AgriBiotech Project :

SQUARE has setup a plant tissue culture laboratory to develop agricultural/agro processing sector in the country and is committed to bring improved quality planting materials and year round production through AgriBiotech. The major activities of AgriBiotech is to provide disease free, stress free, high yielding seed & seedlings such as potato, banana, ginger, turmeric and some flowers including varieties of orchids to the farmer & nurserymen to solve quality seed problems in this agro based country.

Well equipped around 4000 SQUARE feet tissue culture laboratory is situated at Uttara, a convenient location, having careful designing and planning, facilitated to produce 10,00000 seedlings per year. The other activities of this project will be of research and development in the field of Biotechnology to protect some of endangered medicinal plant and to bring some new as cane, rattan, bamboo which is almost extinct in the country.

The hospital is nearing completion at a cost of over US$ 40 million and is scheduled to go into operation in mid 2006.

Focused to provide International standard healthcare services at an affordable price SQUARE Hospitals Ltd. is a multi-disciplinary hospital with specialty in Cancer, Cardiac and Pediatrics. One stop state of the art Diagnostic Services will be it’s another major service. The hospital will be exclusively managed by Bumrungrad Hospital International of Thailand, only US accredited hospital in Asia.

The 300-bed hospital is located in the city center. 1200 patients can be served per day by its out patient department through it’s 60 exam room. Housed in an 18 storied building covering 40,000 sq. meters the facility can also accommodate 200 cars in its 3 basement parking areas Dedicated to bring the nature’s best for human health

SQUARE is the one of the leading Pharmaceuticals of the country. SQUARE is dedicated to advance technology and the pioneer in introducing innovative ideas.

SQUARE HERBAL & NUTRACEUTICALS LTD. – an endeavor of SQUARE Group that has been evolved to ensure the availability of modern Herbal Medicines to the people of this country. To ensure modern Herbal Medicines, the company is –

─ Dealing with the products of natural sources that have scientific data to prove their clinical indications and efficacy.

─ Operating a GMP compliant manufacturing plant and quality assurance that are in line with the practices of developed world.

─ Sourcing raw materials from the renowned suppliers only.

─ Ensuring the products having quality assurance commensurate to SQUARE’s quality policy.

─ Involving highly qualified, skilled and well trained personnel in manufacturing, marketing, sales and distribution.

Price in Theory

In ordinary usage, price is the quantity of payment or compensation for something. People may say about a criminal that he has ‘paid the price to society’ to imply that he has paid a penalty or compensation. They may say that somebody paid for his folly to imply that he suffered the consequence.

Economists view price as an exchange ratio between goods that pay for each other. In case of barter between two goods whose quantities are x and y, the price of x is the ratio y/x, while the price of y is the ratio x/y.

This however has not been used consistently, so that old confusion regarding value frequently reappears. The value of something is a quantity counted in common units of value called numeraire, which may even be an imaginary good. This is done to compare different goods. The unit of value is frequently confused with price, because market value is calculated as the quantity of some good multiplied by its nominal price.

Theory of price asserts that the market price reflects interaction between two opposing considerations. On the one side are demand considerations based on marginal utility, while on the other side are supply considerations based on marginal cost. An equilibrium price is supposed to be at once equal to marginal utility (counted in units of income) from the buyer’s side and marginal cost from the seller’s side. Though this view is accepted by almost every economist, and it constitutes the core of mainstream economics, it has recently been challenged seriously.

There was time when people debated use-value versus exchange value, often wondering about the Diamond-Water Paradox (paradox of value). The use-value was supposed to give some measure of usefulness, later refined as marginal benefit (which is marginal utility counted in common units of value) while exchange value was the measure of how much one good was in terms of another, namely what is now called relative price.

Price in Real Life

Price, though sounds simple, is very difficult to explain. This simple term may mean different things to different people. Traditionally, by price we mean the amount of money we pay or charge for a product or service. Price must therefore be conceived of as a multidimensional process involving change of asset, proving service, obtaining service, maintenance of assets, day to day expenses and many more.

We can easily find that price is related with every aspect of our life. If we take one day a person’s life for our experiment we can easily decide what is price and how it is a part of our every day life.

For example we have chosen Mr. X. He lives in Mohammadpur with his family. He has to pay a certain amount of money to the owner of the flat as he is living in it. This price is called rent. He usually wakes up 7 am in the morning. He then prepare for his office. He takes the bus for which he has to bought a ticket and pay for the ticket. This expense is called fare. When he arrives at his office his boss congratulates him and says that he has got promotion and his salary will be increased. This is another kind of price because he has achieved it with hard work. Few hours later a person comes to his desk and offers money if he helps the person illegally. He refused to do so. This offer is also a price called bride. After a while he goes to the bank for official work the bank officer said he has got taka 1300 interest in his account. This amount of money is also a price called interest. Later he went to pick up his son from the school and paid exam fees and the tuition. These types of payments are also a dimension of price. So we can see that price is related in our everyday life.

What a price should do

A well chosen price should do three things :

- achieve the financial goals of the firm (eg.: profitability)

- fit the realities of the marketplace (will customers buy at that price?)

- support a product’s positioning and be consistent with the other variables in the marketing mix

- price is influenced by the type of distribution channel used, the type of promotions used, and the quality of the product

- price will usually need to be relatively high if manufacturing is expensive, distribution is exclusive, and the product is supported by extensive advertising and promotional campaigns

- a low price can be a viable substitute for product quality, effective promotions, or an energetic selling effort by distributors

- price is influenced by the type of distribution channel used, the type of promotions used, and the quality of the product

From the marketers point of view, an efficient price is a price that is very close to the maximum that customers are prepared to pay. In economic terms, it is a price that shifts most of the consumer surplus to the producer.A good pricing strategy would be the one which could balance between the Price floor(the price below which the organisation ends up in losses) and the Price ceiling(the price beyond which the organisation experiences a no demand situation).

Definitions of Pricing

The effective price is the price the company receives after accounting for discounts, promotions, and other incentives.

Price lining is the use of a limited number of prices for all your product offerings. This is a tradition started in the old five and dime stores in which everything cost either 5 or 10 cents. Its underlying rationale is that these amounts are seen as suitable price points for a whole range of products by prospective customers. It has the advantage of ease of administering, but the disadvantage of inflexibility, particularly in times of inflation or unstable prices.

A loss leader is a product that has a price set below the operating margin. This results in a loss to the enterprise on that particular item, but this is done in the hope that it will draw customers into the store and that some of those customers will buy other, higher margin.

Types of Pricing

Fixed Pricing

A model of pricing in which a project is undertaken by the service provider for a pre-agreed-upon price is called fixed pricing. One advantage is that it’s easy for the client to budget for the project. Two disadvantages are that the service provider may overestimate costs beforehand for possible unforeseen conditions or cut corners during the project to compensate for expenses that are higher than anticipated. The service provider will charge a premium for a fixed price relative to the risks involved. It is appropriate for the efficiency of deals.

Dynamic Pricing

Dynamic Pricing refers to fluid pricing between the buyer and seller, rather than the more traditional fixed pricing. Current models for dynamic pricing include auctions, reverse auctions (where buyers set the price they are willing to pay and then sellers bid for their business), trading exchanges, price matching, quantity pricing, and group pricing systems. Typically these systems will better reflect the true market value of the product involved. Examples of dynamic pricing in e-commerce today include eBay and Priceline.com

Fixed Pricing Vs Dynamic Pricing

Today many organization use dynamic pricing. Internet has given us the opportunity to have dynamic pricing. It is beneficiary for the sellers as well as buyers. Now,

Buyers can

- charge lower prices, reap higher margins.

- monitor customer behavior and tailor offers to individuals

- change prices on the fly according to changes in demand or costs

Sellers can

- get instant price comparisons from thousands of vendors

- find and negotiate lower prices

Both Buyers and sellers can

- negotiate prices in online auctions

Our focus: SQUARE Bangladesh

SQUARE has been using fixed pricing strategies for almost all of its products. If we take one of their segments for our experiment then we can easily conclude that. We have chosen for our analysis. SQUARE has been setting fixed price for their products. If someone want to know detail information including price of any product of SQUARE he can do it by consulting directly with SQUARE Sales and Service department or with the help of internet. For example we have searched for the product Protein Plus Meril Shampoo and the following information. From this information we can easily conclude that SQUARE has been using fixed price strategy.

Factors to Consider When Setting Prices

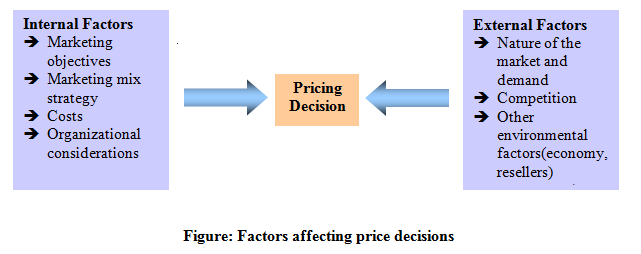

The company has to consider many factors in setting its price. A company’s pricing decisions are affected by both internal company factors and external environmental factors.

Internal Factors Affecting Pricing Decisions

There are some internal factors affecting pricing include the company’s marketing objectives, marketing mix strategy, costs and organizational considerations.

Marketing Objectives:

The company first has to decide what it wants to accomplish with its particular product offer. If the company has selected its target market and positioning carefully, then its marketing-mix strategy, including price, will be fairly straightforward.

The clearer a company’s objectives, the easier it is to set price. A company may seek additional objectives. Common objectives include survival, maximum current profit, maximum current revenue, maximum sales growth, maximum market skimming, product-quality leadership.

- Survival:

Companies pursue survival as their major objective if they are plagued with overcapacity, intense competition, or changing consumer wants. To keep the plant operating and the inventories turning over, they will cut prices. Profits are less important than survival. As long as prices cover variable costs and some fixed costs, the companies stay in business. However, survival is only a short-run objectives. In the long run, the firm must learn how to add value or face extinction.

- Maximum current profits:

Many companies try to set the price that will maximum current profits. They estimate the demand and costs associated with alternative prices and choose the price that produces Maximum current profits, cash flow, or rate of return on investment.

There are problems associated with current profit maximization. This strategy assumes that the firm has knowledge of its demand and cost functions; in reality, these are difficult to estimate. Also, by emphasizing current financial performance the company may sacrifice long-run performance, ignoring the effects of other marketing-mix variables, competitors’ reactions, and legal restraints on price.

Our focus: SQUARE Bangladesh

This business segment of SQUARE has been using this objective as their short term goal.

SQUARE’s investment in this segment for Unit 1 is US$ 20.00 million and for Unit 2 is US$ 13.50 million. But its annual turnover is around US$ 34.00 million. So we can easily find that this segment of SQUARE has been focused on maximizing current profit. Again we have known from one of their top executives that they are concerned about China and India in this sector. So they are trying to maximize their current profit as long as possible

- Maximum current revenue:

Some companies set a price that maximizes sales revenue. Revenue maximization requires estimating only the demand function. Many managers believe that revenue maximization will lead to long-run profit maximization and market-share growth.

- Maximum sales growth:

Some companies want to maximize unit sales. They believe that a higher sales volume will lead to lower unit costs and higher long-run profit. They set the lowest price, assuming the market is price sensitive. This practice is called market-penetration pricing.

The following conditions favor setting a low price:

(1) The market is highly price sensitive, and a low price stimulates market growth;

(2) Production and distribution costs fall with accumulated production experience;

(3) A low price discourages actual and potential competition

Our focus: SQUARE Bangladesh

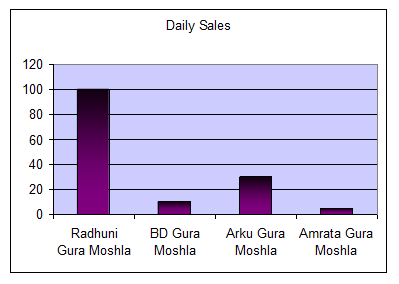

SQUARE has set the price of some of its consumer products at a lower rate than others. By this strategy they are maximizing their sales growth. If we take one of SQUARE’s one of the consumer product ‘Radhuni Gura Moshla’ then we can see that SQUARE has set its price at the lowest possible level to maximize sales growth. If the prices of some kind of products are very low then 1 or 2 taka less or higher may create a huge impact on the consumers mind. The prices of SQUARE’s product and some competitors are shown below:

Radhuni Gura Moshla: 8 taka (50 gram)

BD Gura Moshla: 8 taka (50 gram)

Arku Gura Moshla: 9 taka (50 gram)

| Product | Daily Sales (on an average) |

| Radhuni Gura Moshla | 100 |

| BD Gura Moshla | 10 |

| Arku Gura Moshla | 30 |

| Amrata Gura Moshla | 5 |

We have visited a super shop and found the following

- Maximum market skimming:

Many companies favor setting high prices to “skim” the market. Market skimming makes sense under the following conditions:

(1) A sufficient number of buyers have a high current demand;

(2) The unit costs of producing a small volume are not so high that they cancel the advantage of charging what the traffic will bear;

(3) The high initial price does not attract more competitors to the market;

(4) The high price communicates the image of a superior product.

- Product-quality leadership:

A company might aim to be the product-quality leader in the market. When the company is able to create a positive image to the mind of people they can follow the product-quality leadership strategy. Because of brand name people will purchase their product.

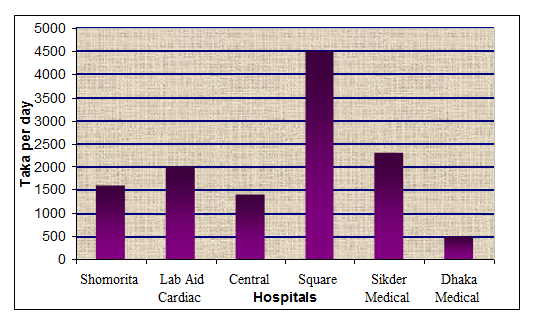

Our focus: SQUARE Bangladesh

If we compare the amount that SQUARE hospitals ltd. has been charging with other hospitals then at first we may think they are charging way too much. But at the same time they are providing better services. They have also managed to create a picture that the money is purchasing a superior product. This hospital is for the people who are willing to expend money for quality service. SQUARE has been successful in creating a sufficient number of buyer who have high demand for quality service.

For example:

The amount one has to pay if he stays one of the famous hospitals in Bangladesh for treatment or checkup:

Shomorita Hospital: 1600 per day

Lab Aid Cardiac Hospital: 2000 per day

Central Hospital: 1400 per day

SQUARE Hospital: 4500 per day

Sikder Medical Hospital: 2300 per day

Dhaka Medical Hospital: 500 per day

Other Pricing Objectives:

Non profit and public organizations may adopt a number of other pricing objectives. A university aims for partial cost recovery, knowing that it must rely on private gifts and public grants to cover the remaining costs. A nonprofit hospital may aim for full cost recovery in its pricing. A nonprofit theater company may price its productions to fill the maximum number of theater seats. A social service agency may sat a social price geared to the varying income situations of different clients.

Marketing Mix Strategy:

The marketing mix is probably the most famous marketing term. Its elements are the basic, tactical components of a marketing plan. Also none as the four P’s, the marketing mix elements are price, place, product, and promotion.

The concept is simple. Think about another common mix- a cake mix. All cakes contain eggs, milk, flour, and sugar. However, you can alter the final cake by altering the amounts of mix elements contained in it. So for a sweet cake add more sugar.

It is the same with the marketing mix. For a high profile brand, increase the focus on promotion and desensitize the weight given to price. Another way to think about the marketing mix is to use the image of an artist’s palette. The marketer mixes the prime colours ( mix elements ) in different quantities to deliver a particular final colours. Every hand painted picture is original in some way, as is every marketing mix.

Price is only one of the marketing mix tools that a company uses to achieve its marketing objectives. Price decisions must be coordinated with product design, distribution, and promotion decisions to form a consistent and effective marketing program. Decisions made for other marketing mix variables may affect pricing decisions. For example, producers using many resellers who are expected to support and promote their products may have to build larger reseller margins into their prices. The decision to position the product on high-performance quality will mean that the seller must charge a higher price to cover higher costs.

Companies often position their products on price and then tailor other marketing mix decisions to the prices they want to charge. Here, price is a crucial product-positioning factor that defines the product’s market, competition, and design. Many firms support such price-positioning strategies with a technique called target costing, a potent strategic weapon.

Target costing:

We have seen that costs change with production scale and experience. They can also change as a result of a concentrated effort by the company’s designers, engineers, and purchasing agents to reduce them. The method called target costing. They use market research to establish a new product’s desired functions. Then they determine the price at which the product must dell given its appeal and competitions’ prices. They deduct the desired profit margin from this price and this leaves the target cost they must achieve. They then examine each cost element- design, engineering, manufacturing, sales, and so on- and break it down into further components. They consider ways to reengineer components, eliminate functions, and bring down supplier costs. The whole objective is to bring the final costs projections into the target cost range. If they can’t succeed, they may decide against developing the product because it could not sell for the target price and make the target profit. When they can succeed, profits are likely to follow.

Other companies deemphasize price and use other marketing mix tools to create non price positions. Often, the best strategy is not to charge the lowest price, but rather to differential the marketing offer to make it worth a higher price.

Thus, marketers must consider the total marketing mix when setting prices. If the product is positioned on non price factors, then decisions about quality, promotion, and distribution will strongly affect price. If price is a crucial positioning factor, then price will strongly affect decisions made about the other marketing mix elements. But even when featuring price, marketers need to remember that customers rarely buy on price alone. Instead, they seek products that give them the best value in terms of benefits received for the price paid.

Costs

Costs set the floor for the price that the company can charge. The company wants to charge a price that both covers all its costs for producing, distributing, and selling the product and delivers a fair rate of return for its effort and risk. A company’s costs may be an important element in its pricing strategy. Companies with lower costs can set lower prices that result in greater sales and profits.

Types of costs:

A company’s costs take two forms, fixed costs and variable costs.

- Fixed costs:

Fixed costs (also known as overhead) are costs that do not vary with production or sales level. For example, a company must pay each month’s bills for rent, heat, interest, and executive salaries, whatever the company’s output. For example, a retailer must pay rent and utility bills irrespective of sales. Unit fixed costs, called average fixed costs (AFC), decline with volume, following a rectangular hyperbola as the inverse of the volume of production.

- Variable costs:

Variable costs vary directly with the level of production. These costs tend to be the same for each unit produced. They are called variable because their total varies with the number of units produced. In the example of the retailer, variable costs may primarily be composed of inventory (goods purchased for sale), and the cost of goods is therefore almost entirely variable. In manufacturing, direct material costs are an example of a variable cost. An example of variable costs is the prices of the supplies needed to produce a product.

- Total costs:

Total costs are the sum of the fixed and variable costs for any given level of production.

- Average costs:

Average cost is the cost per unit at that level of production; it is equal to total costs divided by production.

Management wants to charge a price that will at least cover the total production costs at a given level of production. The company must watch its costs carefully. If it costs the company more than competitors to produce and sell its product, the company will have to charge a higher price or make less profit, putting it at a competitive disadvantage.

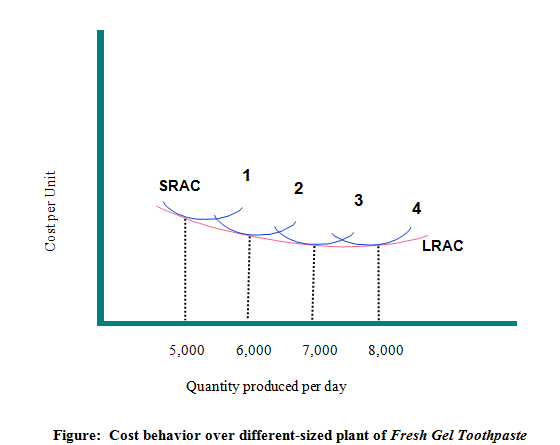

COSTS AT DIFFERENT LEVELS OF PRODUCTION

SQUARE varies its cost with different levels of production. For example SQUARE produces 5,000 bottle of Fresh Gel Tooth Paste every day in a single machine. And cost of one unit is taka 20. But if SQUARE wants to produces 10,000 unit per day it would cost them 25 taka per unit. So, 5,000 units is the optimum cost effective production unit for Fresh Gel Tooth Paste per day.

Again, SQUARE has a different type of machine. SQUARE produces 5,000 bottle of Fresh Gel Tooth Paste every day in machine 1. It can produce 6,000units, 7,000 units and 8,000 units with its other three machines. And the cost of one unit is taka 25, taka 22, taka 20, and taka 22 per unit respectively for four machines. We can get SQUARE’S long run average cost by taking all of the machine’s short run average cost. So, 7,000 units is the optimum cost effective production unit for Fresh Gel Tooth Paste per day.

Costs as a function of production experience:

To price wisely, management needs to know how its costs vary with different levels of production. The average cost per unit decreases over some time. Because of experience people become expert on same kind of works. This drop in the average cost with accumulated production experience is called the experience curve or the learning curve.

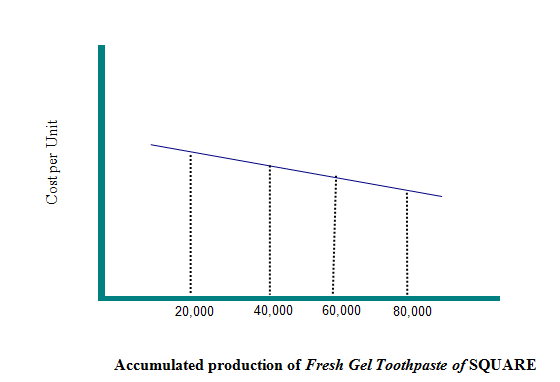

Experience Curve of Fresh Gel Tooth Paste of SQUARE:

We can see from the experience curve of Fresh Gel Tooth Paste of SQUARE that when it produces more and more over time its average cost per unit decreases.

Costs as a function of differentiated marketing offers:

Today’s companies try to adapt their offers and terms to different buyers. Thus a manufacturer dealing with different retail chains will negotiate different terms. One retailer may want everyday delivery (to keep stock lower) while another retailer may accept twice-a-week delivery in order to get a lower price. As a result, the manufacturer’s costs will differ with each retail chain, and its profits will differ too. To estimate the real profitability of dealing with different retailers, the manufacturer needs to use activity-based cost accounting instead of standard cost accounting.

Activity-based cost accounting tries to identify the real costs associated with serving each entity (the different customers). Both the variable costs and the overhead costs must be decomposed and tagged back to the entity. Companies that fail to measure their real costs correctly are not measuring their profit correctly. They are likely to misallocate their

marketing and other efforts. Identifying the true costs arising in a customer relationship also enables a company to better explain its charges to the customer.

Organizational Considerations:

Management must decide who within the organization should set prices. Companies handle pricing in a variety of ways. In small companies, prices are often set by top management rather than by the marketing or sales departments. In large companies, pricing is typically handled by divisional or product line managers. In industrial markets, salespeople may be allowed to negotiate with customers within certain price ranges. Even so, top management sets the pricing objectives and policies, and it often approves the prices proposed by lower-level management or salespeople.

In industries in which pricing is a key factor, companies often have a pricing department to set the best prices or help others in setting them. This department reports to the marketing department or top management. Others who have an influence on pricing include sales managers, production managers, finance managers, and accountants.

External factors afflicting pricing decisions

The Market and Demand

Market:

In economics, a market is a social structure for exchange of rights, which enables people, firms and products to be evaluated and priced. There are two roles in markets, buyers and sellers. The definition implies that at least three actors are needed for a market to exist; at least one actor, on the one side of the market, who is aware of at least two actors on the other side whose offers, can be evaluated in relation to each other. A market allows buyers and sellers to discover information and carry out a voluntary exchange of goods or services. It is one of the two key institutions for organizing trade, along with the right to own property. In everyday usage, the word “market” may also refer to the location where goods are traded, or in other words, the marketplace.

Demand:

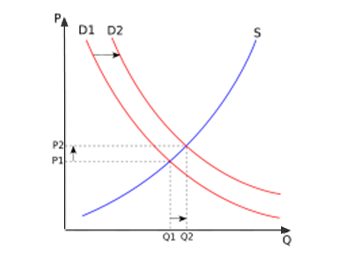

The amount of a particular economic good or service that a consumer or group of consumers will want to purchase at a given price is called demand. The demand curve is usually downward sloping, since consumers will want to buy more as price decreases. Demand for a good or service is determined by many different factors other than price, such as the price of substitute goods and complementary goods. In extreme cases, demand may be completely unrelated to price, or nearly infinite at a given price. Along with supply, demand is one of the two key determinants of the market price.

If supply is held constant, an increase in demand leads to an increased market price, while a decrease in demand leads to a decreased market price.

Market–demand relationship:

To set a specific price for a specific product, the marketer must understand the relationship between the market situation and the demand of the product in the market. Without understanding it, a marketer can:

- Over-price the product or

- Undervalue the product

Both these effects may be devastating the company, especially when launching a new product. In the following pages, we tried to focus on how the various market situations and buyer perception of the product may influence the pricing decision.

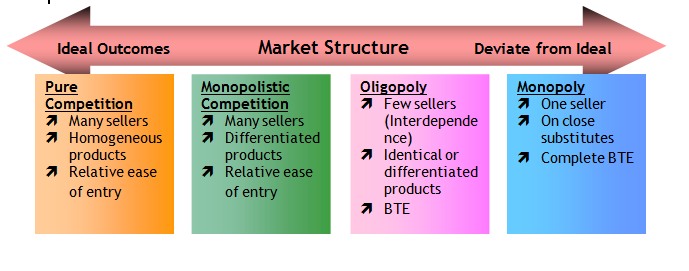

Pricing in different types of market

In the real world economy, various forms of market can be observed which drastically affect the pricing and marketing of the products of the companies related to each form. Each type of market situation requires marketers to set reasonable prices which allow them to obtain highest profit. Form the viewpoint of economics; we can categorize the markets in following types:

1. Pure or Perfect competition:

Perfect competition is an economic model that describes a hypothetical market form in which no producer or consumer has the market power to influence prices. According to the standard economical definition of efficiency (Pareto efficiency), perfect competition would lead to a completely efficient outcome. The analysis of perfectly competitive markets provides the foundation of the theory of supply and demand

Assumptions of perfect competition:

Often models of perfect competition assume that some subset of the following six conditions be fulfilled. In such a market, prices would normally move instantaneously to economic equilibrium. It should be noted however that these represent sufficient, not necessary conditions.

Atomicity

An atomic market is one in which there are a large number of small producers and consumers on a given market, each so small that its actions have no significant impact on others. Firms are price takers, meaning that the market sets the price that they must choose.

Homogeneity

Goods and services are perfect substitutes; that is, there is no product differentiation. (All firms sell an identical product)

Perfect and complete information

All firms and consumers know the prices set by all firms (see perfect information and complete information).

Equal access

All firms have access to production technologies, and resources are perfectly mobile.

Free entry

Any firm may enter or exit the market as it wishes (see barriers to entry).

Individual buyers and sellers act independently

The market is such that there is no scope for groups of buyers and/or sellers to come together with a view to changing the market price (collusion and cartels are not possible under this market structure)

Behavioral assumptions of perfect competition are that:

- Consumers aim to maximize utility

- Producers aim to maximize profit

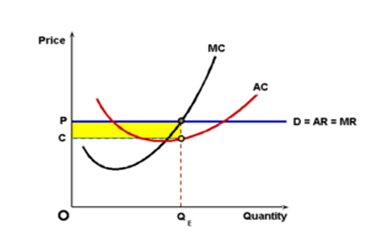

Results of perfect competition:

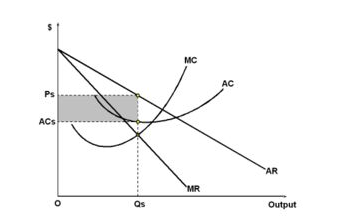

In the short-run, it is possible for an individual firm to make abnormal profit. This situation is shown in this diagram, as the price or average revenue, denoted by P is above the average cost denoted by C

However, in the long run, abnormal profit cannot be sustained. The arrival of new firms in the market causes the (horizontal) demand curve of each individual firm to shift downward, bringing down at the same time the price, the average revenue and marginal revenue curve. The final outcome is that, in the long run, the firm will make only normal profit (zero economic profit). Its horizontal demand curve will touch its average total cost curve at its lowest point.

Our focus: SQUARE Bangladesh

In this report we have focused on the related fields of SQUARE Bangladesh Limited. Among the firms of SQUARE Bangladesh Limited is SQUARE InformatiX Ltd.

SQUARE InformatiX Ltd. a data communication service provider has been providing cost effective multi location business connectivity and also internet connection anywhere in the country. SQUARE has developed this section to provide internet services, especially in commercial arena. But there is a wholesome competition exists in this area of business. There are other internet service providers operating their business other than SQUARE InformatiX Ltd. Following is a list of internet service providers in Bangladesh:

Internet Service Providers in Bangladesh

- AB Network Limited

- Access Telecom Limited

- Aftab IT Limited

- Agni Systems Limited

- Asia Online (BD) Ltd.

- Bangladesh Online Ltd.

- Bangladesh T&T Board

- BD com Ltd.

- Bd Corp

- Bdcom Online Limited

- Bijoy Online.net

- BG Tech

- Brac Network System

- Dolphi Net

- Drik Online Limited

- E-Net Communications Ltd.

- Global Information Services Ltd.

- Grameen Cybernet Ltd.

- Information Services Network Ltd.

- KLBd Online

- Link3 Technologies Ltd.

- NCLL

- Pradeshta Network Limited

- ProshikaNet Online Limited

- Raspit.com

- Shapla.net

- Span Internetworks Ltd

- Spark Systems Ltd.

- Spectra Solution Limited

- SpectraNet Limited

- SQUARE InformatiX Ltd

- Trans-net System Ltd.

- Vas Digital Communications Ltd.

- Westec Limited

From the point of view of the internet service user, there are some conditions which a user requires to be fulfilled before starting to enjoy the services of an internet service provider. These conditions may be the followings:

- the location of the service provider

- charge of using the service

- data transfer speed

In Bangladesh, most internet service providers operate their businesses in almost a pure competitive situation. Reasons for this remark are:

Internet service providers have a homogeneous service.

- They charge same price almost everywhere, it varies a little with change of locations.

- They attract customers on the basis of the location, in maximum cases it does not provide them with any kind of competitive advantage.

2. Monopolistic competition:

Monopolistic competition is a common market form. Many markets can be considered monopolistically competitive, often including the markets for restaurants, cereal, clothing, shoes and service industries in large cities.

Monopolistically competitive markets have the following characteristics:

1. There are many producers and many consumers in a given market.

2. Consumers perceive that there are non-price differences among the competitors’ products.

3. There are few barriers to entry and exit.

4. Producers have a degree of control over price.

The characteristics of a monopolistically competitive market are almost the same as in perfect competition, with the exception of heterogeneous products, and that monopolistic competition involves a great deal of non-price competition (based on subtle product differentiation). A firm making profits in the short run will break even in the long run because demand will decrease and average total cost will increase. This means in the long run, a monopolistically competitive firm will make zero economic profit. This gives the company a certain amount of influence over the market; because of brand loyalty, it can raise its prices without losing all of its customers. This means that an individual firm’s demand curve is downward sloping, in contrast to perfect competition, which has a perfectly elastic demand schedule.

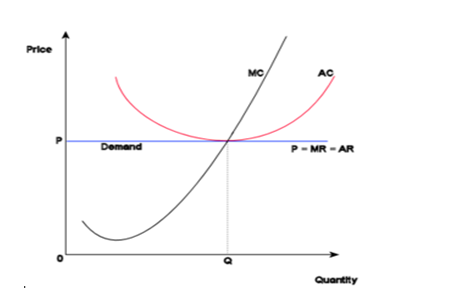

Short-run equilibrium of the firm under Monopolistic Competition

A monopolistically competitive firm acts like a monopolist in that the firm is able to influence the market price of its product by altering the rate of production of the product. Unlike in perfect competition, monopolistically competitive firms produce products that are not perfect substitutes. As such, brand X’s product, which is different (or at least perceived to be different) from all other brands’ products, is available from only a single producer. In the short-run, the monopolistically competitive firm can exploit the heterogeneity of its brand so as to reap positive economic profit (i.e. the rate of return is greater than the rate required to compensate debt and equity holders for the risk of investing in the firm). One possible effect of advertising on a firm’s long run average cost curve when earning an economic profit in the short run is to raise the curve.

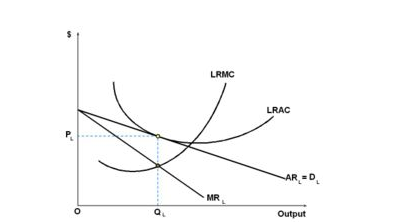

Long-run equilibrium of the firm under Monopolistic Competition

In the long-run, however, whatever distinguishing characteristic that enables one firm to reap monopoly profits will be duplicated by competing firms. This competition will drive the price of the product down and, in the long-run, the monopolistically competitive firm will make zero economic profit (i.e. a rate of return equal to the rate required to compensate debt and equity holders for the risk of investing in the firm).

Unlike in perfect competition, the monopolistically competitive firm does not produce at the lowest attainable average total cost. Instead, the firm produces at an inefficient output level, reaping more in additional revenue than it incurs in additional cost versus the efficient output level.

Our focus: SQUARE Bangladesh

One of the most common and most well known factions of SQUARE Bangladesh is SQUARE Pharmaceutical Limited Bangladesh. This portion of the corporation deals with the large field of Pharmaceutical products and SQUARE is mainly recognized for it. Following is a list of Pharmaceutical Products SQUARE offers to the consumers:

- Alimentary Preparations

- Antiallergy Preparations

- Antiparasite Preparations

- Bone Calcium Regulator

- Cardiovascular Preparations

- CNS Preparations

- Drugs for Urinary Incontinence

- Eye and Ear Preparations

- Lipid Modifying Preparations

- Local Anesthetics

- Mineral Supplements

- NSAIDs and Antigout Preparations

- Other Antibacterials

- Other Beta-lactam antibiotic except Penicillin and Cephalosporin

- Penicillins and Cephalosporins

- Quinolone Antibiotics

- Respiratory Tract Preparations

- Systemic Antifungal, Antiviral and Antiprotozoal Agents

- Topical Preparations

- Vitamins and Minerals

In Bangladesh there are many other companies which are operating in the Pharmaceutical field. The companies in this area are listed below:

- ACI Pharmaceuticals

- Aristopharma Ltd

- Amico Laboratories

- The ACME Laboratories Ltd

- Beximco Pharmaceuticals Ltd

- Eskayef Bangladesh Limited

- Gaco Pharmaceuticals

- Ganashastha Pharmaceuticals

- Ibn Sina Pharmaceuticals

- Incepta Pharmaceuticals Limited

- Navana Pharmaceuticals

- SQUARE Pharmaceuticals Ltd. Bangladesh

- Orion Pharmaceuticals

- Pharmadesh

The companies related in Pharmaceutical production have a vast number of different products which are offered to the consumers. Maximum products are homogeneous and almost all companies provide consumers with products according to therapeutic class. Some companies are new to the business and they are finding some grounds to stand on and operate. Aristopharma Ltd (founded in 1986) & Incepta Pharmaceuticals Limited (founded in 1999) are companies quite new to the business yet they are performing quite well.

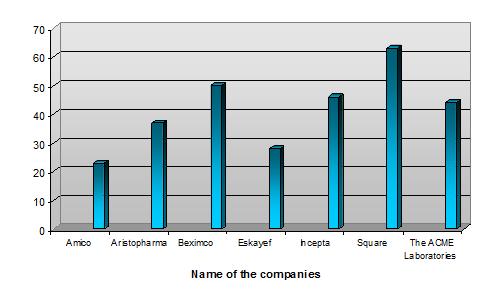

Following figures show the amount of annual production in some of the prominent company:

|

|

|

| Production in 2006 (in millions) | |||||

| Amico Laboratories | 23 | ||||||||

| Aristopharma Ltd | 37 | ||||||||

| Beximco Pharmaceuticals Ltd | 50 | ||||||||

| Eskayef Bangladesh Limited | 28 | ||||||||

| Incepta Pharmaceuticals Limited | 46 | ||||||||

| SQUARE Pharmaceuticals Ltd. Bangladesh | 63 | ||||||||

| The ACME Laboratories Ltd | 44 | ||||||||

Above data is graphically shown in the subsequent graph:

Considering the types of products and the relative market conditions it can be remarked that SQUARE Pharmaceutical Limited Bangladesh is operating its business in monopolistic competition.

3. Oligopolistic competition:

An oligopoly is a market form in which a market or industry is dominated by a small number of sellers (oligopolists). The word is derived from the Greek for few sellers. Because there are few participants in this type of market, each oligopolist is aware of the actions of the others. The decisions of one firm influence, and are influenced by the decisions of other firms. Strategic planning by oligopolists always involves taking into account the likely responses of the other market participants. This causes oligopolistic markets and industries to be at the highest risk for collusion.

Oligopoly is a common market form. As a quantitative description of oligopoly, the four-firm concentration ratio is often utilized. This measure expresses the market share of the four largest firms in an industry as a percentage. Using this measure, an oligopoly is defined as a market in which the four-firm concentration ratio is above 40%.

Oligopolistic competition can give rise to a wide range of different outcomes. In some situations, the firms may collude to raise prices and restrict production in the same way as a monopoly. Where there is a formal agreement for such collusion, this is known as a cartel.

Firms often collude in an attempt to stabilize unstable markets, so as to reduce the risks inherent in these markets for investment and product development. There are legal restrictions on such collusion in most countries. There does not have to be a formal agreement for collusion to take place (although for the act to be illegal there must be a real communication between companies) – for example, in some industries, there may be an acknowledged market leader which informally sets prices to which other producers respond, known as price leadership.

In other situations, competition between sellers in an oligopoly can be fierce, with relatively low prices and high production. This could lead to an efficient outcome approaching perfect competition. The competition in an oligopoly can be greater than when there are more firms in an industry if, for example, the firms were only regionally based and didn’t compete directly with each other.

The welfare analysis of oligopolies suffers, thus, from sensitivity to the exact specifications used to define the market’s structure. In particular, the level of deadweight loss is hard to measure. The study of product differentiation indicates oligopolies might also create excessive levels of differentiation in order to stifle competition.

In an oligopoly, firms operate under imperfect competition and a kinked demand curve which reflects inelasticity below market price and elasticity above market price, the product or service firms offer, are differentiated and barriers to entry are strong. Following from the fierce price competitiveness created by this sticky-upward demand curve, firms utilize non-price competition in order to accrue greater revenue and market share.

Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point and, incidentally, the kink point.

Kinked” demand curves are similar to traditional demand curves, as they are downward-sloping. They are distinguished by a hypothesized convex bend with a discontinuity at the bend – the “kink.” Therefore, the first derivative at that point is undefined and leads to a jump discontinuity in the marginal revenue curve.

Our focus: SQUARE Bangladesh

SQUARE Bangladesh first ventured into the textile sector with the establishment of the first unit of the Textile Ltd. in 1997. A year later the establishment of the second unit followed.

In Bangladesh there are some other companies working in this sector. Following names are the most prominent:

- Base Textile Limited

- Beximco Textiles

- KDS Apparels, Chittagong

In most cases SQUARE Textile Ltd. and Beximco Textiles are dominating the market and they respond to price changes of each other severely. In that sense, it can be said that SQUARE is operating in a oligopolistic market structure.

4. Monopoly:

A monopoly [from Greek mono (μονό), alone or single + polο (πωλώ), to sell] is a persistent situation where there is only one provider of a product or service in a particular market. Monopolies are characterized by a lack of economic competition for the good or service that they provide and a lack of viable substitute goods. [1]

A monopoly should be distinguished from monopsony, in which there is only one buyer of a product or service; a monopoly may also have monopsony control of a sector of a market. Likewise, a monopoly should be distinguished from a cartel (a form of oligopoly), in which several providers act together to coordinate services, prices or sale of goods.

A government-granted monopoly or legal monopoly is sanctioned by the state, often to provide an incentive to invest in a risky venture. The government may also reserve the venture for itself, thus forming a government monopoly.

Economic analysis:

1. No close substitutes:

A monopoly is not merely the state of having control over a product; it also means that there is no real alternative to the monopolized product.

2. A price maker:

Because a single firm controls the total supply in a pure monopoly, it is able to exert a significant degree of control over the price by changing the quantity supplied.

Other common assumptions in modeling monopolies include the presence of multiple buyers (if a firm is the only buyer, it also has a monopsony), an identical price for all buyers, and asymmetric information

The result of these conditions is that a company with a monopoly does not undergo price pressure from competitors, although it may face pricing pressure from potential competition. If a company raises prices too high, then others may enter the market if they are able to provide the same good, or a substitute, at a lower price. [2] The idea that monopolies in markets with easy entry need not be regulated against is known as the “revolution in monopoly theory”.

Price setting for unregulated monopolies:

In economics, a firm is said to have monopoly power — or at least a degree of market power –if it is not facing a horizontal demand curve (see supply and demand). This is in contrast to a price-taking firm which always faces a horizontal demand curve, and therefore sells little or nothing at prices above equilibrium. In contrast, a business with monopoly power can choose the price at which it wants to sell.

In most markets, falling demand associated with increased price is due partly to losing customers to other sellers and partly to customers who are no longer willing or able to buy the product. In a pure monopoly market, only the latter effect is at work. Therefore, the drop in sales as prices rise may be much less dramatic than one might expect, especially for necessary commodities such as medical care. However, unless the monopoly is a coercive monopoly, there is also the risk of competition arising if the firm sets its prices too high.

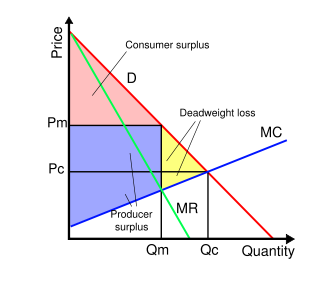

If a monopoly can set only one price, it will produce a quantity where marginal cost (MC) equals marginal revenue (MR), as seen on the diagram at right. The monopolist will then set the highest price at which that quantity can be sold. This, the optimal price according to supply and demand theory, is above the competitive price (Pc) and below the competitive quantity (Qc).

Our focus: SQUARE Bangladesh

In Bangladesh monopoly businesses can only be seen in the Social Services sectors. These businesses are mainly operated by the Government and no private business institution is allowed to establish any business concerning these sectors. WASA is one of the monopoly businesses regulated by the Government.

Our main focus SQUARE Bangladesh does not operate any kind of monopoly business.

- Consumer perception of price and value:

The ultimate end users of the product basically determine whether the price of the product is right or wrong. The marketers must understand the need and want of the consumers. Consumers forego the value (price) in exchange of the product. If their perceived value of the product is lower than the price they have foregone, then the product will face a critical phase of failing. Again if the perceived value is higher than the price, then the marketers will lose substantial amount of profit. Effective buyer-oriented pricing involves understanding how much value consumers place on the benefits of the product and setting a price that fits this value.

- Analyzing the price demand relationship:

In economics, the demand curve can be defined as the graph depicting the relationship between the price of a certain commodity, and the amount of it that consumers are willing and able to purchase at that given price.

Demand curves are used to estimate behaviors in competitive markets, and are often combined with supply curves, often to estimate the equilibrium price (the price at which all sellers are able to find a willing buyer, also known as market clearing price) and the equilibrium quantity (the amount of that good or service that will be produced and bought without surplus/excess supply or shortage/excess demand) of that market. Please see the article on Supply and Demand for more details on how this is done.

Demand schedules are tables that contain experimentally obtained information of buying habits at varied prices. From these data a demand curve is then estimated and graphed, usually with the amount of a good or service demanded graphed to the x axis (often named in equations as “Q”) and the price at which the good or service would be purchased on the y axis (often named in equations as “P”).

Other determinants of demand such as income, taste and preference, prices of related or substitute goods/services (those consumed in place of said good or service), etc. are supposedly held constant.

A change in one of these constants will cause a shift in the demand curve, and the expected behavior of that market. Movement along the demand curve shows the changes in the quantity demanded compared to changes in the price of the good/service.

The demand curve usually slopes downwards from left to right; that is, it has a negative association (for two theoretic exceptions, see Veblen good and Giffen good).

This negative slope is often referred to as the “law of demand,” which means that when all things but price are held equal, if the price of the good/service increases; the less of that good/service will be purchased by consumers.

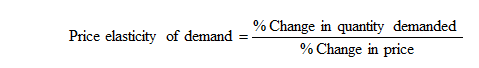

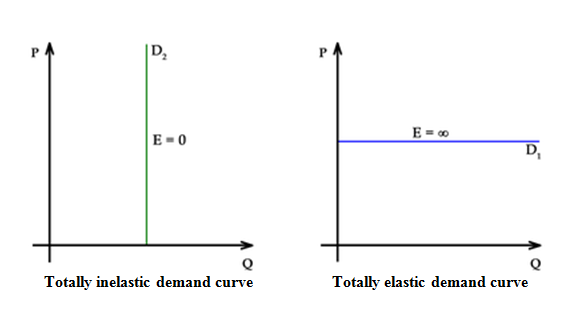

- Price elasticity of demand:

One typical application of the concept of elasticity is to consider what happens to consumer demand for a good (for example, apples) when prices increase. As the price of a good rises, consumers will usually demand a lower quantity of that good, perhaps by consuming less, substituting other goods, and so on. The greater the extent to which demand falls as price rises, the greater the price elasticity of demand. Conversely, as the price of a good falls, consumers will usually demand a greater quantity of that good, by consuming more, dropping substitutes, and so forth. However, there may be some goods that consumers require, cannot consume less of, and cannot find substitutes for even if prices rise (for example, certain prescription drugs). Another example is oil and its derivatives such as gasoline. For such goods, the price elasticity of demand might be considered inelastic.

Further, elasticity will normally be different in the short term and the long term. For example, for many goods the supply can be increased over time by locating alternative sources, investing in an expansion of production capacity, or developing competitive products which can substitute. One might therefore expect that the price elasticity of supply will be greater in the long term than the short term for such a good, that is, that supply can adjust to price changes to a greater degree over a longer time.

This applies to the demand side as well. For example, if the price of petrol rises, consumers will find ways to conserve their use of the resource. However, some of these ways, like finding a more fuel-efficient car, take time. So consumers as well may be less able to adapt to price shocks in the short term than in the long term

Competitors costs, price and offers:

One of the most important factors affecting the marketers pricing decision is the competitor’s cost and prices. It is also vulnerable to the competitor’s possible reaction to the decisions of its own product pricing. How much the pricing decision of the competitor is gong to affect the company depends on the market situation. In the oligopolistic market structure, price of the competitors has severe effect on the company’s pricing decision. On the other hand, in pure competition, it has no effect on the company, because the price of the product is same of everyone. Monopolistically competitive companies depend on the pricing of the competitors but it has much less affect on the pricing decision. In case of monopoly, the company has little competition and it can take drastic measures in pricing decisions to ward off competitors.

Our focus: SQUARE Bangladesh

The toiletries section of the company operates in the monopolistically competitive situation. One of the products of the SQUARE Toiletries Ltd. is Meril Beauty Soap. It has different versions of the product. We focus on the product named Pink Meril Beauty Soap. At present each 100 gm pack cost 15 taka in retail stores.

Few months back Unilever Bangladesh, the competitor of the SQUARE Toiletries Ltd., changed the price of their similar product from taka 15 to taka 13. In response SQUARE changed their product price to taka 13 and at the same time they launched a new promotional campaign which requested the consumers to return three used pack of the product to get a single product for free.

As the price of the raw material increased Unilever changed their price of the product to 15 again. In the same way SQUARE responded to the price change and put back their product price to taka 15 and as the subsequent campaign of the price decline was not profitable, it was stopped.

Other external factors

1. Economic Conditions:

Pricing decision of the company is also affected by the economic condition in which the company is subjected to. In Bangladesh, there is higher rater of interest and inflation prevailing and these change quite often. So, SQUARE has to consider these factors while setting prices and it has to change their product price accordingly.

2. Resellers:

Any change in the pricing of the products may affect the reactions of the resellers. Specially, the products which have relatively smaller manufacturer to ultimate consumer marketing channel, resellers of these products respond quickly to these price changes.

3. Government:

Policies of the government also affect the pricing decisions. For example, when Government decreased export duties on Medicine, SQUARE had increased their production of medicine. Within last five years SQUARE has increased their production by 17.93 percent as well as decreased the price of their product in foreign markets because of favorable government policies. Condition of the Government is also an important aspect of the company. Investment in textile sector has decreased in the last year because investors are afraid to make any contribution while the Caretaker Government is still in power.

4. Social concerns:

Social groups can also make immense impact in the pricing policy. Again any psychological change in the society will have impact on production and price. SQUARE has to consider this factor as well. For example, they can not increase the price of medicine too much because it will create negative impact on the society.

Pricing Policy and Strategy

Managers should start setting prices during the development stage as part of strategic pricing to avoid launching products or services that cannot sustain profitable prices in the market. This approach to pricing enables companies to either fit costs to prices or scrap products or services that cannot be generated cost-effectively. Through systematic pricing policies and strategies, companies can reap greater profits and increase or defend their market shares. Generally, pricing policy refers how a company sets the prices of its products and services based on costs, value, demand, and competition. Pricing strategy, on the other hand, refers to how a company uses pricing to achieve its strategic goals, such as offering lower prices to increase sales volume or higher prices to decrease backlog.

Our focus: SQUARE Bangladesh

In SQUARE Bangladesh setting prices is one of the principal tasks of marketing and finance managers in that the price of a product or service often plays a significant role in that product’s or service’s success, not to mention in a company’s profitability.

After establishing the bases for their prices, managers begin developing pricing strategies by determining company pricing goals, such as increasing short-term and long-term profits, stabilizing prices, increasing cash flow, and warding off competition. Managers also must take into account current market conditions when developing pricing strategies to ensure that the prices they choose fit market conditions. In addition, effective pricing strategy involves considering customers, costs, competition, and different market segments.

Pricing strategy entails in SQUARE Bangladesh more than reacting to market conditions, such as reducing pricing because competitors have reduced their prices. Instead, it encompasses more thorough planning and consideration of customers, competitors, and company goals. Furthermore, pricing strategies tend to vary depending on whether a company is a new entrant into a market or an established firm. New entrants sometimes offer products at low cost to attract market share, while incumbents’ reactions vary. Incumbents that fear the new entrant will challenge the incumbents’ customer base may match prices or go even lower than the new entrant to protect its market share. If incumbents do not view the new entrant as a serious threat, incumbents may simply resort to increased advertising aimed at enhancing customer loyalty, but have no change in price in efforts to keep the new entrant from stealing away customers.

The following sections explain how SQUARE Bangladesh develops pricing policy and strategy. First, cost-based pricing is considered. This is followed by the second topic of value-based pricing. Third, demand-based pricing is addressed followed by competition-based pricing. After this, several strategies for new and established pricing strategies are explained.

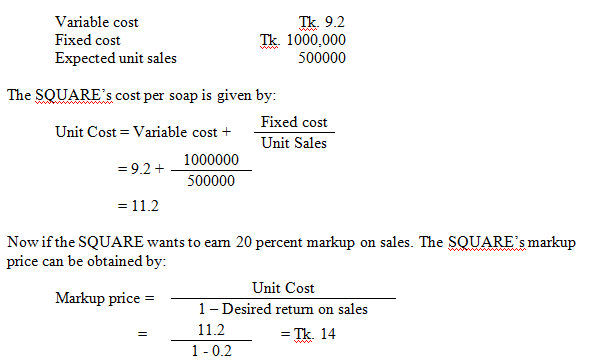

1. Cost-Based Pricing In SQUARE Bangladesh

The traditional pricing policy can be summarized by the formula:

Cost + Fixed profit percentage = Selling price.

Cost-based pricing involves the determination of all fixed and variable costs associated with a product or service. After the total costs attributable to the product or service have been determined, managers add a desired profit margin to each unit such as a 5 or 10 percent markup. The goal of the cost-oriented approach is to cover all costs incurred in producing or delivering products or services and to achieve a targeted level of profit.

By itself, this method is simple and straightforward, requiring only that managers study financial and accounting records to determine prices. This pricing approach does not involve examining the market or considering the competition and other factors that might have an impact on pricing. Cost-oriented pricing also is popular because it is an age-old practice that uses internal information that managers can obtain easily. In addition, a company can defend its prices based on costs, and demonstrate that its prices cover costs plus a markup for profit.

However, critics contend that the cost-oriented strategy fails to provide a company with an effective pricing policy. One problem with the cost-plus strategy is that determining a unit’s cost before its price is difficult in many industries because unit costs may vary depending on volume. As a result, many business analysts have criticized this method, arguing that it is no longer appropriate for modern market conditions.

Our focus: SQUARE Bangladesh

To illustrate markup pricing we consider the following cost and expected sales of soap produced by SQUARE Toiletries Ltd.:

While managers must consider costs when developing a pricing policy and strategy, costs alone should not determine prices. Many managers of industrial goods and service companies sell their products and services at incremental cost, and make their substantial profits from their best customers and from short-notice deliveries. When considering costs, managers should ask what costs they can afford to pay, taking into account the prices the market allows, and still allow for a profit on the sale. In addition, managers must consider production costs in order to determine what goods to produce and in what amounts. Nevertheless, pricing generally involves determining what prices customers can afford before determining what amount of products to produce. By bearing in mind the prices they can charge and the costs they can afford to pay, managers can determine whether their costs enable them to compete in the low-cost market, where customers are concerned primarily with price, or whether they must compete in the premium-price market, in which customers are primarily concerned with quality and features.

2. Break-Even Analysis and Target Pricing

The break-even point is the sales level at which revenue equals total costs. This means that at the break-even level of sales, there is neither a profit nor a loss. Understanding how profit varies requires an analysis of costs to identify those that change with a changing volume of sales and those that do not. With knowledge of the level of sales at which break-even is achieved and knowledge of the rate of change of profit, it is possible to estimate the profit for any level of sales within a large range. By using break-even concept a company can set their target pricing.

Our focus: SQUARE Bangladesh

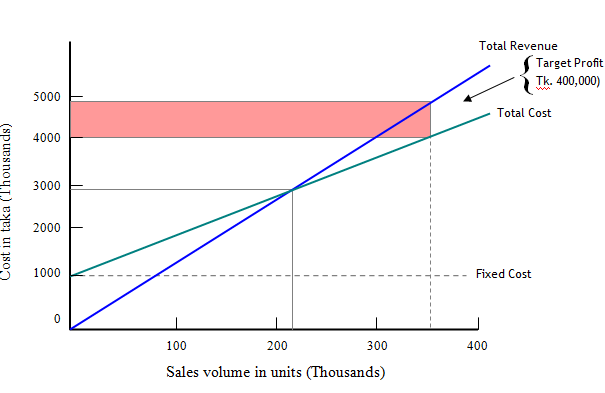

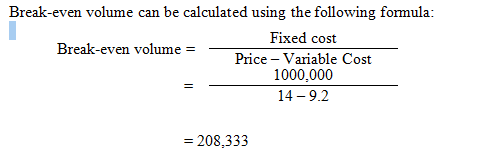

The figure shows break-even chart of SQUARE Toiletries Ltd for producing soap. Fixed costs are Tk. 1000,000 regardless of sales volume. Variable costs are added to fixed cost to form total costs, which rise with volumn. The total revenue curve starts at zero and rises with each unit sold. The slope of the total revenue curve reflects the price of Tk. 14 per soap.

The total revenue and total cost curves cross at 357,143 units. This break-even volume means at Tk. 14 SQUARE must sell at least 208,333 units of soap to reach break-even.

If the SQUARE wants to make a target profit, it must sell more than 208,333 units of soap at Tk. 14 each. If SQUARE invested Tk. 40,00,000 and wants to set price to earn a 20 percent return or Tk. 8,00,000 then SQUARE must sell at least 3,42,857 units at Tk. 14 each.

3. Value-Based Pricing

Value pricers adhere to the thinking that the optimal selling price is a reflection of a product or service’s perceived value by customers, not just the company’s costs to produce or provide a product or service. The value of a product or service is derived from customer needs, preferences, expectations, and financial resources as well as from competitors’ offerings.

Our focus: SQUARE Bangladesh

The managers of SQUARE Bangladesh have to query customers and research the market to determine how much they value a product or service. In addition, they compare their products or services with those of their competitors to identify their value advantages and disadvantages.

For example SQUARE Toiletries Ltd. manufactures Meril lip gel and petroleum jelly for all kinds of consumers according to their perceived value.

Yet, value-based pricing is not just creating customer satisfaction or making sales because customer satisfaction may be achieved through discounting alone, a pricing strategy that could also lead to greater sales. However, discounting may not necessarily lead to profitability.

Value pricing involves setting prices to increase profitability by tapping into more of a product or service’s value attributes. SQUARE Toiletries Ltd. This approach to pricing also depends heavily on strong advertising, especially for new products or services, in

order to communicate the value of products or services to customers and to motivate customers to pay more if necessary for the value provided by these products or services.

4. Demand-Based Pricing

Managers adopting demand-based pricing policies are, like value pricers, not fully concerned with costs. Instead, they concentrate on the behavior and characteristics of customers and the quality and characteristics of their products or services. Demand-oriented pricing focuses on the level of demand for a product or service, not on the cost of materials, labor, and so forth.

According to this pricing policy, managers try to determine the amount of products or services they can sell at different prices. Managers need demand schedules in order to determine prices based on demand. Using demand schedules, managers can figure out which production and sales levels would be the most profitable. To determine the most profitable production and sales levels, managers examine production and marketing costs estimates at different sales levels. The prices are determined by considering the cost estimates at different sales levels and expected revenues from sales volumes associated with projected prices.

The success of this strategy depends on the reliability of demand estimates. Hence, the crucial obstacle managers face with this approach is accurately gauging demand, which requires extensive knowledge of the manifold market factors that may have an impact on the number of products sold. Two common options managers have for obtaining accurate estimates are enlisting the help from either sales representatives or market experts. Managers frequently ask sales representatives to estimate increases or decreases in demand stemming from specific increases or decreases in a product or service’s price, since sales representatives generally are attuned to market trends and customer demands. Alternatively, managers can seek the assistance of experts such as market researchers or consultants to provide estimates of sales levels at various unit prices.

5. Competition-Based Pricing

With a competition-based pricing policy, a company sets its prices by determining what other companies competing in the market charge.

This is an opportunity to grow the business personally and professionally. People will buy from the company because of its honesty and competitive prices. Once the company captured its customers, it should invite them to join its mailing list which will make it easier for them to find great prices since it will update them when it has specials or new products to offer. The company may also want to use this list to hold a contest or to announce other benefits such as a frequent buyer program.

Our focus: SQUARE Bangladesh

The SQUARE Bangladesh follows competition-based pricing for sum of theirs product. They use the following steps:

- Identify its present competitors in the market

- Assesses its own product or service

- Identify the advantages and disadvantages of their products

- Setting prices higher/ lower/ equal with the competitors.

This pricing policy allows SQUARE to set prices quickly with relatively little effort, since it does not require as accurate market data as the demand pricing. Competitive pricing also makes distributors more receptive to their products because they are priced within the range the distributor already handles. Furthermore, this pricing policy enables SQUARE to select from a variety of different pricing strategies to achieve their strategic goals.

Competition based pricing of Meril Baby lotion manufactured by SQUARE Toiletries Ltd.

Product | Manufacturer | Quantity | Price |

| 1. Meril Baby lotion | SQUARE Toiletries Ltd. | 100 ml | 50 |

| 2. Johnson’s Baby lotion | Johnson & Johnson | 100 ml | 70 |

| 3. Ponds Body lotion | Uniliver | 100 ml | 45 |

SQUARE is facing a strong competition in the market. But it has set its product’s price by analyzing the market competition. It has been also successful in creating a loyal consumer segment that will purchase their product.

SQUAREBangladesh is one of the leading business organizations. There is no doubt effective use of pricing consideration and approaches play a vital role in their success. The growth of the company is remarkable (18.3%) in 2007 considering the market situation and the threshold is the implementation of new marketing strategies as well as other reforms.

In our report we have covered almost all of the business segments of SQUARE. We have found that all of those business segments sets price according to market demand, competition, cost and customers’ perceived value. So we can easily conclude that their pricing considerations and approaches are successful.

But in some sectors pricing should be a bit more realistic, such as their internet service providing sector. They should also have more interest in launching new products. Because new product pricing is much more challenging. And we think SQUARE should be more attentive to the pricing considerations and approaches of new products. Again they should vary their products and prices according to the target groups as they mostly charge same price for all.