A technical indicator that defines trend direction is the weighted moving average (WMA). Recent data points are given more weight, whereas older data points are given less. The weighted moving average is determined by increasing every perception in the informational collection by a foreordained weighting factor. Numerically, the weighted moving normal is the convolution of the datum focuses with a fixed weighting capacity. It goes a step further and is more precise than the simple moving average (SMA), which determines market movement by giving all the numbers in a data set the same weight.

In a specialized investigation of monetary information, a weighted moving average (WMA) has the particular significance of loads that decline in arithmetical movement. Dealers utilize the weighted normal apparatus to produce exchange signals. If the market action moves towards or above the weighted moving average, for example, the signal can be interpreted as a signal to exit a trade. If the market action, on the other hand, dips near or just below the weighted moving average, it could be a good time to enter a trade. Utilize the WMA to help decide pattern course. It very well may be a sign to purchase when costs plunge close or just underneath the WMA. It very well may be a sign to sell when costs rally towards or simply over the WMA.

Moving averages may also be used to identify areas of support and resistance. A rising WMA tends to help price movement, while a falling WMA tends to provide resistance. This methodology builds up purchasing when cost is close to the rising WMA or selling when cost is close to the falling WMA. The weighted moving average is more reliable than the simple moving average in determining trend direction because it assigns equal weights to all numbers in the data set.

When the price approaches or crosses over the WMA line on the map, for example, it may indicate that a short-term price drop is on the way. As a result, traders should close their positions. In any case, if the value plunges close or just beneath the WMA line, it could imply that the cost may before long go up. Hence, it’s a great chance to enter the exchange. Every single moving normal, including the WMA, are not intended to recognize an exchange at the specific base or top. Moving averages appear to confirm that your trade is in the general trend’s direction, but with a slight lag at entry and exit. The WMA has a faster response time than the SMA.

At the point when the value crosses over its moving normal, this shows the cost is getting more grounded comparative with where it was in the past in light of the fact that the latest value currently sits higher than the normal. In the event that the value crosses underneath its moving normal, it shows the cost is getting more vulnerable comparative with where it was before. Moving averages have been used by traders, technical analysts, and statisticians for many years. They are often grouped together with other methods that deal with “Time Series Analysis.”

While computing the weighted moving normal, the new information focuses are relegated a more noteworthy weighting, though past information focuses are allotted less weighting. It is utilized when the figures in the informational collection accompany various loads, comparative with one another. The total weight should be one hundred percent or one. The most recent data is given a higher weighting and thus contributes more to the final WMA value. The time chosen for the predictor determines the weighting factor used to measure the WMA.

The count for the weighted moving average (WMA) is not the same as that of the simple moving average (SMA), where all information focuses are allocated an equivalent weighting. The final weighted moving average value is more representative of the frequency of concurrency than the simple moving average because it represents the significance of each data point.

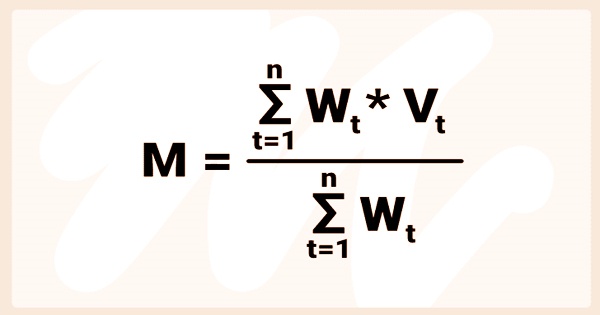

The weighted moving average (WMA) formula is expressed as follows:

Where:

M = Average value

V = Actual value

W = Weighting factor

n = Number of periods in the weighting group

To provide trading signals, moving averages can be combined with other indicators. Assume the number of cycles is ten, and we want a weighted moving average of four stock prices of $70, $66, $68, and $69, the first being the most recent. The most recent weighting will be 4/10, the previous period will be 3/10, the next period will be 2/10, and the original period weighting will be 1/10, based on the details provided. The following is the formula for calculating the weighted average of the four different prices:

WMA = (70 × (4/10)) + (66 × (3/10)) + (68 × (2/10)) + (69 × (1/10))

WMA = $28 + $19.80 + $13.60 + $6.90 = $68.30

The weighted moving average is by and large more touchy to value development making it a superior measure just as distinguishing patterns sooner than the SMA. In any case, this can be a blade that cuts both ways as the WMA is probably going to encounter more instability than its comparing SMA. The fundamental distinction between the two factual measures is that basic moving normal computes the normal by summarizing every one of the perceptions in an informational index and partitioning the complete by the all-out number of perceptions. In straightforward terms, it applies equivalent weighting to every one of the perceptions in the example.

Weighted moving average, on the other hand, assigns a specific weight or frequency to each observation, with the most recent observation receiving a higher weight than those from the distant past in order to calculate the average. As a trader, knowing how to use the weighted moving average in combination with other technical indicators is crucial. However, one form of moving average isn’t inherently better than another since they use different approaches to calculate average prices.

Information Sources: