Return on marketing investment (ROMI) is a metric used in online marketing to measure the effectiveness of a marketing campaign. ROMI is the contribution to profit attributable to marketing (net of marketing spending), divided by the marketing ‘invested’ or risked. ROMI is not like the other ‘return-on-investment’ (ROI) metrics because marketing is not the same kind of investment. It examines results in relation to the specific marketing objective. ROMI is a subcategory of return on investment or ROI because here the cost is incurred on marketing. Instead of money that is ‘tied’ up in plants and inventories (often considered capital expenditure or CAPEX), marketing funds are typically ‘risked’. Effective marketers are driven to connect their time, energy and advertising spend with results that contribute to company growth. Marketing spending is typically expensed in the current period (operational expenditure or OPEX).

The idea of measuring the market’s response in terms of sales and profits is not new, but terms such as marketing ROI and ROMI are used more frequently now than in past periods. Marketing a product could be expensive across various avenues available such as a website, social media, print, magazines, or hoardings. It’s a relatively crucial strategic metric for many things. For one, it could be used to decide whether to partner with a new supplier or whether a particular product is working particularly well. Usually, marketing spending will be deemed as justified if the ROMI is positive. In a survey of nearly 200 senior marketing managers, nearly half responded that they found the ROMI metric very useful.

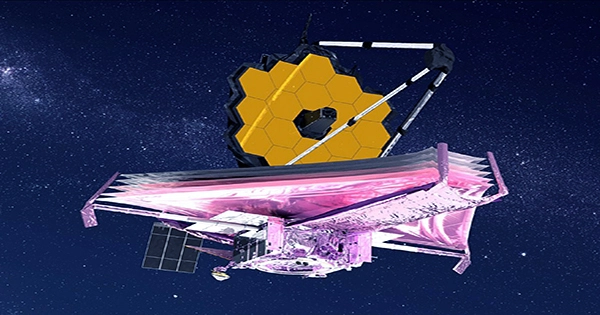

Fig: Return Marketing Investment Average Roi Marketing Campaigns

ROMI will tell you precisely how much profit a marketing campaign is making in comparison to the costs of running a said campaign. The purpose of ROMI is to measure the degree to which spending on marketing contributes to profits. Marketers are under more and more pressure to “show a return” on their activities. In a nutshell, it calculates how much money has been invested and, then, what you’ve earned through this investment. It examines results in relation to the specific marketing objective. ROMI is a subcategory of return on investment or ROI because here the cost is incurred on marketing.

For instance, instead of money that is ‘tied’ up in plants and inventories (often considered capital expenditure or CAPEX), marketing funds are typically ‘risked’. Meaning, marketing spending is typically expensed in the current period (operational expenditure or OPEX). The ROMI concept first came to prominence in the 1990s.

Example: Let’s say we have a company that averages 4% organic sales growth and they run a $10,000 campaign for a month. The sales growth for that month is $15,000. The calculation goes:

Return on Marketing Investment = [($15,000 – $10,000) / $10,000)] x 100 = 50%