Executive summary

The financial institutions industry in our country represents one of the most important industries those control the monetary flow in the economy. From the very first of its journey (Started by Industrial Promotion Company of Bangladesh Limited.) this industry has shown so much prospect as well as progress. Sharing some common characteristics of Banks & some of its own it brought diversification in the financial market. In the same time it witnessed impressive growth during the last years.

But currently the industry seems to become matured with so many competitors. The recent inclusion of another two new financial institutions (Bangladesh Infrastructure Finance Fund Limited (BIFFL) & Agrani SME Financing Company Limited) in the market has increased the number of competitors at 31. From the research & provided data it is very clear that the companies are trying to strengthen their position in the market as the investment n fixed asset seems to on the rise. Besides following the stock market crash in 2010 and recent rise in the dollar price, the cost of fund has also significantly jumped. Altogether these factors are provoking the decline in the growth in income for the companies.

As per Section 7 of the Banking Companies Act 1991, commercial banks also started different activities offered by financial institutions, specially leasing. Following the act, commercial banks started their leasing operation effectively in 1995. At present, almost all major private commercial banks are involved in non-bank financial operations. The entry of banks in this sector has also helped to brace the growth momentum and will fill the gap in acquiring the institutional finance and serve the needs of the industrial sector in the acquisition of capital assets. And now following the recent emergence of new Banks and three specialized NRB (Non-Resident Bangladeshi) banks, the competition seems to be worsened.

So, as from the present issues the overall market situation for the financial institutions seems to be a bit critical. Not only these institutions are competing in a very highly competitive industry but also they have to compete with the banking sector to survive. So, altogether the earning capability as well as the earning possibilities for these companies is decreasing.

In our country like most other industries financial institutions are also big city especially Dhaka concentrated. Financial institutions rarely spread their branches outside divisional cities let alone the urban areas. So the fierce competition among as well as across the group is strengthening. So the market segmentation, expansion and product diversification may be some key tools to get out of the situation for the FIs.

Besides, FIs in Bangladesh may also explore the possibilities of gaining access to new sources of funds like issuance of commercial paper and discounting or sale of lease receivables. In this connection, IPDC launched first asset backed securities in 2004 as an alternative source of funding. This new instrument emerged as an important tool and added a new dimension in the financial market. But changes in taxation policy in 2005 by the government have made the future of this instrument less attractive for the concerned financial institutions.

Despite these constrains the industry has performed remarkably well. These companies are to be nurtured carefully and required support must be provided for their development. If they get the appropriate support NBFIs will play more significant role in the economic and financial development of our country.

Introduction

Origin of the report

This internship report on “Performance & Growth of Financial Institution of Bangladesh” focusing IPDC Bangladesh Limited, MIDAS Financing Limited, and First Lease Finance & Investment Limited & Premier Leasing & Financing Limited is prepared as a partial requirement of the MBA program offered by the Department of Management Studsies, Jagannath University Dhaka & guided by Mr Shah Ridwan Chowdhury, honorable lecturer of the Department of Management Studies, Jagannath University ,Dhaka.

Objectives of the report

The report “Performance & Growth of Financial Institution of Bangladesh.” focusing IPDC Bangladesh Limited, MIDAS Financing Limited, and First Lease Finance & Investment Limited & Premier Leasing & Financing Limited has been prepared with a view to analyzing the growth factors of the NBFI industry in Bangladesh and its performance over the last Six Financial Years. Besides the report has been composed to obtain following objectives

To know about the contribution of NBFI to the national economy .To fulfill the partial requirement of the internship program offered in MBA program.

To get real experience about the business sector.

To comprehend the learning in the classroom and bridging the gap between real life situation and theories.

Evaluating financial performance of 4 assigned Financial Institution of Bangladesh.

Research Methodology

The report was assigned as identifying the growth and performance of the financial institutions of Bangladesh. Currently there are Thirty One (31) financial institutions in our country. This Four Companies, IPDC Bangladesh Limited, MIDAS Financing Limited, First Lease Finance & Investment Limited & Premier Leasing & Financing Limited will represent the whole NBFI sectors of our country. All the findings & declaration has made throughout the report on the basis of these four companies and their performance.

The research has been done using following steps.

Theoretical Background for our financial market;

Theoretical Background for our financial institutions;

Brief Company background & Analysis for the pre-stated four companies.

Inter-company analysis.

Performance Analysis

Growth analysis.

In order to make the report as perfect as possible I here used data collection procedures which articulate the way that I have followed in my report.

Data source

In my research, I used both primary data and secondary data. So, the sources of data are two types.

Secondary Sources:

For the organization part of my report I have used the following data sources:

The Websites of IPDC Bangladesh Limited, MIDAS Financing Limited, First Lease Finance & Investment Limited & Premier Leasing & Financing Limited.

The Annual Reports of the stated companies.

Several reports published by different renowned institution like Bangladesh Bank, Statistical Bureau of Bangladesh etc.

Primary Sources:

To conduct the research I have collected the primary data through my Internship period with IPDC Bangladesh Limited, the very first established financial institution in our country. Besides I also contacted with other three companies to provide reliable information in the report.

Limitation of study

There are some limitations to do any types of works. I have also faced a number of problems that may be turned as the limitation of the study. The problems are given below:

- Shortage of Information;

- Some assumptions needed.

From the very beginning of society, men were always looking for a well organized transaction system or a reasonably performing market. Through the process of establishment of society and development of economic system men introduced so many systems and developed those by process. With these turning processes of development “Financial System” was introduced and now this financial system is pouring the main lifeline for the economy. So, now it is well accepted that well-performing financial systems are prerequisite to economic development.

Well-functioning financial systems are by definition efficient allocation of funds to their most productive uses. It also covers other vital purposes such as offering savings, payment, and risk management products to as large a set of participants as possible, seeking out and financing good growth opportunities wherever they may be. The policy makers, practitioners and researchers have so far emphasized efficiency and stability aspects of financial systems and ignored the broader access to financial services. However, the current development theories increasingly project the role of access to financial services, the lack of which is often the critical element underlying income inequality as well as slower growth.

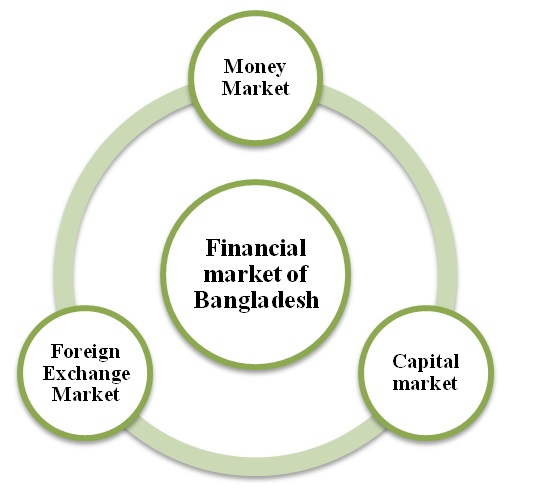

Overview of Financial market of Bangladesh

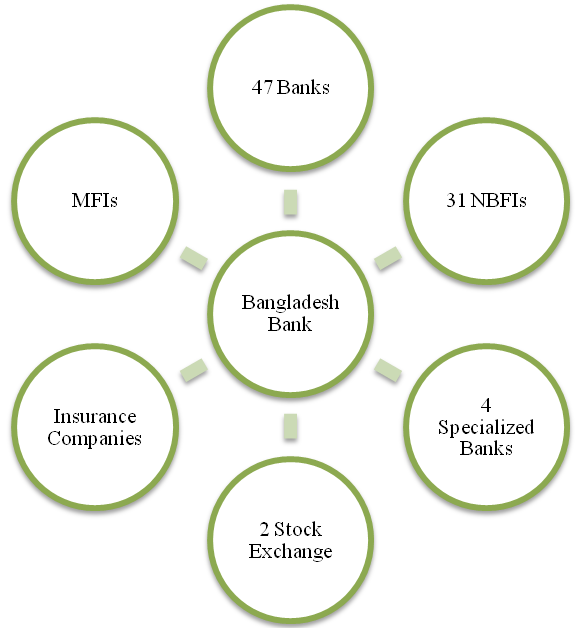

Figure 1: Financial market of Bangladesh

2.1.1 Money Market

The primary money market is comprised of banks, FIs and primary dealers as intermediaries and savings & lending instruments, treasury bills as instruments. There are currently 15 primary dealers (12 banks and 3 FIs) in Bangladesh. The only active secondary market is overnight call money market which is participated by the scheduled banks and FIs. The money market in Bangladesh is regulated by Bangladesh Bank (BB), the Central Bank of Bangladesh.

2.1.2 Capital market

The primary segment of capital market is operated through private and public offering of equity and bond instruments. The secondary segment of capital market is institutionalized by two (02) stock exchanges-Dhaka Stock Exchange and Chittagong Stock Exchange. The instruments in these exchanges are equity securities (shares), debentures, corporate bonds and treasury bonds. The capital market in Bangladesh is governed by Securities and Commission (SEC).

2.1.3 Foreign Exchange Market

Towards liberalization of foreign exchange transactions, a number of measures were adopted since 1990s. Bangladeshi currency, the taka, was declared convertible on current account transactions (as on 24 March 1994), in terms of Article VIII of IMF Article of Agreement (1994). As Taka is not convertible in capital account, resident owned capital is not freely transferable abroad. Repatriation of profits or disinvestment proceeds on non-resident FDI and portfolio investment inflows are permitted freely. Direct investments of non-residents in the industrial sector and portfolio investments of non-residents through stock exchanges are reparable abroad, as also are capital gains and profits/dividends thereon. Investment abroad of resident-owned capital is subject to prior Bangladesh Bank approval, which is allowed only sparingly. Bangladesh adopted Floating Exchange Rate regime since 31 May 2003. Under the regime, BB does not interfere in the determination of exchange rate, but operates the monetary policy prudently for minimizing extreme swings in exchange rate to avoid adverse repercussion on the domestic economy. The exchange rate is being determined in the market on the basis of market demand and supply forces of the respective currencies. In the for-ex market banks are free to buy and sale foreign currency in the spot and also in the forward markets. However, to avoid any unusual volatility in the exchange rate, Bangladesh Bank, the regulator of foreign exchange market remains vigilant over the developments in the foreign exchange market and intervenes by buying and selling foreign currencies whenever it deems necessary to maintain stability in the foreign exchange market.

2.2 Formal financial sector in Bangladesh

In our country the formal financial system includes some all regulated institutions like Banks, Non-Bank Financial Institutions (FIs), Insurance Companies, Capital Market Intermediaries like Brokerage Houses, Merchant Banks, Micro Finance Institutions (MFIs). The participants are mostly governed by our central bank, Bangladesh Bank.

2.3 Banking industry in our country-At a glance

After the independence, banking industry in Bangladesh started its journey with 6 nationalized commercialized banks, 2 State owned specialized banks and 3 Foreign Banks. In the 1980’s banking industry achieved significant expansion with the entrance of private banks. Now, banks in Bangladesh are primarily of two types:

Scheduled Banks: The banks which get license to operate under Bank Company Act, 1991 (Amended in 2003) are termed as Scheduled Banks.

Non-Scheduled Banks: The banks which are established for special and definite objective and operate under the acts that are enacted for meeting up those objectives, are termed as Non-Scheduled Banks. These banks cannot perform all functions of scheduled banks.

There are 47 scheduled banks in Bangladesh who operate under full control and supervision of Bangladesh Bank which is empowered to do so through Bangladesh Bank Order, 1972 and Bank Company Act, 1991.

The commercial banking system dominates Bangladesh’s financial sector. And the banking systems is dominated by the 4 Nationalized Commercial Banks, which together control more than 54% of deposits and operate 54% of the total branches. The banking system is composed of

ü Four state-owned commercial banks (SCBs),

ü Thirty private commercial Banks (PCBs),

ü Nine foreign commercial banks (FCBs) and

ü Five specialized development banks (SDBs).

Commercial Banks

The commercial banking system dominates the financial sector with limited role of Non-Bank Financial Institutions and the capital market. The Banking sector alone accounts for a substantial share of assets of the financial system. The banking system is dominated by the 4 State Owned Commercial Banks, which together control more than 30% of deposits and operates 3383 branches (50% of the total) as of June 30, 2008.

Specialized Banks

Out of the 4 specialized banks, 2 (Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank) were created to meet the credit need of the agricultural sector while the other one Bangladesh Development Bank Ltd for extending term loans to the industrial sector of Bangladesh.

There are now 4 non-scheduled banks in Bangladesh which are:

- i. Ansar VDP Unnayan Bank,

- ii. Karmashangosthan Bank,

- iii. Probashi Kollyan Bank,

- iv. Jubilee Bank

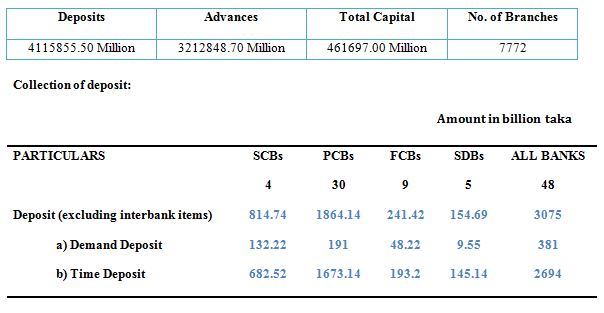

Statistics regarding banks in our country as of December 2011

Allocation of deposit: Loans& Credit

Amount in billion taka

| PARTICULARS | SCBs 4 | PCBs 30 | FCBs 9 | SDBs 5 | ALL BANKS 48 |

| Credit provided in Bangladesh | 509.37 | 1343.95 | 148.59 | 147.31 | 2149.22 |

| a) Loans and Advances | 458.4 | 1271.33 | 142.44 | 145.3 | 2017.47 |

| b) Inland Bills | 23.75 | 64.77 | 2.88 | 1.23 | 92.63 |

| c) Foreign Bills | 27.22 | 7.85 | 3.27 | 0.78 | 39.12 |

| Credit Deposit Ratio (%) | 62.53% | 72.05% | 61.55% | 95.08% | 69.88% |

Allocation of deposit: Investment in securities

Amount in billion taka

| PARTICULARS | SCBs 4 | PCBs 30 | FCBs 9 | SDBs 5 | ALL BANKS 48 |

| Total Investment in securities (Book value) | 210.53 | 243.16 | 47.06 | 9.44 | 510.19 |

| Investment Deposit Ratio (%) | 25.80% | 13.03% | 19.50% | 6.07% | 16.58% |

SLR & CRR (Commercial Banks)

According to Bangladesh Bank Every scheduled bank has to maintain reserve in securities at a rate of 13% & in cash at a rate of 5.5%…

Different stats for banks (Commercial Banks)

| Bank rate | 5% |

| Call Money Rate | 3.83% |

| Exchange Rate (Average) Taka-Dollar | 69.4156 |

| Foreign Exchange Reserve (In million US$) | 10871.61 |

| Lending Rate | 16.00% |

| Borrowing Rate | 7.17% |

| Interest Rate spread | 5.17% |

| ROA | 1.19% |

| ROE | 15.98% |

Theoretical Background : The Financial Institutions of Bangladesh

3.1 Non-Bank Financial Institutions (NBFIs) by definition

Non-bank Financial Institutions financial intermediaries that accumulate funds by borrowing from the general public and lend the same to meet specialized financing needs, but are prohibited to accept such deposits payable either on demand or by cheque, draft, etc, and operate checking accounts for which their liabilities are not a part of the money supply. The first non-bank financial institution (NBFI) was a fire insurance company established in 1680 in London.

Although all financial institutions have a common basis for their operations and some role with respect to lender-borrower relationships, there are some fundamental differences between the banks and NBFIs. The liabilities created by the banks are unique in that these liabilities are themselves ‘spendable’ i.e., the deposits in banks are used as money by the holders of the deposits whereas the liabilities of a NBFI, such as a building society cannot be used in this way. Banks can actually increase the total volume of spending in the economy by their capacity to add to the stock of credit in existence. But the non-bank financial institutions do not have that capacity and they are merely ‘honest brokers’ and transmitting funds, which have been created elsewhere, e.g. by the banking system. Banks now have less savings deposits and more demand deposits. The NBFI, such as a leasing company, receives additional funds and is capable of adding to its mortgage lending by withdrawing from its larger demand deposits kept with the deposit money bank. The leasing company thus adds to the volume of credit and enables additional spending (on house purchase) to take place. The combination of financial assets created by the banks and NBFIs for ultimate lender varies depending on the origin of the asset.

3.2 Banking and Non Banking Financial Institution’s Basic Differences

In Bangladesh now different commercial banks and the non banking financial organizations are operating their business. And every organization now involved attracting the retail customers that means the middle income group people of the country. To draw their attention the sells persons of different organization try to knock every possible door. These activities of different organization increase the interest about this sector. As both commercial banks and the non financial institutes are in the market, so it makes confusion to the general people about the activities of these organizations.

Banks, usually a corporation, that accepts deposits, makes loans, pays checks, and performs related services for the public. The Bank Holding Company Act of 1956 defines a bank as any depository financial institution that accepts checking accounts (checks) or makes commercial loans, and its deposits are insured by a federal deposit insurance agency. A bank acts as a middleman between suppliers of funds and users of funds, substituting its own credit judgment for that of the ultimate suppliers of funds, collecting those funds from three sources: checking accounts, savings, and time deposits; short-term borrowings from other banks; and equity capital. A bank earns money by reinvesting these funds in longer-term assets. A Commercial Bank invests funds gathered from depositors and other sources principally in loans. An investment bank manages securities for clients and for its own trading account. In making loans, a bank assumes both interest rate risk and credit risk.

Non-bank financial institutions represent one of the most important parts of a financial system. In Bangladesh, NBFIs are new in the financial system as compared to banking financial institutions (BFIs). A total of 31 NBFIs are now working in the country. The NBFIs sector in Bangladesh consisting primarily of the development financial institutions, leasing enterprises, investment companies, merchant bankers etc. The financing modes of the NBFIs are long term in nature. Traditionally, our banking financial institutions are involved in term lending activities, which are mostly unfamiliar products for them. Inefficiency of BFIs in long-term loan management has already leaded an enormous volume of outstanding loan in our country. At this backdrop, in order to ensure flow of term loans and to meet the credit gap, NBFIs have immense importance in the economy. In addition, non-bank financial sector is important to increase the mobilization of term savings and for the sake of providing support services to the capital market.

The basic difference may include

- A Bank is an organization that accepts customer cash deposits and then provides financial services like bank accounts, loans, share trading account, mutual funds, etc.

- A NBFC (Non Banking Financial Company) is an organization that does not accept customer cash deposits but provides all financial services except bank accounts.

- A bank interacts directly with customers while an NBFI interacts with banks and governments

- A bank indulges in a number of activities relating to finance with a range of customers, while an NBFI is mainly concerned with the term loan needs of large enterprises

- A bank deals with both internal and international customers while an NBFI is mainly concerned with the finances of foreign companies

- A bank’s main interest is to help in business transactions and savings/investment activities while a NBFIs main interest is in the stabilization of the currency.

- NBFIs cannot issue cheques, pay-orders or demand drafts.

- NBFIs cannot receive demand deposits,

- NBFIs cannot be involved in foreign exchange financing,

- NBFIs can conduct their business operations with diversified financing modes like syndicated financing, bridge financing, lease financing, securitization instruments, private placement of equity etc.

Besides the differences between the both commercial banks and the non banking financial institutions they play both for the development of the economic structure of the country. If the both play positively than it can be said that, the development of the country is sure.

3.3 The emergence Non-Bank Financial Institutions (NBFIs) in our country

The non-bank financial institutions operating in East Pakistan were the Industrial Development Bank of Pakistan, Equity Participation Fund, Pakistan Industrial Credit and Investment Trust Corporation, Investment Corporation of Pakistan, National Investment Trust and insurance companies. Such institutions established in Bangladesh in the 1970s include the House Building Finance Corporation (1973) and the Investment Corporation of Bangladesh (1976). These institutions extended their business in industrial, commercial and housing financing, and in the stock market activities. They are also granted permission by the Bangladesh Bank to participate in the inter-bank money market transactions.

In the beginning, NBFIs were introduced in our financial system under the Companies Act, 1913 and were regulated by the provision relating to Non-Banking Institutions as restricted in Chapter V of the Bangladesh Bank Order, 1972. But this regulatory framework was not sufficient and NBFIs had the scope of carrying out their business in the line of banking. Later, Bangladesh Bank promulgated an order titled “Non Banking Financial Institutions Order, 1989” to endorse better regulation and also to eliminate the vagueness concerning to the acceptable areas of business of NBFIs. But the order did not cover the complete range of NBFI activities. It also did not mention anything about the statutory liquidity requirement to be maintained with the central bank. To remove the regulatory deficiency and also to define a wide range of activities to be covered by NBFIs, a new act titled ‘Financial Institution Act, 1993’ was enacted in 1993. Industrial Promotion and Development Company (IPDC) was the first private sector NBFI in Bangladesh, which started its operation in 1981. Since then the number has been increasing and in December 2011 it reached at 31.

Now in our country the operations of NBFIs in Bangladesh are regulated by the Bangladesh Bank. The grant of authority to engage in borrowing from the general public is normally based on such factors as minimum capital requirement, quality of management, compliance with the concerned laws, rules, and regulations, and stability of financial standing. NBFIs may grant loans to their members and the general public up to a certain amount and may also engage in trust functions with prior permission of the central bank. They are not allowed to engage in foreign exchange transactions.

3.4 Non Bank Financial Institutions in Bangladesh:

As of December 2011 31 FIs are operating in Bangladesh while the maiden one was established in 1981. Out of the total, 2 is fully government owned, 1 is the subsidiary of a SOCB, 13 were initiated by private domestic initiative and 15 were initiated by joint venture initiative.

- Bangladesh Finance and Investment Co. Ltd.

- Bangladesh Industrial Finance Company Limited (BIFC)

- Bay Leasing and Investment Limited

- Delta Brac Housing Finance Corporation Ltd. (DBH)

- Fareast Finance and Investment Limited:

- FAS Finance and Investment Limited

- First Lease Finance and Investment Ltd.

- GSP Finance Company (Bangladesh) Limited (GSPB):

- IDLC Finance Limited

- Industrial and Infrastructure Development Finance Company (IIDFC) Limited

- Industrial Promotion and Development Company of Bangladesh Limited (IPDC)

- Infrastructure Development Company Limited (IDCOL)

- International Leasing and Financial Services Limited

- Islamic Finance and Investment Limited

- LankaBangla Finance Ltd.

- MIDAS Financing Limited (MFL)

- National Finance Limited

- National Housing Finance and Investments Limited

- Oman Bangladesh Leasing and Finance Limited

- People’s Leasing and Financial Services Ltd

- Phoenix Finance and Investments Limited

- Premier Leasing and Finance Limited

- Prime Finance and Investment Ltd

- Saudi-Bangladesh Industrial and Agricultural Investment Company Limited (SABINCO)

- The UAE-Bangladesh Investment Co. Ltd

- Union Capital Limited

- United Leasing Company Limited (ULCL)

- Uttara Finance and Investments Limited

- Ahsania-Malaysia Hajj Investment and Finance Company Limited

- Agrani SME Financing Company Limited

- Bangladesh Infrastructure Finance Fund Limited (BIFFL)

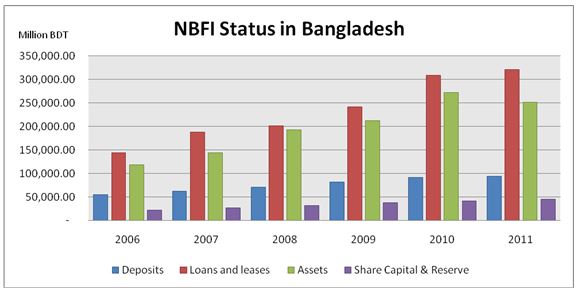

3.5 Statistics regarding Financial Institutions in our country as of December 2011

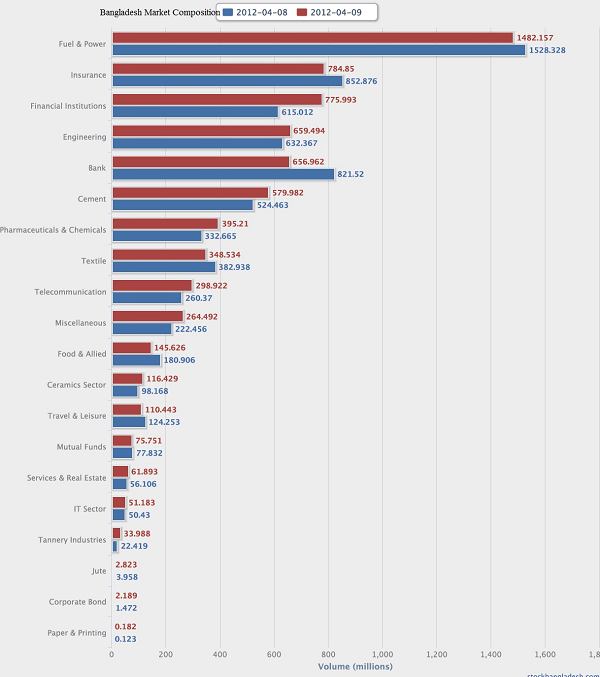

Figure 3: NBFI Status in Bangladesh (Source: Bangladesh Bank)

Sector details-NBFI

| Sector: | Financial Institutions |

| Sector PE: | 23.85 |

| Sector Cap | 193299703177.00 |

| Sector Earnings: | 8103387182.49 |

| Sector Beta: | 0.87 |

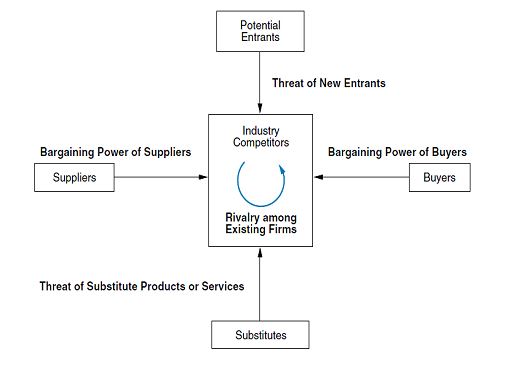

3.6 Porter 5 factor Analysis

3.6.1 Porter 5 factors for financial institutions in Bangladesh

| Financial Institutions: Industry status : Matured | ||

| factors | High/low | Reasons |

| Competition with rivals | High | Competing within the same market niche |

| Threat of new entrants | low | Cost of fund is relatively high |

| Threat of substitute | high | Banks are proving the almost identical services & products |

| Bargaining power of buyers | high | Switching cost is low |

| Bargaining power of suppliers | high | Supplier of funds are relatively small in numbers other than public investors |

Company Analysis

4.1 First Lease Finance and Investment Limited (FLFIL)

First Lease Finance and Investment Limited (FLFIL), having its registered and operational office is located at Jahangir Tower (3rd Floor), 10 Kawran Bazar C/A, Dhaka-1215, Bangladesh was incorporated in Bangladesh as a private limited company on June 28, 1993 and the company was subsequently converted into public limited company under the Companies Act, 1994 which have long-term prospect. In the year 2001, it expanded its range of services by introducing House Financing. In year 2002 it started financing Taxi-Cab with our continuous drive in introducing new products and success.

4.1.1 Company Chronicles

| Incorporation of the company As a private company | 28th June, 1993 |

| Commencement of Leasing Business | Since Incorporation |

| Conversion into Public Company | 18th July, 1996 |

| Licensed From Bangladesh Bank | 5th October, 1999 |

| First Trading On Stock Exchange (DSE and CSE) | 9th October, 2003 |

| Opening of Branch office in Chittagong | 20th December, 2005 |

| First Trading day under CDS Systems in DEMAT form | 4th January, 2009 |

| Approval of Name Changes of the Company | 27th April, 2009 |

4.1.2 Capital Details

| Paid up Capital | 503 M |

| Market Capital | 628.135 M |

| Trade % of MCAP | 1.32% |

| Public Securities | 24401223 |

| Public Cap | 305M |

4.1.3 Services

ü Lease Finance

ü Corporate Finance

ü Real Estate Loan

ü Short Term Finance

ü Bridge Equity Finance

ü Syndicate Finance

ü Work Order Finance

ü Team Finance

ü Purchase Scheme

ü Deposit Scheme

ü Bangladesh Bank Refinance Scheme

4.1.4 Financial Performance

Year | Earnings per share | Net Asset Value Per Share | % Dividend |

2011 | 1.64 | 17.38 | 20B |

2010 | 3.45 | 19.68 | 25B |

2009 | 4.53 | 28.42 | 75 |

2008 | 5.34 | 27.78 | 10 |

2007 | 5.90 | 28.33 | 20 |

2006 | 5.51 | 26.51 | 20 |

4.1.5 Earnings Flow of First Lease Finance and Investment Limited (FLFIL)

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Total Interest Income | 298,301,536 | 180,125,140 | 250,040,000 | 213,218,111 | 269,496,849 | 340,569,173 |

| Operating Profit | 155,615,117 | 113,603,599 | 136,630,000 | 136,466,441 | 163,130,069 | 203,149,652 |

| Net Income | 79,914,630 | 91,140,459 | 111,623,065 | 104,180,856 | 138,673,577 | 127,468,318 |

4.1.6 Growth of First Lease Finance and Investment Limited (FLFIL)

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Branch Expansion | 3 | 3 | 3 | 3 | 4 | 4 |

| Employee Creation | 18 | 24 | 30 | 38 | 50 | 58 |

4.2 Premier Leasing & Finance Limited

Premier Leasing & Finance Limited, a third generation financial institution, was registered on September 26, 2001 as a Public Limited Company as Premier Leasing International Limited with authorized capital of TK.400 Million and initial paid-up capital of TK.51 Million. The Company went for public subscription by floating its shares in the capital market in July 2005. Company’s issued and fully paid-up capital as on December 31, 2008 stood at TK.344 Million. The Company was renamed as Premier Leasing & Finance Limited on September 25, 2007.

The Company started its operation in the leasing sector in Bangladesh from February 25, 2002 and carrying out its activities by allowing Lease Finance and Term Finance in various sectors, viz. transport, industrial expansion, household durables, office equipment, agricultural equipment, industrial machinery and equipment etc.

4.2.1 Company Chronicles

| Date of incorporation | September 26, 2001 |

| Date of commencement of business | September 26, 2001 |

| License from Bangladesh Bank | February 4, 2002 |

| Date of commercial operation | February 25, 2002 |

| Signing of first lease agreement | March 14, 2002 |

| Permission of Initial Public Offering (IPO) from SEC | July 5, 2005 |

| Date of Initial Public Offer for subscription | August 14-18, 2005 |

| Date of Listing with Dhaka Stock Exchange Limited. (DSE) | October 20, 2005 |

| Date of Listing with Chittagong Stock Exchange Limited. (CSE) | October 20, 2005 |

| First Trading of Shares in DSE & CSE | October 20, 2005 |

| Chittagong Branch opened | May 20, 2007 |

4.2.2 Capital Details

| Paid up Capital | 1042 M |

| Market Capital | 608.551 M |

| Public Securities | 51050964 |

| Public Cap | 298M |

4.2.3 Products

- Lease finance (LF) for acquisition of capital equipment and machinery.

- Term loan (TL) as financial support for acquisition of fixed assets.

- Short term loan (STL) to meet emergent cash requirement of business.

- Syndicated financing with other banks & financial institutions for meeting large financial needs.

- Various term deposit schemes at attractive profit for deposits.

- SME Finance

- Housing Finance including refinance Housing Loan Scheme of Bangladesh Bank

Refinance Scheme for Women Entrepreneurs in Small and Medium Enterprises

4.2.4 Financial Performance

Year | Earnings per share | Net Asset Value Per Share | % Dividend |

| 2010 | 3.15 | 14.91 | 20B |

| 2009 | 19.53 | 135.15 | 15 B |

| 2008 | 13.50 | 127.19 | 10 B |

| 2007 | 14.77 | 127.89 | 12.50 B |

| 2006 | 19.80 | 113.12 | 15.00 |

4.2.5 Earnings Flow of Premier Leasing & Finance Limited

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Total Interest Income | 174,283,000 | 295,824,000 | 442,972,000 | 578,229,166 | 566,708,886 | 604,236,250 |

| Operating Profit | 76,173,000 | 88,899,000 | 105,631,000 | 161,629,896 | 122,870,666 | 119,640,649 |

| Net Income | 60,385,000 | 45,063,000 | 46,336,000 | 73,704,785 | 136,870,488 | 135,469,324 |

4.2.6 Growth of Premier Leasing & Finance Limited

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Branch Expansion | 1 | 2 | 2 | 2 | 4 | 4 |

| Employee Creation | 17 | 25 | 29 | 34 | 42 | 48 |

4.3 Industrial Promotion and Development Company of Bangladesh Limited (IPDC)

IPDC is the first private sector Financial Institution in Bangladesh established in 1981 by a distinguished multilateral team of shareholders. The mission of the company is to be the brand of quality and integrity for delivering innovative and tailored financial solutions to a diverse client base.

IPDC specializes in project financing and provides innovative investment solutions. This includes investing in projects that add value and contribute to the country’s overall economic development. It invests through equity participation, term lending and lease financing. IPDC has played pivotal role in almost all the industrial sectors. It has also special focus in infrastructure and social sector projects.

IPDC has also been providing innovative investment solutions and project advisory services to its clients in industrial and social sectors like education and health care. IPDC makes investments in order to achieve a number of objectives:

- Employment and income generation

- Revenue generation for the government

- Production capacity addition

- Earned or saved foreign exchange

- Linkage and business development

- Skills and technology transfer

- Offering environmental risk assessment and its management

The positive image IPDC has created has been established through more than two decades of consistent commitment towards excellence in providing financial services. With a conscious effort to anticipate influences in the domestic and foreign investment, IPDC has the ability to adapt to the changing needs of time.

4.3.1 Capital Details

| Paid up Capital | 949 M |

| Market Capital | 1997.043 M |

| Trade % of MCAP | 0.12% |

| Public Securities | 23808316 |

| Public Cap | 501M |

4.3.2 Financial Performance

Year | Earnings per share | Net Asset Value Per Share | % Dividend |

| 2011 | 1.18 | 20.02 | 10B |

| 2010 | 1.541 | 22.95 | 10B |

| 2009 | 14.13 | 235.49 | 10B |

| 2008 | 14.58 | 244.91 | 10B |

| 2007 | 20.60 | 253.36 | 5C, 10B |

| 2006 | 27.57 | 249.65 | 10C, 5B |

4.3.3 Earnings Flow of IPDC

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Total Interest Income | 941,852,379 | 777,485,073 | 631,729,460 | 545,287,424 | 465,262,655 | 539,473,781 |

| Operating Profit | 103,583,854 | 183,920,324 | 174,567,346 | 185,069,729 | 166,734,298 | 123,707,819 |

| Net Income | 172,910,365 | 133,167,179 | 103,897,173 | 110,737,808 | 132,901,188 | 31,056,048 |

4.3.4 Growth of IPDC

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Branch Expansion | 2 | 2 | 2 | 2 | 3 | 5 |

| Employee Creation | 37 | 43 | 46 | 62 | 73 | 102 |

4.4 MIDAS FINANCING LTD. (MFL)

MIDAS FINANCING LTD. (MFL) is leading financial institution of the country licensed by Bangladesh Bank under the financial institutions Act 1993. MFL Housing Loan Scheme has been launched to fulfil the dream of the limited income people by extending financial support in the form of term loan for constructing a house and/or purchasing an apartment/readymade house/commercial space.

4.4.1 Company Chronicles

| Incorporation | May 16, 1995 |

| License from Bangladesh Bank | October 11, 1999 |

| Commencement of Commercial Operation | January 01,2000 |

| Commencement of Leasing Business | July 01, 2001 |

| Commencement of Consumers’ Credit Operation | October 01, 2001 |

| First Deposit taking from individual investors | June 08, 2002 |

| Initial Public Issue of Shares (Date of Allotment) | August 12,2002 |

| Listing with Dhaka Stock Exchange Limited | October 26, 2002 |

| Listing with Chittagong Stock Exchange Ltd. | July 27, 2004 |

| Entry in CDBL | March 23, 2005 |

| Issue of Rights Share (Date of Allotment) | May 15, 2005 |

4.4.2 Capital Details

| Paid up Capital | 601 M |

| Market Capital | 1068.899 M |

| Trade % of MCAP | 0.14% |

| Public Securities | 18076382 |

| Public Cap | 321M |

4.4.3 Financial Performance

Year | Earnings per share | Net Asset Value Per Share | % Dividend |

| 2011 | 12.14 | 13.24 | 10B |

| 2010 | 42.34 | 162.32 | 35B |

| 2009 | 20.02 | 140.47 | 2.50C, 15B |

| 2008 | 26.17 | 138.41 | 5C, 12.50B |

| 2007 | 19.39 | 135.77 | 5C, 10B |

| 2006 | 13.67 | 134.78 | 2C. 10B |

| 2005 | 18.06 | 121.94 | 2C, 10B |

4.4.4 Earnings Flow of Industrial MIDAS FINANCING LTD. (MFL)

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Total Interest Income | 135,139,599 | 185,803,867 | 325,131,539 | 335,780,000 | 367,038,169 | 707,848,648 |

| Operating Profit | 34,757,371 | 87,287,389 | 112,114,009 | 108,119,657 | 179,517,493 | 273,604,109 |

| Net Income | 35,357,917 | 55,164,060 | 81,920,480 | 70,484,196 | 171,466,400 | 66,379,345 |

4.4.5 Growth of MIDAS FINANCING LTD. (MFL)

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Branch Expansion | 4 | 4 | 7 | 7 | 12 | 16 |

| Employee Creation | 83 | 74 | 83 | 91 | 102 | 121 |

Inter-company analysis

6.1 Financial Profitability Measures (Financial Ratios)

These financial ratios measure the return earned on a company’s capital and the financial cushion relative to each dollar of sales. A firm that has high gross profit margins, for instance, is going to be much harder to put out of business when the economy turns down than one that has razor-thin margins. Likewise, a company with high returns on capital, even with smaller margins, is going to have a better chance of survival because it is so much more profitable relative to the shareholders’ contributed investment.

Financial ratios show current financial performance. Through analysis, financial manager can recommend changes in procedures or policies necessary for the organization to achieve its goals. Trends in financial ratios show whether or not the organization can achieve its goals. Ratios are indicators, designed to maximize information at minimal cost. Ratios monitor trends and point out possible problems in the making while they can still be handled expeditiously.

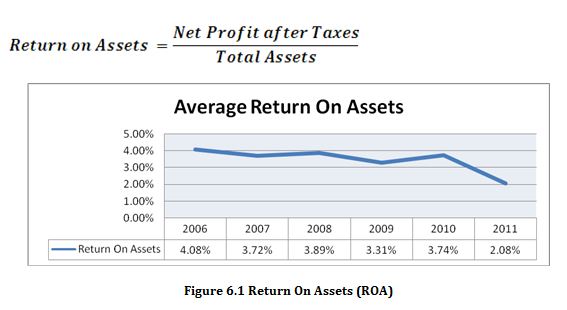

6.1.1 Return on Assets (ROA)

It is considered as a measure of how effectively assets are used to generate a return.

The average return on asset is declining year by year. And of 2011 the return on asset is only 2.08%. This may be because huge investment required in this sector. Besides the process of financial institutions also require huge working capital. But still the average ROA is quite alarming.

6.1.2 Return on Equity-The DuPont Analysis

The return on equity (ROE) ratio can be broken down into two ratios net profit margin and equity turnover. This breakdown of ROE into component ratios is generally referred to as the DuPont system. The importance of ROE as an indicator of performance makes it desirable to divide the ratio into several components that provide insights into the causes of a firm’s ROE or any changes in it.

This identity reveals that ROE equals the net profit margin times the equity turnover, which implies that a firm can improve its return on equity by either using its equity more efficiently (increasing its equity turnover) or by becoming more profitable (increasing its net profit margin).

A firm’s equity turnover is affected by its capital structure. Specifically, a firm can increase its equity turnover by employing a higher proportion of debt capital. So, here another relationship is formed. This effect can be shown by considering the following relationship:

Similar to the prior breakdown, we have both multiplied and divided the equity turnover ratio by total assets. This equation indicates that the equity turnover ratio equals the firm’s total asset turnover (a measure of efficiency) times the ratio of total assets to equity, a measure of financial leverage. Specifically, this latter ratio of total assets to equity indicates the proportion of total assets financed with debt. All assets have to be financed by either equity or some form of debt (either current liabilities or long-term debt).

Combining these two breakdowns, the ROE is composed of three ratios as follows:

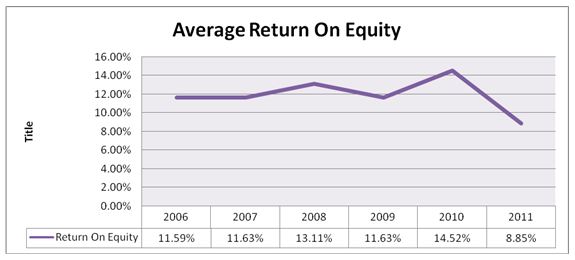

The return on equity is also declining through the years. Especially from 2010 to 2011 it almost jumped down to half in amount. So, the return does not express any good sign about the performances of the companies.

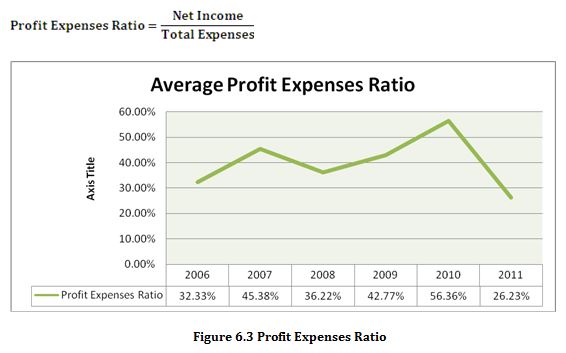

6.1.3 Profit Expenses Ratio

Profit expenses ratio represents the ratio between net income & total cost.

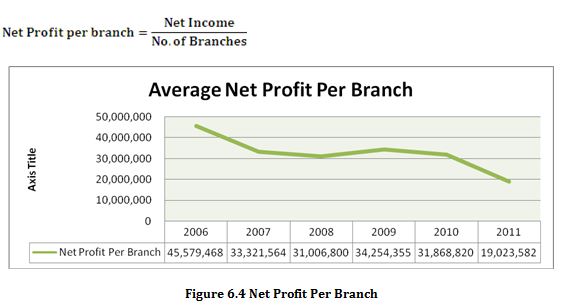

6.1.4 Net Profit per Branch

The ratio net profit per branch declares the average profit earned by different branches of the companies. The ratio may be expressed like below.

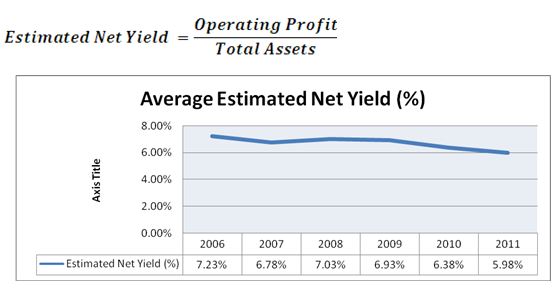

6.1.5 Estimated Net Yield (%)

This ratio is also like Return on asset ratio. The difference is, here operating profit is taken over the net income.

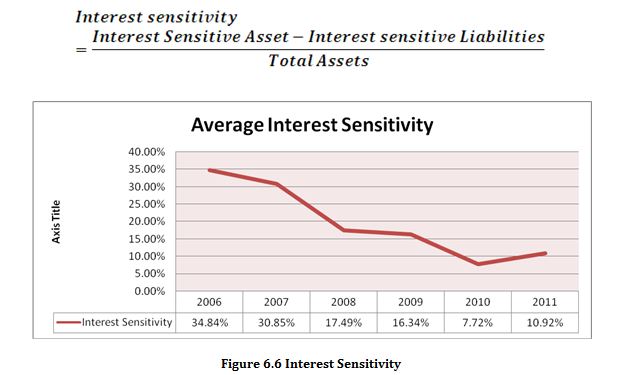

Interest Sensitivity

Interest sensitivity of a company is very important. Especially for financial institutions interest sensitivity bears more importance. The ratio refers to

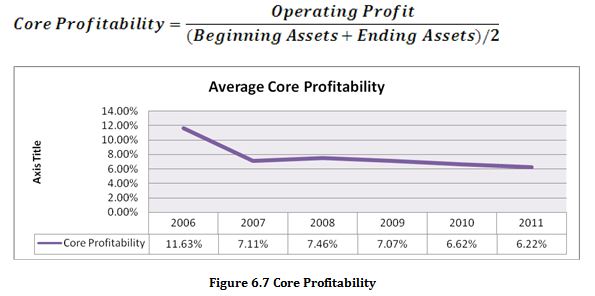

Core Profitability

This ratio is also very much similar to ROA. Here operating profit is used instead of net profit & average asset is used instead of total assets. This ratio measures the very core profitability situation of a company.

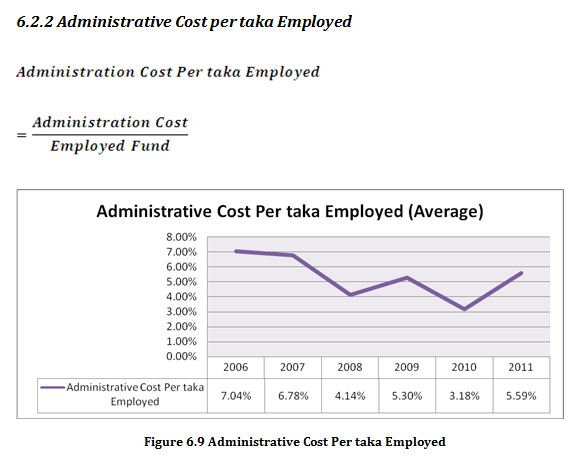

Operational Efficiency

The operational efficiency of a company is measured by the administration cost and cost to fund ratio. This is very important because the more a company is efficient in its operation the more cost reduction is possible. And consequently it will lead to higher profitability. Here to identify the operational efficiency two ratios are discussed.

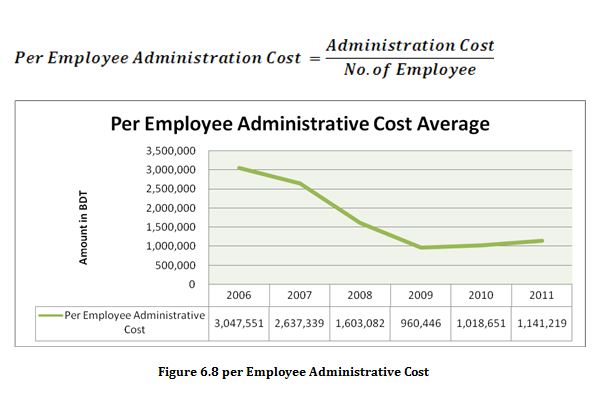

Per Employee Administrative Cost

Administrative Cost Per taka Employed

per Employee Administrative Cost

In financial institutions administration cost is very negligible in compare with interest expense. Because in financial institutions both number of branches & number of employees are very low.

6.3 Asset Quality

Assets in the financial institutions are mostly loan, advances, and investments. And these assets are risky because high default risk involved in such assets. So, the quality of such asset depends on provisions made against these risks.

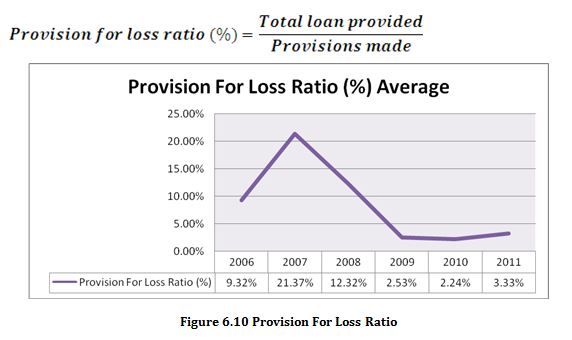

6.3.1 Provision for Loss Ratio (%)

This is the ratio of provision maintained against different sort of investments to increase the asset quality.

6.4 Productive Efficiency

Effective performance, fund utilization etc. brought the efficiency in production. A company mostly relies on its productivity to ensure its success. The productive efficiency of a company can be analyzed by the following ratio items:

Fund Utilization Ratio

Profit Employed Fund Ratio

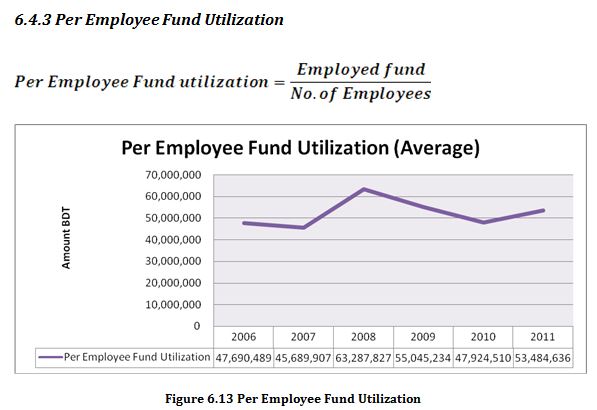

Per Employee Fund Utilization

Financial Expenses Control Efficiency

Composite Productivity

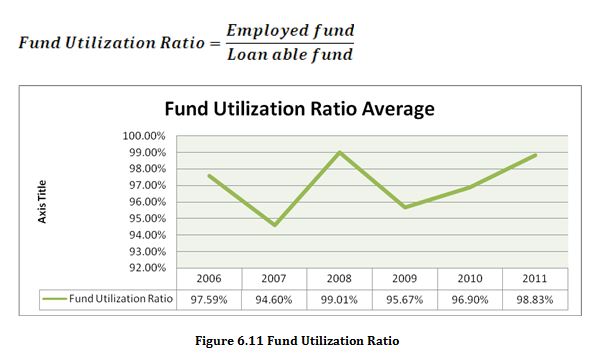

6.4.1 Fund Utilization Ratio

Fund is the bloodline for a company. The success of a company mostly depends on the utilization of its fund. This fund utilization ratio is expressed by the following formula:

The fund utilization in the financial institutions is quite satisfactory. The NBFIs seem to utilize almost their entire fund. But still some funds are unutilized.

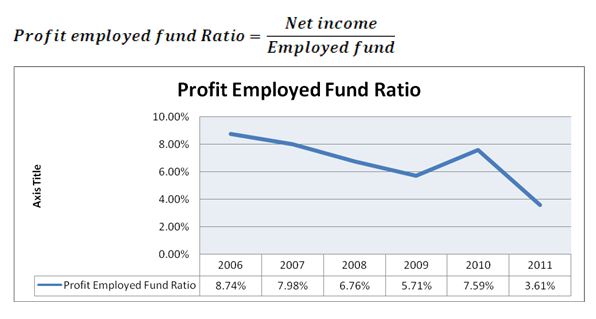

6.4.2 Profit Employed Fund Ratio

The ratio describes the rate of return earned by a company on the funds it utilized or employed.

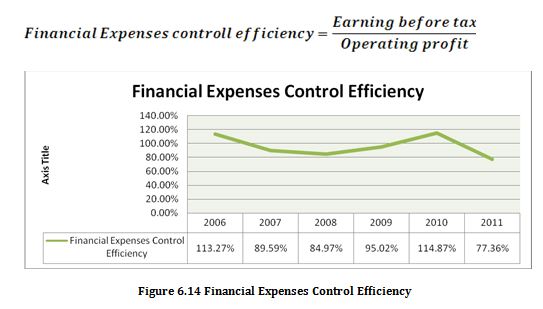

6.4.4 Financial Expenses Control Efficiency

This ratio describes the ability of a company to control its administration cost. This is the ratio of earning before tax & operating profit.

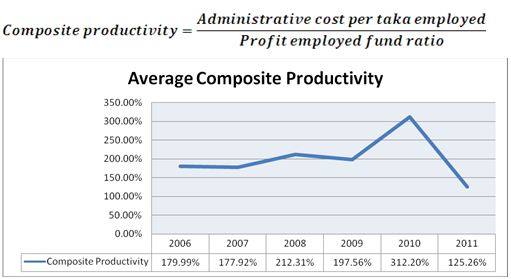

6.4.5 Composite Productivity

Composite productivity is the ratio of administrative cost per taka employed and profit employed fund ratio.

6.5 Earnings Flow

The capability of a company to earn & ensuring continuous flow of earning is matter of judgment in this ratio part. The earning flow of the companies has been analyzed by the following two ratios:

Interest Coverage Ratio

Debt to Equity Ratio

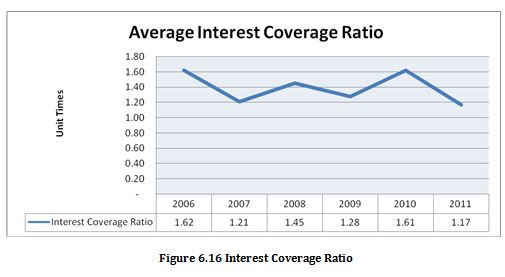

6.5.1 Interest Coverage Ratio

The interest coverage ratio is a measure of the number of times a company could make the interest payments on its debt with its earnings before interest and taxes, also known as EBIT. The lower the interest coverage ratio, the higher is the company’s debt burden and the greater is the possibility of bankruptcy or default.

For stockholders, the interest coverage ratio is important because it gives a clear picture of the short-term financial health of a business.

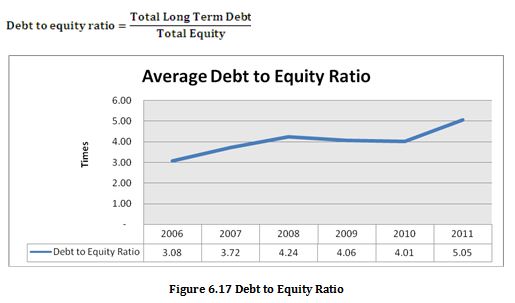

6.5.2 Debt to Equity Ratio

The amount of long term debt on a company’s balance sheet is crucial. It refers to money the company owes that it doesn’t expect to pay off in the next year. Long term debt consists of things such as mortgages on corporate buildings and / or land, as well as business loans.

A great sign of prosperity is when a balance sheet shows the amount of long term debt has been decreasing for one or more years. When debt shrinks and cash increases, the balance sheet is said to be “improving”. When it’s the other way around, it is said to be “deteriorating”. Companies with too much long term debt will find themselves overwhelmed with interest payments, a risk of having too little working capital, and ultimately, bankruptcy. This debt to equity ratio can tell if a business has borrowed too much money.

The proportion of capital derived from debt securities compared to equity capital that is Debt to equity ratio. The debt-equity ratio is:

So, from the stated Debt to equity ratio it is clear that the companies in this industry are taking more & more debt. And the debt in proportion to equity is going higher and higher.

Performance Analysis: Growth

7.1 Growth analysis

In this portion of analysis growth in interest income and some other balance sheet items has been calculated. For this, firstly the growth of different items from year to year has been calculated. And then weighting different years growth the average growth for different items have been found. In the weighted average method I have put more weight in recent year growth and gradually have reduced the percentage of weights for the previous years. The growth has been calculated for the following items:

Interest Income

Investment

Total Asset

Current Asset

Fixed Assets

Equity & Liabilities

Total Equity

Total Liability

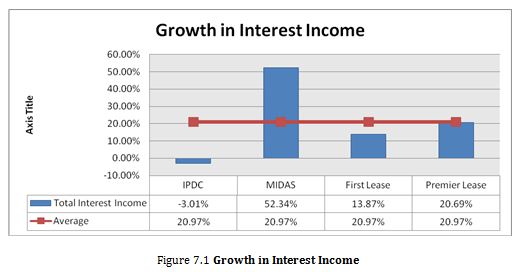

7.2 Growth in Interest income

The interest income in financial institutions has been grown at an average 21% per year. Among this IPDC’s income earning situation is not satisfactory as its earning is consequently decreasing resulting in a negative growth rate.

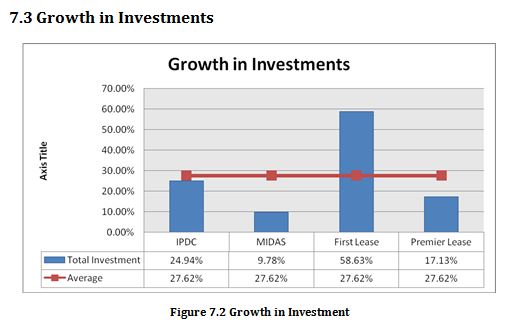

In investments the companies are experiencing remarkable growth rate. Among the companies, first lease finance & investments leading in terms of growth rate.

7.4 Growth in Asset

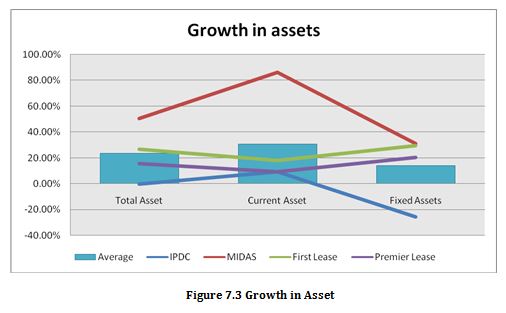

In recent years financial institutions are experiencing high growth in fixed asset investment. The recent data about the changes in asset shows enough evidence about this.

Table 7.1 Growth in Asset

IPDC | MIDAS | First Lease | Premier Lease | Average | |

| Total Asset | -0.06% | 50.57% | 26.78% | 15.86% | 23.29% |

| Current Asset | 9.26% | 86.09% | 17.95% | 9.36% | 30.66% |

| Fixed Assets | -25.56% | 30.96% | 29.43% | 20.45% | 13.82% |

7.5 Growth in Liabilities

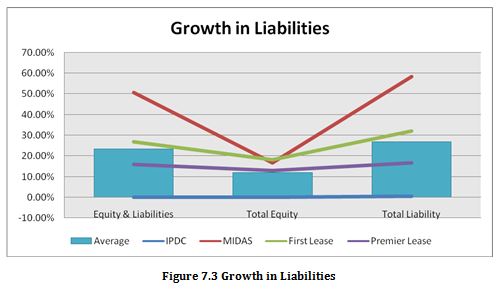

The financing cost for the financial institutions is higher than that of banks. But as the both group of industries are competing with some similar type of products and banks are getting cheaper source of funds, the competing ability for the financial institutions is weakened. So, in order to survive the companies need to introduce newer and cheaper sources of fund. The FIs in our country are mainly liability based and the portion of equity for most of the firms is negligible in compare to liability. This is also reflected in the growth statistics for the liabilities.

Table 7.1 Growth in Asset

IPDC | MIDAS | First Lease | Premier Lease | Average | |

| Equity & Liabilities | -0.06% | 50.57% | 26.78% | 15.86% | 23.29% |

| Total Equity | 0.07% | 16.60% | 18.27% | 12.94% | 11.97% |

| Total Liability | 0.47% | 58.33% | 31.95% | 16.70% | 26.86% |

Performance Analysis: Investment Perspective

8.1 Performance in the view point of Investments

It is often said that actual performance of a company is reflected in the stock market. So, performance can also be measured by its movement of share price or return from the share price.

For identifying return the following steps are used.

Collection of data

Price Adjustments

* Cash dividend adjustment

* Stock dividend adjustment

* Right share adjustment

* Split Adjustments

Preparation of Return Series

8.2 Collection of data

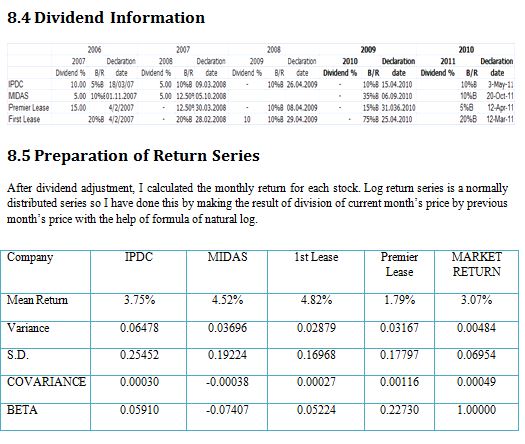

Here I have used the month ended closing share price from 2006 to 2011 for the four assigned companies- IPDC Bangladesh Limited, MIDAS Financing Limited, First Lease Finance & Investment Limited & Premier Leasing & Financing Limited.

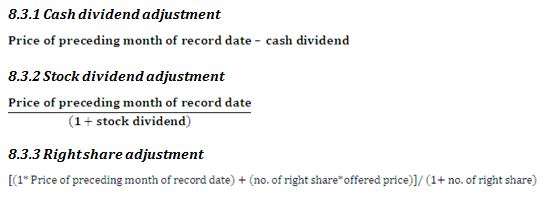

8.3 Price Adjustments

In price adjustment process, I’ve collected all dividend information related to these companies and adjusted the share price to find out the actual share price. The split of shares has also been adjusted.

From the investment view point the position of the financial institutions are good. All the companies except Premier Lease are outperforming market. Though, the market is not performing well too. In terms of variance, standard deviation or other risk measurement tools- the price & thereby the return of these companies fluctuates too much. So, the variance, standard deviation is very high.

Regression & Correlation analysis

9.1 Analyzing Data set

Here to understand and analyze the performance & growth of our financial industries I’ve done regression & Correlation analysis using the data of the four assigned companies- IPDC Bangladesh Limited, MIDAS Financing Limited, and First Lease Finance & Investment Limited & Premier Leasing & Financing Limited. Before regression & Correlation analysis it is important to understand the key numerical factors for these companies.

9.1.2 Key variables

Identifying the key variables for growth or understanding the key growth factor is very important. These are some key factor.

Cost of Fund

Interest income

Term Deposit

Investment

Total Asset

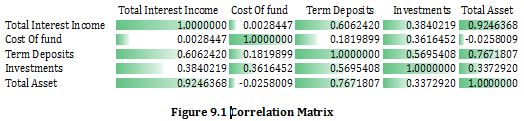

9.2 Correlation analysis

To understand the variables correlation analysis has been done using excel. A correlation matrix has been formed using excel data analysis tool bar.

From the result it is clear that interest income is the best controlling variable among these. There are significant correlation between interest income and term deposit & interest income and assets. Among these variables only cost of capital and asset are showing negative correlation.

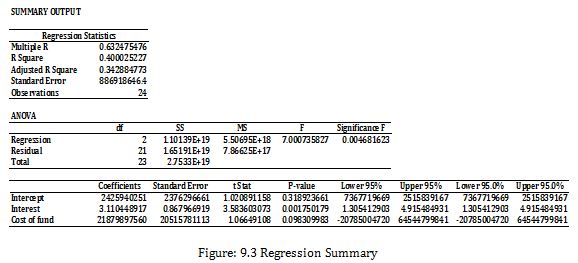

9.3 Regression analysis

Regression analysis is a statistical tool for the investigation of relationships between variables. Usually, the investigator seeks to ascertain the causal effect of one variable upon another—the effect of a price increase upon demand, for example, or the effect of changes in the money supply upon the inflation rate. To explore such issues, the investigator assembles data on the underlying variables of interest and employs regression to estimate the quantitative effect of the causal variables upon the variable that they influence. The investigator also typically assesses the “statistical significance” of the estimated relationships, that is, the degree of confidence that the true relationship is close to the estimated relationship.

9.3.1 Multiple regressions

The concepts and principles developed in dealing with simple linear regression (i.e. one explanatory variable) may be extended to deal with several explanatory variables. “Multiple regressions” is a technique that allows additional factors to enter the analysis separately so that the effect of each can be estimated. It is valuable for quantifying the impact of various simultaneous influences upon a single dependent variable. Further, because of omitted variables bias with simple regression, multiple regressions are often essential even when the investigator is only interested in the effects of one of the independent variables.

9.3.2 Independent & dependent variable

Here for the regression analysis I have used Cost of capital & Interest income as independent variable. And the other variables are assumed to be dependent on these variables. Firstly, Total asset has been taken as a dependent variable and running regression analysis using Excel I’ve found the following result-

Here the number of observations are 24, model degree of freedom 2, R-squared r2 = .4, adjusted R-squared 0.3429 & F statistics (F) = 7.

There is a moderate positive correlation among the variables. The independent variables as a whole can explain only 40% variations of the dependent variables. The constant is 2,425,940,251. This indicates that if all the independent variables are unchanged for the next time period then the dependent variable (Term Deposit) will be 2,425,940,251Tk. The other coefficients indicate that an increase of 1 Tk. of Interest earning will increase the term deposit by 3.11 Tk. & 1% increase in cost of fund will increase the term deposit by 21,879,897,560 Here all P values are more than .05 except interest income. So cost of fund is not as significant to control the dependent variables.

So the regression equation will be:

Term Deposit = 2,425,940,251+3.11 (Interest Income) + 21,879,897,560 (Cost Of fund)

Conclusion

10.1 Challenging Issues for Financial Institutions

10.1.1 Banks’ Entry in Non-Bank Financial Activity

With the dawn of new financial institutions, the market share is being extended over the competing firms and the demand facing each firm is becoming more elastic. Active participation of commercial banks in the non-bank financing activities has further increased the level of competition in the industry.

Commercial banks worldwide are directly or indirectly involved in activities such as leasing, hire purchase, term lending, house financing and capital market operation. In developed countries commercial banks are also actively involved in different activities other than banking. In Bangladesh, commercial banks started their non-bank financial activities especially leasing operation effectively in 1995. At present, almost all major private commercial banks are involved in non-bank financial operations.

Operation by banks in what have been traditional non-banking areas is often questioned by financial institutions although both can act as complementary to each other rather than being competitors. Bangladesh Lease and Finance Companies Association (BLFCA) alleged that commercial banks of the country are engaged in non-bank finance activities within the existing banking rules, which is posing difficulties for non-bank financial institutions. This is because by having access to cheaper rate funds, banks have a comparative advantage over financial institutions that does not ensure proper competition for both. Again, it is argued that if banks continue in the leasing business then the default culture of the banking system may also infect the leasing industry

10.1.2 Sources of Funds

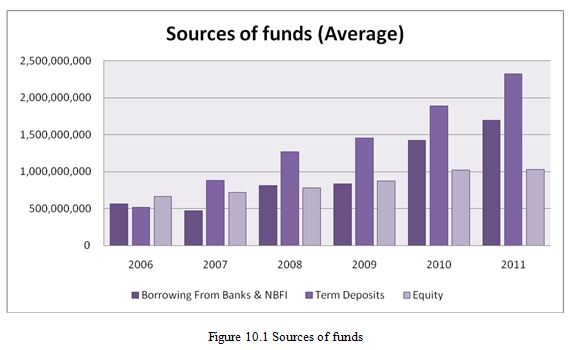

Financial Institutions collect funds from a wide range of sources including financial instruments, loans from banks, financial institutions, insurance companies and international agencies as well as deposits from institutions and the public. Line of credit from banks constitutes the major portion of total funds for financial institutions. Deposit (Term Deposit) from public is another important source of fund for financial institutions, which has been increasing over the years. Financial institutions are allowed to take deposits directly from the public as well as institutions. According to the central bank regulation, financial institutions has the restriction to collect public deposits for less than one year, which creates uneven competition with banks as banks are also exploring the business opportunities created by financial institutions with their lower cost of fund. Although recent reduction of the minimum tenure of the term deposit from one year to six months for institutional investor has had a positive impact on their deposit mobilization capacity. Financial institutions can develop attractive term deposit products of different maturities to have access to public deposits as these are one significant source of their funds.

Although share capital is another prospective source of fund for financial institutions, many companies have not utilized this opportunity fully. As all financial institutions are incorporated as public limited companies, it could be a better alternative for them to raise fund through initial public offerings in order to finance the expanding horizon of activities. It is clear that loan from bank and deposit base are the key sources for financial institutions’ fund and account for nearly 65 percent of the total. It can also be seen that the dominance of bank loan in the total fund is decreasing while the importance deposit base is gaining momentum.

According to a directive of the central bank issued in April ’05 (FID Circular No. 3, April 30, 2005), financial institutions have to raise capital and reserve of at least BDT 250 million, a portion of which must be collected through the issuance of IPO. This arrangement will make their operations more transparent, bring accountability to the shareholders and reduce dependence on credit lines. Though all financial institutions were required to raise their minimum capital requirement thorough IPOs by September 2006 (extended from June 2006), ten (10) companies are yet to float their shares in the market. Among the Thirty one financial institutions Twenty one Financial Institutions are listed in the stock exchange. Four of these have already submitted necessary documents to Securities and Exchange Commission (SEC) for review while four others are still in the process of doing so.

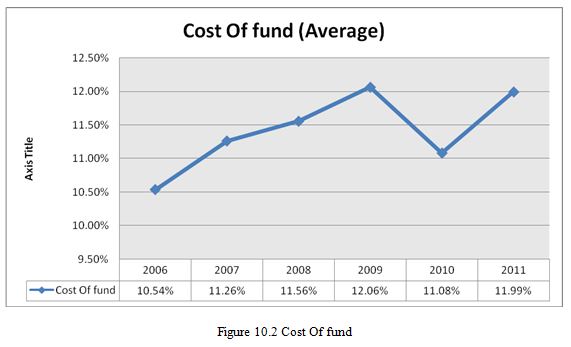

Cost of Fund

The structure of cost of fund for financial institutions does not follow any unique trend. But the studies shows that weighted average cost of fund for the financial institutions is always positioned much higher than that of banks. Generally cost of funds for the financial institutions varied between 10.50 to 12 percent (according to Bangladesh Bank Report it is much higher varying from 8.54% to 15.4%) while that of banks was between 8.5 to 9.5 percent. About 15 percent of the deposit of the banking sector was reported to be demand deposits, which are interest free while 35 percent constituted low cost saving deposits having an average of 4 to 5 percent interest rate and the rest were fixed deposits bearing an average of 9 percent. Thus the weighted average cost of fund for banks would be at best 7 to 8 percent, which is almost half of that of our financial institutions.

As stated earlier, the principal sources of fund for financial institutions are loan from banks and deposits from institutions and individuals. But financial institutions face comparative disadvantage in collecting funds compared to the banks because financial institutions cannot collect short term (less than one year) deposits from individuals due to the central bank’s restriction, and again deposits in financial institutions are perceived to be less safe to the public. As a result financial institutions have to offer higher rates on deposits, which are sometimes as expensive as bank borrowing. Again, excessive dependence on bank loan and deposit has had an adverse impact on the overall industry. Due to the liquidity crisis, when interest rate goes up, the average rate of interest on bank credit lines and deposit rate also increases, which causes significant rise in the cost of fund for financial institutions. The high cost of fund for financial institutions compels them to operate on a relatively low profit margin.

Product Diversification

Financial institutions emerged primarily to fill in the gaps in the supply of financial services which were not generally provided by the banking sector, and also to complement the banking sector in meeting the financing requirements of the evolving economy. Financial institutions are permitted to undertake a wide array of activities and should therefore not confine themselves to a limited number of products only. Leasing, no doubt, presents a good alternative form of term financing. Even in leasing, investments were not always made in the real sector and non-conventional manufacturing sector. Almost all the leasing companies concentrated on equipment leases to BMRE (balancing, modernization, replacement and expansion) units only. New industrial units were hardly brought under the purview of leasing facilities. This implies that the new customer base has not been created and the growth of industrial entrepreneurship could not be facilitated through financial institution financing packages. Diversifying the product range is a strategic challenge for financial institutions in order to become competitive in the rapidly growing market.

Asset-Liability Mismatch

Asset-liability mismatch is another cause of concern for financial institutions. Demand for funds to meet the increasing lending requirements has increased many times. But the availability of funds has become inadequate as financial institutions are mostly dependent on loan from commercial banks. International Finance Corporation (1996) observed that leasing companies are in a great dilemma while managing the mismatch between their asset and liability. According to IFC, the average weighted life of the company’s business portfolio should be less than the average weighted life of its deposits and borrowing in its operating guidelines for a leasing company. Only one company in Bangladesh was successful in maintaining the above guideline. Therefore, financial institutions have to explore alternative ways for raising funds.

Investment in High Risk Portfolio

It is already mentioned that cost of funds for financial institutions are higher than that of banks. In order to sustain the high cost of borrowing, financial institutions may be inclined to invest in the high return segments, which can expose them to commensurately higher risks. Moreover, fierce competition among competitors may also force many financial institutions to reduce the margin at the expense of quality of the asset portfolio. This strategy may eventually create the possibility of an increase in the non-performing accounts. Unless adequate risk management capabilities are developed, the growth prospects of financial institutions would not only be hindered but it might also be misapprehended.

Weak Legal System

Although the default culture has not yet infected financial institutions to any major extent, they face difficulties in recovering the leased assets in case of a default. Moreover delays in court procedures create another cause of concern. The situation cannot be improved only by making the legal system stronger through enactment of new laws rather ensuring proper implementation existing ones is more of concern

Lack of an established Secondary Market

Even in cases when the defaulted asset is recovered, the disposal of the same becomes difficult because of lack of an established secondary market. For the promotion of a secondary market, financial institutions may consider initiating the concept of operating lease instead of the prevalent mode of finance lease in case of these recovered assets to create a demand for second hand or used machinery and equipment.

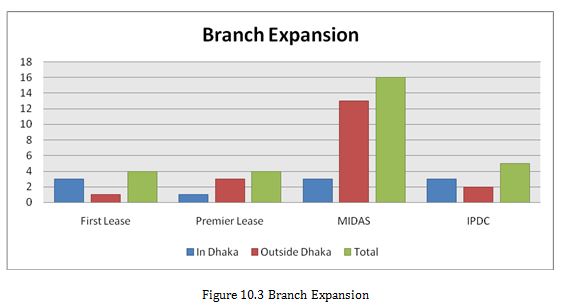

Branch Expansion

The financial institutions in our country are competing in a very congested market. Most of the FIs are big city especially Dhaka concentrated. They have very few branches outside divisional cities. The urban and rural areas are quite outside the range of financial institutions.

Suggested Alternatives

So, as from the present issues the overall market situation for the financial institutions seems to be a bit critical. Not only these institutions are competing in a very highly competitive industry but also they have to compete with the banking sector to survive. So, altogether the earning capability as well as the earning possibilities for these companies is decreasing. In order to get out of the situation some strict steps must be taken.

Finding new sources of fund

The finance and leasing companies across the world are using different sources for collecting funds. NBFIs in Bangladesh may also explore the possibilities of gaining access to new sources of funds like issuance of commercial paper and discounting or sale of lease receivables. Another innovative and promising source of funds may be the securitization of assets. Securitization is the process whereby the ownership of a large number of receivables (Leases/Loans) is transferred to a securitization company to form a pool of such receivables and a trustee to manage the issue of bonds against the receivables. The bonds will be purchased by investors and traded in the secondary market but initially banks, insurance companies and other financial institutions may purchase the instruments. Ultimately the lessee/borrower will pay their dues to the Securitization Company which will in turn make payment to the investors. In this connection, IPDC launched first asset backed securities in 2004 as an alternative source of funding. This new instrument emerged as an important tool and added a new dimension in the financial market. The core attraction of this scheme was the tax benefit made available to investors at the rate of 10 percent at the time of credit of such interest or at the time of payment thereof, whichever is earlier, and this deduction was deemed to be final discharge of tax liability. But changes in taxation policy in 2005 by the government have made the future of this instrument less attractive for the concerned financial institutions.

Product diversification

Some of NBFIs are primarily engaged in leasing, some are also diversifying into other lines of business like merchant banking, equity financing etc. Currently, 22 NBFIs (out of 31) specialize in lease financing. NBFIs are permitted to undertake a wide array of activities and therefore should not confine themselves to one or two types of product only. Leasing, no doubt, presents a good alternative form of term financing but NBFIs should also venture into diversified use of their funds such as merchant banking, venture capital financing, factoring, etc. for a healthy growth of the capital market.

Developing ethical and technical norms

NBFIs in Bangladesh are operating in a highly competitive environment. The competition for NBFIs is even more challenging as they have to compete with banks. Though banks and NBFIs compete with each other they can also perform complementary functions. As complementary institutions both banks and NBFIs should follow some ethical and technical norms.

Market segmentation

Besides, there must be exact law for these companies. The arena of work for these companies must be well distinguished. Banks wishing to enter in the leasing business, which is essentially a core operation of NBFIs, should do so through opening subsidiaries (Like Prime bank & Prime Finance) so that a level playing field for NBFIs can be maintained.

Reducing cost of fund

As from the earlier discussion, banks have access to lower cost funds compared to NBFIs, which puts the former in an advantageous position. Alternatively, banks can go for joint financing under syndication arrangements with leasing companies on any project proposal. Again, banks can concentrate on working capital finance and foreign exchange operations, which matches more with their asset-liability management. Long term investment like financing capital machineries can be done by NBFIs and in the event when banks want to engage in such activities they can place their funds with an NBFI to extend lease facility for those machineries. This will be beneficiary for two reasons

In case of lease facility, the machineries will remain under the ownership of leasing companies, who will have absolute authority and control on their assets.

Machineries will be imported in the name of a leasing company and letter of credit will be opened against its name. So, over invoicing or under invoicing may be averted and thereby more transparency will be ensured and tax evasion may be plugged.

Increasing capital market activity

NBFIs around the world carry out a significant role in the development of the capital market. Strong institutional support is necessary for a lively capital market which is the core of economic development in any market based economic system. NBFIs through their merchant banking wing can act in this regard. A total of 31 companies are now listed as merchant banks in Bangladesh, of which 23 are full-fledged, 6 are issue managers, and only one is a portfolio manager. Only nine NBFIs have registered with SEC for performing merchant banking activities. But their activities in the capital market are rather limited (Financial Sector Review, Bangladesh Bank, 2009). Active involvement of merchant banks is essential to accelerate the capital market activities which can expedite the economic growth of the country. The success of merchant banking operations is largely linked to the development of the security market. So NBFIs should focus more on their opportunities in the capital market.

Market Expansion

Our financial institutions are competing within the group as well as across the group in a very small market. Most of the companies are Dhaka concentrated having some branches in some divisional cities like Chittagong, Sylhet etc. Whereas the banks have spread its branches throughout the country NBFIs are dealing with some negligible number of branches. So, in order to survive financial institutions should spread its wings further and develop customized product to serve the urban and rural people.

Conclusion

Banks and Non-Bank Financial Institutions are both fundamental elements of a sound and steady financial system. Banks usually control the financial system in most countries because businesses, households and the public sector all rely on the banking system for a wide range of financial products to meet their financial needs. However, by providing additional and alternative financial services, NBFIs have already gained considerable popularity both in developed and developing countries. In one hand these institutions help to smooth the progress of long-term investment and financing, which is often a face up to to the banking sector and on the other hand the growth of NBFIs widens the range of products presented for individuals and institutions with resources to invest. Through their operation NBFIs can assemble long-term funds necessary for the development of equity and corporate debt markets, leasing, factoring and venture capital. Another important role which NBFIs play in an economy is to act as a buffer, especially in the moments of economic distress. An efficient NBFI sector also acts as a systemic risk remover and contributes to the overall goal of financial stability in the economy.

NBFIs of Bangladesh have already passed more than three decades of operation. The journey started in 1981 holding the hand of Industrial Promotion & Development Company of Bangladesh Limited (IPDC). And now in 2012 the number of companies goes up to thirty one. In spite of quite a few constraints, the industry has performed remarkably well and their role in the economy should be duly acknowledged. It is important to term NBFIs as a catalyst for economic growth and to provide necessary support for their development. A long term approach by all concerned for the development of NBFIs is necessary. Given appropriate support, NBFIs will be able to play a more significant role in the economic development of the country.

![Report on One Bank LTD [Part-3]](https://assignmentpoint.com/wp-content/uploads/2013/03/one-bank1-200x58.jpg)