SME plays an important role in the economic and social life and it can generate large numbers of non-agriculture jobs, exports, sales and value addition. They contribute to the employment creation as well as to the improvement of skills by providing on the job training to individuals who have already little experience and knowledge. It is strongly believed that with the right policies and frameworks, SMEs have a crucial role to play for the economy of a developing country like Bangladesh by adopting new technologies and approaches. (Annual report of Basic Bank Ltd on SME2010)

There are at least six million small and medium enterprises (SMEs), which have employed around 80 percent of the total industrial workforce (excludes agriculture, Financial Institutions and forestry sector) and contribute nearly 25 percent to the Bangladesh’s gross domestic products (GDP). Nearly 95 percent of the country’s total business falls under the category of micro, small and medium enterprises that share more than 40 percent of the entire manufacturing output and therefore, SMEs can be termed as the driving force behind the expanding economy. (www.smenet.org/foundation/)

SME has become a common slogan today around the world including Bangladesh. It is now very much in the public and trade support institutions policy renown in Bangladesh, but still SMEs are facing lots of problems among the problems; access to credit has been the key factor during the last two decades. Nowadays Financial institutions, including state owned and private commercial banks, are also rendering their support by providing investment facilities and promotional services to SMEs throughout the country. Though the risk has been increases but in reality financial institutions are managing the risk and making a significant profit from this sector.

Objective of the Report

Main objective

- To know the contribution of SME in finance sector in Bangladesh

Other objectives

- To promote congenial environment for SMEs.

- To introduce entrepreneurial components at all levels of our training and education system to ensure that the trainees and students can get the opportunity to gather knowledge, skills and attitude regarding entrepreneurship.

- To promote inter-enterprise linkages, strategies for transfer of knowledge, skills and technology, franchising, internationalization and promotion of women entrepreneurs.

- To find out Policy considerations related to Small Scale Project and Micro-credit Operations in BASIC Bank.

- To find out Scenario of SME in Bangladesh and Role of BASIC Bank Limited

Literature Review

World wide viewpoint

Worldwide SMEs are recognized as engines of economic growth (Ahmed, 1999). The Commonly perceived qualities often emphasized for their promotion especially in the developing countries like Bangladesh. In recent times, small and medium Enterprises (SMEs) have come into the forefront of Development agenda due to the recognition of their contribution in fostering growth, Sustaining global economic recovery, generating employment and reducing poverty (OECD, 2004).

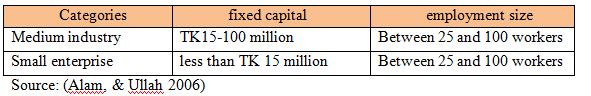

Table-Industrial policy announced in 2005

Developing country viewpoint

From a developing country perspective, the firm level evidence does not favor SME subsidization as a mechanism for boosting innovation and productivity growth. Moreover, Productivity studies show that total factor productivity is actually highest for medium sized

Firms and the smallest firms are the least efficient (Little, 1987)

Accouding to Alam, & Ullah (2006) there should be a consensus on developing a uniform definition of each category of SMEs with generic classification around the country. It should be given standard industrial code (SIC). Without uniform definition, formulation policy and their implementations are not possible.

Marketing viewpoint

Markets for SMEs are characterized by the demand and supply side. The demand for SME Products can be thought of arising from consumers in domestic as well as foreign economies.

On the supply side, firms will try to continue (or expand) the production of commodities for which markets already exist and they may also introduce new products. A demand side analysis of factors that affect production by SMEs, either individually or through some interaction between them is followed by a supply side analysis (Beck,Kunt,& Peria, 2006).

Razzaque (2003) has noted that lack of information is a major constrain to market development in Bangladesh of SME.

Advertisement is an important determinant of demand but SMEs in Bangladesh in most cases is not in a position to use this as a marketing tool. Export-oriented SMEs have very little Marketing activities (Beck et al. 2006).

Finance viewpoint

Bhattacharya (2000) has been found that in most cases banks and non-bank financial Institutions require collateral in the form of land and buildings for advancing loans to their clients. The value of the real-estate security is usually set at twice the amount of loan SME enterprises in Bangladesh chiefly require financing for three purposes – for start-up for working capital, and for fixed capital. Unavailability of working capital from form financial institutions is recognized as one of the major complaints of SMEs in Bangladesh (Meagher, 1998).

Meagher (1998) has noted another reason for which banks are not happy to provide Finance to SMEs is lack of financial statement. Without financial statement banks are not able to judge financial standing, profitability and credibility of SMEs.

So, the definition of SMEs is not unique; it varies across countries and in some countries the definition differs further between sectors. Number of people employed and size of capital, Sales, assets, etc. are used to classify enterprises into micro, small, and medium.

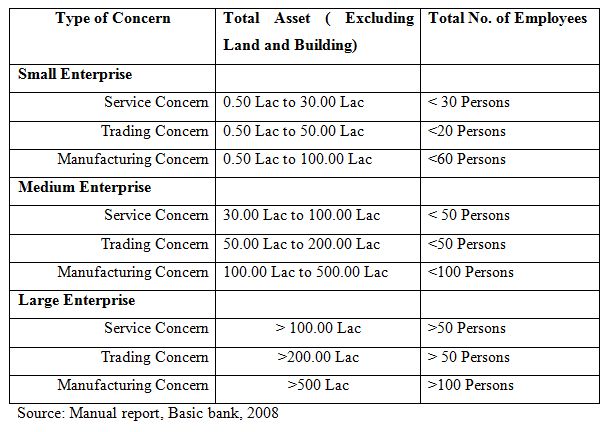

Table-Definition of SME

As per BRPD (2005) circular the adopted definition is as follows:

Methodology

The report has been prepared on the basis of experience gathered during the period of internship. For preparing this report, I have also got the information from annual report and website of the BASIC Bank Ltd.

Sources of Data

Data has been collected from:

- Primary Sources

- Secondary Sources

Data Collection Method

While preparing the report, taken information has been gathered through the following method:

Primary Sources of Data: Face to face conversation with the respective officers and stuffs of the branch and head office.

Secondary Sources of Data: Daily diary (containing my activities of practical orientation in BASIC Bank Ltd.)

- Annual Report of 2008

- Website of BASIC Bank Ltd.

- Various publications on bank

Sample size

- Face to face conversation with clients visited the branch.

- Practical work experience in the different desk of the department of the branch covered. Total numbers of samples are 10

Sampling

Convenience sampling has been used to do this project. I have collected data randomly from the field. This sample technique helps me what I want to know for my case study. (Malhotra, N. K. (2008)

Scope of the study

The study would focus on the following areas:

- SMEs of Bangladesh and Role of BASIC Bank Limited

- Portfolio Analysis of different commercial banks in comparison with BASIC Bank Ltd, in term of SME financing.

- To find out the problem of SME in Bangladesh.

- Suggestions for further SMEs Development

Each of the above areas would be critically analyzed in order to determine the efficiency of BASIC Bank’s SME approach.

Limitation of the study

The study is focused on financing in SMEs by BASIC Bank Limited. Large scale lending is beyond the scope of this report. This study report is based upon secondary source of information from the documents and databases of the Bank. Though I tried my level best in preparing this report, some limitations were yet present there:

- Information from Annual report regarding SMEs is not sufficient for in depth analysis.

- Banks policy did not permit to disclose various data and information related my topic. As well as they say it is confidential.

About Basic Bank Ltd.

The BASIC Bank Limited (Bangladesh Small Industries and Commerce Bank Limited) establishes as a banking company under the companies Act 1913 launched its operation in 1989. It was incorporated under the Act on the 2nd of August, 1988.The Bank started its operation from the 21st of January, 1989 .It is governed by the Banking Companies Act 1913.The Bank was established as the policy makers of the country felt the urgency for a bank in the private sector for financing Small Scale Industries (SSIs). At the outset, the Bank started as a joint venture enterprise of the BCC Foundation with 70 percent shares and the Government of Bangladesh (GOB) with the remaining 30 percent shares. The BCCI, the Government of Bangladesh took over 100 percent ownership of BASIC on 4th June 1992.Thus there is state-owned. However, the Bank is not nationalized; it operates like a private bank as before. (Annual report of Basic Bank, 2008)

Basic Bank is unique in its objectives. It is blend of development and commercial banks. The Memorandum and Articles of Association of the Bank stipulate that that 50 percent of loan able funds shall be invested in small and cottage industries sector. (SMEs)

Steady growth in client base and their high retention rate since Bank’s inceptions testify to the immense confidence they repose on its services. Diversified products both liability and assets sides particularly a wide range of lending products related to development of small industries and micro enterprises, and commercial and training activities attract entrepreneurs from varied economic fields. Along with promotion of products special importance is given to individual clients through providing personalized services. In fact individuals matter in this Bank. This motto has been followed for development of clientele as well as human resources of the Bank.

Coping with the competitive and rapidly changing financial market of the country, BASIC Bank Limited maintains close connection with its clients, the regulatory, the shareholders (Government of Bangladesh), other banks and financial institutions. (Annual report of Basic Bank, 2008)

SME Development: Experience of BASIC Bank Ltd.

In the year 2002, the Bank estimates its recoveries at 88 percent for term loans. This figure was 88 % and 87 % for the year 2001 and 2000 respectively. Thus, the Bank experiences a comparatively better recovery compared to that of other institutions engaged mostly in large loan and commercial financing. In loan recovery litigation, BASIC has used the strategy of offering a 50 percent interest remission as an inducement to settlement – after a decision is rendered but before execution.

BASIC Bank perceives that capital is not a strong constraint for the SMEs since personal capital and those borrowed from family and informal sources generally allow SME to start up. After a year or two of operations, they can access financial institutions on the basis of a good track record and on the basis of orders received from clients, which could be discounted as collateral for loans in some environments.

The Bank’s SME program is yielding some important insights about how small and medium scale business might best be supported not only in Bangladesh, but perhaps in other regions as well:

- SMEs are much more dynamic and responsive to markets than generally believed.

- It is essential and it is possible to involve the SME community in identifying the main constraints they face.

- “Strategic Alliances” are the most important mechanism for transferring information, technology, and credit to and among SMEs.

- Credit is overemphasized as a constraint to SME performance.

- There is an overemphasis on the problem of high interest rates.

Information has a price. SME have to compete with large firms to get information on new markets, technologies, sources of supply of raw materiel and intermediate products, and resources such as credit. SME are put at a disadvantage given that the initial costs would be a large proportion of their total costs. Often the information has to be gathered through foreign travel, participation in trade fairs, access to domestic sources of information such as customs data, data on the registration of competitive enterprises, and the like.

BASIC Bank limited is primarily interested in Small and Medium Industrial project lending to encourage growth industrialization in the country. Its mandate is that 50% of the loan able fund has to be invested in SMEs. BASIC is concentrating on this core objective. From this percentage of SME Loan amount in total credit portfolio is 81% in 2005 and this is a significant figure describing its attitude towards SME financing.

Corporate Strategy

- Financial establishment of small units industries and businesses (SMEs) and facilitate their growth.

- Steady and sustainable growth.

- Investment in a cautious way.

- Adoption of new building technology.

- Profit maximization.

- Establishing small and medium scale industries.

Organizational Goals

Basic Bank’s Ambitions

- BASIC Bank Limited dedicated their service to the nation through active financial participation in all segments of economy, small industries, trade, commerce and service sector etc.

- The Banks main manifest to progress as an institution par excellence to customer satisfaction.

- Global Banking is changing rapidly and BASIC is working hard to adapt to these changes.

- To pay a vital role in human development and employment generation.

- To undertake project promotion to identify profitable areas of investment.

- To search for newer avenues for investment and develop new products to suit such needs.

- To establish linkage with other institution which are engaged in financing micro enterprise

- BASIC keeping pace with the changing environment.

- To corporate and collaborate with institutions entrusted with the responsibility of promoting and aiding SME sector.

- Deep commitment to the society and growth of national economy.

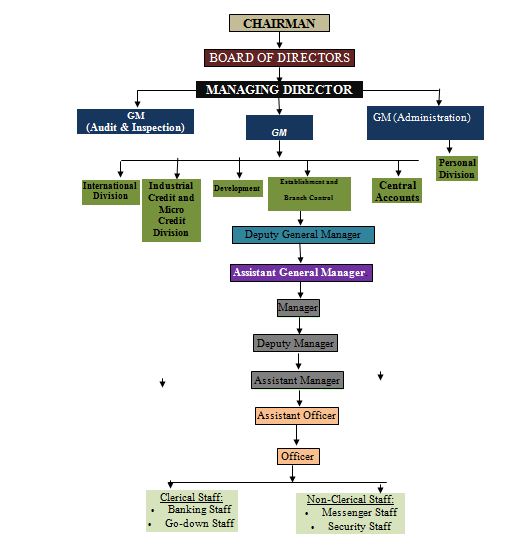

Organizational Structure

To achieve its organizational goals, the Bank conducts its operations in accordance with the major policy guidelines laid down by the Board of Directors, the highest policy making body. The management looks after the day-to-day operation of the Bank.

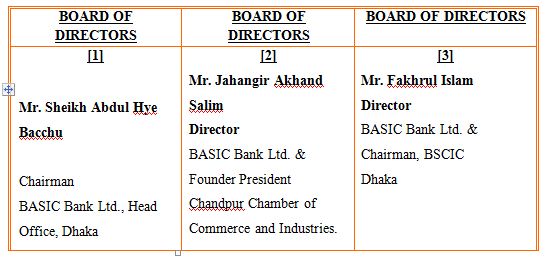

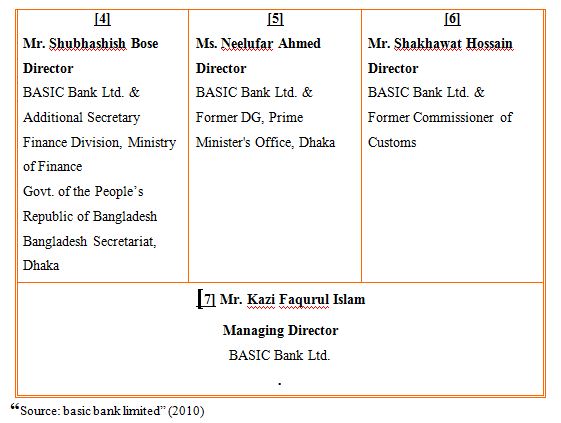

Board of Directors

As stated earlier the government holds 100 percent ownership of the Bank. The Government of Bangladesh appoints all the Directors of the Board. The secretary of the Ministry of Industries is the Chairman of the Bank. Other Directors of the Bank are high Government and central Bank executive The Managing Director is an ex-officio member of the Board of Directors. There are at present 7 Directors including the Managing Director.

Board of Directors.

Management

The Managing Director heads the management. The two General Managers and Departmental Heads in the Head office assist him. BASIC is different in respect hierarchical structure from other banks in that it is much more vertically integrated as far as reporting to the Chief executive is concerned. The Branch Managers of the Bank report direct to the Managing Director and, for functional purpose, to the Heads of Departments. Consequently, quick decision making in disposal of assess is ensured.

ORGANOGRAM OF BASIC BANK

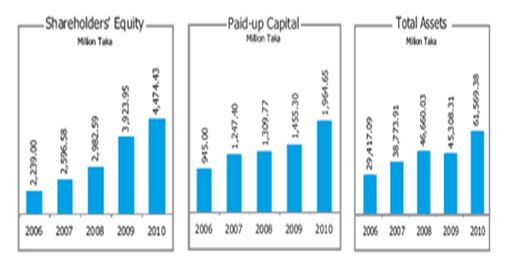

Progress at a Glance (2006-2010) Graph:

Functions

Basic Bank Limited Offers:

- Term loans to industries especially to small-scale enterprise.

- Full-fledged commercial banking services including collection of deposit, short-term trade finance, working capital finance in processing and manufacturing units and financing and facilitating international trade.

- Technical support to Small Scale Industries (SSIs) and MSIs in order to enable them to run their enterprise successfully.

- Micro-credit to the urban poor linkage with Non-Government Organizations (NGOs) with view facilitating their access to the formal financial market for mobilization of funds.

- In order to perform the above tasks, BASIC works closely with the clients, the regularly authorities the shareholders Government of Bangladesh (GOB), banks and other financial institution.

Activities

Industrial Credit

The industrial loan reflected a significant growth of 29.85 percent over the previous year. Total outstanding industrial loans including term and working capital stood at Taka 9,987.50 million at the end of 2005 compared to Taka 7,691.20 million of 2004. Total outstanding term loan stood at Taka 3,517.85 million as on December 31, 2005 compared to Taka 2,553.26 million in 2004 reflecting a growth of 37.78 percent. The outstanding working capital finance extended to industrial units stood at Taka 6,469.71 million at the end of the reporting period compared to Taka 5,137.95 million in 2004. Growth rate here was 25.92 percent. BASIC Bank’s services are specially directed towards promotion and development of small industries. Its exposure to small and medium industries sector accounted for 51.70 percent of the total loans and advances.

Commercial Credit

BASIC Bank lends support towards development of trades, business and other commercial activities in the country. Short other term trade finance and other non-fund services get full attention in the Bank. The Bank offers a complete range of services to the exporters and importers by extending various facilities. The Bank provides cash credit for local trade, export cash credit, packing credit, local and foreign bills purchase facilities. As on 31 December 2005, total amount outstanding in respect of these facilities stood at Tk.5, 013.055 million compared to Taka 4,024.70 million in 2004. This includes cash credit for local trade; export cash credit including packing credit, local bills purchase and foreign bills purchase etc.

Micro Credit

BASIC launched a Micro Credit Scheme in 1994. Micro Credit Scheme provides support for the poor for generation of employment and income on a sustainable basis, particularly in urban and suburban areas. The Bank follows three systems of credit delivery. These are:

- Lending to the NGOs who on-lend to their members. At present there are 17 such NGOs.

- Lending direct to the target groups or ultimate borrowers under the Bank’s own management.

- Lending direct to the member-borrowers and NGOs providing non-financial services like group formation and monitoring and supervision fee. As at the end of 2004, a cumulative amount of micro credit of TK. 284.10 million was disbursed. Recovery rate during this period remained at a satisfactory rate of 98.00 percent.

Foreign Trade

The Bank handles foreign trade in which it has a comparatively large share despite it’s small size. BASIC provides various facilities related to L/C and post import finance like loan against imported merchandise (LIM) and loan against trust receipt (LTR) to the importers and back to back L/C and pre-shipment finance facilities like export credit, packing credit and foreign bills purchase (FBP) to exporters. So far the Bank has established correspondence relationship with as many as 11 foreign banks in order to facilitate foreign trade. The Bank handled total export business of Taka 11,097.23 million and import business Taka 14,094.96 million in 2005.(annul report 2005)

Other Activities

The Bank provides services floor remittance, underwriting, guarantee, public offering of shares etc. The Bank also provides funds to investment and leasing companies. The Bank has recently created a venture capital fund for equity support to innovative but risky projects.

Resources & Capabilities

BASIC Bank Limited is well prepared to and capable of meeting the demand for a broad range of banking services. It has got adequate resources, both human and physical, to provide the customers with the best possible services.

Physical & Technological Resources

A great deal of investment for developing the physical resource base of the Bank has been made. The Bank has its presence in all the major industrial and commercial hubs of Bangladesh in order to cater to the needs of industry and trade. At present, there are thirty-two conveniently located branches throughout Bangladesh with eleven (11) branches in the capital city of Dhaka and seven (7) branches in Chittagong.

Major features of these branches are:

• Fully computerized accounts maintenance.

• Well decorated air conditioned facilities.

• A fully operational computer network which is currently being implemented. The work of Local Area Network (LAN) and Wide Area Network (WAN) installation having reliable and secured communication between the branches and the Head Office is in progress to facilitate any Branch Banking and ATM Services.

• Money counting machine for making cash transactions easy and prompt.

Human Resources

BASIC Bank Limited has a well diversified pool of human resources which is composed of people with high academic background. Also, there is a positive demographic characteristic – most employees are comparatively young in age yet mature in experience. As of December 2008 the total employee strength is 735. BASIC Bank Limited has been investing its resources with a view to developing an efficient and professional work force.

Training

Intensive training program, on a regular basis is being imparted to employees of both management and non-management levels to meet the challenges in the banking industry and to help employees adapt to changes and new working conditions. During the year 2008, a total of 602 employees of the Bank were provided with training in various fields. Out of them 11 employees participated in training courses abroad.

Recruitment of New Officers

The Bank follows a strict recruitment policy in order to ensure that only the best people are recruited. The Bank, so far, has recruited six batches of entry-level management staff, all of whom have excellent academic background.

Monetary & Financial Resources

Mobilization of Fund

Like any other financial intermediaries, BASIC Bank Limited is no exception in performing its core functions viz. Mobilization of fund and utilizing such mobilized fund for profitable purposes.

The main sources of fund for the Bank are:

1. Deposit and 2. Borrowing

Deposit

Deposit is the mainstay of the Bank’s sources of funds. Following usual practices, it collects deposit through:

A. Current Deposit

B. Savings Deposit

C. Term Deposit

Borrowing

Apart from deposit, BASIC Bank Limited received funds from:

A. Bangladesh Bank

B. Asian Development Bank (ADB)

C. Kew (kreditanstalt fur Wieder-aufbau Credit Institution for Reconstruction), a German development bank. All of these funding sources are for relatively longer period. Receiving the credit lines from ADB and KfW has been a recognizing of the Bank’s highly satisfactory performance.

Utilization of Fund

BASIC Bank Limited utilizes its funds in accordance with its organizational goals and corporate strategy. Main use is for lending to industrial and trade sectors. Maintenance of cash and statutory liquidity reserve with the Bangladesh Bank covers 20 percent of demand and time liabilities. Placement of funds in Nostro Accounts to handle foreign trade and investment in money market is also done as usual.

Credit Policy

BASIC was established to provide term loan (including working capital loan) and other financial assistance (including all kinds of banking facilities) to accelerate the pace of development to small & medium scale industry of Bangladesh. It is mandated in the Memorandum & Articles of Association of Bank to advance a minimum of 50% of the loan able fund to the small industry sector. As a broad policy objective in respect of small industry financing the Bank undertakes the following tasks:

- Extend financial assistance to small industries in private sector.

- Extend financial assistance to micro-enterprises and collaborate with other institutions engaged in financing and developing such enterprises. The financial assistance shall include short-term working capital loan, medium term and long-term capital finance to viable new SSI projects and BMRE of SSI.

- Undertake project promotion to identify profitable area of investment. Cooperate and collaborate with institutions entrusted with the responsibilities of promoting and aiding SSI sector.

At the time of extending SME credit BASIC Bank Limited follows certain principles. Main principles of loans and advances are as follows:

- 50% of total loans and advances will be to small industry sector.

- All lending will be adequately secured with acceptable security and margin requirements as laid down by the Head Office Credit Committee.

- The Bank will not incur any uncovered foreign exchange risk (currency exposure) in the lending of funds.

- No term loans will be approved for the commercial sector. Exceptions will be rare and will require approval of the Head Office Credit Committee.

- End-use of term loan and working capital facilities will be closely monitored to ensure that the funds are used for the purpose for which they were advanced.

- Loans and advances shall be normally funded from customers’ deposits of permanent nature, and not out of short-term temporary funds or borrowings from other banks or through short-term money market operations.

- The aggregate outstanding loans and advances (excluding loans and advances covered by specific counter-finance arrangements) will be dispersed according to the following guidelines (subject to item 2 above whereby scan,;) of lending being to small industry section):

- Spreads over cost of funds on loans and advances and commissions and fees on other transactions should be commensurate with the rating of the borrower, quality of risk and the prevailing market conditions.

- No credit shall be extended to a Customer Entity that exceeds in total commitment more than 10% of the Bank’s capital and free reserves. Exception will require approval of the Board of Directors.

- Short term commercial lending. This category includes working capital to hotel and tourism.

- Facilities to Shipping and Transport (facilities for the purchase and construction of ships / vessels and other modes of transport both by land and air).

Credit evaluation will include:

- Prevalent credit practices in the market place.

- Credit worthiness, background and track record or the borrower.

- Financial standing of the borrower supported by financial statements and other documents.

- Legal jurisdiction and implications of applicable laws. Effect of any applicable regulations and laws.

- Purpose of the loan / facility. Tenure of the loan / facility.

- Viability or the business proposition. Cash flow projections of the project.

- Quality and adequacy of security, if available.

- Risk taking capacity of the borrower.

- Entrepreneurship and managerial capabilities of the borrower.

- Volume of risk in relation to the risk taking capacity of the Bank.

- Profitability of the proposal to the Bank or company concerned.

Lending Criteria

The entrepreneurs of small industry concern/project requiring financial assistance from BASIC need to fulfill the following criteria:

- Standard loan application form is issued only after the promoter is found credit worthy and acceptable alter evaluation of information submitted in First Information Sheet.

- Viability of each and every project recommended for financing is subjected to thorough scrutiny and detailed appraisal. The report must cover the basic areas of project viability.

- In appraisal foremost importance is attached to the capability, earnestness, financial conduct – past, present and expected future.

- A project in crowded sector to be avoided. Innovative projects and projects having both domestic and export market should get preference.

- Bank shall make out list of preference sectors of investment every year.

- Project location should have necessary infrastructural facilities and environment aspect shall be carefully examined.

- Project land should be free and unencumbered, Leasehold land should have sufficient (at least 15 years) long tenure of lease.

- Building should be well planned well laid to withstand weather condition of Bangladesh.

- Project should be designed with appropriate and balanced machinery.

- Technology requirement of the project should be adequate.

- Technology transfer in case of borrowed know-how should be ensured.

- Market prospect and potential should be fully assured at competitive prices.

- Besides, export oriented and import substitution products, certain types of manufacturing/servicing industries (like essential consumer goods, goods based on indigenous raw materials, products for linkage industries, export oriented industries, etc.) may also receive due consideration or the bank

- The debt/equity composition should be determined after due consideration of debt servicing capacity of the project, security coverage of term loan. etc.

- The period of loan should be determined based on cash flow potential and pay back period and shall not normally exceed 5 years.

- Debt service coverage ratio should be at least 2.5 times at the optimum level of production.

- Return on Average Capital and Equity at the optimum level of production should not ordinarily be less than 15% to 20% respectively.

Pricing of Loan

Pricing of loan is a great important element in banking business. Because through pricing, bank usually create margin/profit. So it is to be determined carefully. In pricing, four components are to be calculated prudently otherwise pricing of that loan will create a definite loss for the hank. The components are:

- Interest Expense or Cost of Fund: The interest to be given to the depositors and central Bank for borrowing

- Administrative Cost

- Cost of Capital: Return expected by the investors for their capital invested in the Bank

- Risk Premium

Addition of the first three elements will provide the “Prime rate” beyond which a hank can never go for lending. Magnitude of the risk premium creates margin for the hank. And this rate or risk premium may vary from person to person and even from sector to sector depending upon the value or importance of the client and the prospective priority of the sector. Once upon a time, it was dictated by the Central bank but now a days, in compliance with the open market operation this power has been delegated to the enlisted commercial banks.

Portfolio Management of Credit

Portfolio Management of Credit implies the deployment of loan able fund among alternative opportunities through proper allocation. The objective of portfolio management of credit is the best and efficient management of loan to ensure profitability. Designing the size and pattern or loan portfolio with accuracy is a tough job. Even then, a prudent loan portfolio management can be done by careful consideration of the factors mentioned in the following:

- Bank’s capital position

- Deposit mix (Tenure of deposit)

- Credit environment

- Influence for monetary and fiscal policies

- Credit needs of the respective commanding area

- Ability & experience of the Bank personnel to handle the loan portfolio

In designing a loan portfolio, three things should be decided – first, the type of customers the bank wants to serve. With each and every coin of loan, there is an involvement of risk. So, the quantum of risk should be spread over the various types loan through diversification. Diversification of credit can be made by extending credit to different sectors, to different geographical area, to different line of product or business and allocating the loan able fund into different type of credit.

Again the concentration of credit into a particular sector or area, product or business should also be observed carefully. If credit is already been concentrated to a particular streamline mentioned earlier, that should be avoided.

Finally, the type & tenure of deposit should be analyzed carefully in determining the loan portfolio of a bank. How much quantum of fund will be earmarked for long term lending and how much for short term, depends to a large extent on the deposit structure.

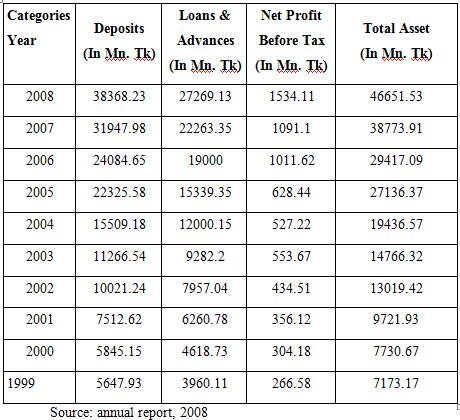

BASIC Bank limited showed a consistent business performance over the years with continuous growth in business size and profit. The business performance of the Bank for previous ten year is shown below:

Table: Business Performance

From the Graph 2.1, it can be seen that the deposit of the Bank has increased from year 1999 to the year 2008 and showing an increasing trend. Deposit in the Year 2008 grew by 20% in respect to the year 2007. So, the Bank is has been showing very good growth over the years.

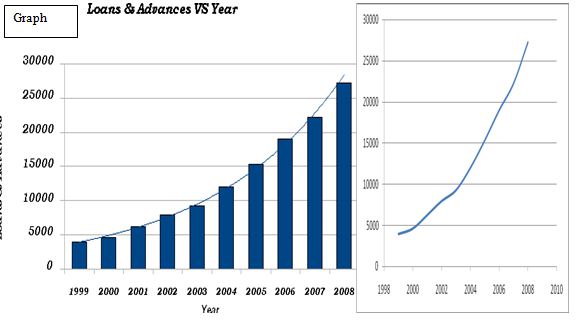

Loans & Advances:

From Graph 2.2, it can be seen that the Loans & Advances have grown significantly over the years. The Total Loans & Advances in the year 2008 were 22% higher than the figure in the year 2007 which shows that the Bank has performed very well in this segment by ensuring high quality services to the clients

Graph 2.3 shows that the Net profit before tax for the Bank generally had an increasing trend but the profit went down a bit in the year 2004 but rose consistently afterwards till the year

2008. The net profit for the Bank grew by 41% in the year 2008 in comparison with the year 2007. It shows that the Bank is performing its activities effectively & efficiently.

Graph 2.4 shows that the Bank’s total asset has increased consistently from the year 1999 to the Year 2008. It signifies a gradual improvement of the Banks financial position and proper utilization of fund to achieve better return. The total asset for the Bank in the year 2008 grew by 20% in comparison to the year 2007. The same trend can be seen to happen over the years.

Graph 2.5 shows that the Loan Portfolio has shown a consistent growth over the years and the proportion of lending in relative sectors (Industrial, Commercial & Microcredit) has been consistent with lending in Industrial Sector has been the biggest in the loan portfolio. It reflects the fact hat BASIC Bank Limited is especially interested in project based industrial financing.

Historically, Bangladesh followed a development strategy in which private investment was controlled through a host of regulations involving investment sanctioning, credit disbursement, import licensing, foreign exchange allocation, etc. While these regulatory barriers thwarted private investment in general, the impact fell unevenly on SMEs. This was because of the relative inability of the SMEs to cope with the regulations compared to their large-scale counterparts.

In a bid to render its industrial sector internationally competitive and to move towards greater efficiency in its production structure, Bangladesh implemented a number of economic reforms during the 1980’s, underwritten by the familiar structural adjustment policy. This included deregulation of sanctioning procedure and relaxation of other regulatory barriers, easing of import procedure, reducing trade barriers, following a market oriented exchange rate policy, and implementation of fiscal, monetary and public enterprise reforms. (Najmul Husain (Job Opportunity and Business Support (JOBS) Program), IRIC, University of Maryland at College Park, October 1998

The development of small and medium enterprises (SMEs) in developing countries is generally believed to be a desirable end in view of their perceived contribution to decentralized job creation and generation of output. SMEs constitute the dominant source of industrial employment in Bangladesh (80%), and about 90% of the industrial units fall into this category. The actual performance of SMEs, however, varies depending on the relative economic efficiency, the macro-economic policy environment and the specific promotion policies pursued for their benefit.

We know Unemployment is one of the biggest problems of our economy and also in our society. It creates social unrest. Perhaps, terrorist acts can also be minimized if sufficient jobs can be created for the unemployed young generation. SMEs have played in many countries all over the world and can play the same role in our country as well in creating jobs. They cannot only significantly contribute to our economic development, but can also contribute to overall social development. Many of the problems in our society today can be resolved through creating jobs for our younger generation. According to a survey, it was revealed that in the later part of 1996 and first half of 1997, the rate of social crimes in our country was low.(role of SME development,2000) It was to some extent, due to the engagement of a large number of young people in the booming stock market during that period. Thus the necessity is to create a favorable general condition to stimulate job creation in SMEs on an urgent basis.

Our Government should knock the services of organizations like UNCTAD and ILO promoting SMEs’ growth for speedy development of SMEs in our country for economic and social development. This is the challenge for the moment to promoting growth of SMEs to our country. This challenge is to be boldly and wisely faced by the Government.

SMEs in the developing countries are engaged in various activities. They range from textiles, clothing, garments, to furniture, auto parts, leather products, chemicals and cleaning solutions, electronic equipment to metal work. The list is wide. As diverse as SME are, their performances also differ according to the country environments they operate, the type of activity and the type of enterprise. Such diversity is inevitable in SME given their wide range. (Service in SME, 2010)

In Bangladesh BASIC Bank finances a wide range of diversified SMEs that include food & allied industry; textile, jute & forest products industry; paper, board, printing, publication & packaging industry; tannery leather & rubber products industry; chemical, pharmaceutical and allied industry; glass, ceramic & other nonmetal products industry; engineering, electrical and electronics industry; service industry and other numerous industrial sectors. Of these SMEs, many are 100 % export oriented projects. (Annul report basic bank, 2010)

Role of BASIC Bank Limited

In order to achieve the aspiring objective of accelerating industrial growth in a country and to attain a greater share of industry in the country’s gross domestic product (GDP), the only way is to develop the small-scale industries (SSIs). Keeping this long-term goal in mind BASIC Bank Ltd. was established in 1988 as a banking company under the Companies Act 1913 and launched its operation in 1989. It is a wholly state-owned bank that devotes, in accordance with its Memorandum and Articles of Association, at least half of its lending portfolio to SSI lending, and the rest to commercial and other lending. While attaching special importance to technical and advisory support to SSIs in order to enable them running their enterprises successfully, it provides clients with a full range of services to help them grow their assets and net-worth.

With the change in the definition of SME in newly adopted Industrial Policy 2005, BASIC amended its Articles of Association as under:

“Fifty percent of the loan able fund shall be invested in small and medium industries till such time it is otherwise decided.”

The management of the Bank believes that it is unwise to expect a sudden upsurge in the growth of SME development in our country settings instead, a medium and sustainable growth in the very sector is always desirable. It can be readily seen from table 3; the Bank’s lending portfolio to SME lending maintains such consistency over years. In order to uphold continuity and consistency in translating its objective of SME development, the Bank is striving from inception to serve people for progress through institutionalization of the following features:

Table -SME performance of basic bank

| SME | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Amount in crore taka | 696 | 960 | 1289 | 1640 | 1937 | 2408 |

| Growth | – | 38% | 34% | 27.23% | 18% | 24% |

| % of total loans & Advances | 75% | 80% | 84% | 86.3% | 87% | 88.29% |

| Total no. of projects | 924 | 1116 | 1367 | 1708 | 1967 | 2384 |

Source: annul report of Basic Bank Ltd, 2008

In the year 2008, the Bank estimates its recoveries at 91% for project loans. Thus, the Bank experiences a comparatively better recovery compared to that of other institutions engaged mostly in large loan and commercial financing. In loan recovery litigation, BASIC has used the strategy of offering a 50 percent interest remission as an inducement to settlement – after a decision is rendered but before execution

BASIC Bank perceives that capital is not a strong constraint for the SMEs since personal capital and those borrowed from family and informal sources generally allow SME to start up. After a year or two of operations, they can access financial institutions on the basis of a good track record and on the basis of orders received from clients, which could be discounted as collateral for loans in some environments.

Different Types of SME Credit Facilities

The making of loan and advance is always profitable to a bank. As the bank mobilizes savings from the general people in the form of deposit, the most important task of it is to disburse the said deposit as loan or advance to the mass people for the development of commercial, industrial, who are in need of fund for investment. The profitability of the banks depends on the efficient manner and avenues in which the resources arc employed. BASIC Bank Limited has made so far efficient use of the deposit and has the classified rates under control. The Bank disburses loan in different form. It varies in purpose wise, mode wise and sector wise. The varieties used by BASIC Bank are briefly described below with the common terms and condition and performance in each mode. BASIC offers loans and advances to projects including RMG projects in the following mode:

Overdraft (OD): It is a continuous advance facility. By this agreement, the banker allows his customer to overdraft his current account up to his credit limits sanctioned by the bank. The interest is charged on the outstanding amount not on the sanctioned amount. OD is of two types practiced in BASIC Bank Limited.

- Secured Overdraft (SOD): BASIC sanctions SOD against different securities like FDR, and Work Orders.

- Temporary Overdraft (TOD): It is given to the valued customers only. It is not that much secured. Usually it forwards without any security or sometimes exercise lien against the instrument, deposited in the bank. It is given by the branch manager discretionary power.

Cash Credit (CC): By this arrangement, a banker allows his customer to borrow money up to a certain limit. CC is a favorite mode of borrowing by traders, industrialists, etc. for meeting their working capital requirements. It is operated like overdraft account. Depending on the needs of the business, the borrower can draw on his cash credit account at different time and when he gets money can adjust the liability. BASIC Bank charges interest on the daily outstanding balance of the account.

Based on charging securities, there are two forms of cash credit:

- Cash Credit (Hypothecation): Hypothecation is a legal transaction whereby goods are made available to the lending banker as security for a debt without transferring either the property in the goods or possession. The banker has only equitable charge on stocks, which practically means nothing. It is given against registered mortgage of land and building, hypothecation of goods and personal guarantee of directors.

Loan (General): It is given against personal guarantee, hypothecation of goods and land and building.

Bills Portfolio: Branch purchases demand bills of exchange that are called ‘Draft’ accompanied by documents of title to goods such as bill of lading, railway receipt or truck receipt. The purchase of bill of exchange drawn at an issuance, i.e. for a certain period maturing on a future date and not payable on demand or sight.

Term Loan: BASIC bank is advancing both short and medium term credit to the industrial sector on the basis of their capital structure, constitution and liquidity consideration. It is given against land and building along with machinery, personal guarantee of directors and hypothecation of raw materials.

Export Cash Credit: Advance allowed as cash credit for processing goods for export. The advance is usually adjusted form export proceeds. The term PC (Packing Credit) is also used for such advance.

Loan Against Imported Merchandise (LIM): Loan allowed against imported merchandise and storing the same in bank’s custody. The bank through its approved clearing agent clears the merchandise. The advance is adjusted by delivering the goods against payment by the importer.

Local Bill Purchase (LBP): Advance allowed against bills drawn under an inland L/C opened and accepted by a local bank. Such local L/C is usually opened as back-to-back L/C against export L/C.

Payment against Documents (PAD): The bank that establishes the letter or credit is bound to honor its commitment to pay for import bills when these are presented for payment, if drawn strictly in terms of the letter of credit. In fact, the amount stands as advance to the importer, which is adjusted by delivery of documents against payment or by allowing post import finance such as LIM or LTR

Foreign Bill Purchase (FBP): Post export credit allowed against export bills. If the bills are drawn as per terms of the L/C, the bank purchases the same and pay equivalent amount of the bill to the credit of the client’s account. The advance is adjusted on realization of export proceeds through foreign agent.

All credit proposals which are in excess of the Branch Managers Credit approval authority require prior approval of the Managing Director / Head Office Credit Committee. If the amount is not within the approval authority the Managing Director / Head Office Credit Committee the proposal required to be placed before the Board of Directors for approval.

Policy Guidelines of Bangladesh Bank

The following policy guidelines for lending are extracted from credit risk manual of Bangladesh Bank which is being followed in BASIC Bank:

Lending Guidelines:

The Lending Guidelines should provide the key foundations for account officers/relationship managers (RM) to formulate their recommendations for approval, and should include the following

Industry and Business Segment Focus The Lending Guidelines should clearly identify the business/industry sectors that should constitute the majority of the bank’s loan portfolio. For each sector, a clear indication of the bank’s appetite for growth should be indicated (as an example, Textiles: Grow, Cement: Maintain, Construction: Shrink). This will provide necessary direction to the bank’s marketing staff. Types of Loan Facilities The type of loans that are permitted should be clearly indicated, such as Working Capital, Trade Finance, Term Loan, etc. Single Borrower/Group Limits/Syndication

Details of the bank’s Single Borrower/Group limits should be included as per Bangladesh Bank guidelines. Banks may wish to establish more conservative criteria in this regard. Lending Caps Banks should establish a specific industry sector exposure cap to avoid over concentration in any one industry sector. Discouraged Business Types Banks should outline industries or lending activities that are discouraged.

As a minimum, the following should be discouraged:

- Military Equipment/Weapons Finance

- Highly Leveraged Transactions

- Finance of Speculative Investments

- Logging, Mineral Extraction/Mining, or other activity that is Ethically or Environmentally Sensitive

- Lending to companies listed on CIB black list or known defaulters

- Counterparties in countries subject to UN sanctions

- Share Lending

- Taking an Equity Stake in Borrowers

- Lending to Holding Companies

- Bridge Loans relying on equity/debt issuance as a source of repayment.

Loan Facility Parameters

Facility parameters (e.g., maximum size, maximum tenor, and covenant and security requirements) should be clearly stated. As a minimum, the following parameters should be adopted:

Banks should not grant facilities where the bank’s security position is inferior to that of any other financial institution.

Assets pledged as security should be properly insured.

Valuations of property taken as security should be performed prior to loans being granted. A recognized 3rd party professional valuation firm should be appointed to conduct valuations.

SME Credit Assessment & Risk Grading

SME Credit Assessment

A thorough credit and risk assessment should be conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment should be presented in a Credit Application that originates from the relationship manager/account officer (“RM”), and is approved by Credit Risk Management (CRM). The RM should be the owner of the customer relationship, and must be held responsible to ensure the accuracy of the entire credit application submitted for approval. RMs must be familiar with the bank’s Lending Guidelines and should conduct due diligence on new borrowers, principals, and guarantors.

It is essential that RMs know their customers and conduct due diligence on new borrowers, principals, and guarantors to ensure such parties are in fact who they represent themselves to be. All banks should have established Know Your Customer (KYC) and Money laundering guidelines which should be adhered to at all times.

Credit Applications should summaries the results of the RMs risk assessment and include, as a minimum, the following details:

- Amount and type of loan(s) proposed.

- Purpose of loans.

- Loan Structure (Tenor, Covenants, Repayment Schedule, Interest)

- Security Arrangements

In addition, the following risk areas should be addressed:

Borrower Analysis. The majority shareholders, management team and group or affiliate companies should be assessed. Any issues regarding lack of management depth, complicated ownership structures or inter-group transactions should be addressed, and risks mitigated.

Industry Analysis. The key risk factors of the borrower’s industry should be assessed. Any issues regarding the borrower’s position in the industry, overall industry concerns or competitive forces should be addressed and the strengths and weaknesses of the borrower relative to its competition should be identified.

Supplier/Buyer Analysis. Any customer or supplier concentration should be addressed, as these could have a significant impact on the future viability of the borrower.

Historical Financial Analysis. An analysis of a minimum of 3 years historical financial statements of the borrower should be presented. Where reliance is placed on a corporate guarantor, guarantor financial statements should also be analyzed. The analysis should address the quality and sustainability of earnings, cash flow and the strength of the borrower’s balance sheet. Specifically, cash flow, leverage and profitability must be analyzed.

Projected Financial Performance. Where term facilities (tenor > 1 year) are being proposed, a projection of the borrower’s future financial performance should be provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans should not be granted if projected cash flow is insufficient to repay debts.

Account Conduct. For existing borrowers, the historic performance in meeting repayment obligations (trade payments, cheques, interest and principal payments, etc) should be assessed.

Adherence to Lending Guidelines. Credit Applications should clearly state whether or not the proposed application is in compliance with the bank’s Lending Guidelines. The Bank’s Head of Credit or Managing Director/CEO should approve Credit Applications that do not adhere to the bank’s Lending Guidelines.

Mitigating Factors. Mitigating factors for risks identified in the credit assessment should be identified. Possible risks include, but are not limited to: margin sustainability and/or volatility, high debt load (leverage/gearing), overstocking or debtor issues; rapid growth, acquisition or expansion; new business line/product expansion; management changes or succession issues; customer or supplier concentrations; and lack of transparency or industry issues.

Loan Structure. The amounts and tenors of financing proposed should be justified based on the projected repayment ability and loan purpose. Excessive tenor or amount relative to business needs increases the risk of fund diversion and may adversely impact the borrower’s repayment ability.

Security. A current valuation of collateral should be obtained and the quality and priority of security being proposed should be assessed. Loans should not be granted based solely on security. Adequacy and the extent of the insurance coverage should be assessed.

Name Lending. Credit proposals should not be unduly influenced by an over reliance on the sponsoring principal’s reputation, reported independent means, or their perceived willingness to inject funds into various business enterprises in case of need. These situations should be discouraged and treated with great caution. Rather, credit proposals and the granting of loans should be based on sound fundamentals, supported by a thorough financial and risk analysis.

Credit Risk Grading

Credit risk is the primary financial risk in the banking system. Identifying and assessing credit risk is essentially a first step in managing it effectively. In 1993, Bangladesh Bank as suggested by Financial Sector Reform Project (FSRP) first introduced and directed to use Credit Risk Grading system in the Banking Sector of Bangladesh under the caption “Lending Risk Analysis (LRA)”. The Banking sector since then has changed a lot as credit culture has been shifting towards a more professional and standardized Credit Risk Management approach.

Keeping the above objective in mind, the Lending Risk Analysis Manual (under FSRP) of Bangladesh Bank has been amended, developed and re-produced in the name of “Credit Risk Grading Manual”. This manual is followed by the BASIC Bank strictly.

Definition of Credit Risk Grading

- The Credit Risk Grading (CRG) is a collective definition based on the pre-specified scale and reflects the underlying credit-risk for a given exposure.

- A Credit Risk Grading deploys a number/ alphabet/ symbol as a primary summary indicator of risks associated with a credit exposure.

- Credit Risk Grading is the basic module for developing a Credit Risk Management system.

Use of Credit Risk Grading

The Credit Risk Grading matrix allows application of uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of a unit, line of business, the branch or the Bank as a whole.

- As evident, the CRG outputs would be relevant for individual credit selection, wherein either a borrower or a particular exposure/facility is rated. The other decisions would be related to pricing (credit-spread) and specific features of the credit facility. These would largely constitute obligor level analysis.

- Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a Bank. It is also relevant for portfolio level analysis.

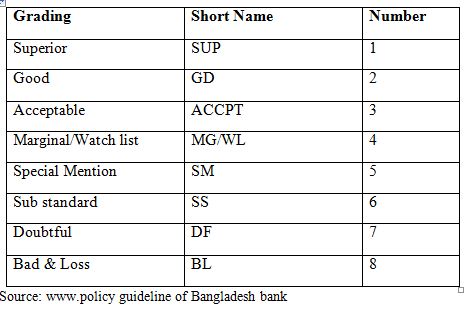

Number and Short Name of Grades used in the CRG

The proposed CRG scale consists of eight categories with Short names and Numbers are provided as follows:

Table Short Name of Grades used in the CRG

Credit Risk Grading Definitions

A clear definition of the different categories of Credit Risk Grading is given as follows:

Superio

- Credit facilities, which are fully secured i.e. fully cash covered.

- Credit facilities fully covered by government guarantee.

- Credit facilities fully covered by the guarantee of a top tier international Bank.

Good

- Strong repayment capacity of the borrower.

- The borrower has excellent liquidity and low leverage.

- The company demonstrates consistently strong earnings and cash flow.

- Borrower has well established, strong market share.

- Very good management skill & expertise.

- All security documentation should be in place.

- Credit facilities fully covered by the guarantee of a top tier local Bank.

- Aggregate Score of 85 or greater based on the Risk Grade Score Sheet.

Acceptable

- These borrowers are not as strong as GOOD Grade borrowers, but still demonstrate consistent earnings, cash flow and have a good track record.

- Borrowers have adequate liquidity, cash flow and earnings.

- Credit in this grade would normally be secured by acceptable collateral (1st charge over inventory / receivables / equipment / property).

- Acceptable management.

- Acceptable parent/sister company guarantee.

- Aggregate Score of 75-84 based on the Risk Grade Score Sheet.

Marginal/Watch list

- This grade warrants greater attention due to conditions affecting the borrower, the industry or the economic environment.

- These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/or inconsistent earnings.

- Weaker business credit & early warning signals of emerging business credit detected.

- The borrower incurs a loss.

- Loan repayments routinely fall past due.

- Account conduct is poor, or other untoward factors are present.

- Credit requires attention.

- Aggregate Score of 65-74 based on the Risk Grade Score Sheet.

Special Mention

- This grade has potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower.

- Severe management problems exist.

- Facilities should be downgraded to this grade if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage).

- An Aggregate Score of 55-64 based on the Risk Grade Score Sheet.

Substandard

- Financial condition is weak and capacity or inclination to repay is in doubt.

- These weaknesses jeopardize the full settlement of loans.

- Bangladesh Bank criteria for sub-standard credit shall apply.

- An Aggregate Score of 45-54 based on the Risk Grade Score Sheet.

Doubtful

- Full repayment of principal and interest is unlikely and the possibility of loss is extremely high.

- However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad & Loss.

- Bangladesh Bank criteria for doubtful credit shall apply.

- An Aggregate Score of 35-44 based on the Risk Grade Score Sheet.

Bad & Loss

- Credit of this grade has long outstanding with no progress in obtaining repayment or on the verge of wind up/liquidation.

- Prospect of recovery is poor and legal options have been pursued.

- Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for.

- This classification reflects that it is not practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. Legal procedures/suit initiated.

- Bangladesh Bank criteria for bad & loss credit shall apply.

- An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

Credit Risk Grading in Practices in BASIC Bank Limited

The following step-wise activities outline the detail process for arriving at credit risk grading. Credit risk for counterparty arises from an aggregation of the following:

- Financial Risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

Each of the above mentioned key risk areas require be evaluating and aggregating to arrive at an overall risk grading measure.

Step Allocate weight ages to Principal Risk Components:

According to the importance of risk profile, the following weight ages are proposed for corresponding principal risks.

Principal Risk Components: Weight:

- Financial Risk 45%

- Business/Industry Risk 18%

- Management Risk 10%

- Security Risk 15%

- Relationship Risk 12%

Recovery of SME Loans & Advances

As earlier stated, it is easy to lend money but difficult to recover the same. The most serious problem that affects the entire banking industry today is the problem of recovery of bank advances. Banker has to keep a close watch on borrower and to take adequate follow up measures for ensuring that recovery of SME loans & advances are smooth and timely. A systematic plan of repayment of Loan should be arranged for each borrower depending upon the nature of loan. It is very much needed for a sound lending system.

Recovery of loans should be prompt and according to repayment schedule to facilitate the bankers to recycle the scares resources for best use of more and more customers for social benefit. Banker should keep a close watch on all their advances to ensure that timely action is taken in each case for adjustment of the account or its renewal should the banker decide to continue the facility. At the time of review of the advance and renewal of sanction, necessary amendments, modifications in terms and conditions are made and the advances are allowed to continue on the amended or modified terms and conditions. If the advances do not run on the sanctioned terms and conditions or if bank find any undesirable feature in the borrower’s account by which recovery of advance becomes difficult and nursing the account is not considered workable, bank recalls such advances.

Bank generally recalls its advances under the following cases:

- If death occurs either of the borrower or the guarantor.

- If the borrower is reported to have committed an act of insolvency or has filed application for his insolvency.

- Dissolution of the partnership.

- Liquidation of the borrowing company.

- Failure to renew the documents sufficiently before the expiry of the limit.

- If there is any serious deterioration in the security charged to the bank and want of satisfactory turnover in the account.

- There has been deterioration in the financial position of the party. If the banker comes to know that his client has committed a fraud or indulged in speculation, it will be invisible to continue the advance.

- Failure to adhere to the terms and conditions of the sanction in spite of repeated reminders to the borrower.

- If the borrower fails to maintain the stipulated margin and does not restore the shortfall in spite of repeated reminders.

- Change in the bank’s policy of certain types of advances.

- The policy of ‘Selective Credit Control’ by Bangladesh Bank.

- Detection of any undesirable features in the account.

- There may also be other reasons for withdrawing the facility, i.e., the law and order situation at a certain place is such that it may be risky to continue the advance.

Procedure for recovery

If a borrower fails to make repayment of dues the bank has to consider what steps n,~cd to be taken to recover the debt. Banker will eventually have to take the following steps to recover the stuck-up advances.

Exerting moral pressure: The banker will visit the borrower’s place of business and find out the cases of non‑payment of the bank’s dues. The banker may also request some influencer customers of the area to exert pressure on the borrower to clear bank’s dues. If there is a guarantor, he is also called upon to adjust the account or have it adjusted by the principal.

In case the borrower does not adjust the account as desired, the only course left open to the bank would be to send a notice by registered post to the last known address of the borrower and guarantor, if any, preferably through a lawyer. In that notice, it has to state the undesirable character of the advance and recall it and ask the party to liquidate it within a stipulated period, say 30 days, failing which the securities will have to disposed off without further reference to him at the best possible market rate either in public auction or by private negotiation according to the convenience of the bank. The notice should also state that the borrower as well as guarantor, if any, would be liable for any balance that might remain due, after the security has been sold and bank shall resort to legal action to recover the dues. If no favorable response is made by the borrower/guarantor after serving notice, the bank has to dispose of the securities and adjust the account. Presently, banks are empowered to dispose off the security without intervention of the court under the ‘Artha Rin Adalat Act 2003.

Filing a suit: If the advance is not fully secured and where there is a shortfall to adjust the advance after disposal of securities, the decision has to be taken by the bank whether to keep the borrower in business or file a suit against him for recovery of bank’s dues. It is well known that once the suit is filed, the borrower ceases to be co‑operative.

BASIC Bank Limited is following a series of measures to recover the default amount of SME loans and advances both in Branch and Head Office level. All branches are kept under serious pressure through circular, circular letter, verbal instruction etc in regular basis to take necessary precautions to avoid new default loan in the branch. Besides, branches have been given yearly target to recover dues from the existing default borrower to reduce the classified SME loans and advances up to minimum level. Head Office monitors each branch whether it is performing in accordance.

Constraints for SME

- SMEs in Bangladesh suffer from many constraints. There are some constrains given below.

- Domestic policy environments have been identified as dominant.

- Bringing about macroeconomic stability, adopting better incentive regimes and strengthening institutions can help SME most.

- Various researches have identified shortage of credit and resources.

- Lack of training and information.

- Managerial, marketing and technological capability etc. as the important constraints.

- Political environment create problem to financing SME.

- Information gap between organization and people.

SWOT Analysis

Strengths

- Highly intelligent and skilled manpower can perform skillful manual operations to produce good quality items.

- Local workshop expertise available for fabricating process equipment those are mechanical and electrical in nature. Most of the existing industries depend on such equipment.

- Producing quality products need measuring and calibration equipment which are expensive if imported. Expertise to develop such equipment (which are mostly electronic) at low cost exist within the country, which if tapped, may result in significant improvement in quality.

- Large domestic market.

- Existence of an efficient chain of independent marketing network for reaching the whole of the country.

- Low labor cost.

- Experienced laborers can form new enterprises after they have learned the skill.

- Indian products that are marginally better than local ones have occupied a substantial market in Bangladesh. This market can be taken up through achievable improvement in quality.

Weaknesses

- Lack of adequate scientific and technical knowledge. Cannot improve quality beyond a certain level.

- Do not have adequate funds. Entrepreneurs do not know about collateral free loan providers. Since banks usually ask for collateral, most entrepreneurs avoid banks.

- Majority does not have proper accounting knowledge required for project evaluation, Pricing, etc. They mostly work through crude mind – calculations which may result in failure, particularly when receiving loans.

- The independent marketing network is beyond the control of the enterprises, rather these distributors play control over them.

- Attitude of customers to go for foreign products, thinking that quality products are not produced in own country. This also results in manufacturers putting labels of foreign brands on local products for easy marketing. This has to be analyzed together with the statements in item

- There is a high end market in the country where quality rather than price is sought.

- However, it would be difficult for SME’s to enter this market unless quality brands are established.

- Government is a big buyer in the country. Vested interest groups manipulate policies to make it difficult for local products to enter.

Opportunities

- A large domestic market exists for low priced products, which is increasing gradually as

- People come out of poverty through various Government and Non-Government initiatives.

- The customers are not yet conscious about consumer rights. This is helpful for start-up enterprises.

- If the Government policies regarding tax and VAT can be changed so that corrupt officials cannot disturb the entrepreneurs, some enterprises will come out of the shell by trying to improve quality, advertising, and establishing brands. This will initiate a healthy Competition. When quality improves, a large export market, both in the economically

- Developing countries and in the Economically Advanced countries, can be tapped as well.

- If favorable policies are adopted (as suggested above) youths with technical education will enter this arena. This will pave the way for producing high quality products in the country.

- Government can be induced to make purchases from local manufacturers through appropriate lobbying and public opinion formation

Threats

- Better quality products from India and China at reasonable prices.

- Possibility of dumping from these countries when local producers try to improve quality.

- Unfavorable Government policies may be taken up due to lobbying of powerful vested interest groups when the local entrepreneurs become a challenge to imported products both in quality and in price.

- Most of the products depend on imported raw materials. A large scale disruption abroad may affect the local production, though it is a remote possibility in the present day world.

Comparison

Commercial Banks in our country primarily channel their fund to commercial activities particularly trading activities, foreign trade, short term loan etc. Their fund allocation for SMEs is very small compared to their total loan exposure. But, some banks are particularly aimed for the development of SMEs of the country focusing more on national interest rather than sole profitability of the bank. BASIC bank is one of its kinds dedicated for SME development of our country. Let’s discuss some of our leading commercial banks in our country in term of SNE sector.

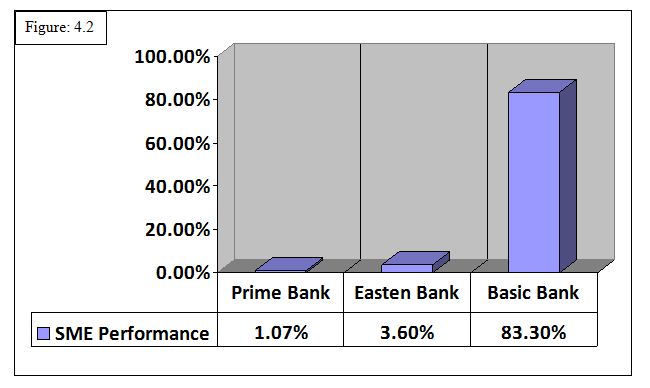

Prime bank Limited

Prime Bank Limited is one of the leading private sector banks of the country. From the inception, their loan portfolio was enriched with large and Medium Scale industry and it is increasing continuously. On the backdrop of SME movement in the country, they have emphasized on SME sector. In 2001, their SME Loan amount was Tk. 60.15 Million only which is 0.66 % of their total loan portfolio. Their total SME loan amount in 2008 was Tk. 341.50 Million which reflects substantial increase from previous time. Although, there is an increasing trend of SME loan but the percentage of SME Loan amount in Total Loan portfolio is still very low that is 1.07% in 2006. (Annual report, 2006)

Eastern Bank Limited

Their loan portfolio is highly diversified and evenly distributed over 13 different industry segments. Textile and RMG exposure is 23.39% of the total loan portfolio reflecting natural growth of business scenario of the country as the export is heavily dependent of Textile and RMG sector. In 2008, Corporate Clients continued to be the largest among BUs holding approximately 88.80% of total loan outstanding while consumer was second with 9.60% and standing of SME was 3.60 %.( Annual reports, 2006)

BASIC Bank Limited

BASIC Bank limited is primarily interested in Small and Medium Industrial project lending to encourage growth industrialization in the country. Its mandate is that 50% of the loan able fund has to be invested in SMEs. BASIC is concentrating on this core objective. Total loan portfolio of the last six years is presented in Table 04. From this percentage of SME Loan amount in total credit portfolio is 86.3% in 2006and this is a significant figure describing its attitude towards SME financing.

Findings

- BASIC Bank is considered as specialized bank by Bangladesh Bank, but in fact it is an excellent blend of development Bank and commercial bank.

- BASIC Bank is giving prime concentration on developing the SME sector by providing loan facilities. In the Year 2008, 88.29% of the total loans & Advances went into SME financing which shows significant contribution to the SME sector by the bank

- BASIC Bank is recently focusing on agro-based industries aligning with government policy for promoting indigenous use of agricultural raw materials such as jute spinning mills. Interest rate in this sector is significantly low compared to other sectors. It is 10% in agricultural products (Primary) and 12.50% in agricultural working capital loan.

- The Bank is showing continuous growth in Deposit collection, Loans & Advances and developing asset base over the years.

- The interest rate offered by BASIC is as follows:

- Industrial Term loan (Medium scale industries) : Interest rate is 13.00%

- Industrial working capital loan (Large scale industries) : Interest rate is 13.00%

- Commercial loan : Interest rate is 13.00%

Besides it any Excess over limit amount will be charged an additional rate of 1.50% above the ruling rate mentioned above.

The drawback in the above stated interest rate is that every project has been considered as equally risky or no risk premium is being added with the prime rate. Interest rate should be adjusted viewing the risk exposure of the project.

- BASIC Bank is practicing the concept of “Project based lending rather traditional security based lending approach” in SME financing. Consequently, Innovative projects and projects having both domestic and export market is getting preferences.

- BASIC Bank is giving special priority on export oriented and import substitution products, certain types of manufacturing/servicing SME industries (like essential consumer goods, goods based on indigenous raw materials, products for linkage industries, export oriented industries, etc.)

- Small scale industry in our country is not structured in any way. Most of the small scale entrepreneurs don’t have any financial statement of their business. It is difficult and time consuming to assess the financial strength of the client in a robust manner.

- Project appraisal techniques are not practiced appropriately due to non availability of information of the said project. SME Lending risk analysis is quite subjective as standardized industry and reliable company information is not available.

- Compliance culture in BASIC Bank is very good. This is another core area of BASIC Bank why the amount of default loan is significantly low.

- Credit Risk is one of the five core risk areas of the Bank. BASIC follows the credit risk policy guidelines as instructed by Bangladesh Bank in different circulars at different times.

- The importance of Relationship Manager is realized by the Bank. It has been observed that some loan becomes problematic due to supervision and monitoring deficiency at the Branch level.

Different statement preparation and compliance of Bangladesh Bank engulfs a significant time in Bank. This has to be efficient using Information technology. BASIC is on the way of implementing the online banking very soon. As a result, core task such as credit appraisal, monitoring and follow up and supervision of the client’s business performance can be practiced emphatically.

- BASIC is facing increasing growth both in industrial and commercial loans. Industrial loan volume is very high as the Bank is contributing towards project financing. Commercial loan volume growth is steady. On the contrary, Micro credit is in static condition.

Recommendations

The following recommendations are aimed for the development of SME sector of our country through extended financing facilities by financial institutions:

- Banks should keep sizable portion of loan able fund in their loan portfolio to make the SME program successful.

- In order to attract investors in SMEs, Bank Should offer lower interest rate to the investors.

- Apart from Commercial Banks , Non Banking financial institutions should come forward for financing in SMEs

- Central Bank will instruct all the banks /NBFIs so that each bank should keep a certain percentage (20% to 50%) of their total loan able fund as mandatory and they would strictly monitor whether the banks/NBFIs are complying the instructions.

- Government will arrange funds from different sources such as World Bank, ADB, IDB, other soft loan arrangement from abroad and eventually distribute the fund to all banks at a lower interest rate. This scheme of Government assistance will obviously encourage the banks to expand their facilities in SMEs.