“Whoa!” is the greatest term I can think of to characterize 2021 as someone who covers Southeast Asian businesses and financing stories. This year international investors began to pay attention to the region’s innovation ecosystems, as well as spend real money on them. Southeast Asia-focused venture companies including Alpha JWC, AC Ventures, and Jungle Ventures raised their largest rounds ever, backed by foreign LPs.

As exits like Grab and Sea’s initial public offerings boosted interest in Southeast Asia’s startup ecosystems, American companies like a16z, Valar Ventures, Hedosophia, and Goodwater Capital were putting up (or planned) regional offices, according to The Ken. Golden Gate Ventures’ thorough analysis also predicted a record number of exits, owing in part to an increase in B and C rounds. Because Southeast Asia is such a huge and complicated region, I always feel a little funny referring to it as “Southeast Asia.” When I am trying to be concise, it is the quickest option, but Southeast Asia is made up of 11 nations, and there are noticeable distinctions between, for instance, Singapore, Myanmar, Laos, Vietnam, the Philippines, and Indonesia.

When compared to its neighbors, one might argue that Singapore’s startup environment is in a class by itself as a global financial hub. In addition, Indonesia, as the world’s fourth-largest economy and the most populous Southeast Asian country (with 273.5 million people), deserves special attention. In 2021, both nations generated a significant number of unicorns. Ninja Van, Carousell, Carro, and Nium were among the firms that achieved unicorn status in Singapore.

While Singaporean startups tend to focus on other Southeast Asian countries (or, in Nium’s case, the United States and Latin America), Indonesian founders may have medium- or long-term plans for international expansion, but most of the ones I spoke with plan to expand within the country for at least the next year. Indonesia is not just big, but also geographically complicated, with over 17,000 islands, around 6,000 of which are inhabited. Businesses often debut in Greater Jakarta before moving to other Tier 1 cities like Bandung and Surabaya, but many, particularly fintech and e-commerce startups, are eyeing smaller cities.

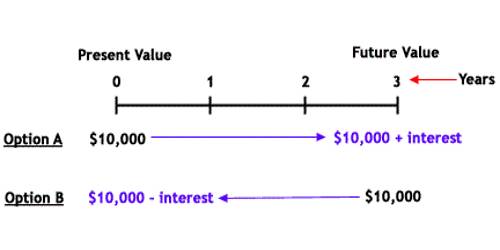

At the start of 2021, a slew of investment apps, many geared at millennials and first-time retail investors, secured modest seed rounds, only to soon follow by considerably bigger follow-on funding a few months later. Pintu, a crypto-focused Indonesian startup, robo-advisor Bibit, Ajaib, Pluang, and Singapore-based Syfe are just a few examples. While retail investment rates in Indonesia are still low, they are increasing because of increased interest in financial planning during the epidemic and the popularity of stock influencers, despite worries about some of them.