1.1) Origin of the Report:As a part of IUB’s requirement for providing BBA Degree, I got placement as an internee at the Dilkusha Branch of Premier Bank on a 12-week internship program. This report is the outcome of my experience at the bank during the internship period.

1.2) Background of the Study:

Achievement of high economic growth is the basic principle of present economic policy of Bangladesh government. In achieving the objectives, the banking sector plays an important role. The banking sector channels resources through deposit mobilization and providing credit for different business ventures. The successful running of a bank business depends upon how effectively the credit management operates quality credit policy and recovered the funds. Premier Bank as a new commercial bank in Bangladesh responsibility bestows upon it to ensure efficient and effective banking operation in a sound manner. The main objectives of Premier Bank are:

- To ensure the safety of depositor and give them different types of credit facilities. Customer credit is one kind of credit facility, which help limited income people to buy and household effects including car, computer and other consumers durable.

- Credit Management is mainly concerned with the credit disbursement and recovery. In order to strengthen credit management and recovery position of the loans/advances by bank it has been decided by Premier Bank to follow some tools and technique for credit appraisal. With the use of such tools Premier Bank’s credit management has shown their efficiency.

1.3) Purpose of the Report:

The report is prepared as partial requirement of the B.B.A program in the final term.

1.4) Objective of the Study:

There were two objective of the study:

- General Objectives.

- Specific Objectives.

General Objectives of the report: As a new Bank, Premier Bank gives a careful look at its Credit Division. The General objective of this report is to describe the credit Management procedure of the bank and it’s efficiency. This report will cover all the procedure regarding all kinds of loan sanction, appraisal, disbursement and recovery.

Specific Objective of the project: Specific objective of the report is describing the practical experience I gathered during the 12 weeks internship program at the Bank.

1.5) Method of Data collection:

There were three basic data collection methods: a) Secondary data, b) Survey data and, c) experimental data. In the report two of the three approaches were used to collect data. They are:

- Secondary data

- Primary data.

Secondary Data: Utilization of data that were developed for some purposes other than helping solves the problem at hand. Secondary data are virtually collected at first because of their time and cost advantages. Secondary data is of two kinds: Internal and External

- Internal secondary data: Data gathered within the organization (Premier Bank) itself.

- External secondary data: Data gathered from sources outside the organization. For the recommendation part of the report different case studies on credit policy were followed.

Primary Data: It is often known as the survey data. Primary data are collected directly to help solve the problem at hand. It is the systematic collection of information directly from respondents. Several ways of collecting data will be used like:

- Personal Interviews with credit officer of the branch.

- Personal interviews with credit officer of the head office

1.6) Methodology of the Study:

Measurement Techniques: There are four major measurement techniques used for data collection:

1. Observation

2. Projection techniques and

3. Depth interviews

1.7) Scope of the Project:

A) Gathering data on the following:

- Credit policy of Premier Bank.

- Credit Sanctioning authority of the Bank.

- Processing and screening of credit proposal.

- Tools for appraisal credit.

- Techniques to recover the loans.

- Comparison efficiency of Credit management team with other banks.

B) Analysis of all the above data, from facts gathered and discussion with PBL management.

1.8) Limitation of the study:

Although I obtained wholehearted co-operation from the employee of Premier Bank, Dilkusha branch and Head Office in Dhaka, They were extremely busy, so they were not able to give me much time. On the way of study, I have faced the following problems, which may be termed as the limitations/shortcoming of the study. These are:

- Non-availability of adequate data: To understand the facts about the study in a realistic way and more clearly, the quantitative expression of information is represented by data. But as the bank is the newer one. That’s why I could not provide necessary secondary data in all area of the study.

- Lesser experience: Experience makes a man efficient. To do such kind of research activity, experience is mandatory. That’s why inexperience created obstacles to follow the systematic and logical research methodology.

2.1) History and Background:

Banking system occupies an important place in a nation’s economy. A banking institution is indispensable in a modern society. It plays a pivotal role in the economic development of a country. Against the background of liberalization of economic policies in Bangladesh, Premier Bank Limited emerged as a new commercial bank to provide efficient banking services with a view to improving the socio-economic development of the country.

Premier Bank Limited has been incorporated on 26th October, 1999 in Dhaka, Bangladesh as a public limited company with the permission of the Bangladesh Bank; Premier Bank Limited commenced formal commercial banking operation from the 26th October, 1999.

There are thirteen sponsors involved in creating Premier Bank Limited; the sponsors of the Bank have a long heritage of trade, commerce and industry. They are highly regarded for their entrepreneurial competence. The sponsors happen to be members of different professional groups among whom are also renowned banking professionals having vast range of banking knowledge. There are also members who are associated with other financial institutions like insurance companies, leasing company’s etc.

2.2) Objectives:

Premier Bank Limited aims at excellence and is committed to explore a new horizon of banking and provide a wide range of quality products and services comparable with those available with any modern bank in the world.

It is a bank for the common people including businessman and professionals. It intends to serve with quality at a price competitive to anyone in the financial market. It would constantly keep on exploring the needs of the clients.

The management of the bank bears in mind the fact that, they are on the threshold of a new millennium, which will pose extra ordinary challenges to be farced and at the same time open up new opportunities and possibilities. A young and talented team of business entrepreneurs and managers shall be required to guide the destiny of nation in the 21st Century.

For this reason the bank shall developed a youthful and exuberant management team-technologically sound and rich in experience. They would work hand in hand with zeal and enthusiasm to achieve the objectives of the bank in the new millennium.

2.3) Mechanism:

Commercial banking is the core activity of Premier Bank Limited. The bank serves all types of customers ranging from individuals to corporate entities, both private and public.

The standard services offered by Premier Bank Limited includes:

- One counter service for all banking needs of the customer.

- Customer counseling.

- Personalized services and relationship banking.

- Deposit baking.

- Loan and advances.

- Export and import financing.

- Inland and foreign remittance facilities.

Long-term target services of Premier Bank Limited include

- Investment banking supported by technology transfers programs.

- Leasing and lease financing.

- Capital market operation.

To reach the objective, Premier Bank Limited has its basket of service, among others.

- In house know how for feasibility study and strategic planning.

- Automated and computerized offices.

- Global network banking facilities.

2.4) Reserve:

Premier Bank Limited has statutory reserve fund of Tk. 25.3 million.

2.5) Operation results and profits appropriation:

The total income of the bank was on December 2001 Tk. 194.27 Crore, against a total expenditure to Tk. 70 Crore. An amount of TK. 15 Crore has been provided for taxation.

2.6) Deposits:

The Bank mobilized total deposits of Tk. 2197.72 Crore as on December 31, 2001. Competitive interest rates, sustained deposit mobilization efforts of he Bank, and increasing customer confidence in the Bank contributed to the notable growth in deposits. Efforts are being made to broaden the deposit base while reducing the average cost of funds.

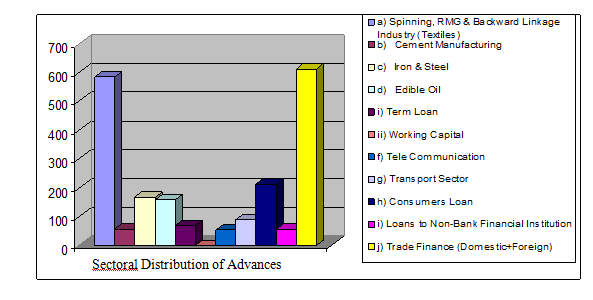

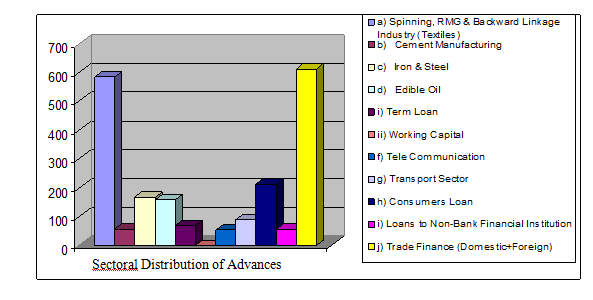

2.7) Advances:

The Bank has formulated its policy to give priority to small and medium businessmen while financing large-scale enterprises through the formation of a consortium of banks. The total loans and advances of the bank stood at Tk. 2057 Crore as on December 31, 2001.

2.8) Investment:

Investment stood at Tk. 270.13 Crore as on December 31, 2001. Investment consisted of Tk. 270 Crore in treasury bills.

2.9) Consumer Credit:

The bank has introduced a Micro Credit Scheme entitle ‘Consumer Credit Scheme’ to provide credit needs of low-income groups for domestic durables. The Consumer Credit Scheme has attracted a good response from customers. An amount of Tk. 212.10 million was disbursed as consumer credit loan. Recovery rate of the scheme is about 100%

2.10) Financial products and Services:

The bank has already introduce a number of financial products and services such as Consumer Credit Scheme, Small Loan Scheme, Lease Finance Scheme, Monthly Income scheme, Monthly Savings Scheme, Double Amount Deposit Scheme, Advance Savings Scheme and Rural Development Scheme.

3.1) General Banking:

General banking is one the main department of any bank to take any banking services one has to fulfill all the requirements of this department.

- Accepting deposit

- Issuance withdraws instrument e.g. cheque book DD TT P.O

3.1.1) Accepting Deposits:

Premier Bank Limited accepts the deposits like other banks may be classified in to

- Demand deposits

- Time Deposits.

Demand deposits: These Deposits are withdraw able without notification e.g. Current deposits Premier Bank Limited accepts demands through the opening of

- Current account

- Saving account

- Call deposits the fellow bankers.

Time deposits: Time deposits are payable at a fixed date or after period of notice. Premier Bank Limited accepts time deposits through fixed deposits receipt (FDR) Short-term deposit (STD) and bearer certificate deposit (BCD) etc. While accepting these deposits a contract is made between the bank and the customer. This contract will be a valid one only when both the parties are competent to enter into contracts. As account opening initiates the fundamental relationship& since the banker has to deal with different kinds of persons with different legal status Premier Bank Limited officials remain very much careful about the competency of customers.

3.1.2) Procedure for opening of accounts:

Before opening of a current or saving account the following formalities must be completed by the customers.

- Application on the prescribed form

- Furnishing photographs

- Introduction by an account holder

- Putting specimen signatures in the specimen card

- Mandate if necessary

- After fulfilling the above formalities Premier Bank Limited provides the customer a cheque book.

3.2) Types of deposits accounts and their formalities:

Premier Bank Limited offers following types of accounts and the formalities in addition to the previous are as follows:

3.2.1) Current account:

n In the name of Individual: The client has to fill up a light green account opening form terms and condition are printed on the back of the form The form contains the declaration clause special instructions etc Two copies of passport size photograph duly attested by the introducer are affixed with the form.

n In the Joint name: In this type, the formality is the same as individual account but in the special instruction clause either or survivor or former or survivor clause is marked.

n Proprietorship: In addition the customer has to submit the valid trade license and tax paying identification number (TIN) along with the application.

n Partnership: In case of partnership account the bank asks for:

- A copy of the partnership agreement (Partnership Deed)

- A letter having signature of all the partners containing the following particulars.

- The name and addresses of all the partners

- The nature of the firm’s business.

- The name of the partners authorized to operate the account in mane of the firm. Including authority to draw, endorse and accepting the bills and mortgage and sell the properties belonging to the firm.

n Limited company: On having the desire to open an account for a limited company, Officer asks for the following documents.

- Registration certificate from the registrar of joint stock of companies.

- Certificate of commencement of business.

- Memorandum of Association

- Articles of Association

- Copies of annual accounts

- Copy of the Board’s resolution which contains-

- The name of the persons who have been authorized to operate the bank account on behalf of the company.

- The name of the persons who are authorized to execute documents with the bank on company’s behalf.

n Societies clubs associations: In case of these sorts of accounts Premier Bank Limited requires the following documents-

- Registration certificate under the societies registration Act 1962

- Copies of Memorandum Articles of Association.

- Resolution of the managing committee

- Power of attorney to borrow.

NGO: The account opening procedure is same but with the exception that the registration certificate from the social welfare department of the government must be enclosed with the application.

Joint account in the name of minor: A minor cannot open an account in his own name due to the incapacity to enter into a contract. He can open an account in Premier Bank Limited in joint name of another person who will be the guardian of the minor.

Illiterate person: An illiterate person can open an account. The thumb impression is taken for the specimen signature card with utmost care Chequebook is issued to them but is kept under Bank’s custody. Premier Bank Limited highly discourages this kind of account.

3.2.2) Savings Accounts:

To encourage savings habit among the general public Banks allow deposits to open savings accounts. Interest is awarded on the balance of the account. The number of withdrawals is generally restricted. Requirements to open an account are as follows.

- Account opening from to be filled up by the applicant.

- Two passport size photograph attested by the introducer is needed.

- Introductory reference to be obtained from account holder acceptable to the bank.

- Specimen signature of the application is taken on the signature card.

- In saving account minimum Tk. 500is taken as deposits.

For opening every type of account a signature card and different register for different types of account is maintained in the bank. An account number is given for each account and the description of the account is entered in the computer. According to the rules of the bank a letter of thanks should be given to the account holder and to the introducer, but in practice it is not done.

n Call Deposits: These deposits are raised from fellow bankers. They can be recalled by the lending bank or repaid by the borrowing bank any time. The rate of interest is usually low, except when the money market is tight.

n Short term Deposits: In short term deposits the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. In Premier Bank Limited various big companies, organizations Government Departments keep money in STD accounts. Frequent withdrawal is discouraged and requires prior notice.

n Fixed Deposits: They are also known as time liabilities or term deposits. These are deposits, which are made with the bank for a fixed period specified in advance. The bank need not maintain cash reserve against these deposits and therefore, the bank offers high rate on such deposits.

In Premier Bank Limited fixed deposit account is opened in two forms- midterm (MTD), which is less than one year & the other, is term deposits, which is more than one year.

3.3) Opening fixed account:

The depositor has to fill an application form wherein he/she mentions the amount of deposits; the period for which the fixed deposit receipt is to be issued. In case of a deposit in joint name, Premier Bank Limited also takes the instructions regarding payment of money on maturity of the deposit. The banker also takes the specimen signature of the depositors. A FDR is then issued to the depositor acknowledging receipt of the sum of the money mentioned therein. It also contains the rate of interest & the date on which the deposit will fall due for payment.

3.4) Payment of Interest:

It is usually paid on maturity of the fixed deposit. Premier Bank Limited calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable account” is debited for the accrued interest.

3.5) Encashment of F.D.R:

In case of premature FDR, Premier Bank Limited is not bound to accept surrender of the deposit before its maturity date. In order to deter such a tendency, the interest on such a fixed deposit is made cut a certain percentage less than the agreed tare normally savings bank deposit interest rate is allowed.

3.6) Loss of F.D.R:

In case of a lost FDR the customer is asked to record a general diary in the nearest police station. After that, the customer has to furnish an indemnity bond to Premier Bank Limited a duplicate FDR is then issued to the customer by the bank.

3.7) Renewal of F.D.R:

In Premier Bank Limited instrument is automatically renewed within seven days after the date of its maturity if the customer does not come to encash the FDR the period for renewal is determined as the previous one.

3.8) Deposit Under Scheme:

Premier Bank Limited has already introduced various deposit schemes for the depositors. They are described as follows:

3.9) Monthly Saving Scheme (MSS):

The behavior of saving in our country is not satisfactory. Premier Bank Limited has introduced MSS to force saving behavior of people. Under this scheme, depositors can deposit a fixed amount for a fixed term, after maturity of this scheme they can get a handsome amount. Premier Bank Limited has designed this scheme under two categories one for small- earnings depositors and other for big-earnings people.

a) Monthly Income Scheme: In our country people have a certain savings amount which they utilize to earn a fixed amount so that they can bear their family maintenance. Beside various institutions want to utilize their fund to earn a fixed amount of profit in a month. To fulfill this type of demand Premier Bank Limited has introduced a scheme named Monthly Income Scheme. The deposits size is multiple of Tk. 50000. One can get 80%of loan securing this deposit for his very need.

b) Double amount Deposit scheme: This Scheme offers the depositors double amount of the deposit if the depositors keep the money under this scheme. They have to keep the amount for 6 years term with a condition of no withdrawn of cash. The deposit amount will be multiple of Tk. 10,000. One can take 80% loan through securing this deposit.

3.10) Cheque Book:

3.10.1) Cheque: According to section 6 of negotiable instruments act, 1881, a cheque is “A Bill of Exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.” To facilitate withdrawals and payments to third parties by the customer, Premier Bank Limited provides a chequebook to the customer. Cheque Book contains 10 leaves for savings account while for current account; it is 25 or 50 leaves. A chequebook issuing register is maintained in this regard. This register contains the chequebook number, leaf number, issuing date. After giving these entries to this register, information is sending to the computer department for taking necessary steps to pass the cheques during withdrawal.

The chequebook also contains requisition slip, which is used by the customer to obtain new chequebook. When all the leaves are used, the customer submits slip to the bank. A senior official then issues a new chequebook and subsequent entries and given in the register and computer.

If the chequebook is lost, the customer has to furnish a guarantee indemnifying the bank. After fulfilling this, a new chequebook is issued.

3.10.2) Dishonor of cheque: If the cheque is dishonored, Premier Bank Limited sends a memorandum (cheque return memo) to the customer describing the reason in the following way:

- Refer to Drawer

- Not arranged for

- Effects not cleared. May be presented again

- Exceeds arrangements

- Full cover not received

- Payment stopped by drawer

- Payee’s endorsement irregular/illegible/required

- Payee’s endorsement irregular, require Bank’s conformation

- Drawer’s signature differs/required

- Alternations in date/figures/words require drawer’s full signature

- Cheque is post dated/out of date/mutilated

- Amount is words and figures differs

- Crossed cheque must be presented through a bank

- Clearing stamp required/requires cancellation

- Addition to Bank’s discharge should be authenticated

- Cheque crossed “Account Payee Only”

- Collection Bank’s discharge irregular/required.

If the chequebook is lost then the customer must inform the police and should take copy of G.D (General Diary). The customer then fills an indemnity form guarantying that the cheque is lost. When the bank is convinced with having the above documents, the bank gives the customer a new chequebook.

3.11) Closing of an account:

The closing of an account may happen

- If the customer is desirous to close the account.

- If Premier Bank Limited finds that the account is inoperative for a long duration.

- If Garnishee Order is issued by the court on Premier Bank Limited.

To close the account, the Chequebook is to be returned to the bank. Premier Bank Limited takes all the changes by debiting the account and the remaining balance is then paid to the customer. Necessary entries are given to the account closing register and computer.

3.12) Demand Drafts (DD):

Demand Draft is an order to pay money, drawn by one office of Bank upon another office of the same Bank for a sum of money payable to order on demand. A draft can’t be drawn payable to bearer of a named payee. A draft can’t be drawn payable to bearer.

Customer or non-customers of the bank may purchase drafts. The purchaser of the draft must fill in the relative application form with his name, amount, and name of the payee, the branch on which the draft is desired, and sign it. He has to tender the amount in cash for the draft and Bank charges, if any. If the purchaser has an account with the bank to debit his account for the amount. The draft is prepared with care regarding the name of the payee, the amount and the office on which it is drawn. In order to ensure safety, the purchaser is advised to cross the draft and the bank gives a test number. Having issued the draft the issuing officer would send to the drawer branch, an advice containing the particulars of the draft.

3.12.1) Issuance of demand draft:

While issuing demand draft an official must be confirmed about the branch where the DD is to be issued or drawn as asked for by the application. Application on banks prescribed from for DD is obtained from the applicant duty filled and signed by them. Transfer, application will be asked to deposit the amount of DD and exchange/commission computed correctly at the prescribed rate. On receipt of cash voucher will be passed and scrolled by the offices, DD will be issued and record to DD issue register filling the appropriate columns. Test number if required is affixed on both DD and advice as instructions given by Head Office.

It is mentioned here that DD application is treated as credit voucher showing credit entry against contra branch (paying branch). For any amount of DD advice of IBCA should be issued and sent to paying branch.

3.12.2) Payment procedure:

Proceeds of DD received by the paying bank as and when it responds the relative advice on receipt of DD advice from different branched the paying banker will verity the genuineness of the advice by way of verifying test and signature. Total amount of advice will be debited of SB A/C and credited to drafts payable A/C. On production of DD by the beneficiary payment will be made by debited to the A/C credited earlier. If payment is to be made before receipt of the advice, DD is paid being recorded in Ex-Advice register by debit to drafts payable A/C (suspense A/C DD paid without advice). On receipt of eh advice, it will be entered into DD advice received register or draft payable register and the amount will be credited to drafts payable A/C or suspense A?C DD paid without advice as the case will be.

Before making payment of the DD the branch will ascertain the genuineness of its insurance as well as the genuineness of the payee open drafts may be paid proper identification of the payee and crossed drafts can never be paid in cash over the counter.

3.13) Telegraphic Transfer (T.T):

Telegraphic transfers are by far the quickest method of transferring funds from one place to another. The remitting branch sends a telegraphic message to the other end, to pay a certain sum of money to a named payee. Such a message is usually sent in code language. Prefixing or suffixing a check cipher authenticates the massage. A check cipher for a remittance is worked out on a test key table, access to which is allowed only to authorized officers. All TT are followed by written confirmations under the signature of authorized officer of the remitting branch. The receiving branch, after thoroughly checking the telegraphic message, acts on it.

3.14) Payment Order (PO):

Banks payment order is an instrument which contains an order for payment to the paid to effect local payment whether on behalf of the bank or its constituents. In the beginning stage, PO was issued only to effect local payment of Banks own obligations. But at present it is also issued to the customers, whom they can, purchases to deposit as secondary money or earnest money. The bank payment order is in the form of receipts and issued by joint signature of two officials. It ensure payment to the payee as the money deposited by the purchaser of PO is kept in the banks own A/C named “Payment Order A/C”. Payment of the instrument to be made from the branch it has been issued. It is not transferred and therefore it can only be paid to:

- The payee in identification.

- The payee’s banker, who should certify that the amount would be credited to payee A/C.

- The payee must authenticate a person holding the letter of authority from the payee whose signature.

- The purpose by cancellation provides the original PO is surrendered by him to the Bank.

3.15) Collection:

For safety and security people use financial instruments like DD, PO, Cheque etc. for financial instruments (bills) on behalf of their customers. The techniques that the Bank uses for this purpose are clearing, send for collection (SC) and Local Short Credit (LSC). When the bill is within the range of local clearinghouse it is sent for collection through clearinghouse. But if the bill is out of the clearing house range then it is collected by SC [Commonly known as Outward Bill for Collection (OBC)] and when the Bank collects bill, as an agent of the collection bank the system is known as LSC [commonly known as Inward Bill for Collection (IBC)].

3.16) Clearing:

As a cheque, payment order or bill comes from a bank within the range of local clearinghouse then it is sent for collection through clearinghouse. The cheque may be crossed or not. If a customer of Premier Bank Limited deposits a cheque another bank, which is within clearing area, then Premier Bank Limited will credit his account and collect it (cheque). Though the amount is credited in the customer’s account but he will not get the money until the cheque is honored.

3.17) Collection procedure for clearing:

- The cheque is first deposited through a received seal with the help of a slip.

- The collection bank gives a crossing with Premier Bank Limited, Dilkusha Branch. It indicates that the mentioned bank is the collection bank.

- Entry for outward clearing register is given with clearing seal and giving the cheque a subsidiary seal.

- The cheque is then send to Premier Bank Limited, Local Office along with other cheque (if any). Three sets of vouchers are prepared for this purpose.

If the cheque is on other branch of Premier Bank Limited with in some clearing area then it is collected through inward clearinghouse of Premier Bank Limited.

3.18) Dispatch:

The literal meaning of the term dispatch is to send away quickly or to receive an official message. There are two types of dispatch:

- Dispatch of letter

- Dispatch of telegram

For convenience of the term dispatch of letter has been classified into two groups, mainly inward mail and outward mail. Outward mail is again classified into ordinary letter and registered letters/registered parcel.

Each branch will maintain a deposit account with the local telegram office to whom the amount of initial deposit will be paid by debit by to charges A/C under advice to accounts division, head office, where a record of all such deposits paid by branches are maintained. The receipt for the deposit will be recorded in the branches documents register and retained with other documents.

3.19) Account Department:

Account department is called as the nerve center of the bank. In banking business, transactions are done every day and these transactions are to be recorded properly and systematically as the banks deal with the depositors money. Any deviation in proper recording may hamper public confidence and the bank has to suffer a lot otherwise. Improper recording of transactions will lead to the mismatch in the debit side and in the credit side. To avoid these mishaps, the bank provides a separate department; whose function is to check the mistakes in assign vouchers or wrong entries or fraud or forgery. This department is called as Account Department.

Besides the above the bank has to prepare some internal statements as well as some statutory statements which to be submitted to the central bank. Account Department prepares these statements also. The department has to submit some statements to the Head Office, which is also consolidated by the Head Office later on. The tasks of the department may be seen in two different angles:

Daily Task:

The routine daily tasks of the Account Department are as follows-

- Recording the transactions in the cashbook.

- Recording the transactions in general and subsidiary ledger.

- Preparing the daily position of the branch of the branch comprising of deposit and cash.

- Preparing the daily statement of affairs showing all the assets and liability of the branch as per.

- General Ledger and Subsidiary Ledger separately.

- Making payment of all the expenses of the branch.

- Recording inter-branch fund transfer and providing accounting treatment in this regard.

- Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’ if otherwise making it correct by calling the respective official to rectify the voucher.

- Recording of the vouchers in the voucher register.

- Packing of the correct vouchers according to the debit voucher and the credit voucher.

Periodical tasks:

The routine periodical tasks performed by the department are as follows-

- Preparing the monthly salary statements for the employees.

- Publishing the basic data of branch.

- Preparing the weekly position for the branch which is send to the Head Office to maintain Cash Reserve Requirement (CRR).

4.1) Principles of loans:

The granting of advances is one of the most important functions of a Bank and the test of Bank strength considerably on the quality of its advances and proportion they bear to the total deposit. Although receipt from exchange, commission and banks charges contribute a fair amount of the profits or commercial Bank, its earning are chiefly derived from interest charged on loans and discounts. A wise and prudent policy with regard to advances is therefore considered an important factor inspiring confidence in the depositor and customers of a Bank. Traditionally banks have been following three cardinal principle of lending. They are: safety, liquidity and profitability.

Loan and advances may be made either of the personal security of the borrower on the security of some tangible assets. The former is called unsecured or clean or personal advances and latter is called secured advances.

Confidence in the borrower is the basis of unsecured advances. The confidence is judge by three considerations, character, capacity and capital.

Secured advances mean loans and made on the security of tangible assets like land, building, machinery, goods and documents of title goods. Such loans provide absolute safely to a banker by creation of charge on the assets in favor of him.

(Dr. A. R. Khan: Bank Management; 3rd Edition)

4.2) Written loan policy:

One of the most important ways a bank can make sure its loans meet regulatory standards and are profitable is to establish a written loan policy. Such a policy gives loan officers and the bank’s management specific guidelines in making individual loan decisions and in shaping the bank’s overall loan portfolio. The actual makeup of a bank’s loan portfolio should reflect what its loan policy says. Otherwise, the loan policy is not functioning effectively and should be either revised or more strongly enforced by senor management.

Elements should cover in the credit policy:

- A goal statement for the bank’s loan portfolio.

- Specification of the lending authority given to each loan officer and loan committee.

- Lines of responsibility in making assignments and reporting information within the loan department.

- Operation procedures for soliciting, reviewing, evaluation and making decisions on customer loan applications.

- The required documentation that is to accompany each loan application and what must be kept in the bank’s credit files.

- Lines of authority within the bank, detailing who is responsible for maintaining and reviewing the bank’s credit files.

A written loan policy statement carries a number of advantages for the bank adopting it. It communicates to employees working in the loan department what procedures they must follow and what their responsibilities are. It helps the bank move toward a loan portfolio that can successfully blend multiple objectives.

(Peter S. Rose: Commercial Bank Management; 4th Edition)

4.3) Standard steps in the lending process:

Most bank loans to individuals arise from a direct request from a customer who approaches a member of the bank’s staff and asks to fill out a loan application. Business loan requests, on the other hand, often arise from contacts the bank’s loan officers and sales representatives make as the solicit new accounts from firms operation in the bank’s market area.

Once a customer decides to request a loan, an interview with a loan officer usually follows right away, giving the customer the opportunity to explain his or her credit needs. That interview is particularly important because it provides an opportunity for the bank’s loan officer to assess the customer’s character and sincerity of purpose.

If a business or mortgage loan is applied for, a site visit is usually made by an officer of the bank to assess the customer’s location and the condition of the property and to ask clarifying questions. The loan officer may contact other creditors who have previously loaned money to this customer to see what their experience has been. Did the customer fully adhere to previous loan agreements and keep satisfactory deposit balances?

If all is favorable to this point, the customer is asked to submit several crucial documents the bank needs in order to fully evaluate the loan request, incluing complete financial statements and, in the case of a corporation, board of directors’ resolutions authorizing the negotiation of a loan with the bank. Once all documents are on file, the credit analysis division of the bank conducts a thorough financial analysis of them aimed at determining whether the customer has sufficient cash flows and backup assets to repay the loan. The credit analysis division then prepares a brief summary and recommendation, which goes to the loan committee for approval. On larger loans, members of the credit analysis division give an oral presentation, and discussion will ensue between staff analysts and the loan committee over the strong and weak points of a loan request.

If the loan committee approves the customer’s request, the loan officer or the credit committee will usually check on the property r other assets to be pledged as collateral in order to ensure that the bank has immediate access to the collateral or can acquire title to the property involved if the loan agreement is defaulted. This is often referred to as perfecting the bank’s claim to collateral. Once the loan officer and the bank’s loan committee are satisfied that both the loan and the proposed collateral are sound, the note and other documents that make up a loan agreement are prepared and are signed by all parties to the agreement.

(Practical Banking Advances by H.L.Bedi & V.K.Hardikar; 9th Edition, 1993)

4.4) Credit Analysis:

The division of the bank responsible for analyzing and making recommendations on the fate of most loan applications is the credit department. Experience has shown that this department must satisfactorily answer three major questions regarding each loan application:

- Is the borrower creditworthy? How do you know?

- Can the loan agreement be properly structured and documented so that the bank and its depositors are adequately protected and the customer has a high probability of being able to service the loan without excessive strain?

- Can the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk?

Let’s look in turn at each of these three key issues in the “yes” or “no” decision a bank must make on every loan request.

4.4.1) Creditworthiness:

The question that must be dealt with before any other is whether or not the customer can service the loan-that is, pay out the credit when due, with a comfortable margin for error.

a) Character: The loan officer must be convinced that the customer has a well defined purpose for requesting bank credit and a serious intention to repay. If the officer is not sure exactly why the customer is requesting a loan, this purpose must be clarified to the bank’s satisfaction. Once the purpose is known, the loan officer must determine if is consistent with the bank’s current loan policy. Even with a good purpose, how ever, the loan officer must determine that the borrower has a responsible attitude to ward using borrowed funds.

b) Capacity: The loan officer must be sure that the customer requesting credit has the authority to request a loan and the legal standing to sign a binding loan agreement. This customer characteristic is known as the capacity to borrow money. The loan officer must be sure that the representative from a corporation asking for credit has proper authority from the company’s board of directors to negotiate a loan and sign a credit agreement binding the corporation. Usually this can be determined by obtaining a copy of the resolution passed by a corporate customer’s board of directors, authorizing the company to borrow money.

Cash: This key feature of any loan application centers on the question: Does the borrower have the ability to generate enough cash, in the form of cash flow, to repay the loan? In general, borrowing customers have only three sources to draw upon to repay their loans:

(a) cash flows generated from sales or income

(b) the sale or liquidation of assets or

(c) funds raised by issuing debt or equity securities.

Any of these sources may provide sufficient cash to repay a bank loan.

c) Collateral: In assessing the collateral aspect of a loan request, the loan officer must ask, does the borrower posses adequate net worth or own enough quality assets to provide adequate support for the loan? The loan officer is particularly sensitive to such feature as the age, condition, and degree of specialization of the borrower’s assets.

d) Conditions: The loan officer and credit analyst must be aware of recent trends in the borrower’s line of work or industry and how changing economic conditions might affect the loan. A loan can look very good or paper, only to have its value eroded by declining sales or income is a recession or by the high interest rates occasioned by inflation.

e) Control: The last factor in assessing a borrower’s creditworthy status in control which center on such question as whether changes in law and regulation could adversely affect the borrower and whether the loan request meets the bank’s and the regulatory authorities’ standards for loan quality.

(Peter S. Rose: Commercial Bank Management; 4th Edition)

4.4.2) Properly structured and documented proposal:

The loan officer is responsible to both the customer and the bank’s depositors and stockholders and must seek to satisfy the demands of all. This requires, first, the drafting of a loan agreement that meets the borrower’s need for funds with a comfortable repayment schedule. The borrower must be able to comfortably handle any required loan payments, because the bank’s success depends fundamentally on the success of its customers. If a major borrower gets into trouble because it is unable to service a loan, the bank may find itself in serious trouble as well. Proper accommodation of a customer may involve lending more or less money than asked for over a longer or shorter period than requested. Thus, the bank’s loan officer must be a financial counselor to customers as well as a conduit for their loan applications.

A properly structured loan agreement must also protect the bank and those it represents- principally its depositors and stockholders- by imposing certain restrictions on the borrower’s activities when these activities could threaten the recovery of bank funds. The process of recovering the bank’s funds- when and where the bank can take action to get its funds returned- also must be carefully spelled out in a loan agreement.

(Commercial Lending by George E. Ruth)

4.5) Credit Risk Evaluation:

An accurate appraisal of risk in any credit exposure is highly subjective matter involving quantitative and quantitative judgments, where

Quantitative factors refer to the analysis of financial statement ratios.

Qualitative factors refer to the assessment of management, industry position, customer/supplier relations, account performance and reputation.

Bank usually analyzes both quantitative and qualitative factors in a combined way for assessing borrower’s financial position. In evaluating any credit proposal, the analyst uses the following distinct and logical steps:

- Evaluating the past performance of the borrower

- Assessing the risk of failure by identifying factors in the borrowers present condition and past performances which indicates likelihood of success to repay the loan

- Forecasting the probable future condition of the borrower and deciding whether to accept or reject a loan proposal

- Setting terms and conditions of credit facilities

- Obtaining the sanction documents and disbursing the loan

- Monitoring performance and ensuring repayment /recovery

The most pertinent and prime part of the process is assessment of risk of failure to repay deals with the overall lending risk combining

- Business Risks

- Financial Risks

- Management Risks

- Security Risks

- Environmental Risks

The following basic aspects are taken into consideration while conducting business risks, financial risks, management risks, security risks and environmental risks.

4.6) Business Risks:

4.6.1) Business Risks analyses:

- Description of business, its characteristics, whether the business is labor intensive or capital intensive, competitive or monopoly. Industrial projects are appraised to determine its size, maturity and diversification.

- Analyzing the suppliers’ bargaining power, reliability, availability and sources of supply

- Sales analysis is conducted to determine the product’s current demand, unsatisfied demand, future demand and competition.

- Production risk involves production capacity, plant and equipment efficiency, technological advances, labor relations etc.

- Industry trend involves market size and its nature, rivalry among industries etc.

4.6.2) Financial Risks:

The purpose of financial appraisal is to assess the viability of the proposed project in terms of its operation in the future year and its financial soundness. To ensure the current solvency as well as the continued solvency during the currency of loan of its client, bank analyzes the following financial aspects:

- Investment outlay and cost of the project

- Means of financing

- Cost of Capital

- Cash Flow Analysis

- Internal Rate of Return

- Analyzing Balance Sheet and Income Statement to determine liquidity, profitability, and debt management.

- Sensitivity Analysis and Ratio Analysis

4.6.3) Management Risks:

Implementing the credit policy adequately before extending a credit depends highly on the promoter’s integrity, experience, competency, commitment and their capabilities. Management risks involve:

- High degree of employee turnover

- Inefficient financial control

- Lack of willingness to adapt the changing situation

- Unaware of different market position.

4.6.4) Security Risks:

Security risks refer to inadequacy of collateral offered and supported by liquidation analysis in terms of marketability, valuations of security and legal issues. It is the risk that the bank falls to realize the security. Security risks involve:

- Obtaining a favorable judgment

- Perfection level of security documents

- Getting possession of security

- Realized security value may be less than the exposure

- Increasing duration of liquidation process.

4.6.5) Environmental / Economic Risks:

A project must be judge from the larger social point of view. It includes:

- Large industries may pollute air and water by the residue like gas and other dangerous chemical liquid, such projects may be considered as environment unfriendly.

- Product or service may be banned by the society or govt.

- Change in weather may affect the demand of the product.

(Practical Banking Advances by H.L.Bedi & V.K.Hardikar; 9th Edition, 1993)

4.7) Collateral:

While large corporations and other borrowers with impeccable credit ratings often borrow unsecured. With no specific collateral pledged behind their loans except their reputations and ability to generate earnings. Most borrowers at one time or another will be asked to pledge some of their assets or to personally guarantee the repayment of their loans. Getting a pledge of certain borrower assets as collateral behind a loan really serves two purposes for a lender. If the borrower can’t pay, the pledge of collateral gives the lender the right to seize and sell those assets designated as loan collateral, using the proceeds of the sale to cover what the borrower did not pay back. Secondly, collateralization of a loan gives the lender a psychological advantage over the borrower.

The goal of a bank taking collateral is to precisely define which borrower assets are subject to seizure and sale and to document for all other creditors to see that the bank has a legal claim to those assets in the event of nonperformance on a loan.

Common types of loan collateral:

Accounts Receivable: The bank takes a security interest in the form of a stated percentage of the face amount of accounts receivable shown on a business borrower’s balance sheet.

Factoring: A bank can purchase a borrower’s accounts receivable based upon some percentage of their book value. The percentage figure used depends on the quality and age of the receivable.

Inventory: In return for a loan, a bank may take a security interest against the current amount of inventory of goods or raw materials owned by a business borrower. Usually a bank will lend only a percentage of the estimated market value of a borrower’s inventory in order to leave a substantial cushion in case the inventory’s value begins to decline.

Personal Property: Banks take a security interest in automobiles, furniture, jewelry, securities, and other forms of personal property owned by a borrower.

Personal Guarantees: A pledge of the stock, deposits, or other personal assets held by the major stockholders or owners of a company may be required as collateral to secure a business loan. Guarantees are often sought by banks in lending to smaller businesses or to firms that have fallen on difficult times.

(Peter S. Rose: Commercial Bank Management; 4th Edition)

4.8) Standard Loan Review Process:

1. Carrying out reviews of all types of loans on a periodic basis- for example, every 30, 60, or 90 days the largest loan outstanding may be routinely examined, along with a random sample of smaller loans.

2. Structuring the loan review process carefully to make sure the most important features of each loan are checked, including:

a) The record of borrower payments. To ensure that the customer is not falling behind the planned repayment schedule.

b) The quality and condition of any collateral pledge behind the loan.

c) The completeness of loan documentation, to make sure the bank has access to any collateral pledged and possesses the full legal authority to take action against the borrower in the courts if necessary.

d) An evaluation of whether the borrower’s financial condition and forecasts have changed, which may have increased or decreased the borrower’s need for bank credit.

e) An assessment of whether the loan conforms to the bank’s lending policies and to the standards applied to its loan portfolio by examiners from the regulatory agencies.

3. Reviewing most frequently the largest loan, because default on these credit agreements could seriously affect he bank’s own financial condition.

4. Conduction more frequent reviews of troubled loans, with the frequency of review increasing as the problems surrounding any particular loan increase.

Loan review is not a luxury but a necessity for a sound bank lending program. It not only helps management spot problem loans more quickly but also acts as a continuing check on whether loan officers are adhering to the bank’s loan policy. For this reason, as well as to promote objectivity in the loan review process, many of the largest banks separate their loan review personnel from the loan department itself.

(Peter S. Rose: Commercial Bank Management; 4th Edition)

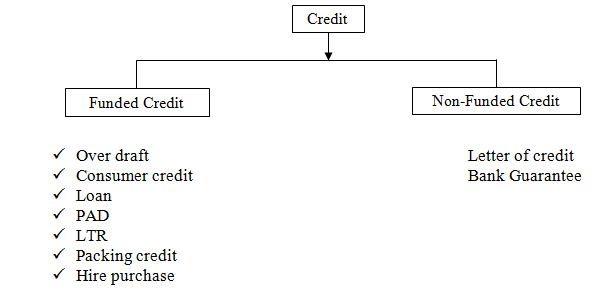

The word credit comes from the Latin word Credo meaning “I believe” It is a lenders trust in a person/firm/company’s ability or potential ability to command goods or service of another in return for promise to pay loans and advances has always been prominent profitable function of bank. Sanctioning credit to customer and other out of the fund at its disposals is one of the principal services of a modern bank. Advances by Premier Bank Limited are made in different forms. Such as loans Overdraft, cash credit bills purchased and discount rate etc. Premier Bank Limited. Deals with the money from the depositors repayable on demand. So, is cannot afford to lock up it fund for long periods. Premier Bank Limited usually grants short-term advances, which are utilized to meet the working capital requirement of the borrower. Only a small portion of bank’s demand and time liability is advanced on long –term basis where the banker usually insists on a regular repayment by the borrower in installments.

qTypes of credit facilities extended by Premier Bank Limited:

The credit facilities extended by Premier Bank Limited can be divided in to two ways.

1.1) Origin of the Report:

As a part of IUB’s requirement for providing BBA Degree, I got placement as an internee at the Dilkusha Branch of Premier Bank on a 12-week internship program. This report is the outcome of my experience at the bank during the internship period.

1.2) Background of the Study:

Achievement of high economic growth is the basic principle of present economic policy of Bangladesh government. In achieving the objectives, the banking sector plays an important role. The banking sector channels resources through deposit mobilization and providing credit for different business ventures. The successful running of a bank business depends upon how effectively the credit management operates quality credit policy and recovered the funds. Premier Bank as a new commercial bank in Bangladesh responsibility bestows upon it to ensure efficient and effective banking operation in a sound manner. The main objectives of Premier Bank are:

- To ensure the safety of depositor and give them different types of credit facilities. Customer credit is one kind of credit facility, which help limited income people to buy and household effects including car, computer and other consumers durable.

- Credit Management is mainly concerned with the credit disbursement and recovery. In order to strengthen credit management and recovery position of the loans/advances by bank it has been decided by Premier Bank to follow some tools and technique for credit appraisal. With the use of such tools Premier Bank’s credit management has shown their efficiency.

1.3) Purpose of the Report:

The report is prepared as partial requirement of the B.B.A program in the final term.

1.4) Objective of the Study:

There were two objective of the study:

- General Objectives.

- Specific Objectives.

General Objectives of the report: As a new Bank, Premier Bank gives a careful look at its Credit Division. The General objective of this report is to describe the credit Management procedure of the bank and it’s efficiency. This report will cover all the procedure regarding all kinds of loan sanction, appraisal, disbursement and recovery.

Specific Objective of the project: Specific objective of the report is describing the practical experience I gathered during the 12 weeks internship program at the Bank.

1.5) Method of Data collection:

There were three basic data collection methods: a) Secondary data, b) Survey data and, c) experimental data. In the report two of the three approaches were used to collect data. They are:

- Secondary data

- Primary data.Secondary Data: Utilization of data that were developed for some purposes other than helping solves the problem at hand. Secondary data are virtually collected at first because of their time and cost advantages. Secondary data is of two kinds: Internal and External

- Internal secondary data: Data gathered within the organization (Premier Bank) itself.

- External secondary data: Data gathered from sources outside the organization. For the recommendation part of the report different case studies on credit policy were followed.

Primary Data: It is often known as the survey data. Primary data are collected directly to help solve the problem at hand. It is the systematic collection of information directly from respondents. Several ways of collecting data will be used like:

- Personal Interviews with credit officer of the branch.

- Personal interviews with credit officer of the head office

1.6) Methodology of the Study:

Measurement Techniques: There are four major measurement techniques used for data collection:

1. Observation

2. Projection techniques and

3. Depth interviews

1.7) Scope of the Project:

A) Gathering data on the following:

- Credit policy of Premier Bank.

- Credit Sanctioning authority of the Bank.

- Processing and screening of credit proposal.

- Tools for appraisal credit.

- Techniques to recover the loans.

- Comparison efficiency of Credit management team with other banks.

B) Analysis of all the above data, from facts gathered and discussion with PBL management.

Although I obtained wholehearted co-operation from the employee of Premier Bank, Dilkusha branch and Head Office in Dhaka, They were extremely busy, so they were not able to give me much time. On the way of study, I have faced the following problems, which may be termed as the limitations/shortcoming of the study. These are:

- Non-availability of adequate data: To understand the facts about the study in a realistic way and more clearly, the quantitative expression of information is represented by data. But as the bank is the newer one. That’s why I could not provide necessary secondary data in all area of the study.

- Lesser experience: Experience makes a man efficient. To do such kind of research activity, experience is mandatory. That’s why inexperience created obstacles to follow the systematic and logical research methodology.

2.1) History and Background:

Banking system occupies an important place in a nation’s economy. A banking institution is indispensable in a modern society. It plays a pivotal role in the economic development of a country. Against the background of liberalization of economic policies in Bangladesh, Premier Bank Limited emerged as a new commercial bank to provide efficient banking services with a view to improving the socio-economic development of the country.

Premier Bank Limited has been incorporated on 26th October, 1999 in Dhaka, Bangladesh as a public limited company with the permission of the Bangladesh Bank; Premier Bank Limited commenced formal commercial banking operation from the 26th October, 1999.

There are thirteen sponsors involved in creating Premier Bank Limited; the sponsors of the Bank have a long heritage of trade, commerce and industry. They are highly regarded for their entrepreneurial competence. The sponsors happen to be members of different professional groups among whom are also renowned banking professionals having vast range of banking knowledge. There are also members who are associated with other financial institutions like insurance companies, leasing company’s etc.

2.2) Objectives:

Premier Bank Limited aims at excellence and is committed to explore a new horizon of banking and provide a wide range of quality products and services comparable with those available with any modern bank in the world.

It is a bank for the common people including businessman and professionals. It intends to serve with quality at a price competitive to anyone in the financial market. It would constantly keep on exploring the needs of the clients.

The management of the bank bears in mind the fact that, they are on the threshold of a new millennium, which will pose extra ordinary challenges to be farced and at the same time open up new opportunities and possibilities. A young and talented team of business entrepreneurs and managers shall be required to guide the destiny of nation in the 21st Century.

For this reason the bank shall developed a youthful and exuberant management team-technologically sound and rich in experience. They would work hand in hand with zeal and enthusiasm to achieve the objectives of the bank in the new millennium.

2.3) Mechanism:

Commercial banking is the core activity of Premier Bank Limited. The bank serves all types of customers ranging from individuals to corporate entities, both private and public.

The standard services offered by Premier Bank Limited includes:

- One counter service for all banking needs of the customer.

- Customer counseling.

- Personalized services and relationship banking.

- Deposit baking.

- Loan and advances.

- Export and import financing.

- Inland and foreign remittance facilities.

Long-term target services of Premier Bank Limited include:

- Investment banking supported by technology transfers programs.

- Leasing and lease financing.

- Capital market operation.

To reach the objective, Premier Bank Limited has its basket of service, among others.

- In house know how for feasibility study and strategic planning.

- Automated and computerized offices.

- Global network banking facilities.

2.4) Reserve:

Premier Bank Limited has statutory reserve fund of Tk. 25.3 million.

2.5) Operation results and profits appropriation:

The total income of the bank was on December 2001 Tk. 194.27 Crore, against a total expenditure to Tk. 70 Crore. An amount of TK. 15 Crore has been provided for taxation.

2.6) Deposits:

The Bank mobilized total deposits of Tk. 2197.72 Crore as on December 31, 2001. Competitive interest rates, sustained deposit mobilization efforts of he Bank, and increasing customer confidence in the Bank contributed to the notable growth in deposits. Efforts are being made to broaden the deposit base while reducing the average cost of funds.

2.7) Advances:

The Bank has formulated its policy to give priority to small and medium businessmen while financing large-scale enterprises through the formation of a consortium of banks. The total loans and advances of the bank stood at Tk. 2057 Crore as on December 31, 2001.

2.8) Investment:

Investment stood at Tk. 270.13 Crore as on December 31, 2001. Investment consisted of Tk. 270 Crore in treasury bills.

2.9) Consumer Credit:

The bank has introduced a Micro Credit Scheme entitle ‘Consumer Credit Scheme’ to provide credit needs of low-income groups for domestic durables. The Consumer Credit Scheme has attracted a good response from customers. An amount of Tk. 212.10 million was disbursed as consumer credit loan. Recovery rate of the scheme is about 100%

2.10) Financial products and Services:

The bank has already introduce a number of financial products and services such as Consumer Credit Scheme, Small Loan Scheme, Lease Finance Scheme, Monthly Income scheme, Monthly Savings Scheme, Double Amount Deposit Scheme, Advance Savings Scheme and Rural Development Scheme.

3.1) General Banking:

General banking is one the main department of any bank to take any banking services one has to fulfill all the requirements of this department.

- Accepting deposit

- Issuance withdraws instrument e.g. cheque book DD TT P.O

3.1.1) Accepting Deposits:

Premier Bank Limited accepts the deposits like other banks may be classified in to

- Demand deposits

- Time Deposits.

Demand deposits: These Deposits are withdraw able without notification e.g. Current deposits Premier Bank Limited accepts demands through the opening of

- Current account

- Saving account

- Call deposits the fellow bankers.

Time deposits: Time deposits are payable at a fixed date or after period of notice. Premier Bank Limited accepts time deposits through fixed deposits receipt (FDR) Short-term deposit (STD) and bearer certificate deposit (BCD) etc. While accepting these deposits a contract is made between the bank and the customer. This contract will be a valid one only when both the parties are competent to enter into contracts. As account opening initiates the fundamental relationship& since the banker has to deal with different kinds of persons with different legal status Premier Bank Limited officials remain very much careful about the competency of customers.

3.1.2) Procedure for opening of accounts:

Before opening of a current or saving account the following formalities must be completed by the customers.

- Application on the prescribed form

- Furnishing photographs

- Introduction by an account holder

- Putting specimen signatures in the specimen card

- Mandate if necessary

- After fulfilling the above formalities Premier Bank Limited provides the customer a cheque book.

3.2) Types of deposits accounts and their formalities:

Premier Bank Limited offers following types of accounts and the formalities in addition to the previous are as follows:

3.2.1) Current account:

n In the name of Individual: The client has to fill up a light green account opening form terms and condition are printed on the back of the form The form contains the declaration clause special instructions etc Two copies of passport size photograph duly attested by the introducer are affixed with the form.

n In the Joint name:In this type, the formality is the same as individual account but in the special instruction clause either or survivor or former or survivor clause is marked.

n Proprietorship: In addition the customer has to submit the valid trade license and tax paying identification number (TIN) along with the application.

n Partnership: In case of partnership account the bank asks for:

- A copy of the partnership agreement (Partnership Deed)

- A letter having signature of all the partners containing the following particulars.

- The name and addresses of all the partners

- The nature of the firm’s business.

- The name of the partners authorized to operate the account in mane of the firm. Including authority to draw, endorse and accepting the bills and mortgage and sell the properties belonging to the firm.

n Limited company: On having the desire to open an account for a limited company, Officer asks for the following documents.

- Registration certificate from the registrar of joint stock of companies.

- Certificate of commencement of business.

- Memorandum of Association

- Articles of Association

- Copies of annual accounts

- Copy of the Board’s resolution which contains-

- The name of the persons who have been authorized to operate the bank account on behalf of the company.

- The name of the persons who are authorized to execute documents with the bank on company’s behalf.

n Societies clubs associations: In case of these sorts of accounts Premier Bank Limited requires the following documents-

- Registration certificate under the societies registration Act 1962

- Copies of Memorandum Articles of Association.

- Resolution of the managing committee

- Power of attorney to borrow.

n NGO: The account opening procedure is same but with the exception that the registration certificate from the social welfare department of the government must be enclosed with the application.

n Joint account in the name of minor: A minor cannot open an account in his own name due to the incapacity to enter into a contract. He can open an account in Premier Bank Limited in joint name of another person who will be the guardian of the minor.

n Illiterate person: An illiterate person can open an account. The thumb impression is taken for the specimen signature card with utmost care Chequebook is issued to them but is kept under Bank’s custody. Premier Bank Limited highly discourages this kind of account.

3.2.2) Savings Accounts:

To encourage savings habit among the general public Banks allow deposits to open savings accounts. Interest is awarded on the balance of the account. The number of withdrawals is generally restricted. Requirements to open an account are as follows.

- Account opening from to be filled up by the applicant.

- Two passport size photograph attested by the introducer is needed.

- Introductory reference to be obtained from account holder acceptable to the bank.

- Specimen signature of the application is taken on the signature card.

- In saving account minimum Tk. 500is taken as deposits.

For opening every type of account a signature card and different register for different types of account is maintained in the bank. An account number is given for each account and the description of the account is entered in the computer. According to the rules of the bank a letter of thanks should be given to the account holder and to the introducer, but in practice it is not done.

n Call Deposits: These deposits are raised from fellow bankers. They can be recalled by the lending bank or repaid by the borrowing bank any time. The rate of interest is usually low, except when the money market is tight.

n Short term Deposits: In short term deposits the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. In Premier Bank Limited various big companies, organizations Government Departments keep money in STD accounts. Frequent withdrawal is discouraged and requires prior notice.

n Fixed Deposits: They are also known as time liabilities or term deposits. These are deposits, which are made with the bank for a fixed period specified in advance. The bank need not maintain cash reserve against these deposits and therefore, the bank offers high rate on such deposits.

In Premier Bank Limited fixed deposit account is opened in two forms- midterm (MTD), which is less than one year & the other, is term deposits, which is more than one year.

3.3) Opening fixed account:

The depositor has to fill an application form wherein he/she mentions the amount of deposits; the period for which the fixed deposit receipt is to be issued. In case of a deposit in joint name, Premier Bank Limited also takes the instructions regarding payment of money on maturity of the deposit. The banker also takes the specimen signature of the depositors. A FDR is then issued to the depositor acknowledging receipt of the sum of the money mentioned therein. It also contains the rate of interest & the date on which the deposit will fall due for payment.

3.4) Payment of Interest:

It is usually paid on maturity of the fixed deposit. Premier Bank Limited calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable account” is debited for the accrued interest.

3.5) Encashment of F.D.R:

In case of premature FDR, Premier Bank Limited is not bound to accept surrender of the deposit before its maturity date. In order to deter such a tendency, the interest on such a fixed deposit is made cut a certain percentage less than the agreed tare normally savings bank deposit interest rate is allowed.

3.6) Loss of F.D.R:

In case of a lost FDR the customer is asked to record a general diary in the nearest police station. After that, the customer has to furnish an indemnity bond to Premier Bank Limited a duplicate FDR is then issued to the customer by the bank.

3.7) Renewal of F.D.R:

In Premier Bank Limited instrument is automatically renewed within seven days after the date of its maturity if the customer does not come to encash the FDR the period for renewal is determined as the previous one.

3.8) Deposit Under Scheme:

Premier Bank Limited has already introduced various deposit schemes for the depositors. They are described as follows:

3.9) Monthly Saving Scheme (MSS):

The behavior of saving in our country is not satisfactory. Premier Bank Limited has introduced MSS to force saving behavior of people. Under this scheme, depositors can deposit a fixed amount for a fixed term, after maturity of this scheme they can get a handsome amount. Premier Bank Limited has designed this scheme under two categories one for small- earnings depositors and other for big-earnings people.

a) Monthly Income Scheme: In our country people have a certain savings amount which they utilize to earn a fixed amount so that they can bear their family maintenance. Beside various institutions want to utilize their fund to earn a fixed amount of profit in a month. To fulfill this type of demand Premier Bank Limited has introduced a scheme named Monthly Income Scheme. The deposits size is multiple of Tk. 50000. One can get 80%of loan securing this deposit for his very need.

b) Double amount Deposit scheme: This Scheme offers the depositors double amount of the deposit if the depositors keep the money under this scheme. They have to keep the amount for 6 years term with a condition of no withdrawn of cash. The deposit amount will be multiple of Tk. 10,000. One can take 80% loan through securing this deposit.

3.10) Cheque Book:

3.10.1) Cheque: According to section 6 of negotiable instruments act, 1881, a cheque is “A Bill of Exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.” To facilitate withdrawals and payments to third parties by the customer, Premier Bank Limited provides a chequebook to the customer. Cheque Book contains 10 leaves for savings account while for current account; it is 25 or 50 leaves. A chequebook issuing register is maintained in this regard. This register contains the chequebook number, leaf number, issuing date. After giving these entries to this register, information is sending to the computer department for taking necessary steps to pass the cheques during withdrawal.

The chequebook also contains requisition slip, which is used by the customer to obtain new chequebook. When all the leaves are used, the customer submits slip to the bank. A senior official then issues a new chequebook and subsequent entries and given in the register and computer.

If the chequebook is lost, the customer has to furnish a guarantee indemnifying the bank. After fulfilling this, a new chequebook is issued.

3.10.2) Dishonor of cheque: If the cheque is dishonored, Premier Bank Limited sends a memorandum (cheque return memo) to the customer describing the reason in the following way:

- Refer to Drawer

- Not arranged for

- Effects not cleared. May be presented again

- Exceeds arrangements

- Full cover not received

- Payment stopped by drawer

- Payee’s endorsement irregular/illegible/required

- Payee’s endorsement irregular, require Bank’s conformation

- Drawer’s signature differs/required

- Alternations in date/figures/words require drawer’s full signature

- Cheque is post dated/out of date/mutilated

- Amount is words and figures differs

- Crossed cheque must be presented through a bank

- Clearing stamp required/requires cancellation

- Addition to Bank’s discharge should be authenticated

- Cheque crossed “Account Payee Only”

- Collection Bank’s discharge irregular/required.

If the chequebook is lost then the customer must inform the police and should take copy of G.D (General Diary). The customer then fills an indemnity form guarantying that the cheque is lost. When the bank is convinced with having the above documents, the bank gives the customer a new chequebook.

3.11) Closing of an account:

The closing of an account may happen

- If the customer is desirous to close the account.

- If Premier Bank Limited finds that the account is inoperative for a long duration.

- If Garnishee Order is issued by the court on Premier Bank Limited.

To close the account, the Chequebook is to be returned to the bank. Premier Bank Limited takes all the changes by debiting the account and the remaining balance is then paid to the customer. Necessary entries are given to the account closing register and computer.

3.12) Demand Drafts (DD):

Demand Draft is an order to pay money, drawn by one office of Bank upon another office of the same Bank for a sum of money payable to order on demand. A draft can’t be drawn payable to bearer of a named payee. A draft can’t be drawn payable to bearer.

Customer or non-customers of the bank may purchase drafts. The purchaser of the draft must fill in the relative application form with his name, amount, and name of the payee, the branch on which the draft is desired, and sign it. He has to tender the amount in cash for the draft and Bank charges, if any. If the purchaser has an account with the bank to debit his account for the amount. The draft is prepared with care regarding the name of the payee, the amount and the office on which it is drawn. In order to ensure safety, the purchaser is advised to cross the draft and the bank gives a test number. Having issued the draft the issuing officer would send to the drawer branch, an advice containing the particulars of the draft.

3.12.1) Issuance of demand draft:

While issuing demand draft an official must be confirmed about the branch where the DD is to be issued or drawn as asked for by the application. Application on banks prescribed from for DD is obtained from the applicant duty filled and signed by them. Transfer, application will be asked to deposit the amount of DD and exchange/commission computed correctly at the prescribed rate. On receipt of cash voucher will be passed and scrolled by the offices, DD will be issued and record to DD issue register filling the appropriate columns. Test number if required is affixed on both DD and advice as instructions given by Head Office.