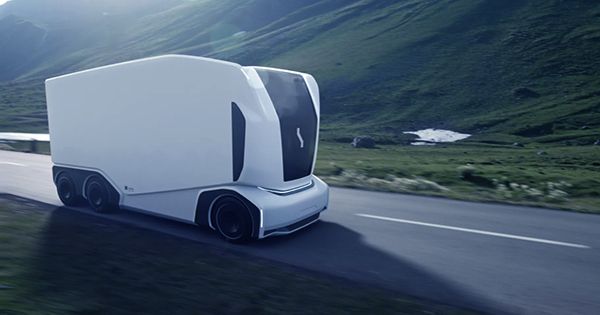

Einride is looking for $75 million in new funding, while at the same time exploring the possibility of creating a public list through a special purpose-achieving organization, according to people familiar with the agency’s plans. TechCrunch has learned that Swedish autonomous electric vehicle startup Einride is working to maintain the momentum of raising additional capital through partnerships with Oatly and Liddell.

Specks, a process in which a publicly traded shell company merges with a private business to lead the capital market in the United States to a storm, is partly focused on the electrification of mobility by startups. For companies like Nicola, the initial success of the public listing (despite its dubious claims) helped to stage the rise of SPAC. Canoe, Fischer Inc., ChargePoint and Lordstown Motors are some of the U.S.-based EV companies that went public last year through a SPAC. Unlike some of the new fictitious spec companies, Einride has some basics. The company has already driven its technology in partnership with Swedish oat milk maker Oatly.

“Sustainability is at the core of what we do, and we work hard to reduce our emissions across the board. That includes emissions for our transportation, which is why we are now moving to electric vehicles, which reduces our climate footprint on this route by 87%, “said Simon Broadbent, director of Oatly’s supply chain, in a statement at the time. Oatly began using Einride’s electric trucks on delivery routes from each of its Swedish production sites in October 2020. So far, the trucks have electrically powered by 8,600 km and as a result have saved 10,500 kg of CO2 compared to diesel, the companies said in a statement.

The deal with Attlee was just beginning. As the ink dried on that partnership, Einride quickly signed on to other marquee Swedish businesses, including food shipping and logistics firm Lidl and electronics maker Electrolux. Large automakers have their own electrical and autonomous plans. Argo, the developer of the self-driving technology for the Ford and VW Group investments, is now $7.5 billion. In addition, VW’s Traton Group announced 2019. Is push for low emissions, electrification through $2.2 billion investment?