Main objective of this assignment is to Analysis Annual Report of Renata Limited. By the analysis of annual report find out various recommendation like identify the market segmentation efficiently, then setting their target market and forecast which market offering more opportunity. Renata Limited Need to develop long term relationship with key parties-buyers, buying house and suppliers. Finally draw SWOT analysis based on Annual Report.

An overview of the Company:

Type of Company: Listed Public Limited (Dhaka Stock Exchange)

Main Business: Manufacture and Marketing of Human Pharmaceuticals and Animal Therapeutics. We have two production sites. The Mirpur Site is 12 Acres and Rajendrapur Site is 17 Acres.

History: The Company started its operations as Pfizer (Bangladesh) Limited in 1972. For the next two decades it continued as a highly successful subsidiary of Pfizer Corporation. However, by the late 1990s the focus of Pfizer had shifted from formulations to research. In accordance with this transformation, Pfizer divested its interests in many countries, including Bangladesh. Specifically, in 1993 Pfizer transferred the ownership of its Bangladesh operations to local shareholders, and the name of the company was changed to Renata Limited

No. of Employees: 2,213 employees.

Distributors and Affiliations: Our Alliance-Partners are as follows:

- Novartis Vaccines (Rabipur, Vaxem HiB, and Agrippal)

- BASF, Germany (Animal Nutrition Products)

- InterVax, Canada (Meningococcal Vaccine)

- Evans Vanodine, UK (Disinfectant)

- Zinpro, USA (Metal Amino Acid Complexes)

- Biomin Laboratories, Singapore (Mycotoxin Binders and Nutraceuticals)

International Presence: Guyana, Jordan, Kenya, Myanmar, Philippines, Sri Lanka, Vietnam, and United Kingdom

Investment: 100% Shareholding in Renata Agro Industries Limited

Bankers: Agrani Bank, Standard Chartered Bank, Eastern Bank, HSBC, Sonali Bank, Citi Bank, and Mutual Trust Bank

General Facility (Mirpur, Dhaka)

Area: 196,730 SFT or 18,277 m2

Manufacturing Capabilities: Tablet, Capsule, Soft Gel, Effervescent Tablet, Dry Syrup, Sterile Dry Fill, Sterile Liquid Fill, Large Volume Parenteral (Pilot), Lyophilisation (Pilot), and Premix

Packaging Capabilities: Blister pack, bottle dry-fill, pot-fill, and strip packaging

History or Background of Renata:

My selected company is Renata Limited. This company belongs to the Pharmaceuticals Industry. Currently the industry is very much profitable and there is a very high probability that the industry will remain profitable in the future as well. Picture of future profitability of this industry can easily found in the company’s financial statements.

The pharmaceutical business registered a growth of 25.2 percent and Renata’s market rank improved from 7th to 6th. In the Animal Health business Renata retained its no. 1 position. It is noteworthy that animal health products were exported for the first time in the history of the Company. The international business in animal health products began with exports to Jordan and the Company hopes to add Vietnam to this list in 2009. In the Contract Manufacturing business segment, Renata produced Prednisolone tablets on behalf of a company in the UK. Renata is also very bullish about the Sprinkles business. Both UNICEF and SMC have strengthened their marketing operations for this product. Moreover, the Sprinkles product is being heavily promoted by donor agencies all over the world, and Renata is regarded as being regarded as one of the few companies in the world with the capability of manufacturing pharmaceutical grade Sprinkles. Now, concluded that provided the exchange rate remains stable, the year 2009 is expected to be good for Renata as its pharmaceutical and contract manufacturing are poised to register significant growth.

It is informed that in the year 2007 Pharma industry witnessed a disinformation campaign about high drug prices and poor quality of medicines which forced the industry to shift its focus from exploring and building for long-term growth to merely fighting for survival. Not since 1982 had the Industry witnessed such a crisis of confidence.

In 2007, Renata’s combined turnover and net profit grew by 31.5% and 38.7%, respectively. Earning per Share (EPS) stood at Tk.348.5 compared to Tk.251.2 in the year 2006. Renata also contributed Tk. 524 million to the national exchequer in the form of Corporate Taxes, Value Added Tax and Import Duties. The retained earnings of the company stand at a healthy Tk.911.3 million against zero long-term debt.

It informed that Renata’s Potent Product Facility was accredited by the Medicines and Healthcare products Regulatory Agency (MHRA) of the UK, the first potent facility in Bangladesh to receive such recognition.

Establishment year:

Renata has five manufacturing facilities on two separate sites. The original 12-acre site is located in Mirpur, Dhaka, while the new 17-acre site located in Rajendrapur, Gazipur began operations.

Listing Year:

Founded in 1972 as a subsidiary of Pfizer Inc. Ownership transferred from Pfizer Inc. to local institutions and the general public in 1993. Company name subsequently changed from Pfizer Laboratories (Bangladesh) Limited to Renata Limited.

Its vision: To establish Renata permanently among the best of innovative branded generic companies.

It’s Mission: To provide maximum value to our customers, shareholders, colleagues, and communities where we live and work.

Product type:

Interpretation of ratio analysis of the Renata Ltd.:

Current ratio is increasing it is good for the growth. Quick ratio is increasing it means quick assets is increasing then quick liability. Cash ratio is decreasing it means current liability is increase then cash a marketable securities. It’s not good for the growth. Cash flow from the operation is decreasing in 2006 and 2007, but it was increased in 2005. Accounts receivables turnover is increasing, it is good for growth. Time interest earned is increasing; it means net income is increasing. In 2005 and 2006 return on assets is same; in 2007 it is increase by 0.01. Total asset turnover is fluctuating; it is increase in 2006 but its decrease in 2007. Equity turnover is also fluctuating it is not good for company. Net profit margin ratio decrease in 2006 but it is increase in 2007, Increase of net profit margin ratio is good for the growth. Return on common stockholders equity is increase; it means return is increasing its good for growth.

General activities of the organization

The Value Chain

The value chain is a systematic approach to examining the development of competitive advantage. It was created by M.E. Porter in his book, Competitive Advantage (1980). The chain consists of a series of activities that create and build value. They culminate in the total value delivered by an organization. The ‘margin’ depicted in the diagram is the same as added value. The organization is split into ‘primary activities’ and support activities.’

Primary activities

Inbound Logistics:

Here goods are received from a company’s suppliers. They are stored until they are needed on the production/assembly line. Goods are moved around the organization.

Operations:

This is where goods are manufactured or assembled. Processes that transform inputs into finished goods. Individual operations could include room service in a hotel, packing of books/videos/games by an online retailer, or the final tune for a new car’s engine.

Outbound Logistics:

The goods are now finished, and they need to be sent along the supply chain to wholesalers, retailers or the final consumer.

Marketing and Sales:

In true customer orientated fashion, at this stage the organization prepares the offering to meet the needs of targeted customers. This area focuses strongly upon marketing communications and the promotions mix.

Service:

This includes all areas of service such as installation, after-sales service, complaints handling, training and so on.

Supportive Activities:

Procurement:

This function is responsible for all purchasing of goods, service and materials. The aim is to secure the lowest possible price for purchases of the highest possible quality. They will be responsible for outsourcing (components or operations that would normally be done in-house are done by other organization), and purchasing (using IT and web-based technologies to achieve procurement aims).

Technology Development:

Technology is an important source of competitive advantage. Companies need to innovate to reduce costs and to protect and sustain competitive advantage. This could include production technology, Internet marketing activities, lean manufacturing, Customer Relationship Management (CRM), and many other technological developments.

Human Resource Management (HRM):

Employees are an expensive and vital resource. An organization would manage recruitment and selection, training and development, and rewards and remuneration. The mission and objectives of the organization would be driving force behind the HRM strategy.

Firm Infrastructure:

This activity includes and is driven by corporate or strategic planning. It includes the Management Information System (MIS) and other mechanisms for planning and control such as the accounting department. The firm’s margin or profit then depends on its effectiveness in performing these activities efficiently, so that the amount that the customer is willing to pay for the products exceeds the cost of the activities in the value chain. It is in these activities that a firm has the opportunity to generate superior value. A competitive advantage may be achieved by reconfiguring the value chain to provide lower cost or better differentiation.

The value chain model is a useful analysis tool for defining a firm’s core competencies and the activities in which it can pursue a competitive advantage as follows:

- Cost advantage: By better understanding costs and squeezing them out of the value-adding activities.

- Differentiation: By focusing on those activities associated with core competencies and capabilities in order to perform them better than do competitors.

A firm may create a cost advantage either by reducing the cost of individual value chain activities or by reconfiguring the value chain. Once the value chain is defined; a cost analysis can be performed by assigning costs to the value chain activities. The costs obtained form the accounting report may need to be modified in order to allocate them properly to the value creating activities. Explain the role of value chain management in achieving superior quality, efficiency, and responsiveness to customers.

Value-Chain management and Competitive Advantage:-

Value Chain:

The functional activities that transform input into outputs of good and service that customer’s value.

- Production function – creates the goods and services of a company.

- Service function – provides after sale service and support.

- Materials management function – the movement of physical materials through the value chain.

- Information systems function electronic systems for inventory, sales tracking, pricing products, and selling products.

Functional Strategies and Competitive Advantage:-

- Functional managers need to be sure that the organization attains superior efficiency, quality, speed, flexibility, innovation, and responsiveness to customers.

- Describe what customers want, and explain why it is so important for manager to be responsive to their needs.

Improving Responsiveness to customers:-

What do customers want?

- A lower price.

- High-quality products.

- Quick service.

- Products with many features.

- Customized products.

- Designing operating systems responsive to customers – the ability of an organization to satisfy its customers depends on its operating system.

- Explain why achieving superior quality is so important.

Improving Quality:

- High quality products are reliable, dependable, and satisfying to customers. Customers usually prefer a higher quality product. Also, higher product quality can increase production efficiency and lower production costs and increase profit.

- Describe the challenges facing managers and organizations that seek to implement total quality management.

Total Quality Management (TQM):-

Improving the quality of products and services should be the focus of everyone in the organization.

- Build commitment to quality.

- Focus on the customer.

- Find ways to measure quality.

- Set goals and create incentives to reach them.

- Use a JIT inventory system.

- Work closely with suppliers.

- Break down barriers between the different functional areas.

- Explain why achieving superior efficiency is so important.

Improving Efficiency:

The fewer imputes required to produce an output, the higher the efficiency of the operating system. Differentiate among facilities layout, flexible manufacturing, just in time inventory, and process reengineering.

- Facilities layout, flexible manufacturing, and efficiency

- Facilities layout – the way in which machines and people are grouped in production.

- Product layout – workers stay in one place and the product comes to them (e.g. mass production in a Ford automobile plant).

- Process layout – workers stay in one place, but the product comes to whichever worker is needed to do the next operation.

- Fixed – position layout, the product in production.

- Stays in one place, and components produced elsewhere are brought to it (e.g. jet planes).

- Time will become more efficient.

- Just-in-time inventory and efficiency increases, if the raw materials or components can be supplied in production very close to the time when they are actually needed in the production process.

- Self-managed work teams and efficiency – these teams provide a flexible workforce and reduce the need for supervision.

- Process reengineering and efficiency – radical redesign of business processes can improve performance.

- Information systems, the internet, and efficiency, the internet can significantly reduce a company’s ordering and customer service functions.

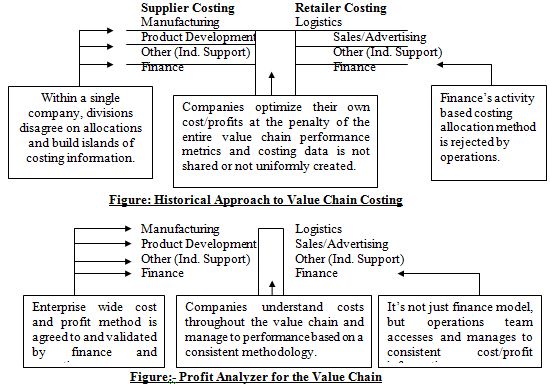

Companies today use Acorn Systems profit Analysis and Improvement Software to identify opportunities to reduce costs and improve profits and to communicate this information with their value chain partners so that the entire value chain operates more cost efficiency. Acorn Systems enables value chains to operate more cost efficiency by:

- Identifying and sharing – yet confidentially maintaining – opportunities to reduce costs, not just shift costs from one member of the value chain to another.

- Identifying opportunities to improve processes, manage efficiencies, measure promotion, rebate and advertising effectiveness.

- Perform what-it profits analysis on new products, processes or distribution strategies.

Acorn Systems Cost Analyzer enables you to determine which processes, orders, and business practices are inefficient and either money losing and below benchmarks. Cost Analyzer provides the specificity by vendor and transaction necessary to engage in “win-win” contract negotiation.

Since an unprofitable business practice of a vendor or customer often drains the profitability of their business partners, many Acorn customers have used Cost Analyzer data to engage in vendor or customer discussions to successfully renegotiate contract and increase the profitability of both companies.

Porter identified 10 cost drivers related to value chain activities:

- Economics of scale

- Learning

- Capacity utilization

- Linkages among activities

- Interrelationships among business units

- Degree of vertical integration

- Timing of market entry

- Firm’s policy of cost or differentiation

- Geographic location

- Institutional factors (regulation, union activity, taxes, etc.)

A firm developers a cost advantage by controlling these drivers better than do the competitors. A cost advantage also can be pursued by reconfiguring the value chain. Reconfiguration means structural changes such a new production process, new distribution channels, or a different sales approach. For example, FedEx structurally redefined express freight service by acquiring its own planes and implementing a hub and spoke system.

Technology and the Value Chain:

Because technology is employed to some degree in every value creating activity, changes in technology can impact competitive advantage by incrementally changing the activities themselves or by making possible new configurations of the value chain.

Linkages between Value Chain Activities:

Value chain activities are not isolated from one another. Rather, one value chain activity often affects the cost or performance of other ones. Linkages may exist between primary activities and also between primary and support activities. Consider the case in which the design of a product is changed in order to reduce manufacturing costs. Suppose that inadvertently the new product design results in increased service costs; the cost reduction could be less than anticipated and even worse, there could be a net cost increase.

Sometimes however, the firm may be able to reduce cost in one activity and consequently enjoy a cost reduction in another, such as when a design change simultaneously reduces manufacturing costs and improves reliability so that the service costs also are reduced. Through such improvements the firm has the potential to develop a competitive advantage.

Analyzing Business Unit Interrelationships:

Interrelationships among business units form the basis for a horizontal strategy. Such business unit interrelationships can be identified by a value chain analysis. Tangible interrelationships offer direct opportunities to create a synergy among business units. For example, if multiple business units require a particular raw material, the procurement of that material can be shared among the business units. This sharing of the procurement activity can result in cost reduction. Such interrelationships may exist simultaneously in multiple value chain activities.

Unfortunately, attempts to achieve synergy from the interrelationships among different business units often fall short of expectations due to unanticipated drawbacks. The cost of coordination, the cost of reduced flexibility, and organizational practicalities should be analyzed when devising a strategy to reap the benefits of the synergies.

Outsourcing Value Chain Activities:

A firm may specialize in one or more value chain activities and outsource the rest. The extent to which a firm performs upstream and downstream activities is described by its degree of vertical integration. A thorough value chain analysis can illuminate the business system to facilitate outsourcing decisions. To decide which activities to outsource, managers must understand the firm’s strengths and weaknesses in each activity, both in terms of cost and ability to differentiate. Managers may consider the following when selecting activities to outsource.

- Whether the activity can be performed cheaper or better by supplier.

- Whether the activity is one of the firm’s core competencies from which stems a cost advantages or product differentiation?

- The risk of performing the activity in-house. If the activity relies on fast-changing technology or the product is sold in a rapidly changing market, it may be advantageous to outsource the activity in order to maintain flexibility and avoid the risk of investing in specialized assets.

- Whether the outsourcing of an activity can result in business process improvements such as reduced lead-time, higher flexibility, reduced inventory, etc.

Marketing Strategy:

Marketing strategy for selected buyers or existing buyers:

Marketing strategy for selected buyer or existing buyer to communicate them time to time and try to fulfill all requirements for each order and keeping the long term relationship.

Marketing strategy for potential buyer:

At first, Communicate with the potential / new buyer by issued Business development letter including complete profile of the factory. By this letter Renata Ltd. offer to buyer for factory evaluation. After that it requested buyers to visit there factory on there suitable time. If buyer satisfied by seeing the factory then there is a chance to get order from buyer.

Just-in-time inventory and efficiency increases, if the raw materials or components can be supplied in production very close to the time when they are actually needed in the production process.

- Self-managed work teams and efficiency – these teams provide a flexible workforce and reduce the need for supervision.

- Process reengineering and efficiency – radical redesign of business processes can improve performance.

- Information systems, the internet, and efficiency, the internet can significantly reduce a company’s ordering and customer service functions.

Risk measured by key parameters:

| Principal Risk Components | Key Parameters |

| Financial Risk | Leverage, Liquidity, Profitability & Coverage ratio |

| Business/Industry Risk | Size of Business, Age of Business, Business Outlook, Industry Growth, Competition & Barriers to Business |

| Management Risk | Experience, Succession & Team Work. |

| Security Risk | Security Coverage, Collateral Coverage and Support. |

| Relationship Risk | Account Conduct ,Utilization of Limit, Compliance of covenants/conditions & Personal Deposit |

Strategic position & action evaluation:

| Company’s competitive advantage | Company’s financial strength |

| Market share | Return on investment |

| Product quality | Leverage |

| Product life cycle | liquidity |

| Product replacement cycle | Capital required/capital available |

| Customer loyalty | Cash flow |

| Competition’s capacity utilization | Ease of exit from market |

| Technological know-how | Risk involved in the business |

| Vertical integration | |

| Industry strength | Environment stability |

| Growth potential | Technological changes |

| Profit potential | Rate of inflation |

| Financial stability | Demand variability |

| Technological know- how | Price range of competing products |

| Resource utilization | Barriers to entry into market |

| Capacity intensity | Competitive pressure |

| Ease of entry into market | Price elasticity of demand |

| Productivity, capacity utilization |

So it company will enjoy a competitive advantage but has limited financial strength and belong to an attractive industry operating in a relatively unstable environment.

SWOT Analysis

A SWOT analysis is overall evaluation of the company’s Strengths, Weakness, Opportunities and Threat. Strengths and Weakness are internal value creating (or destroying) factors such as assets skills or recourses etc. And Opportunities and thereat are external value creating (or destroying) factors a company can’t control.

Strengths of Renata Ltd.:

- The large portion of this company established in their own land.

- This company is well equipped with skilled, and expertise and productive manpower. They are doing timely shipment and 100% perfect quality.

- Ability to cope with the change.

- Attractive pay package.

- They arranged required raw materials as per requirements of their valued buyers and provide samples on specific queries in a very quicker way.

- Experienced management team.

- Good working condition.

- Modern technology.

- Innovative product line.

- They are corresponding with buyers firstly.

- World wide.

Weakness of Renata Ltd.:

- Short of marketing expertise.

- Lacking accountability.

- Number of employee is not so much.

- Need to require proper coordination with different section.

- Delay in payment from supplier.

- Conflict and working load are seen.

- The subordinate are not taking any decision or policy making meeting. The decision always comes from Managing director.

- Location of the factory.

- Power centralization by the top management.

- Nepotism and corruption are available.

Opportunities of Renata Ltd.:

- Developing market area ( EU, USA, China, etc.)

- They can lead against weak competitor.

- They always try to higher dynamic young people so that output will come more.

- Attain different trade fare and get new idea related with today’s business.

- They can give extra facility to gain customers satisfaction.

- The students as customers through some special offers.

- Scope of expansion on of business.

Thereat to Renata Ltd.:

- Government tax and vat structure.

- In Bangladesh, so many companies are there. For that reason, buyer are offering lower price.

- Competitor offer and new innovative substitute products.

- Increased trade barriers and quota system withdrawn.

- Delay of payment from buyer creates some times bad situation of company’s liquidity and future financial budget plan.

- Strike (Hartal)

- Skilled employee switching.

Conclusion:

The key guidelines to the assignment planning, analysis which have been clearly articulated in the paper and made my concept sharpen are-

- Develop a strategy that leads to a sustainable competitive advantage.

- Sharpen the ability of the firm to identify promising investment opportunities.

- Arrange required raw materials as per requirements of their valued buyers and provide samples on specific queries in a very quicker way.

In conducting the appraisal i felt a short coming of my technical knowledge and practical experience to comprehend the conceptual framework of this type of assignment. Nevertheless i tried to understand almost all the key components of this assignment appraising at least those covered in the assignment.

Recommendation

I would like to recommend on the following areas that’s should be help to achieve the goals of Renata Ltd. Generally I will give concentration on marketing strategy and as well as performance evaluation process.

- Identify the market segmentation efficiently, then setting their target market and forecast which market offering more opportunity.

- Renata’s marketing department must try to understand the buyer needs, wants and demands.

- Need to develop long term relationship with key parties-buyers, buying house and suppliers.

- To achieve the goals, Renata’s marketing team need to establish effective marketing mix (product, price, promotion and place).

- Today’s business world moving very first by the digital revolution. The impact of the digital revolution and it can implement data based marketing.

- Survey on buyer intentions regarding plant, equipment, raw materials, place, compliance etc.

- Identify their position based on the product life cycle and position of their competitors, and then take a corrective action.