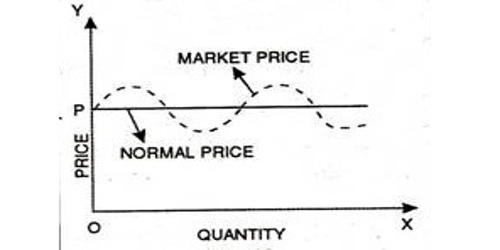

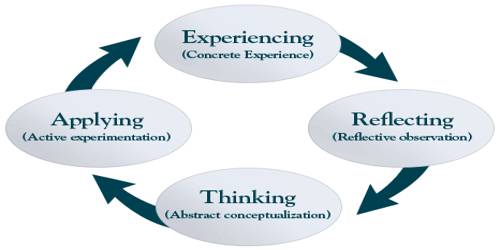

A variable benefit plan is similar to a conventional DB plan (Defined Benefit Plan), except that the employers and not the sponsor of the plan on the investment risk and positive return. A variable benefit plan is, in reality, a type of pension plan in which the payment to which the beneficiary is entitled is subject to adjustment in accordance with the performance of the investments made as part of the plan. It permits the arrangement holder to deal with their own record. Paradoxically, a characterized advantage plan furnishes the arrangement holder with foreordained installments upon retirement that don’t change and which depend on a qualification recipe as opposed to on venture returns. The advantage that the retired person is qualified for changes couple with market vacillations, thus the utilization of the expression “variable” for the sake of the arrangement. An accrual rate (i.e. how much profit is received per year) is determined by the plan manager, normally a percentage of current year pay payable as an annuity at normal retirement. A “hurdle rate” is often specified by the plan sponsor; that is, the asset return benchmark, typically between 5 percent and 7 percent. In relation to the hurdle rate, the real asset return for the year is.

Variable-benefit plans move the burden of investment from the employer to the worker. It is likely that if he makes bad investment decisions, the employee will end up with less money from a variable-benefit package. Not at all like a characterized benefits plan, where the recipient is ensured a fixed revenue stream after retirement, a variable-advantage plan offers a non-steady or “variable” revenue stream after retirement. Be that as it may, a representative likewise has the ability to settle on prevalent speculation decisions and end up with better advantages. In variable-benefit plans, the employee’s ability to make wise investment choices is also important.

Example of Variable-Benefit Plan

There is no change to the cumulative gain of the participant if the asset return matches the hurdle rate. The cumulative benefits are raised proportionately if the asset return reaches the hurdle threshold. If the return on the asset is below the hurdle rate, the accumulated advantages are reduced proportionately. An annuity plan is a monetary solidness plot for workers. Under such plans, the business or the support is needed to make commitments to a pool of assets. The assets are then contributed for the future advantage of a representative at that association. In order to pay for their retirement, people have invested in financial markets for as long as the history of capitalism itself. In 1875, the American Express Corporation first introduced a pension scheme to its employees, becoming the first private pension plan in the United States.

Let’s say, for example, that the hurdle rate is 6%. We are not going to incorporate new accruals for convenience just yet (as would be the case for a deferred vested participant or someone no longer in an eligible class of employees).

| Age | Year | Accrued Benefit | Asset Return for Year |

| 50 | 2016 | $500.00 | 6% |

| 51 | 2017 | $500.00 | 0% |

| 52 | 2018 | $471.70 | 15% |

| 53 | 2019 | $511.75 | 10% |

| 54 | 2020 | $531.06 |

Each gain is the benefit of the previous year, balanced by the real return and divided by the hurdle rate (6 percent in our example). At age 50, the participant received a $500 per month payout. As Americans’ future rose all through the late nineteenth and mid-20th hundreds of years, the issue of how to accommodate the retirement of individuals from the developing working-class happened to expanding significance. Congress looked to support the development of private benefits by making commitments to such records charge deductible during the 1920s. By 1929, there were 397 private-sector plans extant in the United States and Canada.

Variable-benefit contracts vary from defined-contribution plans. The holder is permitted to administer their own account on their own in the former. It is a distinct model from that of a defined-benefit contract, which presents a fixed collection of payments upon retirement to the plan holder. The installments don’t change from period to period, and the measure of every installment depends on a set qualification equation that is unique in relation to one dependent on speculation returns. After World War Two, as unions started to strike in large numbers, demanding the provision of pensions, the growth of pension schemes exploded.

A defined-benefit pension, or a pension under which a worker is guaranteed a fixed collection of benefits until death, was a significant form of retirement coverage for American workers from the end of World War Two to about 1980. An accrual rate is calculated and used in a variable-benefit contract. Here, the support, who is the business, contributes a given level of every member’s compensation to the arrangement on a yearly premise. However, such benefits put an extraordinary focus on American organizations, which were confronting expanded rivalry from unfamiliar opponents, and from investors who were requesting the greatest returns. This has led the private sector to focus more on contingent benefit plans, where the company’s contribution is determined, but the actual payout depends on the success of the pension assets.

The burden is transferred from the employer to the employee in variable-benefit plans. It is also likely that the employee can end up with less cash under variable-benefit plans than with defined-benefit plans. This can occur because the pensioner makes bad investment decisions. According to the perspective of the worker (or retired person), the most important part of a variable-advantage plan is that representatives are qualified to get an annuity that capacities like a set month to month pay. It is not quite the same as a single amount sum got under a customary characterized advantage plan or even a money balance plan.

Recall that liability is the current value of the benefits payable in the future to the plan participants. The actuary shall calculate the present value for each participant of the benefits payable at normal retirement, which shall be the accrued benefit influenced by all future rates of asset return and all future hurdle rates. From the point of view of the worker (or support), it is more advantageous to decide on a variable-advantage plan. This is on the grounds that such plans dispose of the customary dangers that might be related with characterized advantage plans. Variable benefit programs allow the management of a business to decide the predictable cost of the retirement benefit contribution. It helps them to choose a strategy that is ideally tailored to the company’s long-term objectives.

Information Sources: