Fixed assets are tangible assets that show in the long-term assets part of a company’s balance sheet. These assets are tangible, measurable resources utilized in a company’s activities to generate profit, such as property, plant, and equipment. Tangible assets may be seen and felt, but they can also be lost due to fire, natural disasters, or accidents. Intangible assets, on the other hand, do not have a physical form and include items like intellectual property, trademarks, and patents.

Tangible assets can regularly consistently be executed for some financial worth however the liquidity of various business sectors will change. The term is most regularly connected with fixed resources, like hardware, vehicles, and structures. It isn’t utilized to portray more limited-term resources, like stock, since these things are expected available to be purchased or transformed to cash. Anything with a physical aspect that is utilized within a corporation qualifies as an asset. Intangible assets have a theoretical worth rather than a transactional exchange value. Tangible assets are the polar opposite of intangible assets.

Some businesses’ primary competitive advantage is tangible assets, especially if they employ the assets effectively to generate sales. Assets are extremely important to a company’s net worth and fundamental activities. The board of resources and resource suggestions are one key motivation behind why organizations keep a monetary record by and large. Resources are recorded on the accounting report and should adjust in the basic conditions resources short liabilities approaches investors’ value which oversees the monetary record.

Current assets, such as inventories, are resources that will be utilized in the current time. Current assets have considerably higher liquidity than fixed assets. Fixed assets, often known as hard assets, are assets that a company keeps for a long time and cannot simply be turned into cash. Depreciation is the process of reducing the value of fixed physical assets over time. Tangible assets are the most fundamental kind of resource on the asset report. They are normally the fundamental type of resources in many ventures. They are additionally typically the most effortless to comprehend and esteem.

Because tangible assets have stable, long-term values that lenders value, they are commonly used as collateral for loans. A short look at a balance sheet will show you how a company’s tangible assets are organized by liquidity. The resource piece of the monetary record is broken out into two sections, current resources, and long-haul resources. These resources ordinarily require a lot of support to maintain their qualities and useful capacities and likely require protection insurance.

Characteristics of Tangible Assets:

- They come in physical form, which means they can be seen, felt, or touched.

- They are depreciated over a period of time.

- They possess a scrap or residual value.

- They can be used as collateral to obtain loans.

- They are used in the daily operations of the business.

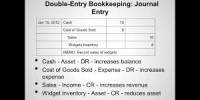

All physical assets are accounted for on the monetary record at their chronicled cost, however, some have uncommon revealing prerequisites. Long haul fixed resources should be devalued over their valuable lives with the aggregated deterioration investigated the front of the asset report. Deterioration on unmistakable resources is a non-cash consumption. It indicates that the spending is for the purpose of obtaining a tax benefit for the firm, but there is no cash outflow from the corporation. All sorts of assets support a company’s operations and assist it in achieving its principal aim, which is to generate income.

As tangible current assets can without much of a stretch be changed over into cash, they give liquidity to the business and, consequently, diminish hazard. However long the worth of the resources possessed by a business is more than the cash gambled in getting them, a business ordinarily stays protected and dissolvable. Intangible assets, on the other hand, are assets that lack physical qualities. These resources are more difficult to evaluate and might fluctuate in value over time. Patents trademarks and investments are examples of these assets.

In a company’s capital structure, tangible assets are crucial. Assets have a positive relationship with leverage since firms with more physical assets are more likely to use debt financing. An organization’s generally fluid, unmistakable current resources incorporate money, cash counterparts, attractive protections, and records receivable. These unmistakable resources are remembered for the estimation of an organization’s speedy proportion.

Fixed assets are linked to an accumulated depreciation contra account, which subtracts the amount of depreciation charged to date against all fixed assets on the reporting entity’s books from the fixed asset balance. These assets are easy to collateralize and don’t lose a lot of value when businesses go bankrupt. Thusly, it is seen that organizations with less substantial resources will in general get less from banks, and organizations with more resources will in general get more from loan bosses.

Inventory, which is not as liquid as cash equivalents but has a finite market value and may be liquidated for cash if needed in liquidation, is included in current ratio assets. The potential total cost of tangible current assets often comprises not only the amount paid for it, as shown on the relevant invoice as part of the inventory acquired, but also any additional expenses spent owing to shipping, installation, and insurance. As a result, knowing the minimal value a firm might obtain from a fast sale or liquidation is critical.

An assessor is recruited and decides the worth that a sale house, hardware dealer, or other mass resource purchasers would pay for such classes of resources as those claimed by the organization. Long-term assets, once in a while called fixed resources, involve the second piece of the resource area on the monetary record. Real estate, manufacturing plants, manufacturing equipment, automobiles, office furniture, computers, and office supplies are examples of these assets.

The management of shareholders’ equity and the return on equity ratio measure are both dependent on asset valuations. The difference between a company’s fair market value of tangible assets and the fair market value of all liabilities, where liabilities reflect the company’s external responsibility, is described as net tangible assets. To put it another way, it’s total assets at fair value minus intangible assets and total or outside debt at fair value. To be able to analyze and quantify their worth with any degree of accuracy, tangible assets must be separated from intangible assets, which is exactly what net tangible assets are really for.

Information Sources: