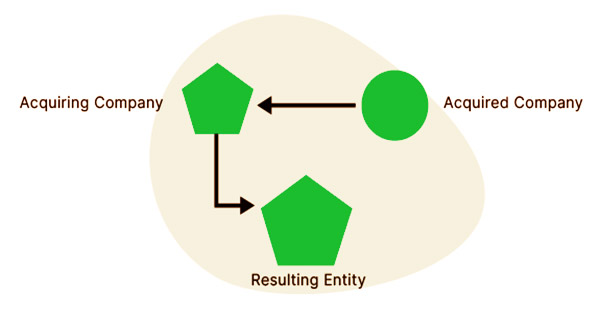

A tuck-in acquisition, sometimes known as a “bolt-on acquisition,” occurs when a larger company or corporation buys a smaller company and integrates it into their own platform or organization. The phrase “tuck-in” relates to the notion of the purchase being “tucked in” under the platform company’s infrastructure. The acquirer is typically a huge organization that has the enormous framework that the more modest organization needs. The acquirer’s foundation comprises of the mechanical design, stock and conveyance frameworks, and any remaining functional parts of the business.

The smaller business does not keep any of its previous systems or structure following the purchase in a tuck-in acquisition. Smaller businesses generally have a strong proprietor but lack the infrastructure, administrative personnel, and/or cash needed to expand. This makes it an expected contender for retention into a bigger organization’s foundation. The acquirer has absolute control of what occurs with this more modest firm, as they give the firm new administration or working designs.

The acquirer seeks for smaller businesses to expand its income, market share, and resources. The basic goal of tuck-in acquisitions is to increase the market share and stock price of the larger firm. Intellectual property, proprietary technology, and complementary product lines are some examples of resources that the acquirer could be interested in.

The ideal objective of a tuck-in acquisition is a more modest organization with restricted development possibilities and assets that are important to the procuring firm. At the point when private value enters a market, it might do as such by obtaining a bigger organization with the board and framework equipped for engrossing other more modest players. Tuck-in and bolt-on acquisitions occur when a larger business absorbs a smaller company through a merger and acquisition process in order to increase market share and revenues or extend product offerings.

The way the purchased assets are treated, however, differs between the two types of purchases. Both organizations are generally in the same sector or occupy similar market areas in a tuck-in purchase, but the acquiring firm has larger operational resources. These assets can go from portions of the overall industry, scholarly freedoms, innovation, or items. Tuck-in acquisition targets are generally more modest organizations which assets which are interesting to a greater firm or the acquirer.

Tuck-in acquisitions are good for bigger platform businesses to absorb since they often have a strong owner but little management depth or administrative resources to continue developing. The acquirer as of now has the innovation structure, appropriation frameworks, and stock, and mostly seeks after the objective organization fully intent on building up its current foundation. While a tuck-in acquisition may work for a looking merchant to relinquish all organization, the interaction addresses an extensive change.

In the event of a bolt-on purchase, acquiring firms enable the smaller organization to maintain its brand name or operate independently since it may be advantageous to do so, especially if the smaller entity’s brand has generated goodwill or name recognition. The more modest organization benefits by taking advantage of the acquirer’s foundation and economies of scale. Then again, the acquirer benefits from growing its piece of the pie, item contributions, and client reach.

The following are some of the benefits that the acquiring company gets after completing a tuck-in acquisition:

New resources: As a means of acquiring fresh resources, a major corporation could consider conducting a tuck-in purchase. Smaller businesses with good management and the necessary resources would be targeted by such a firm. The acquirer will be able to enhance its yearly income by acquiring fresh resources.

Additionally, owing to a larger pool of resources that may be used as collateral for bank loans, acquiring cash for future acquisitions will be easier. Acquiring resources that the firm does not already have will allow the acquirer to expand its operations to include new product and service lines, resulting in increased revenue.

Market dominance: Tuck-in acquisitions are frequently used by large corporations to expand their market share. In high-competition sectors, when multiple major businesses fight for a portion of current consumers, this strategy is typical. When a major corporation buys and absorbs one of its smaller competitors, it might expand its market presence, decrease the competitor’s market share, and diversify its product offering.

Increased return on investments: When investors acquire the shares of the acquiring business, they do so with the hope of a strong long-term return on investment. In a market with fierce rivalry, however, the company’s development may be gradual or stagnant as each competitor seeks to expand its market share. Tuck-in acquisitions can help a major business improve its market share and total profits, which helps it meet shareholders’ expectations.

Despite their advantages, tuck-in acquisitions also come with a number of drawbacks:

Costly to implement: Completing a purchase is a costly endeavor, and the expenses may occasionally surpass prior estimates. Asset acquisition expenses, legal fees, loan fees, regulatory fees, commissions, and so on may all be included in the purchase cost.

Poorly matched partner: If the two firms are incompatible or rush to complete the agreements without doing due diligence, the acquisition may fail.

The stage organization will hope to incorporate a tuck-in organization as fast as conceivable into normal bookkeeping frameworks, depository, and working methods. While changes are pointed toward making esteem over the long haul, the proprietor of the tuck-in organization should be ready for the huge change that happens in the primary year and guarantee that he/she oversees fittingly how the remainder of the representatives will respond to the mix cycle.

Information Sources: