An accumulation bond is a form of security that is sold for less than its face value but will gradually return to that value over a given period of time. To put it another way, the bondholder, or lender, is simply lending the issuing company less money than it could legally borrow. In return, the loan specialist will swear off the interest pay since the bond backer isn’t needed to make interest installments, as is commonly done. The accumulation bond, also known as a discounted bond, operates in a similar way to buying a savings bond and waiting for it to mature before cashing it in.

Accumulation bonds are additionally alluded to as accumulation bonds. It is so named in light of the fact that the estimation of the bond gathers over the long haul. They are otherwise called zero-coupon markdown bonds. An accumulation bond sells at a discount to the original issue par value. The face value of a bond is its par value, and accumulation bonds often sell for less than their face value. Investment funds security is bought for the measure of the presumptive worth, with the understanding, the estimation of the security will increment as it develops; on the opposite side limited securities work in the exact inverse manner. Bureaucratic, nearby, or state government offices regularly issue amassing bonds.

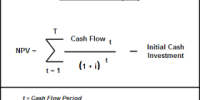

The holder of an accumulation bond pays less money to the issuing firm, but the bond’s interest is accrued and charged at maturity. Despite the fact that the bondholder isn’t accepting coupon installments, the interest on the bond actually gathers and should be accounted for as interest pay on the bondholder’s assessment form every year. This is at times alluded to as phantom income. When filing tax returns with the Internal Revenue Service, the accrued interest is measured and filed as interest income. This interest income has a bearing on the bondholder’s tax return for that year.

A financial instrument with a face value and a concept is known as an Accumulation Bond. The Bond’s main characteristics are as follows:

- The Bond is not sold at Face Value.

- No interest payments are made.

Since the Bond is sold at a Discounted Value rather than Face Value, the buyer benefits. However, it is important to note that accumulation bonds experience significant price drops, especially as interest rates rise. Hence, the accumulation bond is a path for putting something aside for the future, while the rebate security is an approach to make a consistent income stream, utilizing our assets to create income as interest installments.

Accumulation bond doesn’t give interest to the bondholders consistently, they give bondholders the maximum of the bond at the development date. i.e., If a corporation issues a bond for $ 2000 and sells it for $ 1500 to bondholders. When a bond’s par value is discounted by $500 and the maturity date is one year, the company will pay the bondholder a total of $2000 at the maturity date. The bondholder’s interest is calculated at $500.

Accumulation bonds, on average, will mature in a reasonable period of time and will pay out more earned interest than a regular savings account. In fact, the accumulation bond can frequently make extra resources with more dependability than various venture alternatives. Accumulation bond investors should be mindful, however, that during periods of increasing interest rates, accumulation bonds are at risk of experiencing steep price declines.

Information Sources: