The term debenture is derived from the Latin word “debere” which means “to owe a debt”. Debentures are a debt instrument used by companies and government to issue the loan. A debenture may be defined as a document issued by the company as evidence of debt. The loan is issued to corporates based on their reputation at a fixed rate of interest. It is the acknowledgment of the company’s indebtedness to its holders. The amount derived from the debenture issue helps the company to implement expansion programs. This helps the company not to depend on fair weather. sources like public deposits.

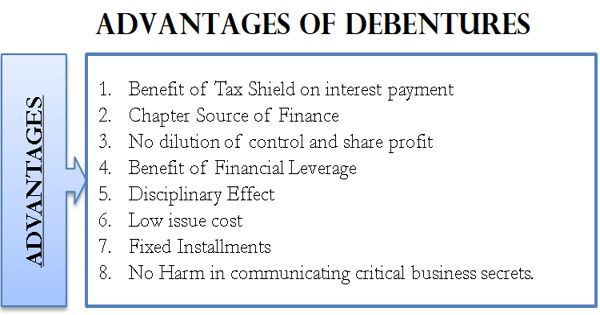

Advantages of Debentures

The following are the advantages of debentures:

- Secured investments

Debentures provide the greatest security to the investors. Investors who want fixed income at lesser risk prefer them. They make a very good appeal to the conservative minds.

- A debenture is Less Investment Risk

The interest on debentures is a charge against profits. The date and rate of payment are certain. So the investors can get interested whether the company makes a profit or not. The company is also benefited from the point of view of tax, as the interest is a charge against its profit.

- Fixed return

Debentures guarantee a fixed rate of interest. The company can trade on equity. In this way, equity shareholders are able to enhance their total earnings from the company.

- Stable prices

The issue of debentures is appropriate in the situation when the sales and earnings are relatively stable. Their prices are more stable as compared to shares because the changing monetary conditions affect the price movement of the debentures very little.

- Less Costly

Usually, the rate of interest is lower than the rate of dividend payable on preference shares and equity shares. So raising capital through debentures is less costly.

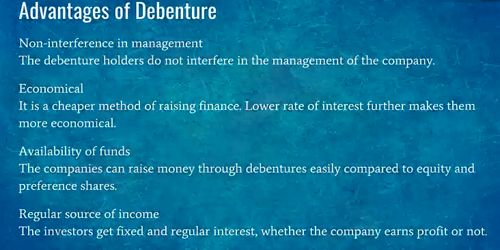

- Non-interference in management

The debenture holders do not interfere in the management of the company. As a debenture does not carry voting rights, financing through them does not dilute the control of equity shareholders on management. Debenture financing permits the company to raise long-term funds without diluting the present control.

- Economical

Financing through them is less costly as compared to the cost of preference or equity capital as the interest payment on debentures is tax-deductible. It is a cheaper method of raising finance. A lower rate of interest further makes them more economical.

- Availability of funds

The companies can raise money through debentures easily compared to equity and preference shares.

- Regular source of income

The investors get fixed and regular interest, whether the company earns a profit or not. The company does not involve its profits in a debenture.

- Remedy against Over Capitalization

Whenever the company feels that it is overcapitalized, it can redeem the redeemable debentures. This will help the company to overcome the defects of overcapitalization.

- Market Response

The company can easily dispose of the debentures in the open market because debentures are having a satisfactory market response. The company may convert different loans into debentures carrying a lower rate of interest.

Information Source: