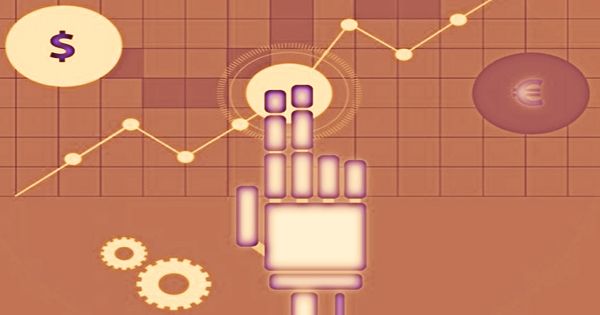

Online investment management services that employ mathematical algorithms to provide financial advice with minimal human involvement are Robo-advisors (also spelled Robo-advisor or roboadvisor). Based on mathematical principles or algorithms, they offer automated financial advice. These algorithms/calculations are planned by monetary guides, venture directors, and information researchers, and coded in programming by developers. An average Robo-counsel gathers data from customers about their monetary circumstances and future objectives through an online review and afterward utilizes the information to offer exhortation and consequently contribute customer resources. In reality, Robo-advisors use online questionnaires that collect data on the degree of risk aversion, financial position, and desired return on investment of the customers.

These algorithms are software-executed and do not need a human advisor to provide a client with financial advice. The software uses its algorithms to delegate, control, and maximizes the assets of customers automatically for either short-run or long-run investment. The best Robo-advisors offer simple record arrangements, strong objective arranging, account administrations, portfolio the board, and security highlights, mindful client assistance, exhaustive instruction, and low charges. Robo advisors are an alternative to conventional financial consultants and are typically a cheaper choice. They’re also an alternative to only selecting and choosing assets on their own for an investor.

The degree of risk aversion relates to the extent to which in order to minimize volatility, investors are able to lower returns. For an investor, it typically varies depending on the investment’s financial objectives and time horizon. There are more than 100 Robo-advisory services. Speculation the executive’s Robo-advice is viewed as a discovery in previously restrictive abundance the board administrations, carrying administrations to a more extensive crowd with lower cost contrasted with customary human guidance. Most Robo-advisors are currently using passive indexing strategies that are optimized using a variant of modern portfolio theory (MPT). Some Robo-advisors have socially responsible investing (SRI) tailored portfolios, Hallal investing, or tactical strategies that mimic hedge funds.

(Robo-Advisor)

An individual/investor can be categorized as:

- Risk-averse: Usually, risk-averse investors search for secure investments, although they can know comparatively lower returns.

- Risk-neutral: Investors who are risk-neutral tend to be indifferent between relatively risky and secure investments.

- Risk-seeking: Typically, risk-seeking investors prefer riskier investments that provide high incentives.

Robo-advisors commonly distribute a customer’s resources based on danger inclinations and wanted objective return. Numerous well-known Robo-advisors urge speculators to routinely add to their records, for example, little week by week stores. It will utilize those commitments to keep up the objective portion. Through providing the service directly to customers, the introduction of modern Robo-advisors has totally changed the narrative. During the financial crisis, the first Robo-advisors were launched in 2008. In 2010, Betterment was introduced by Jon Stein, a 30-year-old entrepreneur, and Robo-advisors soared in popularity.

The first Robo-advisers were used by financial advisors as an online interface to control and align client assets. As this form of software has been in use by financial advisors and managers since the early 2000s, this technology was not new to this area. Following a time of improvement, Robo-advisors are currently fit for taking care of substantially more refined undertakings, for example, charge misfortune reaping, venture choice, and retirement arranging. As a consequence, the industry has experienced exponential growth; Robo-advisor managed customer assets reached $60 billion at the end of 2015 and are expected to reach US$2 trillion by 2020 and $7 trillion by 2025 worldwide.

Robo advice is sometimes referred to as automated guidance. It can be described as “a self-guided online wealth management service that provides automated investment advice at low costs and low account minimums, employing portfolio management algorithms.” In order to create passive, indexed portfolios for their users, the majority of Robo-advisors use modern portfolio theory (or some variant). Once developed, Robo-advisors continue to track those portfolios to ensure that even after markets change, the optimal asset class weightings are retained. By using rebalancing bands, Robo-advisors accomplish this.

Robo advisor fees can be arranged as a fixed monthly fee or as an asset percentage. Monthly fixed rates can be as low as $1. Percentage fees vary from approximately 0.15% to 0.50%. Although in the United States, Robo-advisors are most prevalent, they are also present in Europe, Australia, India, Canada, and Asia. The fundamental favorable position of Robo-advisors is that they are minimal effort options in contrast to customary consultants. By taking out human work, online stages can offer similar administrations at a small amount of the expense. Robo-advisors are reaching out into fresher business roads, such as retail utilization sparing decisions and retirement and decumulation arranging.

Also, Robo-advisors are more accessible; as long as the user has an Internet connection, they are available 24/7. The risk of a portfolio controlled by a Robo-advisor completely depends on the investor’s expectations. Robo-advisors are neither safe nor risky. It offers a range of risk and timeline preferences for investors to choose from. The portfolios that Robo-advisors offer are commonly trade exchanged assets. Be that as it may, some offer unadulterated value portfolios. By evaluating each individual speculator’s craving for hazard, Robo-advisors can minister customized portfolios.

Information Sources: