A voluntary reserve is a sum of money held by an insurance firm above and above any government-mandated minimum. Government agencies routinely control reserves in order to ensure an insurance company’s stability. Voluntary reserves are also held as fluid resources. State guidelines set least save prerequisites for insurance agencies that are expected to guarantee they stay dissolvable. Because government entities are required to have a specific amount of reserves, optional reserves are surplus or additional liquid assets.

In a company’s financial records, voluntary reserves, also known as additionally held liquid assets, are recorded as such. Insurance companies will retain voluntary reserves in order to seem financially stable and boost liquidity ratios. The prerequisites of a voluntary reserve are chosen by the insurance agency and not government controllers. State controllers have comparative save prerequisites for monetary establishments inside their wards. Like insurance companies, those institutions may have voluntary reserves.

State regulators use resources from the Insurance Regulatory Information System (IRIS), which is managed by the National Association of Insurance Commissioners (NAIC), to evaluate an insurance company’s solvency ratio. Reserve accounts are required to be between 8% and 12% of total revenue. The two administrative bodies utilize monetary data recorded by insurance agencies to compute which insurance agencies will confront dissolvability issues.

The IRIS is a set of values that define a company’s solvent status, with numbers outside the range requiring special attention. The regulatory authority establishes a range of liquidity ratio levels that are acceptable for each business. Outlier numbers imply that regulators should look into an insurer more closely. To guarantee the dissolvability of banks, monetary establishments and insurance agencies, government organizations endorse a specific measure of financial stores that these elements should hold.

A voluntary reserve is a balancing act for every insurance firm. It’s because insurers must meet the state’s minimum reserve requirements, yet boosting reserves over the minimum will limit the amount of money allocated by the insurance business to shareholder wealth generation. A lot of money available is an indication of the organization’s security and its capacity to satisfy the needs of any disaster. However, it likewise diminishes the sum accessible to reinvest in the business or prize investors.

Different bookkeeping and expense laws keep property and loss guarantors from saving additional cash for future occasions like fiascos. There are not many limitations on the utilization of a deliberate save, notwithstanding. The organization could decide to pay any surprising cost from it or, so far as that is concerned, use it’s anything but an investor profit. The recommended level of a voluntary reserve is 8% to 12% of total revenue for an insurance firm. However, because a voluntary reserve is dependent on the sort of risk that the organization is facing, there is no set amount.

Property and casualty insurers, in particular, are discouraged from laying aside surplus funds, even for catastrophes, due to a variety of tax rules and accounting standards. However, if a corporation wants to be more economically sound, it can set aside more money than is required. Principle-Based Reserving (PBR) is a new method for determining the voluntary reserve for life insurance firms in the United States. The PBR approach was introduced by the National Association of Insurance Commissioners in a report.

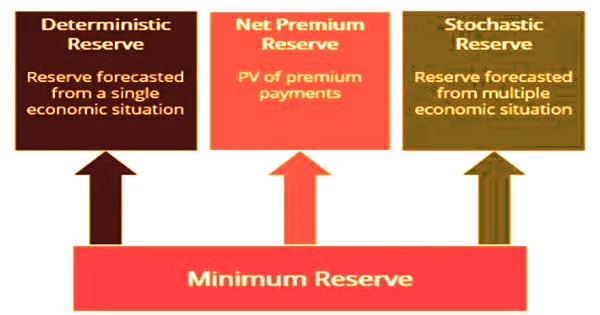

To estimate the minimum reserve under PBR, an insurer must examine three separate reserves, including:

- Deterministic Reserve: The deterministic reserve technique calculates gross premium based on a single best economic revenue and expense assumption plus a margin. The risk level that an insurer faces in a single economic scenario is taken into account by the margin. An exclusion test is embraced for deterministic save, where a gathering of approaches is thought of and disposed of if their net premium is not exactly the amount of expected gross charges the entire year.

- Net Premium Reserve (NPR): The net premium reserve (NPR) is the minimal level of reserve that an insurer estimates for each of their products using set formulas and assumptions. Universal Life Secondary Guarantees (ULSG) and term life products, however, have different formulas. The equation for NPR is the actuarial present worth of future advantage installments short the actuarial present worth of future net premium installments.

- Stochastic Reserve: Estimates are determined using the stochastic reserve approach, which involves altering a set of random values for variables such as morbidity rate, mortality rate, and so on and recording the results. The risk of unusual events is calculated using the stochastic technique, which is repeated over a thousand times. To figure the stochastic reserve, the normal of the top 30% of the assessments are thought of, and a stochastic avoidance test is utilized by a daily existence safety net provider to exclude certain approaches while ascertaining the stochastic reserve. Finally, under PBR, the quantity of reserves for each product may be varied, as it appropriately depicts the level of risk. As a result, PBR as a methodology is adaptable to new insurance products.

The voluntary reserve of an insurance company is distinct from the claim reserve, which is a sum of money set aside for unfiled policyholder claims. The most prevalent reason for this is that it makes them appear more liquid and stable. It can also be used as a contingency reserve to meet unexpected obligations and pay future bills. In the industry, standard reserve levels range from 8% to 12% of total sales. The standards differ based on the risks that a corporation takes on.

Information Sources: