This report is written on the Customers’ Satisfaction of Prime Bank Limited.

In chapter 1, I have introduced the topic, along with the objective of the report, which was mainly understand how to gain real life exposure in the banking sector and to get a clear idea about overall customers’ satisfaction.

Chapter 2. Start with the methodology followed to gather the information and the sources of data and I have also mentioned the data collection techniques.

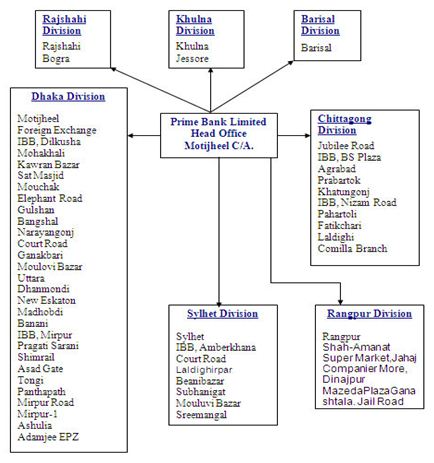

The company profile is started in the chapter 3. It includes the background of the bank, with principle activities, management and branch’s hierarchy, branch network, ratio analysis of the Prime Bank Limited and SWOT analysis of Prime Bank Limited.

Chapter 4. Starts with findings in different situations about Customers’ Satisfaction on Prime Bank Limited. In this chapter all the survey information are graphically presented.

Chapter 5. Draws summary of this report. I have tried to draw out some solution to those problems and some recommendation.

Finally chapter 5 has the tables and graphs and other information in the appendix that might be needed for the better understanding of the report.

A person or institution that has come to get services and is then obligated to repay it and any additional fees according to the service terms. Customer satisfaction is so much important for any bank because if they know the perception level of their Customers then they can do all the service activities easily. That’s why in this report I have tried to explain and highlight this issue precisely.

CHAPTER 01: INTRODUCTION

1.1 Foundation of the Study

As part of the Internship Program of Bachelor of Business Administration course requirement, I was assigned for doing my internship in The Prime Bank Limited as an intern by Northern College Bangladesh. In PBL, I was assigned in the General Banking department of the Motijheel Branch, Dhaka and my organizational supervisor was Ms. Mst. Ashrafun Nesa Officer of Account Opening Section. My project was Customers’ Satisfaction in Prime Bank Limited, which was assigned by Mr. Md. Yusuf Ali, Senior Assistant Vice President of the said PBL and my faculty supervisor Md. Mahmudul Haque, lecturer of Northern College Bangladesh also approved the project and authorized me to prepare this report as part of the fulfilment of internship requirements

1.2 Justification of the Study

Theoretical knowledge is not enough for a student. It is miles difference between theoretical knowledge and practical field. So, this two should be synchronized. Internship is launched mainly for this purpose. Another purpose that may be is to know about the rules, regulations and environment of an organization before getting a job. Such experience may facilitate a student to have a better job.

1.3 Objectives of the Study

Before setting up this report certain objectives were in depth in mind and the research work went accordingly. The objectives are enumerated –

To gather comprehensive knowledge on overall banking functions and the expectation of the customers regarding the service quality of PBL.

To find out the lacking in customer service quality of PBL.

To have the idea of customers’ satisfaction level.

To relate the theories of banking with the practical banking activities.

To have an exposure on the financial institution, especially on banking environment of Banglade

1.4 Scope of the Study

While preparing this report, I had a great opportunity to have in depth knowledge about the customer services and banking practices. Additionally, I have achieved some practical experiences with the customers’. I think it will be helpful for me to have an idea about the customers’ attitude towards private commercial banks and overall banking sector as well.

1.5 Limitations of the Study

It is an uphill task to study the on the management so the report was completed under certain constrains which were:

- Difficulty in gaining accesses to financial sector.

- Non‐availability of the most recent statistical data.

- As I am student it is not possible for me to collect all the necessary information.

- I had to complete this report within a very short span of time that was not sufficient for investigation.

- Lake of Experience.

CHAPTER 02: METHODOLOGY

2.1 Methodology of the Study

The following methodology will be followed for the study both primary and secondary data sources will be used to generate this report. Primary data sources are scheduled survey, informal discussion with professionals and observation while working in different desks. The secondary data sources are annual reports, manuals, and brochures of Prime Bank Limited and different publications of Bangladesh Bank.

To identify the implementation, supervision, monitoring and repayment practice- interview with the employee and Customer and extensive study of the existing file was and practical case observation was done.

2.2 Population

Population refers to any group of people or objects which are similar in one or more ways and which forms the subject of the study in a particular survey. So our population is all Customers’ of prime bank ltd. That means our population is the all bank account holders of Prime Bank Ltd.

2.3 Sampling

- Target population: Total 50 clients in Prime Bank Limited.

- Elements: Which clients are involved in this bank and other banks for last five years?

- Extent: Dhaka city.

- Sampling frame: Sampling frame for the study has collected from Prime Bank Limited (PBL) has a detail list of Clients of Dhaka city.

- Sample size: Clients = 50.

- Organization experts: 3.

- Sampling procedure: Convenience sampling procedure has been selected for this study.

2.5 Questionnaires:

There is different type of questionnaire. But we use only structured questionnaire which content two basic types.

They are : Closed ended questionnaire & Open ended questionnaire

2.6 Sources of Data Collection

In conducting this report basically, there have been two types of data and information used. The name of those two types and their sources to reveal the information for preparing this report has been showed in a flow chart.

2.7 DATA ANALYSIS

The main target of the study is to find out “Customer satisfaction of banking services of prime bank ltd by using procedure, rules and regulation of banking.” In Bangladesh there are 50 or more (public, private and foreign) commercial bank is running their business. But the entire bank is not providing the same services. Mainly public banks are not providing the online banking facility. But Maximum of the private and foreign banks is providing the online banking facility to their customer. Now a day’s people like such kind of banking service which can provide better banking service as well as online service. In that case whose banks are providing maximum branches, facilities and providing easy banking service with better customer service they can get maximum customer. In This present situation Bangladeshi people are using online banking a lot. But maximum times we can see the online banking holders are not satisfied with the bank services. Because banks are charging more amount as service charge. The customer thinks that banks are not able to provide the best services in terms of their policy. Even some customer blame that they are charging higher service charge in terms of interest rate for savings account. So we can say that customer is not fully satisfied. My main target of study that what kind of service customers want from the bank and what kind of new facilities they want from the bank.

2.9 Analysis and Interpretation of Data

Despite the challenges, Prime Bank closed on a high note and made an impressive progress in many lines of business during 2008.Through my survey I tried to find out the strengths and weaknesses of banking service. Now I am going to show the results through Table and some graphs.

2.10 Data Collecting Technique

For the purpose of the study two methods of techniques used:

- Observation

- Interview

Observation: Observation method is often used to complete this qualitative research because it is very difficult to provide any specific example from any file about certain document, as the matter is very sensitive for the client as well as for the bank.

Interview: Primarily some data are collected from face-to-face interview of different employees of Prime Bank Limited at Matijheel Branch. By face to face conversation with the Customer’s and by personal interviewing it is easy to collect the accurate information for the study. For the purpose of this interview, customers were asked to fill up a questionnaire. Based on their answer, it is easy to justify the Customer’s Satisfaction on Prime Bank Limited.

CHAPTER 03: AN OVERVIEW OF PRIME BANK LIMITED

3.1 Background of Prime Bank Limited

During the booming years of the banking industry of Bangladesh, a group of highly skilled local entrepreneurs came up with an idea to float a commercial bank with a different outlook. The idea was to build a banking organization with excellence, competence and consistent delivery of reliable service with superior customer satisfaction. The outcome of this thinking was the Prime Bank Limited, commenced its business on April 17, 1995.

Since the beginning the bank is being managed by a team of professionals, with dedication and sincerity. Their experience and hard work has taken the bank in the leading position. The bank is constantly focused towards the understanding and predicting customer’s needs and meeting them. It is giving a tough competition to other banks in case of performance and customer satisfactions.

The bank offers almost all sorts of commercial banking services within the framework of Banking Company Act, and the rules and regulations lay down by the Bangladesh Bank. These services include corporate Banking, Retail Banking, and Consumer Banking etc.

Within this short time the bank has already claimed a position among the top ranked banks in our country through ensuring high profile management, experienced, dedicated and skilled employees, and a whole lot of hard works. It has adopted the CAMEL rating, BASEL II and all other international requirements. It is always responding to technological enhancements and developments.

The introduction of ATM in March 2008 and Internet Banking in 2009 ushered a new era and prime Bank is now wed poised towards the expansion of alternative delivery across Bangladesh. Prime Bank is one of the most renowned names among the well performing banks in the banking industry and it is continuously working hard to hold its position in the market as the leader through providing top class services.

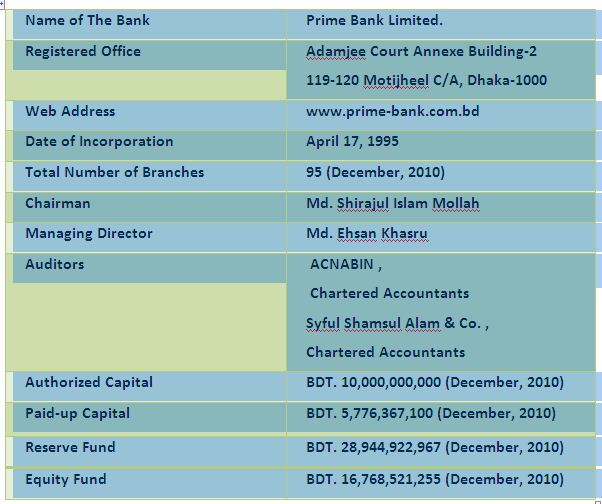

3.2 Prime Bank Limited at a Glance

3.3 Names of Founders

3.4 Company Vision

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

3.5 Company Mission

- To build Prime Bank Limited into an efficient, market driven, customer focused institution with good corporate governance structure.

- Continuous improvement in business policies and procedures through integration of technology all the levels.

3.6 Goals and Objectives

Maximization of profit through customer satisfaction is the main objective of the bank. In addition, the others relevant objectives are:

- To be the market leader in high quality banking products and services.

- Active excellence in customer service through providing the most modern and advance technology in the different spheres of banking.

- To participate in the industrial development of the country to encourage the new and educated young entrepreneurs to undertake productive venture and demonstrate their creativity and there by participate in the national development

- To provide credit facilities to the small and medium size entrepreneur located in urban & sub-urban area and easily accessible by branches.

- To develop saving attitude and making acquaintance with modern banking facilities.

- To inspire for undertaking small projects for creation of employment through income generating activities.

- To play a significant role in the economic development of the country.

3.7 Marketing Strategic Priority

To have sustained growth, broaden and improve range of products and services in all areas of banking activities with the aim to add increased value to shareholders’ investment and offer highest possible benefits to the customers.

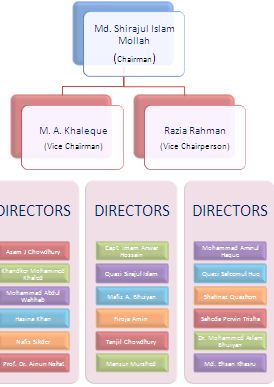

3.8 Management Hierarchy of Prime Bank Limited

From the top to the bottom management body of Prime Bank Limited can be divided into four levels:

- Top Level Management

- Executive Level Management

- Mid Level Management

- Junior Level

3.10 Network of the Bank:

3.11 Bank Operational Area of PBL

All branches of Prime Bank Limited are divided into three departments:

- General Banking Department.

- Credit Department.

- Foreign Exchange Department.

General Banking Department:

General Banking Department plays a very significant role to portray a good image on the customer’s mind as it is considered as the direct customer service centre. The banking operation begins with this department. This department delivers day to day services to the customers. The Clients and Customers build their impression here and the client decides whether they should go for further dealings or not; on the basis of the services delivered by the officials. It comprises of some basic activities on which other sectors continue their operation.

Credit Department:

Modern banking operations touch almost every sphere of economic activity. The extension of bank credit is necessary for expansion of business operations. Bank credit is a catalyst for bringing about economic development. Without adequate finance there can be no growth or maintenance of a stable output. Bank lending is important to the economy, for it makes possible the financing of agricultural, commercial and industrial activities of a nation.

Foreign Exchange Department:

Banks play a very important role in effecting foreign exchange transaction of a country. Mainly transactions with overseas countries are in respect of imports; exports and foreign remittance come under the purview of foreign exchange department. Banks are the vital sectors by which such transactions are effected /settled. Central Bank records all sorts of foreign exchange transactions.

The other banks dealing with foreign exchange are to report to Bangladesh Bank regularly (viz. daily, monthly, quarterly, yearly etc.).

3.12 Business Activities of PBL

The Principal activities of the bank were banking and related businesses. The banking businesses included deposits taking, extending credit to corporate organization, retail and small & medium enterprises, trade financing, project financing, international credit card etc. Prime Bank Limited provides a full range of products and services to its customers, some of which are mentioned below with a brief overview of the major business activities.

Retail Banking:

As a part of risk diversification strategy PBL expended the lending activities in this sector during 2006. The growth rate of PBL’s consumer financing was 38% during this year. The loan schemes offered by the bank include Home Loan, Loan against Salary, Marriage Loan, Car Loan, Hospitalization Loan, Education Loan, Doctors Loan, Travel Loan etc

SME Lending:

Job creation is essential and it must come from Small and Medium Enterprise that will ultimately dominate the private sector. During 2006 bank’s Strategy was focused on customer convenience. The Bank provided working capital loans to suppliers or dealers of large corporations or clusters of small exporters of non‐traditional items. Outstanding loan of SME is Tk.437 million. The growth rate of PBL’s SME Lending was 41% during this year.

Corporate Credit:

PBL’s strategy is to provide comprehensive service to the clients of this segment who are large and medium size corporate customers with expertise in trade finance and related services. Besides trade finance bank are providing working capital finance, project finance and arranging syndication for our corporate clients. Syndication and structured Finance Unit of the Bank strengthened its footstep in the consortium financial market and arranged a number of syndication deals for its corporate clients.

Islamic Banking:

For the development of Islamic Banking Business, 2006 was also a commendable year. It has been observed that compliance of Shariah has improved in 2006 as compared to the preceding years. According to their advice Islamic Banking operation of the bank has been separated from the operation of Conventional Banking and shown separately in the bank’s financial statement. It is found that the investment and deposits grew by 38% and 89% respectively in the year 2006. The operating profit of Islamic Banking Branches grew by 45% during the Year.

Credit Card:

In the year of 2005, Prime Bank Ltd has launched VISA. Before that PBL started its credit card operation in 1999 by introducing Master Card. Now PBL has become the first local Bank of the country to achieve principal membership of both the worldwide‐accepted plastic money network i.e. Master Card and VISA. PBL has redesigned the credit card facility by providing the incentive of “Free Life Insurance Coverage” for their valued cardholders to mitigate the financial risk

Custodial Service:

PBL equator fulfils its strategic commitment to provide custody and clearing services. Equator’s focuses are on the following:

- Commitment to quality

- Dedication to customer needs

- Sustained investment in people and systems

International Trade Management:

This division is operational throughout the group and PBL’s core strength is trade finance and services. With an experience, Prime Bank has developed knowledge of trade finance, which is world class. Principle services to importers include imports letter of credit, import bills for collection and back‐to‐ back letters of credit facilities. Services provide to exporters include export letters of credit, direct export bills, bonds, and guarantees.

Cash Management:

Prime Bank recognizes the importance of cash management to corporate and financial institutional customers, and offers a comprehensive range of services and liquidity management.

Institutional Banking:

Prime Bank Limited provides a wide range of services to institutional clients, commercial, merchant and central banks; brokers and dealers; insurance companies; funds and managers, and others. It provides relationship managers who are close to their customers and speak local language. This wide network of institutional banking facilities includes transaction, introduction, problem solving and renders advice and guidelines on local trading condition.

Treasury:

Treasury operations had been consideration as an important avenue for income generation purpose within Head Office. In fact, in the past, income from treasury operation was quite sizable and significant to the total income generated by the bank. The treasury division publishes daily and weekly currency newsletters, which provide analyses of currency trends and related issues. Seminars and workshops are conducted for customers from time to time on foreign exchange related topics. Prime Bank is one of the first local banks in Bangladesh to integrate treasury dealings of local money market and foreign currency under one Treasury umbrella. The bank has handled significant volumes of treasury over the last several years. Prime Bank’s Dealing Room is connected with automated Reuters Terminal facility thus enabling the bank to provide forward/future facilities to its corporate clients at a very competitive rate.

Foreign Exchange Business:

The foreign exchange business handled by the bank in 2010 was Tk 283.08 billion in 2010 against Tk 199.00 million in 2009 indicating a growth rate of 42 percent which was contributed by growth in import, export and remittance business as below:

• Import business handled was Tk 147.70 billion which was 125 percent of the budget and showed 53 percent growth;

• Export volume was Tk 106.94 billion which was 115 percent of the budget with growth rate of 41 percent;

• Remittance business was Tk 28.43 billion which was 86 percent of the budget but showed growth rate of 8 percent;

Merchant Banking:

The Bank’s operation in this sector was limited to Underwriting, Portfolio Management and Banker to the Issue functions. The compulsory requirement for opening BO account for share trading has increased the demand for opening BO account.

Online Branch Banking:

The bank has set up a Wide Area Network (WAN) across the country to provide online branch banking facility to its valued clients. Under this scheme, clients of any branch shall be able to do banking transaction at other branches of the bank.

Under this system a client will be able to do following type of transactions:

• Cash withdrawal from his/her account at any branch of the bank.

• Cash deposit in his/her account at any branch of the bank irrespective of the location.

• Cash deposit in other’s account at any branch of the bank irrespective of the location.

• Transfer of money from his/her account with any branch of the bank.

At present 24 (Twenty Four) branches are under online. Clients can easily deposit and withdraw money from those online branches in a moment.

SWIFT:

Prime Bank Limited is one of the first few Bangladeshi banks, which have become member of SWIFT (Society for Worldwide Inter‐bank Financial Telecommunication) in 1999. SWIFT is a member‐owned co‐operative, which provides a fast and accurate communication network for financial transactions such as Letters of Credit, Fund Transfer etc. By becoming a member of SWIFT, the bank has opened up possibilities for uninterrupted connectivity with over 5,700 user institutions in 150 countries around the world.Information Technology in Banking Operation:

Prime Bank Limited adopted automation in banking operation from the first day of its operation. The main objective of this automation is to provide efficient and prompt services to the bank’s clients. At present, all the branches of the bank are computerized. At branch level, the bank is using server‐based multi‐user software under UNIX operating system to provide best security of automation.

Profitability and Shareholder Satisfaction:

The bank had been one of the most profitable in the banking sector. The bank’s return on assets (ROA) was 2.16% in the year 2010. Even though the capital market of the country has been suffering over the last few years, the good performance of Prime Bank made sure that the banks share price remained in a respectable position.

3.13 Products and Services of PBL

Prime Bank Limited offers various kinds of deposit products and loan schemes. The bank also has highly qualified professional staff members who have the capability to manage and meet all the requirements of the bank. Every account is assigned to an account manager who personally takes care of it and is available for discussion and inquiries, whether one writes, telephones or calls.

CARD DIVISION SERVICE

- ATM Card:

Automated Teller Machine (ATM) card is new concept in modem banking, has already been introduced to facilitate subscribers 24 hour cash access through a plastic card. Prime Bank Limited has started their ATM card services from 15th March 2008 by opening a ATM booth at Motijheel Branch. After that Prime Bank Limited made an agreement with Dutch Bangla Bank to use their ATM Booth.

- Master Debit Card:

Master the power of money with us! Withdrawal or shopping was no easier and convenient ever before! Prime Bank offers you Master Debit Card; the fast, secure and convenient way to withdraw cash and convenient transactions at different MasterCard branded POS terminals. If you are a SD/CD/STD account holder of Prime Bank, you can avail this debit card and can master over 1300 ATMs all over Bangladesh and can get privilege in the MasterCard branded POS or MasterCard branded network.

Other Products & Services:

- Online Banking Service

- SWIFT Service

- Letter of Credit Delivery Service

- Locker Service

3.14 SWOT Analysis of Prime Bank Ltd at a Glance

| Strength | Weaknesses |

|

|

| Opportunities | Threats |

|

|

3.15 Financial Position of PBL

Loans and Advances of the Bank grew strongly by 24.55% to 111,167.39 million in 2010. Bills purchased and discounted increased by 5% indicating strong growth in export performance.

The deposits balance of PBL reached the level of Tk.124.519 million during 2010 from Tk. 106.96 million of previous years. The growth rate is 26.34 percent. This was possible due to superior customer service delivery at the branch level, expansion of branch network to rural areas where foreign remittance flow is significant as well as liability campaign by retail liability team for mobilization of no cost and low cost deposits.

3.16 Achievement of Business targets in 2010

Performance of the bank for the year 2010 was good considering the prevailing market challenges arising from global financial crisis. The performance of the bank against targets is as below:

Taka in million

| Particulars | Budget(2010) | Actual (2010) | Budget Achievement (%) |

| Operating Profit | 5,700 | 6,078 | 107 |

| Deposit | 137,000 | 124,519 | 91 |

| Advance | 113,000 | 118,000 | 98 |

| Import | 111,167 | 147,704 | 125 |

| Export | 93,000 | 106,943 | 115 |

| Inward Remittance (Foreign) | 33,000 | 28,433 | 86 |

| Guarantee | 18,000 | 29,000 | 161 |

PBL is subject to regulations and compliance of regulation is must. Changes in policies with regard to interest rates, pricing have significant effect on the performance of the Bank. Bangladesh Bank is expected to continue its persuasion to reduce the spread and charges further which is likely to affect the performance. Changes in provisioning requirement will also affect the performance of the bank.

CHAPTER 04: PROJECT PAR

Data Analysis and Findings.

During the survey I have found lots of positive things as well as some negative things. Now I am going to discuss one by one-

- In Bangladeshi family, most of the time male provide the maximum effort for family. From my survey I have found that maximum percentage (74%) Respondent are male. That means normally male handle the bank account to survive the family needs.

- From my survey I found that now a day’s young person are encouraged to open a bank account. I found 62% of customers are in age between 18 to 35 years old. Because they are very much concern about savings.

- Prime bank Ltd always gets all level of people to open a bank account.

- Prime bank ltd will be really happy to learn that almost 94% of customer certifies that PBL is providing excellent service to their customer. Because almost all respondent are agree or strongly agree that PBL is excellent in service.

- From the survey I found that PBL has all kind of facilities including security, Better services, simplicity and faster, they cover wide area of online banking and also have low maintenance cost.

- Customers are almost satisfied with ATM service. Because 60% of people said that they don’t feel any hassle during ATM card using. Though 40% of them are not satisfied.

- As 40% people are not satisfied, they said why they don’t agree to satisfy. Because some of them strongly said that technical defects are available in ATM booth.

- In case of service charge customers are almost same as service charge ok or not. 48% people are not satisfied with present charge. They ask to minimize service charge more.

- Bank can be satisfied that they are providing excellent ATM services. Because during survey I found that customer are frequently using ATM booth. Some of them are using ATM Booth 7 to 9 or more than that in every week.

- When I ask about cheque book the frequently answer me that they also use cheque book. Because by ATM card customer cannot withdraw large amount. Another thing that customer are using cheque book because it is transferable.

- Prime bank ltd allows their customer only 20000Tk to withdraw money by using ATM card in a day. That’s why some of customers are not satisfied.

So from all findings we can say that without some specific case Prime bank ltd almost covered their customer requirement and expectation. That much they did not, hope fully cover very near future to reach the core of customer heart.

CHAPTER 05: RECOMMENDATION AND CONCLUSION

5.1 Recommendations

I had the practical exposure in Prime Bank Ltd. Motijheel Branch for just three months, with my little experience in the bank in comparison with vast and complex banking system, it is very difficult for me to recommend. I have observed some shortcomings regarding operational and other aspects of their banking. On the basis of my close observation I would like to propose the following recommendations-

- Improve office atmosphere to give customer friendly feeling.

- Provide intimate attention to your customers’ needs.

- Customers’ convenience will be of Top priority.

- Fast Service Policy should be introduced. So that everybody get faster service.

- The bank should try to arrange more training programs for their officials. Quality training will help the official to enrich them with more recent knowledge of banking and improve their skill.

- Over burden of work and ill defined assignment unable the employee to discharge their duties in cool manner. It is also creates a hazardous situation in the work process. So all the employees should be assigned with proper and specific assignment.

- Time consumed in servicing customers is minimized.

- Develop communication skills.

- Help new entrepreneurs to formulate business plans.

- PBL provide a lot of ATM booth for their client. But problem is that some time technical problems are occurring. So they should look after it carefully.

PBL should provide a specific information desk in all branches for customers

5.2 Conclusion

The Bank is committed to being a sophisticated prominent and professional institution, providing a one window service to its customers. During the first five years Prime Bank’s strategy was focused on continuing in provident of internal procedures and operating structures, to have a greater control on the quality of our business and to provide better management direction. After five years of working on the Banks structure, its culture and controls, the management is confident that the Bank can move forward on a rapid growth path. The PBL’s corporate philosophy is to build its non-funded fee and commission income stream, thus reducing its reliance on interest income alone.

We can say that without some specific case Prime bank ltd almost covered their customer requirement and expectation. That much they did not, hope fully cover very near future to reach the core of customer heart. So, yes customers are satisfied with banking service and ATM service of Prime Bank Ltd. The report attempts to show the summarized picture of Customer satisfaction of Prime Bank LTD. The results of our study and observation on the given topic “Customer satisfaction on overall banking services Of PBL”. After collecting information I have learnt that they are reached the maximum customer satisfaction level by providing many functions in banking transactions. Prime Bank LTD. is that one kinds of bank that deals different functions in different customer or clients. Its dedicated customer service canters are staffed with experienced specialists to ensure that their entire customers are well served.

CHAPTER 06: Bibliography and Appendix

Books and publications:

- Book of banking policy by different writers.

- Foundation Training Book of Prime Bank Limited.

- Prospectus of prime bank ltd.

- Annual Report 2010 of Prime Bank Limited.

- Some articles of banking award.

Websites:

- www.primebank.com.bd

- www.wikipedia.com

6.2 Appendix

Questionnaire:

Sample questions for survey

Topic: Customer satisfaction on banking service of prime bank Ltd.

1. Name _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2. Sex

a) Male b) Female

3. Age

a) 20-30 Years b) 31-50 Years c) 51-70 Years

4. Occupation

a) Student b) Service c) Business d) Others _ _ _ _ _ _ _ _

5. What is your monthly income?

a) Below 10000 c) 20000-30000

b) 100000-20000 d) 300000 & More

6. Is there any reason behind choosing Prime Bank Ltd for open a bank account?

a) More secured

b) Better service, Faster & Simplicity

c) Coverage in wide area

d) Low maintenance cost e) others (specify)……………………….

9. I thing that Prime Bank Ltd is charging a reasonable service charge.

a) Agree b) Strongly Agree c) Disagree d) Strongly Disagree

10. If disagree, how much charge you want to pay in a year for overall banking service?

…..……………………………

15. Do you use chequebook for withdraw money?

a) Yes b) No

16. What is the reason behind using chequebook instead of ATM card for withdraw money?

a) Larger amount can withdraw at a time

b) Cheque is transferable

c) Technical Problem may occur in ATM booth

d) Others (specify)…………

7. Are you satisfied about the online banking services of Prime Bank Limited?

a) Yes b) No

14. How many times you use ATM booth in a week?

a) 1-3 times b) 4-6 times c) 7-9 times d) More than 9 times

17. What is the maximum amount you can withdraw in a day by using ATM card?

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

18. Are you satisfied to withdraw this amount by using ATM card?

a) Yes b) No

12. Do you feel any hassle of using ATM card?

a) Yes b) No

13. If yes, mention the reason of your inconveniences

a) Shortage of ATM booth

b) Stand in a long queue

e) Technical defects of ATM Machine

d) Others (specify)……………………….

11. How satisfied are you with the internet banking service?

a) Very Satisfied b) Satisfied c) Neutral d) Dissatisfied e) Very Dissatisfied

8. I think Prime Bank Ltd is providing excellent service from the beginning.

a) Agree b) Strongly Agree c) Disagree d) Strongly Disagree

19. Do you want to attach any special feature to improve the services?

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _