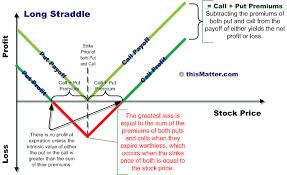

General objective of this article is to Analysis on Call Options Strategy for Investors. Here explain Call Options Strategy in portfolio finance point of view. A financial transaction through which sellers of call options own the corresponding volume of, for example, shares, stocks or other securities is usually a covered call. Investing in this option is not a simple profit return strategy, but is regarded as an income oriented approach for virtually any individual, especially with the incentive of finding a call premium every thirty days. This is a well designed strategy, often used by experienced traders and those a new comer to options and due into it being a limited risk, there are fewer restrictions placed on using this particular strategy simply by brokerage firms.

Analysis on Call Options Strategy for Investors