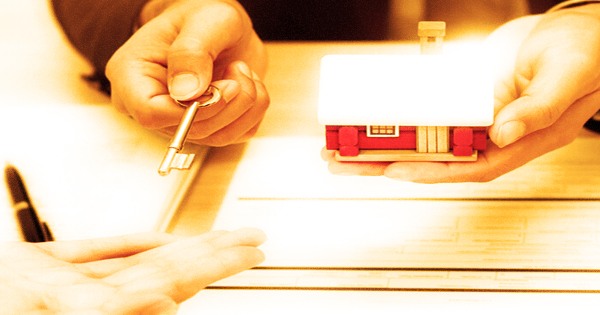

A voluntary lien, also known as a consensual lien, is a lien in which the owner of a property gives another party a legal claim to the property in exchange for the repayment of a debt. Liens are secured against a piece of property rather than a person. A voluntary lien is legally binding or consensual, implying that the lien is made by an activity taken by the borrower, for example, a home loan credit to purchase land. The borrower deliberately allows the lien to the moneylender, and the property goes about as insurance. The property with the lien attached would be confiscated if a debtor defaulted on payments.

This is the polar opposite of an involuntary lien issued by a regulatory authority, such as a tax or special assessment lien. Because the house or car is collateral for the loan, when someone takes out a mortgage to buy a house or a loan to buy a vehicle, he or she has created a voluntary lien. An involuntary lien is the inverse of a voluntary lien. They are liens that are imposed on a property inadvertently by the law, as the name implies. If taxes are not paid, a court or another regulatory authority can impose a lien on a piece of real land.

There are other instances in which a lien would be used as security:

- Business loan

- Credit agreement

- Personal loan with collateral

- Rent-to-own appliances or furniture

Naturally, while a lien is in place, the owner of the property cannot legally sell it. The property is given to an outside entity, usually a lender, as security for a debt or service done. The lien should be based on the true market value of the property being utilized as collateral. In the event of a debt default, the lien holder can take ownership of the property, such as through foreclosure proceedings in real estate or car repossession.

You agree to have a lien put on the property when you finance a house or an automobile. If the debtor defaults, it prevents the lenders from losing money. Although the lien is normally put on the property used to obtain the loan, this is not always the case. The property can sometimes be used to acquire a cash advance or a line of credit. If a debtor fails to make payments on a home that they funded, the lender will foreclose and confiscate the property.

The car will be repossessed if a debtor who acquired a new sedan fails to make payments. In either situation, the item can be reclaimed by the lender who maintains the lien in order to regain the value lost due to missed payments. The physical property is frequently used as collateral under the lien; however, a voluntary lien can be used for corporate loans, personal loans with collateral other than vehicles or residences, credit agreements, and even rent-to-own items.

While there is a lien on the property, the owner cannot sell it; if the borrower defaults, the lien holder may take ownership. The lien could be arranged in such a way that it is put on something other than the property obtained through the loan. When a borrower is attempting to get financing, voluntary liens are frequently required. Without it, the lender takes on too much risk, and most lenders are unwilling to incur the risk of default without collateral.

Instead, an existing piece of property is used as security for a line of credit or cash advance that will be utilized for other reasons. Involuntary liens are liens that are put on a property against the owner’s will by an outside authority. Involuntary liens are often imposed on properties by regulatory agencies for outstanding debt obligations, rather than mortgage lenders placing a lien on the property.

A homeowner who has paid off their mortgage may require additional funds and seek a home equity line of credit. The house would act as security, similar to a mortgage, with the lien holder receiving interest. Your real estate, other personal belongings, and financial assets are all subject to the lien. You won’t be able to recover your assets until the obligations are paid off if you have a lien against them. In the case of a tax lien, the government will be compensated in some way.

Mortgages on a home and liens filed on financed autos are the most common examples of voluntary liens. Liens can be established on any form of valuable property voluntarily. The purpose of a voluntary lien is to allow a lender to get collateral in exchange for a debt or service delivered. Property that voluntary liens are placed on include:

- Homes

- Cars

- Boats

- Appliances

- Valuable art

Furthermore, if a business owner takes out a line of credit to pay various operating costs and initiatives, the business may be subject to a voluntary lien. They would not take custody of the company in this situation. Instead, they’d get a security interest in the property. A lien is nothing more than a claim on a piece of property or an asset. There exist voluntary liens, in which a property owner decides to give another party legal title on their property. A voluntary lien’s opposite is an involuntary lien, which occurs when a party claims an owner’s property or assets against their consent. It comes as a result of money being owed.

Information Sources: