1.1 Introduction

Banks are the blood of economy; banking system plays very important role in the economic life of the nation. The total money circulation of the economy is done through the banks. In a developing country like Bangladesh banks perform key role to make equal distribution of fund in all sectors of the economy. Side-by-side the banks also need to maintain profitability to ensure their continuity. But the intense competition between the banks exposes the banks to more risk and requires them to make innovation to sustain in the economy. SME financing is a new innovation in banking industry of Bangladesh. SME contributes more to the development of a developing country.

Realizing the importance of Commercial Banks and SME development for a developing country like Bangladesh, I have chosen to do my internship report titled-

“SME Banking & Performance Analysis of Mercantile Bank Limited”

The internship-training is an integral part of BBA degree requirement. After completion of BBA degree, students are sent to different organizations to expose them to real life management situation in the profit seeking commercial and non- profit seeking organizations. The theoretical knowledge that we acquired from class lectures, books, journals, case studies, project, workshop etc. is replenished in the practical settings. Here we also get an opportunity to realize the relevance and usefulness of the learning. Hence, I was placed in Mercantile Bank Limited, Mohakhali Branch by BBA program placement office for practical orientation in Bank.

1.2 Objectives of the study

The main objective of the study is to highlight the present SME financing practices by banks in Bangladesh and to suggest measures to make SME financing more purposeful and effective. Besides the following objectives are also to be taken under discussion:

v To highlight the importance of SME financing in Bangladesh.

v To highlight the initiative of Bangladesh Bank to promote SME financing by commercial banks.

v To become familiar with the operations of Mercantile Bank Limited.

v To become familiar with the SME product policy guidelines maintained by Mercantile Bank.

v To analysis the SME Lending procedures maintained by Mercantile Bank.

v To observe SME Lending activities of Mercantile Bank Limited.

v To state the present condition of SME financing of Mercantile Bank.

v To analyze the comparative performance of Mercantile Bank Limited with third generation banks.

v To analyze the overall performance of Mercantile Bank over the years.

v To measure the profitability and probability of book value insolvency of Mercantile Bank.

v To find out the challenging areas and recommend some better solutions for solving the problems.

1.3 Methodology

Types of research:

- Descriptive &

- Analytical

The study is based mainly on depth discussion with the management of the organization and published information collected from secondary sources of the organizations.

Data Selection:

Problem identification can solve the major portion of the problem. So first of all it was tried to identify required information about the study.

Data Collection:

Both primary and secondary data have been used for the purpose of the study. Following are the sources of primary and secondary data:

Major Sources of Primary Data:

- Informal interview with the officers of SME department of Mercantile Bank, Mohakhali Branch.

- Direct participatory observation: This technique of data collection is the main technique for the study. It was done by maintaining daily office hours strictly and recording daily activities in a diary book.

- Information conversation with the SME clients of Mercantile Bank Limited.

Major Sources Secondary Data:

- Annual report.

- Bank brochures.

- Bank’s Web site.

- Books, journals & magazines.

Data Analysis Technique:

I have analyzed the data of last five years of Mercantile Bank. Data has been presented is an easy and understandable from. Data analysis includes various aids like:

- Graphical Analysis

- Tabular Analysis

- Statistical Analysis

Sequence tasks of arranging the report:

The main body of the report has been divided into three parts viz. descriptive analysis, numerical & statistical analysis and finding & recommendation.

Descriptive analysis includes Company profile, Products & services of Mercantile Bank, Definition of SME, SME in Bangladesh, Bangladesh Bank’s endeavor, SME product policy guidelines of Mercantile Bank, SME Lending procedures and present condition of SME in Mercantile Bank.

Numerical & Statistical analysis includes Comparative performance analysis, overall financial performance analysis, Measurement of risk index & probability of insolvency and regression analysis.

Finding & recommendation session includes the challenges and remedy actions to meet the challenges.

1.4 Rationale of the Study

Bangladesh is a developing country and the development of a developing country are depends on the development of root people. The significance of small and medium enterprises’ is very much in the development of the whole economic situation of Bangladesh. Since this sector is labor intensive and the gestation period is smaller that’s why it contributes more to increase National income and employment opportunity of the country. In Bangladesh, SME sector performing great job for poverty alleviation and reducing gender discrimination. Now SME is viewed as ‘employment generating machine’ which helps to accelerate economic growth, reduce unequal distribution and poverty alleviation.

Banking sector has a vital role to play in the economic activities and development of any country. The whole scenario of the economy of a country can be ascertained by examining the condition of the banking sector. To develop SME sector, the contributions of banks and financial institutions are enormous. According to the guidelines of Bangladesh Bank, the commercial banks provide SME financing to the people at flexible terms and conditions to boost this sector. Beside profit motive the commercial banks also perform corporate social responsibility by enhancing SME financing. Not only finance the banks are also provides guidelines and training to the people to enrich their small and medium enterprises.

1.5 Scope of the study

This internship report will encompass a wide area ranging from Mercantile Bank’s organizational structure, background and objectives, operational scenario, business performance of Mercantile Bank Limited as whole to Bangladesh Bank’ rules & regulations. The main part covers operational scenario and financial performance of SME of Mercantile Bank.

1.6 Limitations of the study

The limitations of my study are mentioned bellow:

a) The bank officials are involved with various functional areas and spend too much busy hour. So, it is tough to make conversation with the officers.

b) Some essential data could not be gathered because of confidentiality concerns. The raw data available in the organization’s database management system was also not properly organized.

c) Another limitation was that the data gathered could not be verified for accuracy.

d) Time was the major limiting factor while preparing the report

e) There were scarcity of written documents about the facilities and other related things.

f) Much information could not be gathered for the reason of confidently.

2.1 Company Profile

Mercantile Bank has been launched by a group of successful entrepreneurs with recognized standing in the society. The management of the Bank consists of a team led by senior bankers with decades of experience in national and international markets. The senior management team is ably supported by a group of professionals many of whom have exposure in the international market.

Mercantile Bank Limited emerged as a new commercial bank to provide efficient banking services and to contribute socio-economic development of the country. Mercantile Bank Limited is one of the fastest growing third generations private commercial Bank started its business operations on June 02, 1999. Presently we have a network of 65 online Branches all over the country. Mercantile Bank Limited (MBL) has achieved a remarkable growth in all the sectors of banking activity including foreign remittance. The inflow of inward foreign remittances of the Bank is increasing day by day steadily. The Bank provides a broad range of financial services to its customers and corporate clients. The Board of Directors consists of eminent personalities from the realm of commerce and industries of the country.

The asset and liability growth has been remarkable. Mercantile Bank has been actively participating in the local money market as well as foreign currency market without exposing the Bank to vulnerable positions.

Mercantile Bank Limited started its service with a vision to serve people with modern and innovative banking products and services at affordable charge. Being parallel to the cutting edge technology the Bank is offering online banking with added delivery channels like ATM, SMS banking. And as part of the bank’s commitment to provide all modern and value added banking service in keeping with the very best standard in a globalize world.

2.1.1 Corporate Information

| Number of Branches | : | 65 |

| Number of SME centers | : | 6 |

| Number of Brokerage Branches | : | 7 |

| Registered Office | : | SwadeshTower (3rd & 4th Floor) 41/6 Purana Paltan, Dhaka-1000 Phone # 02-9563876, 02-7119932, 02-7111482, 02-7122515, 02-7111202, Fax # 02-7119078 |

2.2 Subsidiary Company of Mercantile Bank

The Board also decided to form a Subsidiary Company in the name of “Mercantile Bank Brokerage House” for Stock Broker and Stock Dealer activities subject to the approval of the regulatory authorities. In the year 2010 The Bank has made revenue of BDT 281.91 million from its brokerage houses.

2.3 Mission of the bank

“Will become most caring, focused for equitable growth based on diversified deployment of resources, and nevertheless would remain healthy and gainfully profitable Bank”

Mercantile Bank do believe that customers are the main stakeholders of the bank. That is why; the bank always tries to satisfy their customers and maintaining fairness growth by diversifying resources to remain lucrative profitable bank.

2.4 Vision of the bank

“Would make finest corporate citizen”

Mercantile Bank is fully committed to conduct its banking business in an economically, environmentally and socially sustainable manner by which MBL will become the leading banks in Bangladesh.

2.5 Objectives of the Bank

The core business objective of Mercantile Bank Limited is not maximizing profit rather it focuses on maximizing its shareholder’s wealth.

Strategic objectives:

* To achieve positive Economic Value Added (EVA) each year.

* To be market leader in product innovation.

* To be one of the top three Financial Institutions in Bangladesh in terms of cost efficiency.

* To be one of the top five Financial Institutions in Bangladesh in terms of market share in all significant market segments we serve.

Financial objectives:

* To achieve 20% return on shareholders’ equity or more, on average.

2.6 Core Values of Mercantile Bank Limited

- For the customers

Providing with caring services by being innovative in the development of new banking

products and services.

- For the shareholders

Maximizing wealth of the Bank.

- For the employees

Respecting worth and dignity of individual employees devoting their energies for the

progress of the Bank.

- For the community Strengthening the corporate values and taking environment and social risks and reward into account.

2.7 Governing Body

The “Board of Directors” and Executive Committee govern the overall activities of the company. At present, the Board of directors consists of 22 members including the Chairman and two Vice Chairmen of the Bank. Most of the members are reputed industrialist, entrepreneurs and philanthropist of our country. The Board is headed by the Chairman. Each of the directors is the member of the Board. The Board has appointed the Managing Director, who is responsible for the welfare of the Bank. Usually, at least one meeting of the Board is held in every month to deal with major issues such as modification of the existing policy or major policy reforms.

Responsibilities for implementing the company’s strategy and day-to-day operations are delegated to the Executive Committee, which meets monthly. The Managing Director chairs the Executive Committee.

The other members include-

Senior Executive Vice President

Executive Vice President

Senior Vice President

Vice President

First Vice President

Assistant Vice President

First Assistant Vice President

2.8 Credit Rating of Mercantile Bank Limited

| Year | Long Term Rating | Short Term Rating |

| 2010 | AA- | ST-2 |

| 2009 | AA- | ST-2 |

| Outlook | Stable | |

| Date of Rating | 29-May-2011 | |

Credit Rating Information and Services Limited (CRISL) has reaffirmed the rating of Mercantile Bank Limited with “AA-” (pronounced as double A minus) in Long Term and reaffirms “ST-2” rating in Short Term based on financials up to December 31, 2010. MBL’s Long Term Rating has been reaffirmed to “AA-” which implies that the bank is adjudged to be of high quality, offer higher safety and have high quality. This level of rating indicates MBL as a corporate entity with a sound credit profile and without significant problems. Risks are modest and may vary slightly from time to time because of economic condition. The Short Term rating “ST-2” indicates high certainty of timely repayment. Liquidity factors are strong and supported by good fundamental protection factors. Risk factors are very small.

2.9 Operational Mechanism of Mercantile Bank

Mercantile Bank has on offer a broad array of innovative financial services specially designed to match the specific requirement of the clientele ranging from large corporate houses, small and medium enterprises, to private individuals. The team of professionals assists the clients in finding the most appropriate financing package making use of the Bank’s own resources and/or organizing loan syndications, to help the clients realize their short-term goals and long-term aspirations. Rated “AA-” by the Credit Rating Agency of Bangladesh, Mercantile Bank is committed to design the best possible financing package for our clients that best fit their individual requirements, covering the entire spectrum of banking operation.

Corporate Banking

Corporate Banking unit offers banking products and services to the corporate clients customized to meet the specific needs of those organizations. Corporate Banking department manages relationship of our multinationals and large corporate clients. The products and services offered by Mercantile Bank Limited to the corporate clients are Corporate Credit, Electronic Banking, Leasing, Payments and Cash Management, Customized Loans, Trade Services etc.

Small and Medium Enterprises

The Bank intends to encourage the small and medium entrepreneurs and hence structured its SME financing activities. The Bank has set the definition of small enterprise in line with Bangladesh Bank guidelines. A special credit scheme under the name and style “Small and Medium Enterprise (SME) Scheme” has been introduced to extend credit facilities to the small and medium entrepreneurs of the country.

Syndication Financing

Syndication means joint financing by more than one bank to the same clients against a common security. This is done basically to spread the risk. It also provides a scope for an independent evaluation of risk and focused monitoring by the agent / lead bank.

In Syndication financing banks also enter into an agreement that one of the lenders may act as Lead Bank. In such case, lead bank has to co-ordinate the activities at various stages of handling the proposal i.e. appraisal, sanction, documentation, sharing of security, disbursement, inspection, follow-up, recovery, distribution of installments. / interest etc. It may also call meeting on syndication members, whenever necessary to finalize any decision.

Capital market Division

Emphasis on diversified services has been ingrained within the Bank to meet the actual and need-based requirements of the customers. MBL unlocked its first Brokerage house in 2009 named, “Mercantile Bank Limited Brokerage House”, bearing membership # 224. At the end of 2010, the Bank has 7 branches of brokerage house. Mercantile Bank Limited Brokerage House has been developed to ensure development of sound capital market and to provide higher, better and diversified services to a wide range of customers. MBL is offering high quality products and services at a competitive rate. With the aim of diversifying the product line and explore the business opportunities of capital market, Mercantile Bank Limited Brokerage House offers full-fledged international standard brokerage service with margin loan facility. MBL is also a full service Depository Participant (DP) of Central Depository Bangladesh Ltd. (CDBL). The brokerage service is designed to provide customers with necessary support profitably in the stock market.

International Trade

Mercantile Bank’s international trade business achieved 47.75 percent growth rates for import and 28.31 percent for export in 2010. The bank has been using SWIFT communication system for foreign trade arrangement. The bank had correspondence relationships with 589 banks at the end of 2010. The bank has been using SWIFT communication system.

Remittance

To strengthen the remittance business the bank has signed a number of long term arrangements with different well connected remittance partners across the world. At present, the bank’s global partners in remittance system are 23 in number. Meanwhile, the bank has established correspondent relationship with large local banks and NGOs to ensure delivery of funds to the recipients anywhere in the country at the shortest possible time.

Mercantile bank has entered into Remittance Arrangement with a good number of Overseas Exchange Companies in different parts of the world to facilitate wage earners to remit their money to Bangladesh. The Bank is also trying to establish its own exchange house aboard to provide better customer services to the expatriates. Very soon, MBL will inaugurate an Exchange House in Birmingham of UK, namely, “Mercantile Bank Exchange House (UK) limited”.

Retail Banking

Retail Banking provides individual and self-employed customers with a wide range of banking and related financial services such as Current Account, Savings Account, Short Term Deposit, Fixed Deposits, Deposit Pension Scheme, Any Branch Banking etc. Apart from traditional savings and private accounts, Mercantile Bank has launched a loan scheme. This is targeted at salaried and/or self-employed individuals, and specially tailored to meet their needs. Under the Coverage scheme there are ten categories of loan facilities encompassing Car Loan, Home Loan, Consumers Credit Scheme, Doctors’ Credit Scheme, Education Loan, Rural Development Scheme, Lease Financing, Cottage Loan, House Furnishing Loan, and Any Purpose Loan Scheme. There are also some other Credit schemes such as Overseas Employment Loan, E T P / Bio-Gas / Solar Energy Loan, Krishi / Polli Loan called “Nabanna”, SME Loan (CHAKA; ANANYA; CHALTI MULDHAN; SINGLE PAYMENT LOAN)

SMS-Banking

Short Message Service (SMS) is one of the most modern banking services. MBL provides endless efforts to serve the Clients adhering modern technology. Using SMS from the Mobile Phones, Clients can easily avail the Banking services, which is convenient, safe low-cost, fast and available round the clock. After withdrawal of cash from the ATM Booths, Customer receives an Instant SMS from the Card Division. In addition to that, MBL SMS Banking offers the following services to the customer:

v Access to account balance

v Last 3 transaction inquiries

v Cheque leaf status inquiry

MBL Cards

Presently the bank is offering a variety of card products to meet the modern and varying needs of the customers such as VISA dual prepaid card, VISA Dual Hajj Card, Credit Card, Debit Card Master Card, VISA credit etc. International/Dual card is accepted all over the world at millions of outlets and ATMs and also get advance against Credit card up to 50% of the card limit

ATM

MBL has now more ATMs and ATMs are proving a wider range of services to a wider range of Users. ATMs enable card holders from other banks can get their account balance and withdraw cash even if the card is issued by a foreign bank. The Bank carries its banking activities through 65 branches in the country. Mercantile Bank customers have access to 31 ATM Booths.

On-line Banking

On-line banking is a means to performing transactions, making payments etc. over the internet. It saves the time and efforts of the customers. Customers can easily deposit and withdraw money transfer money from one place to another place by using online banking facility.

Legal and recovery Activities

One of the most important departments is our legal and recovery department which monitors, manages and provides in-house legal opinion to all accounts and different matters of the bank. The department also directly manages all the classified accounts to maximize recovery of bank’s dues from the defaulted borrowers.

Human Resource Management

Mercantile Bank believes that the employees are the most important and valuable component of doing business. Knowledge and skill development is a continuous process and to keep our employees abreast of all the latest developments in the banking sector, the bank continuous to organize various training programs and workshops. Mercantile Bank is maintaining its own training institute namely, “Mercantile Bank Training Institute (MBTI)” which is equipped with all modern study aid and material. Mercantile Bank has an “Internship Program” in order to get fresh graduates acquainted with the real world corporate affairs. HR department arrange both Off-the-job and on-the job training program.

2.10 Products and Services of Mercantile Bank at a glance

| Business Banking Term Loan Overdraft Demand Loan Time Loan Letter of Credit Loan against Trust Receipt Loan Syndication & Structured Finance Trade Finance Letter of Guarantee Consumer Finance Consumers Credit Scheme Doctors Credit Scheme Education Loan Rural Development Scheme Lease Financing Any Purpose Loan Car Loan Home Loan House Furnishing Loan Cottage Loan Overseas Employment Loan E T P / Bio-Gas / Solar Energy Loan Krishi / Polli Loan

| Deposit Accounts Saving Account Current Account Fixed Deposit Monthly Savings Scheme Double Benefit Deposit Scheme 1.5 Times Benefit Deposit Scheme Family Maintenance Deposit Scheme Advance Benefit Deposit Scheme Quarterly Benefit Deposit Scheme Capital Market Division Brokerage Operation MBL cards VISA Dual Hajj Card VISA Dual Prepaid Card Credit Card Debit Card Service Products ATM Services Remittance Service Locker Service Online Banking Internet banking SMS Banking SWIFT |

| Small & Medium Enterprise (SME) Term Loan Chaka Anany Chalti Muldhan Single Payment Loan

|

3.1 Definition of Small Enterprise:

Small enterprises are those institutions which are not categorized as public limited company and accomplish the following norms:

| Serial No. | Sectors | The amount of fixed assets excluding land & building | Number of labor |

| Service | 50,000-50,00,000 | 25 | |

| Trading | 50,000-50,00,000 | 25 | |

| Manufacturing | 50,000-1,50,00,000 | 50 |

Table 1: Criterion of Small Enterprise

3.2 Definition of Medium Enterprise:

Medium enterprises are those institutions which are not categorized as public limited company and accomplish the following norms:

| Serial No. | Sectors | The amount of fixed assets excluding land & building | Number of labor |

| Service | 50,00,000-10,00,00,000 | 50 | |

| Trading | 50,00,000-10,00,00,000 | 50 | |

| Manufacturing | 1,50,00,000-20,00,00,000 | 150 |

Table 2: Criterion of Medium Enterprise

3.3 SME Finance in Bangladesh:

Higher growth of the Small and Medium Enterprises (SMEs) can help cut poverty to a satisfactory level by eliminating various prejudices against labor intensive and creating jobs for the skilled manpower in the SME sector.

The Bangladesh Bank report said, the key reasons behind the SMEs are not entering into manufacturing are financial constrains, dismal state of utilities, technology and policy discriminations. On the others hand, Bank and others financial institutions generally prefer large enterprise clients because of lower transition costs, and greater availability of collateral.

The SMEs also fall outside the reach of micro finance schemes, and thus compelled to depend on formal sources of funds at much higher interest rates, the Bangladesh Bank report said.

The BB report, however, said that other interrelated problems like shortage of short and long term finance, lack of modern technology and lack of promotional support services are major obstacles in the way of development of the SMEs sector.

Considering these obstacles, Bangladesh Bank has adopted a preferential lending policy to promote the SME sector in line with the government development policies.

With a view to resolve the problems of business starting SME Foundation launched “SME Business Manual” to provide proper information and guidelines to manage the business efficiently.

3.4 Bangladesh Bank’s Endeavor in 2011

SME & Special Programmers Department

To give emphasis on SME financing and to ensure supervision, regulation, and monitoring of SME financing, Bangladesh Bank has formed a new department namely “SME and Special Programmers Department” vide Administrative Circular No.18, dated 17/12/2009 of Human Resources department, Bangladesh Bank, Head Office.

Workshop on “SME Financing for Women Entrepreneurs”

As women folk are the worst sufferers of our society, to make them capable enough for the self earnings and self sufficient for better future and social esteem Bangladesh bank has arranged SME financing specially for the women entrepreneurs. Women are the best suited for the SME financing and the recovery rate is also pretty good. Hence to promote this neglected population BB’s such action is really praiseworthy and from now on the women entrepreneurs will never be deprived of exploring their potentiality for want of fund as financing is now easy with the banks after this directive.

Women Entrepreneurs dedicated desk

For the ultimate betterment and ease of access in the Bangladesh Bank, a dedicated one stop desk has been arranged where all the financial solutions regarding the SME will be available at the earliest convenience of the entrepreneurs which will certainly reduce the time, cost, labor and bureaucratic delays working as the major hindrance on the way of SME development.

Fund increment in the SME sector

To enhance, encourage and strengthen the SME sector of Bangladesh, the governing body of Bangladesh bank’s “Refinance Scheme for Small Enterprise Sector” has increased the fund.

Bangladesh Bank inaugurates “AREA APPROACH” method to distribute SME loan and “Cluster Development Policy” to promote SME businesses in Bangladesh.

More emphasis on small entrepreneurs than medium entrepreneurs in case of loan distribution.

The maximum range of loan in case of small entrepreneur is TK. 50,000 to TK. 50, 00,000.

The banks and financial institutions should give highest priority to small and medium women entrepreneurs in case of loan sanction and terms &conditions.

Under the refinance scheme of Bangladesh Bank, the banks and financial institutions can give loan to women entrepreneurs up to TK. 25.00 lacs without any collateral except personal guarantee.

In case of SME loan distribution to women entrepreneurs the interest rate is 10%.

Teknaf to Tetulia Road show

Extending loan to Small & Medium Enterprise (SME) sectors

To enhance the SME loans, all banks and financial institutions have been advised to take help from the NGO’s for selecting the borrowers, disbursing and collection of loans to reduce the collection and supervision cost of SME loans. Also the tenor for the medium term industrial loan has been increased from 3 years to 4 years.

Importance for Extending Loans To SME IT and Broadband Internet Operators

The country is going to be digitalized and every sector of business is going underneath of the change of internet. Hence, the access of internet facilities and the IT instruments is a major factor on the way to be properly addressed. To develop the infrastructure and the IT curriculum according to the government promise of digital Bangladesh, BB puts much emphasis on the extending loans to SME IT and broadband internet operators.

3.5 Bangladesh bank directives for SME loan

- Regional & cluster wise credit policy

- Select 131 types industries & businesses.

- 12 types programs for loan principles.

- Chosen 13 banks as lead banks at 13 important points.

- Target SME financing for this year is Tk. 24000 crores.

- 3 step monitoring system- HO office of BB, BO of BB & HO of banks.

3.6 Principles of Bangladesh bank directives

- Financing is most important than loan rate.

- 40% of SME loan for small entrepreneurs.

- Reserve 10% for women entrepreneurs.

- Loan up to Tk. 25 lacs for small & women entrepreneurs against only personal guarantee.

- Logical grace period for loan repayment.

3.7 The Target amount of Loan in SME Sector (2010)

| Name of the organizations | Taka in Crore | |

| Nationalized Banks | 3,897 | |

| Specialized Banks | 600 | |

| Private Commercialized Banks | 17,478 | |

| Foreign Banks | 707 | |

| Non-Bank Financial Institution | 1313 | |

| Grand Total= | 23,995 |

Table 3: Targeted Disbursement of SME Loan in Banks & Financial Institutions

4.1 SME Products of Mercantile Bank at a glance

| “Sachondo” Product Features: | |||||

| SL | Product Name | Nature | Maximum Loan Tenor | Interest Rate | Loan Type |

| 1 | Chaka | Term loan | 3 years | 15% | Equal Monthly Installment |

| 2 | Ananya | Women Entrepreneur loan | 3 years | 10% | Equal Monthly Installment |

| 3 | Chalti Muldhan | Continuous loan | 3 years | 13% | Equal Monthly Installment |

| 4 | Single payment Loan | Short term Seasonal loan | Maximum 09 months | 15% | Single Installment |

Table 4: SME Product Features of Mercantile Bank

4.2 SME Products Policy Guideline

4.2.1 Term Loan

Product Name: Chaka (Trade; Manufacturing; Service)

Loan Selling Limit: 2 lacs to 50 lacs.

Purpose: Working capital requirement, fixed asset financing or both.

Age of the entrepreneur: Minimum 21, Maximum 60.

Experience of the entrepreneur: is skilled in managing his/ her business preferably 2(two) years.

Loan Tenor: Maximum 36 months,

Security (As applicable):

- All usual/related charge documents

- Two Personal Guarantees of spouse/parents/brother(s)/sister(s)/other family members and land owners (as applicable).

- Third personal guarantee, other than immediate family members.

- Post dated cheques for each installment and one undated cheque for loan value including full interest payable thereon.

Key Factors to Consider:

- The entrepreneur must have an acceptable social standing in the community.

- The entrepreneur must have ability to run and demonstrate to his business.

- Background of the entrepreneur with regard to willingness to repay.

- Clear-cut indication of sources of income.

Other Factors:

Loan limit and security depends on the basis of nature and prospects of the business.

Loan Repayment System: Equal monthly installment.

Rate of Interest: 15% (10% for Women entrepreneur)

4.2.2 Women Entrepreneur Loan

Product Name: ANANYA (Trade; Manufacturing; Service)

Loan Selling Limit: 1 lac to 50 lacs.

Purpose: Working capital requirement, fixed asset financing or both.

Age of the entrepreneur: Minimum 21, Maximum 60.

Experience of the entrepreneur: is skilled in managing his/ her business preferably 2(two) years.

Loan Tenure: Maximum 36 months.

Security (As applicable):

- One Personal Guarantee of spouse/parents/brother(s)/sister(s)/other family members and land owners (as applicable)

- Post dated cheques for each installment and one undated cheque for loan value including full interest payable thereon.

- Registered mortgage of land property (minimum force sales value 125% of the loan amount) or registered mortgage of land property plus FDR (Face value of FDR and force sales value of registered mortgage of land property = 100% of the loan amount)

- All usual/related charge documents

Key Factors to Consider:

1. The entrepreneur must have an acceptable social standing in the community.

2. The entrepreneur must have ability to run and demonstrate to his business.

3. Background of the entrepreneur with regard to willingness to repay.

4. Clear-cut indication of sources of income.

Other Factors:

Loan limit and security depends on the basis of nature and prospects of the business.

Loan Repayment System: Equal monthly installment.

Rate of Interest: 10%

4.2.3 Continuous Loan

Product Name: CHALTI MULDHAN (Manufacturing/Service/Trading)

Loan Selling Limit:

0.50 lac to 50.00 lacs for Small Entrepreneur

0.05 lac to 500.00 lacs for Medium Entrepreneur.

Purpose: To meet up any justifiable and acceptable working capital requirements.

Nationality: Bangladeshi

Age of the entrepreneur: Minimum 21, Maximum 60.

Experience of the entrepreneur: is skilled in managing his/her business preferably 2(two) years.

Security/Collateral:

- Registered mortgage with Irrevocable General Power of Attorney of the property/ownership of the space/possession right purchased.

- Hypothecation of machinery, equipments, vehicles, inventories, advance payments.

- Lien of cash collateral (FDR, Scheme Deposit) and competent authority approved other en-cashable financial instruments.

- In case of proprietorship concern, personal guarantee of the proprietor and spouse.

- In case of Private Ltd Co. or partnership firm, personal guarantee of all directors/partners and their spouses to be obtained.

- In case of third party personal guarantee, guarantors must be subject to the same credit assessment as made for the principal borrower and acceptable to bank.

- Usual charges documents.

- Others as applicable in compliance with the policy of the Bank.

Insurance: Fire & Other insurance coverage as applicable

Interest rate: 13% p.a. However, the interest rate is subject to change based on the market conditions and policy of the Bank.

Penal interest rate: 2 % higher over the prescribed rate on overdue amount or as per policy of the Bank.

Other fees & Charges: As per policy and scheduled charges of our Bank.

Interest applied: Quarterly/Monthly rest basis.

Tenure of the loan: 1(One) Year on revolving basis.

Repayment method:

- By depositing daily sales proceeds in the loan account.

- Full and final adjustment by depositing sales proceed or from own sources of the customer on or before the expiry.

- Every drawing to be adjusted by 90 days

4.2.4 Seasonal Loan

Product Name: SINGLE PAYMENT LOAN

Purpose: To meet up legitimate short-term working capital requirements of business entity.

Loan limit: Tk 0.50 lac to Tk 50.00 lacs.

Nationality: Bangladeshi

Age limit: From 21 years to 60 Years (last installment of the loan has to be deposited before the borrower reaches the age of 60).

Note: Age bar may be relaxed /waved by the Managing Director & CEO of the Bank on acceptable grounds.

Minimum income: Minimum income must be commensurate with the amount of loan requested.

Borrower’s eligibility: The entrepreneur:

- Must be literate.

- Is skilled in managing his/ her business preferably 2(two) years.

- Has good reputation.

Security/Collateral:

- Registered mortgage with Irrevocable General Power of Attorney of the property/ownership of the space/possession right purchased.

- Hypothecation of machinery, equipments, vehicles, inventories, advance payments.

- Lien of cash collateral (FDR, Scheme Deposit) and competent authority approved other en-cashable financial instruments.

- In case of proprietorship concern, personal guarantee of the proprietor and spouse.

- In case of Private Ltd Co. or partnership firm, personal guarantee of all directors including Chairman & Managing Director/partners and their spouses to be obtained.

- In the Private Ltd Co./ partnership/ proprietorship firm, if the customer is unable to provide adequate collateral security, 02(two) personal guarantee including 01 (One) third party (guarantors must be subject to the same credit assessment as made for the principal borrower and acceptable to bank).

- Usual charges documents.

- Others as applicable in compliance with the policy of the Bank.

Insurance: Fire & Other insurance coverage as applicable.

Interest rate: 15% p.a. but in case of Woman Entrepreneur’s Refinance Scheme, 10% p.a. However, the interest rate is subject to change based on the market conditions and policy of the Bank.

Penal interest rate: 1 % higher over the prescribed rate on overdue amount or as per policy of the Bank.

Other fees & Charges: As per policy and scheduled charges of our Bank.

Interest applied: Monthly rest basis

Tenure of the loan: Maximum 09 (Nine) months.

Repayment method:

- Service interest on monthly basis.

- Entire outstanding loan amount will be repaid on or before the expiry date of the loan.

4.3 Credit Principles that govern SME Loan

These fundamental guidelines have been established specially for SME loan with a view to provide a structure on which lending decisions must be based. They are the key elements supporting bank’s credit culture with regard to SME loan; and will dictate our behavior when dealing with customers and managing lending portfolio of such loans.

It is the fact that credit policies and procedures can never sufficiently capture all the complexities of the product. For all Mercantile bank staffs initiating lending decisions the following credit principles are the ultimate reference points:

- Assessment of the customer’s character for integrity and willingness to repay.

- While lending consider the customers capacity and ability to repay.

- Preplan for recovery considering the possibility of default.

- You may recommend only if you can realize that you will be able to understand and manage the risk.

- Use common sense and past experience in conjunction with through evaluation and credit analysis. Do not base decisions solely on customer’s reputation, accepted practice, other lender’s risk assessment or the recommendation of other officers.

- Behave ethically in all credit activities.

- Be proactive in identifying, managing and communicating credit risk.

- Be diligent in ensuring that credit exposures and activities comply with the requirement set out in this project program.

- Minimize risk and optimize reward by striking a suitable balance between risk and reward.

- Build and maintain a diversified credit risk portfolio to avoid risk concentrations and to ensure better liquidity management.

4.4. Loan Processing Procedures for a SME Loan Application

4.4.1 Preliminary Steps for Loan Processing

4.4.1.1 Relation building or Customer acceptance policy/KYC & relationship

First of all we have to know the customer. If the applicant is new to us then we let the client open bank account and continue transaction for a certain time and upon good reflection of transaction we will proceed with the loan proposal. Having an account or opening an account is must to proceed for any loan request from any customer. Whatever we want to facilitate the customer depends on our knowledge on the client. And an account helps up to enrich our knowledge on our client. And if the transaction in the customer account reflects healthy and sound views then we proceed with the loan application to the next step as follows:

4.4.1.2 Identification of Customer Needs

For Working Capital (W/C) Finance: The loan amount should also be small or within comfortable range of the customer with sufficient cushion to cover unforeseen troubles in business.

For Fixed Asset (F/A) Finance: The age & nature of the business & investment in fixed asset is very important in case of fixed asset finance.

4.4.1.3 Collection of Data & Required Papers

Applicant’s Required Papers:

- Trade License of business (Up to Date).

- T.I.N Certificate.

- Voter ID / National ID.

- Photograph four (4) copies.

- Original rental deed copy of Shop / Business institute.

- Bank Statement 12 months.

- Recent Electricity bill of shop/Business institute.

- Recent electricity bill of residence. (If applicable)

- Recent rents recite copy of Shop / Business institute.

- Photograph of Shop / Business institute (6-8).

- Name, Relation, Profession, Address & Mobile No. of four (4) close relatives.

- Pad of Shop/Business institute (10).

- Sanction Letter & Loan Statement Others Bank. (If applicable)

- Copy of land valuation report in case of property mortgage.

- Papers on land and building or any other property.

Required Financial Information:

- Stock to be purchased from proposed loan amount and their value & quantity.

- Yearly operating expenses of the client’s business

- Current receivable and buyer list.

- Current payable and supplier list.

- Fixed assets list

Information regarding Sister concerns/affiliates

- Following information regarding sister concerns/affiliates will be furnished:

Name of the enterprise(s), Location of the business, type of business, name of other owners, if any

Annual sales, rate of net profit, receivables

Payables, inventory, Borrowings

- The following papers will be submitted:

- Sanction advice of loan a/c, if any

- Loan account statement for the last 1 year

Other documents

In case the land on which the factory/ sales center/office is situated is owned by the entrepreneur(s)/ owner(s): title of deed/ up to date rent receipt of the landed property will be obtained.

In case the possession is purchased or hired: the possession deed or rental deed in non-judicial stamp of Tk. 150.00 denomination will be obtained.

Guarantor’s Required Papers:

- 1. Spouse Guarantor

a) Voter ID / National ID.

b) Photograph two (2) copies.

- 2. Relative Guarantor

a) Voter ID / National ID.

b) Photograph two (2) copies.

c) Visiting Card. (If applicable).

d) Trade License of business Up to Date. (If applicable)

- 3. Business Guarantor

a) Voter ID / National ID.

b) Photograph two (2) copies.

c) Visiting Card.

d) Trade License of business (Up to Date).

e) TIN certificate. (If applicable)

f) Recent electricity bill of residence. (If applicable)

- 4. Guarantor- Permanent Residence in Dhaka

a) Voter ID / National ID.

b) Photograph two (2) copies.

c) Visiting Card. (If applicable)

d) Trade License of business (Up to Date). (If applicable)

e) TIN certificate. (If applicable)

f) Recent electricity bill of residence.

4.4.1.4 Onsite Inspection & Data Verification

The Relationship officer of SME department should visit the business at least twice, once in the morning and once in the afternoon (depending on business sales frequency)

The Relationship officer should spend at least 3 hours each time in the business and take note of the following:

Customer dealing

Sales/day

Inventory/stock

Selling price

Credit Sales

Payment behavior

The Relationship officer should also assess:

How many times the customer needs to buy stock/month

How much money he spends for stock purchase and

How/from where he pays for the stock

4.4.1.5 Financial Spread Sheet (FSS)

This is an intensive analysis of projected financial figures of the project to assess the financial strength of the project or proposal. Here we prepare the following financial statements:

- Balance sheet.

- Profit and Loss Statement.

- Projected cash flow statement.

Financial Ratio Analysis:

Here also we analyze the following rations to assess financial strength:

i. Gross profit margin.

ii. Net profit margin.

iii. Gross profit ratio (%) (Gross profit / Total sales)

iv. Net profit ratio (%) (Net profit / Total sales)

v. ROI (Average EAT or Net profit / Total Investment)

vi. PBP (Total investment / Net cash benefit or net profit)

vii. Debt service ratio (Operating cash / Installment paid)

viii. Gross rate of sales ( Current year sales / Last year sales)

ix. Leverage ratio (Total Liabilities / Net worth) Debt-equity ratio may be up to maximum 1:1

4.4.1.6 Collection of CIB Report

Mercantile Bank collects CIB report from the department of “Credit Information Bureau” of Bangladesh Bank regarding the proposed loan applicants. Approval will be accorded subject to receipt of clean CIB report from Bangladesh Bank. In case of existing liability satisfactory (unclassified loan status) CIB report will serve the purpose.

4.4.1.7 Credit Assessment

A thorough credit and risk assessment is conducted prior to the granting of loans. The result of this assessment is presented in a Credit Application that originates from the Relationship Manager (RM) or Account Officer are familiar with the Lending Guidelines and conduct due diligence on new borrowers, principals or guarantors. Mercantile Bank Limited has established Know Your Customer (KYC) and Money Laundering Guidelines which has been adhered to at all times. The assessment includes the following:

| v Amount & types of loan proposed | v Historical Financial analysis |

| v Purpose of loan | v Projected Financial performance |

| v Loan structure (Tenor, Covenant, Repayment schedule, Interest) | v Account conduct |

| v Security arrangement | v Adherence to lending guidelines |

| v Borrower analysis | v Mitigating factors |

| v Industry analysis | v Loan structure |

| v Supplier/ Buyer analysis | v Security |

4.4.1.7.1 Credit Assessment Technique:

The selection of good customers is depending on the careful assessment of the following 5C’s:

- Character

- Capacity

- Conditions

- Capital

- Collateral

Among the 5 Cs the most important for an SME loan are:

v CHARACTER & CAPACITY

How to assess CHARACTER: WILLINGNESS TO PAY?

Home visit: A picture tells a thousand words.

Social status

Honesty

Repayment behavior (utility bills, house rent, suppliers etc).

Commitment to his business and Experience.

How to assess CAPACITY: ABILITY TO PAY?

Cash flow

Other source of income (if any)

Inventory/stock

Account Receivables (A/R)

Account Payables (A/P)

Check with suppliers if his orders have increased over time

Dealings with other banks

Family burden (unmarried young daughter, sick parent/child)

Other debts/personal loans etc.

What Market CONDITIONS to assess?

Industrial/Sector Analysis

Market trends

Consumer habits/attitudes (if any change is foreseen)

Business location

Prospect of business

Other players in the business

Demand of product

Seasonality

Competitor’s Analysis

How to assess CAPITAL?

Assess NET WORTH

ü What are the customers’ assets and what are his liabilities

ü Whether his net worth has increased over last couple of years or remained same or declined (if declined that is a bad sign)

ü Assess the trend of net worth

Is the customer investing his own capital in the business?

ü If “yes” then it is a good sign, what is the trend of his investment (increased/same/decreased?)

How to assess COLLATERAL?

Assess the GUARANTORS

ü Their credibility/Net worth/age

ü Their commitment to repay the loan in case of default

ü Is s/he is an influential person

HYPOTHECATION of assets/stock/inventory

Assess the MORTGAGE

ü Liquidity

ü Location of land urban/semi-urban/rural

ü Type of land

ü Ownership documents (fake/original)

The security should be precious to the customer for psychological pressure.

The security should be weighed against the size of the loan required.

4.4.2 Secondary Steps for Loan Processing

4.4.2.1 Drafting of Proposal & Recommendation

Then we draft the proposal for the loan facility to the customer and send this proposal to the Corporate Office through Zonal Head. And this proposal is send to head office along with Risk Grade Score Sheet, Copy of Land valuation report, FSS, Copy of audited accounts of the applicant, copy of feasibility report of the project and other relevant documents.

The Proposal should enclose the following information:

| v Background of the applicant | v Performance with other Bank |

| v Present Proposal | v Liabilities with us |

| v Name of the Applicant | v Liability with other banks |

| v Nature of Business | v Brief Particulars of the project |

| v Constitution of the applicant’s business | v Financial highlights |

| v Year of establishment | v Credit Risk Grading |

| v Capital structure | v Estimation of working Capital Requirement |

| v Bank checking | v Particulars of the Proposed Facility |

| v Particulars of the Directors | v Source of Repayment |

| v Particulars of the Guarantors, if any | v Projected earnings (annually) |

| v Brief description of the management | v Branch’s visit report |

| v Sister/allied concern | v Documentation status |

| v Account relationship with us | v Bank’s Credit Policy Compliance |

| v Performance with us | v Comments & recommendation |

| v Account Profitability | v Security and Collateral/control |

Then head office will evaluate the proposal and upon due approval send the proposal to the branch.

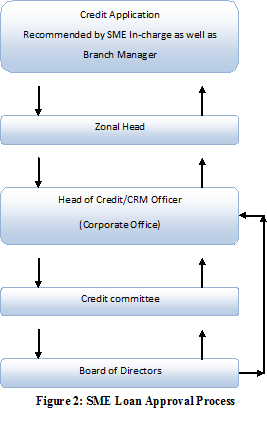

4.4.2.2 Approval Process

to the documentation. It is a very important part of credit activities. Failure of proper documentation may lead to a loss of bank in case of client’s failure to repay it. If all the charge documents are not maintained properly then bank may fail to take any legal action against the defaulter.

Legal Documents

1) Sanction Letter Accepted by Entrepreneur

2) Demand Promissory Note

3) General Loan & Collateral Agreement

4) Hypothecation of Debts and Assets

5) Letter of Hypothecation

6) Continuing Guarantee/Personal Guarantee

7) Letter of Installment

8) Letter of Disbursement

9) Letter of Disclaimer

10) Memorandum of Deposit of Cheque

11) Hypothecation of Fixed Assets (for the manufacturing and fixed asset financing)

12) Letter of charge/ Lien and set off (for FDR)

13) Legal opinion for Registered Mortgage (if required)

14) Registered Mortgage Deed Vetted by Lower

15) Registered Mortgage Receipt

16) Irrevocable General Power of Attorney (IGPA)

17) Insurance of Covering Risk

18) Other usual charge documents

4.4.2.4 Disbursement

Proper documentation and approval are necessary prior to the disbursement of loan facilities. Security documents are prepared in accordance with approval terms are legally enforceable. Standard loan facility documentation that has been reviewed by legal counsel is used in all cases. Disbursements under loan facilities are only made when all security documentation is in place. CIB report reflects or includes the name of all lenders with facility, limit and outstanding. All formalities regarding SME loans are guided by Bangladesh Bank circulars and related section of Banking Companies Act.

After disbursement tasks

End use of funds to be certified by branch/unit recommending the facilities:

- In case of fixed assets purchase financing, the respective branch/unit/center will

- Obtain minimum 3 price guarantee/indents/pro-forma invoices and upon verification of same and

- Issue a certificate confirming the purchase of the fixed assets as per prescribed format

The respective branch/unit/center will obtain stock reports as per BA’s prescribed format of the borrowers on 1st time after 2 months and next quarterly basis and upon review of same for drawing power send to SME Loan administration department at corporate office.

4.4.2.5 Credit Monitoring

To minimize credit losses monitoring procedure and systems are in place that provides an early indication of the deteriorating financial health of a borrower. At a minimum, systems are in place to report the following exceptions to relevant executives to relevant in CRM and RM team.

v Past due principal or interest payment, past due trade bills, account excesses and breach of loan covenants.

v Loan terms and conditions are monitored financial statement are received on a regular basis, and any covenants breaches or exceptions are referred to CRM and the RM team for timely follow up.

v Timely corrective action is taken to address findings of any internal, external or regular inspection or audit.

v All borrower relationship or loan facilities are reviewed and approved through the submission of a credit Application at least annually.

v Early alert account is one that has risk or potential weakness of material nature requiring monitoring, supervision, or close attention by management.

After disbursement the most vital task of back is to ensure timely collection of the loan repayment. And for this proper monitoring is required.

4.4.2.6 Classification/Credit Risk Grading

The loan administration division/credit division will have full authority to assign Credit Risk Grading and to classify any loan as default i.e., SUP, GD, ACCPT, MG/WL, SMA, SS, DF, BL on qualitative judgment criteria. And we also prepare report on classified loan each month and send it to Bangladesh Bank through Corporate office. The classified listing and provision are as follows:

| Loan Status | Overdue Installments | Provision percentage |

| Unclassified | Less than 6 | 1% |

| Specially Mentioned Account (SMA) | 3 installments | 2% |

| Substandard | 6 installments | 20% |

| Doubtful | 12 installments | 50% |

| Bad Debt | 18 installments | 100% |

Table 5: SME Loan Classification/Credit Risk Grading

Classified loans are non-performing assets of bank and are a matter of great concern. Monetary authority also is cautious about these loans.

4.4.2.7 Credit Recovery

| Days Past Due (DPD) | Collection Action |

| 1-14 | Letter, Follow up &Persuasion over phone |

| 15-29 | 1st Reminder letter & Serial. No. 1 follows |

| 30-44 | 2nd reminder letter + Single visit |

| 45-59 | 3rd reminder letter Group visit by team member Follow up over phone Letters to Guarantor, Employer, reference all above effort follows Warning on legal action by next 15 days |

| 60-89 | Call up loan Final Reminder & serve legal notice Legal proceedings begin Repossession starts |

| 90 and above | Telephone calls/ Legal proceedings continue Collection effort continues by officer & agent Letter to different banks/Association |

Table 6: SME Loan Recovery Steps

4.5 Risk Avenues & Preventive Measures of Mercantile Bank

| Risk Avenues | Preventive Measures |

| Fund Diversion |

|

| Over financing |

|

| Wrong selection |

|

| Absconding Client |

|

| Business stops operating |

|

| Poor Character |

|

| Seasonal Affect |

|

| Competition Increases for the customer |

|

| High Receivables |

|

| Change in Business Location |

|

6.3 By Comparing Different Banks With Mercantile Bank We Found the Following Things:

- Ø Loan size: Loan size means the amount of Loans. The Mercantile Bank’s position is medium according to the loan size whether Dutch Bangla Bank has the highest loan size. Dhaka Bank Limited also provide the lowest loan..

- Ø Rate of interest or Profit Rate: The Mercantile Bank Limited is in the medium position whether Brac Bank Limited provide the highest interest rate. Lowest rate is provided by Eastern Bank Limited.

- Ø Loan Processing Fees: Loan processing fees is that fee which is used to process a loan. The Mercantile Bank provide the highest rate of loan processing fees compared with the Brac Bank And Premier Bank Limited.

- Ø Supervision Fees: Supervison fees is that fees which uses for the guideline for the SME loan taking procedure. There are supervision fees only in Dhaka Bank Limited and Mercantile Bank limited.

- Ø Utilization Fees: Utilization fees are the annual fees Charged by a bank against a portion of revolving line of credit. There are utilization fees in Dhaka bank, Eastern Bank, and Mercantile Bank Limited.

- Ø Period of Loan: period of loan indicates the time of the loan. The Mercantile Bank and Eastern Bank limited provide unlimited loan period .

- Ø Mode of Investment: Mode of the investment is type of the loan. Most of the Bank has provided working capital as well as term loan.

- Ø Security: security what assurance is provide by the borrower in the time of taking loan all the Bank provides personal guarantee in case of primary loan. In case of secondary loan all the Bank Have to submit Collateral.

Credit Amount In 3rd Generation Private Banks:

(Amount in Crore)

SL. # |

Name Of The Bank | Credit Excluding Inter Bank as on 31-12-2003 | Credit Excluding Inter Bank as on 31-12-2004 | Credit Growth (%) | Share intotal credit

|

1 | Standard Bank Limited | 495.22 | 780.10 | 57.53 | 0.74 |

2 | One Bank Limited | 605.09 | 961.49 | 58.90 | 0.92 |

3 | Exim Bank Limited | 1228.91 | 1768.25 | 43.89 | 1.69 |

4 | Mercantile Bank Limited | 1077.59 | 1766.93 | 63.97 | 1.69 |

5 | Bangladesh Commerce Bank Ltd. | 292.00 | 317.87 | 8.86 | 0.30 |

6 | Mutual Trust Bank Limited | 590.03 | 1168.08 | 97.97 | 1.12 |

7 | First Security Bank Limited | 647.67 | 850.03 | 31.24 | 0.81 |

8 | The Premier Bank Limited | 809.58 | 1502.55 | 85.60 | 1.43 |

9 | The Trust Bank Limited | 434.00 | 680.45 | 56.79 | 0.65 |

10 | Bank Asia Limited | 819.11 | 1186.54 | 44.86 | 1.13 |

11 | Brack Bank Limited | 286.92 | 569.22 | 98.39 | 0.54 |

12 | Shahjalal Bank Limited | 431.91 | 715.66 | 65.70 | 0.68 |

13 | Jamuna Bank Limited | 323.95 | 672.28 | 107.53 | 0.64 |

Source: Banking Regulation and Policy Department, Bangladesh Bank, H.O. Dhaka

6.1 Comparative Analysis of SME Credit Scheme of Six Different Banks in Bangladesh

( Year 2011 )

Particulars | The Premier Bank Limited | Dhaka Bank Limited | Eastern Bank Limited | Dutch Bangla Bank Limited | Mercantile Bank Limited | BRAC Bank Limited |

| Loan Size

| 2 lacs to 50 lacs | 0.50 lacs to 50 lacs | 1 lacs to 30 lacs | 2 lacs to 15 lacs | 0.40 lacs to 45 lacs | 3 lacs to 30 lacs |

Rate of interest or Profit rate | 12.00%-13.00% p.a. | 12.00%-13.00% p.a. | 10.00%-13.00% p.a. | 11.00%-13.00% p.a. | 12%-14% p.a. | 13%-14% |

Loan Processing Fee | 0.50% of loan amount | 1.00%of loan amount | ……… | 1.50% of loan amount | 2.00% of loan amount | 1.50% of loan amount |

Risk Fund | ………. | 1.00-2.00% p.a. of the loan amount | ……… | …….. | 1.50-2.20% p.a. of the loan amount | …….. |

Supervision Fee | ………. | 1.50% p.a. of loan amount | ……… | ……… | .50% p.a. of loan amount | ……… |

Utilization Fees | ………. | 1.50% p.a. (quarterly charged) | 2.20% (Half yearly charged) | 1.75% (yearly Charged) | 2.00%(yearly charged) | ……… |

Period of Loan | 1 to 5 year | 1 to 3 year | Up to 1 year | 1.5 to 5 year | Up to 1 year | 1 to 3 year |

Mode of Finance | Term loan as well as working capital loan | Term loan as well as working capital loan | Only working capital loan | Term loan and working capital loan | Term loan and working capital on fixed assets | Only term loan |

Past Experience of the Owner | 2 years | 3 years | 2 years | 2 years | 3 years | 3 years |

Security | ||||||

a)Primary b)Secondary | Personal Guaranty | Personal Guaranty | Personal Guaranty | Personal Guaranty | Personal Guaranty | Personal Guaranty |

Collateral Security provision depend on case to case basis | Up to tk. 5.00 lacs collateral free (case to case) above tk 5 lacs collateral mandatory | Collateral security mandatory | Under tk.5 lacs without collateral security and up to tk 5 lacs with collateral | Collateral security mandatory (forced sale value 1.25 times of loan amount) | Under tk. 8 lacs without collateral security up to tk.8 lacs with collateral security |

6.2 Comparative Analysis of SME Credit of Different Banks ( Example of a loan)

Example of a Loan | The Premier Bank Limited | Dhaka Bank Limited | Eastern Bank Limited | Dutch Bangla Bank Limited | Mercantile Bank Limited | BRAC Bank Limited |

Principle Amount | Tk. 1.00 lac | Tk. 1.00 lac | Tk. 1.00 lac | Tk. 1.00 lac | Tk. 1.00 lac | Tk. 1.00 lac |

Period of Loan | 1 Year | 1 Year | 1 Year | 1 Year | 1 Year | 1 Year |

No. of Installment | 12 | 12 | 12 | 12 | 12 | 12 |

Installment Size | Tk. 9,025 | Tk. 8,931 | Tk. 9,025 | Tk. 8,978 | Tk.9,025 | Tk.9,168 |

Total Installment Payment | Tk. 108230 | Tk. 1,07,172 | Tk. 1,08,300 | Tk. 1,07,736 | Tk. 1,08,230 | Tk. 1,10,016 |

Loan Processing Fee | Tk. 500 | Tk. 1,000 | ……… | ………. | Tk. 3,700 | Tk. 1,500 |

Risk Fund | …….. | Tk.2,000 | ………. | ……….. | Tk 2,200 | ……… |

Supervision fee | …….. | Tk.1,500 | ………. | ………. | Tk. 500 | ………. |

Utilization Fee | ……… | Tk.1,500 | Tk. 2,200 | ……….. | Tk. 2,000 | ………. |

Total Payment | Tk. 1,08,730 | Tk. 1,13,172 | Tk. 1,10,500 | Tk. 1,70,736 | Tk. 1,16,630 | Tk. 1,11,516 |

7.1 Findings regarding SMEs of Bangladesh

In Bangladesh scarcity of raw materials hinder the ability of SME to be export oriented and limits its ability to reach more advanced stages of international business.

Lack of infrastructural facilities hinders the development of SME in Bangladesh.

Most of the SME financing are coming from informal and friends and family members.

The financial institutions are charging higher interest on SME loan.

Small & Medium entrepreneurs’ necessitate proper guidelines and more information to start any business and successfully run it.

Government of Bangladesh emphasis more on women entrepreneurs for SME financing.

Bangladesh Bank started marketing campaign to promote SME sectors.

The major portion of GDP is coming from SME sectors.

7.2 Findings regarding Mercantile Bank

The first ever bank in Bangladesh established with the acquisition of two foreign banks,

Mercantile Bank is one of the fastest growing banks in Bangladesh,

Mercantile Bank got second position comparative to third generation banks according to profit,

Mercantile Bank needs Work-Life Balance for their employee,

Mercantile Bank show remarkable performance in SME financing,

Most of SME loan are given to trading sectors.

Mercantile Bank provides almost all sorts of modern banking facilities,

The assets, deposits, loans & advances, remittance & export-import business constantly increasing which shows the expansion of operations day by day,

The working environment of Mercantile Bank is excellent,

Mercantile Bank operates their functions according to the guidelines of Bangladesh.

Mercantile Bank has very few own ATM booths.

8.1 General Recommendation

Development of infrastructure is essential for the optimum growth of SME. So government of Bangladesh needs to take appropriate policy strategy for the infrastructure development of Bangladesh.

Due to the absence of uniform definition the policy formulation and implementations are not possible. Government should take initiative to develop a uniform definition of each category of SMEs.

Our monetary policy & fiscal policy should be modified in favor of SME sectors.

In order to ensure the retention of skilled workforce the government should make the entrepreneurial career attractive by minimizing the uncertainty.

Appropriate legal framework is necessary to ensure the development of SME of Bangladesh.

Research and Development (R&D) is must for the development and growth of SME. So government must have to invest in R&D for ensuring the intensification of SME of Bangladesh.

Restriction may be imposed on import of SMEs’ products which are available in Bangladesh.

8.2 Recommendation for Mercantile Bank

Mercantile Bank should spread their SME banking in both urban and rural areas to capture more customers.

Mercantile Bank should recruit experienced employee in SME banking division.

Concentrate to provide SME loan more in manufacturing and service sectors.

The Bank should go for advertising and promotional activities to get a broad geographic exposure of SME business.

The Bank should have a separate research and development division to create new dimension in SME banking.

Mercantile Bank should increase skilled human resources to do its financial activities more efficiently and also maintain Work-Life Balance for their employee. So, that, many of the employees do not have to do extra work loads and works late hours without any overtime facilities.

They need to increase their own ATM booths, for their business expansion.

The Bank should introduce a merchant banking division to provide more corporate facilities.

The senior officials should always motivate the new and junior officers to get the official jobs done effectively and efficiently.

The Bank should recruit experienced, efficient and knowledgeable workforce as it offers attractive compensation package and good working environment.

Mercantile Bank needs to control their Credit deposit ratio, which is very high.

Conclusion

Small and medium enterprises (SMEs) act as a vital player for the economic growth, poverty alleviation and rapid industrialization of the developing countries like Bangladesh. Financial intermediaries, especially banks have a very important role to play to develop our SME sectors through launching SME Banking. SME banking is one of the latest innovations in our banking sector and now most of the banks provide SME financing.

Although government of Bangladesh has taken some initiative to ensure the growth of SME but those steps are not enough at all. But government shows its positive attitude towards this sector. Bangladesh government should continue to give more focuses on some areas, such as arrangement of finance, provide infrastructure facilities, frame appropriate legal framework, establish national quality policy etc.

Mercantile Bank Ltd. is a new generation Bank in the private banking scenario of Bangladesh with a promise to fulfill every possible customer need with high efficiency and satisfaction. Mercantile Bank started to provide SME banking from 2006. Since 2006 to now Mercantile Bank achieves remarkable growth in SME banking. The amount of SME loan, income from SME loan and number of SME customers of Mercantile Bank increase year by year.

From the sequence of this analysis it seems that for the economic development of Bangladesh SME can play a vital role. I am quite optimistic that if the above mentioned suggestions are implemented then the growth of SME sector in Bangladesh and the SME banking of Mercantile Bank will be accelerated.