The significance of Time Value of Money –

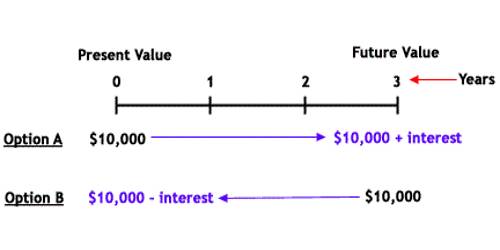

The time value of money is the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. Time value of money is a widely used concept in the literature of finance. Financial decision models based on finance theories basically deal with the maximization of the economic welfare of shareholders. A fundamental idea in finance that money that one has now is worth more than money one will receive in the future.

The concept of time value of money contributes to this aspect to a greater extent. The significance of the concept of time value of money could be stated as below:

Investment Decision

The investment decision is concerned with the allocation of capital into long-term investment projects. The cash flow from long-term investment occurs at a different point in time in the future. In other words, investment decisions are concerned with the question of whether adding to capital assets today will increase the revenues of tomorrow to cover costs. They are not comparable to each other and against the cost of the project spent at present. To make them comparable, the future cash flows are discounted back to present value. As such investment decisions are concerned with the choice of acquiring real assets over the time period in a productive process.

The concept of time value of money is useful to securities investors. They use valuation models while making an investment in securities such as stock and bonds. These security valuation models consider the time value of cash flows from securities.

Financing Decision

Financing decision is concerned with designing optimum capital structure and raising funds from the least cost sources. The concept of time value of money is equally useful in financing decision, especially when we deal with comparing the cost of different sources of financing. It is concerned with the borrowing and allocation of funds required for the investment decisions. The effective rate of interest of each source of financing is calculated based on the time value of money concept. Similarly, in leasing versus buying decision, we calculate the present value of the cost of leasing and the cost of buying. The present value of costs of two alternatives is compared against each other to decide on an appropriate source of financing. The objective of financial decision is to maintain an optimum capital structure, i.e. a proper mix of debt and equity, to ensure the trade-off between the risk and return to the shareholders.

Besides, the concept of time value of money is also used in evaluating proposed credit policies and the firm’s efficiency in managing cash collection under current assets management.

Information Source: