Apex Food s Ltd.

As a custom food manufacturer, Apex Food specializes in the development and production of a wide variety of food products, including dips, dressings, soups, pastas, sauces, gravies,marinades, bastings, salsas, spice blends, seasonings, salads and processed vegetables and cooked items, to name a few.Our core competencies include research, recipe and product development, ingredient sourcing, custom-packaging and merchandising expertise in serving our grocery, food service,chain restaurant, wholesale-club, convenience store and institutional clients. As a multi-faceted manufacturer of food product, Apex Food supplies fresh, fresh-frozen and frozen foods, in a multitude of rigid and flexible packaging, as refrigerated and shelf-stable,according to client needs. Flexible, service-driven, with a proven record of performance, we blend our experience and industry knowledge with professional expertise and advanced technology, to deliver successful food solutions for the clients we serve.

Company Background

Apex Foods Co., Ltd. is the subsidiary of Apex Group Co., Ltd. established in 1994. And under great effort of all staffs , Apex Foods Co., Ltd. was granted with GMP. We are determine to deliver the best standard of production by choosing good quality of raw materials and manufacturing all products in high hygienic rooms.

Furthermore, we have quality control in every process and provide training program for employee’s hygienics in order to correspond to GMP system. As the result, our products have delivered top standard quality and met customers’ expectations.

Company Determination

We have done market researches before designing and developing each item by professional team. Meanwhile, we are also importing goods from oversea. Our goal is to have the best selection for accomplishing the customers’ satisfaction.

Awards

– GMP (Good Manufacturing Practice)

It is a set of regulations and guidelines controlling the quality of manufacturing operations aimed at ensuring consistency of product quality in order to

ensure patient safety.

– Halal

It means all food should be prepared, processed, packaged, transported and stored in such a manner

Quality Policy

“Pursuiting on the Quality Acknowledgement of the Problem Improvement and Development For Customer Satisfication

Subsidiary Companies

Apex Group Co., Ltd. – holding in subsidiary companies.

Apex Toys Co., Ltd. – manufactures plastic toys.

Apex Foods Co., Ltd. – manufactures snack foods such as candy, wafer, and corn snack.

Apex Marketing (Thai) Co., Ltd. – distributes toys and snack foods nationwide.

Apex Plastech Co., Ltd. – custom mold maker, OEM manufacturer of plastic industry.

Apex Import & Export Co., Ltd. – imports and exports manufactured goods.

M.T.R. Group Co., Ltd. – distributes toys and snack foods to department stores and mini marts.

New Charoen Sang Ltd., Part. – wholesales and traditional markets.

General Products

Apex Foods is the manufacturer and distributor of yoghurt wafers, corn snacks, candies, and etc. We also manufacture “candy toys” type, which most of products are licensees of famous characters around the world.

Licensed Products

We have been working with well-known Japanese and other licensors such as

– Disney (Micky Mouse, Winnie The Pooh, Lilo & Stich, Ben Ten, and Toy story)

Imported Product

In addition, we are trying to expand our market by importing many products around the world such as Chocolate and Biscuit (Japan) Sanrio and Disney (Hong Kong), Mints (Canada), Biscuit (France), Pastilles (Australia), and etc.

Distribution Channels

Our main distribution channels are

- Convenience store : 7-Eleven, Familymart, Suncolor, Freshmart, and etc.

- Hypermarket : Big C, Carrefour, Makro, Tesco Lotus, and etc.

- Supermarket : Foodland, Home Fresh Mart, Marketplace, Tops, Villa Market, and etc.

- Department Store : Siam Paragon, The Emporium, Central, Isetan, Robinson, The Mall, Tung Hua Seng, and etc.

- Gas station : Jet, Shell, Petronas, Caltex, and etc.

| Nowadays, customer satisfaction is the most important factor. Apex Foods has expanded and increased production capacity by doing OEM in order to customize customer satisfaction. We accept OEM of Yoghurt wafer, Wafer, Corn Snack, and Fruit Candy. We have worked with Big C Leader Price under “WAFRUIT brand” since 2003. It comes with Banana, Orange, and Blueberry Flavors. |

In April 2008, Apex Foods has closed deal with Everest Foods Marketing Co., Ltd. to produce OEM products under Yofruit and Crusty brand. Yofruit is a yoghurt wafer combine with fruit flavors. There are 3 flavors for Yofruit (Orange, Blueberry, and Strawberry).

Moreover, Crusty is a crunchy filled cream flavor. There are 2 flavors under Crusty brand (Chocolate and Strawberry flavor). These ranges will reserve for Malaysia, Singapore, and Brunei.In October 2008, Apex Foods has signed the contract with Korea Trading Co., Ltd, (Korea) who will introduce Yofruit brand under Sanrio license in Korea. At the beginning, it comes up with Strawberry Yoghurt Flavor. More flavors will be introducing after all.

In February 2009, Apex Foods has introduced WAFRUIT brand (Wafer Filled Cream) to Kim Lee Kiat in Singapore. There are 3 flavors, such as Banana, Blueberry, Orange flavor. Main distribution channel is to sell in local office, goverment body, and institution (including military). In coming future, Kim Lee Kiat and Apex Foods will develop new flavors for this market to satisfy customer’s requirement.

About Us

APEX FOODS, a Taiwanese company with international objectives. We are committed to developing, producing and marketing beverages. Besides our personal brands like “CASTLE” “AKIHABARA” “VITA POWER” “HAWAII JAVA JAVA“, we also develop special orders and private labels for the international market.

We provide complete and professional services, which include product package designing, flavor researching and manufacturing. Customer satisfaction is our working guideline.

{Quality and Service is the prerogative of marketing}- is our working concept. Our commitment to high quality and excellent taste has gained us many loyal and satisfied customers. Trust is the basis of our business and is achieved through honest and knowledgeable service.

APEX FOODS would like to offer you fantastic and wide variety of beverage, with our brands or yours, combining excellent quality and competitive price. If you are interested in collaborating with us as an importer, distributor or agent in your territory or creating your own label for our products, please feel free to contact us via Tel: (886) 2-8712-8497 /Fax: (886) 2-8712-8501 or e-mail at apex@apexfoods.com.tw, or visit our website: http://www.apexfoods.com.tw

Definition of ‘Cost Of Goods Sold – COGS’

The direct costs attributable to the production of the goods sold by a company. This amount includes the cost of the materials used in creating the good along with the direct labor costs used to produce the good. It excludes indirect expenses such as distribution costs and sales force costs. COGS appears on the income statement and can be deducted from revenue to calculate a company’s gross margin. Also referred to as “cost of sales”.

Cost of goods sold (COGS) refers to the inventory costs of those goods a business has sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out (FIFO), or average cost. Costs include all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. Costs of goods made by the business include material, labor, and allocated overhead. The costs of those goods not yet sold are deferred as costs of inventory until the inventory is sold or written down in value.

Cost of goods made by the business

The cost of goods produced in the business should include all costs of production.[8] The key components of cost generally include:

- Parts, raw materials and supplies used,

- Labor, including associated costs such as payroll taxes and benefits, and

- Overhead of the business allocable to production.

Most businesses make more than one of a particular item. Thus, costs are incurred for multiple items rather than a particular item sold. Determining how much of each of these components to allocate to particular goods requires either tracking the particular costs or making some allocations of costs. Parts and raw materials are often tracked to particular sets (e.g., batches or production runs) of goods, then allocated to each item.

Labor costs include direct labor and indirect labor. Direct labor costs are the wages paid to those employees who spend all their time working directly on the product being

manufactured. Indirect labor costs are the wages paid to other factory employees involved in production. Costs of payroll taxes and fringe benefits are generally included in labor costs, but may be treated as overhead costs. Labor costs may be allocated to an item or set of items based on timekeeping records.

Materials and labor may be allocated based on past experience, or standard costs. Where materials or labor costs for a period exceed the expected amount of standard costs, a variance. Such variances are then allocated among cost of goods sold and remaining inventory at the end of the period.

Determining overhead costs often involves making assumptions about what costs should be associated with production activities and what costs should be associated with other activities. Traditional cost accounting methods attempt to make these assumptions based on past experience and management judgment as to factual relationships. Activity based costing attempts to allocate costs based on those factors that drive the business to incur the costs.

Overhead costs are often allocated to sets of produced goods based on the ratio of labor hours or costs or the ratio of materials used for producing the set of goods. Overhead costs may be referred to as factory overhead or factory burden for those costs incurred at the plant level or overall burden for those costs incurred at the organization level. Where labor hours are used, a burden rate or overhead cost per hour of labor may be added along with labor costs. Other methods may be used to associate overhead costs with particular goods produced. Overhead rates may be standard rates, in which case there may be variances, or may be adjusted for each set of goods produced.

Variable production overheads are allocated to units produced based on actual use of production facilities. Fixed production overheads are often allocated based on normal capacities or expected production.[9] More or fewer goods may be produced than expected when developing cost assumptions (like burden rates). These differences in production levels often result in too much or too little cost being assigned to the goods produced. This also gives rise to variances.

One of the things that makes accounting tricky is that many common everyday words have very precise definitions in accounting. “Depreciation” is one good example. “Overhead” is another. They are common words that everyone understands. But in accounting, the words have special meaning. In order to get your homework correct, you need to have a clear understanding of the precise definitions.

Direct Labor:

The definition of direct labor is pretty easy. Direct labor represents the people who do the core work of the business. For example, if the business is a construction company, direct labor would be the people actually constructing the building. They would be the people with hammers and saws in their hands. In a retail store, direct labor would be the people helping on the sales floor doing the basic work that takes place serving the customers. In a grocery bag factory, direct labor are the people running the machines actually making the bags. I think of direct labor as the people who make or build the product.

The Tricky Thing About Direct Labor

Determining if a person should be classified as direct labor can be tricky at times. This is especially so if the company operates on a “job order” basis. Job order businesses are common. Almost any time a product is customized for a customer, the company will operate on a “job order” basis. Some examples would include an auto mechanic shop, a construction company building custom homes, and the grocery bag factory. The grocery bag factory was always doing special orders for Safeway and other stores. Here is the trick with direct labor and job order companies.

The labor must clearly be associated with a particular job, in order for the labor to be called “direct labor.”

Here is an example. A secretary in a large, custom home construction company will usually do a variety of things, but it is almost impossible to keep track of how or when the secretary benefits a certain custom home project when their are several projects going at the same time. Since the secretary’s time cannot be assigned conveniently to any certain custom home, the secretary would not be considered direct labor.

Another example would be the inspector at the grocery bag factory. The inspector would go from machine to machine inspecting grocery bags to make sure their were not any defects in the bags. Although the inspector did an important job, it was impossible to assign the inspector’s time to any particular customer’s order. As a result, the inspector’s labor was not considered direct labor.

One last thought… If a person’s labor cannot be easily linked to a specific customer’s order or the person does not directly build the product, the person’s labor is called “indirect labor.”

Direct Materials:

All of the materials that go into making a product are called “Raw Materials.” Raw materials come in two flavors: Direct Materials and Indirect Materials.

Direct materials are the raw materials that become part of the product. For example, bricks, shingles, and bath tubs would be the direct materials when building a house.

Paper would be a direct material when making grocery bags. Seems easy, but there is a catch.

The Catch with Direct Materials

In order for a raw material to be classified as a direct material, the amount of raw material must be easily counted or kept track of. Here is an example. When making grocery bags, it is pretty easy to keep track of the amount of paper being used for each bag, but it is very difficult to know exactly how much glue is being used to hold the paper bag together. Of course, if a person got a magnifying glass and really examined the bags, maybe the amount of glue could be determined. But would it be worth all of the time and effort? Compared to the paper, the glue is pretty inexpensive. Other than holding the bag together, the glue is rather insignificant. Sooooo….. The glue is not tracked on a product or job basis. It is just not worth the effort. Since the glue is not tracked on a product or job basis, the glue is not considered a direct material even though the glue is part of the product.

In a nutshell, direct materials are those materials that become part of the finished product… providing it is possible and worth the effort to keep track of those materials on a per product basis.

So what are raw materials called that are either not worth keeping close track of or are difficult to know exactly how much raw material is going into each product? Indirect materials. Indirect materials also include other materials used in the production process such as oil for machines, welding rods for repairs, sand paper for making tables, and any other small miscellaneous materials.

Overhead:

The definition for overhead is easy. Here it is……

If a cost is not direct labor or direct materials, the cost is overhead.

In other words, overhead is a multitude of different costs including indirect labor and indirect materials. Here are a few of many examples: electricity, property taxes, advertising, accounting, janitors, cleaning supplies, distribution costs, legal fees, interest, inspectors, human resources department, etc, etc, etc.

Life would be too easy if it were just that simple. There is one wrinkle. There is a distinction between between overhead and manufacturing overhead.

Overhead’s Wrinkle:

The generic term “overhead” can refer to all the costs in a company that are not direct labor or direct materials.

Manufacturing overhead means the same thing…. all costs except direct labor and direct materials. The difference is that manufacturing overhead refers to those costs closely related to the factory or production process. So here is a definition for manufacturing overhead:

Manufacturing overhead is everything (all costs) except direct labor, direct materials, administrative costs, and marketing costs.

So, manufacturing overhead does not include the president’s salary, accountants, lawyers, interest expense, advertising, marketing, secretarial staff, distribution costs, income taxes, etc, and any other costs related to a company’s administration. By the way, manufacturing overhead is what goes on the “Cost of Goods Manufactured Statement.”

direct material

Definition

All items such as raw materials, standard and specialized parts, and sub-assemblies required to assemble or manufacture a complete product. Direct material costs are assignable to a specific product, cost center, or work order.

direct labor

Definition

Employees or workers who are directly involved in the production of goods or services. Direct labor costs are assignable to a specific product, cost center, or work order.

Direct labor cost is a part of wage-bill or payroll that can be specifically and consistently assigned to or associated with the manufacture of a product, a particular work order, or provision of a service also, we can say also it is the cost of the work done by those Factory overhead, also called manufacturing overhead or factory burden, is the total cost involved in operating all production facilities of a manufacturing business. It generally applies to indirect labor and indirect cost, it also includes all costs involved in manufacturing with the exception of the cost of raw materials and direct labor. Factory overhead also includes certain costs such as quality assurance costs, cleanup costs, and

property insurance premiums.worker who actually make the product on the production line.

FACTORY OVERHEAD

The definition for overhead is easy. Here it is……

If a cost is not direct labor or direct materials, the cost is overhead.

In other words, overhead is a multitude of different costs including indirect labor and indirect materials. Here are a few of many examples: electricity, property taxes, advertising, accounting, janitors, cleaning supplies, distribution costs, legal fees, interest, inspectors, human resources department, etc, etc, etc.

Life would be too easy if it were just that simple. There is one wrinkle. There is a distinction between between overhead and manufacturing overhead.

Factory Overhead is not a financial statement account

It is a “suspense account” for capturing and reallocating overhead costs

Factory Overhead is debited for actual overhead costs incurred

Factory Overhead is credited to allocate overhead to production

Regression Analysis

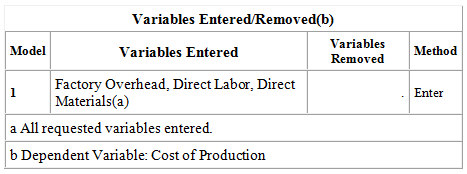

Interpretation of output summary

The regression model like that,

Here, Y= Cost of production

A= Constant

b1,b2 &b3= Regression coefficient

X1= Direct Materials

X2 = Direct Labor

X3= Factory overhead

From the co-efficient table, the values of a, b1,b2& b3 are found out & the regression model can be written as follows:

Y= a+b1x1+b2x2+b3x3

= -6537089.828+.248×1+38.489×2+12.326×3

This equation indicates that if taka of direct materials increases by 1taka, the cost production will increases by .248 taka and other things remain constant.

Again, if taka of direct labor increases by 1 taka, the cost of production will increases by 38.489 taka and other things remain constant.

On the other hand, if taka of factory overhead increases by 1taka, the cost of production will increases by 12.326 taka and other things remain constant.

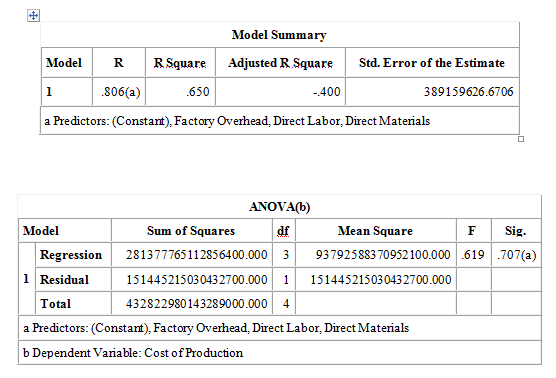

The relationship among the variables in relative term

The relationship among the variables in relative terms can be estimated with the help of coefficient of correlation, (r).

r= .806 indicates that there exists a high degree of positive relationship among the variables.

Explanatory power of independents variables

The explanatory power of independents variables can be assessed with the help of coefficient of determination (r2 ).

r2= .650 indicates that 65.00% of the variations in cost of production can be explained by the variation of direct materials, direct labor and factory overhead .

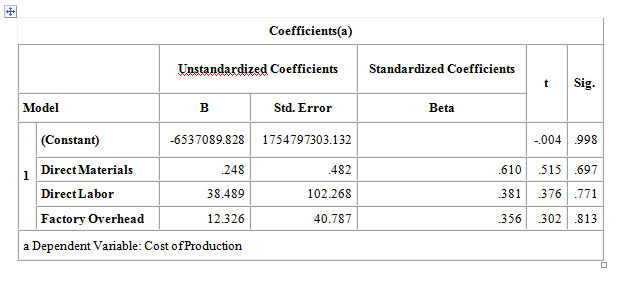

Influencing power of independent variables

The influencing power of independent variable can be assessed with the help of of standardized Coefficient β(beta).

β (dm)=.610

β (dl)= .381

β (foh)=.356

βdm>βdL>βFOH

SO, it is evident that taka of direct materials has more influencing power than taka of direct labor and factory overhead , and also taka of direct labor has more influencing power than taka of factory overhead.

Significant of results or, model fitness

From the ANOVA ( analysis of variance) table, it is evedent that the results are statically insignificant because they are statically significant at .707 or 70.7% level which I higher than that of .05 or 5% level.

Measuring the significance of the coefficients

In the out put above we see that the t values are given for each of the variables. Besides this significance level for each t values are given in the model as well as.

And from the coefficient table , it is evident that b1, b2 &b3 are statistically insignificant because they are statistically significant at .696 or 69.6% another one .771 or 77.1% and, last one is .813 or 81.3% level respectively which higher than that of .05 or 5%.