Introduction:

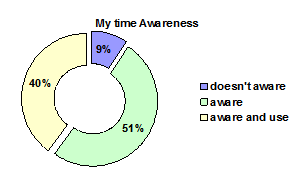

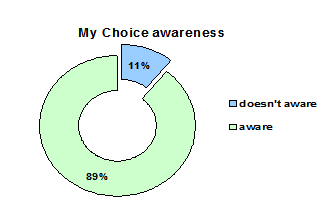

GrameenPhone subscribers, hence obviously GP has to increase awareness of subscribers. Increased service awareness status will raise the service value of GP, increase subscribers usages rate result increase revenue for GP. If continuous development of new product and service can not simultaneously aware subscribers then it will neither worth much to subscribers nor add value to the company. Hence, it is clearly observed there is GAP between services provided and services awareness.

Origin of the Report:

Thesis Program of Stamford University is a requirement for the MBA students. This report is a partial requirement of the Thesis program. This report is prepared for Tanvir Ahmed Minar faculty, School of Business, after having the authorization of doing report on the mentioned topic. I have completed my thesis over the marketing division of GrameenPhone Ltd. I have visited several times the office of the GrameenPhone Ltd. And Collected information from different GPC (Grameen Phone Center) in Bangladesh.

Background of the Report:

GrameenPhone launched its mobile phone service on March 26, 1997 and since then has become the largest mobile phone operator in the country. Its number of subscribers has grown rapidly, as has its coverage throughout the country. The company is continuously improving and offering new services to add value. Along with GSM features GrameenPhone is offering Value Added Services (VAS), Special services, Push Pull services, after sales services and information services.

On top of providing top quality service, GrameenPhone has also proved to be very innovative in its Value Added Service (VAS). In this paper GrameenPhone is proposes to give its subscribers an upgraded telecommunication system, which may increase productivity with integration with existing phone system that adds to the benefit of mobility.

Accordingly, GrameenPhone is contemplating a research that would give feedback form the subscribers and generate new ideas about future products and services. This will give GrameenPhone an idea about the expectations of the subscribers and hence provide assistance to design its product in future.

Problem Statement:

To continue the leading position in the telecommunication market GP has to provide different sort of services in accordance with the customers need. At the same time GP has build awareness and adoption (habituated) of services among this telecommunication market based subscribers’ life. GP has to serve services in a completive time, to endeavor excellence in business and to sustain existing customers.

GP in its initial business stage mainly focused on the voice based services, now GP is mainly focusing to provide and encourage subscribers to increase usages of non-voice services like SMS, cell e-mail, Chat, ring tone & logo down load, push pull services.

GP is already providing various types services for its subscribers but to some extend it is unsuccessful to build service awareness among its subscribers, and if subscribers are aware about a service then they are hardly adopting and using it. Under the above circumstances, the problem statement would be— “GrameenPhone wants to know its subscribers’ awareness level, adoption enthusiasm of different sort of services, effective medias and via to make subscribers aware and promote its services and based on their feedbacks about currents services, intends to provide new and customized services, thus become subscribers’ service awareness status, awareness building possible ways”.

Objective:

The objectives of this report are:

1 To determine the GrameenPhone subscribers services awareness status and services usages.

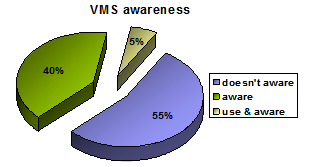

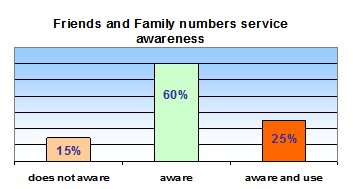

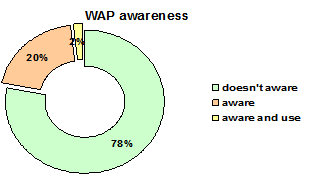

2 To recognize the popularity of the VAS and determine the frequency of its usage.

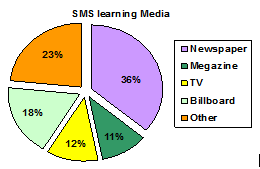

3 To identify the efficient and effective Medias to build services awareness among GrameenPhone’s subscribers.

Scope of the Study:

This report renders a close analytical look at the subscribers’ service awareness and usages with a closer to view subscribers’ expected Medias to learn GP services. At the same time this report will help to gather knowledge about the services provided by GrameenPhone.

The type of business research used in this report is of descriptive nature. Through this descriptive research, the report sought to determine the answers to why, what, where and how questions of the existing GP subscribers and their expectations. Primary data was collected through telephone survey for analysis and secondary data was be used as a support tool.

Data Collection and Sources of Data:

Primary data for this report has been collected through telephone questionnaire. Here the total number of GrameenPhone subscribers is considered the population of the research and out of these total subscribers randomly picked 55 subscribers will be the sample. For this purpose a questionnaire was developed encompassing the objectives of the reports and the sample. Printed reports available at CMD, annual reports, leaflets, brochures and the official web site were the sources of secondary data.

Sample Size Determination:

To determine the sample size I planned to use the rule for – Sample Size Determination by Proportion. Here, I am interested in estimating the proportion of GrameenPhone subscribers who has service awareness for its products and services.

Formula for sample size determination: П (1- П) z2

D2

Here,

n = Sample Size =?

П = proportion of GrameenPhone subscribers who has service awareness for its products and services = 64% = .64

D = Allowable specified level of interval = ±0.10

Z = Specified Level of confidence is 90%. So, allowable interval is ±0.10. From the z table we find z = 2.33

Thus after the whole calculation based on the stated assumption, I found the value of n is 54.63 ≈ 55 (The closest integer).

Data Processing and Analysis:

Collected information was compiled and processed with the aid of some statistical package tool like- MS Excel, Minitab & SPSS. Detailed explanation, analysis and future projections and were also incorporated in the report.

Limitations:

The major limitation factor for this report is complexity of the topic. Since the survey will be conducted in telephone questionnaire, it is a grate challenge to ensure the actual validity of the response. In some cases, the topics were not understood by general GP subscribers who have minimal idea about the VAS. Yet the nature of the topic required the questionnaire to be designed in such a way that it extracts information as much as possible indented. On the other hand, most of the relevant literature and study materials on the web site were not up to date. Some information will be withheld to retain confidentiality of the company. Last but not the least; it is never possible to obtain 100% accurate data since the survey will be done on a set of sample, not the entire population.

The Company:

GrameenPhone Limited, the number one and leading mobile phone company in the area of telecommunications in Bangladesh. Of four mobile operators, GP managed to grab 62% of the market share only by providing cost-effective & best service available in the market of mobile telecommunication. GP has made its expansion not only in the urban areas, but also it stretched its network in the rural areas for the economic empowerment of the rural people. GrameenPhone has made a special arrangement with Grameen Telecom, an affiliate of Grameen Bank in providing the cellular services in the rural country

GP believes Excellency in its service towards its subscribers. It is growing and at the same time being competitive. To keep up this upward trend and leading position absolute dedication to understanding and fulfilling their customer needs with the appropriate mix of standard service, reliability, improved technology and skilled as well as dedicated manpower is necessary.

Historical Background:

GrameenPhone was offered a cellular license in Bangladesh by the Ministry of Posts and Telecommunications in November 28, 1996.It launched its service on the Independence Day of Bangladesh March 26, 1997.GrameenPhone has a dual purpose: to receive an economic return on its investments and to contribute to the economic development of Bangladesh where telecommunications can play a critical role. GrameenPhone has attained the Three million-subscriber milestones.

The Vision, the Mission and the Objective

Company Vision

“We are here to help”

Company Mission:

The vision will be achieved by

Connecting Bangladesh with ease and care

Being user-friendly

Providing value for money

Providing simple and timely connections

Having a right and understandable process

Objectives of the GrameenPhone:

GrameenPhone’s basic strategy is the coverage of both urban and rural areas. The Company has devised its strategies so that it earns healthy returns for its shareholders and at the same time, contributes to genuine development of the country. In short, it pursues a dual strategy of good business and good development.

Serving the mass market is one of GP’s primary goals. By serving the general public as opposed to niche markets, the Company plans to achieve economies of scale and healthy profits. At the same time, service to the general public means connectivity to a wider population and general economic development of the country. In contrast to the “island” strategy followed by some companies, which involves connecting isolated islands of urban coverage through transmission links, GrameenPhone builds continuous coverage, cell after cell. While the intensity of coverage may vary from area to area depending on market conditions, the basic strategy of cell-to-cell coverage is applied throughout GrameenPhone’s network. In addition, GP has positioned itself to capitalize on the declining prices of handsets, making its goal to serve the general public realistic.

The Purpose:

GrameenPhone has a dual purpose to receive an economic return on its investments and to contribute to the economic development of Bangladesh where telecommunications can play a critical role. This is why GrameenPhone, in collaboration with Grameen Bank and Grameen Telecom, is aiming to place one phone in each village to contribute significantly to the economic benefit of the poor.

The Strategies

GrameenPhone’s strategy is coverage of both urban and rural areas. In contract to the “island” strategy followed by some companies, which involves connecting isolated islands of urban coverage through transmission links, GrameenPhone builds continuous coverage, cell after cell. While the intensity of coverage may vary from area to area depending on market conditions, the basic strategy of cell-to-cell coverage is applied throughout GrameenPhone’s network.

The People:

The people who are making it happen- the employees are young, dedicated and energetic. All of them are well educated at home or abroad, with both sexes (gender) and minority groups in Bangladesh being well represented. They know win their in hearts that GrameenPhone is more than phones. This sense of purpose gives them the dedication and the drive, production-in about five years- the biggest coverage and subscriber-base in the country. GrameenPhone knows that the talents and energy of its employees are critical to its operation and treats them accordingly.

The Technology:

GrameenPhone’s Global System for Mobile or GSM technology is the most widely accepted digital system in the world, currently used by over 750 million people in 150 countries. GSM brings the most advanced development in cellular technology at a reasonable cost by spurring severe competition among manufactures and driving down the cost of equipment. Thus consumers get the best for the least.

Company Service:

GrameenPhone believes in service, a service that leads to good business and good development. Telephony helps people work together, raising their productivity. This gain in productivity is development, which in turn enables them to afford a telephone service, generating a good business. Thus development and business go together.

Shareholders of GrameenPhone:

Telenor AS: is the state-owned Telecommunications Company in Norway, a country with one of the highest mobile phone densities in the world. It holds 62% share in GrameenPhone. Telenor has played a pioneering role in development of cellular communications, particularly, but not exclusively, GSM technology. In addition to Norway and Bangladesh, Telenor owns GSM companies in Portugal, Denmark, Greece, Austria, Hungary, Russia, Ukraine, and Montenegro, Thailand and in Malaysia and recently in Pakistan.

Telenor is using the expertise it has gained in its home and international markets and putting it to use in an emerging market such as Bangladesh. Telenor has many alliances in other countries, bringing experience and competence, both technological and business, to ventures such as GrameenPhone. Telenor has opened a regional Asia office in Singapore, an expansion that emphasizes its ‘No Barriers motto.

Grameen Telecom: Grameen Telecom is a not-for-profit organization and a sister concern of Grameen Bank, the internationally recognized bank for the poor with an expansive rural network and extensive understanding of the economic needs of the rural population. Grameen Telecom has 38% share in GrameenPhone. Grameen Telecom, with the help of Grameen Bank, administers the Village Phone services to the villagers and trains the operators as well as handles all service-related issues. Grameen Bank covers 40,486 villages, or 60 percent of rural Bangladesh through its 1175 bank branches. Grameen Telecom’s objectives are to provide easy access to telephones in rural Bangladesh, introduce a new income-generating source for villagers, bring the Information Revolution to villages and prove that telecommunications can serve as a weapon against poverty. More than 95,000 village phone is delivered to poor women to meet their financial need.

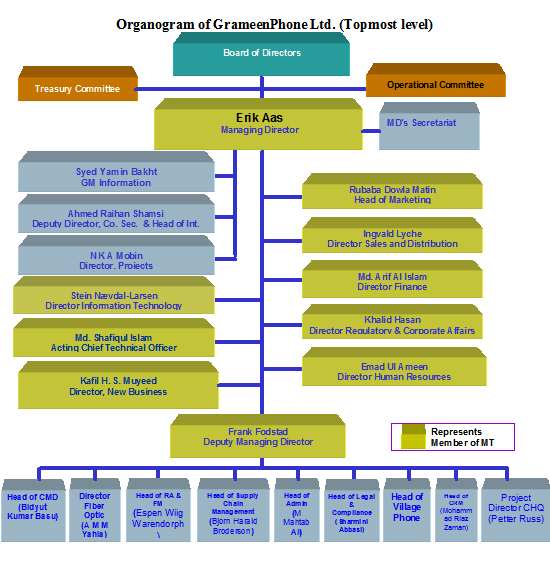

Organizational Structure:

GP has in total 1131 employees. Major divisions of GP are: Customer Relations, Sales & Marketing, Technical, Finance, and Personnel & Organization. The Managing Director (MD) also heads a separate department. We would like to focus on each of these divisions to understand their work pattern and basic functions.

Organization Structure of GrameenPhone Ltd:

GrameenPhone is divided into several departments namely technical, sales & marketing, customer relations, administration, human resource, finance and IT.

The top level management structure of GrameenPhone is shown below:

Organogram of GrameenPhone Ltd. (Topmost level)

Departments and Divisions:

Recently management has brought a change in the organizational structure in view of need of time. As of the recent change, line function of the company comprises of the 3 different tasks. These are:

- Build & Operate

- Sell

- Care

Accordingly 3 main divisions were identified as the line organization part of the company. These are:

- Technical Division

- Sales

- Marketing Division and

- Customer Relation Division.

Besides there are:

- Finance Division.

- Administrative Division

- Corporate Affairs

- Human Resource Division

- Information Technology

The divisions of GrameenPhone are discussed in detail in the next.

Marketing Division:

The marketing department has a wide span of management. It requires a high delegation of authority and allows for more discretion for subordinate managers in their own relevant fields. In the chart below the line responsibilities starting from Divisional head to departments are shown:

Marketing Department:

Marketing department’s activities are of two types: Market Research and Development and Market communication.

Market Research and Development:

MRD is responsible for communication with different departments about existing products. MRD gets feedback from Customer Care, Sales, and Market Communication departments regarding customer needs and market requirements. Feedback helps in redefining an existing product. Information flow is horizontal as well as vertical for the marketing department.

New ideas are developed after evaluation of market demands. MRD gives shape and form to vague ideas in the process of developing a new product. It then co-ordinates with Operation & Maintenance, Information System and Billing departments to get solutions and to check the functionality of Product features and prices.

Market Communication:

The main function here is to develop product and promote concept building for promotional activities. It includes advertisement in the leasing dailies in the most effective manner within a given budget, to arrange out-door advertisement, hoarding, promotions of gift items like dairy, calendar etc. It also analyses competitor’s activity. This department is also responsible for all kinds of publications of GP. It is the responsibility of the marketing department to design and publish the monthly newsletter of GP.

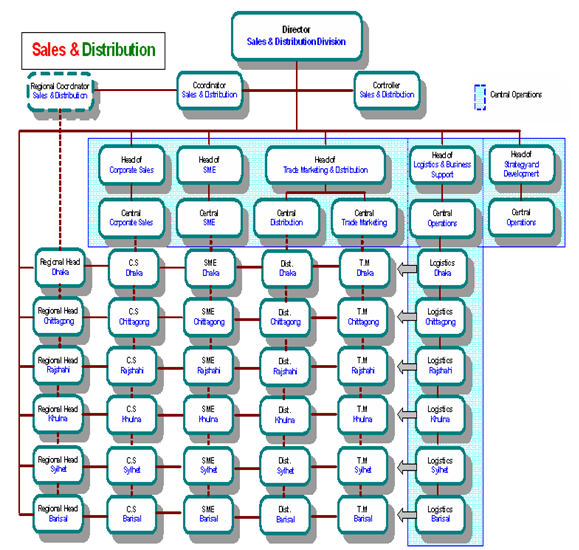

Sales & Distribution:

This department is involved in the selling procedure of GP. All sales to companies as well as individuals are part of this department. Distribution and Logistics department are main to department that carries out this task.

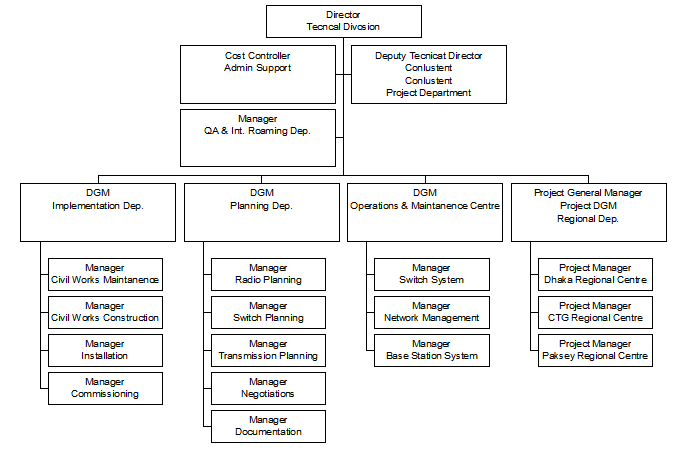

Technical Division:

The technical division is vital to a technical service oriented company like GrameenPhone Ltd. It is split into two parts:

- Roll -Out Division: responsible for building the network.

- Operations Divisions: responsible for operation and maintenance of the network.

The department has a rather narrow span of management for close supervision and fast communication between top and lower level management. This is important as decision making and implementation due to technical difficulties must be addressed as fast as possible. The organogram is shown in the next page.

Figure 1.3: Organogram of the Technical Division

The Roll-Out Division

The Roll-Out division has two sections, they are:

· Planning Section and

- Implementation section

Planning:

The planning section is mainly responsible for Base Station related planning. It also plans the data transmission equipment from Base Station to switch. In addition, it is in charge of timely supply of equipment, negotiating with homeowners for building Base Station on the roof and roaming agreement with other countries.

Implementation:

The implementation section is responsible for construction and maintenance and Base station room, installation of Base Station hardware and start-up and operation of Base Station.

Operations Divisions:

The major responsibilities of the operations division are:

Operation and maintenance of Switch (MSC), Base station, transmission equipment

Overall management of the network.

Fault detection of network

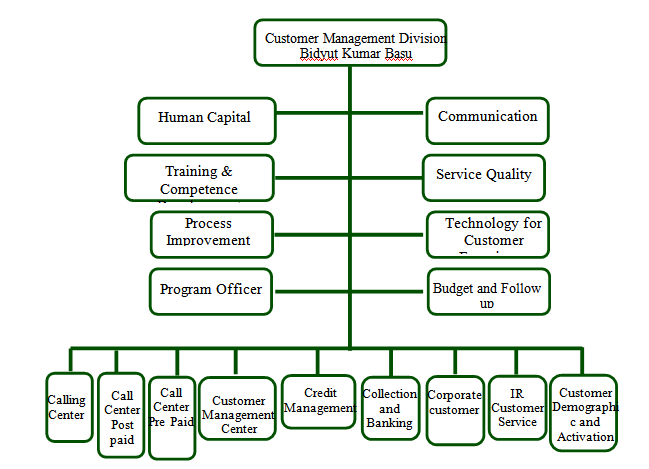

Customer Management Division:

Maintaining high quality service is one of the major requirements of large market service oriented companies like GrameenPhone. The organgram of Customer Management Division:

Figure 1.4: Organogram of Customer Management Division

Customer Care:

Customer care bridges customers and the company. It works with the objective to meet all kinds of queries from customer and provide optimum solutions. There are 135 personnel working under the supervision of one Additional General Manager and one Deputy General Manager.

Image Center:

Image center answers all Queries by providing 24-hour service for subscribers of GrameenPhone. Information about bill and barred lines are available here through verbal communication.

Information Center:

It provides on the spot solutions as subscribers can physically go there and get services. It deals with the following areas.

1. Bill Clarification

2. Preparation of manual bill

3. Bill correction

Customer Demographic and activation:

The first contact point of dealers/agents as they sell a subscription. The major task of Subscription service is to activate the newly sold subscription along with the collection, reconciliation, sorting, scanning and archiving the subscription and after sales documents. In addition, this unit provides “Instant services” by verifying the signature as well as other documents prompts after sales services to the subscribers. This unit also executes reconnection, product migration, SIM replacement and transfer of ownership.

Vision

To sustain a dynamic position providing premium support for customer satisfaction in a challenging environment.

Mission

Strategic

To deliver high quality accelerated services for both the internal and external customers meeting specific targets.

Operational

- To ensure finest quality of service in every phase.

- To carry out all the projects around the corner in time.

- To develop innovative and efficient techniques in the reporting, analyzing and checking activities.

- To evaluate and improve current performance result.

- To foster increased responsiveness.

- To create a learning environment by means of acquiring and transferring knowledge inside the constituent.

Human Resource Division:

Human Resource Division is one of the most important divisions in GrameenPhone. It mainly works for the employees, with the employees. This department is mainly responsible for building and shaping employees, their career and performance also. Organogram of GP HR is given below-

HR Operation:

HR operation is mainly dealing with the operational activities of Human Resource dept. It deals with employees’ salary, overtime, bank account, employees’ survey, and other employee relations activities. It also works for various operational activities like- employees’ dealing with various dept and cross functional events through out the GrameenPhone.

HR Recruitment & Selection:

This dept. is mainly working for selecting and recruiting employees for GP. It has structured recruitment policy and rules. Within this rules the dept. work for workforce collection. R&S also deals with employees promotion and transfer during the job period. They also search for talents in various universities and organization when it is needed.

Human Resources Development (HRD):

While employee performance must be evaluated in economic terms of efficiency and effectiveness, it can be best achieved through recognizing and enhancing the human dignity of each employee. The quality of the human resources can be effectively increased through education, training, and personal development.

Human Resources Development functions aim to increase the quality of the human resources especially through training. GP training involves the following steps-

- Assessing training needs

- Selection of the participants

- Conducting training programs.

GP provides both local and overseas training on the basis of the need analysis of the employee.

Health, Safety & Environment (HSE):

This dept. is mainly deals with employees’ health and safety. More specifically they work for environmental issues development with in the GP, canteen facility, health clinic, various vaccination and internal medical service etc. HSE also ensures insurance facility for the employees.

Expatriate Affairs & Travel:

This dept is dealing with employees’ travels and tours. GP has been arranging many travels and tours for its employees’ in many countries around the world. This dept is mainly to assist employees in this occasion.

Corporate Social Responsibility (CSR):

Activities of this dept. are self explanatory. This dept looks for various social responsibilities. This aligns with GP strategies and also social welfare. Thus this dept. is mainly the interface of GP in the society.

Finance Division:

The major task of the Finance department is budgeting which is an important part of controlling. Finance division consists of various departments like- Investment Control, Financial Control, Payroll and Tax, Financial policy and Strategy (FPS), Capital Market etc. Organogram for the division is given below

Finance Department:

The main role of this department is financial planning and control and budgeting and control. In addition it performs tasks such as methodology and development of the system, providing management information, analysis of financial statement for future action and co-ordination of information flow for inter-departmental and intradepartmental purposes.

Payroll, Tax and other departments:

This is a very sensitive and important segment in the finance department. This department is responsible for complying with the Companies Act and rules regulations of the Government. It also works as legal advisory of tax, VAT and other external affairs.

There is also an External Co-Ordination & Legal section which is responsible for the regulatory obligation and legal findings of the Company. They handle both internal and external legal affairs.

In addition there are the Accounts Department and the Cost and Budget Department. At present, the above departments are under supervision of the divisional director and manager of finance along with accounts officers for assistance.

Information Technology (IT) Department:

Daily activities of GrameenPhone like computer applications, PABX phone system, e-mails and other internet related issues are all managed by the Information System Department. Whenever users face any problems in the above-mentioned activities, this department provides instant help.

IS mainly works with Switch and Customer Care department. It maintains and manages the server oriented application software which is known as CABS 2000. Billing and Customer Care use CABS 2000 and in this way they are closely related with IS Department.

Information System Department includes the Information Department which is responsible for information flow both within and outside the organization.

In addition to the formal management structure GrameenPhone provides a close, well-knit informal structure. Employees enjoy a recreational center with modern facilities and occasions such as GP nights celebrating achievements or rewarding competent employees. They have a well organized Cafeteria, TV room and several other facilities for relaxation. Building a encouraging environment to work together as a family is extremely important to GrameenPhone.

Network & Network Coverage of GrameenPhone

GrameenPhone aims to build a full range of service all over the country. The company has targeted to build extensive network all over the country. For better coverage, GP has taken 1600 Km fiber optic cable network leased from Bangladesh Railway. In April 2004, GP had 750 base stations. Now till May’05, it has 1750 base stations. Furthermore, considering the subscribers’ need of quality network and extensive coverage, the company is planning to set up another thousand base stations in the following year. Recently GP has doubled its speech quality 900GSM MHz to 1800GSm MHz. Already the company has expanded its network to 61 districts out of 64 districts and 400 upazillas out of 460 upazillas. It’s the only company which covers the most of the land areas with its net work. Approximately 52% land area is covered by GrameenPhone’s network. In over all, GrameenPhone offers the most competitive network facility to its subscribers, and continue improving it. Existing coverage areas are divided into six zones according to the divisional boundary. These are-

| |

The zone in which a subscriber is registered with GrameenPhone is that subscriber’s Home Zone, and all other zones are Remote Zones.

Distribution Channel:

Distribution channel is the bridge between the company and the consumers. Distribution channel is very important for any company. If there is a gap in the distribution channel, the marketer is unable to reach its products/services to the customers in time.

GP decided to distribute its products through its own distribution channel. And the agents would sell the mobiles to the customers. As GP’s growth rate is very high, there are many interested people who want to become distributor of GrameenPhone. But GP has some strict policies that are maintained while giving permission to the new sales agents.

Moreover, GP has agreements with established distribution channels like Butterfly, Flora, and Rangs; who are also acting as GP’s distributors. Currently the number of distributors in the country is over 430.

At the beginning, GP started its sale through only 12 POS (Point of Sales) around the country. Then simultaneously its POS have been increasing with growing demand of mobile service. The total number of Points of Sales in the GP distribution network increased to 391 in December 2003 from 353 in December 2002. Recently, total Number Point of Sales is 1047 as of March’05. Meanwhile, till March’05, GP has 75 Scratch Card distributors with 14,500 retail outlets throughout the Country.

Industry Analysis

Background of the Industry:

In a highly populated country like Bangladesh, telecommunication can play a vital role to boost the economy and social level of people. The introduction of cellular phones has dramatically changed the lives of businesses and individuals.

As there is a growing trend of workers turning from farming to other occupations, the need for mobiles is increasing among the thousands of impoverished villages. The overall efficiency of other business has increased as an aftermath of the government’s decision of deregulating the telecommunications sector, which until the late 1980s had been a state monopoly.

Privatization of the telecommunications sector began in 1989, when Sheba and BRTA were awarded 25-year licenses to install and operate fixed-wire lines and wireless services in rural areas. The same year, Pacific Telecom Bangladesh got the government’s permission to launch the country’s first cellular phone and paging service sold under brand name CityCell in collaboration with a Hong Kong-based company. The company targeted only the higher class of the society. During that time price of mobile was above Tk 50,000/=. Naturally, the growth of the industry was too slow. CityCell had a virtual monopoly until 1996, when the government gave licenses to three more companies to operate cell phones in Bangladesh. So, the government decided to bring more companies in the market and break the monopoly.

After careful evaluation the government decided to provide three licenses to GrameenPhone, TM International (AkTel), and Sheba Telecom (Banglalink). Only CityCell is using Code Division Multiple Access (CDMA) technology, AkTel, GrameenPhone, Banglalink these three companies are using GSM (Global System for Mobile) technology. GSM is the most popular mobile telecommunication technology in the world. About 60% of the cell phone users of the world use GSM technology.

These three new companies entered the market, not only helped trim down over-dependence on BTTB’s fixed-line system, but also made mobile phones cheaper and easier to get. The price of a cell phone came down from $2,000 to as low as $100, depending on the features of the handset and SIM price is only Tk.200-300. BTTB’s mobile phone Teletalk has been launched.

A definite development has been observed in the Business Market with comparatively high expectations. Customer maturity and anticipation regarding technology has increased over time. Rumors regarding new entrants have groomed expectations in the market. Consequently, people are expecting cheaper handsets with lowered airtime.

Telecom Market Growth:

At the initial stage of the mobile telecom industry because of high startup cost and high tariff there was only a few numbers of subscribers. In 1997 there were approximately 23,000 mobile subscribers around the country with a low market penetration rate (.02%). At present, the number of mobile users in the country is approximately 5.87 million and among them GP’s subscribers are over 3.5 million. Right now, in mobile industry, Bangladesh has four private companies and newly Teletalk a sister concern of BTTB has entered in the market with a target to get 0.25 million subscribers by first 6 months of launch and 1 million by 2006. Teletalk has offered lower rate with PSTN connection all over the country. The total number of districts covered in mobile industry has been increased to 61 in 2004 from 1in 1997. The total telecom growth has increased to 55% in 2004 from 19% in 1998. Initially, mobile growth rate was too high which was 178% in 1998 and now it is come into 67% in 2004. That means this industry is now going to its maturity stage. From the comparison of different operators’ subscriber base, it can be concluded that GP is still leading the way with a sharp distance. Though Citycell is the first mobile operator in Bangladesh, it is not doing its business so good. It is increasing its subscriber from 2000 in 1997 to 370000 in 2004. On the other hand, AkTel is growing its subscribers faster than Citycell which is from 3000 in 1997 to 1000000 in 2004.

| 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 |

| Market Penetration | 0.02% | 0.05% | 0.10% | 0.21% | 0.53% | 0.87% | 1.88% | 3.13% |

| Districts Covered | 1 | 2 | 26 | 36 | 40 | 49 | 59 | 61 |

| Mobile Growth rate | 178% | 96% | 121% | 149% | 65% | 116% | 67% | |

| Telecom Growth Rate | 19% | 17% | 34% | 66% | 42% | 40% | 55% | |

Subscriber Base | ||||||||

| Grameen | ||||||||

Phone

18,000

30,000

60,000

191,690

471,371

775,310

1878,000

2424,177

Citycell2,00019,000

26,200

33,500

100,000

160,000

2250000

370,000

AkTel

3,000

12,000

28,500

34,200

96,000

150,000

300,000

1000,000

BanglaLink

–

3,000

11,000

19,000

27,000

60,000

70,000

100,000

Table 5: Development of the Telecom Market 1997-2004

The penetration rate of mobile phone industry in Bangladesh is increasing rapidly. The rate was increasing slowly from 1997 to 1999. After that, the rate was increasing faster and now till March” 05 the penetration rate is 3.48% and only GrameenPhone’s penetration rate is 2.12%. Fixed network penetration is .72%.

Subscriber Base of Mobile Operators:

The mobile market consists of four mobile operators. Among them, GP holds 2,927,850, AkTel 1,355,000, CityCell 400,000, and BanglaLink 130,000. The total number of subscriber of all mobile operators is 4,317,506.

MOBILE OPERATORS SUBSCRIBER BASE (EOY March 05)

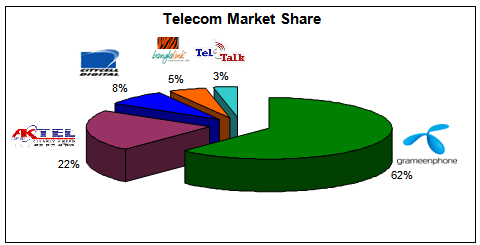

Market Share of Mobile Operators:

The mobile phone market consists of four operators. Out of which, 62% share of the market belongs to GP, 8% to CityCell, 22% to AkTel, and 5% to Banglalink and the rest 3% to Teletalk as of June, 06. GP holding the major share maintains a ‘market leader’ strategy to all other players in the market. The telecom market intends to grow at penetration rate of more than 3.48%; where GP has already penetrated at 2.12%.

MARKET SHARE OF MOBILE OPERATORS (EOY June 06)

Competitive Position of the mobile operator:

Table 6: Relative position of mobile phone operators

| Target Customer | Price & Tariff | Quality | Technology | Strategy |

| Corporate/ |

Individual

Low

Deteriorating services

CDMA

Network expansion & attractive products

Corporate/SME/ Individual

Competitive

High quality service but limited coverage

GSM

Increase coverage and market share Corporate/SME/ Individual

Very affordable

Low quality and limited coverage

GSM

Increase coverage and Market share

GrameenPhoneCorporate/

SME/

Individual

Competitive

Good network with wider coverage

GSM

To maintain the no. 1 position as a cell phone operator SME/ Individual

Competitive

Limited Coverage

GSM

To grab the market share

Target customers are almost same for the four mobile operators. Regarding to price and tariff, AkTel and GrameenPhone are very much competitive. Banglalink’s price and tariff is very affordable and Citycell is able to give low price to its subscribers. In case of service quality and network coverage, GrameenPhone is leading the number one position among them. Only Citycell use CDMA technology and others three use GSM technology. By this, Citycell differentiates its products from the others. Except GP, Other operators’ recent strategy is increase coverage and market share through attractive products. On the other hand, GP’s strategy is to maintain its number one position. Teletalk’s main strategy is to grab the market share as much as they can

Highlights of Competitive Positioning of Mobile Operators

- The operators have been engaged in intense competition in terms of start-up cost and tariff. Most of the competitors of GP has adopted and will adopt network expansion strategy.

- Good relationship with regularity authority is strength of some of the other mobile operators while GP has achieved it to some extent by abiding by laws and showing positive results.

Current Market Scenario:

The telecom market is experiencing a transition period, at present. Singtel has already come up with CityCell to invest in the mobile telecom market of Bangladesh. Another Egyptian company named as Orascom has bought all the share of BanglaLink and planed to invest a huge amount to capture a market share of 300,000 by the mid of 2005. Flat duty has been introduced for network equipment hardware. GSM product of Bangladesh is now considered to be most economical in the region even though the startup cost has increased to BDT 5000 for mobile phones.

The parties involved in mobile and fixed telephony business have taken appropriate measures to improve their products and services accordingly. BTTB has lowered its start up cost in small towns. They have also reduced their NWD and ISD call rates. New areas of North Bengal have come under coverage through other mobile operators. CityCell and AkTel have launched pre-paid service with PSTN access. AkTel and BanglaLink have reduced their monthly access fee. Moreover, Citycell has introduced Super Off-peak rates for efficient use of technical facilities. For reducing the complexity of talk time charge, Banglalink has introduced new charge for all time which is less than 2.50 Tk/minute. Offering free talk time and free SMS is now becoming the hottest promotional tool for being competitive in the market.

Besides improved products, services, and better deals, the competitors are also competing with distinct communication strategies. They are also trying to expand their distribution network. CityCell has signed two big distributors, namely Singer and Sony.

Key Success Factors:

In an industry like telecommunication in Bangladesh, competitors’ analysis is an important factor. To analyze the industry competitors there should be specific determination of Key Success Factors (KSF’s). These KSF’s will help to determine which competitor is more attacking and having the competitive power. Some of the key success factors are-

Call rate

Network coverage

Customer Service

Value Added service

Marketing & Promotion

Brand Value

Competitors Profile Matrix (CPM):

Based on the key success factors we have calculated CPM for the companies. The companies competing in the industry are taken into consideration and they are weighted with some values. CPM for telecom companies of Bangladesh is given below-

| KSF’s | Weight | GP | AKTEL | Banglalink | CITYCELL | ||||

| Rating | Score | Rating | Score | Rating | Score | Rating | Score | ||

| 1. Call rate | 0.15 | 2.00 | 0.30 | 3.00 | 0.45 | 2.00 | 0.30 | 4.00 | 0.60 |

| 2.Network Coverage | 0.30 | 4.00 | 1.20 | 3.00 | 0.90 | 2.00 | 0.60 | 2.00 | 0.60 |

| 3. Customer Service | 0.25 | 4.00 | 1.00 | 3.00 | 0.75 | 3.00 | 0.75 | 2.00 | 0.50 |

| 4. Value added service | 0.10 | 4.00 | 0.40 | 3.00 | 0.30 | 2.00 | 0.20 | 1.00 | 0.10 |

| 5. Marketing & Promotion | 0.15 | 4.00 | 0.60 | 3.00 | 0.45 | 4.00 | 0.60 | 2.00 | 0.30 |

| 6. Brand Value | 0.05 | 3.00 | 0.15 | 2.00 | 0.10 | 3.00 | 0.15 | 2.00 | 0.10 |

| Total | 1.00 | 3.65 | 2.95 | 2.60 | 2.20 | ||||

From the calculation above it has been a clear idea that GrameenPhone is the most facvorable position in the market in terms of competitive advantage. Competitive Profile matrix- CPM for GP is 3.65 which is quite high than any other mobile operator. The closest competitor is AKTEL having the score 2.95. All other competitors are far behind from GP. The strongest position in Network Coverage provides the most favorable and strong position in the market. GP needs to concentrate on increasing brand value and customer service because call rate won’t be GP’s turning point to survive. GP’s policy is “Not to be cheapest rate provider in mobile market”

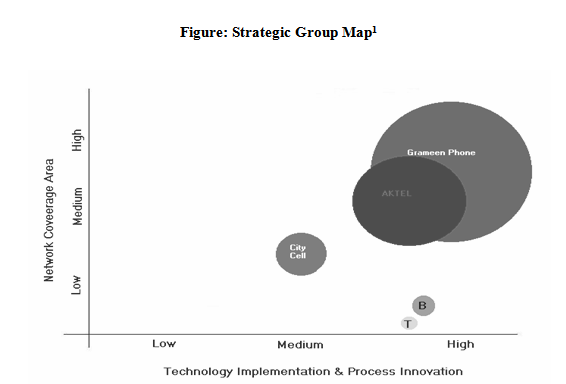

Position in the market for GrameenPhone:

Perceptual mapping helps to understand the position of a company in the market. It portrays the perfect picture of a company based on the characteristics and competencies it has. Thus, Strategic position for GrameenPhone has been designed here based on network coverage area and technology implementation and process innovation. Here is the strategic position map-

Bangladesh Telecom Outlook (till 2005)

Industry analysis with Porters five forces:

Porter’s five forces Model is a key Analytical Tool for Diagnosing the Competitive Environment. It has used five forces to reveal the state of competition. It has become an important tool for analyzing an organizations industry structure in strategic processes. It allows the strategic thinkers to formulate appropriate strategy for a particular entity through systematic and structured analysis of market structure and competitive situation, and helps improve the position of the organization. The model is presented through five competing forces which are given below.

Through Porter’s model, I have tried to define the five key factors for analyzing competitiveness and attractiveness of the over all mobile Telecommunication industry.

The degree of rivalry within the industry

Currently, there are 5 competitive companies (GrameenPhone, AkTel, Citycell, Banglalink, Teletalk) in the market Out of which, 62% share of the market belongs to GP, 12% to CityCell, 25% to AkTel, and the rest 2% to Banglalink. GP holding the major share maintains a ‘market leader’ strategy to all other players in the market. The telecom market intends to grow at penetration rate of more than 1.33%; where GP has already penetrated at 1.56%. Number of competitors is low but the competitors are powerful and highly competitive. That’s why the degree of rivalry within the industry is very high.

Threat of new and potential entrants

As GrameenPhone is having the highest number of subscriber and there is a high demand for their service, customer pulling is also high. So, they are on the way to achieve economics of scale. Using economics of scale and experiencing this advantage, they are trying to keep the price lower. This strategy can discourage potential entrants from entering the market. In the long run, they have strategy to attract the highest number of local people by marketing and also lot of national or multinational by establishing high technology and achieve further economics of scale more efficiently, which is also a threat for the potential entrants. In the near future after reaching the break-even they may decrease the average cost per unit and can get the absolute cost advantage.

GrameenPhone became popular within short period of time through their effective promotions. Company made lot of press releases, TV, radio Ad, which made the name “GrameenPhone” familiar to the customers.

High switching cost for post paid subscription is a barrier for the potential entrants in this industry. As the technology, expertise, capital needed for this sector is not easily obtainable that’s why switching cost is higher.

Threat of substitute products:

BTTB has already reduced the NWD and ISD call charge. Furthermore, around 50 private companies get the license to provide wireless phone and lane phone service. Rankstel, North Bengal Phone Company One Tel has already started their operation. Rankstel provides wireless phone service and it covers Dhaka, Gajipur. The growing number of substitute products indicates that the existing players have to face threat from these products. But again, in other sense I can say that mobile phone service gives the freedom of mobility which its substitute cannot give. Hence, the threat of substitute is moderately is low.

Supplier’s bargaining power:

GrameenPhone has been maintaining good relation with its suppliers. The company has strategic coordination with its suppliers; hence its suppliers bargaining power is moderately low. GSM technology give the advantage to the company and its subscribers to change mobile set any time they want. Again, the industry has lots of suppliers, as a result GrameenPhone has possible alternative to change suitable supplier.

Buyer’s bargaining power:

There are many players in the market, which gives the customers alternative and power to choose different brand according to their preference. That’s why buyer concentration is high. The competition in the market makes the customer more powerful and the companies more competitive among each other’s

Integrated evaluation of Porter’s Five Forces:

| The degree of rivalry within the industry | HIGH | Industry attractiveness is low |

| Threat of new and potential entrants | Moderately low | Industry attractiveness is moderately high |

| Threat of substitute products | Moderately low | Industry attractiveness is Moderately high |

| Supplier’s bargaining power | Moderately low | Industry attractiveness is moderately high |

| Buyer’s bargaining power | Moderately High |

Evaluation of the industry’s attractiveness

From the above consequences of Porter five forces, I have identified that the mobile telecommunication industry has high degree of rivalry within the industry, low threat of new entrants and substitute products, low bargaining power of suppliers, high bargaining power of buyers. So this situation leads to consider Mobile Telecommunication industry’s attractiveness is moderately high for the existing players. Again, Government’s overall support made the telecommunication industry look more attractive for the existing players. Government has licensed only five companies for operating in market, which created an entry barrier for potential entrants. Government allowed establishing plants in the rural area, which definitely helped GP to create a vast network all over the country.

Other factors for Environment:

SWOT Analysis:

SWOT stands for Strength, Weakness, Opportunity, and Threat. This is a very important tool for a company to analyze its internal and external environment. Let us carry out a SWOT Analysis of GrameenPhone.

Strengths:

- Market Leader:

GrameenPhone (GP) became the country’s leading cell phone operator since 2001. From year 2001 to till now GrameePhone’s subscribers has increased 471,300 to 3.3 million represent 62% of the market share. GrameenPhone in recent years has maintained its consistent growth strategy country wide, offering cellular voice and non voice services to the market at an affordable price, on a scale hitherto unprecedented. The expansion of the mobile network has gradually included a large number of remote villages.

- Good Owner Structure

GrameenPhone is 62% owned by Telenor, a sate-owned telecommunication company from Norway and 38% owned by Grameen Telecom. From these companies GrameenPhone get financial and technical supports.

- Financial Soundness:

GrameenPhone has a huge amount of capital mainly invested by the shareholders. Capital size is $280 million. Moreover, global institutions like IMF, World Bank etc. have sanctioned loan for GP. This is a huge success for GP. GrameenPhone’s total capitalization was US$120,000,000, including around US$50 million from IFC/CDC, and the Asian Development Bank (ADB). It also received US$60 million in equity from the four GrameenPhone private partners. Grameen Telecom borrowed US$10.6 million from the Open Society Institute to set up Village Phone. The company continued to invest heavily in expanding the capacity of its network and coverage.

- Largest Geographical Coverage:

GrameenPhone has the largest geographical network coverage compare to its competitors. GP will continue to make fresh investments to further expand its coverage throughout the country and increase the capacity of the network, so that more people can avail the service. GP has already put into operation 459 new base stations this year alone, bringing the total number of base stations to 1128 operating around the country. Presently, GrameenPhone has coverage in some 61 districts and 400 Upazilas. There are 1750 base stations in operation around the country. Further more the company is panning to set another thousand base station by this year. The competitors are also lagging far behind in this regard.

- Competitive price:

Price is a big competitive advantage for GP. GP is selling the hand-sets and connection package at a very low rate. E.g. lowest package rate of GP was TK 5,900/=. The competitors are no where near GP, in this regard.

- Availability of Backbone Network (Optical fiber):

GrameenPhone Ltd. sub-leases the Transmission Capacity of its 1600 Fiber Optic Network, leased from Bangladesh Railway, commercially to the prospective business units/clients. There is a contract between GrameenPhone and Bangladesh Railway that GP will use this network for the next 25 years. This advantage enables GP to set a Nation Wide Network in a very contemptible expense. GP optic facilitates nationwide coverage, technical expertise, robust network and minimum downtime for non-protective circuits.

- International Roaming:

As mentioned previously, GrameenPhone is providing international roaming facility to GP Regular subscribers. These subscribers can avail this facility after fulfilling some requirements. GP has international roaming agreement with 202 mobile phone operators of 71 countries.

- Dynamic management team:

GrameenPhone has a dynamic management team that consist experts from both home and abroad. This helps GP to always remain on track and move forward at a consistent pace.

- 24 hours customer service:

GP has a 24 hour customer service tool. This is popularly known as ‘helpline’. This service keeps a continuous relationship with the subscribers.

- GPGP Network:

GrameenPhone has an absolute advantage in mobile to mobile phone (GPGP) market in comparison to the competitors. This is really a new concept in the mobile telecommunication network. GP has developed this alternative network that is fully dominated by themselves.

- WAP:

As we have already mentioned that WAP stands for Wireless Application Protocol. Very recently they have launched this service.

- Established Brand / Brand Name / Grameen Image:

The branding activities have led GrameenPhone to build a strong brand. The mother brand is placed on the same platform as other renowned brands like British American Tobacco, Citicorp etc in Bangladesh. GrameenPhone has already built its brand image by its profound service, widest network coverage and social responsibilities. Moreover GP is the second largest taxpayer created a better brand image in customers mind.

- Individualism:

Although GrameenPhone has close affiliation with its multinational parent company, GrameenPhone has an independent brand identity in the market.

- Extensive Market presence (availability):

To make telecommunication accessible to the mass market, GP has set up its POS in the most convenient areas of the districts under the GP network. Till year 2004 the company has 1038 POS.

- Skilled Human Resource:

The employees– are young, dedicated and energetic. All of them are well educated at home or abroad, with both sexes (genders) and minority groups in Bangladesh being well represented.

- Access to the widest rural distribution network through Grameen Bank:

To day 35.000 villages are connected and women, linked to the renowned Micro Credit Program through Grameen Bank, have become borrowers and owners of the Village Phone. The Program offers mobile service to over 40 million people in remote areas. On average a Village Phone Operator earns nearly 1.000 USD a year, nearly three times more than the average per capita income.

- Value added service:

GP recently launched two new value-added services. The SMSPAY service enables you to send subscribers bill payment information to avoid barring subscription, while the “Cell E-mail” service allows sending and receiving e-mail using GP mobile phone. Email through mobile phone service has already proved to be beneficial to the subscribers, who don’t have access to the Internet.

Weaknesses

- Weak Coverage:

GP has weak coverage in some districts like Netrokona, Laxmipur, Naogaon, Pirojpur, Maulvibazar, Habiganj, Cox’s Bazar and so on. As the subscribers’ complaints, they can not communicate effectively in these weak networks. Again GP still now has not three districts namely Rangamati, Bandarban and Hilltracks.

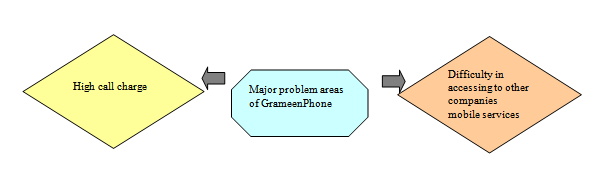

- Billing System:

The abrupt barring of connection due to a complicated billing system confuses the customers. Such hassles lead to an unfavorable impression for the company.

- Network Limitation:

Call drop, congestion, and poor connectivity with BTTB result in bad image of the company.

- Some value-added services are not successful:

-Voice Mail service due to language barrier, lack of promotions, lack of know how about interactive services and also because people are reluctant to speak to a machine.

-Usage of Short Message Service is still low due to lack of promotion, lack of knowledge of English, unawareness of handset configuration and un-ergonomic nature of keypad.

-Difficulty in Configuration, handset barrier and slow connectivity are hampering WAP’s popularity.

-Lack of co-ordination is used as an excuse not to solve problems

- Complicated price structure:

Post-paid call charge is very complicated to the customers. Even though per unit call charge is mentioned, sometimes customers get confused about their bill.

- No long-term Distribution/Channel strategy:

GrameenPhone has not yet taken initiatives of its long-term distribution channel strategy. GP’s current market expansion with its short-term distribution channel goal meet it present requirement. But for its future market expansion and to reach its new segment of customers more effectively in efficient manner GP needs to take bold steps from now on.

- Commercial ads are not too creative:

GP’s commercial ads are not that much appealing its prospective customers compare to its competitors. Valuable features are not focused in its ad. GP does not show its competitive advantages through its ads whereas its competitor such as Citicell has done it effectively.

- Becoming Market Follower:

GrameenPhone Is now becoming market follower as competition is going so fast in mobile telecommunication industry. As a market leader, it is not good for GrameenPhone to become reactive to its competitors.

Opportunities

- Land Phone:

Bangladesh Government has already started to provide license to private sector to setup land phone. GrameenPhone has a very good reputation in the country. They can capitalize this goodwill and take initiatives to enter the market of land phone.

- Attractive market:

Bangladesh is a highly attractive market for mobile services due to its large and highly concentrated population, low penetration of telecommunications services, and high growth in mobile subscribers. With approximately 140 million inhabitants, it ranks as the eighth most populous country in the world and is among the most densely populated. Bangladesh is served by only 1million fixed lines and has only approximately 4.5 million mobile subscribers. While mobile services have been available in Bangladesh since 1991, growth in this sector has only accelerated in recent years. This market has still low penetration rate but still there is opportunity to increase high penetration rate.

- Huge need for telecom services:

Current market growth rate of the telecommunication is significant which arises a great opportunity for the cellular phone companies to grow rapidly. The demand of the cell phone is still increasing. Variety services with most lucrative features made this sector more and more attractive day by day. Recent year’s growth reflects the enormous potential for the development to telecommunications and information technology in the country.

- Declining prices for handsets

The prices of the mobile sets are declining in Bangladesh that makes a easy gate way for the customers to use cell phones. It will create an opportunity for the telecommunication industry by getting large number of customers. There are some others opportunities, which can be important factors for GrammenPhone, are: Economic growth of Bangladesh, new and better interconnection agreement and future privatization of the fixed network

Threats

- Global Companies:

As global companies like AT&T, BPL are operating in India, they might think to enter the Bangladeshi market with higher capital. If so, it will be a huge threat for GP.

- T&T Mobile:

T&T is now entering the mobile telecommunication industry. It is now becoming the great threat business for all other mobile phone operators by providing unfair advantages and cause sever problems.

- City Cell and AkTel’s Recent Expansion Plan:

Among the existing competitors, City Cell and AkTel are planning to develop country wide network. This can also divide the advantage that is currently enjoyed by GrameenPhone alone.

- More rigid government regulations:

Government rigid regulations and policy narrows the direction of the cellular phone companies. GrameenPhone has to go through lengthy government procedures to take permission to launch a new service package. The imposed increased taxes for SIM price will slower the growth of this industry.

- Threats of potential new entrants:

There are rumors in the market that some companies are trying to enter the market with cheaper technology. Potential new entrants can get into the telecommunication market with cost effective approach and take off market shares. New domestic and foreign cellular phone companies can start telecommunication network business. As Bangladeshi people are very much price sensitive, it might cause serious problem for GP.

- BTTB has reduced NWD and ISD call charge:

Recently BTTB has reduced its NWD and ISD call charges to promote LAN phone usages. This has affected the mobile phone industry and significantly reflected in the revenue earning of BTTB.

- Inadequate interconnection with BTTB:

From the beginning GrameenPhone is facing inadequate interconnection with BTTB. As a result its interconnectivity network does not perform up to the mark.

- National catastrophes:

National catastrophe may severely hamper the networking system. GP’s towers at different location are affected by natural calamities.

- Price war:

All the four companies are fighting to get the market share by cutting price of the mobile phone connection. All competitors are lowering the unit price and also providing pulse facility like AkTel provides pulse at the thirty seconds of the first minute. So the market is fighting with each other with their pricing strategy.

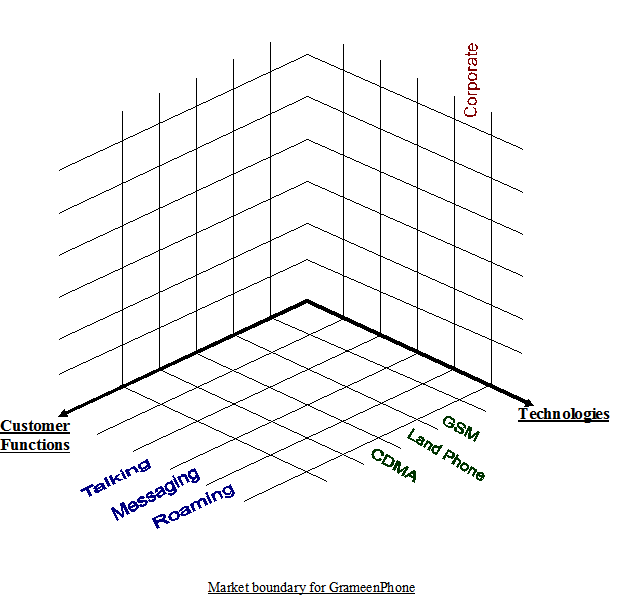

Market Boundary:

Market boundary is an important phenomenon for a company as in needs to integrate the customer group, customer functions and technological uses. A market boundary diagram helps us to build a schematic image for the company’s products and service demand and potential market. For GP I have drawn a market boundary diagram It is shown in the next page-

GP’s services include all the customer functions. But it mostly serves the purpose of being mobile at a cheaper expense. GP uses GSM technology out three available options and its major customer group is individuals.

Segmentation:

GP’s mobile phone service targeted towards the consumer market. So, it can be treated as a consumer product or service or package.

The major factors that play important roles in the process of consumer segmentation are:

- Demographic factors (age, income, sex etc.)

- Socioeconomic factors

- Geographic factors

- Psychological factors

- Consumption patterns

- Perceptual factors

- Brand loyalty patterns

Proper consideration of the above factors will result in effective consumer segmentation for GP.

Value Chain Analysis for GP:

Value Chain is an important analysis method for determining how the firm is creating value for the end users. It involves various primary and secondary activities both inside and outside the firm. Both primary and secondary/ support activities help to create value for the firm. Here, I am going to analyze the value chain activities performed by GrameenPhone.

Primary Activities:

- R&D- In terms of R&D GP is not in a satisfactory position. GP generally conducts its R&D activities relating the research firms and their own employees. The company has its own R&D team.

- Procurement- Procurement is an important and crucial activity that GP has been performing over the years. The company has created the environment favorable by designing different procurement team.

- Marketing & Sales- Marketing and sales is the most important primary activities for the company. Success of the company mostly depends on the marketing strategies and sales efficiency. In terms of marketing GP is doing satisfactorily compared to other competitors like AKTEL and Banglalink.

- Customer Service- Customer service is another important phenomena for a company to create value to the stakeholders. After sales service and instant service is operated by GP can create the ultimate value for the customers. Customer service is a heavily weighed key success factor in telecommunication industry. That’s why this should be emphasized more.

Secondary/Support Activity:

- Information System- For a company like GP it is very important to be attached to the information technology. Each and every day more and more technology is coming in to the scenario. Thus GP needs to integrate the information system for better service delivery.

- Inventory Management- As GP is one of the service providers in the telecom sector, it does not need to deal with Inventory issue.

- Human Resource- Another important value creation activity is managing human resources inside the firm. Without experienced and skilled human resource it is not possible to ensure efficiency for service delivery activities. Highly educated and experienced employees can take a great role in value creation activities.

Thus I think there are lacking in value chain activities for GrameenPhone which should be solved as early as possible.

8. Social Commitment of GrameenPhone

Orphanage Project: The orphanage is situated at Vatara Bazar, Baridhara, Dhaka. At present 75 children are residing there. Twenty five staffs are employed for overall look after of the children. The children are aged between 4 and 15 years The orphanage is a project of CDP (Children development program) and is funded by Telenor, the major(51%) share holder of GP.

Dhaka Shishu Hospital Project: GrameenPhone has sponsored one of the wards of DhakaShishuHospital (ward #4) with various utility facilities like Pure Drinking Water, providing Bed linen, utensils, mosquito net etc.

Against Dengue:

a) Awareness buildup:

i) To create awareness against deadly diseases like dengue GP has published articles dealing with the preventive and protective measure of this disease in their monthly newsletter and in form of booklets.

ii) GP has also provided in field and in house training to create awareness among people of different classes of society.

iii) GP uses its sources in its regional offices in Chittagong, Rajshahi, Khulna And Sylhet to create awareness against this disease in those cities.

b)Spraying against Mosquito: With collaboration to Dhaka City Corporation GP has sprayed aerosol for destroying mosquito in areas like Fourth class employees colony of D.C.C in Gulshan1,Gp office premises and in locality of Gulshan circle 1 & 2.

c) Cleanliness Program: GP has sponsored Cleanliness programs in its own locality and in slam areas of Gulshan to prevent the breeding of mosquitoes and for healthy environment.

Awareness about EPI diseases:

GrameenPhone has extended its hand of cooperation in generating awareness about EPI diseases by helping UNICEF in arranging various programs in this regard. GP sponsored several programs involving children and parents with UNICEF like seminars, art competitions etc.

Awareness about Asthma:

Collaborated with Asthma Association of Bangladesh GrameenPhone has arranged rallies and seminars to create awareness about prevention & treatment of Asthma.

Awareness about Health & Hygiene:

GrameenPhone HSE team has worked extensively to create awareness about personal & community health & hygiene. GP has conducted seminars, rallies, in field and in house training in this regard in its Head office, regional offices and other organizations like EC & Nordic Club. First aid, safety in working place, clean environment etc topics is generally discussed in these awareness programs.

Blood Donation Program:

One of prominent social contribution of GP is in the field of Voluntary blood donation. GrameenPhone has sponsored and directly participated in various voluntary Blood Donation Programs around the country with voluntary blood donation organizations like Shandhani and Red Cresent Society.

Each year GP arranges a yearly HSE (Health, Safety & Environment) week. One of the regular programs of HSE week is blood donation camp in GP Head office & regional offices. Moreover round the year GP helps in arranging voluntary Blood Donation camps and works through seminars and camps to produce awareness between mass people about blood donation.

GrameenPhone maintains a database containing the information about blood groups of all the employees. When any employee or his family or friend needs blood, he can contact HSE personnel and get contacted with the persons having the required blood group.

Furthermore in February 2003 GrameenPhone has launched the new “Push-Pull” value-added service. “Push-Pull” service provides access to various information. If a subscriber sends a Text Message (SMS) to a specific number writing a key word in the message, then he/she will get the requested information instantly. For example, if a subscriber writes Blood in his text message and send it to 2000, instantly he/she will get the names and telephone numbers of major Blood Bank services. if a subscriber writes TAXI in his text message and send it to 2000, instantly he/she will get the names and telephone numbers of major Taxicab services.

Plantation Program:

GrameenPhone has under taken plantation program in its office premises in Dhaka, Chittagong, Rajshahi & KhulnaCity as a part of their social awareness & responsibility. GP has also planted plants in the road side in areas like Gulshan, Baridhara etc.

GrameenPhone Products

The products of GrameenPhone can be characterized as:

Post Paid

Pre-Paid

GrameenPhone’s post paid products are :

GP-Regular

GP-GP National

Any Time 300

Any Time 500

Post Paid

GP-Regular:

GP Regular connects to BTTB local, BTTB-NWD (Nationwide Dialing), ISD (International Standard Dialing), all GrameenPhone mobiles, other mobiles and receives calls from the same. Recently all GP Regular phones have been given the mobility facility that enables a GP Regular mobile holder to receive and send calls from anywhere in the country (under GP coverage). This product has ‘Friends & Family’ offer for 3 GP numbers.

Tariffs and Charges:

- All tariffs are subject to change without assigning any reason

- 15% VAT applicable to all Airtime charges, monthly fees & BTTB charges.

Monthly Fee | Outgoing | Incoming | Friends & Family (24 Hrs.) | ||||

Mobile to Mobile | Mobile to BTTB | From Mobile | From BTTB | ||||

Peak 8am-8pm | Off-Peak 8pm-8am | Peak 8am-8pm | Off-Peak 8pm-8am | ||||

Tk. 350 | Tk. 4/min. | Tk. 3/min. | Tk. 4/min. + BTTB Local/ NWD/ ISD charge | Tk. 3/min. + BTTB Local/ NWD/ ISD charge | Free | 1st min. free & Tk. 2/min. from 2nd min. onwards | Tk. 1.5/min. for 3 GP nos. |

- 30 sec pulse in the 1st min

- 15 sec pulse after 1st min

- During Friday, 24 hours Off-Peak rate applicable

- For ISD & NWD calls: BTTB’s Peak (8am – 10pm) & Off-peak (10pm – 8am) rate will be applicable for BTTB charge.

GP-GP National:

GP-GP National is another addition of post-paid products of GrameenPhone. This phone can connect all mobiles within the home zone and all GP mobiles throughout GP’s coverage area. It has National Roaming facility and a flat rate airtime charge of Tk. 4 (+Tax) per minute for all calls to anywhere within GP’s coverage. This product has ‘Friends & Family’ offer for 3 GP numbers.

Monthly Fee | Outgoing | Incoming | Friends | |||

GP-GP | GP-Others | |||||

Peak | Off-Peak | Peak | Off-Peak | |||

Tk. 150 | Tk. 4/min. | Tk. 3/min. | Tk. 6/min. | Tk. 5/min. | Free | Tk. 1.5/min to 3 GP nos. |

- 30 sec pulse in the 1st min

- 15 sec pulse after 1st min

- During Friday, 24 hours Off-Peak rate applicable

Any Time 300:

Any Time 300 is same as GP National connections which can connect all mobiles within the home zone and all GP mobiles throughout GP’s coverage area. The main difference is that Any Time 300 has a bundle fee of TK. 1000/= for which the subscriber will get 300 min talk time free for GP-GP outgoing calls and there is no monthly access fee like TK. 250/= for GP National. It has National Roaming facility and a flat rate airtime charge of Tk. 4 (+Tax) per minute for all calls to anywhere within GP’s coverage after the first 300 min. This product has no ‘Friends & Family’ offer.

Monthly | Outgoing | Incoming | |||

Within 1st 300 mins. | After 1st 300 mins. | ||||

Peak | Off-Peak | Peak | Off-Peak | ||

Tk. 1000 | Tk. 0/min. | Tk. 0/min. | Tk. 4/min. | Tk. 3/min. | Free |

- 30 sec pulse in the 1st min

- 15 sec pulse after 1st min

- During Friday, 24 hours Off-Peak rate applicable (after 1st free 300 mins.)

Any Time 500

Any Time 500 is same as GP Regular connections which connects to BTTB local, BTTB-NWD (Nationwide Dialing), ISD (International Standard Dialing), all GrameenPhone mobiles, other mobiles and receives calls from the same. The main difference is that Any Time 450 has a bundle fee of TK. 1300/= for which the subscriber will get 450 min talk time free for GP-GP outgoing call. This product don’t have ‘Friends & Family’ offer. It’s the only package which offer 1 sec pulse from the first minute.

Tariff of Any time 500

Monthly Fee | Monthly Bundle Fee | Outgoing | Incoming | ||||||||

Mobile to Mobile | Mobile to BTTB | From Mobile | From BTTB | ||||||||

Within 1st 500 mins | After 1st 500 mins | Within 1st 500 mins | After 1st 500 mins | ||||||||

Peak 8am-11pm | Off-Peak 11 pm-8am | Peak 8am-11pm | Off-Peak 11pm-8am | Peak 8am-11pm | Off-Peak 11 pm-8am | Peak 8am-11pm | Off-Peak 11pm-8am | ||||

Tk. 350 | Tk. 1,500 | Tk. 0/min. | Tk. 0/min. | Tk. 4/min. | Tk. 3/min | Tk. 0/min + BTTB Local/ NWD/ ISD charge | Tk. 0/min + BTTB Local/ NWD/ ISD charge | Tk. 4/min + BTTB Local/ NWD/ ISD charge | Tk. 3/min + BTTB Local/ NWD/ ISD charge | Free | 1st min. free & Tk. 2/min. from 2nd min. onwards |

- 1 sec pulse in the 1st min

- During Friday, 24 hours Off-Peak rate applicable (after 1st free 500 mins.)

GrameenPhone’s Pre Paid Packages:

Easy Pre-paid

Easy Gold

Djuice

EASY Pre-Paid

Introduction of GrameenPhone’s EASY pre-Paid Service is another development of mobile telephony in Bangladesh. EASY has National Roaming facility and a flat airtime charge of Tk. 6 per minute. There is no incoming charge. This service helps the subscriber to control costs. It frees the subscriber from the hassles of paying bills, security deposits and line rents. But it contains nearly all services available in other GP products. Subscribers can subscribe the service from all GP authorized points of sale. To start with, one has to buy the EASY Starter Kit and a handset. The Starter kit contains a pre-activated SIM card and a Green EASY card. The Starter kit costs Tk. 1,675, the Green EASY card worth of Tk. 300 is provided free.

Outgoing | Incoming | My EASY | My Time | ||

Peak | Easy Hour | ||||

1st & 2nd min. | 3rd min. onwards | Tk. 3/min. | Free | Tk. 3/min. | Tk. 3/min. |

Tk. 6/min. | Tk. 4/min. | ||||

- 30 sec pulse in the 1st min.

- 20 sec pulse after 1st min.

EASY GOLD

Easy Gold is same as Easy Pre-Paid while it connects to BTTB local, BTTB-NWD (Nationwide Dialing), ISD (International Standard Dialing), all GrameenPhone mobiles, other mobiles and receives calls from the same. Easy Gold has a flat airtime charge of Tk. 6 per minute and 2 incoming from T&T. There are no incoming charges from mobile.

Outgoing | Incoming | My EASY | My Time | |||||||||

Mobile to Mobile | Mobile to | From Mobile | From BTTB | |||||||||

| BTTB Local/ISD | BTTB NWD | |||||||||||

Peak 6am-12am | Easy Hour 12am-6am | Peak 8am-12am | Easy Hour 12am-6am | Peak 8am-12am | Easy Hour 12am-6am | |||||||

1st & 2nd min. | 3rd min. onwards | Tk. 3/min. | 1st & 2nd min. | 3rd min. onwards | Tk. 3/min. + BTTB charge | 1st & 2nd min. | 3rd min. onwards | Tk. 3/min. + Tk. 3/min. (Flat) | Free | Tk. 2/min. from 1st min. onwards | Tk. 3/min. to 1 GP no. | Tk. 3/min. to any GP no. |

Tk. 6 /min. | Tk. 4 /min. | Tk. 6/min. + BTTB charge | Tk. 4/min. + BTTB charge | Tk. 6/min. + BTTB charge | Tk. 4/min. + BTTB charge | |||||||

- 30 sec pulse in the 1st min

- 20 sec pulse after 1st min. (for mobile to mobile)

- For BTTB outgoing (ISD) the pulse is 30 sec after the 1st minute. For NWD calls pulse is 60 sec.

after 1st min. - For ISD calls: BTTB’s Peak (8am – 10pm) /Off-peak (10pm – 8am) rate will be applicable for BTTB charge.

Djuice:

After GrameenPhone’s eight years successful operation with tremendous business growth and development, the company has come with its sub brand djuice with remarkable advertisement camping. The company launched djuice in last Pohela Boishak (14th April, 2005). Djuice targeted young generation who craving to communicate and to interact people. Djuice is committed to meet young generation need of communication with lucrative demanding features. While focusing it target group djuice has included comparatively low charged SMS, SMS chat, music and movie top list etc. Djuice claim that it is more than a mobile phone service. Djuice by its entire means tried to grab the target groups’ attention with its creative advertisements, products features and brand image. At present it’s the only mobile operators’ sub brand, which is trying to create its own image inside subscribers mind. With 20 sec pulse throughout djuice offers improved affordability

- Peak hour tariff (calls to any mobile)

Calls to any mobile during Peak hours only Tk 1.66 /pulse - Off peak hour tariff (calls to any mobile)

Calls to any mobile during Off-Peak hours only Tk 0.66 /pulse.

Service Provided by GrameenPhone:

GrameenPhone along with its various products also provides variety of services. Only GrameenPhone subscribers can avail it. These services can be categorized by Value Added Services and After Sale services. Furthermore, GrameenPhone also offer GSM features.

Value Added Services:

Value Added Services (VAS) offer subscribers a service which can create value in subscribers mind and add value to the company’s service. These services generate revenue for the company. VAS are sometime created to meet subscribers demand and sometime to create demand of new services. Value added service also include non-voice services where the company concentrating to make subscribers adapt and increase usages, because the company knows one day voice service will reach to its saturation and then non-voice services will keep continuous growth of the company’s annual revenue. Hence, the bundle of VAS is a great resource for the company to generate revenue.

At present the available VAS can be categorized into the following four ways:

Push Pull Service:

From the word push and pull this service can be defined as a service in which a subscriber push buttons of his/her mobile set to ask for a query and pull it. Push Pull is a SMS based service which is launched in January 2003. Instead of asking query to the call centers subscribers can directly pull information by sending SMS to some selective numbers provided by GrameenPhone.

It is Text SMS based service. Subscribers can pull necessary information only by sending SMS writing specific words. For example, for cricket updates a subscriber has to write “crik” and send it to 2002. Both post-paid and pre-paid customers can enjoy this service with common air Tariff 2Tk for each query. Push pull service offers Bill general emergency query, News, Emergency, Entertainment, Standard & Chartered Bank Account info, Destiny 2000 Agent info, Vanik Account info, Bank Asia Account info, Quiz (Prothom-Alo & Daily Star), ring tone and logo down load. Except Ring tone and logo down load all the push pull services charges 2Tk/min. Logo down load and Ring tone down load charges Tk10 for each down load.

Data Service:

Fax and Data Service: