flows is a key to supply chain success

Responsibilities of Purchase Departments

The Purchase Departments are responsible for –

- Procuring goods and services of desired quality to the economic advantage of the Bank.

- Procuring adequate quantity of stores and office supplies at right time so as to ensure timely delivery for meeting demands of indenting Divisions, Departments, Units and Branches.

- Ensuring execution of contracts in the manner that the Bank’s interest is well protected.

- Prioritizing procurement of indigenous products as far as practicable in keeping with the maintenance of quality.

- Collecting indents from various Divisions and Branches on quarterly basis in time and processing those for procurement by examining quality, determining quantity and comparing prices.

- Following appropriate method for procurement of the items for which indents are received.

- Maintenance of Economic Order Quantity of different items so that operations can be carried on unhindered.

- Standardizing items for procurement for bringing in economy.

Budget of FMD

Budget –

The budget of a bank or any organization is compiled annually. A finished budget usually requires considerable effort and can be seen as a financial plan for the new financial year.

While traditionally the Finance department compiles the company’s budget, modern software allows hundreds or even thousands of people in the various departments (operations, human resources, IT etc) to contribute their expected revenues and express to the final budget.

If the actual numbers delivered through the financial year turn out to be close to the budget, this will demonstrate that the company understands their business and has been successfully driving it in the direction they had planned. On the other hand, if the actual diverge wildly from the budget, this sends out an ‘out of control’ signal and the share price could suffer as a result.

Work on Budget in Facility Management Division (FMD) of Prime Bank Limited:

At the month of October it is time to prepare Budget of Facility Management Division (FMD).

Capital budget

The process in which a business determines whether projects such as building a new plant or investing in a long-term venture are worth pursuing. Oftentimes, a prospective project’s lifetime cash inflows and outflows are assessed in order to determine whether the returns generated meet a sufficient target benchmark.

Expenditure Budget:

Here we will see two sections of expenditure budget of FMD. Here is a graph showing comparison between months of 2014, in Security expenses and Land rent section.

Security expense: Here we can see there is not that much difference between each month. Security expense does not rise and fall that much because Prime Bank has installed necessary equipments earlier so they don’t need to buy any further equipment. So there is not that much fluctuation we can see here but a little amount of maintenance charge is needed every month so they have included that amount as a basis of assumption. Sometimes CCTV, DVR, alarm bell need to repair and changing of parts is needed.

Land rent and tax: In the land rent and tax graph we can see not much significant changes in values per month. The land rent and deed is most of the time for many years and not usually changes very often. The little value changes here shown are for the utility bills and other charges that may varies for reasons. And for the last month of the year they keep a large amount for the adjustment because sometimes the land owner charges the repairing works and other fees to the bank.

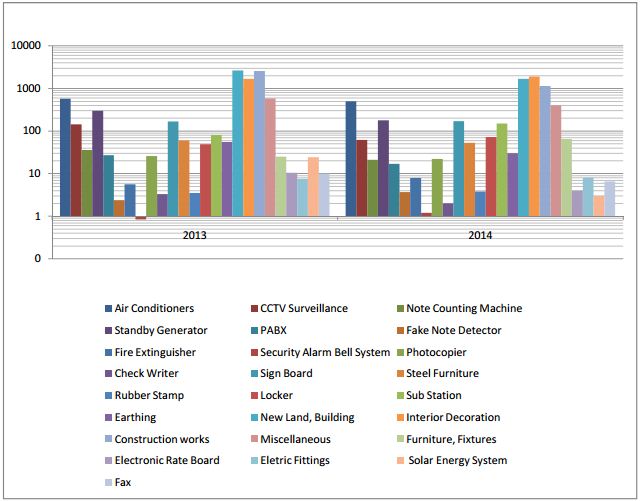

Capital Budget:

Here we can see the capital budget for the year 2013 and 2014 in the graph. There are some sections in the capital budget. We can now see the reasons behind the fluctuations between two years.

Air conditioners: the amount has decreased in 2014. In 2013 the budget was 571 lakh and in 2014 the budget is 497 lakh. In 2013 Bangladesh Bank has order to increase the number of branches countrywide so they have proposed few branches and there were more head offices to increase like one in motijheel and one gulshan area, so number of air conditioners was in the budget list but this year in 2014 there are not much branches to complete, most of the branches have been completed by 2013. The number of old AC repaired in 2013 was huge and the cost was real high so the amount of budget was more in 2013.

CCTV surveillance: in 2013 the budget for CCTV was 143 lakh but in 2014 the budget has been decreased to 62 lakh only. In 2013 prime bank has opened some new branches according to the order of Bangladesh bank and for those new branches they have installed some CCTV as a security concern and for risk factor. In 2014 they don’t go for more new branches, only those have ongoing works the budget is for those branches only so the amount is less in 2014.

Note counting machines: In note counting machine segment we can see there is not that much difference, in 2013 the need of note counting machine was equivalent to 36 lakh taka and in 2014 the need is decreased to 22 lakhs approximate. It was more in 2013 because those new branches what opened in 2013 was in need of new note counting machines.

Standby generator: In 2013 the 12 new branches needed new generator and replacement of generator and the head office needs another standby generator so the cost rises at 299 lakh. But in 2014 few numbers of branches and replacement of standby generator has been decreased so the budget for 2014 is 179 lakh only.

Furniture and fixture: in this section the budget amount has increased in 2014 because they have bought new set of furniture for 5 new branches and they have supplied furniture for different divisions of head office.

PABX system: In 2013 prime bank has upgraded the existing PABX system all over the branches and head offices and the number of extension has been increased so in 2013 the budget was increased than the 2014 budget.

Fire extinguisher: in 2014 the budget amount has significantly increased just because the number of fire extinguisher unit has been increased for many purposes. For ATM booth, head office, generator room and garage many units of fire extinguisher has been supplied all over the countries so the 2014 budget is more than the 2013 budget.

Photocopier and fax machine: In the section of photocopier and fax machine, in year 2013 the budget is more than the budget 2014. To fulfill the requirement of the machines for the new branches they had to spend more in 2013 and for the replacement of the parts for those machines they had to pay huge money in 2013.

Steel furniture: Not that much difference we can see in this section because in 2013 the steel furniture were required for the new branches and for 2014, they have increased their safety precautions and for that they replaced all the older steel furniture with new iron safe and fire proof cabinet.

Land and Building: In this section we can see the budget is higher in 2013 because they have hired and bought some new building like Sarkar mansion in motijheel and BM Heights in Chittagong, a building in Khulna. In 2014 they have to just pay the rent and tax fees and registration fees.

Interior decoration and renovation: As like the early sections, the 2013 budget is higher than the 2014 budget. They have completed the new branch and for those new branches they had to pay a lot for the decoration works so the decoration cost is higher in 2013 but in 2014 there were not that much branches left for the pending work, so they had to pay little only for the new ATM booths and other pending works.

Construction works: In 2013 the budget was way high for the construction works just because they had to build the corporate office at nikunja and a corporate office at KEPZ ctg. And the proposed construction works for the Prime view in gulshan will be started from 2014 so the budget is carried out on 2014.

Miscellaneous: in this section they have bring many small facts like ups, MICR reader, Power factor improvement panel, note binding machine, mobile handset, water purifier, metal detector, intruder alarm, renovation, access control, lift etc. Some of these items are needed every year and sometimes these items need to be replaced or repaired, so the budget for these items is tentative and according to the previous record. In this section we can see the budget is higher in 2013 than the budget 2014.

Recommendations

- Management should start thinking about establishing wings of FMD in major divisions of Bangladesh. So it can save the time and cost simultaneously.

- Top management involvement differs for each category: strategic items involves deeper than other items. Non-critical items have no top-management involvement.

- Early supplier involvement differs for each category: strategic items involve more deeply than others. Suppliers of strategic items should provide training sessions and early product design involvement to PBL.

- There should be a provision for price monitoring of different low-value goods supplier i.e. table stationary supplier.

- Improvement of working environment is essential. The LSSD working environment was found to be noisy.

- Sometimes dual Manager ship create problem, so in few cases employee empowerment can be better.

- Keep storing unit at different Branches under direct authorization of FMD; it will help to reduce cost.

Observed in the Organization:

Facility Management Division is well organized by the departmental Head. Every employee’s were active and dedicated for their work. But this division can’t do their work individually. Some limitation or problem was observed while working.

- FAD’s approval is must for any requisition. So sometimes it saw some misunderstanding between FMD and FAD.

- In my Internship period I observed the misuse of papers, pins, printing machines.

- Sometimes the place was crowded so it was difficult to concentrate in work.

- Sometimes the workplace makes me monotonous because it is difficult to concentrate on the same work again and again.

- Large amount of printing cost in LSSD.

Summary

PRIME BANK is “a bank with a difference” incorporated as a public limited company on 17 th April 1995 under the company acts 1994. Prime Bank limited is a full service commercial bank with local and international institutes. Prime bank has been striving to provide best-in-the-class services to its diverse range of customers spread across the country under an on-line banking platform.

The main objectives of this study are to give a brief idea about Facility Management Division of Prime Bank Limited.

Facility Management Division of Prime Bank Limited is committed to provide the right kind of supports to all the bank’s Delivery Outlets and Head Office Divisions by introducing an effective procurement and delivery system. Its objective is to provide right kind of logistics at right time, at right place, at right quality, at right price and at right quantity.

Conclusion

There are a number of Private Commercial Banks, Commercial Banks and Foreign Banks. Prime Bank Limited is one of them. For the future planning and the successful operation for achieving its prime goal, this report can be a helpful guideline in current competitive environment.

Facility Management Division is not a general banking division. Having integrated Logistic Support Services System in place is a fundamental requirement for a banking organization to meets its performance goals. Different divisions in head office and branches all over the country taking support & services from FMD. This division is working like a nucleus for Prime Bank Ltd.