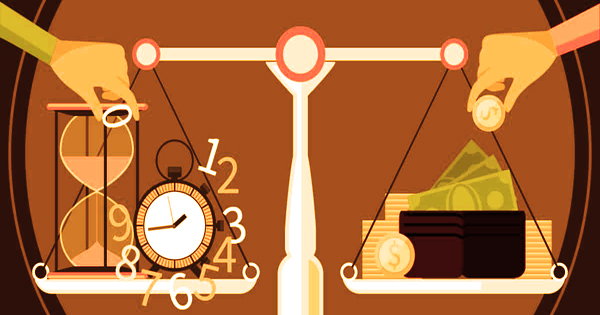

Value-based pricing (also known as value optimized pricing) is a pricing approach that changes the price depending on the perceived value of the product rather than its historical price. It will increase profitability by producing higher pricing without having a significant impact on sales volume if it is correctly implemented. Value pricing is client-centered estimating, which means organizations base their evaluating on how much the client accepts an item is worth. This methodology will in general bring about exceptionally excessive costs and correspondingly high benefits for those organizations that can convince their clients to consent to it.

Value-based pricing differs from “cost-plus” pricing, which includes manufacturing expenses in the pricing equation. It ignores the cost of the goods or service, as well as current market prices. Value-based pricing is well-known among designer clothes firms. While a designer shirt may cost somewhat more to make than a non-designer shirt, the designer brand’s prominence elevates the shirt’s perceived worth.

Many organizations profit by such insight, expanding their edges extraordinarily, while negligibly decreasing deals volume. Value-based pricing is generally applied to extremely concentrated administrations. For instance, a lawyer experienced in safeguard against criminal accusations can charge an excessive cost to their customers, since the worth to them of not being imprisoned is probably very high. A lawyer who specializes in initial public offerings, for example, might utilize value pricing since his or her clients would not be able to raise millions of dollars without his or her help.

When items are marketed based on emotions (fashion), in specialized markets, in shortages (e.g. beverages during an open-air event on a hot summer day), or for complimentary products, the strategy is most successful (e.g. printer cartridges, headsets for cell phones). Organizations that offer one-of-a-kind or exceptionally significant components or administrations are better situated to exploit the worth valuing model than organizations that mostly sell commoditized things. A comparative methodology may likewise be utilized when the buying choice is sincerely determined. Other areas where value-based pricing may be an option include:

- Product design

- Bankruptcy workouts

- Cost reduction analysis

- Lawsuit defense

- Pharmaceuticals engineering

The value-based pricing approach is most commonly used in marketplaces where owning an item improves a customer’s self-image or allows them to have unrivaled life experiences. It’s also more useful in instances when the executive level approves the customer rather than the procurement department. Because the purchasing team is more experienced in analyzing supplier prices, such pricing would be less likely to be permitted. The artist’s prestige, as well as other emotional characteristics that the consumer may identify with, are used to determine the value and price.

Although pricing value is an inexact science, marketing strategies may be used to establish the price. Cost-plus pricing is commonly used to sell highly traded goods (such as oil and other commodities). When there is a scarcity factor, value-based pricing is frequently employed. Products which are offered to profoundly complex clients in enormous business sectors (for example auto industry) have likewise in the past been sold utilizing cost-in addition to estimating, however on account of present-day evaluating programming and evaluating frameworks and the capacity to catch and investigate market information, an ever-increasing number of business sectors are relocating towards market-or worth based valuing.

Any business that practices value pricing must have a product or service that sets it apart from the competitors. Value-based pricing isn’t always the ideal pricing approach for a business, and putting it in place can be difficult. It might be difficult to assess a product’s or service’s perceived worth. The product must be customer-centric, which means that any changes and new features should be based on the wants and needs of the consumer.

Value-based pricing in its strict sense suggests putting together evaluating with respect to the item benefits apparent by the client rather than on the specific expense of fostering the item. With cost-in addition to estimating or rivalry-based valuing, a cost can be chosen generally effectively by assessing costs or the contender’s costs. The value-based pricing procedure includes mystery and is more subjective in nature.

Advantages and Disadvantages of Value Based Pricing –

The following are advantages to using the value based pricing method:

- Increases profits. This approach optimizes earnings by allowing you to charge the greatest feasible price.

- Customer loyalty. You may obtain exceptionally high client loyalty for recurring business and referrals despite the high prices paid, but only if the service or product offered justifies the high price. This advantage stems from the nature of the sales connection, which must be both close and trustworthy before value-based pricing can be considered.

The following are disadvantages of using the value based pricing method:

- Niche market. Only a tiny percentage of clients will be willing to pay the exorbitant prices that this approach will entail. It could even turn off some potential consumers.

- Not scalable. This technique is most effective for smaller, highly specialized businesses. It’s more harder to implement in larger companies with lower staff skill levels.

- Competition. Any firm that uses value-based pricing on a regular basis is leaving a lot of opportunity for competitors to offer cheaper rates and steal their market share.

- Labor costs. If you’re providing a service, you’re probably providing a high-end skill set, which means the personnel needed to perform the service will be extremely pricey. There’s also the possibility that they’ll quit to establish their own business.

The organization should likewise have open correspondence channels and solid associations with its clients. In doing as such, organizations can get input from its clients in regards to the provisions they’re searching for just as the amount they’re willing to pay. Because the price will be greater than a cost-plus method, the perceived value must be high. For decades, many attorneys and investment bankers have used value-based pricing, demonstrating that it is a viable technique.

However, in most firms, where regular competitive forces make value-based pricing unfeasible, it is not relevant. Cost-based pricing, on the other hand, is a method of determining a product’s price by summing the costs of production, manufacturing, and distribution. After then, the firm adds a premium and ends up with a sale price. Furthermore, distinguishing the product from comparable rival items may necessitate a significant expenditure.

Information Sources: