The adaptive markets hypothesis (AMH) combines principles of the well-known and often controversial efficient market hypothesis (EMH) with behavioral finance. Andrew Lo, the theory’s founder, believes that people are mainly rational, but sometimes can overreact during periods of heightened market volatility. The adaptive markets hypothesis, as proposed by Andrew Lo, is an attempt to reconcile economic theories based on the efficient market hypothesis with behavioral economics, by applying the principles of evolution to financial interactions: competition, adaptation, and natural selection. It considers both these conflicting views as a means of explaining investor and market behavior.

AMH argues that people are motivated by their own self-interests, make mistakes, and tend to adapt and learn from them. Under this approach, the traditional models of modern financial economics can coexist with behavioral models. This suggests that investors are capable of optimal dynamic allocation. It contends that rationality and irrationality coexist, applying the principles of evolution and behavior to financial interactions. Lo argues that much of what behaviorists cite as counterexamples to economic rationality—loss aversion, overconfidence, overreaction, and other behavioral biases—are, in fact, consistent with an evolutionary model of individuals adapting to a changing environment using simple heuristics. The emerging discipline of behavioral economics and finance has challenged the EMH, arguing that markets are not rational, but rather driven by fear and greed.

The adaptive markets hypothesis (AMH) is based on the following basic tenets:

- People are motivated by their own self-interests

- They naturally make mistakes

- They adapt and learn from these mistakes.

Andrew W. Lo: The main idea behind the adaptive markets hypothesis is that financial markets are governed more by the laws of biology than by the laws of physics. There are some basic tenets of adaptive markets:

- People act in their own self-interest.

- People make mistakes.

- From those mistakes, they learn, adapt, and innovate.

- This evolutionary process is what determines financial market dynamics.

Implications

One of the most influential ideas in the past 30 years is the efficient market hypothesis, the idea that market prices incorporate all information rationally and instantaneously. The adaptive markets hypothesis has several implications that differentiate it from the efficient market hypothesis:

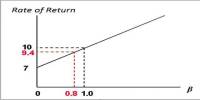

- To the extent that a relationship between risk and reward exists, it is unlikely to be stable over time. This relation is influenced by the relative sizes and preferences of populations and by institutional aspects. As these factors change, any risk/reward relation is likely to change as well.

- There are opportunities for arbitrage.

- Investment strategies—including quantitatively, fundamentally, and technology-based methods—will perform well in certain environments and poorly in others.

- The primary objective is survival; profit and utility maximization are secondary. When a multiplicity of capabilities that work under different environmental conditions evolves, investment managers are less prone to become extinct after rapid changes.