According to Daniele Antonucci, chief economist and macro strategist at Quintet Private Bank, if sticky inflation and tight labor markets continue, the U.S. Federal Reserve may be obliged to violate market expectations by hiking interest rates sharply once more later this year.

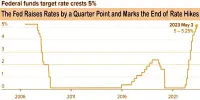

According to the CME Group’s Fed Watch tracker of prices in the fed funds futures market, the market is pricing in a 60% chance that the central bank will pause its monetary tightening cycle at its June meeting after increasing by 25 basis points to bring the fed funds rate into the 5%-5.25% target range earlier this month.

In an effort to control sky-high inflation, the Fed has been raising rates quickly during the past year, but the market anticipates that they will start to decline before the year is through. Annual headline inflation fell to 4.9% in April, its lowest for two years, but remains well above the Fed’s 2% target.

Meanwhile, the labor market remains tight, with jobless claims still close to historically low levels. Job growth also hit 253,000 in April despite a slowing economy, while the unemployment rate sat at 3.4%, tied for the lowest level since 1969. Average hourly earnings rose 0.5% for the month and increased 4.4% from a year ago, both higher than expected.

Jerome Powell has been particularly critical of the ‘stop and go’ monetary policy in the 1970′s that contributed to the stagflationary underpinning of the economy, and which required an aggressive monetary policy to restore price stability.

Quincy Krosby

Antonucci told CNBC’s “Squawk Box Europe” on Friday that Quintet disagrees with the market’s pricing of rate cuts later in the year.

“We think this is a hawkish pause it’s not a pivot from hawkish to dovish it’s a pause, the level of inflation is high, the labor market is tight, and so markets can be disappointed if the Fed doesn’t lower rates,” he said.

Given the strength of the labor market, Antonucci suggested that a rate cut “seems an implausible scenario and it is only the first issue.”

“The second one is that the tension here is that if the labor market remains strong, if economic activity doesn’t eventually deteriorate to a point to have a recessionary environment and disinflation, the Fed may have to tighten policy more aggressively and then you have a recession including an earnings recession,” he added.

“The Fed may need to hike more aggressively if inflation stays elevated.”

Antonucci’s position mirrored messaging from some members of the Federal Open Market Committee this week, who have reiterated the importance of waiting to monitor the lagged effect of prior rate increases but also indicated that the data does not yet justify a dovish pivot.

Cleveland Fed President Loretta Mester said Tuesday that the central bank is not yet at the point where it can “hold” rates, while Dallas Fed President Lorie Logan suggested on Thursday that the data so far does not justify skipping a rate hike at the June meeting.

Investors will be closely watching a speech from Fed Chairman Jerome Powell on Friday for clues as to the FOMC’s potential trajectory.

“Jerome Powell has been particularly critical of the ‘stop and go’ monetary policy in the 1970′s that contributed to the stagflationary underpinning of the economy, and which required an aggressive monetary policy to restore price stability,” said Quincy Krosby, chief global strategist at LPL Financial.

“If he mentions this when he speaks on Friday, the market could interpret it as signal that unless the data improves markedly regarding inflation, he’ll advocate another rate hike.”

Krosby added that the week’s “Fedspeak chorus” has served to remind markets that the central bank’s mandate is to restore price stability, and that the FOMC is prepared to raise rates again to “get the job done if inflation doesn’t cooperate.”