Executive Summary

The economic development of the country depends largely on the activities of commercial Banks. Especially in a country like Bangladesh, our agricultural, industrial and economic developments are very much depending on smooth operation of Banks. So we must ensure efficient and effective performance of Banks. In this respect I have tried to find out the satisfaction level of customer of Shahjalal Islami Bank Limited (SJIBL). How efficiently they serve the customer with their services and whether the customers are really satisfy or nor by conducting a scientific research I tried to find out as my best level.

I found that there are some lacking in the services done by the various part of Shahjalal Islami Bank Limited (SJIBL) as well as there are also some strengths in different sectors. I find that the overall performances of branch services, cashier services, and customer care services are better than SMS Banking Services. SMS Banking Services need better improvement as it is the most important in the branch service.

Finally it can be said that the customer services level of Shahjalal Islami Bank Limited (SJIBL), should be increased to cope up the present arising problem. Otherwise it may lose its customers due to its strong competitors. However, I have identified some loopholes of the program which needs special attention. I hope that if the existing problems are addressed properly the bank will be able to expand the program as per their target and it will continue to provide more revenues in maximizing the wealth of the bank in the years to come.

Introduction:

The word “Bank” refers to the financial institution deals with money. Commercial banks are the primary contributors to the economy of the country. On the other hand they are borrowing money from the locals and lending the same to the business as loans and advances. So the people and the government are very much dependent on these banks as the financial intermediary. Moreover, banks are profit – earning concern, as they collect deposit at the lowest possible cost and provide loans and advances at higher cost. The differences between two are the profit for the bank.

A student takes the internship program when he or she is at the last leg of the BBA degree; internship program brings a student closer to the real life situation and thereby helps to launch a career with some experience.

Back ground of the study:

As the student of Bachelor of Business Administration (BBA) every student has to conduct a practical orientation (Internship) on any organization for fulfilling the requirements of the B.B.A program. In order to fulfill this requirement of the Internship program I choose Shahjalal Islami Bank Limited (SJIBL). The main purpose of the program is to know the real world situation. The topic of my report is “Training Program of Shahjalal Islami Bank Ltd’’. In this regard I have opportunity to make my internship in Shahjalal Islami Bank Limited from September 28 to December 28, 2011.

With the objective of achieving success here & hereafter by pursuing the way directed by Allah and the path shown by His Rasul (SM), Shahjalal Islami Bank Ltd was established (registered) as a private limited company on 10 May 2001, under Bank Company Act, 1991 and incorporated as a public limited company under companies act, 1994.

During this short span of time, the bank has been successful to position itself as a progressive and dynamic financial institution in the country.

Involvement of the banking sector in different financial events is increasing day by day. At the same time the banking process is becoming faster, easier and the banking area is becoming wider. As the demand for better service increases, the banking organizations are coming with innovative ideas. In order to survive in the competitive field of the banking sector, all banking organizations are looking for better service opportunities to provide to their clients.

Within short time SJIBL expands its branches all over the country. But as their experience in terms of success rate in each branch which includes profit, client size, etc. The performance of Ashkona branch is also very good as like other branch. As a part of my topic I will try to identify the all important part of the training program.

Origin of the report

Present world is changing rapidly to face the challenge of competitive free market economy. To keep pace with the trend banks need executive with modern knowledge and provide fresh graduate with modern theoretical and practical knowledge in banking and financial institution management. As the practical origination is an integral part of the BBA degree requirement, I was sent to Shahjalal Islami Bank Limited (SJIBL) (Ashkona Branch) to take the real life exposure of the activities of banking financial institution for three months only starting from 28th September, 2011. This research is a partial requirement of BBA Internship Program in the Southeast University and report is being prepared from three months extensive knowledge and research.

Objective of the report

The primary objective of this report is to comply with the requirement of my course. But the objective behind this study is something broader. The principal intent of this report is to analyze the trends of modern banking training systems. Objectives of the study are summarized in the following manner:

- To identify the present state of the training program of Shahjalal Islami Bank Limited (SJIBL)

- To observe the effectiveness of the training program of SJIBL.

- To observe the employee reaction towards the training program.

- To know about the modest of investment in Islamic Banks.

- To provide the recommendation for improvement of training systems of (SJIBL)

- Finally, to sketch out the overview of (AIBL)

Scope of the study

Shahjalal Islami Bank Limited (SJIBL) is one of the new generation banks in Bangladesh. The scope of the study is limited to the Ashkona Branch. The report will cover the functions of different departments of Shahjalal Islami Bank Limited (SJIBL), Ashkona Branch like Products and services of the bank.

I will include on my report first of the introduction of Shahjalal Islami Bank. Then the overall banking activities, products and services. Finally, I shall provide an analytical view on a real project that Shahjalal Islami Bank arranges training program for its employees and this is the special focus of my report.

Methodology of the Study:

Data Collection:

Secondary Source:

- HR manual of the Shahjalal Islami Bank Limited.

- Archiving Instruction Manual of the Shahjalal Islami Bank Limited.

- Prior research Report.

- Web site of Shahjalal Islami Bank.

- Internet browsing ( to know about the detail of archiving management system)

Primary Source:

The “Primary Sources” are as follows-

a) Face-to-face conversation with the respective officers and staffs of the Branch.

- Informal conversation with the clients.

- Practical work exposures form the different desks of the four departments of the Branch covered.

Relevant file study as provided by the officers concerned

Limitation of the study:

In all high opinion some limitation and weakness remain within which failed to escape by any means. These are follows:

- Limitation of time: It was one of the main constraints that hindered to cover all aspects of the study.

- Lack of Secondary data: The HR manual was the main secondary Information source of information that was not enough to complete the report and private the reader a clear idea about the bank.

- Confidentiality of data: Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own privacy that is not open to others.

- Lack of understanding of the respondents: Lack of understanding of the respondents was the major problem that created much uncertainty about proof of theoretical question.

History of the SJIBL:

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. During last ten years SJIBL has diversified its service coverage by opening new branches at different strategically important locations across the country offering various service products both investment & deposit. Islamic Banking, in essence, is not only INTEREST-FREE banking business, it carries deal wise business product thereby generating real income and thus boosting GDP of the economy. Board of Directors enjoys high credential in the business arena of the country, Management Team is strong and supportive equipped with excellent professional knowledge under leadership of a veteran Banker Mr. Md. Abdur Rahman Sarker.

Objectives of SJIBL :

The objectives of Shahjalal Islami bank is to be the unique modern Islami Bank in Bangladesh and to make significant contribution to the national economy and enhance customers’ trust & wealth, quality investment, employees’ value and rapid growth in shareholders’ equity. Moreover it has so many objectives to achieve its yearly targets , customers’ trust , Life time banking and so on. those are given below in short :

- To provide quality services to customers.

- To set high standards of integrity.

- To make quality investment.

- To ensure sustainable growth in business.

- To ensure maximization of Shareholders’ wealth.

- To extend our customers innovative services acquiring state-of-the-art technology blended with Islamic principles.

- To ensure human resource development to meet the challenges of the time.

- To review & updates policies, procedures & practices to enhance the ability to extend better services to the customers.

- To train & develop all employees & provide them adequate resources so that the customer’s needs are reasonably addressed.

- To promote organizational efficiency by communicating company plans, polices & procedures openly to the employees in a timely fashion.

Functions of the SJIBL:

- To strive for customers best satisfaction & earn their confidence.

- To manage & operate the Bank in the most effective manner.

- To identify customers needs & monitor their perception towards meeting those requirements.

- To review & updates policies, procedures & practices to enhance the ability to extend better services to the customers.

- To train & develop all employees & provide them adequate resources so that the customer’s needs are reasonably addressed.

- To promote organizational efficiency by communicating company plans, polices & procedures openly to the employees in a timely fashion.

- To cultivate a congenial working environment.

- To diversify portfolio both the retail & wholesale markets.

Role of the Shahjalal Islami Bank Limited in the economic development:

This has been divided 2 major parts:

1. Islamic and economic development.

2. Use of Islamic banking and finance for economic development of nation.

Economists today argue that “development is about outcomes, that is, development occurs with the reduction and elimination of poverty, inequality, and unemployment within a growing economy” (Dudley Seers), seeing three objectives of development:

- Producing more ‘life sustaining’ necessities such as food, shelter, and health care and broadening their distribution

- Raising standards of living and individual self esteem

- Expanding economic and social choice and reducing fear.

Attention around Islamic fundamentalism, as well as the number of supporters, received a great boost after the Arab nations’ defeat against Israel in the Six-Day War of 1967. Many Muslims felt that this humiliating defeat was caused by the Arabs turning away from God and embracing foreign ideologies such as communism or capitalism ideologies which are viewed as inherently opposed to Islam and therefore unable to solve the problems of the Muslim world. The fundamentalists call for a return to Islamic law, the Sharia, which is believed to offer solutions to economic and social problems of all times and all places. This message naturally has great appeal in many Muslim countries, due to widespread poverty, inequality and unemployment. Islamic scholars point to the military and economic success of early Islamic society to prove that adherence to Islam may bring about great material achievements. Islam is not the only religion with a fundamentalist economic agenda. Indeed, there are striking similarities between the economic analysis

Development theory demonstrating that interest-free loans and other forms of gift exchange are common institutions in traditional, rural societies in poor parts of the world today. Economic development, however, challenges these informal institutions, for a variety of reasons. Similarly, the viability and success of the Islamic scheme of interest-free banking can be expected to be far greater in a traditional, rural setting, relative to a modern, urbanized environment. Islamic banks be implemented as rural development banks.

As Shahjalal Islami Bank is an Islamic financial organization, first of all its strictly bans on the interests. The ban on interest is the only issue where there is some degree of consensus amongst Islamic economists. as a result , the interest ban is without comparison the Islamic economic issue that has attracted the most attention from both supporters and observers of Islamic economics.

The general Islamic norms of altruism and honesty are common to most ethical systems, religious and non-religious. This is not to say that such norms are unimportant for the market economy. My point is simply that these general norms cannot be expected to influence economic development in a Muslim country in other ways than they affect economic development in a non-Muslim country.

Economic development and growing international trade brought with it an increase in market transactions, such as interest-based banking. A first response to this challenge was for the medieval religious scholars, Christian as well as Muslim, to insist on the principle of the interest prohibition, but to allow interest in practice through a number of legal tricks.

Being an Islamic bank , Shahjalal Islamic bank follows all the rules of Allah in the financial transactions, in this sense obviously Shahjalal Islamic Bank contributes a lots to the welfare of the society and as well as economic development of the Bangladesh.

Shariah Council:

Shariah Council of the Bank is playing a vital role in guiding and supervising the implementation and compliance of Islamic Shariah principles in all activities of the Bank since its very inception. The Council, which enjoys a high status in the structure of the Bank, consists of prominent ulema, reputed banker, renowned lawyer and eminent economist.

Members of the Shariah Council meet frequently and deliberate on different issues confronting the Bank on Shariah matters. They also conduct Shariah inspection of branches regularly so as to ensure that the Shariah principles are implemented and complied with meticulously by the branches of the Bank.

Schedule of Profit Rate

| Sl. | Deposit Product | Provisional Rate |

| 01. | Mudaraba Savings Deposit | 4.00% |

| 02. | Mudaraba Special Notice Deposit | |

| Average balance less than 1 crore | 5.00% | |

| Average balance 1 crore to less than 25 crore | 7.00% | |

| Average balance 25 crore to less than 50 crore | 8.00% | |

| Average balance 50 crore to less than 100 crore | 8.50% | |

| Average balance 100 crore and above | 9.00% | |

| 03. | Mudaraba Term Deposit | |

| i) 1 Month | 12.00% | |

| ii) 2 Month | 12.00% | |

| iii) 3 Months | 12.00% | |

| iv) 6 Months | 12.00% | |

| v) 1 Year | 12.00% | |

| 04. | Mudaraba Scheme Deposits | |

| a) Monthly Income Scheme: | ||

| 1 year-3 Years | 12.00% (Tk.1,000/-per month per lac) | |

| b) Multiple Benefit Scheme: | ||

| i) Double Benefit Yearly Rate: 12.25% | 11.61% (Will be doubled in 6 years) | |

| ii) Triple Benefit Yearly Rate: 12.25% | 11.62% (Will be tripled in 9.5 years) | |

| c) Millionaire Scheme: | ||

| i) 5 Years (Tk 12,470/ Per Month) | 11.00% | |

| ii) 10 Years (Tk. 4,500/ Per Month) | 11.25% | |

| iii) 12 Years (Tk.3,280/ Per Month) | 11.25% | |

| iv) 15 Years (Tk.2,120/ Per Month) | 11.30% | |

| v) 20 Years (Tk.1,080/ Per Month) | 11.45% | |

| vi) 25 Years (Tk.575/ Per Month) | 11.51% | |

| d) Monthly Deposit Scheme:* | ||

| i) 5 Years Yearly:11.54% | 11.00% | |

| ii) 8 Years Yearly:11.66% | 11.10% | |

| iii) 10 Years Yearly:11.83% | 11.25% | |

| e) Hajj Scheme:** | ||

| Up to 10 Years | 11.25% |

*Mudaraba Hajj Scheme Deposit: Monthly installment and provisional amount payable at maturity (amount in Taka)

| Year | Monthly Installment | Expected Amount payable at Maturity to meet-up Hajj Expenses | Yearly Rate |

| 1 | 25,000 | 3,19,000 | 11.65% |

| 2 | 12,000 | 3,24,250 | 11.75% |

| 3 | 7,700 | 3,31,000 | 11.75% |

| 4 | 5,500 | 3,34,500 | 11.80% |

| 5 | 4,200 | 3,39,300 | 11.80% |

| 6 | 3,350 | 3,45,500 | 11.82% |

| 7 | 2,725 | 3,49,000 | 11.82% |

| 8 | 2,275 | 3,55,000 | 11.83% |

| 9 | 2,000 | 3,74,500 | 11.83% |

| 10 | 1,700 | 3,77,800 | 11.83% |

SJIBL ATM Location

Shahjalal Islami Bank Limited is providing ATM services to its valuable cardholders 24/7 for 365 days. At present the Bank has 13 ATM’s of its own and also providing ATM services to its customers through shared ATM with Q-Cash member Banks, DBBL, Brac Bank and other VISA ATMs.

Risk Management

Shahjalal Islami Bank Ltd. introduces Risk Management Unit (RMU) to analyze and measure business risk with taking effective steps to reduce the risks involved in the business of Banking.

SJIBL has set up a separate Risk Management Unit in line with the regulatory requirement to address and supervise the existing and potential business and capital risks. This specialized unit cautions the bank against any financial and operational risk at macro level impacting the micro functionalities. It intimate the management of various kinds of core risk as prescribed by the Bangladesh Bank in different functional areas: credit, foreign exchange, asset and liability management, internal control and compliance, money-laundering and information communication technology risks, apart from capital adequacy risk.

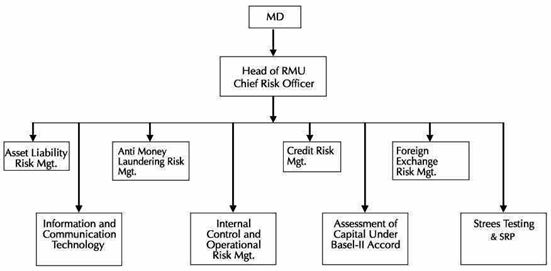

Reporting line of Risk Management Unit direct to the Deputy Managing Director of the Bank with reporting to the Audit Committee of the Board of Directors of the Bank as and when required. The Risk Management Unit is headed by a Deputy Managing Director who is the Chief Risk Officer (CRO) of the Bank. The Organ ogram of the RMU is given below which emphasis on management of different risk profiles of the Bank:

The RMU reviews quarterly the risk status of the bank and based on qualitative and quantitative Key Risk Indicators (KRI) on different risk areas, place a monthly Risk Management Paper (RMP) entailing Credit Risk, Market Risk, Operation Risk, Liquidity Risk, Sustainability Risk, Capital Adequacy Risk and Earning risk components of the risk domain to the Managing Director. Risk Management Paper is also submitted to the Bangladesh Bank as compliance report on quarterly basis.

Importance of the RMU:

In early 2003 and 2004 Bangladesh Bank issued guidelines on the followings six (6) core risks to comply the Risk Management in the Banking sector:

- Investment Risk Management (IRM)

- Asset Liability Risk Management (ALCO)

- Foreign Exchange Risk Management

- Internal Control and Compliance Risk Management

- Anti Money Laundering Risk Management

- Information Technology Risk Management

When world recession had started in 2008 & 2009 and heavily affected world economy as well as Bangladesh economy also at that time. Due to simplicity of financial system in Bangladesh, our Banking sector was not severely affected. Bangladesh Bank introduced Risk Management Unit (RMU) to supervise all core risk in banking which will assist to create business environment with analysis of risk and to reduce the risk associated in banking.

Types of Investment:

There are several types of investment that SJIBL has provides to the customer, those are:

- Small and Medium Enterprise (SME) Investment Operation

- Small Business Investment Scheme

- Car Purchase Investment Scheme

- Household Durable Investment Scheme

- CNG Conversion Investment

- Overseas Employment Investment Scheme

- Investment Scheme for Doctors

- Investment Scheme for Executives

- Investment Scheme for Education

Conclusion

This paper has outlined the framework for the study of the role of SJIBL in Islamic banking within the overall relationship between culture and information systems. Despite the richness of the study area, this topic has been largely neglected to date. The notion of ‘role’, a rich description of expected behavior and responsibilities, seems to be an appropriate approach to study the influence of Islamic culture, strongly supported by Actor Network Theory to identify relevant actors (human and non-human), networks and relationships. Islam is a fast growing religion whose fundamentals are appealing to an ever-growing Muslim community. This community is itself growing in economic and political importance globally. Islamic banking is an essential component of everyday Muslim business life. It is thus felt that the research will make a useful contribution to IS theory and practice.