A solvency ratio is a crucial metric used by prospective business lenders to assess an organization’s capacity to satisfy long-term debt obligations. Lenders, potential investors, suppliers, and any other organization interested in doing business with a company can all benefit from the measure. It for the most part contrasts the element’s benefit and its commitments to decide if it is monetarily solid. A dissolvability proportion demonstrates whether an organization’s income is adequate to meet its drawn-out liabilities and consequently is a proportion of its monetary wellbeing.

It determines if a company’s cash flow is sufficient to satisfy its long-term obligations. As a result, it’s regarded as a barometer of the company’s financial health. An unfavorable ratio indicates that a corporation is likely to default on its debt obligations. The principal solvency ratios are the obligation to resources proportion, the interest coverage ratio, the value proportion, and the debt-to-equity (D/E) ratio. These actions might be contrasted and liquidity proportions, which consider an association’s capacity to meet transient commitments as opposed to medium-to long haul ones.

To compute the ratio, partition an organization’s after-charge overall gain and add back devaluation by the amount of its liabilities (present moment and long haul). Dissolvability proportions are regularly utilized by imminent moneylenders while assessing an organization’s reliability just as by potential security financial backers. Different countries calculate the solvency ratio using various approaches and have different standards. In India, for example, insurers must maintain a minimum ratio of 1.5.

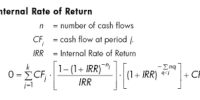

Solvency ratios and liquidity ratios both measure an organization’s monetary wellbeing however dissolvability proportions have a more extended term standpoint than liquidity ratios. It is an overall proportion of dissolvability, as it estimates an association’s real income, instead of net gain, by adding deterioration and other non-cash costs to assess an organization’s ability to remain above afloat. There are a few alternative techniques to determine a company’s solvency, as mentioned below, but the fundamental formula for determining the solvency ratio is as follows:

Solvency Ratio = (Net Income + Depreciation) / All Liabilities (Short-term + Long-term Liabilities)

Solvency ratios are used to assess a company’s ability to repay long-term debt. It’s worth noting that the percentage of Shareholders’ Funds (Owner’s Equity) in relation to total liabilities establishes an organization’s solvency. Critical to note is that an organization is considered monetarily solid in the event that it accomplishes a dissolvability proportion surpassing 20%. The higher the Shareholder’s Funds contrasted with different liabilities of the Organization, the more noteworthy the Solvency business appreciates and the other way around.

When reviewing insurance firms, a solvency ratio is used to compare the size of the capital to the premiums written, and it measures the risk an insurer faces on claims it cannot cover. This ratio evaluates a company’s long-term debt repayment abilities as well as the interest on that debt to determine its long-term health. Albeit the solvency ratio is a helpful measure, there is one region where it misses the mark. It doesn’t factor in an organization’s capacity to secure new financing sources in the long haul, like assets from stock or bonds.

Types of Solvency Ratios –

- Interest Coverage Ratio: The interest coverage ratio is used to determine if a corporation can pay interest on its outstanding debt obligations. It is calculated by dividing the company’s EBIT (earnings before interest and taxes) by the amount of debt interest due for the accounting period. It is preferable to have a larger ratio. If the ratio falls below 1.5, it may suggest that a corporation will have trouble paying its obligations’ interest.

- Debt to equity ratio: The debt-to-equity ratio is similar to the debt-to-assets ratio in that it shows how debt is used to fund a company. The higher the ratio, the more debt a business has on its books, and the greater the risk of default. The debt-to-equity ratio examines how much of the debt can be covered by equity in the event of a liquidation. The long-term debts involve bank loans, bonds payable, notes payable etc.

- Proprietary Ratio or Equity Ratio: Equity ratios are another name for proprietary ratios. It establishes a link between the owner’s funds and the company’s net assets or capital. A company’s health is measured by its number. The higher the number, the better. The lower the number, the more debt a business has compared to its equity.

- Debt-To-Assets Ratio: The debt-to-assets ratio compares the overall debt of a corporation to its total assets. It calculates a firm’s leverage and shows how much of the company is funded by debt vs assets, as well as the company’s ability to repay debt with available assets. A higher ratio, particularly one above 1.0, suggests that a corporation is heavily reliant on debt and may struggle to satisfy its obligations.

Before an individual or organization invests in or lends money to a firm, they must be confident that the company will stay solvent in the long run. As a result, interested parties use solvency ratios to assess a company’s ability to repay its loans in the long run. The solvency ratio for pension schemes is the ratio of assets to liabilities (the pensions to be paid). The going concern ratio, which gauges the cost of pensions if the pension plan continues to exist, is another indicator of the pension plan’s capacity to pay all benefits in perpetuity.

Analysts should be concerned if one of the ratios indicates limited solvency. If several of these ratios indicate low solvency, that’s a big deal, especially if the overall economy is doing well. It’s essential to take a gander at an assortment of proportions to fathom the genuine monetary strength of an organization, just as comprehend the explanation that a proportion is the thing that it is. An organization that battles with dissolvability when things are acceptable is probably not going to toll well in an unpleasant financial climate.

Furthermore, a number by itself will not provide much information. To establish whether a company’s ratio is acceptable or not, it must be compared to its counterparts, particularly strong companies in its field. A high solvency ratio means that security, while a low proportion signals monetary shortcoming. To get an unmistakable image of the organization’s liquidity and dissolvability, potential financial backers utilize the measurement close by others, like the obligation to-value proportion, the obligation to-capital proportion, and the sky is the limit from there.

It should be noticed that the different Solvency Ratios talked about above ought not be found in seclusion yet ought to be thought about all things considered, which will assist partners with bettering and like the significance of these proportions and make a superior judgment identified with the drawn-out dissolvability and capacity of the business to respect its monetary responsibilities and keep being a worth maker. Liquidity and solvency ratios are comparable, but there are several key differences. Both of these types of financial measures will give you an idea of how healthy a firm is.

It should motivate business owners to minimize debt, increase assets, or do both. For a potential investor, these are major warning signs of impending troubles, as well as a concerning indicative of the stock price’s prospective path. Solvency ratios examine a company’s whole asset base, including long-term loans such as bonds with maturities of more than a year. Traders may see this as a signal to sell the stock short, however they would consider a variety of other criteria in addition to solvency before making such a move.

Information Sources: